Deck 3: Project Selection and Portfolio Management

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/99

العب

ملء الشاشة (f)

Deck 3: Project Selection and Portfolio Management

1

One project factor that directly impacts a firm's internal operations is the:

A) Expected return on investment.

B) Financial risk.

C) Need to develop employees.

D) Impact on company's image.

A) Expected return on investment.

B) Financial risk.

C) Need to develop employees.

D) Impact on company's image.

C

2

Numeric project selection models,by their very nature,employ objective values.

False

3

If a model can be applied successfully by people in all areas and levels of an organization,it is said to possess the trait of:

A) Capability.

B) Ease of use.

C) Flexibility.

D) Realism.

A) Capability.

B) Ease of use.

C) Flexibility.

D) Realism.

B

4

Souder's project screening criterion of realism addresses the question:

A) How many workers will the project need?

B) Will the project work as intended?

C) Who are the stakeholders?

D) How often should the project team meet?

A) How many workers will the project need?

B) Will the project work as intended?

C) Who are the stakeholders?

D) How often should the project team meet?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

5

An MBA redesign committee plans to spend a decade traveling the world to benchmark graduate programs at other universities.Regardless of the screening model being used,it will suffer from poor performance in the area of:

A) flexibility.

B) Capability.

C) Comparability.

D) Cost.

A) flexibility.

B) Capability.

C) Comparability.

D) Cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

6

Quality risk refers to the chance that:

A) The project relies on developing new or untested technologies.

B) The firm's reputation may suffer when the product becomes available.

C) The well-being of the users or developers may decline dramatically.

D) The firm may face a lawsuit.

A) The project relies on developing new or untested technologies.

B) The firm's reputation may suffer when the product becomes available.

C) The well-being of the users or developers may decline dramatically.

D) The firm may face a lawsuit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

7

One facet of risk in project screening is:

A) The change in manufacturing operations resulting from the project.

B) The initial cash outlay.

C) The potential for lawsuits or legal obligation.

D) The strategic fit of the project with the company.

A) The change in manufacturing operations resulting from the project.

B) The initial cash outlay.

C) The potential for lawsuits or legal obligation.

D) The strategic fit of the project with the company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

8

Souder's model selection criterion that encourages ease of adaptation to changes in tax laws,building codes,among others,is called:

A) Ease of use.

B) Cost.

C) Capability.

D) Flexibility.

A) Ease of use.

B) Cost.

C) Capability.

D) Flexibility.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

9

A writer estimates it will take three months to generate spiffy documents to accompany a seminal work in operations management.He grossly underestimates the time required and misses his deadline by two months.This estimate was:

A) Objective and accurate.

B) Subjective and accurate.

C) Objective and inaccurate.

D) Subjective and inaccurate.

A) Objective and accurate.

B) Subjective and accurate.

C) Objective and inaccurate.

D) Subjective and inaccurate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

10

A project screening criterion that allows the company to compare long-term versus short-term projects,projects with different technologies,and projects with different commercial objectives is:

A) Flexibility.

B) Ease of use.

C) Capability.

D) Realistic.

A) Flexibility.

B) Ease of use.

C) Capability.

D) Realistic.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

11

An internal operating issue in project screening and selection is:

A) Expected return on investment.

B) Change in physical environment.

C) Patent protection.

D) The chance that the firm's goodwill will suffer due to the quality of the finished project.

A) Expected return on investment.

B) Change in physical environment.

C) Patent protection.

D) The chance that the firm's goodwill will suffer due to the quality of the finished project.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which statement regarding project selection and screening criteria is BEST?

A) The most complete model in the world is still only a partial reflection of organization reality.

B) It is possible, given enough time and effort, to identify all relevant issues that play a role in project selection.

C) Decision models are either objective or subjective.

D) For many projects, more than 80% of the decision criteria are vital.

A) The most complete model in the world is still only a partial reflection of organization reality.

B) It is possible, given enough time and effort, to identify all relevant issues that play a role in project selection.

C) Decision models are either objective or subjective.

D) For many projects, more than 80% of the decision criteria are vital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

13

Every decision model contains both objective and subjective factors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

14

A commercial factor in project selection and screening might be:

A) A need to develop employees.

B) The likelihood that users of the project are injured.

C) The long-term market dominance.

D) The impact on the company's image.

