Deck 13: Deficits and Debt: the Austerity Debate

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/32

العب

ملء الشاشة (f)

Deck 13: Deficits and Debt: the Austerity Debate

1

For each of the following state what is happening to the structural and passive budget deficits:

(a) Economy is experiencing an expansion.

(b) Economy is experiencing a recession.

(c) Economy is growing at its long-term secular growth rate.

(d) The potential level of output declines while equilibrium output remains unchanged.

(a) Economy is experiencing an expansion.

(b) Economy is experiencing a recession.

(c) Economy is growing at its long-term secular growth rate.

(d) The potential level of output declines while equilibrium output remains unchanged.

(a) Passive deficit is declining.Structural deficit is unchanged.

(b) Passive deficit is rising.Structural deficit is unchanged.

(c) Passive deficit is zero.Structural deficit is unchanged.

(d) Passive deficit is unchanged.Structural deficit rises.

(b) Passive deficit is rising.Structural deficit is unchanged.

(c) Passive deficit is zero.Structural deficit is unchanged.

(d) Passive deficit is unchanged.Structural deficit rises.

2

In which framework are government surpluses and deficits viewed as being better (or worse) for the economy-the short run or the long run? Explain.

Economic theory suggests that in the long-run government surpluses are good because they provide additional saving available for investment for an economy and deficits are bad because they reduce saving, growth, and income (provided they are not offset by private decisions about saving).In the short-run, the view of surpluses and deficits depends on the state of the economy relative to potential income.If the economy is operating below potential income, deficits are good and surpluses are bad because deficits increase expenditures, moving output closer to potential.This is true only if government surpluses are not offset by private decisions about saving.

3

What is the difference between a nominal deficit and the real deficit? How can inflation wipe out the burden of the national debt? Who bears the cost of eliminating debt with inflation?

A nominal deficit is the deficit determined by looking at the differences between actual expenditures and actual receipts.The real deficit is the nominal deficit adjusted for inflation.The two deficit concepts can be related using the following formula: real deficit = nominal deficit - (inflation × total debt).

Inflation wipes out the burden of national debt by making the value of dollars that are used to pay back debt worth less in real terms than when they were borrowed.But the cost of a fall in the value of money falls on the holders of government securities.These people are paid back the principal that they loaned the government (when they bought the bond) plus interest.But if they are not compensated for the decline in the value of each dollar they receive as repayment (because inflation has occurred in the interim) they are the losers.The government's gain is the bondholders' loss.Bondholders pay off part of the debt with their lost purchasing power.

Inflation wipes out the burden of national debt by making the value of dollars that are used to pay back debt worth less in real terms than when they were borrowed.But the cost of a fall in the value of money falls on the holders of government securities.These people are paid back the principal that they loaned the government (when they bought the bond) plus interest.But if they are not compensated for the decline in the value of each dollar they receive as repayment (because inflation has occurred in the interim) they are the losers.The government's gain is the bondholders' loss.Bondholders pay off part of the debt with their lost purchasing power.

4

What are two ways growth in GDP reduces the problems posed by deficits and debt? Explain each of them.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

5

How can inflation wipe out debt?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

6

Define deficit and surplus.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

7

What has been happening to the U.S.government debt and the debt/GDP ratio since WWII?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

8

What's the difference between a structural and a passive budget deficit? What contributes to a passive deficit? Use the distinction between passive and structural deficits and surpluses to explain how the $5.9 trillion surplus that economists back in 2000 predicted would occur over 15 years quickly disappeared during the 2001/2002 recession

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

9

What's the difference between a structural and a passive budget deficit? What contributes to a passive deficit?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

10

Who owns the U.S.debt? How much of the debt is owned by U.S.government agencies? How much is owned by individuals and how much is owned by foreigners?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

11

Why is it important to judge an economy's external debt relative to its assets? (Remember: an internal debt creates an equal amount of financial assets.) Give an example to support your explanation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

12

Why do economists prefer to examine the national debt as a percentage of GDP rather than as an absolute value?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

13

Does inflation actually wipe out the real burden of the debt? Who (if anyone) bears the cost of eliminating debt with inflation?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

14

How do accounting practices affect the definitions of deficits and surpluses? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

15

What is the difference between a nominal deficit and the real deficit? Write a formula that shows the relationship between the two.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

16

What is the difference between a passive deficit or surplus and the structural deficit or surplus?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

17

What has been happening to the U.S.government debt and interest on that debt (relative to GDP) since WWII?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

18

Define the terms deficit and debt.Which is a flow concept and which is a stock concept?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

19

How is government debt different from an individual's debt? Provide three reasons.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

20

Define deficits, surpluses, and debt.How do accounting practices affect the definitions of deficits and surpluses?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

21

The nominal deficit is $150 billion, inflation is 4%, and the total debt is $8 trillion.Does this economy have a real deficit or a real surplus? Show your calculations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

22

What is the debt service?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

23

What has been happening to the U.S.interest/GDP ratio since WWII?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

24

An economy has a government debt of $6 trillion, its GDP is $10 trillion, and it has a 3% growth rate.

(a) What is its debt-to-GDP ratio?

(b) What size government budget deficit could this economy have without increasing the debt to GDP ratio?

(a) What is its debt-to-GDP ratio?

(b) What size government budget deficit could this economy have without increasing the debt to GDP ratio?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

25

The nominal surplus is $100 billion, inflation is 3%, and total debt is $5 trillion.What is the real surplus?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

26

How does Social Security make the current budget deficit smaller than it otherwise would be?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

27

What is the distinction between the nominal deficit and the real deficit? Why can inflation wipe out debt?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

28

Calculate the real deficit from the figures in the examples given below:

#1: Nominal deficit = $8 million; Inflation = 5%; Total debt = $100 million

#2: Nominal deficit = $8 million; Inflation = 8%; Total debt = $100 million

#3: Nominal deficit = $8 million; Inflation = 8%; Total debt = $200 million

#1: Nominal deficit = $8 million; Inflation = 5%; Total debt = $100 million

#2: Nominal deficit = $8 million; Inflation = 8%; Total debt = $100 million

#3: Nominal deficit = $8 million; Inflation = 8%; Total debt = $200 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

29

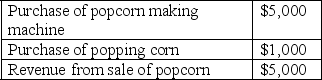

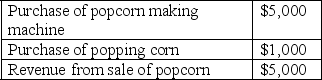

To earn money, you decide to open up a popcorn stand at your student union.At the end of your first year of operation, your financial condition is as follows: Assume that the opportunity cost of your time is zero.

(a) Did you run a deficit or a surplus during your first year?

(a) Did you run a deficit or a surplus during your first year?

(b) Assuming a four-year useful life for your popcorn-making machine, how does your answer to (a) change if you evenly depreciate the value of your machine?

(c) How do your answers to (a) and (b) relate to the government's budget balance calculations? Explain.

(a) Did you run a deficit or a surplus during your first year?

(a) Did you run a deficit or a surplus during your first year?(b) Assuming a four-year useful life for your popcorn-making machine, how does your answer to (a) change if you evenly depreciate the value of your machine?

(c) How do your answers to (a) and (b) relate to the government's budget balance calculations? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

30

The government has just issued a news bulletin announcing that it is currently running a budget deficit of $100 billion.Two economists are arguing (imagine!) over this announcement.One economist claims that the deficit is larger than the government is reporting, while the other maintains that the government is actually running a budget surplus.Here are the facts: the size of the economy is $7 trillion, potential output is $7.5 trillion, and the marginal tax rate is 25%.Government expenditures do not vary with income.It turns out that both economists are correct! How can this be? Hint: Consider the difference between the passive and the structural deficit concepts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

31

An economy's actual income is $800 billion, its potential income is $900 billion, and it has a budget deficit of $50 billion and a marginal tax rate of 25%.Government expenditures do not vary with income.What is its structural deficit? What is the passive deficit?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck

32

Consider an economy with an annual GDP of $5 trillion that is growing at a real rate of 3% per year, and has a government debt of $3 trillion.

(a) What is this economy's relative debt burden?

(b) How much of a deficit can this economy's government have each year and still maintain its current relative debt burden?

(a) What is this economy's relative debt burden?

(b) How much of a deficit can this economy's government have each year and still maintain its current relative debt burden?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 32 في هذه المجموعة.

فتح الحزمة

k this deck