Deck 4: Long-Term Financial Planning and Corporate Growth

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

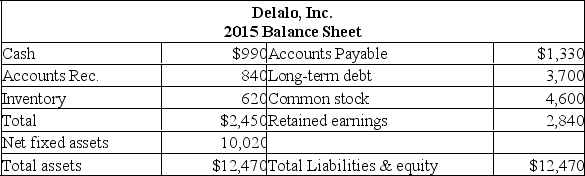

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

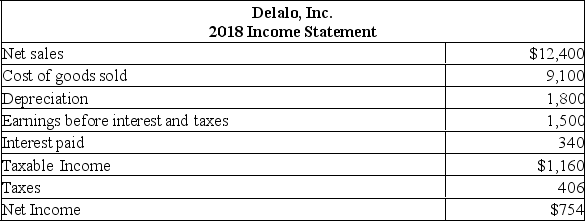

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

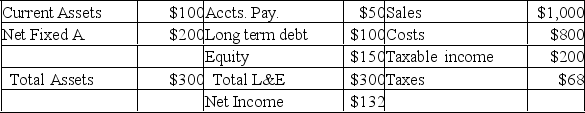

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/379

العب

ملء الشاشة (f)

Deck 4: Long-Term Financial Planning and Corporate Growth

1

In most industries, planning beyond the period of one year is not very useful.

False

2

Sales forecasts are a common element among financial planning models.

True

3

Very few financial planning models require an externally supplied sales forecast.

False

4

Financial planning is important because the only way for a firm to prosper is for it to grow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

5

A pro forma balance sheet must always maintain the current debt-equity ratio of a firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

6

A pro forma income statement should consider both macroeconomic and industry forecasts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

7

With good financial planning, managers can be less vigilant in their day to day management of the firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

8

A pro forma balance sheet should include consideration of the capacity level of the firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

9

Pro forma statements are a common element among financial planning models.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

10

By developing a financial plan, a firm benefits by being forced to focus on best case scenarios.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

11

Asset requirements is a common element among financial planning models.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

12

By developing a financial plan, a firm benefits by being forced to set goals and establish priorities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

13

Conventional wisdom holds that financial plans don't work, but financial planning does.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

14

All else equal, the lower the forecast growth the larger the level of external financing needed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

15

The firm's investment and financing decisions are unrelated and should not be analyzed at the same time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

16

If total assets increase by the same percentage as sales increase it is likely assets and sales will increase by identical dollar amounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

17

Pro forma statements should consider the dividend policy of the firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

18

Financial planning helps investigate the linkages between goals and the different aspects of a firm's business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

19

Aggregation refers to the process by which a firm first projects its aggregate investment requirement, then it breaks that total up and allocates it to the investment proposals of the firm's smaller units.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

20

By developing a financial plan, a firm benefits by being forced to think about and forecast the future.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

21

All else the same, greater depreciation expense would likely be associated with a firm which has a high capital intensity ratio, relative to other firms in the same industry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

22

The retention ratio is equal to one plus the dividend payout ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

23

One would expect the capital intensity ratio of an auto manufacturing firm to be lower than that of a software development firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

24

Generally speaking, actions that increase the firm's ability to generate funds internally decrease its ability to grow without obtaining external financing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

25

If total assets increase by the same percentage as sales increase: the firm is assumed to be operating at full capacity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

26

All else equal, a firm that utilizes assets inefficiently will have a higher sustainable growth rate than a firm that does not.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

27

If total assets increase by the same percentage as sales increase the larger the increase in sales, the more likely there will be a need for external financing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

28

When utilizing the percentage of sales approach, managers need to determine the capital intensity ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

29

If the Limberger Institute currently operates at full capacity, then accounts receivable would most likely vary directly with sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

30

If the Ballard Institute currently operates at full capacity, then fixed assets would most likely vary directly with sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

31

If the Ballard Institute currently operates at full capacity, then long-term debt would most likely vary directly with sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

32

An increase in a firm's capital intensity ratio implies a decrease in how efficiently it uses its assets to generate sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

33

When utilizing the percentage of sales approach, managers need to identify which expenses are variable and which are fixed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

34

When utilizing the percentage of sales approach, managers need to determine the level of sales required based on the desired profit margin percentage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

35

The retention ratio is also known as the plowback ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

36

The dividend policy decision is a basic policy element of financial planning.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

37

All else the same, lower fixed asset turnover ratio would likely be associated with a firm which has a high capital intensity ratio, relative to other firms in the same industry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

38

All else equal, an increase in a firm's capital intensity ratio will increase its external financing needed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

39

All else the same, lower return on assets (ROA) ratio would likely be associated with a firm which has a high capital intensity ratio, relative to other firms in the same industry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

40

When utilizing the percentage of sales approach, managers can ignore any projected dividends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

41

Jack's currently has $798,200 in sales and is operating at 73% of the firm's capacity. What is the full capacity level of sales?

A) $582,686

B) $804,927

C) $1,013,714

D) $1,093,425

E) $1,380,886

A) $582,686

B) $804,927

C) $1,013,714

D) $1,093,425

E) $1,380,886

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

42

The sustainable growth rate is dependent on profit margin.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

43

All else the same, an increase in a firm's dividend payout ratio will decrease its sustainable growth rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

44

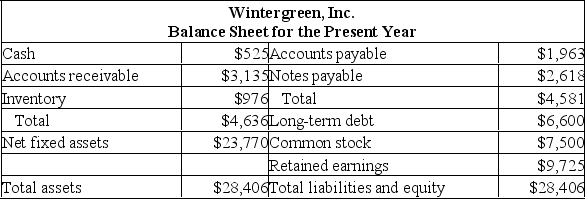

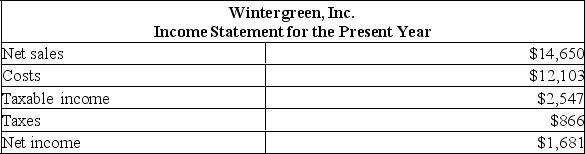

Assets, accounts payable and costs are proportional to sales. Debt and equity are not.

Assets, accounts payable and costs are proportional to sales. Debt and equity are not.Sales of Wintergreen, Inc. are expected to increase by 13% next year. The dividend payout ratio is 35%. The company is currently operating at 93% of capacity. What is the projected retained earnings balance at the end of next year?

A) $132

B) $414

C) $1,235

D) $2,087

E) $2,203

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

45

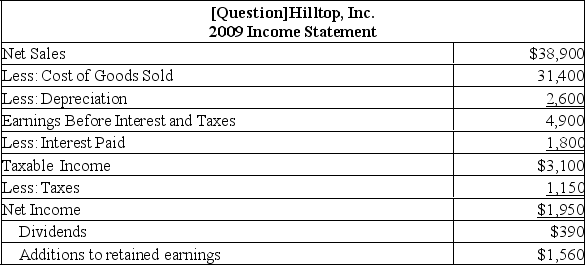

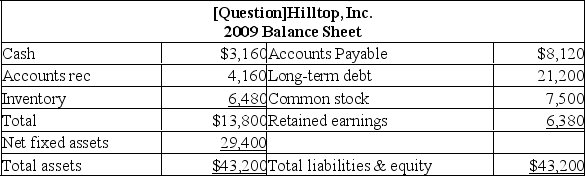

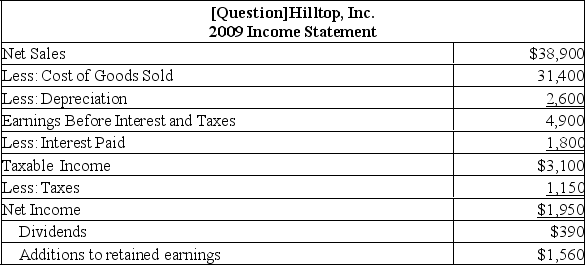

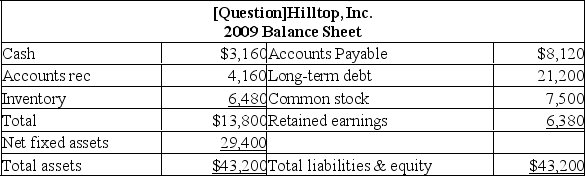

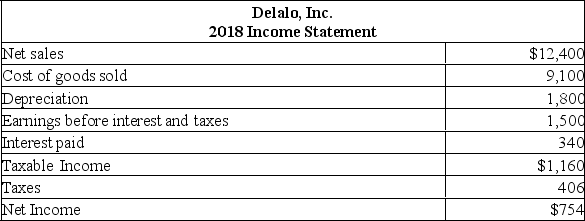

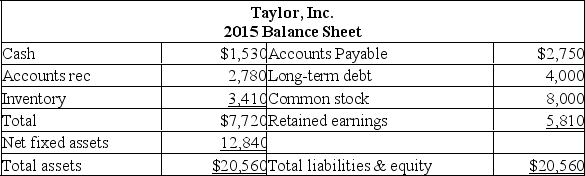

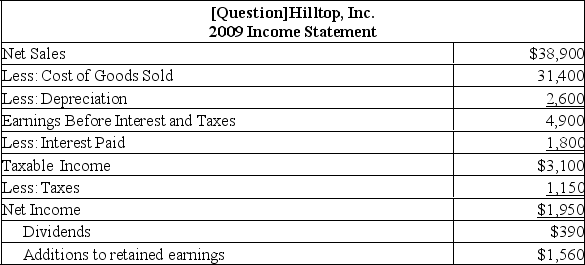

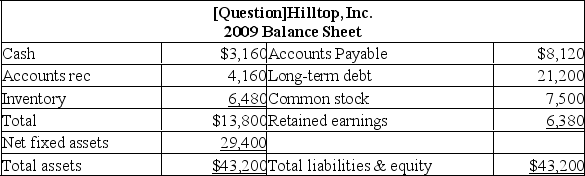

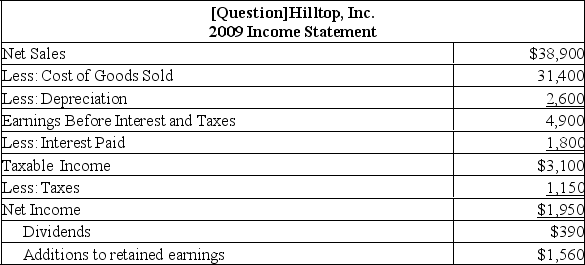

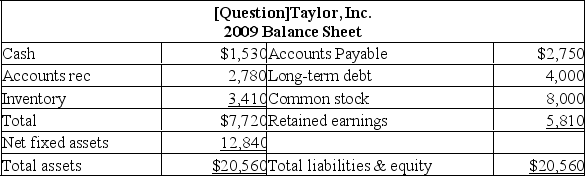

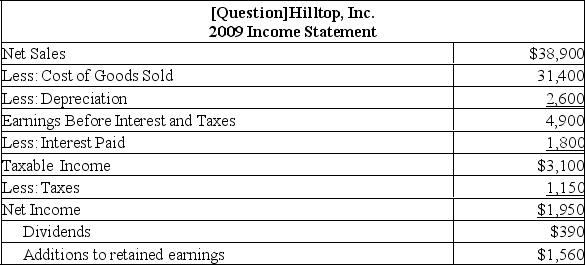

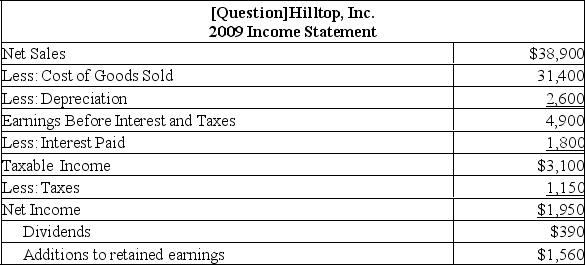

The following balance sheet and income statement should be used:

Hilltop, Inc. is currently operating at 82% of capacity. The profit margin and the dividend payout ratio are constant. Net working capital and fixed assets vary directly with sales. Sales are projected to increase by 20 percent. What is the external financing need?

Hilltop, Inc. is currently operating at 82% of capacity. The profit margin and the dividend payout ratio are constant. Net working capital and fixed assets vary directly with sales. Sales are projected to increase by 20 percent. What is the external financing need?

A) -$736

B) -$487

C) $1,144

D) $5,708

E) $6,768

Hilltop, Inc. is currently operating at 82% of capacity. The profit margin and the dividend payout ratio are constant. Net working capital and fixed assets vary directly with sales. Sales are projected to increase by 20 percent. What is the external financing need?

Hilltop, Inc. is currently operating at 82% of capacity. The profit margin and the dividend payout ratio are constant. Net working capital and fixed assets vary directly with sales. Sales are projected to increase by 20 percent. What is the external financing need?A) -$736

B) -$487

C) $1,144

D) $5,708

E) $6,768

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

46

The sustainable growth rate includes a constant debt-equity ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

47

Profit margin is a determinant of growth.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

48

Calculate depreciation expense given the following information. Interest expense $2,000; times interest earned 5; cash coverage ratio 5.5.

A) $1,000

B) $1,200

C) $1,400

D) $1,600

E) $1,800

A) $1,000

B) $1,200

C) $1,400

D) $1,600

E) $1,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

49

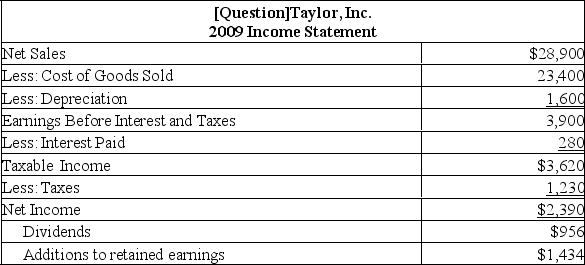

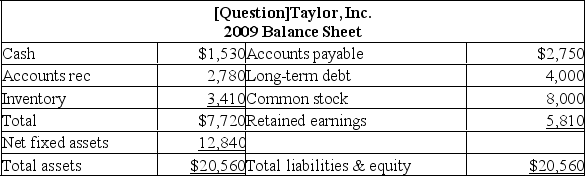

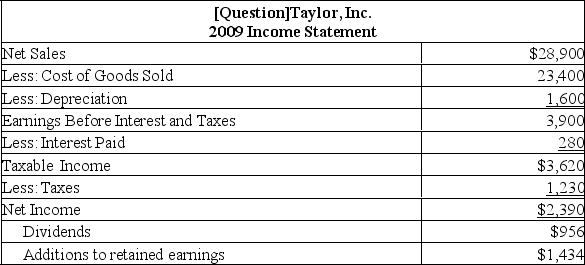

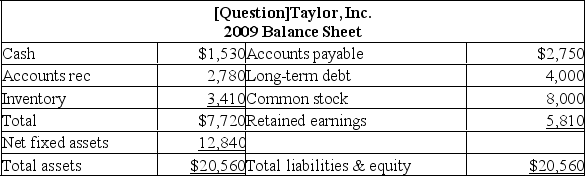

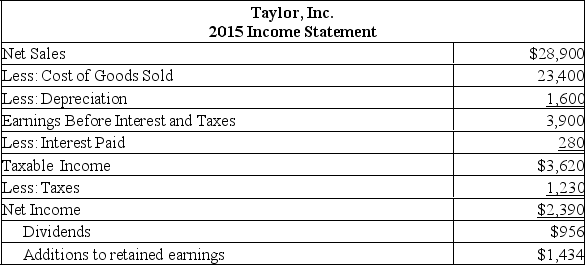

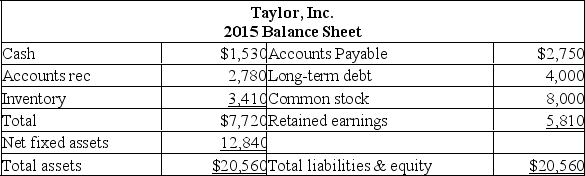

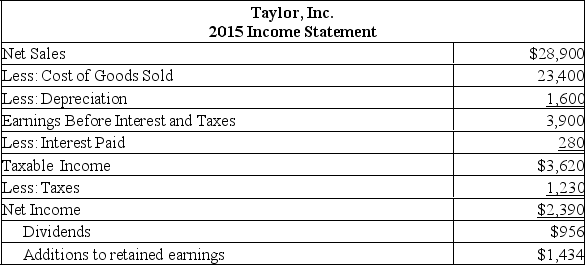

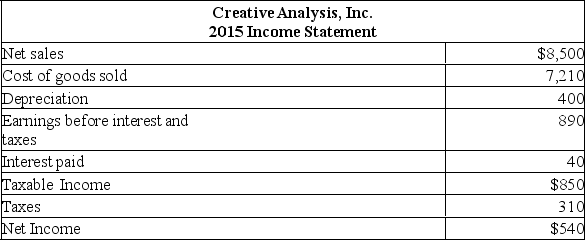

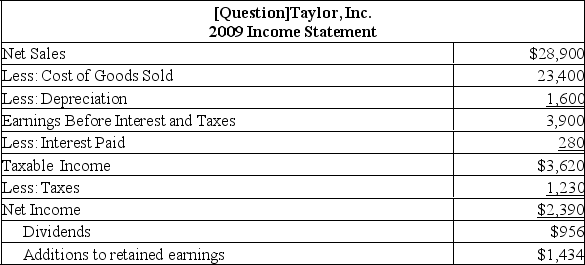

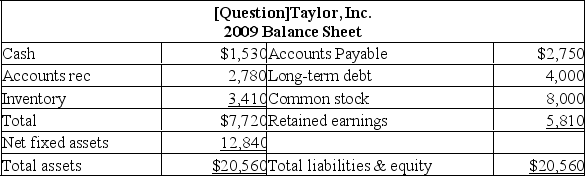

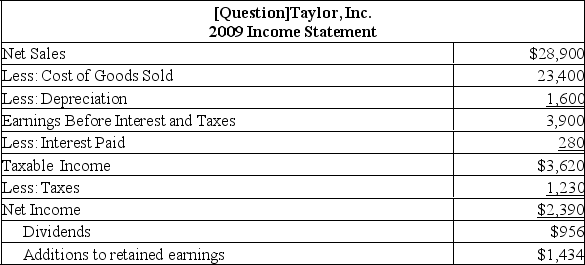

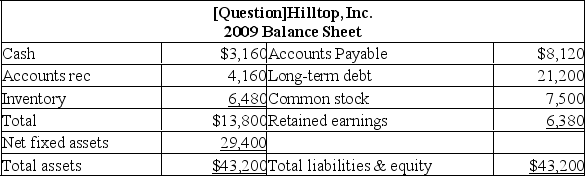

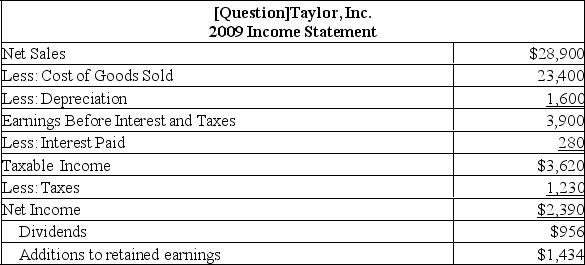

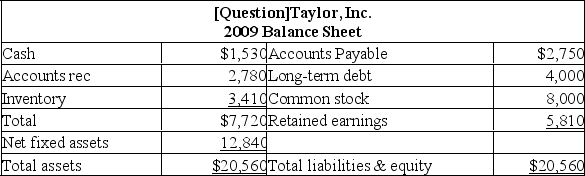

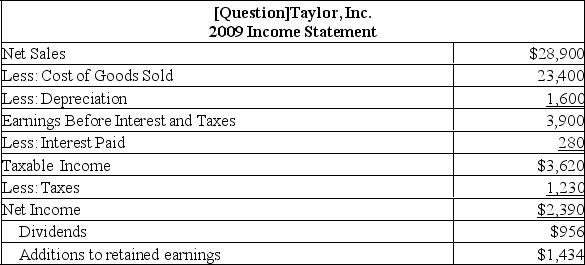

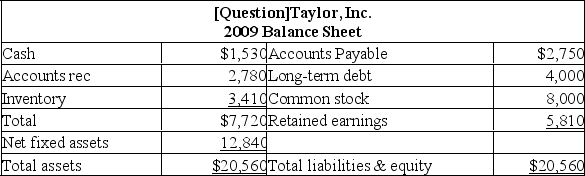

The following balance sheet and income statement should be used:

Taylor, Inc. is projecting sales to increase by 7% next year with the profit margin remaining constant. The firm is increasing the dividend payout ratio to 50 percent. What is the amount of the projected addition to retained earnings for next year?

Taylor, Inc. is projecting sales to increase by 7% next year with the profit margin remaining constant. The firm is increasing the dividend payout ratio to 50 percent. What is the amount of the projected addition to retained earnings for next year?

A) $822.16

B) $989.13

C) $1,106.67

D) $1,278.65

E) $1,534.38

Taylor, Inc. is projecting sales to increase by 7% next year with the profit margin remaining constant. The firm is increasing the dividend payout ratio to 50 percent. What is the amount of the projected addition to retained earnings for next year?

Taylor, Inc. is projecting sales to increase by 7% next year with the profit margin remaining constant. The firm is increasing the dividend payout ratio to 50 percent. What is the amount of the projected addition to retained earnings for next year?A) $822.16

B) $989.13

C) $1,106.67

D) $1,278.65

E) $1,534.38

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

50

The sustainable growth rate excludes any kind of external financing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

51

Total asset turnover is a determinant of growth.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

52

The sustainable growth rate includes a variable debt-equity ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

53

Assets, accounts payable and costs are proportional to sales. Debt and equity are not.

Assets, accounts payable and costs are proportional to sales. Debt and equity are not.Sales of Wintergreen, Inc. are expected to increase by 12% next year. Wintergreen is currently operating at 85% of capacity. The plowback ratio is 60%. What is the external financing need?

A) -$809

B) -$433

C) $1,290

D) $1,563

E) $2,043

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

54

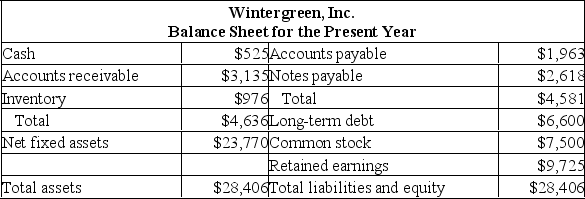

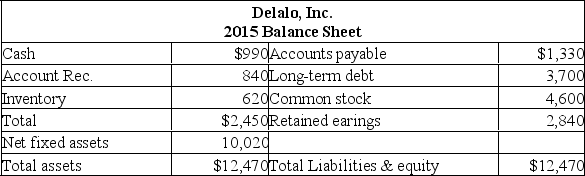

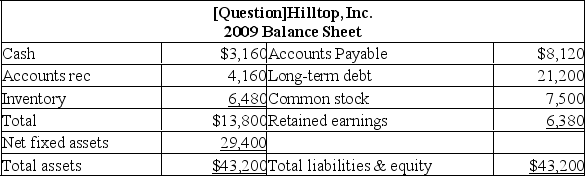

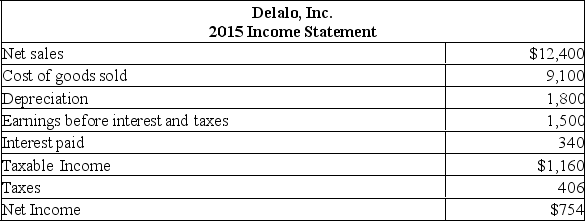

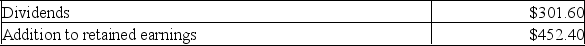

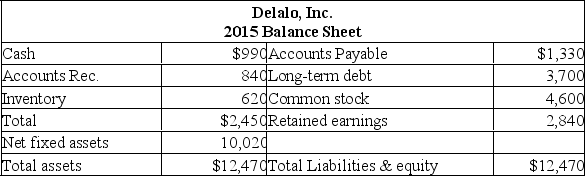

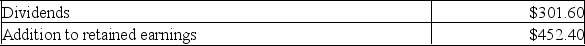

Assume that Delalo, Inc. is operating at full capacity. Also assume that all costs, net working capital, and fixed assets vary directly with sales. The debt-equity ratio and the dividend payout ratio are constant. What is the projected increase in net fixed assets if sales are projected to increase by 11 percent?

Assume that Delalo, Inc. is operating at full capacity. Also assume that all costs, net working capital, and fixed assets vary directly with sales. The debt-equity ratio and the dividend payout ratio are constant. What is the projected increase in net fixed assets if sales are projected to increase by 11 percent?A) $269.50

B) $506.00

C) $1,102.20

D) $1,371.70

E) $2,719.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

55

All else the same, an increase in a firm's dividend payout ratio will decrease its external financing needed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

56

The following balance sheet and income statement should be used:

What is the projected addition to retained earnings if Taylor, Inc. grows at the internal rate of growth and both the profit margin and the dividend payout ratio remain constant?

What is the projected addition to retained earnings if Taylor, Inc. grows at the internal rate of growth and both the profit margin and the dividend payout ratio remain constant?

A) $1,326.45

B) $1,387.22

C) $1,434.00

D) $1,490.63

E) $1,541.52

What is the projected addition to retained earnings if Taylor, Inc. grows at the internal rate of growth and both the profit margin and the dividend payout ratio remain constant?

What is the projected addition to retained earnings if Taylor, Inc. grows at the internal rate of growth and both the profit margin and the dividend payout ratio remain constant?A) $1,326.45

B) $1,387.22

C) $1,434.00

D) $1,490.63

E) $1,541.52

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

57

The sustainable growth rate excludes additional equity financing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

58

There are no direct connections between the growth that a company can achieve and the financial policies undertaken by the financial managers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

59

All else the same, an increase in a firm's dividend payout ratio will decrease its internal growth rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

60

The equity multiplier is a determinant of growth.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

61

The following balance sheet and income statement should be used:

Hilltop, Inc. is currently operating at 89% of capacity. The profit margin and the dividend payout ratio are projected to remain constant. Sales are projected to increase by 10% next year. What is the projected addition to retained earnings for next year?

Hilltop, Inc. is currently operating at 89% of capacity. The profit margin and the dividend payout ratio are projected to remain constant. Sales are projected to increase by 10% next year. What is the projected addition to retained earnings for next year?

A) $1,527

B) $1,692

C) $1,716

D) $1,804

E) $1,856

Hilltop, Inc. is currently operating at 89% of capacity. The profit margin and the dividend payout ratio are projected to remain constant. Sales are projected to increase by 10% next year. What is the projected addition to retained earnings for next year?

Hilltop, Inc. is currently operating at 89% of capacity. The profit margin and the dividend payout ratio are projected to remain constant. Sales are projected to increase by 10% next year. What is the projected addition to retained earnings for next year?A) $1,527

B) $1,692

C) $1,716

D) $1,804

E) $1,856

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

62

The Smith Co., which is currently operating at full capacity, has sales of $3,000, current assets of $800, current liabilities of $400, net fixed assets of $1,900, and a 6% profit margin. The firm has no long-term debt and does not plan on acquiring any. The firm does not pay any dividends. Sales are expected to increase by 9% next year. If all assets, liabilities, and costs vary directly with sales, how much additional equity financing is required for next year?

A) $10.80

B) $40.00

C) $103.50

D) $196.20

E) $207.00

A) $10.80

B) $40.00

C) $103.50

D) $196.20

E) $207.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

63

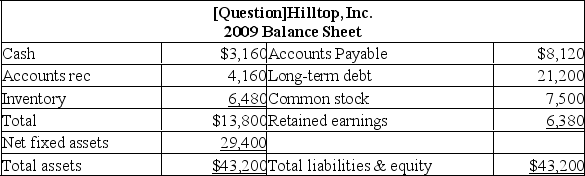

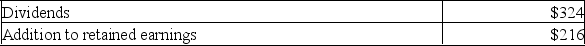

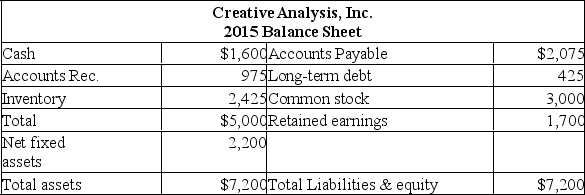

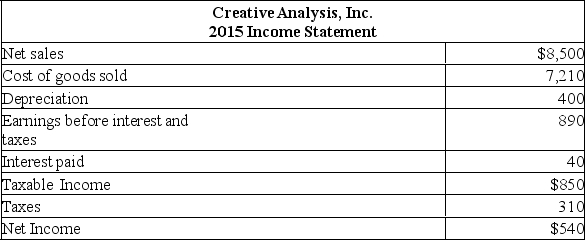

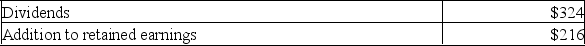

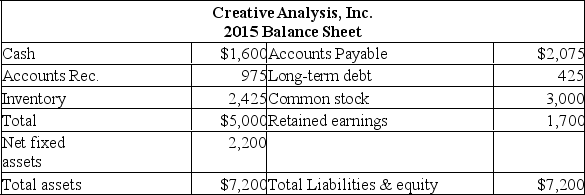

Assume the profit margin and the dividend payout ratio of Creative Analysis, Inc. are constant. If sales increase by 8 percent, what is the pro forma retained earnings?

Assume the profit margin and the dividend payout ratio of Creative Analysis, Inc. are constant. If sales increase by 8 percent, what is the pro forma retained earnings?A) $237.60

B) $356.40

C) $1,870.00

D) $1,933.28

E) $2,294.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

64

Knudsen, Inc.'s firm's full-capacity sales level is $3,000,000. If the firm is currently operating at 80% of capacity, what is the current level of sales?

A) $600,000

B) $1,500,000

C) $1,750,000

D) $2,400,000

E) $3,750,000

A) $600,000

B) $1,500,000

C) $1,750,000

D) $2,400,000

E) $3,750,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

65

Given the following information, calculate sales value. Total asset turnover 0.80; total liabilities $5,000; total equity $5,000.

A) $8,600

B) $8,000

C) $10,600

D) $11,600

E) $12,600

A) $8,600

B) $8,000

C) $10,600

D) $11,600

E) $12,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

66

Baker's Dozen has current sales of $1,400 and a profit margin of 7 percent. The firm estimates that sales will increase by 8% next year and that all costs will vary in direct relationship to sales. What is the pro forma net income?

A) $90.72

B) $98.00

C) $105.84

D) $107.84

E) $119.84

A) $90.72

B) $98.00

C) $105.84

D) $107.84

E) $119.84

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

67

Assuming that a company has a policy of paying out a constant fraction of net income in the form of a cash dividends, calculate the addition to retained earnings given the following information: cash dividends = $3,000; net income = $15,000.

A) $10,000

B) $12,000

C) $14,000

D) $16,000

E) $18,000

A) $10,000

B) $12,000

C) $14,000

D) $16,000

E) $18,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

68

Calculate the projected fixed assets needed given the following information: current sales = $275,000; current sales capacity = 75%; current fixed assets = $40,000; projected future sales = $475,000.

A) $11,818

B) $51,818

C) $12,818

D) $52,818

E) $60,818

A) $11,818

B) $51,818

C) $12,818

D) $52,818

E) $60,818

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

69

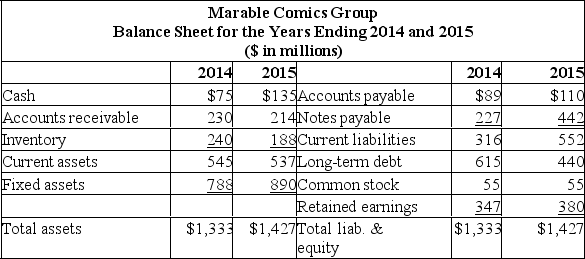

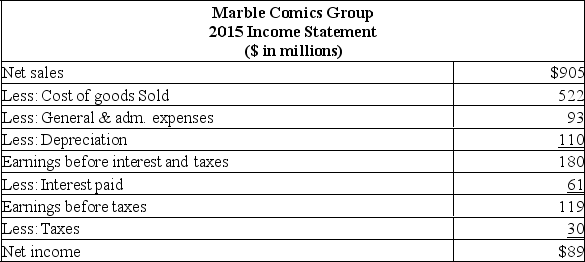

Assume Marble is projecting a 20% increase in sales for the coming year, and that assets, all costs, and current liabilities are proportional to sales. Long-term debt is not proportional to sales. Assume the firm's tax rate remains unchanged and the dividend payout is 40%. What is the external financing needed (EFN) for 2018 ($ in millions)?

Assume Marble is projecting a 20% increase in sales for the coming year, and that assets, all costs, and current liabilities are proportional to sales. Long-term debt is not proportional to sales. Assume the firm's tax rate remains unchanged and the dividend payout is 40%. What is the external financing needed (EFN) for 2018 ($ in millions)?A) $64.1

B) $110.9

C) $132.3

D) $146.7

E) $152.9

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

70

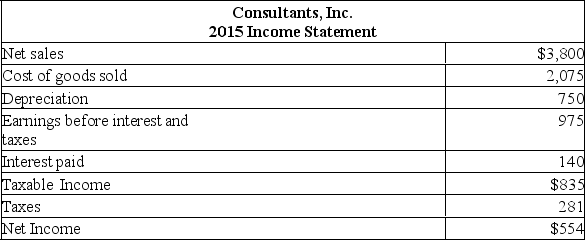

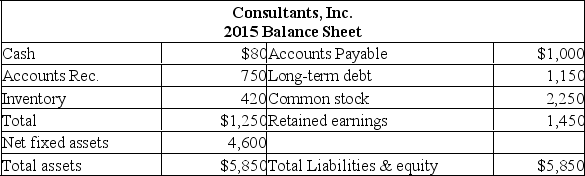

Consultants, Inc. is currently operating at full capacity. The profit margin and the dividend payout ratio are constant. Net working capital and fixed assets vary directly with sales. Sales are projected to increase by 5%. What is the external financing needed?

Consultants, Inc. is currently operating at full capacity. The profit margin and the dividend payout ratio are constant. Net working capital and fixed assets vary directly with sales. Sales are projected to increase by 5%. What is the external financing needed?A) -$293.78

B) -$193.78

C) $122.50

D) $292.50

E) $367.27

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

71

Calculate sales given the following data. Total fixed assets $400,000; long-term liabilities $155,000; total liabilities $280,000; total shareholders' equity $320,000; net working capital turnover 20.

A) $1,500,000

B) $1,700,000

C) $1,900,000

D) $2,100,000

E) $2,250,000

A) $1,500,000

B) $1,700,000

C) $1,900,000

D) $2,100,000

E) $2,250,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

72

The following balance sheet and income statement should be used:

The profit margin, the debt-equity ratio, and the dividend payout ratio are constant. Sales are expected to increase by $4,624 next year. What is the projected addition to retained earnings for next year?

The profit margin, the debt-equity ratio, and the dividend payout ratio are constant. Sales are expected to increase by $4,624 next year. What is the projected addition to retained earnings for next year?

A) $229.44

B) $1,108.96

C) $1,663.44

D) $2,241.41

E) $2,772.40

The profit margin, the debt-equity ratio, and the dividend payout ratio are constant. Sales are expected to increase by $4,624 next year. What is the projected addition to retained earnings for next year?

The profit margin, the debt-equity ratio, and the dividend payout ratio are constant. Sales are expected to increase by $4,624 next year. What is the projected addition to retained earnings for next year?A) $229.44

B) $1,108.96

C) $1,663.44

D) $2,241.41

E) $2,772.40

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

73

The following balance sheet and income statement should be used:

Hilltop, Inc. is currently operating at 75% of capacity. What is the required increase in fixed assets if sales are projected to increase by 30 percent?

Hilltop, Inc. is currently operating at 75% of capacity. What is the required increase in fixed assets if sales are projected to increase by 30 percent?

A) $0

B) $680

C) $1,470

D) $1,840

E) $2,160

Hilltop, Inc. is currently operating at 75% of capacity. What is the required increase in fixed assets if sales are projected to increase by 30 percent?

Hilltop, Inc. is currently operating at 75% of capacity. What is the required increase in fixed assets if sales are projected to increase by 30 percent?A) $0

B) $680

C) $1,470

D) $1,840

E) $2,160

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

74

Assume that Delalo, Inc. is operating at 80 percent of capacity. All costs and net working capital vary directly with sales. What is the amount of the pro forma net fixed assets if sales are projected to increase by 25%?

Assume that Delalo, Inc. is operating at 80 percent of capacity. All costs and net working capital vary directly with sales. What is the amount of the pro forma net fixed assets if sales are projected to increase by 25%?A) $9,616

B) $10,020

C) $12,040

D) $15,025

E) $18,781

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

75

The following balance sheet and income statement should be used:

Assume that Taylor, Inc. is operating at 85% of capacity. All costs and net working capital vary directly with sales. What is the amount of total fixed assets required if sales are projected to increase by 20 percent?

Assume that Taylor, Inc. is operating at 85% of capacity. All costs and net working capital vary directly with sales. What is the amount of total fixed assets required if sales are projected to increase by 20 percent?

A) $12,840.00

B) $13,096.80

C) $13,108.68

D) $13,397.24

E) $13,414.14

Assume that Taylor, Inc. is operating at 85% of capacity. All costs and net working capital vary directly with sales. What is the amount of total fixed assets required if sales are projected to increase by 20 percent?

Assume that Taylor, Inc. is operating at 85% of capacity. All costs and net working capital vary directly with sales. What is the amount of total fixed assets required if sales are projected to increase by 20 percent?A) $12,840.00

B) $13,096.80

C) $13,108.68

D) $13,397.24

E) $13,414.14

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

76

Assume that Creative Analysis, Inc. is currently operating at 90 percent of capacity and that sales are projected to increase to $10,000. What is the projected addition to fixed assets?

Assume that Creative Analysis, Inc. is currently operating at 90 percent of capacity and that sales are projected to increase to $10,000. What is the projected addition to fixed assets?A) -$122

B) $100

C) $129

D) $246

E) $388

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

77

Assume costs and assets increase at the same rate as sales. Also assume 40% of net income is paid out in dividends, the current debt to equity ratio is optimal, and that no new equity sales are possible. Forecast the addition to retained earnings assuming the firm's sales increase at the maximum percent possible given these assumptions.

Assume costs and assets increase at the same rate as sales. Also assume 40% of net income is paid out in dividends, the current debt to equity ratio is optimal, and that no new equity sales are possible. Forecast the addition to retained earnings assuming the firm's sales increase at the maximum percent possible given these assumptions.A) $43.2

B) $88.5

C) $113.3

D) $146.7

E) $167.8

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

78

Silver's Jewelers has current sales of $138,900 and a profit margin of 8 percent. The firm estimates that sales will increase by 4% next year and that all costs will vary in direct proportion to sales. What is the pro forma net income?

A) $6,000.48

B) $6,240.50

C) $11,112.00

D) $11,556.48

E) $12,629.32

A) $6,000.48

B) $6,240.50

C) $11,112.00

D) $11,556.48

E) $12,629.32

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

79

Calculate the external financing needed given the following information: current sales = $275,000; current sales capacity = 75%; current fixed assets = $40,000; projected future sales = $475,000.

A) $11,818

B) $51,818

C) $12,818

D) $52,818

E) $60,818

A) $11,818

B) $51,818

C) $12,818

D) $52,818

E) $60,818

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck

80

The profit margin, the debt-equity ratio, and the dividend payout ratio are constant. Sales are expected to increase by $525 next year. What is the projected addition to retained earnings for next year?

The profit margin, the debt-equity ratio, and the dividend payout ratio are constant. Sales are expected to increase by $525 next year. What is the projected addition to retained earnings for next year?A) $19.15

B) $31.92

C) $106.47

D) $234.78

E) $471.55

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 379 في هذه المجموعة.

فتح الحزمة

k this deck