A) A need to develop employees.

B) The likelihood that users of the project are injured.

C) The long-term market dominance.

D) The impact on the company's image.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

15

An expert's opinion on an issue may be subjective but very accurate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

16

An effective project selection model must reflect organizational objectives,including a firm's strategic goals and mission.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

17

A wedding planner allows $10,000 for flowers and three weeks to receive all RSVPs back from the list of 700 guests.Both estimates are correct within a fraction of a percent.We could describe this factoid as:

A) Numeric and subjective.

B) Numeric and objective.

C) Non-numeric and subjective.

D) Non-numeric and objective.

A) Numeric and subjective.

B) Numeric and objective.

C) Non-numeric and subjective.

D) Non-numeric and objective.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which statement regarding project selection is BEST?

A) Organizational reality can be perfectly captured by most decision-making models.

B) Before selecting any project, the team should identify all the relevant issues that play a role in project selection.

C) Decision models must contain either objective or subjective factors.

D) Every decision model has both objective and subjective factors.

A) Organizational reality can be perfectly captured by most decision-making models.

B) Before selecting any project, the team should identify all the relevant issues that play a role in project selection.

C) Decision models must contain either objective or subjective factors.

D) Every decision model has both objective and subjective factors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

19

A selection model that is broad enough to be applied to multiple projects has the benefit of:

A) Ease of use.

B) Comparability.

C) Capability.

D) Flexibility.

A) Ease of use.

B) Comparability.

C) Capability.

D) Flexibility.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

20

Souder's project screening criterion that indicates an effective model must reflect organization objectives,including a firm's strategic goals and mission is called:

A) Realism.

B) Capability.

C) Comparability.

D) Ease of use.

A) Realism.

B) Capability.

C) Comparability.

D) Ease of use.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

21

A checklist screening model does NOT consider:

A) Whether one criterion is more important than another.

B) Governmental or stakeholder interference.

C) Product durability and future market potential of the product line.

D) The riskiness of the new venture.

A) Whether one criterion is more important than another.

B) Governmental or stakeholder interference.

C) Product durability and future market potential of the product line.

D) The riskiness of the new venture.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

22

Your university is considering two projects to increase enrollment: offering traditional classes from midnight to 6 a.m.or offering house call classes where the professor would visit your home to provide instruction.Use a simple scoring model with at least three criteria to evaluate these two potential projects and indicate which project should be chosen.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

23

Describe or define any four important attributes for screening models used to evaluate projects.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

24

A simplified scoring model addresses all the weakness of a checklist model for project screening.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

25

The simplest method of project screening and selection is developing a list of criteria that pertain to the choice of projects and then applying them to alternatives.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

26

The checklist model of project screening has a mechanism to accommodate the differential importance of relevant criteria.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which statement about the Analytical Hierarchy Process is FALSE?

A) AHP scores are significant.

B) AHP can be used to capture choice options that do not yield positive outcomes.

C) AHP can improve the process of developing project proposals.

D) AHP groups subcriteria that share the weight of a common higher-level criterion.

A) AHP scores are significant.

B) AHP can be used to capture choice options that do not yield positive outcomes.

C) AHP can improve the process of developing project proposals.

D) AHP groups subcriteria that share the weight of a common higher-level criterion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

28

A simplified scoring model is used to determine that project Cow has a score of 38 and project GiGi has a score of 30.Project Cow is therefore 26.7% better than project GiGi.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

29

The pairwise comparison approach:

A) Is a method to split the weights assigned to subcriteria.

B) Is a method to compare pairs of hierarchies prior to any further analysis.

C) Is a means of achieving all project objectives within the allocated time frame.

D) May be used instead of AHP if time is limited.

A) Is a method to split the weights assigned to subcriteria.

B) Is a method to compare pairs of hierarchies prior to any further analysis.

C) Is a means of achieving all project objectives within the allocated time frame.

D) May be used instead of AHP if time is limited.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

30

The simple scoring model has this advantage over a checklist model for screening projects.

A) Scaling from 1 to 5 is extremely accurate.

B) Scaling models ensure a reasonable link between the selected and weighted criteria and the business objectives that motivated their selection.

C) Scaling models allow decision makers to treat one criterion as more important than another.

D) Scaling models have been proven to make correct decisions better than 95% of the time while checklists only achieve 80% accuracy.

A) Scaling from 1 to 5 is extremely accurate.

B) Scaling models ensure a reasonable link between the selected and weighted criteria and the business objectives that motivated their selection.

C) Scaling models allow decision makers to treat one criterion as more important than another.

D) Scaling models have been proven to make correct decisions better than 95% of the time while checklists only achieve 80% accuracy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

31

What are the advantages and limitations of simple scoring models?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

32

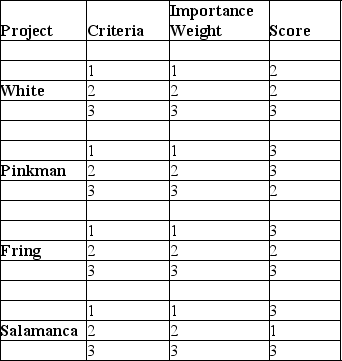

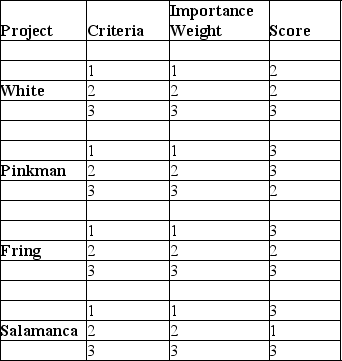

A project manager is using a simple scoring model to decide which of four projects is best,given the company's limited resources.The criteria,importance weights,and scores for each are shown in the table.Which project should be chosen?

A) Project White

B) Project Pinkman

C) Project Fring

D) Project Salamanca

A) Project White

B) Project Pinkman

C) Project Fring

D) Project Salamanca

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

33

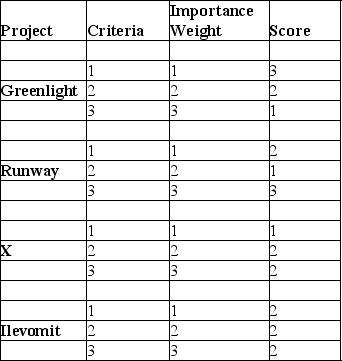

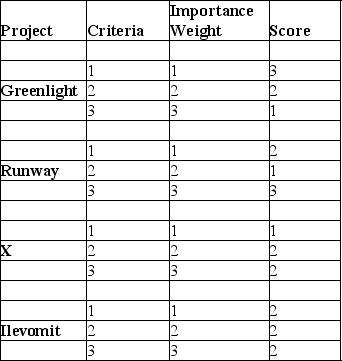

A project manager is using a simple scoring model to decide which of four projects is best,given the company's limited resources.The criteria,importance weights,and scores for each are shown in the table.Which project should be chosen?

A) Project Greenlight

B) Project Runway

C) Project X

D) Project Ilevomit

A) Project Greenlight

B) Project Runway

C) Project X

D) Project Ilevomit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

34

A simple scoring model is used to decide among three projects that we'll call A,B,and C.The total score for project A is 30,for project B is 20,and for project C is 10.Which of the following statements is BEST?

A) If project A is successfully completed, it will yield three times the benefits that project C would have provided.

B) If project C is chosen, the company would benefit only half as much as if they had chosen project B.

C) Project C is better than project B for this company at this point in time.

D) Project A is better than project B for this company at this point in time.

A) If project A is successfully completed, it will yield three times the benefits that project C would have provided.

B) If project C is chosen, the company would benefit only half as much as if they had chosen project B.

C) Project C is better than project B for this company at this point in time.

D) Project A is better than project B for this company at this point in time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

35

How does a checklist project screening model work?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

36

The Analytic Hierarchy Process is being employed in a project selection decision.One major criteria,cost,receives a weighting value of 40%,which is split into short term (50%),intermediate term (30%),and long term (20%).Which of these statements is BEST?

A) Short term, intermediate term, and long term must receive overall weightings that total 100%.

B) There must be at least one other major criteria that has 40% weighting.

C) Intermediate-term cost receives a weighting of 12%.

D) Long-term cost receives an overall weighting of 80%.

A) Short term, intermediate term, and long term must receive overall weightings that total 100%.

B) There must be at least one other major criteria that has 40% weighting.

C) Intermediate-term cost receives a weighting of 12%.

D) Long-term cost receives an overall weighting of 80%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

37

Describe any four types of risk that projects may hold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

38

A simple scoring model for project evaluation requires:

A) Importance weights from 1 to 10 assigned to each criterion.

B) Score values assigned to each criterion in terms of its rating.

C) A division of weights by scores to arrive at a standardized score for each criterion.

D) A summation for each criterion to achieve an overall criterion score.

A) Importance weights from 1 to 10 assigned to each criterion.

B) Score values assigned to each criterion in terms of its rating.

C) A division of weights by scores to arrive at a standardized score for each criterion.

D) A summation for each criterion to achieve an overall criterion score.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

39

The first step in the Analytical Hierarchy Process:

A) Requires supporting requirements to be combined into Level II challenges.

B) Is analyzing the process you intend to improve before undertaking any improvement project.

C) Requires Saatyfication of the team members.

D) Consists of constructing a hierarchy of criteria and subcriteria.

A) Requires supporting requirements to be combined into Level II challenges.

B) Is analyzing the process you intend to improve before undertaking any improvement project.

C) Requires Saatyfication of the team members.

D) Consists of constructing a hierarchy of criteria and subcriteria.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

40

Provide an example of a numeric and non-numeric project selection model and indicate what advantage each might hold over the other.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

41

Which of these statements about internal rate of return analysis is BEST?

A) If the IRR is less than the company's required rate of return, the project is worth funding.

B) Projects having lower IRR are generally superior to those having higher IRR.

C) IRR and NPV calculations always make the same investment recommendations.

D) If net outflows follow a period of net inflows, IRR may give conflicting results.

A) If the IRR is less than the company's required rate of return, the project is worth funding.

B) Projects having lower IRR are generally superior to those having higher IRR.

C) IRR and NPV calculations always make the same investment recommendations.

D) If net outflows follow a period of net inflows, IRR may give conflicting results.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

42

How does the Analytical Hierarchy Process differ from a simple scoring model? Is it worth the extra effort?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

43

Describe the use of a profile model and sketch an example,clearly labeling every component and the best alternative in your example.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

44

The present value of money is lower the further out in the future I expect to spend it.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

45

Which statement about the use of the profile model is BEST?

A) The profile model requires careful calculation of the percentage risk for each possible project.

B) The scale used for the profile model can be any two numerical variables that a company deems important.

C) The efficient frontier in the profile model is where return is 100% (or greater) and risk is 0%.

D) For a given level of risk, a positive move on the return axes would indicate a superior project.

A) The profile model requires careful calculation of the percentage risk for each possible project.

B) The scale used for the profile model can be any two numerical variables that a company deems important.

C) The efficient frontier in the profile model is where return is 100% (or greater) and risk is 0%.

D) For a given level of risk, a positive move on the return axes would indicate a superior project.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

46

The Analytical Hierarchy Process is used to decide among three projects that we'll call A,B,and C.The total score for project A is .650,for project B is .514,and for project C is .321.Which of the following statements is BEST?

A) Project A is twice as good as project C.

B) The analysis must be incorrect because the total scores should sum to 1.00.

C) The analysis must be incorrect because there are two total scores that exceed 0.50.

D) The analysis must be incorrect because project C's total score is odd.

A) Project A is twice as good as project C.

B) The analysis must be incorrect because the total scores should sum to 1.00.

C) The analysis must be incorrect because there are two total scores that exceed 0.50.

D) The analysis must be incorrect because project C's total score is odd.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

47

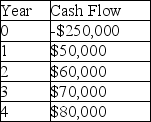

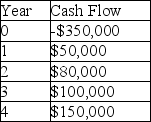

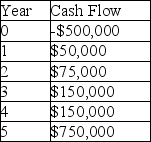

A project manager is using the payback method to make the final decision on which project to undertake.The company has a 10% required rate of return and expects a 4% rate of inflation for the following four years.What is the non-discounted payback of a project that has cash flows as shown in the table?

A) 3.875 years

B) 3.625 years

C) 3.750 years

D) 3.500 years

A) 3.875 years

B) 3.625 years

C) 3.750 years

D) 3.500 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

48

The profile model plots a graph on a(n):

A) Perception-reality pair of axes.

B) Risk-return pair of axes.

C) Efficiency-effectiveness pair of axes.

D) Saxon-Norman pair of axes.

A) Perception-reality pair of axes.

B) Risk-return pair of axes.

C) Efficiency-effectiveness pair of axes.

D) Saxon-Norman pair of axes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

49

A project manager is using the internal rate of return method to make the final decision on which project to undertake.Which of these four projects has the highest internal rate of return?

A) $100,000 initial outlay with $10,000 cash inflows during the first two years, $20,000 during the third and fourth years, and $30,000 during the fifth year

B) $100,000 initial outlay with a $5,000 cash inflow during the first year, $15,000 cash inflow during the second year, and $25,000 cash inflows during years three through five

C) $75,000 initial outlay with a $5,000 cash inflow during the first year, increasing by $5,000 per year through the fifth year

D) $50,000 initial outlay with $5,000 cash inflows during the first two years, $15,000 during the third and fourth years, and $20,000 during the fifth year

A) $100,000 initial outlay with $10,000 cash inflows during the first two years, $20,000 during the third and fourth years, and $30,000 during the fifth year

B) $100,000 initial outlay with a $5,000 cash inflow during the first year, $15,000 cash inflow during the second year, and $25,000 cash inflows during years three through five

C) $75,000 initial outlay with a $5,000 cash inflow during the first year, increasing by $5,000 per year through the fifth year

D) $50,000 initial outlay with $5,000 cash inflows during the first two years, $15,000 during the third and fourth years, and $20,000 during the fifth year

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

50

Between projects A and B,project A will be considered a superior financial undertaking if it has:

A) A shorter payback period than project B.

B) A lower average rate of return than project B.

C) A lower net present value than project B.

D) A longer payback period than project B.

A) A shorter payback period than project B.

B) A lower average rate of return than project B.

C) A lower net present value than project B.

D) A longer payback period than project B.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

51

A project manager is using the internal rate of return method to make the final decision on which project to undertake.Which of these four projects has the highest internal rate of return?

A) $25,000 initial outlay with $10,000 cash inflows during the following five years

B) $12,500 initial outlay with $10,000 cash inflows during the following five years

C) $25,000 initial outlay with $5,000 cash inflows during the following five years

D) $12,500 initial outlay with $5,000 cash inflows during the following five years

A) $25,000 initial outlay with $10,000 cash inflows during the following five years

B) $12,500 initial outlay with $10,000 cash inflows during the following five years

C) $25,000 initial outlay with $5,000 cash inflows during the following five years

D) $12,500 initial outlay with $5,000 cash inflows during the following five years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

52

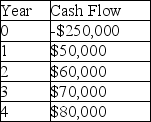

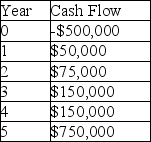

A project manager is using the net present value method to make the final decision on which project to undertake.The company has a 12% required rate of return and expects a 3% rate of inflation for the following four years.What is the NPV of a project that has cash flows as shown in the table?

A) -$9,762

B) -$56,859

C) -$69,387

D) -$98,780

A) -$9,762

B) -$56,859

C) -$69,387

D) -$98,780

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

53

Internal rate of return is preferable to net present value because IRR employs a weighted average cost of capital discount rate that reflects potential reinvestment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

54

The reciprocal of the payback period is used to calculate the average rate of return for a project.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

55

Which of these statements about valuation models is NOT correct?

A) NPV employs a weighted average cost of capital discount rate that reflects potential reinvestment.

B) IRR and NPV calculations typically make the same investment recommendations only when the projects are independent of each other.

C) If cash flows are not normal, IRR may arrive at multiple solutions.

D) IRR is a more robust determinant of project viability than NPV.

A) NPV employs a weighted average cost of capital discount rate that reflects potential reinvestment.

B) IRR and NPV calculations typically make the same investment recommendations only when the projects are independent of each other.

C) If cash flows are not normal, IRR may arrive at multiple solutions.

D) IRR is a more robust determinant of project viability than NPV.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

56

A company facing an interest rate of 8% must choose among projects offering the following four-year cash flows.If the company is employing the net present value criterion,which project should they choose?

A) $25,000 in year 1; $15,000 in year 2; $10,000 in year 3; and $5,000 in year 4

B) $5,000 in year 1; $5,000 in year 2; $20,000 in year 3; and $30,000 in year 4

C) $15,000 in year 1; $15,000 in year 2; $15,000 in year 3; and $15,000 in year 4

D) $5,000 in year 1; $5,000 in year 2; $25,000 in year 3; and $25,000 in year 4

A) $25,000 in year 1; $15,000 in year 2; $10,000 in year 3; and $5,000 in year 4

B) $5,000 in year 1; $5,000 in year 2; $20,000 in year 3; and $30,000 in year 4

C) $15,000 in year 1; $15,000 in year 2; $15,000 in year 3; and $15,000 in year 4

D) $5,000 in year 1; $5,000 in year 2; $25,000 in year 3; and $25,000 in year 4

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

57

Net present value is being used to break the tie among four otherwise equal projects.If the interest rate is 4%,which of these anticipated four-year flows would yield the greatest net present value?

A) $10,000 in year 1; $11,000 in year 2; $12,000 in year 3; and $13,000 in year 4

B) $13,000 in year 1; $12,000 in year 2; $11,000 in year 3; and $10,000 in year 4

C) $10,000 in year 1; $10,000 in year 2; $13,000 in year 3; and $13,000 in year 4

D) $11,000 in year 1; $11,000 in year 2; $12,000 in year 3; and $12,000 in year 4

A) $10,000 in year 1; $11,000 in year 2; $12,000 in year 3; and $13,000 in year 4

B) $13,000 in year 1; $12,000 in year 2; $11,000 in year 3; and $10,000 in year 4

C) $10,000 in year 1; $10,000 in year 2; $13,000 in year 3; and $13,000 in year 4

D) $11,000 in year 1; $11,000 in year 2; $12,000 in year 3; and $12,000 in year 4

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

58

The efficient frontier in a profile model is the set of options that offers a maximum return for a given level of risk or a minimum risk for every level of return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

59

The Analytical Hierarchy Process elegantly addresses scaling issues in criteria and negative utility in alternative scores.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

60

The efficient frontier in project management is the set of portfolio options that offer:

A) A minimum return for a minimum risk.

B) A minimum return for a maximum risk.

C) A maximum return for a minimum risk.

D) A maximum return for a maximum risk.

A) A minimum return for a minimum risk.

B) A minimum return for a maximum risk.

C) A maximum return for a minimum risk.

D) A maximum return for a maximum risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

61

What is an internal rate of return and what advantages and disadvantages are accrued by using it to evaluate projects?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

62

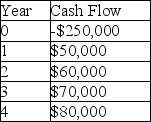

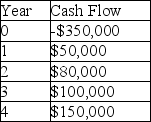

A project manager is using the net present value method to make the final decision on which project to undertake.The company has a 15% required rate of return and expects a 5% rate of inflation for the following four years.What is the NPV of a project that has cash flows as shown in the table?

A) $4.955

B) $42,586

C) -$23,667

D) -$122,569

A) $4.955

B) $42,586

C) -$23,667

D) -$122,569

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

63

A project with the chance for a big payout may be funded if an important criterion is:

A) Cost.

B) Opportunity.

C) Top management pressure.

D) Risk.

A) Cost.

B) Opportunity.

C) Top management pressure.

D) Risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

64

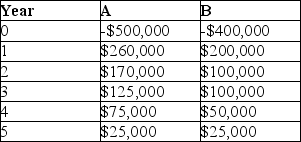

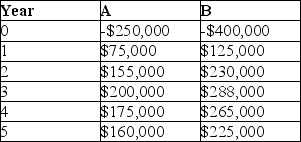

Inatech is contemplating two different projects and decides to perform a financial analysis to determine which is more financially lucrative.Project A and B have the cash flows as shown and Inatech uses a required rate of return of 8%.Compute the internal rate of return for both projects to determine which is worth of funding.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

65

What is the time value of money principle and how does it apply to project selection?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

66

A project that is exceptionally risky might still be undertaken by a firm if they have several other projects underway that are considered more of a sure thing.This approach to project selection is BEST described by the criterion called:

A) Strategic "fit."

B) Risk.

C) Desire for portfolio balance.

D) Top management pressure.

A) Strategic "fit."

B) Risk.

C) Desire for portfolio balance.

D) Top management pressure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

67

What two simple rules should be followed when choosing a project selection approach?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

68

The systematic process of selecting,supporting,and managing a firm's collection of projects is called:

A) Heavyweight project management.

B) Matrix project organization.

C) Profile management.

D) Project portfolio management.

A) Heavyweight project management.

B) Matrix project organization.

C) Profile management.

D) Project portfolio management.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

69

An options model could be used when financial criteria would change significantly over time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

70

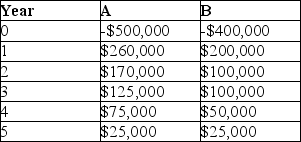

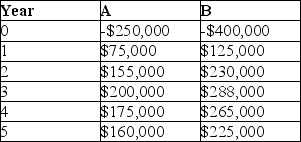

Inatech is contemplating two different projects and decides to perform a financial analysis to determine which is more financially lucrative.Project A and B have the cash flows as shown and Inatech uses a required rate of return of 10% and an inflation rate of 4%.Compute the payback in years and the net present value for both projects and offer advice as to the best course of action.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

71

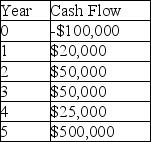

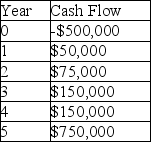

A project manager is using the payback method to make the final decision on which project to undertake.The company has a 10% required rate of return and expects a 4% rate of inflation for the following five years.What is the discounted payback of a project that has cash flows as shown in the table?

A) 3.4 years

B) 2.6 years

C) 5.0 years

D) 4.2 years

A) 3.4 years

B) 2.6 years

C) 5.0 years

D) 4.2 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

72

Options models are used to assist in project selection decisions:

A) When IRR calculations are favorable but NPV calculations are unfavorable.

B) When a company may not recover the money it invests in a project.

C) When NPV calculations are favorable but IRR calculations are unfavorable.

D) When a company is guaranteed to recover the money it invests in a project.

A) When IRR calculations are favorable but NPV calculations are unfavorable.

B) When a company may not recover the money it invests in a project.

C) When NPV calculations are favorable but IRR calculations are unfavorable.

D) When a company is guaranteed to recover the money it invests in a project.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

73

The concept of project portfolio management holds that firms should:

A) Regard all projects as unified assets.

B) Manage projects as independent entities.

C) Focus on short-term strategic goals.

D) Focus on long-term constraints.

A) Regard all projects as unified assets.

B) Manage projects as independent entities.

C) Focus on short-term strategic goals.

D) Focus on long-term constraints.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

74

What are options models and when should they be used to evaluate projects? Provide an example.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

75

The most important thing to remember when using project selection models is to be consistent and objective.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

76

Evaluating projects in terms of their strategic fit with existing project lines or their ability to augment the current product family is known as:

A) Balance.

B) An open criterion.

C) Weighted criterion.

D) Complementarity.

A) Balance.

B) An open criterion.

C) Weighted criterion.

D) Complementarity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

77

Regardless of which selection method a firm uses,it should always:

A) Be able to predict how much revenue will be returned to the firm each year.

B) Know which project will ultimately succeed and which ones will fail.

C) Be objective in their selection method.

D) Use a weighted scoring technique.

A) Be able to predict how much revenue will be returned to the firm each year.

B) Know which project will ultimately succeed and which ones will fail.

C) Be objective in their selection method.

D) Use a weighted scoring technique.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

78

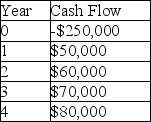

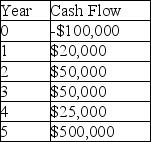

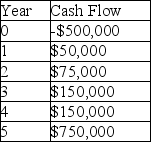

A project manager is using the payback method to make the final decision on which project to undertake.The company has a 10% required rate of return and expects a 4% rate of inflation for the following five years.What is the non-discounted payback of a project that has cash flows as shown in the table?

A) 3.7 years

B) 4.1 years

C) 5.0 years

D) 4.8 years

A) 3.7 years

B) 4.1 years

C) 5.0 years

D) 4.8 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

79

How can a payback period approach be used to evaluate potential projects?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

80

A project manager is using the payback method to make the final decision on which project to undertake.The company has a 15% required rate of return and expects a 5% rate of inflation for the following five years.What is the discounted payback of a project that has cash flows as shown in the table?

A) 3.9 years

B) 4.3 years

C) 4.6 years

D) 4.1 years

A) 3.9 years

B) 4.3 years

C) 4.6 years

D) 4.1 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck