Deck 10: Switching Models

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/19

العب

ملء الشاشة (f)

Deck 10: Switching Models

1

What are the steps required to estimate an ARCH/GARCH model?

A) First specify the appropriate equations for the correlation and the variance, then specify LLF and the computer will generate parameter values that maximise the LLF

B) First specify the appropriate equations for the median and the variance, then specify LLF and the computer will generate parameter values that maximise the LLF

C) First specify the appropriate equations for the mean and the variance, then specify LLF and the computer will generate parameter values that maximise the LLF

D) None of the above

A) First specify the appropriate equations for the correlation and the variance, then specify LLF and the computer will generate parameter values that maximise the LLF

B) First specify the appropriate equations for the median and the variance, then specify LLF and the computer will generate parameter values that maximise the LLF

C) First specify the appropriate equations for the mean and the variance, then specify LLF and the computer will generate parameter values that maximise the LLF

D) None of the above

First specify the appropriate equations for the mean and the variance, then specify LLF and the computer will generate parameter values that maximise the LLF

2

Suppose that a researcher wanted to obtain an estimate of realised ("actual") volatility. Which one of the following is likely to be the most accurate measure of volatility of stock returns for a particular day?

A) The price range (high minus low) on that day

B) The squared return on that day

C) The sum of the squares of hourly returns on that day

D) The squared return on the previous day

A) The price range (high minus low) on that day

B) The squared return on that day

C) The sum of the squares of hourly returns on that day

D) The squared return on the previous day

The sum of the squares of hourly returns on that day

3

Which of the following statements are true regarding volatility:

(I) It measures the total risk of financial assets

(II) It can be used in computing value-at-risk

(III) It is a component of the Black-Scholes formula for deriving the prices of traded options

(IV) It can be estimated using the variance of asset returns

A) I only

B) I and II only

C) I, II and III only

D) I, II, III and IV

I, II, III and IV

4

Suppose that a researcher estimates a GARCH(1,1) model and obtains a log likelihood function (LLF) value of 71.22. He is interested in testing whether an ARCH(1) model is a better model at describing volatility. If he estimates a model which imposes the necessary restrictions and obtains an LLF value of 68.21, what would be the conclusion of his likelihood ratio test (assuming a 5% significance level)?

A) Statistical evidence suggesting that ARCH(1) is better than GARCH(1,1)

B) Statistical evidence suggesting that ARCH(1) is not better than GARCH(1,1)

C) Statistical evidence suggesting that GARCH(1,1) is better than ARCH(1)

D) We cannot say because we would need to know the number of observations

A) Statistical evidence suggesting that ARCH(1) is better than GARCH(1,1)

B) Statistical evidence suggesting that ARCH(1) is not better than GARCH(1,1)

C) Statistical evidence suggesting that GARCH(1,1) is better than ARCH(1)

D) We cannot say because we would need to know the number of observations

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

5

What would typically be the shape of the news impact curve for a series that exactly followed a GARCH(1,1) process?

A) It would be asymmetric, with a steeper curve on the left than the right

B) It would be asymmetric, with a steeper curve on the right than the left

C) It would be symmetric about zero

D) It would be discontinuous about zero

A) It would be asymmetric, with a steeper curve on the left than the right

B) It would be asymmetric, with a steeper curve on the right than the left

C) It would be symmetric about zero

D) It would be discontinuous about zero

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

6

GJR and EGARCH are types of GARCH models that allow for:

A) An asymmetric response of returns to positive and negative shocks in the dependent variable

B) An asymmetric response of returns to positive and negative shocks to its lagged values

C) A symmetric response of volatility to positive and negative shocks

D) An asymmetric response of volatility to positive and negative shocks

A) An asymmetric response of returns to positive and negative shocks in the dependent variable

B) An asymmetric response of returns to positive and negative shocks to its lagged values

C) A symmetric response of volatility to positive and negative shocks

D) An asymmetric response of volatility to positive and negative shocks

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

7

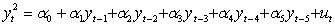

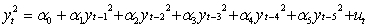

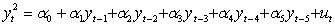

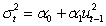

Which of the following is the most plausible test regression for determining whether a series y contains "ARCH effects"?

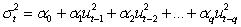

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

8

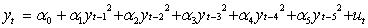

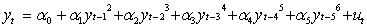

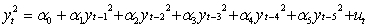

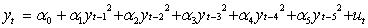

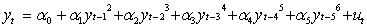

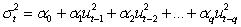

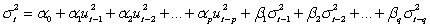

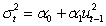

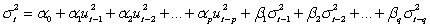

What are the names of the following models?

(I) (II)

(II)  (III)

(III)  (IV)

(IV)

A) GARCH (1), ARCH (1,1), GARCH(q) and ARCH(p,q), respectively

B) ARCH(1), GARCH(1,1), ARCH(q) and GARCH(p,q), respectively

C) ARCH(1), EGARCH(1,1), ARCH(q) and EGARCH(p,q), respectively

D) EGARCH (1), ARCH(1,1), EGARCH (q) and ARCH(p,q), respectively

(I)

(II)

(II)  (III)

(III)  (IV)

(IV)

A) GARCH (1), ARCH (1,1), GARCH(q) and ARCH(p,q), respectively

B) ARCH(1), GARCH(1,1), ARCH(q) and GARCH(p,q), respectively

C) ARCH(1), EGARCH(1,1), ARCH(q) and EGARCH(p,q), respectively

D) EGARCH (1), ARCH(1,1), EGARCH (q) and ARCH(p,q), respectively

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

9

Consider the three approaches to conducting hypothesis tests under the maximum likelihood framework. Which of the following statements are true?

(I) The Wald test is based on estimation only under the null hypothesis

(ii) The likelihood ratio test is based on estimation under both the null and the alternative hypotheses

(iii) The lagrange multiplier test is based on estimation under the alternative hypothesis only

(iv) The usual t and F-tests are examples of Wald tests

A) (ii) and (iv) only

B) (i) and (iii) only

C) (i), (ii), and (iv) only

D) (i), (ii), (iii), and (iv)

(I) The Wald test is based on estimation only under the null hypothesis

(ii) The likelihood ratio test is based on estimation under both the null and the alternative hypotheses

(iii) The lagrange multiplier test is based on estimation under the alternative hypothesis only

(iv) The usual t and F-tests are examples of Wald tests

A) (ii) and (iv) only

B) (i) and (iii) only

C) (i), (ii), and (iv) only

D) (i), (ii), (iii), and (iv)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

10

What is an appropriate approach to testing for 'ARCH effects'?

A) Run a regression, collect the residuals, regress the squared residuals on their lags and conduct a hypothesis test to check whether the coefficients of the lagged squared residuals are equal to zero

B) Run a regression, collect the fitted values, regress the fitted values on their squared lags and conduct a hypothesis test to check whether the coefficients of the lagged squared fitted values are equal to zero

C) Employ White's test

D) All of the above

A) Run a regression, collect the residuals, regress the squared residuals on their lags and conduct a hypothesis test to check whether the coefficients of the lagged squared residuals are equal to zero

B) Run a regression, collect the fitted values, regress the fitted values on their squared lags and conduct a hypothesis test to check whether the coefficients of the lagged squared fitted values are equal to zero

C) Employ White's test

D) All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which of these cannot be used to test for non-linearity?

A) Portmanteau tests

B) White test

C) Ramsey's RESET test

D) The BDS test

A) Portmanteau tests

B) White test

C) Ramsey's RESET test

D) The BDS test

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following would represent the most appropriate definition for implied volatility?

A) It is the volatility of the underlying asset's returns implied from the price of a traded option and an option pricing model

B) It is the volatility of the underlying asset's returns implied from a statistical model such as GARCH

C) It is the volatility of an option price implied from a statistical model such as GARCH

D) It is the volatility of an option price implied from the underlying asset volatility

A) It is the volatility of the underlying asset's returns implied from the price of a traded option and an option pricing model

B) It is the volatility of the underlying asset's returns implied from a statistical model such as GARCH

C) It is the volatility of an option price implied from a statistical model such as GARCH

D) It is the volatility of an option price implied from the underlying asset volatility

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

13

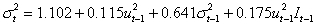

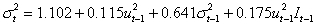

Assume that you have estimated a GJR model of monthly stock returns and you obtain the following equations:

Suppose that , what would be the fitted conditional variance for time t if and then if ?

Suppose that , what would be the fitted conditional variance for time t if and then if ?

A) 1.62 and 1.67, respectively

B) 1.64 and 1.59, respectively

C) 1.59 and 1.64, respectively

D) 1.67 and 1.62, respectively

Suppose that , what would be the fitted conditional variance for time t if and then if ?

Suppose that , what would be the fitted conditional variance for time t if and then if ?

A) 1.62 and 1.67, respectively

B) 1.64 and 1.59, respectively

C) 1.59 and 1.64, respectively

D) 1.67 and 1.62, respectively

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

14

Volatility clustering is

A) The tendency for financial asset returns to have distributions that exhibit fat tails

B) The tendency for financial asset return volatility to appear in bunches

C) The tendency for volatility to rise more following a large price fall than following a price rise of the same magnitude

D) All of the above

A) The tendency for financial asset returns to have distributions that exhibit fat tails

B) The tendency for financial asset return volatility to appear in bunches

C) The tendency for volatility to rise more following a large price fall than following a price rise of the same magnitude

D) All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which of the following are NOT features of an IGARCH(1,1) model?

(I) Forecasts of the conditional variance will converge upon the unconditional variance as the horizon tends to infinity

(ii) The sum of the coefficients on the lagged squared error and the lagged conditional variance will be unity

(iii) Forecasts of the conditional variance will decline gradually towards zero as the horizon tends to infinity

(iv) Such models are never observed in reality

A) (ii) only

B) (ii) and (iv) only

C) (ii), (iii) and (iv) only

D) (i), (ii), (iii) and (iv)

(I) Forecasts of the conditional variance will converge upon the unconditional variance as the horizon tends to infinity

(ii) The sum of the coefficients on the lagged squared error and the lagged conditional variance will be unity

(iii) Forecasts of the conditional variance will decline gradually towards zero as the horizon tends to infinity

(iv) Such models are never observed in reality

A) (ii) only

B) (ii) and (iv) only

C) (ii), (iii) and (iv) only

D) (i), (ii), (iii) and (iv)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which one of the following problems in finance could not be usefully addressed by either a univariate or a multivariate GARCH model?

A) Producing option prices

B) Producing dynamic hedge ratios

C) Producing time-varying beta estimates for a stock

D) Producing forecasts of returns for use in trading models

(e) Producing correlation forecasts for value at risk models

A) Producing option prices

B) Producing dynamic hedge ratios

C) Producing time-varying beta estimates for a stock

D) Producing forecasts of returns for use in trading models

(e) Producing correlation forecasts for value at risk models

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of the following is true about ARCH and GARCH models?

(I) They are used for modelling and forecasting volatility

(II) They are non-linear models

(III) They can both be estimated using OLS

(IV) Series estimated using these models must have a unit root process

A) I only

B) I and II only

C) I, II and III only

D) I, II, III and IV

(I) They are used for modelling and forecasting volatility

(II) They are non-linear models

(III) They can both be estimated using OLS

(IV) Series estimated using these models must have a unit root process

A) I only

B) I and II only

C) I, II and III only

D) I, II, III and IV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which of these is an appropriate technique used in estimating models from the GARCH family?

A) Maximum likelihood

B) Instrumental variables

C) Indirect least squares

D) Ordinary least squares

A) Maximum likelihood

B) Instrumental variables

C) Indirect least squares

D) Ordinary least squares

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

19

Consider the following conditional variance equation for a GJR model. ht = 0 + 1+ ht-1+ ut-12It-1  where It-1 = 1 if ut-1 < 0 = 0 otherwise

where It-1 = 1 if ut-1 < 0 = 0 otherwise

For there to be evidence of a leverage effect, which one of the following conditions must hold?

A) 0 positive and statistically significant

B) positive and statistically significant

C) statistically significantly greater than 0

D) 1+ statistically significantly less than

where It-1 = 1 if ut-1 < 0 = 0 otherwise

where It-1 = 1 if ut-1 < 0 = 0 otherwiseFor there to be evidence of a leverage effect, which one of the following conditions must hold?

A) 0 positive and statistically significant

B) positive and statistically significant

C) statistically significantly greater than 0

D) 1+ statistically significantly less than

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck