Deck 8: Market Failure Versus Government Failure

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/160

العب

ملء الشاشة (f)

Deck 8: Market Failure Versus Government Failure

1

All of the following are considered sources of market failure except:

A) public goods.

B) imperfect information.

C) profit-maximizing behavior.

D) externalities.

A) public goods.

B) imperfect information.

C) profit-maximizing behavior.

D) externalities.

C

2

Moral hazard problems can occur when insured individuals change their behavior to the detriment of the insurer.

True

3

Some economists believe that the market will not solve all problems. They are referring to:

A) market failure.

B) market incentive plans.

C) optional policy.

D) the need to balance the good of the individual with the good of society as a whole.

A) market failure.

B) market incentive plans.

C) optional policy.

D) the need to balance the good of the individual with the good of society as a whole.

A

4

Adverse selection problems can occur when buyers and sellers have different amounts of information about a good for sale.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

5

Government provides secondary education because of its private good aspects.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

6

Direct regulation means that government sets specific limits on the use of scarce resources.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

7

If a market has no externalities, marginal private costs:

A) exceed marginal social costs.

B) equal marginal social costs.

C) are below marginal social costs.

D) intersect marginal social costs.

A) exceed marginal social costs.

B) equal marginal social costs.

C) are below marginal social costs.

D) intersect marginal social costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

8

If a program requires people to pay a price that reflects the cost of an externality associated with their actions that they previously did not pay, it will be in their best interest to change their behavior.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

9

An optimal policy is one in which the marginal cost of undertaking a policy is less than the marginal benefit of that policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

10

Government attempts to offset market failures can prevent the market from dealing with a problem more effectively.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

11

If government action is likely to do some good, it is always best for government to intervene in the marketplace.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

12

Economists tend to believe that market incentive plans are generally more efficient than direct regulation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

13

Economists generally prefer direct regulation to incentive-based programs because explicit regulation tends to be more efficient.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

14

Economists generally call the effect of an agreement on others that is not taken into account by the parties making the agreement:

A) excess burden.

B) welfare loss.

C) Pareto optimality.

D) an externality.

A) excess burden.

B) welfare loss.

C) Pareto optimality.

D) an externality.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

15

Alex is playing his music at full volume in his dorm room. The other people living on his floor find this to be nuisance, but Alex does not care. Alex's music playing is an example of a:

A) negative externality.

B) positive externality.

C) normative externality.

D) Pareto externality.

A) negative externality.

B) positive externality.

C) normative externality.

D) Pareto externality.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

16

Externalities can be either positive or negative.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

17

Economists are likely to oppose direct regulation because they do not believe there is any need for government to take action when negative externalities exist.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

18

What do economists mean when they say there is "market failure"?

A) Business has introduced a product that consumers do not want.

B) Free markets have led to excessive profits.

C) Markets have surpluses or shortages so that government rationing is necessary.

D) Free markets yield results that economists do not consider socially optimal.

A) Business has introduced a product that consumers do not want.

B) Free markets have led to excessive profits.

C) Markets have surpluses or shortages so that government rationing is necessary.

D) Free markets yield results that economists do not consider socially optimal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

19

Economists believe that free riders often can undermine the social commitment of many in the society, causing voluntary policies to fail.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

20

The best example of a positive externality is:

A) roller coaster rides.

B) pollution.

C) alcoholic beverages.

D) education.

A) roller coaster rides.

B) pollution.

C) alcoholic beverages.

D) education.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

21

If a negative externality exists in the production of paper and paper is sold in a perfectly competitive market, at the equilibrium output:

A) additional net gains to society are possible by reducing the output of paper.

B) additional net gains to society are possible by increasing the output of paper.

C) the marginal social benefit of paper equals its marginal social cost.

D) additional net gains to society are not possible from either increasing or decreasing the output of paper.

A) additional net gains to society are possible by reducing the output of paper.

B) additional net gains to society are possible by increasing the output of paper.

C) the marginal social benefit of paper equals its marginal social cost.

D) additional net gains to society are not possible from either increasing or decreasing the output of paper.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

22

When negative externalities are present, market failure often occurs because:

A) the cost borne by a third party not involved in the trade is not reflected in the market price.

B) the cost borne by a third party not involved in the trade is reflected in the market price.

C) the existence of imports from foreign countries takes jobs (and income) away from U.S. citizens.

D) consumers will consume the good at a level at which their individual marginal benefits exceed the marginal costs borne by the firm producing the good.

A) the cost borne by a third party not involved in the trade is not reflected in the market price.

B) the cost borne by a third party not involved in the trade is reflected in the market price.

C) the existence of imports from foreign countries takes jobs (and income) away from U.S. citizens.

D) consumers will consume the good at a level at which their individual marginal benefits exceed the marginal costs borne by the firm producing the good.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

23

An externality is present in a free market whenever:

A) a monopolist spends funds to keep potential competitors out of the market.

B) an activity generates costs or benefits that are not reflected in market prices.

C) firms hire employees from outside the firm to fill positions normally filled by promotion from within the firm.

D) a tax is imposed on the supplier of a good.

A) a monopolist spends funds to keep potential competitors out of the market.

B) an activity generates costs or benefits that are not reflected in market prices.

C) firms hire employees from outside the firm to fill positions normally filled by promotion from within the firm.

D) a tax is imposed on the supplier of a good.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

24

James enjoys gardening in the nude because he says it puts him in touch with nature. His neighbors find his gardening routine very offensive, but James replies that they should mind their own business and not watch him. To an economist this situation illustrates the concept of:

A) the tragedy of the commons.

B) a negative externality.

C) a positive externality.

D) adverse selection.

A) the tragedy of the commons.

B) a negative externality.

C) a positive externality.

D) adverse selection.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

25

When positive externalities exist in the consumption of a good, the marginal social benefit:

A) equals the marginal benefit received by consumers of the good minus the marginal benefit to third parties.

B) equals the marginal cost of producing the good plus the marginal cost to third parties.

C) equals the marginal benefit received by consumers of the good plus the marginal benefit to third parties.

D) could be either greater than or less than the marginal benefit received by consumers of the good depending on the equilibrium price determined in competitive markets.

A) equals the marginal benefit received by consumers of the good minus the marginal benefit to third parties.

B) equals the marginal cost of producing the good plus the marginal cost to third parties.

C) equals the marginal benefit received by consumers of the good plus the marginal benefit to third parties.

D) could be either greater than or less than the marginal benefit received by consumers of the good depending on the equilibrium price determined in competitive markets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

26

Carbon dioxide emissions are thought to contribute to global warming, and there is a concern that changes in climate will be costly. Emitting carbon dioxide is an example of:

A) a public good.

B) a negative externality.

C) an adverse selection problem.

D) an effluent fee.

A) a public good.

B) a negative externality.

C) an adverse selection problem.

D) an effluent fee.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

27

An example of a negative externality is the:

A) decrease in your real income that results when photographic equipment you purchase increases in price because of increased demand by others for these items.

B) cost you bear when your neighbor has a noisy party and does not compensate you for your discomfort.

C) benefit you receive without paying when your neighbor installs a smoke detector.

D) decrease in income to farmers that results from a drought.

A) decrease in your real income that results when photographic equipment you purchase increases in price because of increased demand by others for these items.

B) cost you bear when your neighbor has a noisy party and does not compensate you for your discomfort.

C) benefit you receive without paying when your neighbor installs a smoke detector.

D) decrease in income to farmers that results from a drought.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

28

If a positive externality exists in the provision of education when education is provided in a perfectly competitive market without government intervention, at the market equilibrium level of education:

A) additional net gains to society are possible by reducing the level of education.

B) additional net gains to society are possible by raising the level of education.

C) the marginal social benefit of education equals the marginal social cost.

D) additional net gains to society are not possible by either increasing or decreasing the level of education.

A) additional net gains to society are possible by reducing the level of education.

B) additional net gains to society are possible by raising the level of education.

C) the marginal social benefit of education equals the marginal social cost.

D) additional net gains to society are not possible by either increasing or decreasing the level of education.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

29

College education provides higher income for the individual but also a more productive and more educated person who will contribute to society in many ways. Higher education is an example of:

A) a positive externality.

B) a negative externality.

C) a nonexcludable service.

D) adverse selection.

A) a positive externality.

B) a negative externality.

C) a nonexcludable service.

D) adverse selection.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which of the following is not an example of an externality?

A) Carbon dioxide from energy generation that adds to the worldwide long-term greenhouse effect.

B) Heat from a factory that makes the neighboring tomato patches more productive.

C) A defective part that causes an automobile to break down three months after purchase.

D) Acidic by-products of fossil fuel combustion that produce acid rain.

A) Carbon dioxide from energy generation that adds to the worldwide long-term greenhouse effect.

B) Heat from a factory that makes the neighboring tomato patches more productive.

C) A defective part that causes an automobile to break down three months after purchase.

D) Acidic by-products of fossil fuel combustion that produce acid rain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

31

If a positive externality is associated with the purchase of smoke detectors:

A) the marginal social benefit of smoke detectors exceeds their price.

B) the marginal social benefit of smoke detectors is zero.

C) the marginal social benefit of smoke detectors equals their price.

D) more than the efficient quantity of smoke detectors will be sold.

A) the marginal social benefit of smoke detectors exceeds their price.

B) the marginal social benefit of smoke detectors is zero.

C) the marginal social benefit of smoke detectors equals their price.

D) more than the efficient quantity of smoke detectors will be sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

32

Alex is playing his music at full volume in his dorm room. The other people living on his floor are enjoying his music, but Alex does not know or care. Alex's music playing is an example of a:

A) negative externality.

B) positive externality.

C) normative externality.

D) Pareto externality.

A) negative externality.

B) positive externality.

C) normative externality.

D) Pareto externality.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

33

The existence of negative externalities:

A) prevents the market from working efficiently.

B) prevents government from intervening in the marketplace.

C) causes the market to work more effectively.

D) necessarily means that government must intervene in the marketplace.

A) prevents the market from working efficiently.

B) prevents government from intervening in the marketplace.

C) causes the market to work more effectively.

D) necessarily means that government must intervene in the marketplace.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

34

The cost of running an electrical utility includes costs for fuel, labor, and capital. In addition, there are sometimes costs associated with pollution from the utility, such an increased health care costs for people living near the utility. To an economist, the costs associated with the pollution resulting from additional electricity are:

A) marginal private costs.

B) marginal social costs.

C) the difference between marginal social costs and marginal private costs.

D) the sum of marginal social costs and marginal private costs.

A) marginal private costs.

B) marginal social costs.

C) the difference between marginal social costs and marginal private costs.

D) the sum of marginal social costs and marginal private costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

35

When negative externalities exist in the production of a good, the marginal social cost of producing the good:

A) is equal to the marginal benefit received by consumers if competitive markets exist and there is no government intervention.

B) equals the marginal cost borne by the firm minus marginal cost borne by a third party that results from the production and consumption of the good.

C) is less than the marginal cost borne by the firm.

D) equals the marginal cost borne by the firm plus the marginal cost borne by third parties from the production and consumption of the good.

A) is equal to the marginal benefit received by consumers if competitive markets exist and there is no government intervention.

B) equals the marginal cost borne by the firm minus marginal cost borne by a third party that results from the production and consumption of the good.

C) is less than the marginal cost borne by the firm.

D) equals the marginal cost borne by the firm plus the marginal cost borne by third parties from the production and consumption of the good.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

36

In the Flint Hills area of Kansas, proposals to build wind turbines to generate electricity have pitted environmentalist against environmentalist. Members of the Kansas Sierra Club support the turbines as a way to reduce use of fossil fuel, but local chapters of the Nature Conservancy say they will befoul the landscape. An argument that supports the Sierra Club position is that that wind turbines:

A) internalize negative externalities.

B) reduce negative externalities elsewhere in the economy.

C) create a free rider problem.

D) are a way of solving a free rider problem.

A) internalize negative externalities.

B) reduce negative externalities elsewhere in the economy.

C) create a free rider problem.

D) are a way of solving a free rider problem.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

37

If a negative externality is associated with burning firewood:

A) the marginal social cost of burning firewood falls short of its price.

B) the marginal social cost of burning firewood is exactly equal to its price.

C) less than the efficient amount of firewood for burning will be used each year.

D) the marginal social cost of burning firewood exceeds the price of burning firewood.

A) the marginal social cost of burning firewood falls short of its price.

B) the marginal social cost of burning firewood is exactly equal to its price.

C) less than the efficient amount of firewood for burning will be used each year.

D) the marginal social cost of burning firewood exceeds the price of burning firewood.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

38

An economist argues that the states that have spent the most on higher education in the last 25 years have experienced the least economic growth. One might conclude that higher education:

A) does not have important positive externalities.

B) does not have important negative externalities.

C) is a nonexcludable service.

D) has problems of adverse selection.

A) does not have important positive externalities.

B) does not have important negative externalities.

C) is a nonexcludable service.

D) has problems of adverse selection.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

39

Proposals in Flint Hills, Kansas, to build wind turbines to generate electricity have pitted environmentalist against environmentalist. Members of the Kansas Sierra Club support the turbines as a way to reduce use of fossil fuel, but local chapters of the Nature Conservancy say they will befoul the landscape. The Nature Conservancy is arguing that that wind turbines:

A) are a source of negative externalities.

B) are a source of positive externalities.

C) create a free rider problem.

D) are a way of solving a free rider problem.

A) are a source of negative externalities.

B) are a source of positive externalities.

C) create a free rider problem.

D) are a way of solving a free rider problem.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

40

Under the Texas law known as "rule of capture," land owners "get to pump as much of the water under it as they want. . .. 'This means whoever sucks it out first, it's their water'-even if that means there isn't enough left for others." Under this law, pumping large amounts of water:

A) imposes a negative externality on others.

B) imposes a positive externality on others.

C) imposes the free rider effect on others.

D) is a private decision with no effects on others.

A) imposes a negative externality on others.

B) imposes a positive externality on others.

C) imposes the free rider effect on others.

D) is a private decision with no effects on others.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

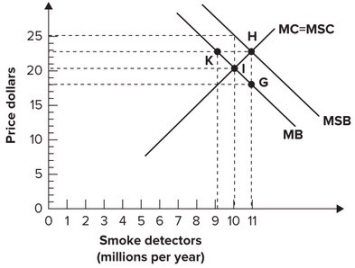

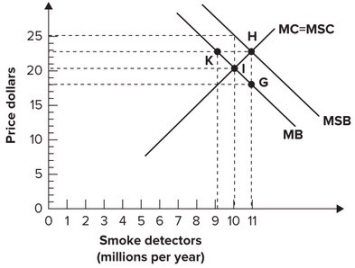

41

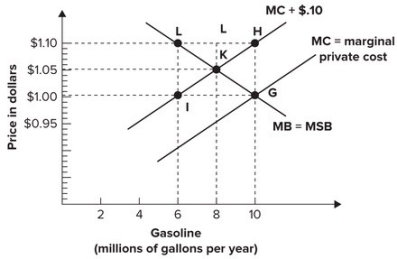

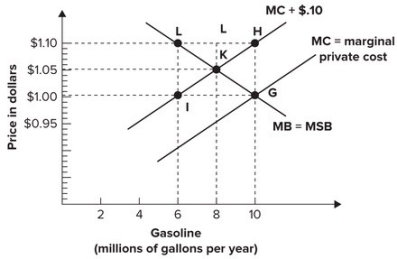

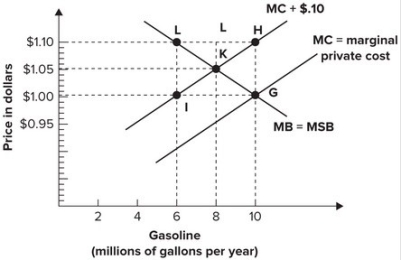

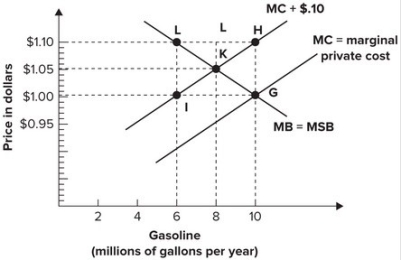

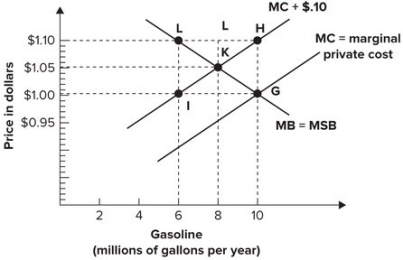

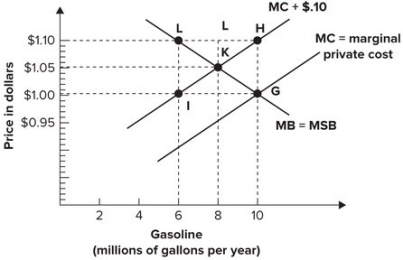

Refer to the graph shown. If the marginal cost external to the trade associated with the use of gasoline is $0.10 per gallon, the point on the graph corresponding to the efficient quantity and price is:

A) G.

B) H.

C) K.

D) L.

A) G.

B) H.

C) K.

D) L.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

42

If a positive externality is to be taken full advantage of, the:

A) consumer of the good should receive a subsidy equal to the marginal cost imposed on third parties that results from production (or consumption) of the good.

B) producers' marginal costs should be increased by an amount equal to the marginal benefit to third parties that results from production of the good.

C) consumer of the good should pay a tax equal to the marginal benefit to third parties that results from production (or consumption) of the good.

D) producers' marginal costs should be decreased by an amount equal to the marginal cost imposed on third parties that results from production of the good.

A) consumer of the good should receive a subsidy equal to the marginal cost imposed on third parties that results from production (or consumption) of the good.

B) producers' marginal costs should be increased by an amount equal to the marginal benefit to third parties that results from production of the good.

C) consumer of the good should pay a tax equal to the marginal benefit to third parties that results from production (or consumption) of the good.

D) producers' marginal costs should be decreased by an amount equal to the marginal cost imposed on third parties that results from production of the good.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

43

A strategy that achieves a goal at the lowest cost in total resources without consideration of who pays those costs is:

A) efficient.

B) inefficient.

C) impossible.

D) always the most profitable to the firm.

A) efficient.

B) inefficient.

C) impossible.

D) always the most profitable to the firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

44

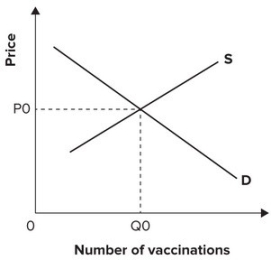

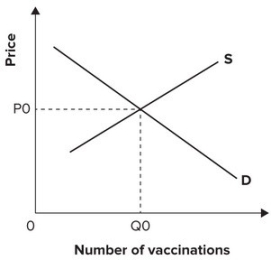

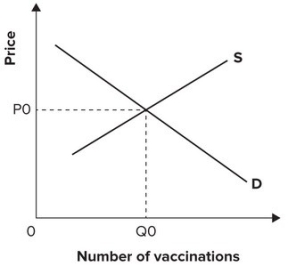

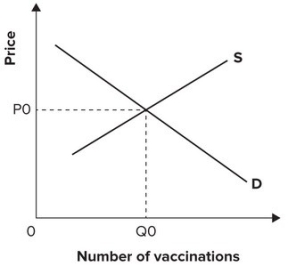

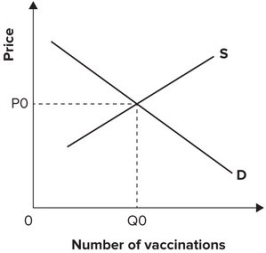

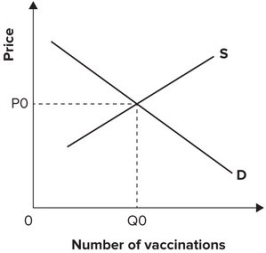

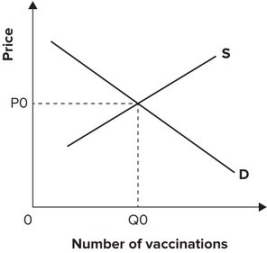

Refer to the graph shown, which shows the demand and supply for a new vaccine against the common cold. Once vaccinated, a person cannot catch a cold or give a cold to someone else. The socially efficient level of output is:

A) less than Q0.

B) greater than or less than Q0 depending on the income elasticity of demand and the effectiveness of the vaccine.

C) greater than Q0.

D) equal to Q0.

A) less than Q0.

B) greater than or less than Q0 depending on the income elasticity of demand and the effectiveness of the vaccine.

C) greater than Q0.

D) equal to Q0.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

45

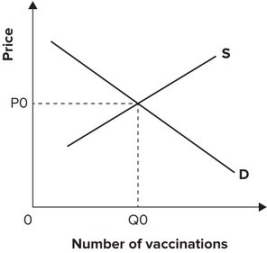

Refer to the graph shown. There is a negative externality associated with the production of the good depicted. The socially efficient level of output is:

A) either greater than or less than Q0, depending on the elasticities of supply and demand.

B) less than Q0.

C) equal to Q0.

D) greater than Q0.

A) either greater than or less than Q0, depending on the elasticities of supply and demand.

B) less than Q0.

C) equal to Q0.

D) greater than Q0.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

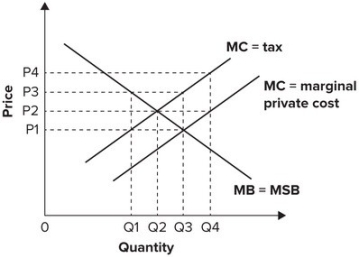

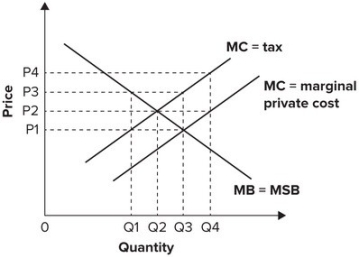

46

Refer to the following graph.  Assuming a marginal cost external to the trade equals the tax shown in the graph, the market price necessary to induce consumers to purchase the efficient quantity each year is:

Assuming a marginal cost external to the trade equals the tax shown in the graph, the market price necessary to induce consumers to purchase the efficient quantity each year is:

A) P1.

B) P2.

C) P3.

D) P4.

Assuming a marginal cost external to the trade equals the tax shown in the graph, the market price necessary to induce consumers to purchase the efficient quantity each year is:

Assuming a marginal cost external to the trade equals the tax shown in the graph, the market price necessary to induce consumers to purchase the efficient quantity each year is:A) P1.

B) P2.

C) P3.

D) P4.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

47

Suppose that government wants a policy that will encourage people to use less oil. For this policy to be efficient, it must:

A) induce those with the highest cost of conserving to reduce their oil consumption the most.

B) induce those with the lowest cost of conserving to reduce their oil consumption the most.

C) force everyone to reduce oil consumption equally.

D) force rich people to reduce oil consumption proportionally more than poor people.

A) induce those with the highest cost of conserving to reduce their oil consumption the most.

B) induce those with the lowest cost of conserving to reduce their oil consumption the most.

C) force everyone to reduce oil consumption equally.

D) force rich people to reduce oil consumption proportionally more than poor people.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

48

If once vaccinated, a person cannot catch a cold or give a cold to someone else, the marginal social benefit resulting from consumption of the vaccine:

A) exceeds the marginal benefit received by consumers of the vaccine.

B) equals the marginal social cost of producing the vaccine in a competitive equilibrium.

C) equals the marginal benefit received by consumers of the vaccine in a competitive equilibrium.

D) is less than the marginal benefit received by consumers of the vaccine.

A) exceeds the marginal benefit received by consumers of the vaccine.

B) equals the marginal social cost of producing the vaccine in a competitive equilibrium.

C) equals the marginal benefit received by consumers of the vaccine in a competitive equilibrium.

D) is less than the marginal benefit received by consumers of the vaccine.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

49

Refer to the following graph.  The point on the graph corresponding to the socially optimal output per year and the price sellers must receive to make that amount available is shown by point:

The point on the graph corresponding to the socially optimal output per year and the price sellers must receive to make that amount available is shown by point:

A) G.

B) H.

C) I.

D) K.

The point on the graph corresponding to the socially optimal output per year and the price sellers must receive to make that amount available is shown by point:

The point on the graph corresponding to the socially optimal output per year and the price sellers must receive to make that amount available is shown by point:A) G.

B) H.

C) I.

D) K.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

50

If a negative externality exists in the market for dirt bikes and that market is perfectly competitive:

A) less than the efficient output of dirt bikes will be produced.

B) the price of dirt bikes exceeds the marginal social cost.

C) the price of dirt bikes equals the marginal social cost.

D) the price of dirt bikes is less than the marginal social cost.

A) less than the efficient output of dirt bikes will be produced.

B) the price of dirt bikes exceeds the marginal social cost.

C) the price of dirt bikes equals the marginal social cost.

D) the price of dirt bikes is less than the marginal social cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

51

Refer to the graph shown. There is a $.010 per-gallon marginal cost external to the trade associated with the use of gasoline. Assuming that gasoline is sold in perfectly competitive markets, the market equilibrium price will be:

A) $0.95.

B) $1.00.

C) $1.05.

D) $1.10.

A) $0.95.

B) $1.00.

C) $1.05.

D) $1.10.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

52

Refer to the graph shown, which shows the demand and supply for a new vaccine against the common cold. Suppose once vaccinated, a person cannot catch a cold or give a cold to someone else. As a result, the marginal social benefit curve will:

A) coincide with the market demand curve.

B) lie strictly below the market supply curve.

C) lie below the market demand curve.

D) lie above the market demand curve.

A) coincide with the market demand curve.

B) lie strictly below the market supply curve.

C) lie below the market demand curve.

D) lie above the market demand curve.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

53

Refer to the graph shown. Assuming a $0.10-per-gallon marginal cost external to the trade that is associated with gasoline, the market price of gasoline necessary to induce consumers to purchase the efficient quantity each year is:

A) $0.95.

B) $1.00.

C) $1.05.

D) $1.10.

A) $0.95.

B) $1.00.

C) $1.05.

D) $1.10.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

54

If a corrective tax on gasoline results in the efficient output of gasoline by internalizing negative externalities associated with pollution:

A) pollution from gasoline will increase because people are also harmed by the tax.

B) there will be no effect on pollution from gasoline because the tax is paid by the supplier.

C) pollution from gasoline will be zero because environmental cleanliness is priceless.

D) the tax will generate enough revenue to compensate society for the damages resulting from the pollution that still occurs.

A) pollution from gasoline will increase because people are also harmed by the tax.

B) there will be no effect on pollution from gasoline because the tax is paid by the supplier.

C) pollution from gasoline will be zero because environmental cleanliness is priceless.

D) the tax will generate enough revenue to compensate society for the damages resulting from the pollution that still occurs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

55

If a negative externality is to be internalized to the decision maker, the:

A) producers' marginal costs should be increased by an amount equal to the marginal cost to those outside the trade that results from production of the good.

B) producers' marginal costs should be reduced by an amount equal to the marginal cost to those outside the trade that results from production of the good.

C) consumer of the good should receive a subsidy equal to the marginal cost to those outside the trade that results from production of the good.

D) consumer of the good should pay a tax equal to the marginal benefit to those outside the trade that results from consuming the good.

A) producers' marginal costs should be increased by an amount equal to the marginal cost to those outside the trade that results from production of the good.

B) producers' marginal costs should be reduced by an amount equal to the marginal cost to those outside the trade that results from production of the good.

C) consumer of the good should receive a subsidy equal to the marginal cost to those outside the trade that results from production of the good.

D) consumer of the good should pay a tax equal to the marginal benefit to those outside the trade that results from consuming the good.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

56

The rule for making optimal decisions is that an activity should be increased until:

A) average costs are minimized.

B) total costs are minimized.

C) total benefits are maximized.

D) marginal benefits equal marginal costs.

A) average costs are minimized.

B) total costs are minimized.

C) total benefits are maximized.

D) marginal benefits equal marginal costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

57

Refer to the graph shown, which shows the demand and supply for a new vaccine against the common cold. Once vaccinated, a person cannot catch a cold or give a cold to someone else. If government does not subsidize the production of this vaccine:

A) the number of workers hired to produce the vaccine will be less than the socially efficient level.

B) the firm producing the vaccine will use too much capital in producing the vaccine.

C) the vaccine will be overproduced because consumers will not take into account the fact that many of their neighbors and co-workers will consume the vaccine.

D) no positive externality can be created.

A) the number of workers hired to produce the vaccine will be less than the socially efficient level.

B) the firm producing the vaccine will use too much capital in producing the vaccine.

C) the vaccine will be overproduced because consumers will not take into account the fact that many of their neighbors and co-workers will consume the vaccine.

D) no positive externality can be created.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

58

Refer to the graph shown. Say that there is a negative externality associated with the production of the good depicted. The marginal social cost from consuming this good at the competitive equilibrium output level is:

A) either greater than or less than P0, depending on the elasticities of supply and demand.

B) greater than P0.

C) less than P0.

D) equal to P0.

A) either greater than or less than P0, depending on the elasticities of supply and demand.

B) greater than P0.

C) less than P0.

D) equal to P0.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

59

Direct regulation is inefficient because:

A) affected firms ignore regulations, for example, by dumping toxic waste illegally.

B) it does not take into account that the costs of reducing consumption are the same for all individuals.

C) it does not take into account the fact that the costs of reducing consumption may differ among individuals.

D) it does not take negative externalities into account.

A) affected firms ignore regulations, for example, by dumping toxic waste illegally.

B) it does not take into account that the costs of reducing consumption are the same for all individuals.

C) it does not take into account the fact that the costs of reducing consumption may differ among individuals.

D) it does not take negative externalities into account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

60

Refer to the graph shown, which shows the demand and supply for a new vaccine against the common cold. Suppose once vaccinated, a person cannot catch a cold or give a cold to someone else. At the competitively determined output level, the marginal social benefit will be:

A) equal to P0.

B) less than P0.

C) greater than or less than P0 depending on the income elasticity of demand and the effectiveness of the vaccine.

D) greater than P0.

A) equal to P0.

B) less than P0.

C) greater than or less than P0 depending on the income elasticity of demand and the effectiveness of the vaccine.

D) greater than P0.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

61

A firm with a highly inelastic demand for coal will:

A) cut consumption more than a firm with a highly elastic demand when price goes up.

B) cut consumption less than a firm with a highly elastic demand when price goes up.

C) refuse to cut consumption for any reason.

D) stop using coal entirely if a tax is imposed.

A) cut consumption more than a firm with a highly elastic demand when price goes up.

B) cut consumption less than a firm with a highly elastic demand when price goes up.

C) refuse to cut consumption for any reason.

D) stop using coal entirely if a tax is imposed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

62

Economists generally oppose direct regulation because:

A) it is unlikely to achieve the desired end as efficiently as possible.

B) it assumes that people behave rationally.

C) it is generally unfair.

D) it does not assume that people behave rationally.

A) it is unlikely to achieve the desired end as efficiently as possible.

B) it assumes that people behave rationally.

C) it is generally unfair.

D) it does not assume that people behave rationally.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

63

If markets are perfectly competitive and production of a good results in water pollution, the imposition of a tax on the good will:

A) reduce the number of firms producing that good in the long run.

B) increase the number of firms producing that good in the long run.

C) reduce the number of firms producing that good in the short run.

D) increase the number of firms producing that good in the short run.

A) reduce the number of firms producing that good in the long run.

B) increase the number of firms producing that good in the long run.

C) reduce the number of firms producing that good in the short run.

D) increase the number of firms producing that good in the short run.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

64

A policy that requires all the people to certify that they have reduced total consumption, not necessarily their own individual consumption, by a specified amount, is a(n):

A) external incentive plan.

B) internal incentive plan.

C) tax incentive plan.

D) market incentive plan.

A) external incentive plan.

B) internal incentive plan.

C) tax incentive plan.

D) market incentive plan.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

65

Based on economic theory, most economists believe market incentive plans are:

A) equitable.

B) efficient.

C) inefficient.

D) unfair.

A) equitable.

B) efficient.

C) inefficient.

D) unfair.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

66

In a tax incentive program, the person who conserves the most pays:

A) relatively less tax.

B) relatively more tax.

C) no tax.

D) no penalties.

A) relatively less tax.

B) relatively more tax.

C) no tax.

D) no penalties.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

67

The following table shows four firms, the amount each pollutes, the marginal cost for each firm to clean up pollution, and the total cost to each firm of eliminating all pollution.

The total discharge of these four companies is 300 tons. Assume there is no one else who pollutes. Suppose that the government gives each company a pollution permit equal to 50 percent of its present discharge. However, companies are allowed to reduce pollution more than 50 percent and sell their permit or reduce less than 50 percent and buy a permit from another company. If firms maximize profits, what would happen?

A) Each firm would reduce pollution by 50 percent.

B) Firms A and D would eliminate pollution and sell their permits with a reasonable price to B and C, which would continue to pollute as before.

C) Firms B and C would eliminate pollution and sell their permits with a reasonable price to A and D, which would continue to pollute as before.

D) There is not enough information to answer this question.

The total discharge of these four companies is 300 tons. Assume there is no one else who pollutes. Suppose that the government gives each company a pollution permit equal to 50 percent of its present discharge. However, companies are allowed to reduce pollution more than 50 percent and sell their permit or reduce less than 50 percent and buy a permit from another company. If firms maximize profits, what would happen?

A) Each firm would reduce pollution by 50 percent.

B) Firms A and D would eliminate pollution and sell their permits with a reasonable price to B and C, which would continue to pollute as before.

C) Firms B and C would eliminate pollution and sell their permits with a reasonable price to A and D, which would continue to pollute as before.

D) There is not enough information to answer this question.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

68

The following table shows four firms, the amount each pollutes, the marginal cost for each firm to clean up pollution, and the total cost to each firm of eliminating all pollution.

The total discharge of these four companies is 300 tons. Assume there is no one else who pollutes. If the government establishes a regulation requiring each company to reduce pollution by 50 percent, what will be spent on reducing pollution?

A) $660

B) $910

C) $1,050

D) $1,710

The total discharge of these four companies is 300 tons. Assume there is no one else who pollutes. If the government establishes a regulation requiring each company to reduce pollution by 50 percent, what will be spent on reducing pollution?

A) $660

B) $910

C) $1,050

D) $1,710

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

69

The following table shows four firms, the amount each pollutes, the marginal cost for each firm to clean up pollution, and the total cost to each firm of eliminating all pollution.

The total discharge of these four companies is 300 tons. Assume there is no one else who pollutes. If the government establishes an effluent fee of $7.00 per ton, how much tax would firms pay to the government?

A) $660

B) $1,050

C) $1,820

D) $2,100

The total discharge of these four companies is 300 tons. Assume there is no one else who pollutes. If the government establishes an effluent fee of $7.00 per ton, how much tax would firms pay to the government?

A) $660

B) $1,050

C) $1,820

D) $2,100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

70

The following table shows four firms, the amount each pollutes, the marginal cost for each firm to clean up pollution, and the total cost to each firm of eliminating all pollution.

The total discharge of these four companies is 300 tons. Assume there is no one else who pollutes and these firms want to maximize profits. If the government wishes to cut discharge by 50 percent, it could do so by establishing an effluent fee of:

A) $3.00 per ton.

B) $4.50 per ton.

C) $5.50 per ton.

D) $10.00 per ton.

The total discharge of these four companies is 300 tons. Assume there is no one else who pollutes and these firms want to maximize profits. If the government wishes to cut discharge by 50 percent, it could do so by establishing an effluent fee of:

A) $3.00 per ton.

B) $4.50 per ton.

C) $5.50 per ton.

D) $10.00 per ton.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

71

The following table shows four firms, the amount each pollutes, the marginal cost for each firm to clean up pollution, and the total cost to each firm of eliminating all pollution.

The total discharge of these four companies is 300 tons. Assume there is no one else who pollutes. If the goal of the government is to reduce pollution by 50 percent, the cheapest way would be to have:

A) all four firms cut their discharge by 50 percent

B) have each firm reduce discharge by 37.5 tons.

C) have firms A and D stop discharging and allow B and C to continue.

D) have firms B and C stop discharging and allow A and D to continue.

The total discharge of these four companies is 300 tons. Assume there is no one else who pollutes. If the goal of the government is to reduce pollution by 50 percent, the cheapest way would be to have:

A) all four firms cut their discharge by 50 percent

B) have each firm reduce discharge by 37.5 tons.

C) have firms A and D stop discharging and allow B and C to continue.

D) have firms B and C stop discharging and allow A and D to continue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

72

An individual with a highly elastic demand for gasoline will:

A) cut consumption more than an individual with a highly inelastic demand when price goes up.

B) cut consumption less than an individual with a highly inelastic demand when price goes up.

C) refuse to cut consumption for any reason.

D) stop using gasoline entirely if a tax is imposed.

A) cut consumption more than an individual with a highly inelastic demand when price goes up.

B) cut consumption less than an individual with a highly inelastic demand when price goes up.

C) refuse to cut consumption for any reason.

D) stop using gasoline entirely if a tax is imposed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

73

If markets are perfectly competitive and production of a good results in water pollution, the imposition of a tax on that good will:

A) increase both the price of that good and pollution.

B) reduce the price of that good and increase pollution.

C) reduce both the price of that good and pollution.

D) increase the price of that good and reduce pollution.

A) increase both the price of that good and pollution.

B) reduce the price of that good and increase pollution.

C) reduce both the price of that good and pollution.

D) increase the price of that good and reduce pollution.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

74

Suppose Mary finds it easier to conserve than Jim does. The difference between a tax incentive program and a marketable certificate plan in this case is that:

A) Mary undertakes most of the conservation in the case of a tax incentive program and least in the marketable certificate program.

B) Mary undertakes least of the conservation in the case of a tax incentive program and most in the marketable certificate program.

C) Mary takes on most of the conservation in both cases but can be paid by Jim in the marketable certificate program.

D) Jim takes on most of the conservation in both cases but can be paid by Mary in the marketable certificate program.

A) Mary undertakes most of the conservation in the case of a tax incentive program and least in the marketable certificate program.

B) Mary undertakes least of the conservation in the case of a tax incentive program and most in the marketable certificate program.

C) Mary takes on most of the conservation in both cases but can be paid by Jim in the marketable certificate program.

D) Jim takes on most of the conservation in both cases but can be paid by Mary in the marketable certificate program.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

75

An effluent fee is an example of:

A) a voluntary approach to pollution.

B) a direct regulation of pollution.

C) a tax incentive policy.

D) a market incentive policy.

A) a voluntary approach to pollution.

B) a direct regulation of pollution.

C) a tax incentive policy.

D) a market incentive policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

76

Which of the following methods of reducing the amount of trash society generates is most likely to be efficient?

A) A mandatory recycling program

B) A completely voluntary recycling program

C) A "trash tax"

D) Landfills and incinerators

A) A mandatory recycling program

B) A completely voluntary recycling program

C) A "trash tax"

D) Landfills and incinerators

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

77

The following table shows four firms, the amount each pollutes, the marginal cost for each firm to clean up pollution, and the total cost to each firm of eliminating all pollution.

The total discharge of these four companies is 300 tons. Assume there is no one else who pollutes. If the government establishes an effluent fee of $7.00 per ton, how much would the firms spend on reducing pollution?

A) $660

B) $1,710

C) $1,820

D) $2,100

The total discharge of these four companies is 300 tons. Assume there is no one else who pollutes. If the government establishes an effluent fee of $7.00 per ton, how much would the firms spend on reducing pollution?

A) $660

B) $1,710

C) $1,820

D) $2,100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

78

A market incentive plan:

A) regulates the amount of a resource a person can consume through direct limits.

B) requires that people choose to consume until the marginal costs exceed the marginal benefits.

C) makes the price of a resource reflect not only the marginal private costs but also the marginal social costs of consuming that resource.

D) makes the price of a resource reflect the marginal private costs of consuming that resource.

A) regulates the amount of a resource a person can consume through direct limits.

B) requires that people choose to consume until the marginal costs exceed the marginal benefits.

C) makes the price of a resource reflect not only the marginal private costs but also the marginal social costs of consuming that resource.

D) makes the price of a resource reflect the marginal private costs of consuming that resource.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

79

To address the problems created by negative externalities, economists prefer programs that:

A) require government to conserve, using general tax revenues to pay for the program.

B) require all people to reduce consumption equally.

C) make people who have the lowest benefit of reducing consumption choose to undertake the most reduction.

D) make people who have the lowest cost of reducing consumption choose to undertake the most reduction.

A) require government to conserve, using general tax revenues to pay for the program.

B) require all people to reduce consumption equally.

C) make people who have the lowest benefit of reducing consumption choose to undertake the most reduction.

D) make people who have the lowest cost of reducing consumption choose to undertake the most reduction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

80

Which policy is likely to be the most efficient in dealing with automobile emission pollution?

A) A mandatory requirement to reduce pollution

B) Voluntary emission control guidelines

C) Subsidizing research and development for alternative forms of transportation

D) An emission tax

A) A mandatory requirement to reduce pollution

B) Voluntary emission control guidelines

C) Subsidizing research and development for alternative forms of transportation

D) An emission tax

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck