Deck 7: Interest Rates and Bond Valuation

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/393

العب

ملء الشاشة (f)

Deck 7: Interest Rates and Bond Valuation

1

Sinking fund provisions are included in the bond indenture.

True

2

The yield to maturity is generally included in a bond indenture.

False

3

Assume you are considering two bonds identical in every way but for coupon frequency-bond A pays interest annually, and bond B pays interest semi-annually. Then, if they have the same price, the yield-to-maturity on bond A will always be greater than that on bond

B.

B.

False

4

Failure to pay either the interest payments or the bond principle as agreed can cause a firm to go into bankruptcy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

5

A sinking fund is used to pay off portions of debt each year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

6

Call provisions are included in the bond indenture.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

7

A call provision, unlike a sinking fund, allows a company to retire its debt early for a specified price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

8

Debt can be subordinated to equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

9

Maintaining a current ratio of 1.5 or better while ensuring the loan collateral in good working order is an example of a positive covenant.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

10

For two bonds identical but for coupon, the market price of the lower coupon bond will change more (in percentage terms) than that of the higher coupon bond for a given change in market interest rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

11

All else the same, if interest rates fall, the percentage price change for long-term bonds will be greater than for short-term bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

12

All else equal, the market value of a corporate bond is always inversely related to its coupon rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

13

The call premium generally starts at 10% of par and decreases to zero with the passage of time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

14

Maintaining a current ratio of 1.5 or better while ensuring the loan collateral in good working order is an example of a negative covenant.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

15

Any regular coupon bond of any maturity will sell for its face value if the coupon rate is the same as the market rate of interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

16

The coupon rate will be less than the yield to maturity when a bond sells at a discount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

17

The call premium increases as the time to maturity decreases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

18

For a bond, total return = yield-to-maturity = market's required return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

19

The repayment of the bond principle is tax-deductible.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

20

The yield to maturity will be greater than the coupon rate when a bond is selling at a premium.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

21

All else the same, if interest rates fall, then bond prices will rise.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

22

The Dominion Bond Rating Service (DBRS) primarily considers interest rate risk rather than default risk when it rates debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

23

Increasing the time to maturity and decreasing the coupon rate will increase the interest rate risk of a bond.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

24

Duration is a useful measure of interest rate risk because it incorporates a bond's default risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

25

Adjustable maturity dates is a common characteristic of floating-rate bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

26

Increasing the coupon rate and decreasing the time to maturity will increase the interest rate risk of a bond.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

27

A high coupon bond is more interest rate sensitive than a low coupon bond.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

28

All else the same, if interest rates fall, coupon payments on floating rate bonds will fall.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

29

The higher the coupon rate, the higher the interest rate risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

30

Prior to 1980, few firms raised funds directly by issuing junk bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

31

All else the same, interest rate risk is highest for bonds with variable rate coupons.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

32

Your firm seeks to obtain a short-term loan from a local bank. The banker quotes you a rate of 9%. This is a real rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

33

The term structure of interest rates includes only the real rate of return and the inflation premium.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

34

The shorter the term, the greater the interest rate risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

35

Bond prices are inversely related to market interest rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

36

The term structure of interest rates can be down-sloping.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

37

The outlook for future inflation influences the shape of the term structure of interest rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

38

Bond ratings issued by DBRS specifically account for default risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

39

The interest rate risk premium is included in the term structure of interest rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

40

Duration is a useful measure of interest rate risk because it incorporates a bond's coupon rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

41

Dhalia Corporation issued $100 million bonds that mature in 30 years and have a 5% coupon rate that is paid annually. If the bonds were sold to yield 3.4%, determine the price of the bonds at the end of year 15.

A) $103,202,658

B) $105,659,506

C) $107,244,589

D) $118,559,603

E) $126,658,944

A) $103,202,658

B) $105,659,506

C) $107,244,589

D) $118,559,603

E) $126,658,944

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

42

An increase in the real rate of interest will cause the slope of the term structure of interest rates to increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

43

J&J Manufacturing just issued a bond with a $1,000 face value and a coupon rate of 7%. If the bond has a life of 30 years, pays annual coupons, and the yield to maturity is 6.8%, what will the bond sell for?

A) $975.18

B) $1,000.00

C) $1,025.32

D) $1,087.25

E) $1,111.81

A) $975.18

B) $1,000.00

C) $1,025.32

D) $1,087.25

E) $1,111.81

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

44

A corporate bond is quoted at a current price of 101.387. What is the market price of a bond with a $1,000 face value?

A) $1,001.39

B) $1,010.39

C) $1,013.87

D) $1,103.87

E) $1,138.70

A) $1,001.39

B) $1,010.39

C) $1,013.87

D) $1,103.87

E) $1,138.70

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

45

Dhalia Corporation issued $100 million bonds that mature in 30 years and have a 5% coupon rate that is paid annually. If the bonds were sold to yield 3.4%, determine the price of the bonds at the end of year 5.

A) $103,202,658

B) $105,659,506

C) $107,244,589

D) $118,559,603

E) $126,658,944

A) $103,202,658

B) $105,659,506

C) $107,244,589

D) $118,559,603

E) $126,658,944

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

46

Dhalia Corporation issued $100 million bonds that mature in 30 years and have a 5% coupon rate that is paid annually. If the bonds were sold to yield 3.4%, determine the price of the bonds at the end of year 25.

A) $103,202,658

B) $105,659,506

C) $107,244,589

D) $118,559,603

E) $126,658,944

A) $103,202,658

B) $105,659,506

C) $107,244,589

D) $118,559,603

E) $126,658,944

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

47

Five years ago, Jackson Corporation issued twenty-five-year 10% annual coupon bonds with a $1,000 face value each. Since then, interest rates in general have risen, and the yield to maturity on the Thompson Tarps bonds is now 12%. Given this information, what is the price of the bonds today?

A) $1,230

B) $851

C) $1,218

D) $880

E) $1,440

A) $1,230

B) $851

C) $1,218

D) $880

E) $1,440

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

48

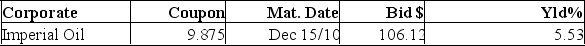

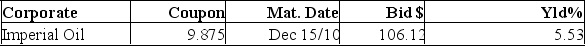

On December 15, 2010 the price of this bond should be:

On December 15, 2010 the price of this bond should be:A) $1,000.00.

B) $1,055.30.

C) $1,061.20.

D) $1,098.75.

E) $1,050.00.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

49

The bonds of Microhard, Inc. carry a 10% annual coupon, have a $1,000 face value, and mature in four years. Bonds of equivalent risk yield 7%. What is the market value of Microhard's bonds?

A) $1,011.20

B) $1,087.25

C) $1,095.66

D) $1,101.62

E) $1,160.25

A) $1,011.20

B) $1,087.25

C) $1,095.66

D) $1,101.62

E) $1,160.25

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

50

The bonds offered by Leo's Pumps are callable in 3 years at a quoted price of 101. What is the amount of the call premium on a $1,000 par value bond?

A) $3.33

B) $5.00

C) $10.00

D) $13.33

E) $100.00

A) $3.33

B) $5.00

C) $10.00

D) $13.33

E) $100.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

51

The bonds offered by Fast Moving Pumps are callable in 4 years at a quoted price of 101.5. What is the amount of the call premium on a $1,000 face value bond?

A) $.015

B) $.15

C) $1.50

D) $15.00

E) $150.00

A) $.015

B) $.15

C) $1.50

D) $15.00

E) $150.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

52

The term structure of interest rates compares the components of the Fisher formula.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

53

A bond with a 7% coupon that pays interest semi-annually and is priced at par will have a market price of _____ and interest payments in the amount of _____ each.

A) $1,007; $70

B) $1,070; $35

C) $1,070; $70

D) $1,000; $35

E) $1,000; $70

A) $1,007; $70

B) $1,070; $35

C) $1,070; $70

D) $1,000; $35

E) $1,000; $70

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

54

A corporate bond is quoted at a current price of 102.77. What is the market price of a bond with a $1,000 face value?

A) $1,000.28

B) $1,002.77

C) $1,027.70

D) $1,102.77

E) $1,276.70

A) $1,000.28

B) $1,002.77

C) $1,027.70

D) $1,102.77

E) $1,276.70

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

55

A 10-year, 8% coupon bond pays interest annually. The bond has a face value of $1,000. What is the percentage change in the price of this bond if the market yield rises to 9% from the current rate of 8.5%?

A) - 4.23%

B) - 4.08%

C) - 3.71%

D) - 3.24%

E) - 2.98%

A) - 4.23%

B) - 4.08%

C) - 3.71%

D) - 3.24%

E) - 2.98%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

56

Rapid River, Inc., has a 7.5% coupon bond that matures in 9 years. The bond pays interest semi-annually. What is the market price of a $1,000 face value bond if the yield to maturity is 6.8%?

A) $1,045.18

B) $1,046.55

C) $1,049.07

D) $1,050.10

E) $1,051.33

A) $1,045.18

B) $1,046.55

C) $1,049.07

D) $1,050.10

E) $1,051.33

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

57

Assume this bond's face value is $1,000. Then the current market price of this bond is ________.

Assume this bond's face value is $1,000. Then the current market price of this bond is ________.A) $987.50

B) $1061.20

C) $1000.00

D) $1,055.30

E) $10,612.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

58

A Treasury bond is quoted at a price of 105:21. What is the market price of this bond if the face value is $1,000?

A) $105.21

B) $106.56

C) $1,052.10

D) $1,056.56

E) $1,065.60

A) $105.21

B) $106.56

C) $1,052.10

D) $1,056.56

E) $1,065.60

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

59

Marconi Corporation issued 30 year semi-annual 14% coupon bonds. If the current yield to maturity is 8%, what is the firm's current price?

A) $572.82

B) $579.84

C) $1,675.47

D) $1,678.70

E) $1,778.55

A) $572.82

B) $579.84

C) $1,675.47

D) $1,678.70

E) $1,778.55

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

60

What is the market value of a bond that will pay a total of 40 semi-annual coupons of $50 each over the remainder of its life? Assume the bond has a $1,000 face value and an 8% yield to maturity.

A) $634.86

B) $642.26

C) $1,135.90

D) $1,197.93

E) $1,215.62

A) $634.86

B) $642.26

C) $1,135.90

D) $1,197.93

E) $1,215.62

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

61

You purchased an investment which will pay you $15,000, in real dollars, a year for the next three years. The nominal discount rate is 8% and the inflation rate is 3.6%. What is the present value of these payments?

A) $41,431.91

B) $42,607.19

C) $43,333.33

D) $43,711.14

E) $44,008.16

A) $41,431.91

B) $42,607.19

C) $43,333.33

D) $43,711.14

E) $44,008.16

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

62

J&J Enterprises wants to issue eighty 20-year, $1,000 zero-coupon bonds. If each bond is to yield 8%, how much will J&J receive (ignoring issuance costs) when the bonds are first sold?

A) $11,212

B) $12,393

C) $17,164

D) $18,880

E) $20,000

A) $11,212

B) $12,393

C) $17,164

D) $18,880

E) $20,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

63

Alpha Manufacturing offers a zero-coupon bond with a 12.25% yield to maturity. The bond matures in 13 years. What is the current price if the face value is $1,000?

A) $222.63

B) $234.18

C) $241.41

D) $243.06

E) $244.09

A) $222.63

B) $234.18

C) $241.41

D) $243.06

E) $244.09

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

64

Today, you want to sell a zero-coupon bond you currently own. The bond matures in 9 years. How much will you receive for your bond if the market yield to maturity is currently 8.88%? Ignore any accrued interest.

A) $465.02

B) $468.10

C) $496.93

D) $676.39

E) $678.73

A) $465.02

B) $468.10

C) $496.93

D) $676.39

E) $678.73

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

65

This morning Tim purchased a 15-year, $1,000 face value zero-coupon bond for $394.34. Assume the yield-to-maturity remains constant over the life of the bond. What price should Tim receive for his bond if he wants to sell it 4 years from today?

A) $505.40

B) $515.60

C) $544.44

D) $555.85

E) $561.33

A) $505.40

B) $515.60

C) $544.44

D) $555.85

E) $561.33

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

66

Moltado Corporation is issuing a zero-coupon bond that will have a maturity of fifty years. The bond's par value is $1,000, and the current yield on similar bonds is 7.5%. Determine the value of the bond.

A) $43.81

B) $42.71

C) $41.61

D) $40.51

E) $26.89

A) $43.81

B) $42.71

C) $41.61

D) $40.51

E) $26.89

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

67

Ted's Co. offers a zero-coupon bond with an 11.3% yield to maturity. The bond matures in 16 years. What is the current price of a $1,000 face value bond?

A) $178.78

B) $180.33

C) $188.36

D) $190.09

E) $192.18

A) $178.78

B) $180.33

C) $188.36

D) $190.09

E) $192.18

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

68

The bonds offered by Glenwood Studios are callable in 4 years at a quoted price of 106. What is the amount of the call premium on a $1,000 par value bond?

A) $30

B) $40

C) $50

D) $60

E) $70

A) $30

B) $40

C) $50

D) $60

E) $70

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

69

A $1,000 face value zero-coupon bond is quoted at a price of 38.62. What is the amount you will pay to purchase this bond?

A) $.39

B) $3.86

C) $38.62

D) $386.20

E) $1,038.62

A) $.39

B) $3.86

C) $38.62

D) $386.20

E) $1,038.62

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

70

Suppose you purchase a zero-coupon bond with face value $1,000, maturing in 20 years, for $214.51. What is the implicit interest, in dollars, in the first year of the bond's life?

A) $14.86

B) $16.84

C) $17.16

D) $39.27

E) $80.00

A) $14.86

B) $16.84

C) $17.16

D) $39.27

E) $80.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

71

A zero-coupon bond with a face value of $1,000 is issued at an initial price of $375. The bond matures in 20 years. What is the implicit interest, in dollars, for the first year of the bond's life?

A) $17.25

B) $18.85

C) $20.50

D) $21.20

E) $23.50

A) $17.25

B) $18.85

C) $20.50

D) $21.20

E) $23.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

72

A $1,000 face value zero-coupon bond is quoted at a price of 43.30. What is the amount you would pay to purchase this bond?

A) $43.30

B) $430.30

C) $433.00

D) $956.70

E) $1,043.30

A) $43.30

B) $430.30

C) $433.00

D) $956.70

E) $1,043.30

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

73

You plan on depositing $10,000 a year in real terms into your investment account for the next four years. The relevant nominal discount rate is 7.5% and the inflation rate is 4.2%. What are these deposits worth in today's dollars?

A) $36,418.02

B) $36,787.78

C) $37,023.03

D) $38,021.21

E) $38,504.19

A) $36,418.02

B) $36,787.78

C) $37,023.03

D) $38,021.21

E) $38,504.19

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

74

Party Time, Inc. has a 6% coupon bond that matures in 11 years. The bond pays interest semi-annually. What is the market price of a $1,000 face value bond if the yield to maturity is 12.9%?

A) $434.59

B) $580.86

C) $600.34

D) $605.92

E) $947.87

A) $434.59

B) $580.86

C) $600.34

D) $605.92

E) $947.87

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

75

This morning, Alicia bought a ten-year 7% coupon bond that pays interest annually. She paid $994 for a $1,000 bond. If the market interest rate on this type of bond declines to 6.5% tonight, how much will Alicia receive for her first interest payment?

A) $32.31

B) $35.00

C) $65.00

D) $69.58

E) $70.00

A) $32.31

B) $35.00

C) $65.00

D) $69.58

E) $70.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

76

Suppose you purchase a zero-coupon bond with face value $1,000, maturing in 20 years, for $214.51. If the yield to maturity on the bond remains unchanged, what will the price of the bond be five years from now?

A) $315.20

B) $387.52

C) $410.91

D) $680.58

E) $1,000.00

A) $315.20

B) $387.52

C) $410.91

D) $680.58

E) $1,000.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

77

A corporate bond is quoted at a current price of 103.68. What is the market price if the face value is $5,000?

A) $4,785.00

B) $4,822.53

C) $5,103.68

D) $5,184.00

E) $5,210.68

A) $4,785.00

B) $4,822.53

C) $5,103.68

D) $5,184.00

E) $5,210.68

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

78

The semi-annual, ten-year bonds of Adep, Inc. are selling at par and have an effective annual yield of 4.295%. What is the amount of each interest payment on a $1,000 Adep bond?

A) $21.25

B) $21.48

C) $21.50

D) $42.50

E) $42.95

A) $21.25

B) $21.48

C) $21.50

D) $42.50

E) $42.95

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

79

A zero-coupon bond with a face value of $1,000 is issued with an initial price of $387.50. The bond matures in 30 years. What is the implicit interest, in dollars, for the first year of the bond's life?

A) $10.38

B) $12.44

C) $14.42

D) $18.79

E) $22.50

A) $10.38

B) $12.44

C) $14.42

D) $18.79

E) $22.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck

80

The semiannual, 12-year bonds of Tracey United are selling at par and have an effective annual yield of 4.6529%. What is the amount of each interest payment if the face value of the bonds is $1,000?

A) $22.50

B) $22.75

C) $23.00

D) $23.27

E) $23.50

A) $22.50

B) $22.75

C) $23.00

D) $23.27

E) $23.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 393 في هذه المجموعة.

فتح الحزمة

k this deck