Deck 27: The Federal Gift and Estate Taxes

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/141

العب

ملء الشاشة (f)

Deck 27: The Federal Gift and Estate Taxes

1

The amount of the unified tax credit is the same for both transfers by gift and transfers by death.

True

2

Barry pays State University for his dependent daughter's room and board. Barry has made a transfer that is subject to the Federal gift tax.

False

3

The election of the alternate valuation date can affect the amount of a charitable deduction allowed to an estate for a bequest to a qualified charity.

True

4

For Federal estate tax purposes, the gross estate cannot include property the decedent does not own.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

5

For Federal estate and gift tax purposes, the exemption equivalent is the same thing as the exclusion amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

6

For both the Federal gift and estate tax, a deduction is allowed for certain transfers to a spouse.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

7

A lifetime transfer that is supported by full and adequate consideration is not a gift.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

8

If the value of the gross estate is lower on the alternate valuation date than on the date of death, the date of death valuation cannot be used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

9

An individual generally tries to reduce the present value of any Federal transfer tax liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

10

Under the alternate valuation date election, each asset in the gross estate is valued at the lesser of the date of death value or six months thereafter.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

11

A father wants to give a parcel of land to his two children. If he wants the survivor to have sole ownership, he should list ownership of the property as joint tenants.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

12

For Federal estate tax purposes, the gross estate does not include property that will pass to a surviving spouse.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

13

Pauline sells antique furniture to her daughter, Nicole, for $10,000. If the furniture is really worth $100,000, Pauline has made a gift to Nicole of $100,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

14

Sandy pays a local college for her non-dependent boyfriend's tuition. The payment is subject to the Federal gift tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

15

Some states impose inheritance taxes, but the Federal tax system does not.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

16

Transfers to political organizations are exempt from the application of the Federal gift tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

17

Kim, a resident and citizen of Korea, dies during an operation at the Mayo Clinic in Rochester (MN). Because Kim died in the U.S., she will be subject to the Federal estate tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

18

The Federal transfer tax system includes three separate taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

19

Paul, a U.S. citizen, will avoid the Federal estate tax if he becomes a Canadian resident and owns no property located in the U.S. at the time of his death.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

20

Manuel, a citizen and resident of Argentina, makes a gift to his children of a ranch located in Colorado. Manuel will be subject to the U.S. gift tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

21

To make the election to split gifts, spouses must file a Form 709 (Federal gift tax return).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

22

A timely issued disclaimer by an heir transfers the property to someone else without a Federal gift tax result.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

23

A surviving spouse's share of the community property is not included in the deceased spouse's gross estate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

24

In determining whether a dividend issued on stock held by a decedent is included in the gross estate, the record date (rather than the declaration or payment dates) controls.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

25

In most cases, the gross estate of a decedent is larger than the probate estate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

26

In Year 1 and with $100,000, Ronald establishes a joint savings account with his cousin, Allison. In Year 2, Allison withdraws the $100,000 and disappears. Ronald made a gift to Allison in Year 2.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

27

Harry and Brenda are husband and wife. Using his funds, Harry purchases real estate which he lists as: "Harry and Brenda, tenants by the entirety with right of survivorship." If Brenda dies first, none of the real estate will be included in her gross estate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

28

In 2018, grandparents contribute jointly owned funds to a § 529 qualified tuition plan on behalf of their granddaughter.

The maximum annual exclusion allowed to them is $150,000 ($30,000 × 5 years).

The maximum annual exclusion allowed to them is $150,000 ($30,000 × 5 years).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

29

Under his grandfather's will, Thad is entitled to receive shares of Kroger Corporation. For Federal transfer tax purposes, Thad is allowed to disclaim some of these shares and accept the others.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

30

A tenancy by the entirety is restricted in most states to having more than two joint owners.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

31

Under certain circumstances, the gift-splitting election can be made even though the electing spouses no longer are married to each other.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

32

Using his separate funds, Wilbur purchases an annuity which pays him a specified amount until death. Upon Wilbur's death, a reduced amount is to be paid to Marcia for her life. Marcia predeceases Wilbur. Nothing concerning the annuity contract is included in Marcia's gross estate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

33

Mitch pays the surgeon and the hospital for his nondependent aunt's heart bypass operation. The transfer is not subject to the gift tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

34

Sam purchases a U.S. savings bond which he registers as follows: "Sam, payable to Don upon Sam's death." A gift occurs when Sam purchases the bond.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

35

Although qualified tuition plans under § 529 are treated favorably for gift tax purposes, such plans are included in the gross estate upon the grantor's death.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

36

Iris dies intestate (i.e., without a will). All of her property passes to her heirs in accordance with the order of distribution prescribed under applicable state law.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

37

Accrued interest on state and local bonds is not subject to the Federal estate tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

38

A husband and wife make a gift of their jointly owned vacation home to their adult children. The gift-splitting election must be made.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

39

Lyle and Kelly are brother and sister. Using his funds, Lyle purchases land, listing title as: "Lyle and Kelly, joint tenants with right of survivorship." If Kelly dies first, none of the land is included in her gross estate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

40

Harry and Brenda are husband and wife. Using her funds, Brenda purchases real estate which she lists as: "Harry and Brenda, joint tenants with right of survivorship." If Brenda dies first, all of the value of the real estate will be included in her gross estate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

41

Which, if any, of the following is a characteristic of the Federal estate tax?

A) A foreign tax credit is available.

B) A credit for tax on prior transfers may be available.

C) A charitable deduction is available.

D) All of the above.

A) A foreign tax credit is available.

B) A credit for tax on prior transfers may be available.

C) A charitable deduction is available.

D) All of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

42

Ray purchases U.S. savings bonds which he lists as "Ray and Donna" as co-owners. Donna is Ray's daughter.

Donna predeceases Ray. No gift or estate tax consequences result from this situation.

Donna predeceases Ray. No gift or estate tax consequences result from this situation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

43

At the time of her death, Emma still owed $36,000 on her church pledge for the year. Because church pledges are not an enforceable obligation in the state where Emma resided, her estate cannot claim a deduction for the $36,000 that it owes and later pays.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

44

In 2004, Katelyn inherited considerable property when her father died. When Katelyn dies in 2018, her estate may be able to claim a credit as to some of the estate taxes paid by her father's estate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

45

Which, if any, of the following is a characteristic of the Federal gift tax?

A) A charitable deduction is available.

B) The alternate valuation date of § 2032 can be elected.

C) A disclaimer procedure may avoid the tax.

D) A marital deduction is available.

E) None of the above.

A) A charitable deduction is available.

B) The alternate valuation date of § 2032 can be elected.

C) A disclaimer procedure may avoid the tax.

D) A marital deduction is available.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

46

To avoid the terminable interest limitation on the marital deduction, a QTIP election must be made.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

47

The purpose of the marital deduction is to defer any estate tax liability until the second spouse dies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

48

At the time of his death, Raul owned a residence with his wife, Manuela, as joint tenants. The residence was purchased by Manuela ten years ago at a cost of $300,000 and has a fair market value of $1.4 million. Raul's estate will be allowed no marital deduction as to the property.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

49

At the time of Dylan's death, he was a resident of the United States. He owns land located in a foreign country, which is subject to that country's estate tax. This same land also can be subject to the Federal estate tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

50

Georgia owns an insurance policy on the life of Jake, with Scarlet as the designated beneficiary. Upon Scarlet's death, no transfer tax consequences result.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

51

Sidney dies and leaves property to his sister Giselle. Thirteen months later, Giselle dies. Giselle's estate can claim a full credit for any Federal estate taxes paid by Sidney's estate as to amounts passing to Giselle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

52

Which of the following is not a characteristic of both the Federal gift tax and the Federal estate tax?

A) A deduction for state death taxes may be available.

B) A charitable deduction is available.

C) A marital deduction is available.

D) An exclusion amount is available in computing the tax.

A) A deduction for state death taxes may be available.

B) A charitable deduction is available.

C) A marital deduction is available.

D) An exclusion amount is available in computing the tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

53

All of the charitable organizations that qualify for estate tax purposes also qualify for income tax purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

54

Manfredo makes a donation of $50,000 to the church where he was baptized in Mexico City. The gift does not qualify as a charitable contribution for Federal income tax purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

55

Lila is the owner and beneficiary of a policy on the life of her husband, Austin. Upon Austin's death, the insurance proceeds paid to Lila do not qualify for the marital deduction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

56

In the case of a transfer by gift, a QTIP election causes the property to be subject to the estate tax upon the death of the donee spouse.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

57

Rachel owns an insurance policy on the life of Albert with Belle as the designated beneficiary. Upon Rachel's death, nothing regarding this policy is included in her gross estate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

58

At the time of his death, Leroy owed Federal income taxes on income earned in a prior year. Leroy's estate can claim an estate tax deduction for the income tax it pays.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

59

Sally's will passes real estate to Otto (her surviving husband). The real estate is worth $800,000 but is subject to a mortgage of $200,000. The transfer provides Sally's estate with a marital deduction of $600,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

60

In his will, Hernando provides for $50,000 to go to the Madrid, Spain, school system. Because it is a foreign charity, the bequest will not qualify as a charitable deduction for estate tax purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

61

The alternate valuation date:

A) Applies for Federal estate tax purposes.

B) Applies for Federal gift tax purposes.

C) Both a. and b.

D) Neither a. nor b.

A) Applies for Federal estate tax purposes.

B) Applies for Federal gift tax purposes.

C) Both a. and b.

D) Neither a. nor b.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

62

The Federal gift tax does not include a:

A) Deduction for state gift taxes paid.

B) Charitable deduction.

C) Gift-splitting election.

D) Marital deduction.

A) Deduction for state gift taxes paid.

B) Charitable deduction.

C) Gift-splitting election.

D) Marital deduction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

63

Which, if any, of the following items is subject to indexation (adjusted to reflect inflation)?

A) The election to split gifts under § 2513.

B) The limitation placed on the amount allowed as a charitable contribution for estate tax purposes (§ 2055).

C) Annual gift tax exclusion.

D) Unified transfer tax rates.

A) The election to split gifts under § 2513.

B) The limitation placed on the amount allowed as a charitable contribution for estate tax purposes (§ 2055).

C) Annual gift tax exclusion.

D) Unified transfer tax rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

64

At the time of his death, Norton was involved in the following transactions.

? Owned land in joint tenancy with Emily. The land is worth $600,000 and was purchased by Norton 15 years ago for $150,000.

? Owned land in a tenancy by the entirety with his wife Amy. The land is worth $800,000 and was purchased by Norton five years ago for $450,000.

? Owned land in an equal tenancy in common with Noah. The land is worth $400,000 and was purchased by Norton four years ago for $300,000.

? Owned City of Dayton bonds worth $500,000. What amount is included in Norton's gross estate?

A) $900,000

B) $1,100,000

C) $1,700,000

D) $2,100,000

? Owned land in joint tenancy with Emily. The land is worth $600,000 and was purchased by Norton 15 years ago for $150,000.

? Owned land in a tenancy by the entirety with his wife Amy. The land is worth $800,000 and was purchased by Norton five years ago for $450,000.

? Owned land in an equal tenancy in common with Noah. The land is worth $400,000 and was purchased by Norton four years ago for $300,000.

? Owned City of Dayton bonds worth $500,000. What amount is included in Norton's gross estate?

A) $900,000

B) $1,100,000

C) $1,700,000

D) $2,100,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

65

In which of the following independent situations has Jean made a gift?

A) Jean gives her 19-year old son $20,000 to be used by him for his college expenses.

B) Jean buys her non-dependent grandfather a new $120,000 RV for his birthday.

C) Jean sends $44,000 to Temple University to cover her nephew's tuition. The nephew does not qualify as Jean's dependent.

D) Jean contributes $10,000 to her U.S. Senator's reelection campaign.

A) Jean gives her 19-year old son $20,000 to be used by him for his college expenses.

B) Jean buys her non-dependent grandfather a new $120,000 RV for his birthday.

C) Jean sends $44,000 to Temple University to cover her nephew's tuition. The nephew does not qualify as Jean's dependent.

D) Jean contributes $10,000 to her U.S. Senator's reelection campaign.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

66

The Federal gift-splitting election:

A) Allows the annual exclusion of both spouses to reduce the gift tax due.

B) Allows the exemption equivalent of both spouses to reduce the gift tax due.

C) Is made on both spouses' Forms 709.

D) All of the above.

A) Allows the annual exclusion of both spouses to reduce the gift tax due.

B) Allows the exemption equivalent of both spouses to reduce the gift tax due.

C) Is made on both spouses' Forms 709.

D) All of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

67

Which, if any, of the following statements correctly reflects the rules applicable to the alternate valuation date?

A) The election is made by the executor.

B) Can be elected even though no estate tax return (i.e., Form 706) need be filed.

C) Can be elected only if it reduces the amount of the gross estate or reduces the estate tax liability.

D) Its election does not affect the income tax basis of property included in the gross estate.

A) The election is made by the executor.

B) Can be elected even though no estate tax return (i.e., Form 706) need be filed.

C) Can be elected only if it reduces the amount of the gross estate or reduces the estate tax liability.

D) Its election does not affect the income tax basis of property included in the gross estate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

68

Ling and Jiang are unrelated and equal joint tenants in a plot of land. Ling died this year. Ling's share of the land goes to:

A) The party named in Ling's will.

B) Ling's surviving spouse.

C) Jiang, under community property principles.

D) Jiang, under a right of survivorship.

A) The party named in Ling's will.

B) Ling's surviving spouse.

C) Jiang, under community property principles.

D) Jiang, under a right of survivorship.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

69

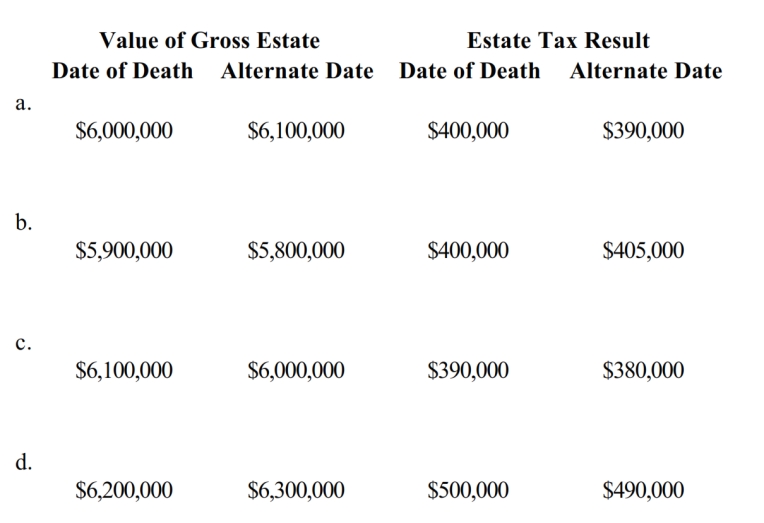

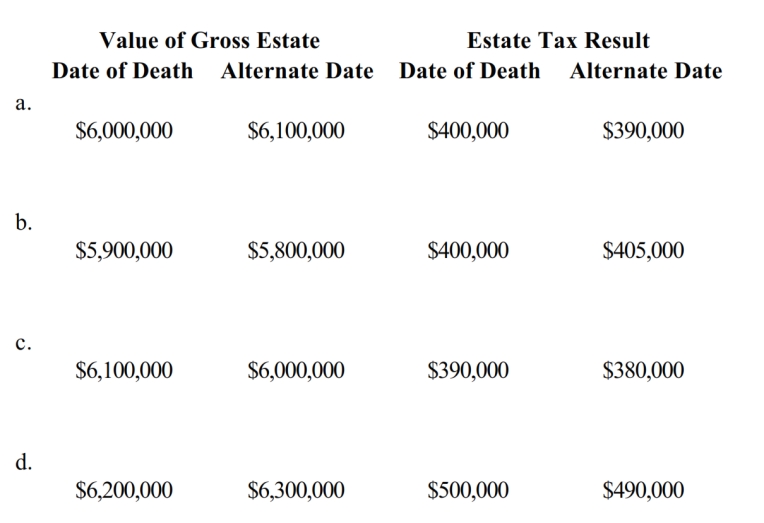

In which, if any, of the following independent situations can the alternate valuation date be elected?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

70

Stacey inherits unimproved land (fair market value of $6 million) from her father on June 1, 2017. Stacey disclaims her interest in the property as follows: one-third on December 1, 2017? one-third on January 3, 2018? and the remaining one-third on May 31, 2018. In all cases, the disclaimers pass the interest to her son (the next heir under state law). The Federal gift tax applies to Stacey for:

A) All of the disclaimers.

B) The disclaimer made in 2017.

C) The May 31, 2018 disclaimer.

D) All of the disclaimers made in 2018.

E) None of the disclaimers.

A) All of the disclaimers.

B) The disclaimer made in 2017.

C) The May 31, 2018 disclaimer.

D) All of the disclaimers made in 2018.

E) None of the disclaimers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

71

Which of the following is a correct statement regarding the filing of a gift tax return (Form 709)?

A) A donor must file a Form 709 in the same year in which the gift was made.

B) The due date of a Form 709 is the same as the due date of the donor's Form 1040.

C) A Form 709 may have to be filed even though the value of the gift was less than the amount of the annual exclusion.

D) Melody gives her husband a new Mercedes convertible for his birthday. Melody must file a Form 709 to report the gift even though no gift tax results.

A) A donor must file a Form 709 in the same year in which the gift was made.

B) The due date of a Form 709 is the same as the due date of the donor's Form 1040.

C) A Form 709 may have to be filed even though the value of the gift was less than the amount of the annual exclusion.

D) Melody gives her husband a new Mercedes convertible for his birthday. Melody must file a Form 709 to report the gift even though no gift tax results.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

72

The Federal transfer taxes generally apply a flat rate of:

A) 10%.

B) 40%.

C) 65%.

D) The taxes apply three graduated rates, not a flat rate.

A) 10%.

B) 40%.

C) 65%.

D) The taxes apply three graduated rates, not a flat rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

73

Mark dies on March 6. Which, if any, of the following items is not included in his gross estate?

A) Interest earned (before death) on City of Cleveland bonds.

B) Cash dividend on stock owned by Mark-declaration date was February 4, and record date was March 4.

C) Federal income tax refund for a prior tax year, -received on March 5.

D) Insurance recovery on auto accident that occurred on February 25.

E) Insurance recovery from theft of sailboat on March 7.

A) Interest earned (before death) on City of Cleveland bonds.

B) Cash dividend on stock owned by Mark-declaration date was February 4, and record date was March 4.

C) Federal income tax refund for a prior tax year, -received on March 5.

D) Insurance recovery on auto accident that occurred on February 25.

E) Insurance recovery from theft of sailboat on March 7.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

74

In which of the following independent situations has Trent made a gift?

A) Trent established an irrevocable trust, income payable to himself for life and, upon his death, remainder to his children.

B) Trent dies owning a U.S. savings bond with ownership listed as: "Trent, payable to Sue on Trent's death." Sue redeems the bond.

C) Trent sends $25,000 to Alice's oral surgeon in payment of her dental implants. Alice is Trent's sister and does not qualify as his dependent.

D) Trent pays Eva $800,000 in a property settlement of her marital rights. One month later, Trent and Eva are divorced.

A) Trent established an irrevocable trust, income payable to himself for life and, upon his death, remainder to his children.

B) Trent dies owning a U.S. savings bond with ownership listed as: "Trent, payable to Sue on Trent's death." Sue redeems the bond.

C) Trent sends $25,000 to Alice's oral surgeon in payment of her dental implants. Alice is Trent's sister and does not qualify as his dependent.

D) Trent pays Eva $800,000 in a property settlement of her marital rights. One month later, Trent and Eva are divorced.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

75

The Federal unified transfer tax exclusion amount:

A) Is indexed for inflation.

B) Applies only to the estate tax.

C) Is a different amount for the estate and gift taxes.

D) Is doubled on a joint gift tax return.

A) Is indexed for inflation.

B) Applies only to the estate tax.

C) Is a different amount for the estate and gift taxes.

D) Is doubled on a joint gift tax return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

76

At the time of her death on October 4, Kaitlyn was involved in the following transactions.

? Was the sole life beneficiary of a trust (assets worth $2 million) created 10 years ago by Paul (Kaitlyn's husband). The transfer was by gift of securities then worth $500,000. Paul and Kaitlyn's children are the remainder beneficiaries.

? Owned stock in Mauve Corporation (basis of $800,000 and fair market value of $1 million). On September 7, a dividend of $48,000 was declared on the stock payable to all shareholders of record on October 3. The $48,000 was received by Kaitlyn's executor on October 19.

? Kaitlyn made a taxable gift of $400,000 in a prior tax year. As to these transactions, Kaitlyn's gross estate includes:

A) $1,048,000.

B) $1,448,000.

C) $3,000,000.

D) $3,048,000.

? Was the sole life beneficiary of a trust (assets worth $2 million) created 10 years ago by Paul (Kaitlyn's husband). The transfer was by gift of securities then worth $500,000. Paul and Kaitlyn's children are the remainder beneficiaries.

? Owned stock in Mauve Corporation (basis of $800,000 and fair market value of $1 million). On September 7, a dividend of $48,000 was declared on the stock payable to all shareholders of record on October 3. The $48,000 was received by Kaitlyn's executor on October 19.

? Kaitlyn made a taxable gift of $400,000 in a prior tax year. As to these transactions, Kaitlyn's gross estate includes:

A) $1,048,000.

B) $1,448,000.

C) $3,000,000.

D) $3,048,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

77

Andrea dies on April 30. Which, if any, of the following items is included in her gross estate?

A) Rents for the month of May (received on May 2) on an apartment building she owned.

B) Rents for the month of March (received on May 2) on an apartment building she owned.

C) Insurance recovery from a fire which occurred on November 1, and destroyed Andrea's residence.

D) A loan made by Andrea to her daughter and forgiven by Andrea in a prior tax year.

A) Rents for the month of May (received on May 2) on an apartment building she owned.

B) Rents for the month of March (received on May 2) on an apartment building she owned.

C) Insurance recovery from a fire which occurred on November 1, and destroyed Andrea's residence.

D) A loan made by Andrea to her daughter and forgiven by Andrea in a prior tax year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

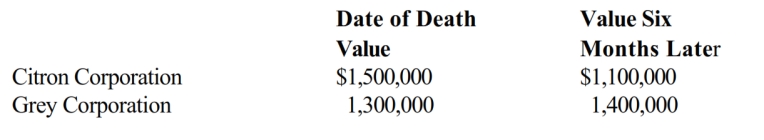

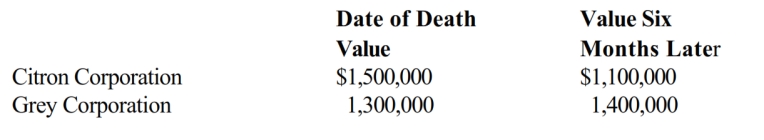

78

At the time of his death, Tom owned some common stock.

If the alternate valuation date is properly elected, the value of Tom's estate as to these stocks is:

A) $2,300,000.

B) $2,400,000.

C) $2,500,000.

D) $2,700,000.

If the alternate valuation date is properly elected, the value of Tom's estate as to these stocks is:

A) $2,300,000.

B) $2,400,000.

C) $2,500,000.

D) $2,700,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

79

The Federal transfer taxes are applied in a manner that is:

A) Unified among the taxes.

B) Cumulative over the individual's lifetime.

C) Both a. and b.

D) Neither a. nor b.

A) Unified among the taxes.

B) Cumulative over the individual's lifetime.

C) Both a. and b.

D) Neither a. nor b.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

80

Concerning the election to split gifts, which of the following statements is incorrect?

A) The election can be made even if the parties are not married for the entire year of the gift.

B) The election doubles the number of annual exclusions available.

C) The election has no utility in a community property jurisdiction.

D) The election can be made even if the parties are divorced as long as neither spouse has remarried by the end of the year.

A) The election can be made even if the parties are not married for the entire year of the gift.

B) The election doubles the number of annual exclusions available.

C) The election has no utility in a community property jurisdiction.

D) The election can be made even if the parties are divorced as long as neither spouse has remarried by the end of the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck