Deck 1: Introduction

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/12

العب

ملء الشاشة (f)

Deck 1: Introduction

1

Financial econometrics can best be described as

A) The application of statistical techniques to problems in finance

B) The application of mathematical models to problems in economics

C) The application of financial techniques to problems in economics

D) None of the above

A) The application of statistical techniques to problems in finance

B) The application of mathematical models to problems in economics

C) The application of financial techniques to problems in economics

D) None of the above

The application of statistical techniques to problems in finance

2

Data that have both time series and cross-sections is referred to as

A) Cross-sectional data

B) Time-cross-sectional data

C) Time series data

D) Panel data

A) Cross-sectional data

B) Time-cross-sectional data

C) Time series data

D) Panel data

Panel data

3

Which of the following is a serious problem encountered by applied econometricians in economics?

A) Small samples problems

B) Measurement error

C) Data revisions

D) All of the above

A) Small samples problems

B) Measurement error

C) Data revisions

D) All of the above

All of the above

4

The numerical score assigned to the credit rating of a bond is best described as what type of number?

A) Continuous

B) Cardinal

C) Ordinal

D) Nominal

A) Continuous

B) Cardinal

C) Ordinal

D) Nominal

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 12 في هذه المجموعة.

فتح الحزمة

k this deck

5

Data that have been collected over a period of time on one or more variables is referred to as

A) Cross-sectional data

B) Time-cross-sectional data

C) Time series data

D) Panel data

A) Cross-sectional data

B) Time-cross-sectional data

C) Time series data

D) Panel data

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 12 في هذه المجموعة.

فتح الحزمة

k this deck

6

An individual invested £106.40 in the stock market and the value of his investment two years later is £138.22. What are the simple and continuously compounded returns on his investment?

A) 26% and 30%, respectively

B) -29% and -34%, respectively

C) 30% and 26%, respectively

D) 30% and 30%, respectively

A) 26% and 30%, respectively

B) -29% and -34%, respectively

C) 30% and 26%, respectively

D) 30% and 30%, respectively

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 12 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which of these is a characteristic of financial data?

A) They are observed at much lower frequencies than macroeconomic data

B) The number of observations is usually very small

C) They are considered to be very noisy

D) It is easy to separate underlying trends from random and uninteresting features

A) They are observed at much lower frequencies than macroeconomic data

B) The number of observations is usually very small

C) They are considered to be very noisy

D) It is easy to separate underlying trends from random and uninteresting features

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 12 في هذه المجموعة.

فتح الحزمة

k this deck

8

An individual has £10000 capital to invest in the stock market. He invests 30% of his capital in stock A, 25% in stock B and 45% in Stock C. What is the return on his/her portfolio assuming that the simple returns on stocks A, B and C are 5%, 10% and 12%, respectively?

A) 9.0%

B) 9.7%

C) 9.3%

D) 9%

A) 9.0%

B) 9.7%

C) 9.3%

D) 9%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 12 في هذه المجموعة.

فتح الحزمة

k this deck

9

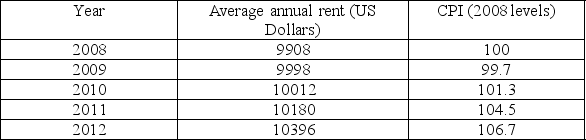

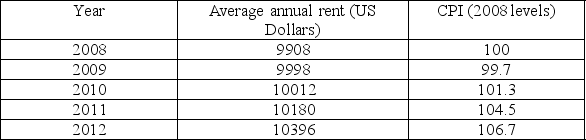

The average nominal annual rent in the US denominated in dollars and the CPI (2008 levels) are given in the table below:

What is the 2012 average annual rent in 2008 terms?

A) 9743

B) 10572

C) 9286

D) 11093

What is the 2012 average annual rent in 2008 terms?

A) 9743

B) 10572

C) 9286

D) 11093

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 12 في هذه المجموعة.

فتح الحزمة

k this deck

10

Suppose that we wanted to sum the 2007 returns on ten shares to calculate the return on a portfolio over that year. What method of calculating the individual stock returns would enable us to do this?

A) Simple

B) Continuously compounded

C) Neither approach would allow us to do this validly

D) Either approach could be used and they would both give the same portfolio return

A) Simple

B) Continuously compounded

C) Neither approach would allow us to do this validly

D) Either approach could be used and they would both give the same portfolio return

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 12 في هذه المجموعة.

فتح الحزمة

k this deck

11

Data that have been collected on one or more variables at a single point in time is referred to as

A) Cross-sectional data

B) Time-cross-sectional data

C) Time series data

D) Panel data

A) Cross-sectional data

B) Time-cross-sectional data

C) Time series data

D) Panel data

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 12 في هذه المجموعة.

فتح الحزمة

k this deck

12

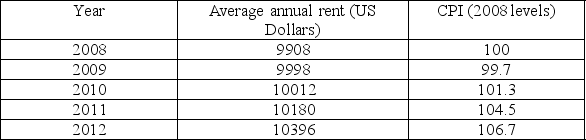

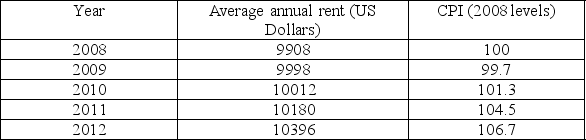

The average nominal annual rent in the US denominated in dollars and the CPI (2008 levels) are given in the table below:

What is the 2008 average annual rent in 2012 terms?

A) 9743

B) 10572

C) 9286

D) 11093

What is the 2008 average annual rent in 2012 terms?

A) 9743

B) 10572

C) 9286

D) 11093

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 12 في هذه المجموعة.

فتح الحزمة

k this deck