Deck 6: Statements of Financial Position and Cash Flows and the Annual Report

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

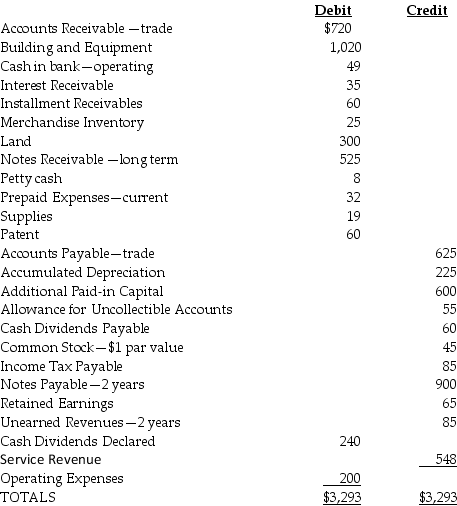

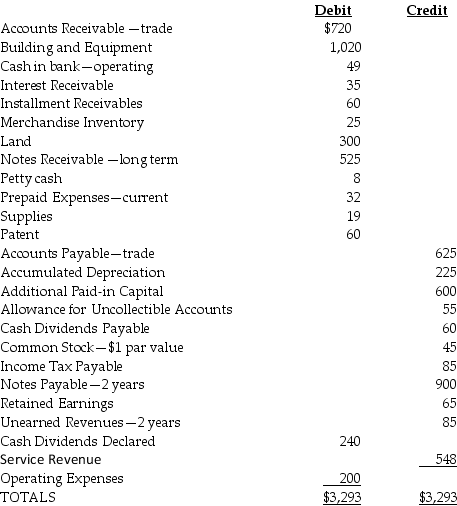

سؤال

سؤال

سؤال

سؤال

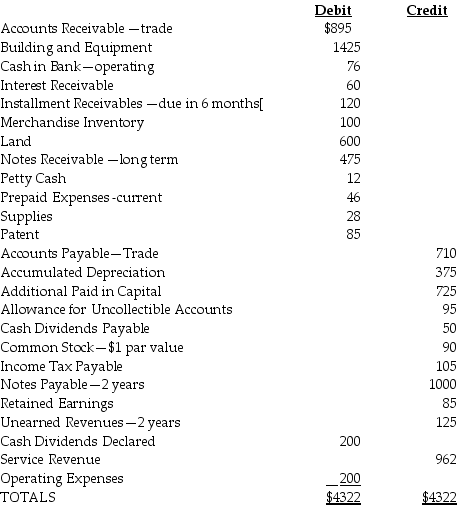

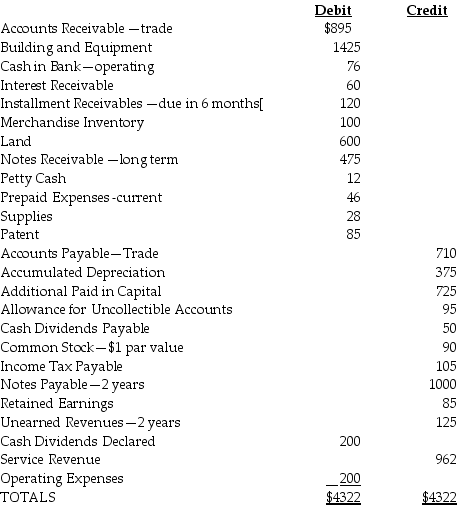

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/177

العب

ملء الشاشة (f)

Deck 6: Statements of Financial Position and Cash Flows and the Annual Report

1

The IFRS definition of current liabilities differs from the definition of current liabilities under GAAP.

True

2

What are three limitations associated with the balance sheet?

1. Many balance sheet accounts are reported at historical cost instead of market values or liquidation values; this limits the relevance of information in the balance sheet.

2. A number of assets and liabilities, such as human capital and reputation, are not reported on the balance sheet.

3. Many balance sheet accounts are based upon estimates as opposed to determinable amounts.

2. A number of assets and liabilities, such as human capital and reputation, are not reported on the balance sheet.

3. Many balance sheet accounts are based upon estimates as opposed to determinable amounts.

3

Accumulated other comprehensive income appears on an entity's income statement.

False

4

The balance sheet reflects the financial position of an entity over a period of time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

5

A firm that responds quickly to unexpected circumstances exhibits a high level of financial flexibility.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

6

Land held for resale is classified as property, plant, and equipment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

7

In order to be a cash equivalent, an investment must have a maturity date of three months or less when purchased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

8

List and explain three common cash flow measures based upon balance sheet information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

9

Current assets are those that a firm expects to convert into cash within one year or its operating cycle, whichever is longer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

10

Prepaid expenses are normally reported as current assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which of the following is not a cash flow measure?

A) profitability

B) solvency

C) liquidity

D) financial flexibility

A) profitability

B) solvency

C) liquidity

D) financial flexibility

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

12

If an entity can borrow funds to meet an unexpected financial crisis, it exhibits high ________.

A) liquidity

B) solvency

C) stability

D) financial flexibility

A) liquidity

B) solvency

C) stability

D) financial flexibility

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which of the following is not a limitation of the balance sheet?

A) Many balance sheet accounts are reported at historical cost instead of market values or liquidation values.

B) A number of assets and liabilities, such as human capital and reputation, are not reported on the balance sheet.

C) Many balance sheet accounts are based upon estimates as opposed to determinable amounts.

D) Many of the balances are reported at their liquidation values.

A) Many balance sheet accounts are reported at historical cost instead of market values or liquidation values.

B) A number of assets and liabilities, such as human capital and reputation, are not reported on the balance sheet.

C) Many balance sheet accounts are based upon estimates as opposed to determinable amounts.

D) Many of the balances are reported at their liquidation values.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

14

The relevance of the balance sheet is limited because many assets are recorded at historical costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which of the following best describes the concept of liquidity?

A) It is a measure of an asset's ability to be quickly converted to cash without risk of loss.

B) It is a measure of a firm's long-term ability to pay its obligations as they mature.

C) It indicates an entity's ability to respond to unexpected needs

D) It indicates a firm's ability to take advantage of opportunities by taking actions that alter the amounts and timing of cash flows.

A) It is a measure of an asset's ability to be quickly converted to cash without risk of loss.

B) It is a measure of a firm's long-term ability to pay its obligations as they mature.

C) It indicates an entity's ability to respond to unexpected needs

D) It indicates a firm's ability to take advantage of opportunities by taking actions that alter the amounts and timing of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

16

IFRS specifies that biological assets should be reported on the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

17

List three areas in which the balance sheet provides important information to financial statement users.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

18

Solvency is a measure of a firm's ability to pay its obligations as they mature.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

19

The portion of long-term debt that matures during the coming year is classified as a current liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which of the following is a current asset?

A) treasury bill acquired with 2 months to maturity

B) land held for investment

C) equipment

D) goodwill

A) treasury bill acquired with 2 months to maturity

B) land held for investment

C) equipment

D) goodwill

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

21

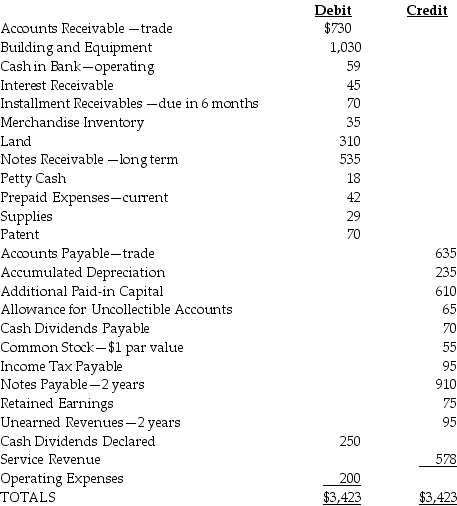

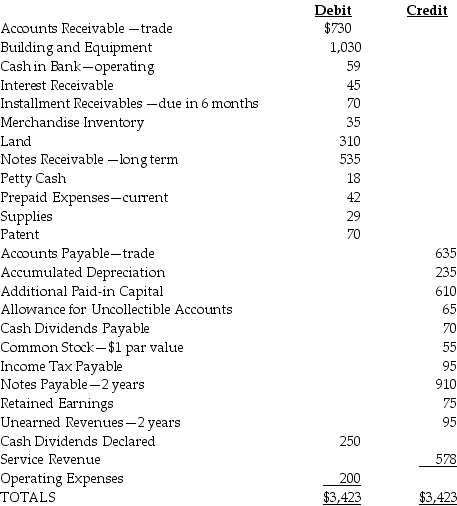

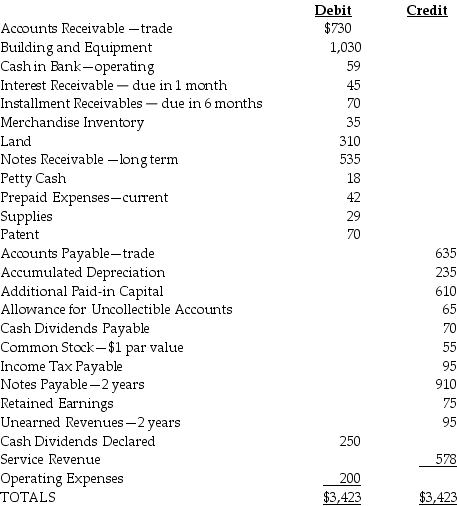

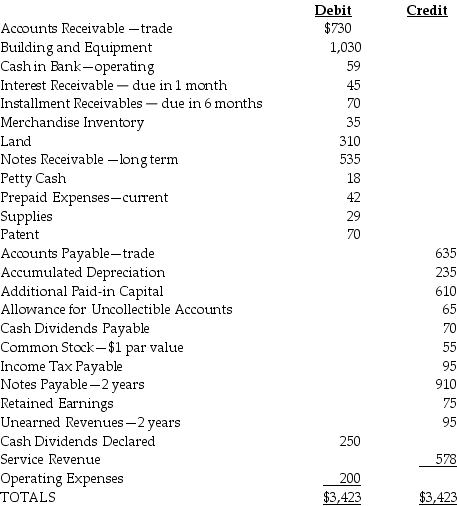

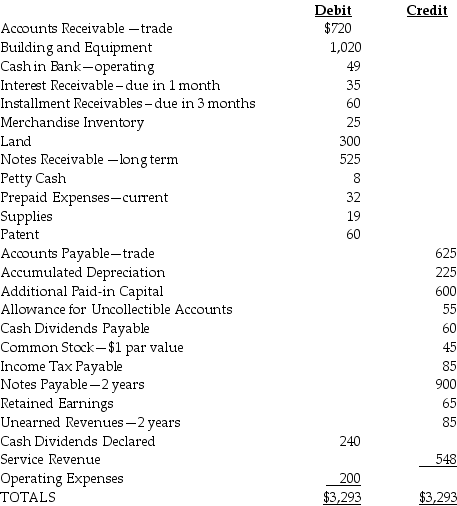

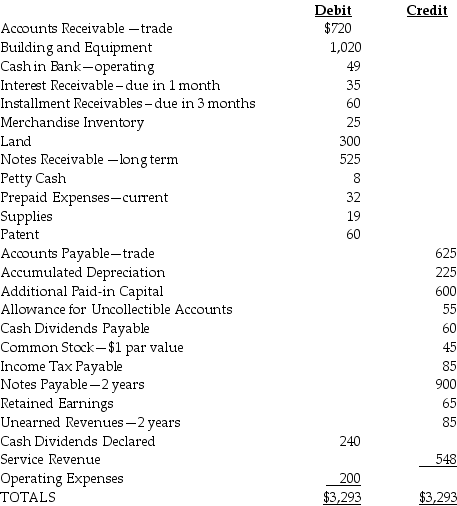

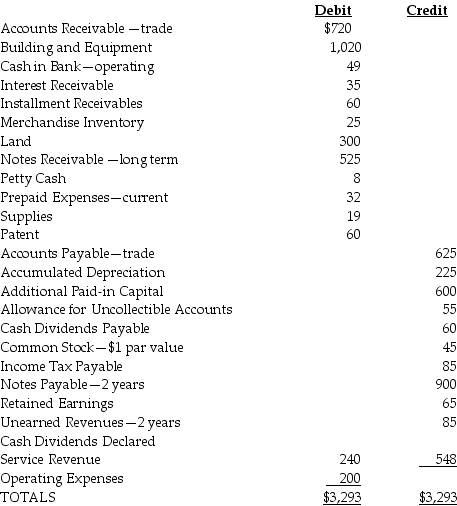

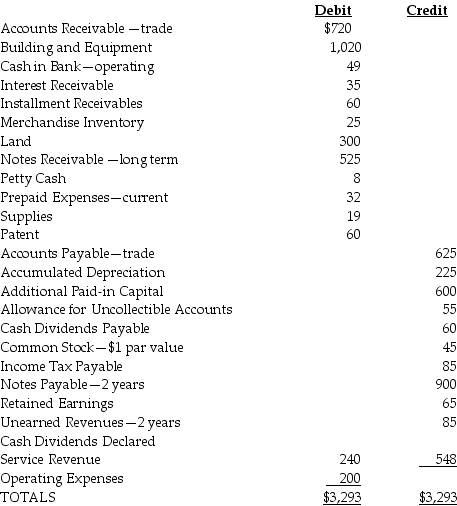

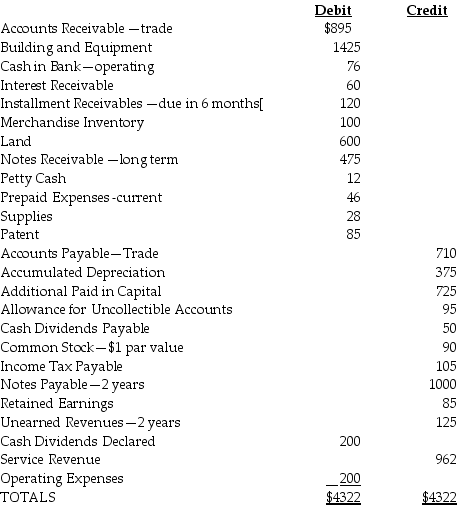

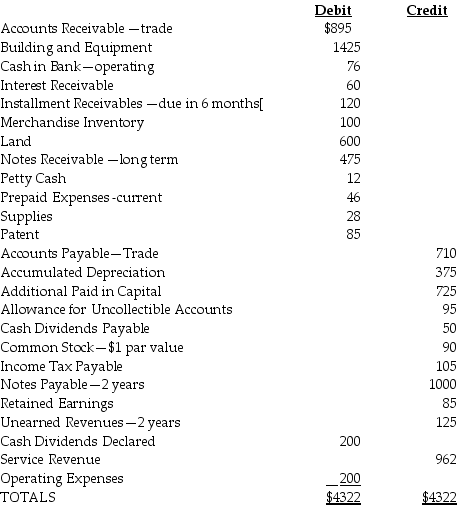

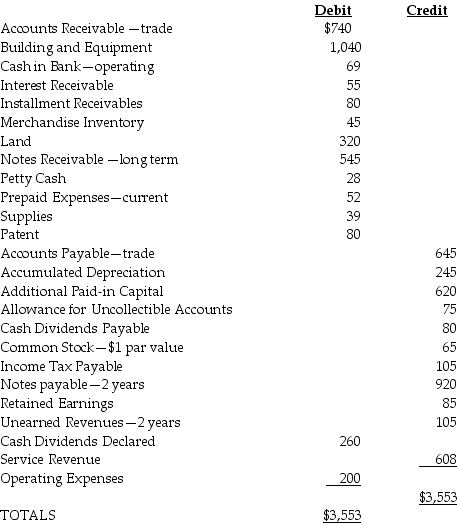

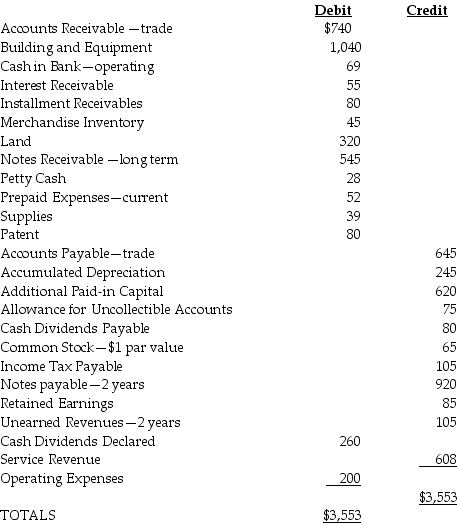

Glover Corporation's trial balance for December 31, the end of its fiscal year, included the following accounts:

The amount that should be classified as current liabilities on Glover's December 31 balance sheet is ________.

A) $71,000

B) $79,000

C) $101,000

D) $161,000

The amount that should be classified as current liabilities on Glover's December 31 balance sheet is ________.

A) $71,000

B) $79,000

C) $101,000

D) $161,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which of the following is not a cash equivalent?

A) commercial paper acquired with 75 days to maturity

B) bond sinking fund

C) money market funds

D) treasury bill acquired with 30 days to maturity

A) commercial paper acquired with 75 days to maturity

B) bond sinking fund

C) money market funds

D) treasury bill acquired with 30 days to maturity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

23

Classify the following accounts as assets (A), liabilities (L), or shareholders' equity (SE) and whether they are current (C), non-current (NC), or not applicable (N/A).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

24

When preparing a balance sheet using IFRS, a company may choose to list noncurrent assets first.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

25

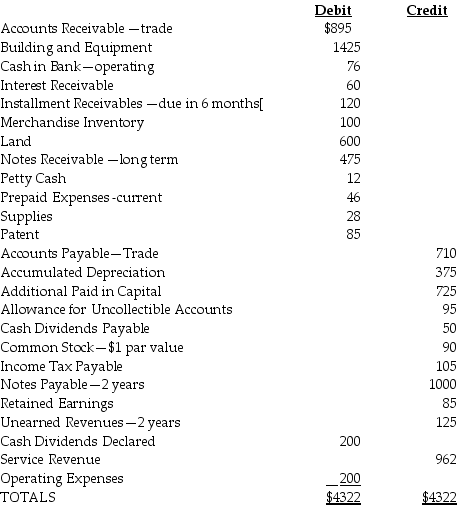

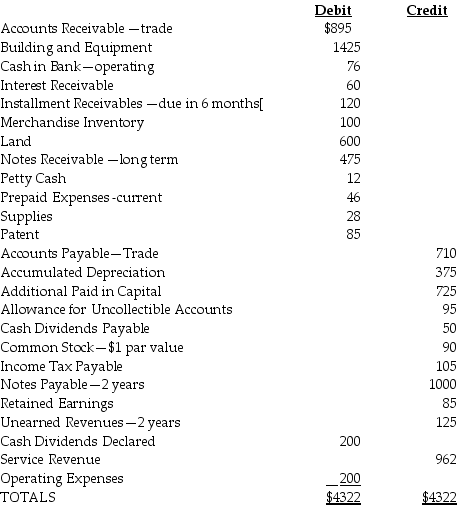

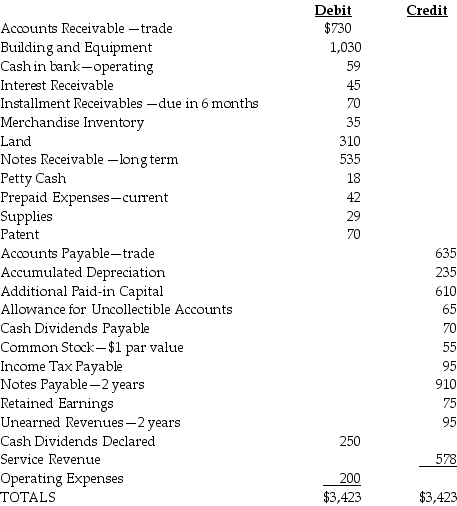

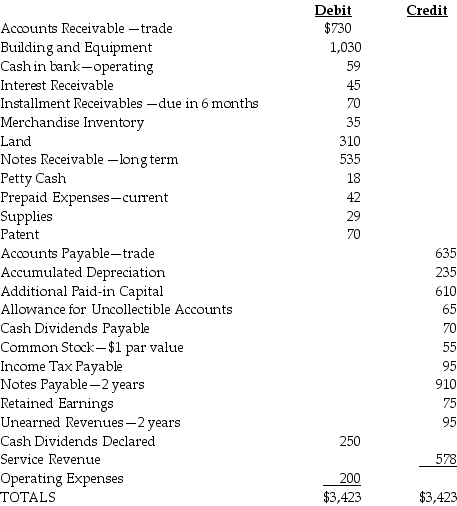

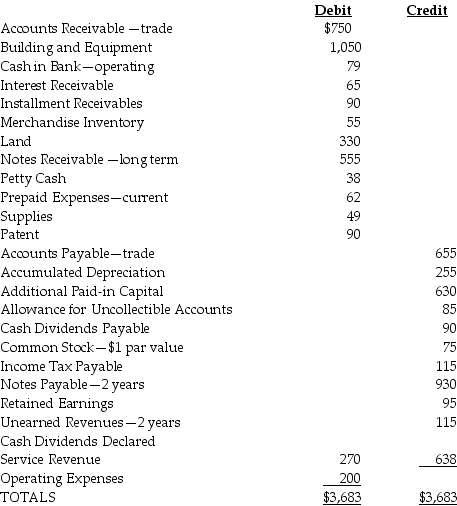

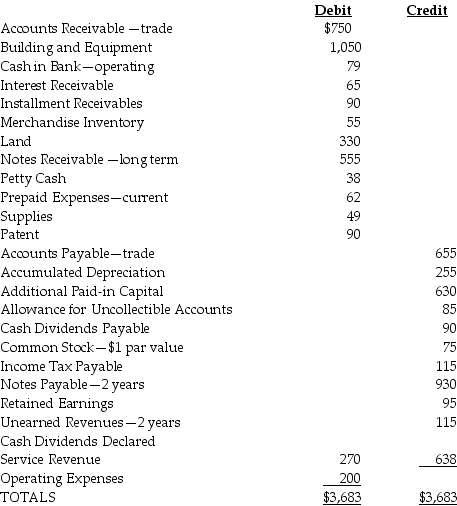

Anderson Corporation's trial balance for December 31, the end of its fiscal year, included the following accounts:

The bond payable is a serial bond with equal amounts of principal maturing each year. The note payable due in 5 years has equal principal payments due each year.

The amount that should be classified as current liabilities on Anderson's December 31 balance sheet is ________.

A) $86,000

B) $96,000

C) $102,000

D) $150,000

The bond payable is a serial bond with equal amounts of principal maturing each year. The note payable due in 5 years has equal principal payments due each year.

The amount that should be classified as current liabilities on Anderson's December 31 balance sheet is ________.

A) $86,000

B) $96,000

C) $102,000

D) $150,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

26

Where does Accumulated Other Comprehensive Income appear?

A) on the balance sheet in the shareholders' equity section

B) on the balance sheet in the long-term liabilities section

C) on the income statement after net income

D) on the balance sheet as a long-term asset

A) on the balance sheet in the shareholders' equity section

B) on the balance sheet in the long-term liabilities section

C) on the income statement after net income

D) on the balance sheet as a long-term asset

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

27

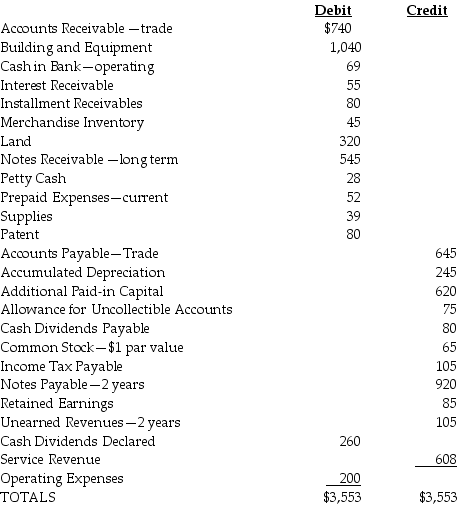

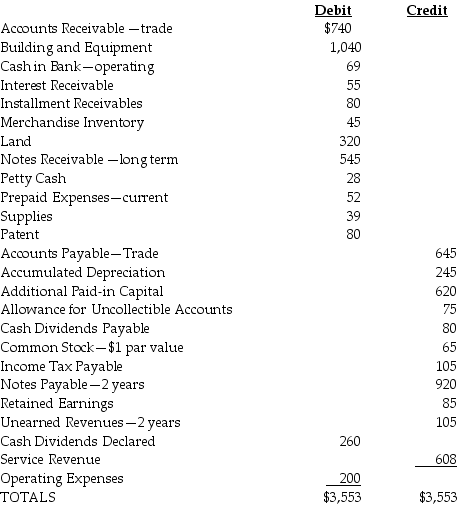

Presented below are selected accounts for San Marcos Corporation for December 31 of the current year.

What is working capital for San Marcos Corporation?

A) $115

B) $163

C) $298

D) $628

What is working capital for San Marcos Corporation?

A) $115

B) $163

C) $298

D) $628

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which of the following is a not a component of shareholders' equity?

A) Common Stock

B) Dividends Payable

C) Additional Paid-in Capital

D) Treasury Stock

A) Common Stock

B) Dividends Payable

C) Additional Paid-in Capital

D) Treasury Stock

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

29

The account format of the balance sheet lists assets on the left side and liabilities and stockholders' equity on the right side of the statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which of the following statements regarding balance sheet presentation is true?

A) IFRS does not prescribe the ordering of liabilities within current and noncurrent groups.

B) The account format lists liabilities and shareholders' equity directly below the assets.

C) The report format lists liabilities and shareholders' equity on the right side of the statement.

D) U.S. GAAP allows assets to be listed in either increasing or decreasing order of liquidity.

A) IFRS does not prescribe the ordering of liabilities within current and noncurrent groups.

B) The account format lists liabilities and shareholders' equity directly below the assets.

C) The report format lists liabilities and shareholders' equity on the right side of the statement.

D) U.S. GAAP allows assets to be listed in either increasing or decreasing order of liquidity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

31

A company reporting under IFRS must list its liabilities in order of liquidity for each grouping.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

32

Presented below are selected accounts for San Marcos Corporation for December 31 of the current year.

What are current assets for San Marcos Corporation?

A) $963

B) $1,028

C) $1,010

D) $1,433

What are current assets for San Marcos Corporation?

A) $963

B) $1,028

C) $1,010

D) $1,433

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following is not a component of shareholders' equity?

A) Retained Earnings

B) Paid-in Capital

C) Accrued Liabilities

D) Accumulated Other Comprehensive Income

A) Retained Earnings

B) Paid-in Capital

C) Accrued Liabilities

D) Accumulated Other Comprehensive Income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

34

Classify the following accounts as assets (A), liabilities (L), or shareholders' equity (SE) and whether they are current (C), non-current (NC), or not applicable (N/A).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

35

A company reporting under IFRS may list its assets in either increasing or decreasing order of liquidity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

36

Webb Corporation's trial balance for July 31, the end of its fiscal year, included the following accounts:

The investments account consists of marketable securities of which management plans to sell half of by December 31. The rest of the securities will be held longer than one year. Prepaid insurance is a two-year policy that was purchased on July 31. The note receivable is an installment note that will be paid in three equal installments on December 31 of each year.

The amount that should be classified as current assets in the July 31 balance sheet is ________.

A) $150,500

B) $153,000

C) $180,500

D) $214,500

The investments account consists of marketable securities of which management plans to sell half of by December 31. The rest of the securities will be held longer than one year. Prepaid insurance is a two-year policy that was purchased on July 31. The note receivable is an installment note that will be paid in three equal installments on December 31 of each year.

The amount that should be classified as current assets in the July 31 balance sheet is ________.

A) $150,500

B) $153,000

C) $180,500

D) $214,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

37

Presented below are selected accounts for San Marcos Corporation for December 31 of the current year.

What are current liabilities for San Marcos Corporation?

A) $710

B) $770

C) $795

D) $855

What are current liabilities for San Marcos Corporation?

A) $710

B) $770

C) $795

D) $855

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

38

The report format of the balance sheet lists assets on the left side and liabilities and stockholders' equity on the right side of the statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following is not a current liability?

A) income tax payable

B) accounts payable

C) subscriptions collected one year in advance

D) bond sinking fund

A) income tax payable

B) accounts payable

C) subscriptions collected one year in advance

D) bond sinking fund

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

40

Hendrickson Corporation's trial balance for July 31, the end of its fiscal year, included the following accounts: Investments are treasury bills that were purchased in May and mature on August 15. Prepaid insurance is a three-year policy that was purchased on July 31.

The amount that should be classified as current assets in the July 31 balance sheet is ________.

A) $129,500

B) $125,500

C) $82,000

D) $199,500

The amount that should be classified as current assets in the July 31 balance sheet is ________.

A) $129,500

B) $125,500

C) $82,000

D) $199,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

41

The statement of cash flows summarizes a firm's cash flows and outflows over a period of time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

42

San Pedro Industries

Presented below are selected accounts from the adjusted trial balance ($ Millions) for San Pedro Industries for June 30 of the current year.

Prepare a classified balance sheet using the account format for San Pedro Industries.

Presented below are selected accounts from the adjusted trial balance ($ Millions) for San Pedro Industries for June 30 of the current year.

Prepare a classified balance sheet using the account format for San Pedro Industries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

43

Presented below are selected accounts for San Marcos Corporation for December 31 of the current year.

What are total assets for San Marcos Corporation?

A) $2,573

B) $2,618

C) $2,628

D) $2,673

What are total assets for San Marcos Corporation?

A) $2,573

B) $2,618

C) $2,628

D) $2,673

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

44

San Pedro Industries

Presented below are selected accounts from the adjusted trial balance ($ Millions) for San Pedro Industries for June 30 of the current year.

Prepare a classified balance sheet using the report format for San Pedro Industries.

Presented below are selected accounts from the adjusted trial balance ($ Millions) for San Pedro Industries for June 30 of the current year.

Prepare a classified balance sheet using the report format for San Pedro Industries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

45

Presented below are selected accounts for San Marcos Corporation for December 31 of the current year.

What is ending retained earnings for San Marcos Corporation?

A) $308

B) $173

C) $305

D) $613

What is ending retained earnings for San Marcos Corporation?

A) $308

B) $173

C) $305

D) $613

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

46

Redemption of bonds payable is classified as a financing activity on the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

47

Presented below are selected accounts for San Marcos Corporation for December 31 of the current year.

What are long-term assets for San Marcos Corporation?

A) $1,175

B) $1,640

C) $1,710

D) $1,945

What are long-term assets for San Marcos Corporation?

A) $1,175

B) $1,640

C) $1,710

D) $1,945

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

48

The statement of cash flows summarizes a firm's cash inflows and outflows at a specific point in time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

49

San Pedro Industries

Presented below are selected accounts from the adjusted trial balance ($ Millions) for San Pedro Industries for June 30 of the current year.

Prepare a classified balance sheet in IFRS-acceptable format for San Pedro Industries.

Presented below are selected accounts from the adjusted trial balance ($ Millions) for San Pedro Industries for June 30 of the current year.

Prepare a classified balance sheet in IFRS-acceptable format for San Pedro Industries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

50

Cash receipts from interest and dividends are classified as operating activities on a U.S. GAAP-based statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

51

Purchases of fixed assets are classified as investing activities on the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

52

The statement of cash flows enables financial statement users to do all of the following except ________.

A) assess an entity's ability to pay liabilities and dividends

B) determine the extent to which an entity will require external financing

C) assess the collectability of existing accounts receivable

D) reconcile differences between net income and the associated cash receipts and payments

A) assess an entity's ability to pay liabilities and dividends

B) determine the extent to which an entity will require external financing

C) assess the collectability of existing accounts receivable

D) reconcile differences between net income and the associated cash receipts and payments

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

53

Dividend payments to shareholders are classified as operating activities on the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

54

Presented below are selected accounts for San Marcos Corporation for December 31 of the current year.

What are total liabilities for San Marcos Corporation?

A) $1,815

B) $1,905

C) $1,950

D) $1,990

What are total liabilities for San Marcos Corporation?

A) $1,815

B) $1,905

C) $1,950

D) $1,990

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

55

In order to sustain operations, a firm must have positive cash flows from operating activities over the long run.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

56

After grouping assets as current and noncurrent what further classifications within those categories are made when compiling a balance sheet? Assume U.S. GAAP.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

57

Compare and contrast the presentation of assets under U.S. GAAP versus IFRS reporting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

58

Presented below are selected accounts for San Marcos Corporation for December 31 of the current year.

What is total stockholders' equity for San Marcos Corporation?

A) $770

B) $918

C) $1,353

D) $1,438

What is total stockholders' equity for San Marcos Corporation?

A) $770

B) $918

C) $1,353

D) $1,438

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

59

Presented below are selected accounts for San Marcos Corporation for December 31 of the current year.

What are long-term liabilities for San Marcos Corporation?

A) $920

B) $1,000

C) $1,025

D) $1,130

What are long-term liabilities for San Marcos Corporation?

A) $920

B) $1,000

C) $1,025

D) $1,130

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

60

List and describe the two balance sheet formats.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

61

When preparing the operating section of the statement of cash flows using the indirect method, which of the following items are added to net income?

A) decrease in accrued expenses

B) gain on sale of long-term assets

C) bad debt expense

D) increase in accounts receivable

A) decrease in accrued expenses

B) gain on sale of long-term assets

C) bad debt expense

D) increase in accounts receivable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

62

Presented below are activities from Prosser Industries, Inc.

Required: Please indicate whether each of these activities is classified as an (O)perating, (I)nvesting, or (F)inancing Activity on the statement of cash flows.

Required: Please indicate whether each of these activities is classified as an (O)perating, (I)nvesting, or (F)inancing Activity on the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

63

The only difference between the statement of cash flows under the indirect method and the direct method is in the reporting of cash flows from operating activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

64

Presented below are activities from Ford Enterprises, Inc.

Required: Please indicate whether each of these activities is classified as an (O)perating, (I)nvesting, or (F)inancing Activity on the statement of cash flows.

Required: Please indicate whether each of these activities is classified as an (O)perating, (I)nvesting, or (F)inancing Activity on the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

65

Describe the statement of cash flows and its purpose including what a financial statement user can determine or assess by reviewing a well-prepared statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

66

When preparing the operating section of the statement of cash flows using the indirect method, which of the following items are subtracted from net income?

A) depreciation expense

B) gain on sale of long-term assets

C) decrease in prepaid expenses

D) increase in income taxes payable

A) depreciation expense

B) gain on sale of long-term assets

C) decrease in prepaid expenses

D) increase in income taxes payable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

67

All of the following activities are classified as operating activities on a statement of cash flows except ________.

A) purchase of inventory with cash

B) sale of merchandise for cash

C) receipts from customers

D) purchase of a certificate of deposit

A) purchase of inventory with cash

B) sale of merchandise for cash

C) receipts from customers

D) purchase of a certificate of deposit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

68

Complete the U.S. GAAP and IFRS columns in the table below by identifying the cash flow activity on the statement of cash flows: Operating, Investing, or Financing. If a standard allows for more than one activity classification be sure to note both. For example, if an activity can be classified as "Operating or Financing," please note both classifications.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

69

Which of the following is classified as an operating activity on a statement of cash flows?

A) payment of dividends

B) sale of equipment

C) issuance of common stock

D) purchase of inventory with cash

A) payment of dividends

B) sale of equipment

C) issuance of common stock

D) purchase of inventory with cash

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

70

When preparing the operating activities section of the statement of cash flows under the indirect method, depreciation expense is subtracted from net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

71

When preparing the operating activities section of the statement of cash flows under the indirect method, gains on sale of equipment are subtracted from net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

72

Which of the following is classified as a financing activity on a statement of cash flows?

A) purchase of a vendor's common stock

B) sale of equipment at a gain

C) payment of dividends to shareholders

D) redemption of a sinking fund

A) purchase of a vendor's common stock

B) sale of equipment at a gain

C) payment of dividends to shareholders

D) redemption of a sinking fund

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

73

When preparing the operating activities section of the statement of cash flows under the indirect method, losses on sales of equipment are omitted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

74

Which of the following is classified as an investing activity on a statement of cash flows?

A) purchase of land

B) issuance of serial bonds

C) purchase of insurance policy

D) purchase of treasury stock

A) purchase of land

B) issuance of serial bonds

C) purchase of insurance policy

D) purchase of treasury stock

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

75

When preparing the operating section of the statement of cash flows using the direct method, which of the following statements is true?

A) An increase in accounts payable is subtracted from cost of goods sold.

B) An increase in accounts receivable is added to sales.

C) Depreciation expense is added to cash flows.

D) Gains on sales of long term assets are subtracted from cash flows.

A) An increase in accounts payable is subtracted from cost of goods sold.

B) An increase in accounts receivable is added to sales.

C) Depreciation expense is added to cash flows.

D) Gains on sales of long term assets are subtracted from cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

76

All of the following activities are classified as investing activities on a statement of cash flows except ________.

A) purchase of land

B) sale of long-term investments

C) purchase of copyright

D) gain on sale of securities

A) purchase of land

B) sale of long-term investments

C) purchase of copyright

D) gain on sale of securities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

77

The FASB prefers the indirect method of preparing the operating activities section of the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

78

All of the following activities are classified as financing activities on a statement of cash flows except ________.

A) distribution of dividends in the form of stock

B) issuance of serial bonds

C) payment of mortgage

D) sale of treasury stock

A) distribution of dividends in the form of stock

B) issuance of serial bonds

C) payment of mortgage

D) sale of treasury stock

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

79

When preparing the operating section of the statement of cash flows using the indirect method, which of the following items are added to net income?

A) decrease in accounts payable

B) unrealized gains on trading securities

C) loss on sale of equipment

D) increase in merchandise inventory

A) decrease in accounts payable

B) unrealized gains on trading securities

C) loss on sale of equipment

D) increase in merchandise inventory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck

80

When preparing the operating activities section of the statement of cash flows under the direct method, an increase in accounts receivable is subtracted from sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 177 في هذه المجموعة.

فتح الحزمة

k this deck