Deck 19: Public Finance: the Economics of Taxation

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/281

العب

ملء الشاشة (f)

Deck 19: Public Finance: the Economics of Taxation

1

Refer to the information provided in Table 19.2 below to answer the question that follows.

Table 19.2

-Refer to Table 19.2. The tax rate structure in this example is

A) proportional.

B) progressive.

C) regressive.

D) marginal.

Table 19.2

-Refer to Table 19.2. The tax rate structure in this example is

A) proportional.

B) progressive.

C) regressive.

D) marginal.

proportional.

2

After subtracting all deductions and exemptions from total income, you are left with

A) taxable income.

B) marginal income.

C) standardized income.

D) the tax base.

A) taxable income.

B) marginal income.

C) standardized income.

D) the tax base.

taxable income.

3

Every tax has two parts: a(n) ________ and a(n) ________.

A) base; rate structure

B) incidence; rate

C) base; incidence

D) rate structure; excess burden

A) base; rate structure

B) incidence; rate

C) base; incidence

D) rate structure; excess burden

base; rate structure

4

The tax rate structure is the

A) measure or value upon which a tax is levied.

B) measure of who pays the tax.

C) study of how taxes change over time.

D) percentage of a tax base that must be paid in taxes.

A) measure or value upon which a tax is levied.

B) measure of who pays the tax.

C) study of how taxes change over time.

D) percentage of a tax base that must be paid in taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

5

The ________ tax rate is the tax rate paid on any additional income earned.

A) average

B) total

C) marginal

D) proportional

A) average

B) total

C) marginal

D) proportional

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

6

A tax whose burden, expressed as a percentage of income, falls as income increases is a

A) regressive tax.

B) progressive tax.

C) proportional tax.

D) benefits-received tax.

A) regressive tax.

B) progressive tax.

C) proportional tax.

D) benefits-received tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

7

A family that earns $20,000 a year pays $400 a year in taxes on clothing. A family that earns $40,000 a year pays $200 a year in taxes on clothing. The tax on clothing is

A) a progressive tax.

B) a regressive tax.

C) a proportional tax.

D) a benefits-received tax.

A) a progressive tax.

B) a regressive tax.

C) a proportional tax.

D) a benefits-received tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

8

A comprehensive tax of 15% on all forms of income with no deductions or exclusions is an example of a

A) proportional tax.

B) progressive tax.

C) regressive tax.

D) rate tax.

A) proportional tax.

B) progressive tax.

C) regressive tax.

D) rate tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

9

The excise tax is

A) progressive.

B) regressive.

C) proportional.

D) an ability-to-pay tax.

A) progressive.

B) regressive.

C) proportional.

D) an ability-to-pay tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

10

A local property tax is a tax on ________, while a tax on your salary is a tax on ________.

A) a flow; a stock

B) a stock; a flow

C) a flow; income

D) a residential holding; a flow

A) a flow; a stock

B) a stock; a flow

C) a flow; income

D) a residential holding; a flow

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

11

A family that earns $20,000 a year pays $200 a year in city wage taxes. A family that earns $40,000 a year pays $1,600 a year in city wage taxes. The city wage tax is

A) a progressive tax.

B) a regressive tax.

C) a proportional tax.

D) a benefits-received tax.

A) a progressive tax.

B) a regressive tax.

C) a proportional tax.

D) a benefits-received tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

12

The largest portion of federal government revenues comes from

A) the individual income tax.

B) excise taxes.

C) social insurance payroll taxes.

D) corporate income taxes.

A) the individual income tax.

B) excise taxes.

C) social insurance payroll taxes.

D) corporate income taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

13

A tax whose burden is the same proportion of income for all households is

A) a regressive tax.

B) a progressive tax.

C) a proportional tax.

D) an equal tax.

A) a regressive tax.

B) a progressive tax.

C) a proportional tax.

D) an equal tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

14

Refer to the information provided in Table 19.3 below to answer the question that follows.

Table 19.3

-Refer to Table 19.3. The tax rate structure in this example is

A) proportional.

B) progressive.

C) regressive.

D) marginal.

Table 19.3

-Refer to Table 19.3. The tax rate structure in this example is

A) proportional.

B) progressive.

C) regressive.

D) marginal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

15

The U.S. individual income tax is designed to be

A) progressive.

B) regressive.

C) proportional.

D) an ability-to-pay tax.

A) progressive.

B) regressive.

C) proportional.

D) an ability-to-pay tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

16

A family that earns $20,000 a year pays $1,000 a year in payroll taxes. A family that earns $40,000 a year pays $2,000 a year in payroll taxes. The payroll tax is

A) a progressive tax.

B) a regressive tax.

C) a proportional tax.

D) a benefits-received tax.

A) a progressive tax.

B) a regressive tax.

C) a proportional tax.

D) a benefits-received tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

17

Refer to the information provided in Table 19.1 below to answer the question that follows.

Table 19.1

-Refer to Table 19.1. The tax rate structure in this example is

A) proportional.

B) progressive.

C) regressive.

D) marginal.

Table 19.1

-Refer to Table 19.1. The tax rate structure in this example is

A) proportional.

B) progressive.

C) regressive.

D) marginal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

18

The total amount of tax you pay divided by your total income is the

A) marginal tax rate.

B) average tax rate.

C) total tax rate.

D) proportional tax rate.

A) marginal tax rate.

B) average tax rate.

C) total tax rate.

D) proportional tax rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

19

The measure or value upon which a tax is levied is the

A) tax base.

B) tax rate.

C) tax structure.

D) tax incidence.

A) tax base.

B) tax rate.

C) tax structure.

D) tax incidence.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

20

A tax whose burden, expressed as a percentage of income, increases as income increases is

A) a regressive tax.

B) a progressive tax.

C) a proportional tax.

D) an ability-to-pay tax.

A) a regressive tax.

B) a progressive tax.

C) a proportional tax.

D) an ability-to-pay tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

21

If the marginal tax rate equals the average tax rate, the tax would be

A) proportional.

B) regressive.

C) progressive.

D) uniform.

A) proportional.

B) regressive.

C) progressive.

D) uniform.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

22

Refer to Scenario 19.1 below to answer the question(s) that follow.

SCENARIO 19.1: An individual earning $60,000 pays $12,000 in taxes. The marginal tax rate on any income earned above $60,000 is 25%.

Refer to Scenario 19.1. Suppose this person earns $70,000 and gives a $1,000 tax deductible donation to charity. The donation reduces her tax payment by

A) $200.

B) $207.

C) $250.

D) $1000.

SCENARIO 19.1: An individual earning $60,000 pays $12,000 in taxes. The marginal tax rate on any income earned above $60,000 is 25%.

Refer to Scenario 19.1. Suppose this person earns $70,000 and gives a $1,000 tax deductible donation to charity. The donation reduces her tax payment by

A) $200.

B) $207.

C) $250.

D) $1000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

23

Refer to the information provided in Table 19.4 below to answer the question(s) that follow.

Table 19.4

-Related to the Economics in Practice on page 393: Refer to Table 19.4. At an income level of $20,000, the average tax rate is

A) 1.2%.

B) 8.3%.

C) 12%.

D) 24%.

Table 19.4

-Related to the Economics in Practice on page 393: Refer to Table 19.4. At an income level of $20,000, the average tax rate is

A) 1.2%.

B) 8.3%.

C) 12%.

D) 24%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

24

Refer to the information provided in Table 19.4 below to answer the question(s) that follow.

Table 19.4

-Related to the Economics in Practice on page 393: Refer to Table 19.4. At an income level of $40,000, the average tax rate is

A) 2%.

B) 5%.

C) 15%.

D) 20%.

Table 19.4

-Related to the Economics in Practice on page 393: Refer to Table 19.4. At an income level of $40,000, the average tax rate is

A) 2%.

B) 5%.

C) 15%.

D) 20%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

25

Refer to Scenario 19.1 below to answer the question(s) that follow.

SCENARIO 19.1: An individual earning $60,000 pays $12,000 in taxes. The marginal tax rate on any income earned above $60,000 is 25%.

Refer to Scenario 19.1. When this person earns $70,000, her average tax rate is

A) 20.7%.

B) 22.5%.

C) 25%.

D) indeterminate from this information.

SCENARIO 19.1: An individual earning $60,000 pays $12,000 in taxes. The marginal tax rate on any income earned above $60,000 is 25%.

Refer to Scenario 19.1. When this person earns $70,000, her average tax rate is

A) 20.7%.

B) 22.5%.

C) 25%.

D) indeterminate from this information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

26

Refer to Scenario 19.1 below to answer the question(s) that follow.

SCENARIO 19.1: An individual earning $60,000 pays $12,000 in taxes. The marginal tax rate on any income earned above $60,000 is 25%.

Refer to Scenario 19.1. When this person earns $60,000, her average tax rate is

A) 5%.

B) 20%.

C) 25%.

D) indeterminate from this information.

SCENARIO 19.1: An individual earning $60,000 pays $12,000 in taxes. The marginal tax rate on any income earned above $60,000 is 25%.

Refer to Scenario 19.1. When this person earns $60,000, her average tax rate is

A) 5%.

B) 20%.

C) 25%.

D) indeterminate from this information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

27

The tax ________ is the measure or value upon which a government levies a tax.

A) base

B) rate

C) structure

D) incidence

A) base

B) rate

C) structure

D) incidence

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

28

Refer to Scenario 19.1 below to answer the question(s) that follow.

SCENARIO 19.1: An individual earning $60,000 pays $12,000 in taxes. The marginal tax rate on any income earned above $60,000 is 25%.

Refer to Scenario 19.1. When this person earns $70,000, her tax payment would be

A) $2,500.

B) $14,500.

C) $17,500.

D) indeterminate from this information.

SCENARIO 19.1: An individual earning $60,000 pays $12,000 in taxes. The marginal tax rate on any income earned above $60,000 is 25%.

Refer to Scenario 19.1. When this person earns $70,000, her tax payment would be

A) $2,500.

B) $14,500.

C) $17,500.

D) indeterminate from this information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

29

Refer to the information provided in Table 19.4 below to answer the question(s) that follow.

Table 19.4

-Related to the Economics in Practice on page 393: Refer to Table 19.4. If income increases from $30,000 to $40,000, the marginal tax rate is

A) 5%.

B) 20%.

C) 35%.

D) indeterminate from this information.

Table 19.4

-Related to the Economics in Practice on page 393: Refer to Table 19.4. If income increases from $30,000 to $40,000, the marginal tax rate is

A) 5%.

B) 20%.

C) 35%.

D) indeterminate from this information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

30

Refer to the information provided in Table 19.4 below to answer the question(s) that follow.

Table 19.4

-Related to the Economics in Practice on page 393: Refer to Table 19.4. If income increases from $20,000 to $30,000, the marginal tax rate is

A) 3%.

B) 15%.

C) 21%.

D) indeterminate from this information.

Table 19.4

-Related to the Economics in Practice on page 393: Refer to Table 19.4. If income increases from $20,000 to $30,000, the marginal tax rate is

A) 3%.

B) 15%.

C) 21%.

D) indeterminate from this information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

31

If the average tax rate exceeds the marginal tax rate, the tax would be

A) proportional.

B) regressive.

C) progressive.

D) uniform.

A) proportional.

B) regressive.

C) progressive.

D) uniform.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

32

________ is a tax on a stock, while ________ is a tax on a flow.

A) A payroll tax; a local property tax

B) A local property tax; a tax on your salary

C) A retail sales tax; a payroll tax

D) A tax on your salary; a retail sales tax

A) A payroll tax; a local property tax

B) A local property tax; a tax on your salary

C) A retail sales tax; a payroll tax

D) A tax on your salary; a retail sales tax

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

33

Refer to the information provided in Table 19.4 below to answer the question(s) that follow.

Table 19.4

-Related to the Economics in Practice on page 393: Refer to Table 19.4. At an income level of $10,000, the average tax rate is

A) 1%.

B) 5%.

C) 10%.

D) 20%.

Table 19.4

-Related to the Economics in Practice on page 393: Refer to Table 19.4. At an income level of $10,000, the average tax rate is

A) 1%.

B) 5%.

C) 10%.

D) 20%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following statements is true?

A) Economists believe that average tax rates have a greater influence on behavior than marginal tax rates.

B) Economists believe that marginal tax rates have a greater influence on behavior than average tax rates.

C) Economists believe that marginal and average tax rates influence behavior to the same extent.

D) Economists believe that neither marginal nor average tax rates have any influence on behavior.

A) Economists believe that average tax rates have a greater influence on behavior than marginal tax rates.

B) Economists believe that marginal tax rates have a greater influence on behavior than average tax rates.

C) Economists believe that marginal and average tax rates influence behavior to the same extent.

D) Economists believe that neither marginal nor average tax rates have any influence on behavior.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

35

The burden of a regressive tax ________ as a percentage of income as income ________.

A) rises; falls

B) rises; rises

C) does not change; falls

D) does not change; rises

A) rises; falls

B) rises; rises

C) does not change; falls

D) does not change; rises

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

36

Refer to the information provided in Table 19.4 below to answer the question(s) that follow.

Table 19.4

-Related to the Economics in Practice on page 393: Refer to Table 19.4. The tax rate structure in this example is

A) proportional.

B) progressive.

C) regressive.

D) marginal.

Table 19.4

-Related to the Economics in Practice on page 393: Refer to Table 19.4. The tax rate structure in this example is

A) proportional.

B) progressive.

C) regressive.

D) marginal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

37

The burden of a proportional tax ________ as a percentage of income as income ________.

A) rises; falls

B) rises; rises

C) falls; falls

D) does not change; rises or falls

A) rises; falls

B) rises; rises

C) falls; falls

D) does not change; rises or falls

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

38

If the marginal tax rate exceeds the average tax rate, the tax would be

A) proportional.

B) regressive.

C) progressive.

D) uniform.

A) proportional.

B) regressive.

C) progressive.

D) uniform.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following is a base on which taxes are levied in the United States?

A) income

B) sales

C) property

D) all of the above

A) income

B) sales

C) property

D) all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

40

The ________ is the percentage of a tax base that must be paid in taxes.

A) tax base

B) tax incidence

C) proportional tax

D) tax rate structure

A) tax base

B) tax incidence

C) proportional tax

D) tax rate structure

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

41

A family that earns $20,000 a year pays $4,000 a year in payroll taxes. A family that earns $40,000 a year pays $8,000 a year in payroll taxes. The payroll tax is a ________ tax.

A) progressive

B) regressive

C) proportional

D) benefits-received

A) progressive

B) regressive

C) proportional

D) benefits-received

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

42

The average tax rate is

A) total income divided by the total tax rate.

B) the total amount of tax paid divided by total income.

C) the marginal tax rate multiplied by the tax base.

D) taxable income multiplied by the tax rate.

A) total income divided by the total tax rate.

B) the total amount of tax paid divided by total income.

C) the marginal tax rate multiplied by the tax base.

D) taxable income multiplied by the tax rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

43

The ________ is an example of a regressive tax.

A) individual income tax

B) tariff

C) sales tax

D) energy tax

A) individual income tax

B) tariff

C) sales tax

D) energy tax

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

44

Refer to the information provided in Table 19.7 below to answer the question(s) that follow.

Table 19.7

-Refer to Table 19.7. The tax rate structure in this example is

A) proportional.

B) progressive.

C) regressive.

D) marginal.

Table 19.7

-Refer to Table 19.7. The tax rate structure in this example is

A) proportional.

B) progressive.

C) regressive.

D) marginal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

45

Refer to the information provided in Table 19.6 below to answer the question(s) that follow.

Table 19.6

-Refer to Table 19.6. The tax rate structure in this example is

A) proportional.

B) progressive.

C) regressive.

D) marginal.

Table 19.6

-Refer to Table 19.6. The tax rate structure in this example is

A) proportional.

B) progressive.

C) regressive.

D) marginal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

46

After ________, you are left with taxable income.

A) adding all deductions and exemptions to total income

B) subtracting all deductions and exemptions from total income

C) paying income taxes

D) deducting all of your yearly expenses from the income you received

A) adding all deductions and exemptions to total income

B) subtracting all deductions and exemptions from total income

C) paying income taxes

D) deducting all of your yearly expenses from the income you received

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

47

The burden of a progressive tax ________ as a percentage of income as income ________.

A) rises; falls

B) falls; rises

C) falls; falls

D) does not change; rises or falls

A) rises; falls

B) falls; rises

C) falls; falls

D) does not change; rises or falls

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

48

If the average tax rate is less than the marginal tax rate, the tax would be

A) proportional.

B) regressive.

C) progressive.

D) uniform.

A) proportional.

B) regressive.

C) progressive.

D) uniform.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

49

The ________ tax is an example of a progressive tax in the United States.

A) retail sales

B) individual income

C) property

D) gasoline

A) retail sales

B) individual income

C) property

D) gasoline

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

50

Refer to Scenario 19.2 below to answer the question(s) that follow.

SCENARIO 19.2: An individual earning $40,000 pays $3,200 in taxes. The marginal tax rate on any income earned above $40,000 is 20%.

Refer to Scenario 19.2. When this person earns $60,000, her tax payment would be

A) $4,000.

B) $7,200

C) $12,000.

D) indeterminate from this information.

SCENARIO 19.2: An individual earning $40,000 pays $3,200 in taxes. The marginal tax rate on any income earned above $40,000 is 20%.

Refer to Scenario 19.2. When this person earns $60,000, her tax payment would be

A) $4,000.

B) $7,200

C) $12,000.

D) indeterminate from this information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

51

Refer to the information provided in Table 19.5 below to answer the question that follows.

Table 19.5

-Refer to Table 19.5. The tax rate structure in this example is

A) proportional.

B) progressive.

C) regressive.

D) marginal.

Table 19.5

-Refer to Table 19.5. The tax rate structure in this example is

A) proportional.

B) progressive.

C) regressive.

D) marginal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

52

Refer to Scenario 19.2 below to answer the question(s) that follow.

SCENARIO 19.2: An individual earning $40,000 pays $3,200 in taxes. The marginal tax rate on any income earned above $40,000 is 20%.

Refer to Scenario 19.2. When this person earns $60,000, her average tax rate is

A) 12%.

B) 14%.

C) 20%.

D) indeterminate from this information.

SCENARIO 19.2: An individual earning $40,000 pays $3,200 in taxes. The marginal tax rate on any income earned above $40,000 is 20%.

Refer to Scenario 19.2. When this person earns $60,000, her average tax rate is

A) 12%.

B) 14%.

C) 20%.

D) indeterminate from this information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

53

A family that earns $20,000 a year pays $400 a year in city wage taxes. A family that earns $40,000 a year pays $1,400 a year in city wage taxes. The city wage tax is a ________ tax.

A) progressive

B) regressive

C) proportional

D) benefits-received

A) progressive

B) regressive

C) proportional

D) benefits-received

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

54

If the marginal tax rate is less than the average tax rate, the tax would be

A) proportional.

B) regressive.

C) progressive.

D) uniform.

A) proportional.

B) regressive.

C) progressive.

D) uniform.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

55

The marginal tax rate is the tax rate paid on

A) all income earned.

B) all supplemental income.

C) any additional income earned.

D) taxable retirement income.

A) all income earned.

B) all supplemental income.

C) any additional income earned.

D) taxable retirement income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

56

The largest portion of ________ comes from the individual income tax.

A) federal government revenues

B) state revenues

C) local municipality revenues

D) All of the above are correct.

A) federal government revenues

B) state revenues

C) local municipality revenues

D) All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

57

A family that earns $20,000 a year pays $200 a year in clothing taxes. A family that earns $40,000 a year pays $800 a year in clothing taxes. The clothing tax is a ________ tax.

A) progressive

B) regressive

C) proportional

D) benefits-received

A) progressive

B) regressive

C) proportional

D) benefits-received

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

58

In 2014, the average federal income tax rate paid by a household in the bottom half of the income distribution in the United States was

A) 3.45%

B) 4.41%

C) 20.0%

D) 23.45%

A) 3.45%

B) 4.41%

C) 20.0%

D) 23.45%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

59

Refer to Scenario 19.2 below to answer the question(s) that follow.

SCENARIO 19.2: An individual earning $40,000 pays $3,200 in taxes. The marginal tax rate on any income earned above $40,000 is 20%.

Refer to Scenario 19.2. Suppose this person earns $60,000 and gives a tax deductible donation of $1,000 to charity. The donation will reduce her tax payment by

A) $80.

B) $120.

C) $200.

D) $1,000.

SCENARIO 19.2: An individual earning $40,000 pays $3,200 in taxes. The marginal tax rate on any income earned above $40,000 is 20%.

Refer to Scenario 19.2. Suppose this person earns $60,000 and gives a tax deductible donation of $1,000 to charity. The donation will reduce her tax payment by

A) $80.

B) $120.

C) $200.

D) $1,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

60

Refer to Scenario 19.2 below to answer the question(s) that follow.

SCENARIO 19.2: An individual earning $40,000 pays $3,200 in taxes. The marginal tax rate on any income earned above $40,000 is 20%.

Refer to Scenario 19.2. When this person earns $40,000, her average tax rate is

A) 8%.

B) 12.5%.

C) 20%.

D) indeterminate from this information.

SCENARIO 19.2: An individual earning $40,000 pays $3,200 in taxes. The marginal tax rate on any income earned above $40,000 is 20%.

Refer to Scenario 19.2. When this person earns $40,000, her average tax rate is

A) 8%.

B) 12.5%.

C) 20%.

D) indeterminate from this information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

61

Refer to the information provided in Table 19.8 below to answer the question(s) that follow.

Table 19.8

-Related to the Economics in Practice on page 393: Refer to Table 19.8. If income increases from $60,000 to $80,000, the marginal tax rate is

A) 5%.

B) 20%.

C) 35%.

D) indeterminate from this information.

Table 19.8

-Related to the Economics in Practice on page 393: Refer to Table 19.8. If income increases from $60,000 to $80,000, the marginal tax rate is

A) 5%.

B) 20%.

C) 35%.

D) indeterminate from this information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

62

In the United States, higher income households face ________ marginal tax rates, and therefore have ________ incentives to seek deductions of various sorts.

A) higher; fewer

B) higher; more

C) lower; fewer

D) lower; more

A) higher; fewer

B) higher; more

C) lower; fewer

D) lower; more

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

63

Refer to the information provided in Table 19.8 below to answer the question(s) that follow.

Table 19.8

-Related to the Economics in Practice on page 393: Refer to Table 19.8. If income increases from $20,000 to $40,000, the marginal tax rate is

A) 2%.

B) 12%.

C) 14%.

D) indeterminate from this information.

Table 19.8

-Related to the Economics in Practice on page 393: Refer to Table 19.8. If income increases from $20,000 to $40,000, the marginal tax rate is

A) 2%.

B) 12%.

C) 14%.

D) indeterminate from this information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

64

Refer to the information provided in Table 19.8 below to answer the question(s) that follow.

Table 19.8

-Related to the Economics in Practice on page 393: Refer to Table 19.8. The tax rate structure in this example is

A) proportional.

B) progressive.

C) regressive.

D) marginal.

Table 19.8

-Related to the Economics in Practice on page 393: Refer to Table 19.8. The tax rate structure in this example is

A) proportional.

B) progressive.

C) regressive.

D) marginal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

65

Tax incidence is the

A) behavior of shifting the tax to another party.

B) ultimate distribution of a tax's burden.

C) structure of the tax.

D) measure of the impact the tax has on employment and output.

A) behavior of shifting the tax to another party.

B) ultimate distribution of a tax's burden.

C) structure of the tax.

D) measure of the impact the tax has on employment and output.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

66

Tax shifting

A) is the way in which a tax is structured.

B) is the ultimate distribution of a tax's burden.

C) occurs when taxes cause prices to increase, but wages to fall.

D) occurs when taxed agents can alter their behavior and do something to avoid paying a tax.

A) is the way in which a tax is structured.

B) is the ultimate distribution of a tax's burden.

C) occurs when taxes cause prices to increase, but wages to fall.

D) occurs when taxed agents can alter their behavior and do something to avoid paying a tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

67

The government imposes a luxury tax on automobiles that cost more than $40,000. As a result, fewer individuals purchase cars that cost more than $40,000. This is an example of

A) tax equity.

B) tax shifting.

C) tax evasion.

D) tax incidence.

A) tax equity.

B) tax shifting.

C) tax evasion.

D) tax incidence.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

68

A household is hurt on the ________ side when its net profits or wages fall, and it is hurt on the ________ side when the prices of goods and services increase.

A) sources; uses

B) uses; sources

C) flow; stock

D) input; output

A) sources; uses

B) uses; sources

C) flow; stock

D) input; output

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

69

Refer to the information provided in Table 19.8 below to answer the question(s) that follow.

Table 19.8

-Related to the Economics in Practice on page 393: Refer to Table 19.8. At an income level of $20,000, the average tax rate is

A) 1%.

B) 5%.

C) 10%.

D) 20%.

Table 19.8

-Related to the Economics in Practice on page 393: Refer to Table 19.8. At an income level of $20,000, the average tax rate is

A) 1%.

B) 5%.

C) 10%.

D) 20%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

70

Refer to the information provided in Table 19.8 below to answer the question(s) that follow.

Table 19.8

-Related to the Economics in Practice on page 393: Refer to Table 19.8. At an income level of $80,000, the average tax rate is

A) 2%.

B) 5%.

C) 15%.

D) 20%.

Table 19.8

-Related to the Economics in Practice on page 393: Refer to Table 19.8. At an income level of $80,000, the average tax rate is

A) 2%.

B) 5%.

C) 15%.

D) 20%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

71

Refer to the information provided in Table 19.8 below to answer the question(s) that follow.

Table 19.8

-Related to the Economics in Practice on page 393: Refer to Table 19.8. At an income level of $60,000, the average tax rate is

A) 1.5%.

B) 6.67%.

C) 15%.

D) 22.5%.

Table 19.8

-Related to the Economics in Practice on page 393: Refer to Table 19.8. At an income level of $60,000, the average tax rate is

A) 1.5%.

B) 6.67%.

C) 15%.

D) 22.5%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

72

Firms may react to a payroll tax by

A) substituting labor for capital.

B) increasing their output.

C) shifting to more capital intensive techniques.

D) increasing workers' wages.

A) substituting labor for capital.

B) increasing their output.

C) shifting to more capital intensive techniques.

D) increasing workers' wages.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

73

A tax that exacts a higher proportion of income from higher-income people than it does from lower-income households is a regressive tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

74

A retail sales tax is a proportional tax with respect to income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

75

Which of the following taxes is most easily shifted?

A) an income tax that allows for no deductions of exemptions

B) a retail sales tax

C) a uniform tax on land

D) a tax on imported rice

A) an income tax that allows for no deductions of exemptions

B) a retail sales tax

C) a uniform tax on land

D) a tax on imported rice

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

76

As a result of an increase in the payroll tax that employers must pay on their employeesʹ wages, employers reduce the starting wage for new employees. This is an example of

A) tax shifting.

B) tax incidence.

C) a regressive tax.

D) tax avoidance.

A) tax shifting.

B) tax incidence.

C) a regressive tax.

D) tax avoidance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

77

Excise taxes on products like gasoline and tobacco are regressive.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

78

A tax that exacts a lower proportion of income from higher-income people than it does from lower-income households is a regressive tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

79

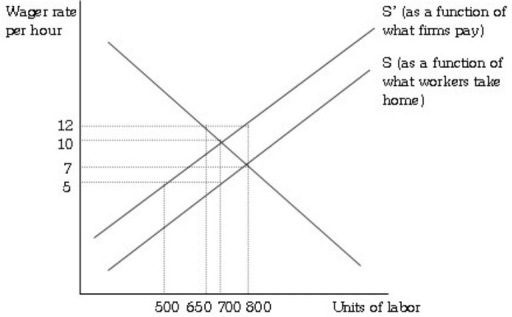

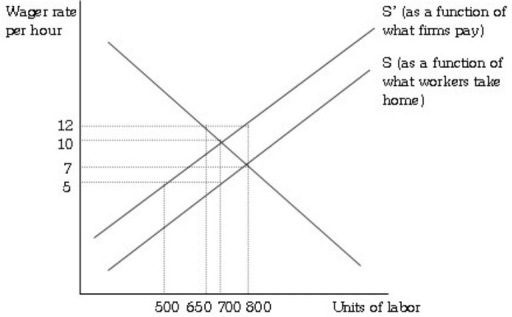

Refer to the information provided in Figure 19.1 below to answer the question(s) that follow.  Figure 19.1

Figure 19.1

Refer to Figure 19.1. Prior to the imposition of a payroll tax, this labor market was in equilibrium at a wage of ________ and employment of ________ workers.

A) $5.00; 500

B) $7.00; 800

C) $10.00; 700

D) $12.00; 650

Figure 19.1

Figure 19.1Refer to Figure 19.1. Prior to the imposition of a payroll tax, this labor market was in equilibrium at a wage of ________ and employment of ________ workers.

A) $5.00; 500

B) $7.00; 800

C) $10.00; 700

D) $12.00; 650

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck

80

If the ________ tax rate equals the ________ tax rate, the tax would be proportional.

A) marginal; average

B) corporate income; personal income

C) sales; personal income

D) average; variable

A) marginal; average

B) corporate income; personal income

C) sales; personal income

D) average; variable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 281 في هذه المجموعة.

فتح الحزمة

k this deck