Deck 14: Economic and Social Policy

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/96

العب

ملء الشاشة (f)

Deck 14: Economic and Social Policy

1

Monetary policy is a shared exercise between the national government and the states.

False

2

Social Security is the least popular social program in the United States.

False

3

The Federal Reserve Board is in charge of fiscal policy in the United States.

False

4

Implementation of a public policy is an ongoing process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

5

Democrats have traditionally sought to change the Social Security system to partial privatization so that the trust fund does not decrease and go bankrupt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

6

Economic regulations created by government officials have a limited impact on the economy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

7

Poverty in America

A) has been addressed by federal officials since 1789.

B) has never been addressed by federal officials.

C) was first addressed by federal officials after the Civil War.

D) was first addressed by federal officials in the 1930s.

A) has been addressed by federal officials since 1789.

B) has never been addressed by federal officials.

C) was first addressed by federal officials after the Civil War.

D) was first addressed by federal officials in the 1930s.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

8

U.S. government officials first made full employment an explicit goal of their economic

policy in 1998.

policy in 1998.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

9

The U.S. Department of Education was created in 1862.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

10

The ownership society articulated by President George W. Bush included partially privatizing Social Security.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

11

Payroll taxes are progressive.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

12

Interest on the debt is mandatory spending.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

13

The age to receive full benefits for retirement in the Social Security program was increased

from 65 to 75 in 2005.

from 65 to 75 in 2005.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

14

Budgetary power shifted from the president to Congress in 1921.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

15

The assassination of President John F. Kennedy led to the passage of gun control legislation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

16

President Ronald Reagan embraced Keynesian economics in the 1980s.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

17

Fiscal policy has redistributive implications.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

18

Federal policy makers have a plan in place to address the baby boomers and Social Security.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

19

Each woman, man, and child in the United States carries, in effect, less than $4,500 of the

national debt.

national debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

20

The Federal-State Unemployment Compensation Program was established in 1965 as part of the creation of Medicare.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

21

Keynesian economics was developed in the ________.

A) 1780s

B) 1840s

C) 1930s

D) 1970s

A) 1780s

B) 1840s

C) 1930s

D) 1970s

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which one of the following statements is accurate?

A) The U.S. Treasury Department distributes money to banks in the Federal Reserve System.

B) The U.S. Treasury Department produces currency and coins.

C) The U.S. Treasury Department is in charge of monetary policy.

D) The Fed is in charge of fiscal policy.

A) The U.S. Treasury Department distributes money to banks in the Federal Reserve System.

B) The U.S. Treasury Department produces currency and coins.

C) The U.S. Treasury Department is in charge of monetary policy.

D) The Fed is in charge of fiscal policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which one of the following statements is accurate?

Which one of the following statements is accurate?A) Budget deficits are cumulative figures over time.

B) Budget deficits are figures in a given fiscal year.

C) The national debt is a figure in a given fiscal year.

D) Borrowing money over time reduces the national debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

24

The theory that lowering taxes will stimulate the economy because of increased investment and spending among the public is called

A) Keynesian economics.

B) fiscal federalism.

C) supply-side economics.

D) central economic planning.

A) Keynesian economics.

B) fiscal federalism.

C) supply-side economics.

D) central economic planning.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

25

The U.S. economy begins to experience rapid inflation. The MOST likely short-term response would be

A) the Commerce Department issues price-control regulations.

B) the Federal Reserve Bank raises interest rates.

C) Congress passes tax increases.

D) the president asks business leaders to hold salaries steady.

A) the Commerce Department issues price-control regulations.

B) the Federal Reserve Bank raises interest rates.

C) Congress passes tax increases.

D) the president asks business leaders to hold salaries steady.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

26

During the nation's economic crisis in 2008-2009, what would a proponent of Keynesian economics have done?

A) supported the government's entire $787 billion stimulus plan of tax cuts and government spending

B) supported the stimulus plan's tax cuts but not the increases in government spending

C) opposed the stimulus plan's tax cuts but supported the increases in government spending

D) opposed the government's entire stimulus plan because it added to the federal debt

A) supported the government's entire $787 billion stimulus plan of tax cuts and government spending

B) supported the stimulus plan's tax cuts but not the increases in government spending

C) opposed the stimulus plan's tax cuts but supported the increases in government spending

D) opposed the government's entire stimulus plan because it added to the federal debt

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

27

Generally, when do members of Congress create their own budget?

A) when there is unified party government

B) when there is divided party government

C) when federal judges order them to do so

D) when the chair of the Federal Reserve orders them to do so

A) when there is unified party government

B) when there is divided party government

C) when federal judges order them to do so

D) when the chair of the Federal Reserve orders them to do so

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

28

Each person (adult and child alike) carries more than ________ of federal debt.

A) $4,500

B) $21,000

C) $47,000

D) $1.5 million

A) $4,500

B) $21,000

C) $47,000

D) $1.5 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

29

What did the Employment Act of 1946 do?

A) provided higher-education assistance to 7.8 million World War II veterans

B) created new regulations and safeguards to protect against inflation

C) guaranteed all Americans the right to unemployment insurance

D) created the Council of Economic Advisers and made full employment a goal of economic policy

A) provided higher-education assistance to 7.8 million World War II veterans

B) created new regulations and safeguards to protect against inflation

C) guaranteed all Americans the right to unemployment insurance

D) created the Council of Economic Advisers and made full employment a goal of economic policy

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

30

What does the gross domestic product (GDP) measure?

A) the annual difference between a country's imported goods and exported goods

B) a country's economic output and activity

C) the country's total annual sales of manufactured goods

D) the goods consumed in the nation over a year

A) the annual difference between a country's imported goods and exported goods

B) a country's economic output and activity

C) the country's total annual sales of manufactured goods

D) the goods consumed in the nation over a year

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

31

State governments

A) have a central role in education and welfare.

B) have a central role in monetary policy.

C) do not administer federal programs.

D) have no role in education since the passage of the No Child Left Behind law.

A) have a central role in education and welfare.

B) have a central role in monetary policy.

C) do not administer federal programs.

D) have no role in education since the passage of the No Child Left Behind law.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which one of the following is an example of mandatory spending in the federal budget?

A) funding for the national park and forest systems

B) national security expenditures for the Department of Homeland Security

C) an entitlement program such as Social Security

D) funding for the National Aeronautics and Space Administration (NASA)

A) funding for the national park and forest systems

B) national security expenditures for the Department of Homeland Security

C) an entitlement program such as Social Security

D) funding for the National Aeronautics and Space Administration (NASA)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

33

When the Budget and Accounting Act of 1921 was passed,

A) the budgetary process was centralized within Congress.

B) budgetary power shifted from the states to the national government.

C) budgetary power shifted from Congress to the president.

D) budgetary power shifted from the president to Congress.

A) the budgetary process was centralized within Congress.

B) budgetary power shifted from the states to the national government.

C) budgetary power shifted from Congress to the president.

D) budgetary power shifted from the president to Congress.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

34

The philosophy of using tax cuts and increased government spending during a recession was developed by ________.

A) John Maynard Keynes

B) Milton Friedman

C) Friedrich Hayek

D) Arthur Laffer

A) John Maynard Keynes

B) Milton Friedman

C) Friedrich Hayek

D) Arthur Laffer

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

35

________ was a staunch advocate of supply-side economics.

A) Ronald Reagan

B) Tip O'Neill

C) Ted Kennedy

D) Jimmy Carter

A) Ronald Reagan

B) Tip O'Neill

C) Ted Kennedy

D) Jimmy Carter

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

36

When there is too much money flowing and too few goods, it is likely to lead to

A) tax cuts.

B) a rise in taxes.

C) an interest rate cut.

D) inflation.

A) tax cuts.

B) a rise in taxes.

C) an interest rate cut.

D) inflation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

37

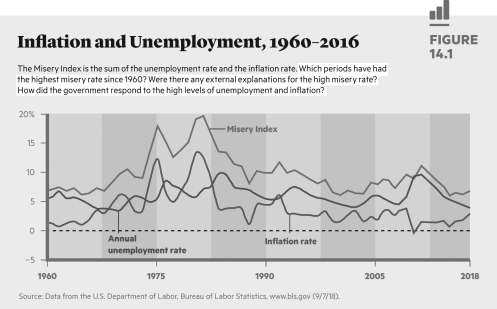

The Misery Index is based on

The Misery Index is based onA) a stagnant economy with inflation.

B) the sum of the inflation rate and the unemployment rate.

C) increases in the cost of living combined with slow growth in the nation's gross domestic product (GDP).

D) the nation's income inequality rate combined with various quality-of-life indicators.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

38

During the Reagan presidency, taxes and spending fell as a share of the overall economy. What was the result?

A) budget surpluses that gradually helped pay off the federal debt

B) a balanced federal budget by the end of Reagan's presidency

C) no major changes in the nation's annual deficits or overall debt

D) continued budget deficits and a significant increase in the nation's federal debt

A) budget surpluses that gradually helped pay off the federal debt

B) a balanced federal budget by the end of Reagan's presidency

C) no major changes in the nation's annual deficits or overall debt

D) continued budget deficits and a significant increase in the nation's federal debt

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

39

Taxing and spending decisions are known as ________ policy.

A) punitive

B) mandatory

C) monetary

D) fiscal

A) punitive

B) mandatory

C) monetary

D) fiscal

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

40

________ and Ronald Reagan had a similar approach to fiscal policy.

A) Jimmy Carter

B) Barack Obama

C) George W. Bush

D) Bill Clinton

A) Jimmy Carter

B) Barack Obama

C) George W. Bush

D) Bill Clinton

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

41

If the Fed governors wanted to put downward pressure on the FFR, they would likely

A) sell government bonds to banks.

B) purchase government bonds from banks.

C) increase the reserve requirement.

D) increase the discount rate.

A) sell government bonds to banks.

B) purchase government bonds from banks.

C) increase the reserve requirement.

D) increase the discount rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

42

Fewer than ________ percent of Americans are living in poverty according to the current measure.

A) 5

B) 14

C) 28

D) 43

A) 5

B) 14

C) 28

D) 43

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

43

The Fed can be characterized as ________.

A) politically dependent on Congress.

B) politically dependent on the president.

C) politically independent.

D) a very weak body that has no power to influence the domestic economy.

A) politically dependent on Congress.

B) politically dependent on the president.

C) politically independent.

D) a very weak body that has no power to influence the domestic economy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

44

The specific interest rate that banks pay each other for emergency overnight loans is called

A) an emergency loan rate.

B) an overnight loan rate.

C) a federal reserve rate.

D) a federal funds rate.

A) an emergency loan rate.

B) an overnight loan rate.

C) a federal reserve rate.

D) a federal funds rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

45

Why was the Interstate Commerce Commission created in 1887?

A) to promote Prohibition

B) to promote morality

C) to regulate railroads

D) to regulate the environment

A) to promote Prohibition

B) to promote morality

C) to regulate railroads

D) to regulate the environment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

46

Which one of the following is an example of a progressive tax?

A) the income tax

B) the payroll tax

C) the gas tax

D) the cigarette tax

A) the income tax

B) the payroll tax

C) the gas tax

D) the cigarette tax

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

47

The logic behind lowering interest rates is to

A) decrease the amount of money being borrowed.

B) lower inflation.

C) increase the amount of money being borrowed.

D) encourage people to buy government bonds.

A) decrease the amount of money being borrowed.

B) lower inflation.

C) increase the amount of money being borrowed.

D) encourage people to buy government bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

48

The reserve requirement requires

A) the federal government to insure all bank deposits of up to $250,000.

B) the Federal Reserve to hold a minimum amount of gold and precious metals.

C) the Treasury Department to reserve a portion of U.S. currency in the event of a

National emergency.

D) banks to have a certain amount of money on hand to back up their assets.

A) the federal government to insure all bank deposits of up to $250,000.

B) the Federal Reserve to hold a minimum amount of gold and precious metals.

C) the Treasury Department to reserve a portion of U.S. currency in the event of a

National emergency.

D) banks to have a certain amount of money on hand to back up their assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

49

The Fed's ultimately accountability is to ________.

A) Congress

B) the president

C) itself

D) government regulators

A) Congress

B) the president

C) itself

D) government regulators

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

50

The ________ put many people to work during the Great Depression.

A) Agricultural Adjustment Act

B) Federal Emergency Relief Administration

C) Civilian Conservation Corps

D) Jobs Training and Partnership Act

A) Agricultural Adjustment Act

B) Federal Emergency Relief Administration

C) Civilian Conservation Corps

D) Jobs Training and Partnership Act

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

51

The specific interest rate that banks pay to the Federal Reserve Bank for short-term loans is called

A) a short-term rate.

B) a discount rate.

C) an emergency loan rate.

D) a federal reserve rate.

A) a short-term rate.

B) a discount rate.

C) an emergency loan rate.

D) a federal reserve rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

52

________ was largely responsible for expanding Medicare to include a prescription drug benefit.

A) Lyndon Johnson

B) Richard Nixon

C) Bill Clinton

D) George W. Bush

A) Lyndon Johnson

B) Richard Nixon

C) Bill Clinton

D) George W. Bush

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

53

The Sherman Antitrust Act led to the dissolution of the ________ monopoly.

A) coal

B) oil

C) railroad

D) telegraph

A) coal

B) oil

C) railroad

D) telegraph

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

54

Which one of the following programs was NOT created during the New Deal?

A) Medicare

B) Social Security

C) Agricultural Adjustment Administration

D) Civilian Conservation Corps

A) Medicare

B) Social Security

C) Agricultural Adjustment Administration

D) Civilian Conservation Corps

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

55

Payroll taxes (Social Security and Medicare) are ________.

A) progressive

B) not redistributive

C) discretionary

D) regressive

A) progressive

B) not redistributive

C) discretionary

D) regressive

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

56

One of the first social welfare programs enacted by the federal government was financial assistance to veterans of ________.

A) the Civil War

B) World War I

C) the Spanish American War

D) World War II

A) the Civil War

B) World War I

C) the Spanish American War

D) World War II

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

57

The Great Society was a set of social policies developed by President ________.

A) Franklin Roosevelt

B) Lyndon Johnson

C) Harry Truman

D) John F. Kennedy

A) Franklin Roosevelt

B) Lyndon Johnson

C) Harry Truman

D) John F. Kennedy

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

58

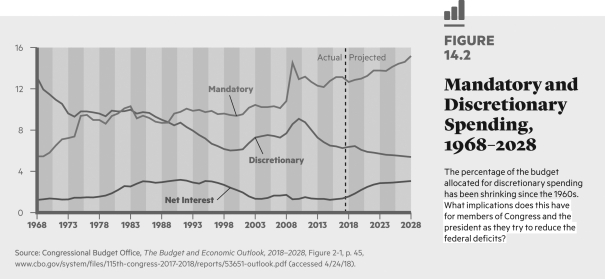

Which one of the following constitutes the highest portion of expenditures in the national budget?

Which one of the following constitutes the highest portion of expenditures in the national budget?A) discretionary spending

B) mandatory spending

C) net interest

D) acutal/projected

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

59

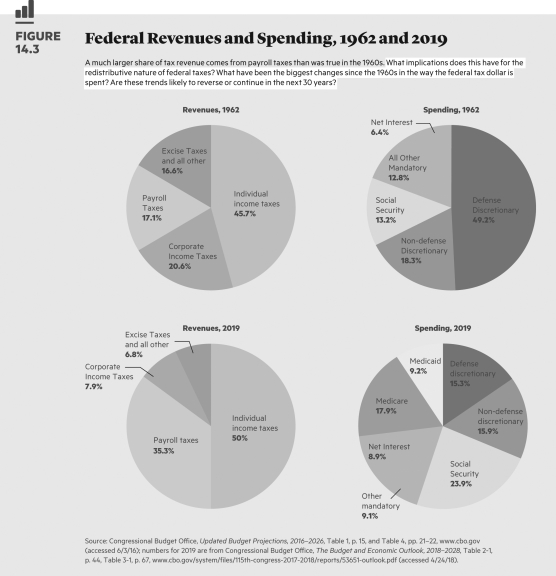

Which one of the following statements is accurate?

Which one of the following statements is accurate?A) The proportion of revenue received from payroll taxes is much lower today than in the early 1960s.

B) The proportion of revenue received from corporate income taxes is much less today than in the early 1960s.

C) The proportion of spending on the net interest on the debt is much higher today than it was in the early 1960s.

D) The proportion of spending on Social Security is lower today than in the early 1960s.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

60

Government assistance, usually in the form of financial assistance, to individuals in need is called ________.

A) block grants

B) welfare

C) Medicare

D) Social Security

A) block grants

B) welfare

C) Medicare

D) Social Security

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

61

About ________ percent of the elderly in America live in poverty.

A) 10

B) 27

C) 33

D) 50

A) 10

B) 27

C) 33

D) 50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

62

What was one of the consequences of No Child Left Behind?

A) increased federal funding for education

B) expanded Head Start to every school district

C) national accountability and testing requirements in every school district

D) decreased federal funding for education

A) increased federal funding for education

B) expanded Head Start to every school district

C) national accountability and testing requirements in every school district

D) decreased federal funding for education

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

63

Which one of the following was a component of President George W. Bush's plan to scale back social programs?

A) end the War on Poverty

B) add a prescription drug plan to Medicare

C) eliminate Medicaid

D) privatize portions of Social Security

A) end the War on Poverty

B) add a prescription drug plan to Medicare

C) eliminate Medicaid

D) privatize portions of Social Security

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

64

What is a major critique of partial and full privatization of Social Security?

A) Recipients will receive less money.

B) The federal government gets to decide which private investments are made.

C) State governments would tax profits made from private investments.

D) Transition to privatization would be expensive.

A) Recipients will receive less money.

B) The federal government gets to decide which private investments are made.

C) State governments would tax profits made from private investments.

D) Transition to privatization would be expensive.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

65

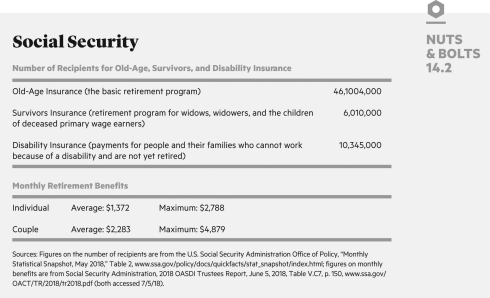

Social Security

Social SecurityA) does not cover disabilities.

B) does not cover those who have survived the death of a loved one.

C) provides benefits to more than 62 million people.

D) provides an average monthly benefit of over $5,000 for most people.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

66

Why is the retirement of the baby-boom generation considered a problem for the future of Social Security?

A) More retirees mean more people on Medicare, which shares a funding pool with Social Security.

B) Retirees tend to cluster in certain states, which means that the states they are moving from will lose the benefits of their Social Security payments.

C) Social Security functions best when there are fewer workers and more retirees, thus increasing support for the program.

D) Retiring baby boomers will reduce the number of workers per retiree and strain the financial resources of the program.

A) More retirees mean more people on Medicare, which shares a funding pool with Social Security.

B) Retirees tend to cluster in certain states, which means that the states they are moving from will lose the benefits of their Social Security payments.

C) Social Security functions best when there are fewer workers and more retirees, thus increasing support for the program.

D) Retiring baby boomers will reduce the number of workers per retiree and strain the financial resources of the program.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

67

Funding for the Great Society was quickly threatened by ________.

A) income tax cuts passed by Congress

B) World War I

C) the Korean War

D) the Vietnam War

A) income tax cuts passed by Congress

B) World War I

C) the Korean War

D) the Vietnam War

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

68

Which one of the following statements is accurate about Medicaid?

A) It is a health care program for the elderly.

B) It is an entitlement.

C) It is a program than mandates federal control over the states.

D) It is a program that operates on a healthy surplus.

A) It is a health care program for the elderly.

B) It is an entitlement.

C) It is a program than mandates federal control over the states.

D) It is a program that operates on a healthy surplus.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

69

Social Security

A) creates class conflict.

B) is very inefficient and wasteful.

C) has helped to reduce poverty.

D) has a 10 percent tax on all income.

A) creates class conflict.

B) is very inefficient and wasteful.

C) has helped to reduce poverty.

D) has a 10 percent tax on all income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

70

Overall, Americans spend ________ on health care compared to the rest of the world.

A) much more

B) a little more

C) a little less

D) much less

A) much more

B) a little more

C) a little less

D) much less

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

71

No Child Left Behind is an example of education policy

A) becoming more controlled by state and local governments.

B) becoming more controlled by the federal government.

C) increasingly being funded by the federal government.

D) passed during the Great Society.

A) becoming more controlled by state and local governments.

B) becoming more controlled by the federal government.

C) increasingly being funded by the federal government.

D) passed during the Great Society.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

72

What do most policy experts say about the future of the Social Security system?

A) The system's collection and allocation of funds will be the same.

B) The amount of funds coming into the system will increase, because the number of people working is increasing dramatically.

C) The amount of money coming into the system will decrease, because the number of people retiring is increasing dramatically.

D) It will cease to exist, because the Social Security Act of 1935 is scheduled to expire in 2050.

A) The system's collection and allocation of funds will be the same.

B) The amount of funds coming into the system will increase, because the number of people working is increasing dramatically.

C) The amount of money coming into the system will decrease, because the number of people retiring is increasing dramatically.

D) It will cease to exist, because the Social Security Act of 1935 is scheduled to expire in 2050.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

73

The purpose of the Land Grant College Act was to

A) build more colleges and universities during the nineteenth century.

B) build more colleges after World War II.

C) establish colleges that would promote education in areas such as business and finance.

D) establish colleges that would promote education in areas such as agriculture and mechanical arts.

A) build more colleges and universities during the nineteenth century.

B) build more colleges after World War II.

C) establish colleges that would promote education in areas such as business and finance.

D) establish colleges that would promote education in areas such as agriculture and mechanical arts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

74

Every president since ________ who attempted comprehensive health care reform failed until Barack Obama.

A) Ulysses S. Grant

B) Theodore Roosevelt

C) Harry Truman

D) Lyndon Johnson

A) Ulysses S. Grant

B) Theodore Roosevelt

C) Harry Truman

D) Lyndon Johnson

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

75

Which one of the following is NOT a recommendation made by public policy experts to keep the Social Security system working effectively?

A) gradually increase the retirement age to 80

B) raise the age requirement to qualify for Social Security

C) lower benefits for nonworking spouses and wealthier individuals

D) raise payroll taxes

A) gradually increase the retirement age to 80

B) raise the age requirement to qualify for Social Security

C) lower benefits for nonworking spouses and wealthier individuals

D) raise payroll taxes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

76

Generally speaking, Medicare provides insurance for ________, while Medicaid provides insurance for ________.

A) government employees; senior citizens

B) senior citizens; the poor

C) the poor; senior citizens

D) senior citizens; government employees

A) government employees; senior citizens

B) senior citizens; the poor

C) the poor; senior citizens

D) senior citizens; government employees

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

77

The Social Security Administration trust fund will not be able to keep up with demand. Projections suggest the program will only be able to pay about ________ percent of its obligated expenditures in 2037.

A) 95

B) 79

C) 52

D) 23

A) 95

B) 79

C) 52

D) 23

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

78

A social policy vision such as George W. Bush's, in which citizens take responsibility for their own social well-being, is called ________.

A) the Second Great Society

B) the New Deal society

C) the ownership society

D) the safety net society

A) the Second Great Society

B) the New Deal society

C) the ownership society

D) the safety net society

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

79

The baby boom generation

A) is set to retire in about 25 years.

B) was born between 1966 and 1986.

C) will pose a financial strain on the Social Security system.

D) has increased the ratio of workers to retirees significantly.

A) is set to retire in about 25 years.

B) was born between 1966 and 1986.

C) will pose a financial strain on the Social Security system.

D) has increased the ratio of workers to retirees significantly.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

80

Although there is some variation, Medicare is a government-sponsored health care program for

A) people living below the poverty line.

B) retired people.

C) all children under the age of 18.

D) the working poor.

A) people living below the poverty line.

B) retired people.

C) all children under the age of 18.

D) the working poor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck