Deck 16: Inflation, Deflation and Macro Policy

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/36

العب

ملء الشاشة (f)

Deck 16: Inflation, Deflation and Macro Policy

1

Is zero inflation better than 2% inflation?

It depends.Inflation can undermine the function of money as a unit of account by making it more difficult to know whether a price increase is a relative price increase.This may lead to a misallocation of production.Inflation can also undermine the public trust in institutions and alter the distribution of wealth in an economy in an undesirable way.Focusing on these costs only suggests zero inflation is better than 2 percent inflation, particularly if the inflation is unexpected.2% inflation is, however, pretty low, and these costs are not likely to be high.

Since inflation has some useful side effects, these useful side effects may more than offset the costs.Specifically, inflation can facilitate relative price changes and allow more expansionary monetary policy.Consider relative price changes.For the overall price level to remain constant, nominal price and wage increases must be offset with declines in nominal price and wages.One segment of society (sellers) will feel good and other segments (buyers) will feel bad.With inflation, it is possible that both buyers and sellers will feel good because both receive nominal price and wage increases.This, however, is an illusion.If all prices rise equally, no one is truly better off-on average, increases in prices received are offset by declines in prices received.If prices rise by different amounts, those whose prices have increased more quickly are better off than those whose prices have not increased as quickly.As long as there are relative price changes, some are better off and others are worse off.Still, with inflation, on average, everyone is receiving higher prices, which can make everyone believe they are doing better even if they are not.

Inflation also allows more expansionary monetary policy because it breaks the zero interest rate lower bound.If there is no inflation, the real interest rate cannot go below zero unless banks are willing to pay interest to hold dollars.If there is inflation, the real interest rate (nominal interest rates less inflation) can go below zero as long as inflation exceeds nominal interest rates.Targeting some level inflation gives the government more flexibility in implementing expansionary monetary policy.When these positive side effects more than offset the costs of inflation, inflation is desirable.

Since inflation has some useful side effects, these useful side effects may more than offset the costs.Specifically, inflation can facilitate relative price changes and allow more expansionary monetary policy.Consider relative price changes.For the overall price level to remain constant, nominal price and wage increases must be offset with declines in nominal price and wages.One segment of society (sellers) will feel good and other segments (buyers) will feel bad.With inflation, it is possible that both buyers and sellers will feel good because both receive nominal price and wage increases.This, however, is an illusion.If all prices rise equally, no one is truly better off-on average, increases in prices received are offset by declines in prices received.If prices rise by different amounts, those whose prices have increased more quickly are better off than those whose prices have not increased as quickly.As long as there are relative price changes, some are better off and others are worse off.Still, with inflation, on average, everyone is receiving higher prices, which can make everyone believe they are doing better even if they are not.

Inflation also allows more expansionary monetary policy because it breaks the zero interest rate lower bound.If there is no inflation, the real interest rate cannot go below zero unless banks are willing to pay interest to hold dollars.If there is inflation, the real interest rate (nominal interest rates less inflation) can go below zero as long as inflation exceeds nominal interest rates.Targeting some level inflation gives the government more flexibility in implementing expansionary monetary policy.When these positive side effects more than offset the costs of inflation, inflation is desirable.

2

What is the basic lesson/insight about the nature of inflation that is drawn from the quantity theory of money?

The basic lesson from the quantity theory of money is that inflation is always and everywhere a monetary phenomenon.

3

Explain how policymakers use changes in productivity and wages to predict inflation.

Changes in both productivity and wages shift the short-run aggregate supply curve.Wage increases shift it up while productivity increases shift it down.Policymakers use the following formula to predict inflation:

Inflation = Nominal wage increase - productivity growth.

If the rise in nominal wage is greater than productivity growth, the short run aggregate supply curve shifts up and inflation occurs.If productivity growth is greater than the rise in nominal wage, the short run aggregate supply curve shifts down and deflation occurs.

Inflation = Nominal wage increase - productivity growth.

If the rise in nominal wage is greater than productivity growth, the short run aggregate supply curve shifts up and inflation occurs.If productivity growth is greater than the rise in nominal wage, the short run aggregate supply curve shifts down and deflation occurs.

4

What is the equation of exchange? State the equation and define its terms

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

5

What is meant by the institutional costs of inflation?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

6

Unexpected inflation redistributes income from lenders to borrowers.Explain using an example.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

7

When people refer to deflation, are they generally referring to asset price deflation or goods price deflation? What is the difference between the two?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

8

Briefly describe three different ways that people form expectations of inflation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

9

Who wins and who loses when there is unexpected inflation? Explain and offer an example.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

10

Describe three different ways that people form expectations of inflation and give an example of each method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

11

When people refer to inflation, are they generally referring to asset price inflation or goods price inflation? What is the difference between the two?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

12

Who wins and who loses when there is an unexpected inflation? Explain and give two examples - one dealing with wages and other dealing with interest rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

13

How does the short-run Phillips curve differ from the long-run Phillips curve? At what level of unemployment will the two curves intersect?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

14

Explain the difference between the distributional effects of asset inflation from the distributional effects of goods inflation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

15

How would institutionally focused economist's explanation of the inflation process likely differ from a quantity theorist's explanation?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

16

Economist's understanding of the costs and benefits of inflation differ from most lay people's understanding of the costs and benefits of inflation?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

17

Explain how the quantity theory of money differs from the equation of exchange.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

18

How is the quantity theory of money related to the equation of exchange? What are the implications of the quantity theory for dealing with inflation? Why do economists who believe in the quantity theory advocate monetary growth rules?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

19

Non-economists often say that inflation makes the nation poorer.Why are they incorrect? What are two actual costs of inflation? Explain your answer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

20

How has globalization changed the nature of the inflation problem faced by the U.S.?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

21

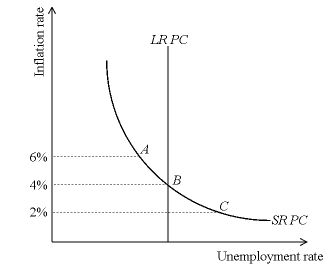

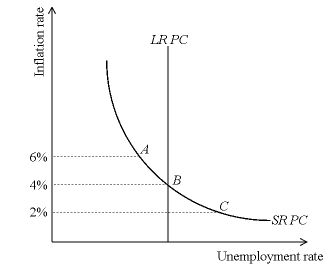

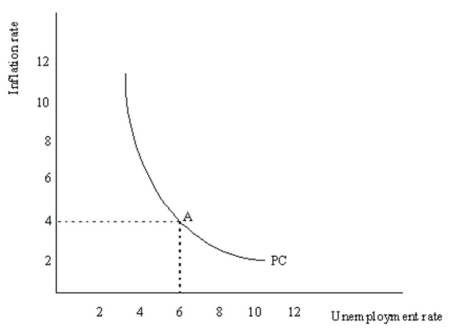

Consider the following Phillips curve diagram:  For the case where the economy is at Point A, Point B, or Point C, explain:

For the case where the economy is at Point A, Point B, or Point C, explain:

(a) whether actual inflation is above or below expected inflation (What is each exactly?)

(b) the likely shift in the short-run Phillips curve

(c) the likely change in unemployment

For the case where the economy is at Point A, Point B, or Point C, explain:

For the case where the economy is at Point A, Point B, or Point C, explain:(a) whether actual inflation is above or below expected inflation (What is each exactly?)

(b) the likely shift in the short-run Phillips curve

(c) the likely change in unemployment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

22

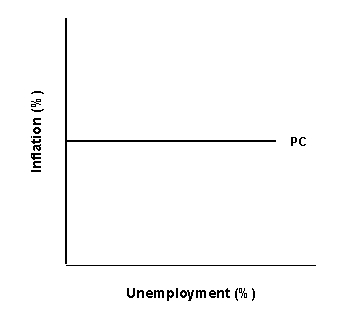

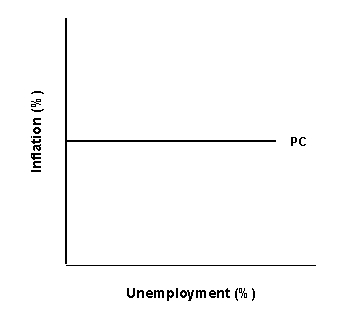

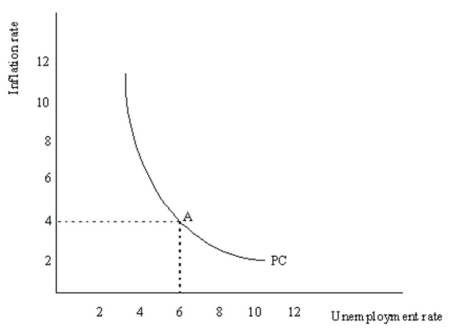

Demonstrate graphically, how globalization has changed the nature of the inflation/ unemployment tradeoff.

Globalization puts a cap on domestic prices, which leads to a horizontal Phillips curve shown by PC in the graph below.This allows government to run expansionary monetary policy, lowering unemployment without increasing inflation.If this expansionary policy, however, leads to asset price inflation, an asset price bubble may develop.Initially that bubble may improve the situation, but if it bursts it will create a financial crisis and throw the economy into a recession or severe depression.

Globalization puts a cap on domestic prices, which leads to a horizontal Phillips curve shown by PC in the graph below.This allows government to run expansionary monetary policy, lowering unemployment without increasing inflation.If this expansionary policy, however, leads to asset price inflation, an asset price bubble may develop.Initially that bubble may improve the situation, but if it bursts it will create a financial crisis and throw the economy into a recession or severe depression.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

23

Assume the money supply is $1000, the velocity of money is 12, and the price level is $4.Using the quantity theory of money:

(a) Determine the level of real output.

(b) Determine the level of nominal output.

(c) Assuming velocity remains constant, what will happen if the money supply rises by 10%?

(a) Determine the level of real output.

(b) Determine the level of nominal output.

(c) Assuming velocity remains constant, what will happen if the money supply rises by 10%?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

24

Economists who believe in the quantity theory favor monetary policy set by rules.Why?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

25

Explain how institutionally-focused economists use the price-setting process of firms to explain inflation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

26

Suppose the money supply is $100 billion and nominal GDP is $500 billion.What is the velocity of money?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

27

Use a Phillips curve diagram to explain the difference between the macroeconomic policy positions of the quantity theorists and the institutionalists.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

28

Using the equation of exchange, describe the difference between economists who ascribe to the quantity theory and those who follow a more institutionally-focused theory of inflation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

29

Consider the following Phillips curve diagram:  (a) The economy is currently at point A with unemployment of 6% and inflation of 4%.The President has informed you that she is about to undertake an expansionary fiscal policy designed to lower unemployment from its current rate of 6% to 4%.She asks you what will happen in the economy as a result of her policy.Base your answer on the Phillips curve in the above diagram.

(a) The economy is currently at point A with unemployment of 6% and inflation of 4%.The President has informed you that she is about to undertake an expansionary fiscal policy designed to lower unemployment from its current rate of 6% to 4%.She asks you what will happen in the economy as a result of her policy.Base your answer on the Phillips curve in the above diagram.

(b) How would your answer to (a) above change if you were to take into account potential changes in inflation expectations and their impact on actual inflation?

(a) The economy is currently at point A with unemployment of 6% and inflation of 4%.The President has informed you that she is about to undertake an expansionary fiscal policy designed to lower unemployment from its current rate of 6% to 4%.She asks you what will happen in the economy as a result of her policy.Base your answer on the Phillips curve in the above diagram.

(a) The economy is currently at point A with unemployment of 6% and inflation of 4%.The President has informed you that she is about to undertake an expansionary fiscal policy designed to lower unemployment from its current rate of 6% to 4%.She asks you what will happen in the economy as a result of her policy.Base your answer on the Phillips curve in the above diagram.(b) How would your answer to (a) above change if you were to take into account potential changes in inflation expectations and their impact on actual inflation?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

30

Draw a short run and long-run Phillips curve.Why is the shape of the short-run Phillips curve different from the shape of the long-run Phillips curve?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

31

Do economists who believe in the quantity theory of money favor an activist monetary policy? Why or why not?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

32

On which side of the economy is the policy focus implied by the quantity theory of money?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

33

Consider the following Phillips curve diagram:  Suppose an expansionary monetary policy has moved the economy from point A to point B.Is point B a long-run equilibrium? If yes, explain why.If no, explain how the economy will get to new long-run equilibrium.

Suppose an expansionary monetary policy has moved the economy from point A to point B.Is point B a long-run equilibrium? If yes, explain why.If no, explain how the economy will get to new long-run equilibrium.

Suppose an expansionary monetary policy has moved the economy from point A to point B.Is point B a long-run equilibrium? If yes, explain why.If no, explain how the economy will get to new long-run equilibrium.

Suppose an expansionary monetary policy has moved the economy from point A to point B.Is point B a long-run equilibrium? If yes, explain why.If no, explain how the economy will get to new long-run equilibrium.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

34

Using the AD/AS and the Phillips curve models, demonstrate graphically and explain in words the changes to output, unemployment and inflation caused by an expansionary fiscal policy.Show the short-run and long-run adjustments.Assume that the economy is initially in both short-run and long-run equilibrium, and that expected inflation is 2%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

35

Define the short-run Phillips curve.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck

36

Demonstrate graphically and explain verbally the short-run Phillips curve relationship.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 36 في هذه المجموعة.

فتح الحزمة

k this deck