Deck 10: Analysis of Financial Statements

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/89

العب

ملء الشاشة (f)

Deck 10: Analysis of Financial Statements

1

Financial ratios can be used to estimate systematic risk.

True

2

Financial ratios can be used to identify firms that might default on a loan or declare bankruptcy.

True

3

Some factors that determine business risk include sales variability and debt to equity ratio.

False

4

Financial ratios are used in stock and bond valuation models.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

5

It is important to compare a firm's performance relative to: the aggregate economy, its industry, its major competitors and its past performance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

6

Some factors that determine financial risk include interest coverage and cash flow coverage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

7

Traditional cash flow and Free cash flow are equivalent concepts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

8

In common size analysis all assets and liabilities on the balance sheet are divided by total sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

9

The current ratio, receivables turnover and total asset turnover are measures of internal liquidity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

10

The income statement indicates the flow of sales, expenses, and earnings during a period of time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

11

According to the DuPont system ROE (return on equity) can be decomposed into the profit margin ratio and the total asset turnover ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

12

A cross-sectional analysis compares a firm to a subset of industry firms comparable in size or characteristics.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

13

The growth of business depends on the percentage of earnings reinvested and the return on equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

14

The statement of cash flows shows the effect on the firm's cash flows of earnings and changes in the assets, current liabilities, long-term liabilities and net worth.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

15

Inventory turnover, net fixed asst turnover and equity turnover are measures of operating efficiency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

16

Financial Accounting Standards Board (FASB) recognizes that it would be improper for all companies to use identical and restrictive accounting principles.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

17

Free cash flow = Cash flow from operations -Capital expenditures + Disposition of property and equipment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

18

Bond rating agencies include the analysis of financial ratios in arriving at corporate bond ratings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

19

The balance sheet shows what assets the firm controls at a point in time and how it financed the assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

20

Cash flow from operations = Net Income + Non cash revenue and expenses -Changes in net working capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

21

The DuPont equation breaks down a firm's return on equity into three components, which are profit margin, total asset turnover, and financial leverage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which of the following statements regarding financial risk and business risk is true?

A)The acceptable level of financial risk for a firm depends on its business risk.

B)A firm with a greater degree of business risk has the ability to take on more debt.

C)A firm with a greater degree of financial risk typically takes on less business risk.

D)Financial risk and business risk are both important but they are not related in any way.

E)Financial risk is more important for small firms and business risk is more important for large firms.

A)The acceptable level of financial risk for a firm depends on its business risk.

B)A firm with a greater degree of business risk has the ability to take on more debt.

C)A firm with a greater degree of financial risk typically takes on less business risk.

D)Financial risk and business risk are both important but they are not related in any way.

E)Financial risk is more important for small firms and business risk is more important for large firms.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

23

A common-size income statement expresses all income statement items

A)As a percentage of Current Assets.

B)As a percentage of Fixed Assets.

C)As a percentage of Total Assets.

D)As a percentage of Net Income.

E)As a percentage of Sales

A)As a percentage of Current Assets.

B)As a percentage of Fixed Assets.

C)As a percentage of Total Assets.

D)As a percentage of Net Income.

E)As a percentage of Sales

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which of the following is not a flow ratio?

A)Interest coverage

B)Fixed charge coverage

C)Debt/equity

D)Cash flow/long term debt

E)Cash flow/total debt

A)Interest coverage

B)Fixed charge coverage

C)Debt/equity

D)Cash flow/long term debt

E)Cash flow/total debt

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

25

Operating performance is divided into which two subcategories of ratios?

A)Efficiency and profitability

B)Efficiency and debt

C)Profitability and growth

D)Debt and equity

E)Liquidity and leverage

A)Efficiency and profitability

B)Efficiency and debt

C)Profitability and growth

D)Debt and equity

E)Liquidity and leverage

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following factors would be an indication of high quality earnings?

A)Earnings are close to cash.

B)Earnings are the result of repeat business.

C)Revenue recognition is based on the installment principle.

D)All of the above.

E)None of the above.

A)Earnings are close to cash.

B)Earnings are the result of repeat business.

C)Revenue recognition is based on the installment principle.

D)All of the above.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which of the following is not a component of return on equity (ROE)?

A)Net income/sales

B)Total assets/equity

C)Equity/sales

D)Sales/total assets

E)Net Profit Margin

A)Net income/sales

B)Total assets/equity

C)Equity/sales

D)Sales/total assets

E)Net Profit Margin

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

28

Limitations on the use of ratios include

A)Accounting comparability.

B)Company homogeneity.

C)Consistent results.

D)A reasonable range within the industry.

E)All of the above

A)Accounting comparability.

B)Company homogeneity.

C)Consistent results.

D)A reasonable range within the industry.

E)All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

29

The five major classes of ratios include the following, except

A)Internal liquidity.

B)Risk analysis.

C)Growth analysis.

D)Market performance.

E)Operating performance.

A)Internal liquidity.

B)Risk analysis.

C)Growth analysis.

D)Market performance.

E)Operating performance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

30

Determinants of market liquidity include all except the

A)Number of shares traded.

B)Dollar value of shares traded.

C)Bid-ask spread.

D)Number of security owners.

E)Market price per share.

A)Number of shares traded.

B)Dollar value of shares traded.

C)Bid-ask spread.

D)Number of security owners.

E)Market price per share.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which equation is valid?

A)g = Percent of earnings retained / Return on equity

B)g = Return on equity/Percent of earnings retained

C)g = Return on equity/ Return on total assets

D)g = Percent of earnings retained * Return on equity

E)g = Total assets *Return on total assets

A)g = Percent of earnings retained / Return on equity

B)g = Return on equity/Percent of earnings retained

C)g = Return on equity/ Return on total assets

D)g = Percent of earnings retained * Return on equity

E)g = Total assets *Return on total assets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which of the following factors would be indicative of a high quality balance sheet?

A)Book value is greater than market value.

B)The presence of off-balance sheet liabilities

C)Market value is greater than book value.

D)Very little unused borrowing capacity.

E)None of the above.

A)Book value is greater than market value.

B)The presence of off-balance sheet liabilities

C)Market value is greater than book value.

D)Very little unused borrowing capacity.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following is not a use of financial ratios?

A)Stock valuation

B)Assigning credit quality ratings on bonds

C)Predicting insolvency

D)Identification of internal corporate variables that affect a stock's systematic risk

E)None of the above (that is, all are uses of financial ratios)

A)Stock valuation

B)Assigning credit quality ratings on bonds

C)Predicting insolvency

D)Identification of internal corporate variables that affect a stock's systematic risk

E)None of the above (that is, all are uses of financial ratios)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

34

A common-size balance sheet expresses all balance sheet items

A)As a percentage of Current Assets.

B)As a percentage of Fixed Assets.

C)As a percentage of Total Assets.

D)As a percentage of Net Income.

E)As a percentage of Sales.

A)As a percentage of Current Assets.

B)As a percentage of Fixed Assets.

C)As a percentage of Total Assets.

D)As a percentage of Net Income.

E)As a percentage of Sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

35

Cross-sectional analysis is a useful technique for estimating future performance that involves examining a firm's relative performance over time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which ratio is considered an internal liquidity ratio?

A)Total asset turnover

B)Net fixed asset turnover

C)Receivables turnover

D)Equity turnover

E)Inventory turnover

A)Total asset turnover

B)Net fixed asset turnover

C)Receivables turnover

D)Equity turnover

E)Inventory turnover

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

37

The comparisons with which ratios should be made include the following, except

A)The firm's own past performance.

B)The firm's major competitor within the industry.

C)The firm's suppliers and customers.

D)The firm's industry or industries.

E)The aggregate economy.

A)The firm's own past performance.

B)The firm's major competitor within the industry.

C)The firm's suppliers and customers.

D)The firm's industry or industries.

E)The aggregate economy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

38

Which of the following ratios is not a measurement of the firm's liquidity?

A)Current ratio

B)Cash ratio

C)Receivables turnover

D)Inventory turnover

E)Total asset turnover

A)Current ratio

B)Cash ratio

C)Receivables turnover

D)Inventory turnover

E)Total asset turnover

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

39

Financial risk is the uncertainty of operating income caused by the firm's industry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

40

DuPont Analysis breaks down return on equity into major areas that can be used to identify a firm's strengths or weaknesses with respect to

A)Profitability

B)Leverage

C)Liquidity

D)Efficiency

E)All of the above are broken out in the basic DuPont equation.

A)Profitability

B)Leverage

C)Liquidity

D)Efficiency

E)All of the above are broken out in the basic DuPont equation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

41

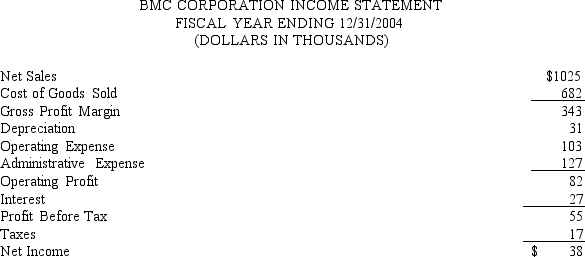

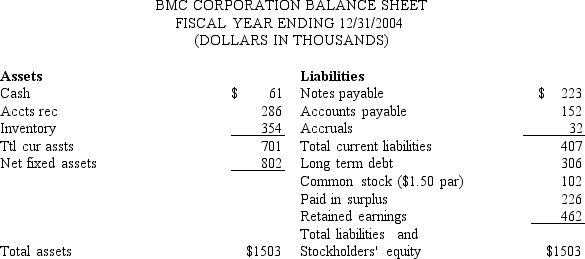

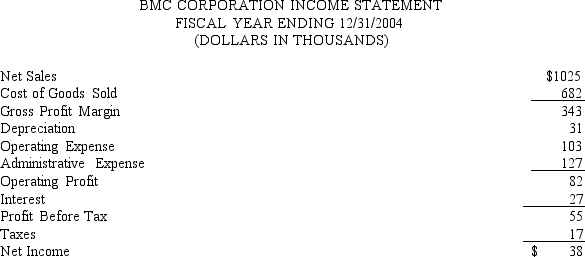

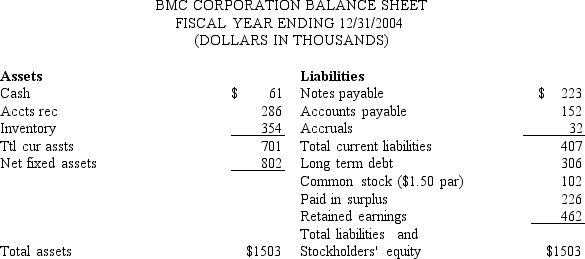

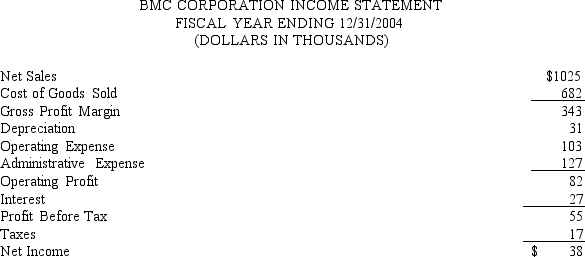

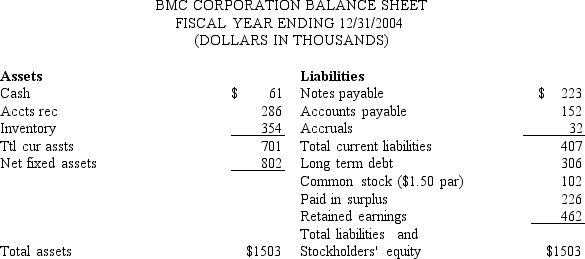

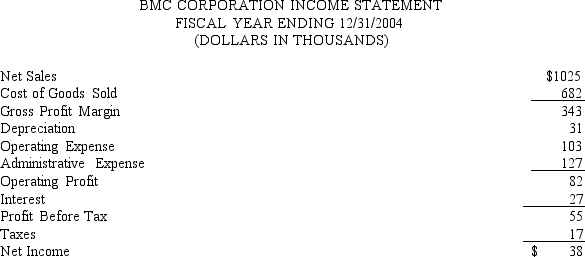

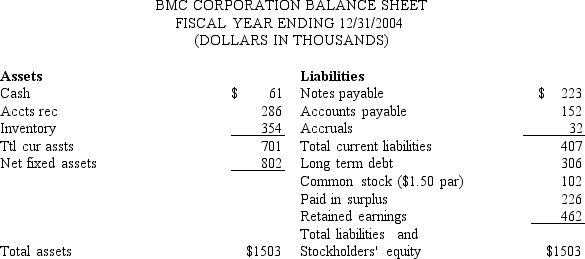

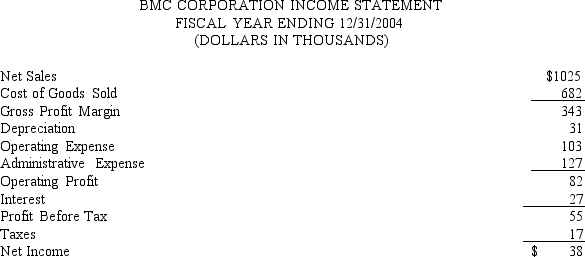

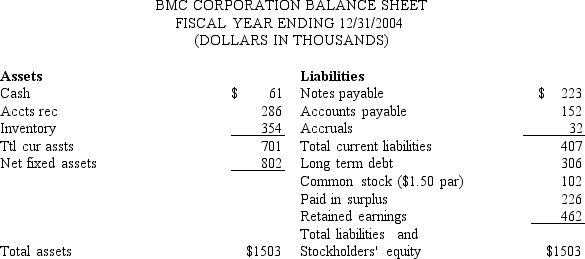

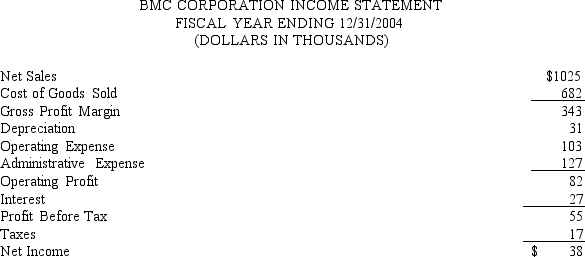

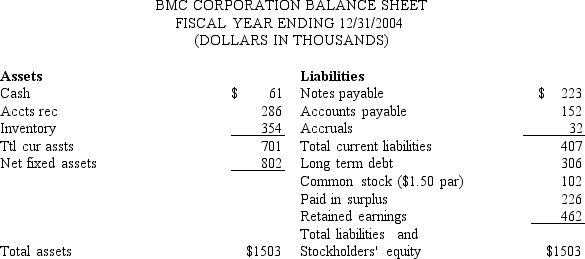

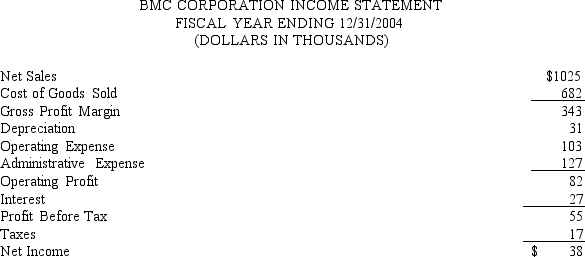

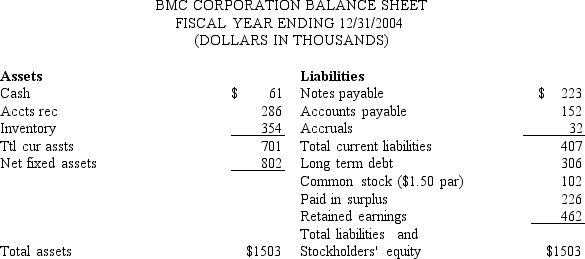

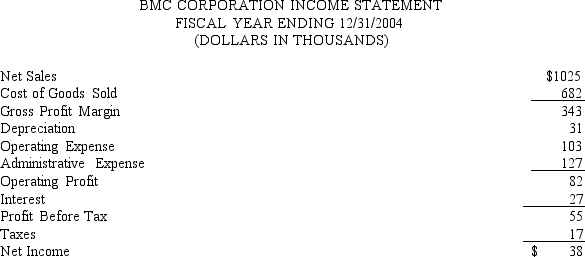

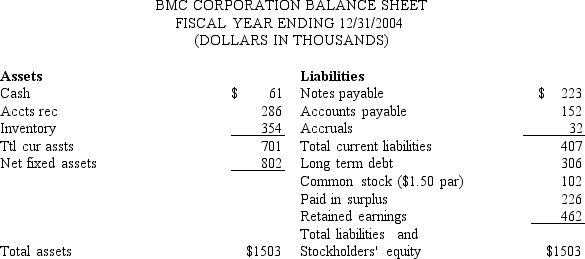

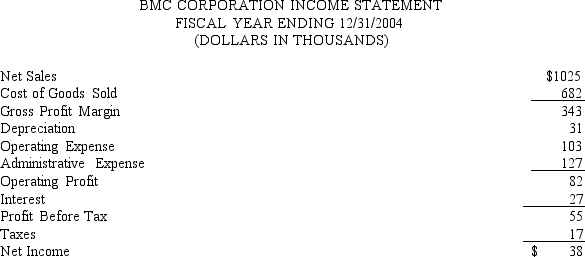

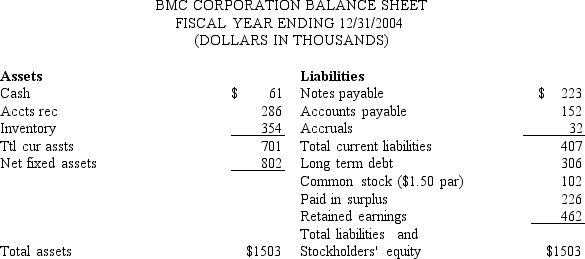

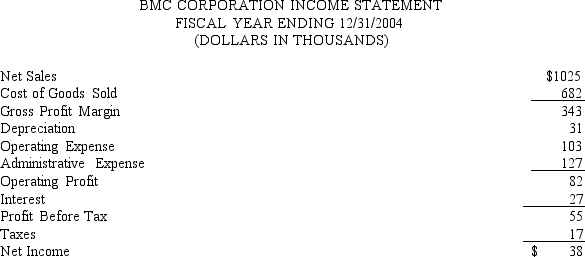

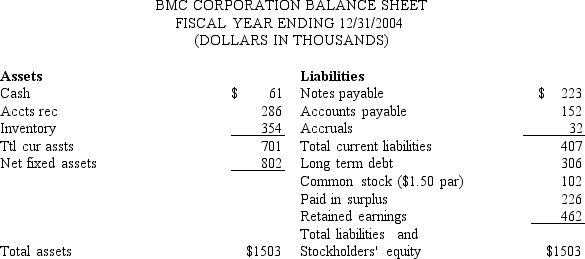

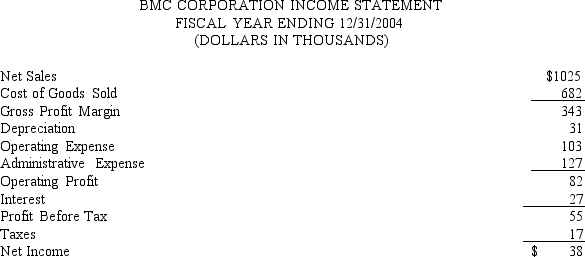

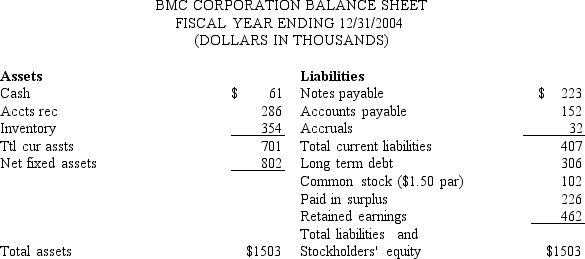

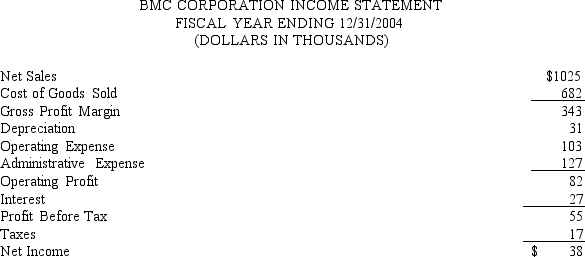

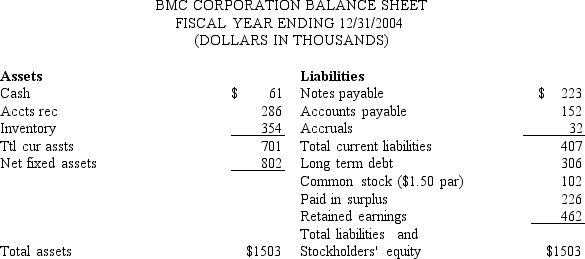

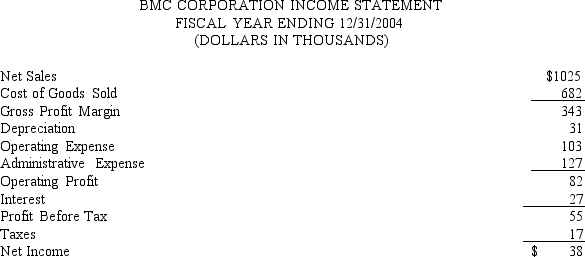

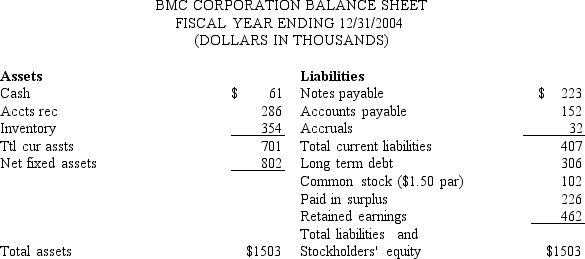

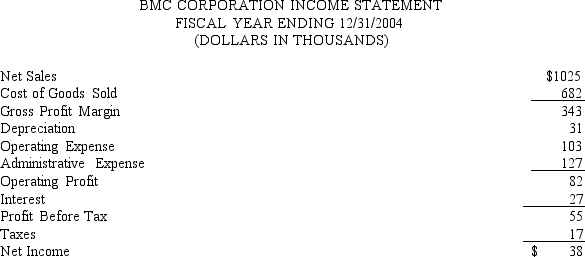

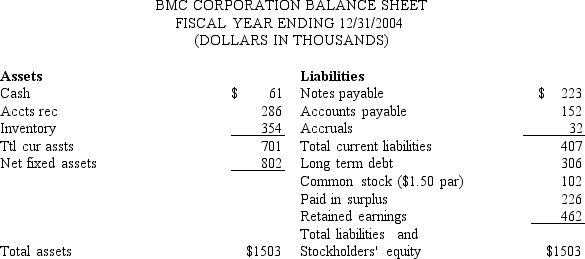

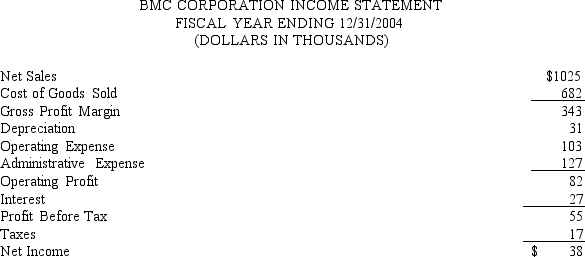

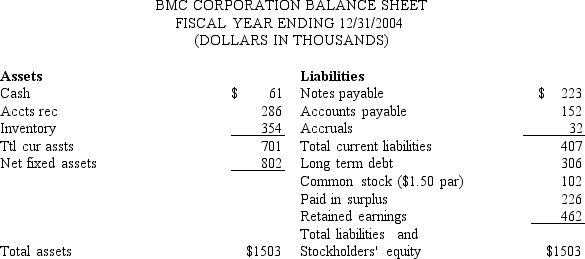

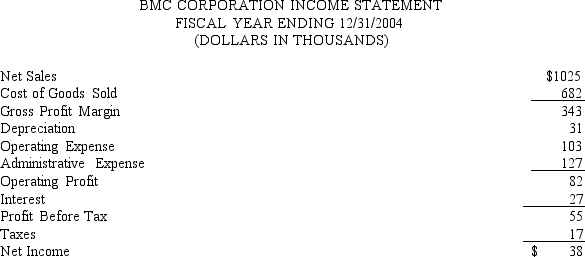

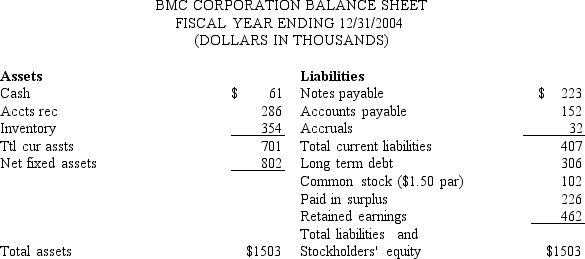

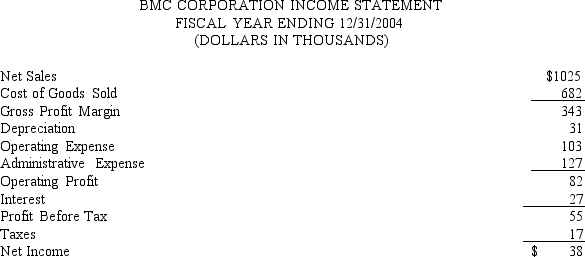

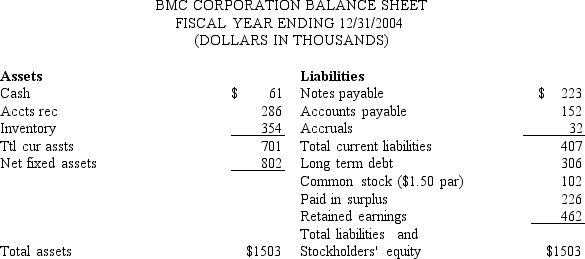

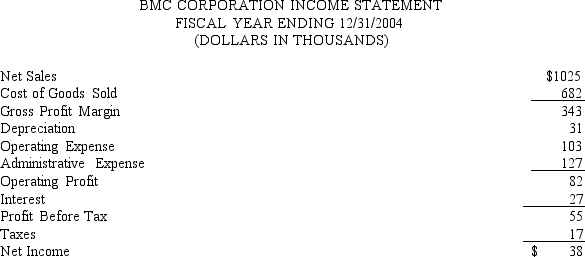

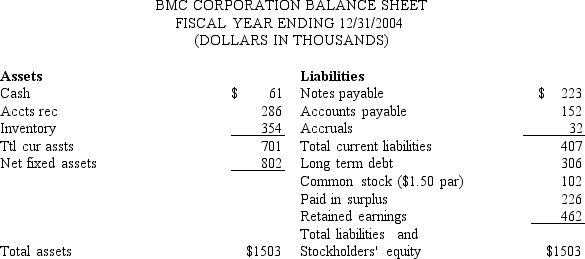

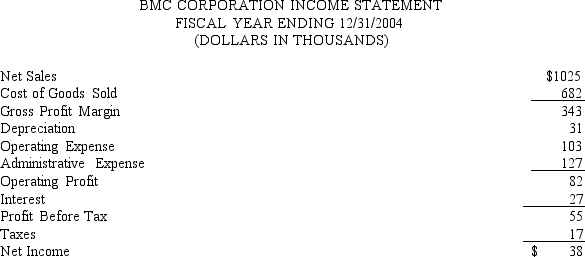

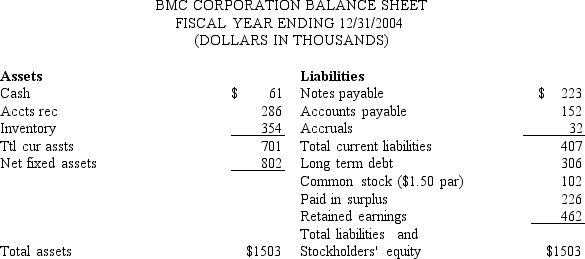

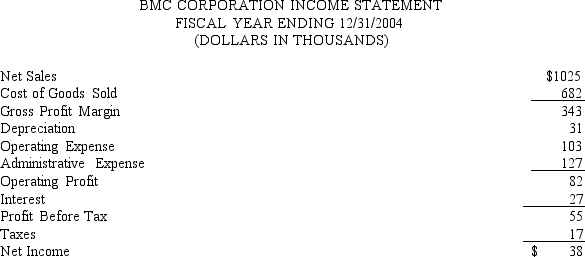

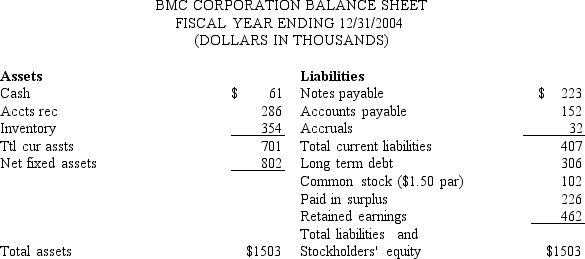

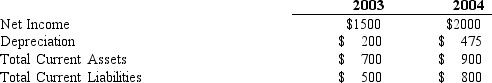

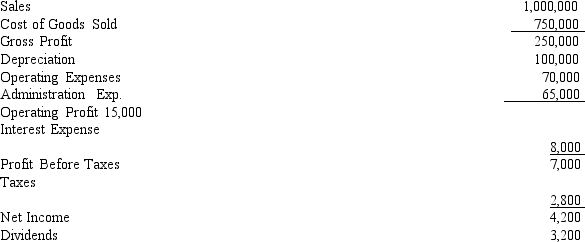

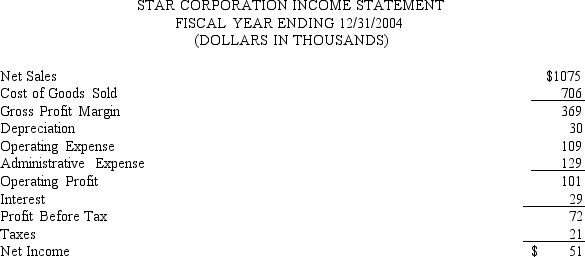

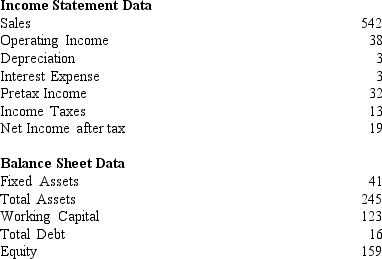

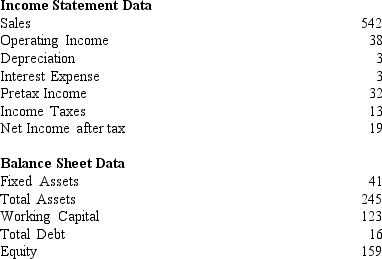

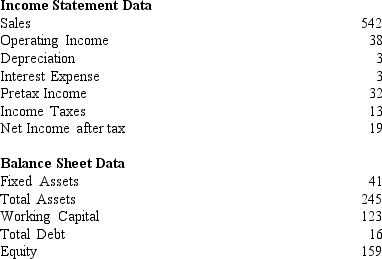

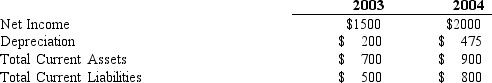

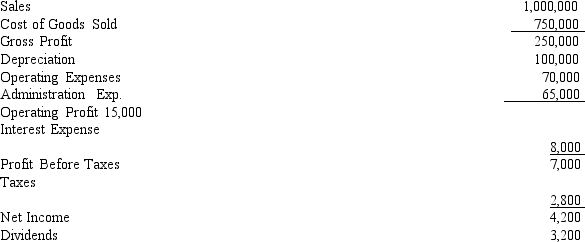

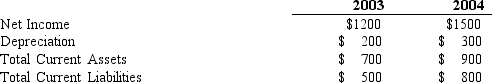

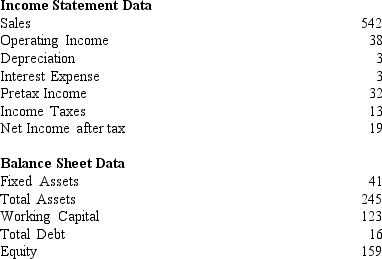

Exhibit 10.1

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 10.1. What was BMC'S current ratio at year-end 2004?

A)0.852

B)1.000

C)1.368

D)1.722

E)1.943

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 10.1. What was BMC'S current ratio at year-end 2004?

A)0.852

B)1.000

C)1.368

D)1.722

E)1.943

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

42

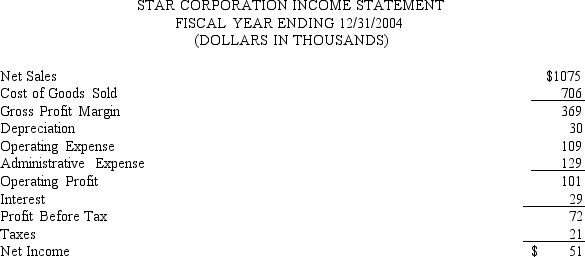

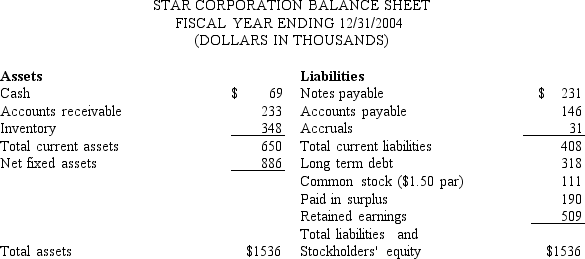

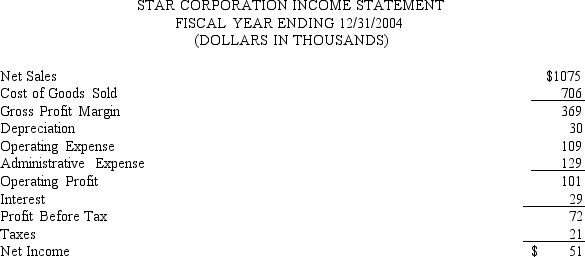

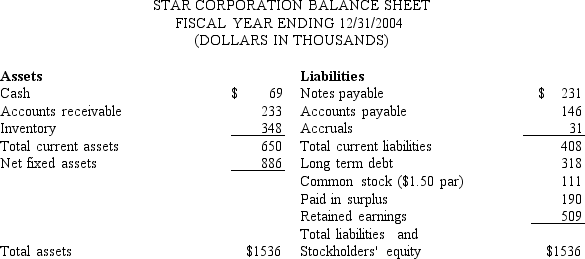

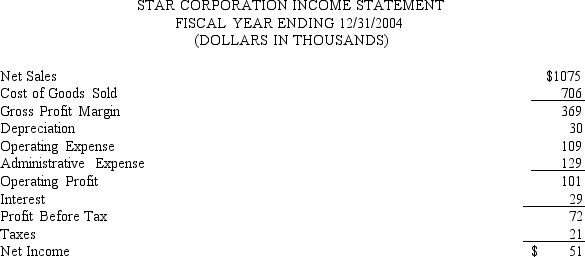

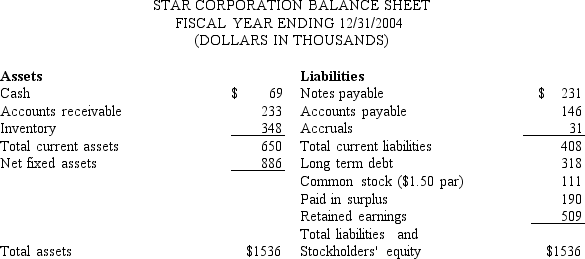

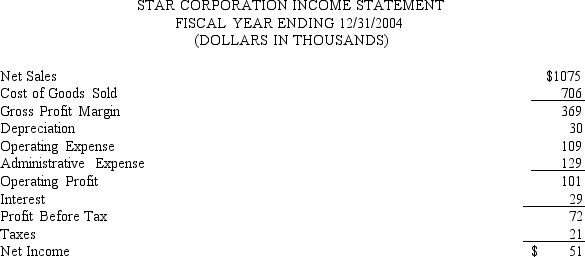

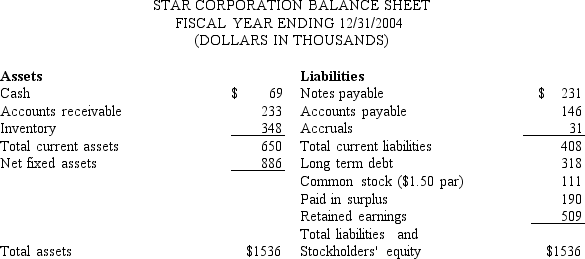

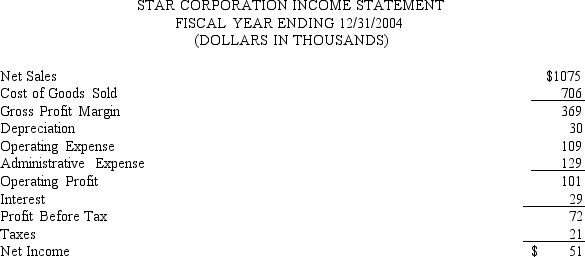

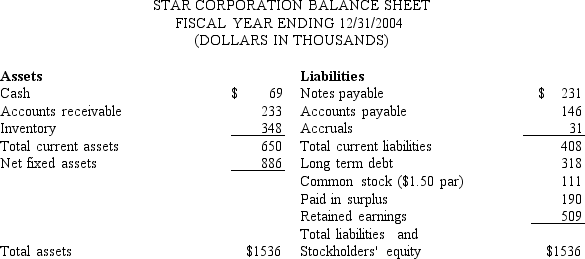

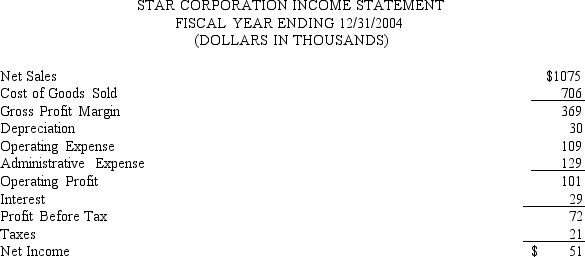

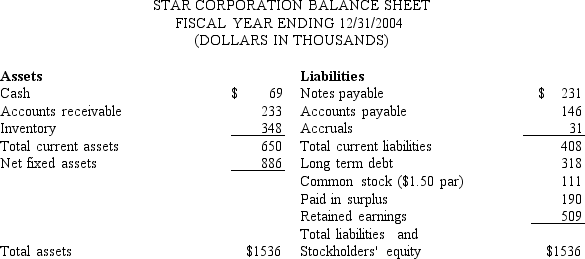

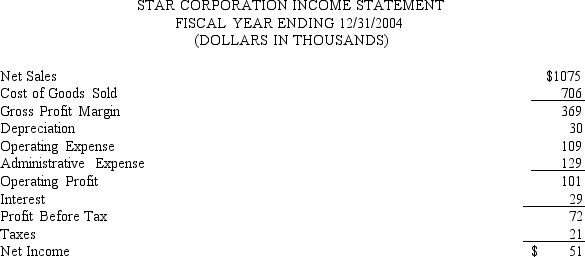

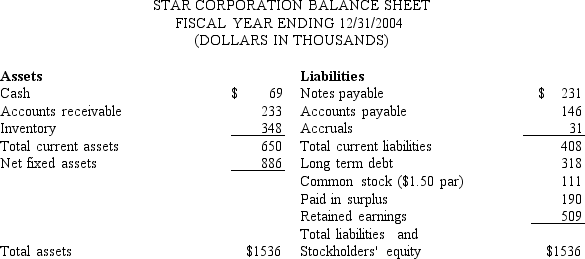

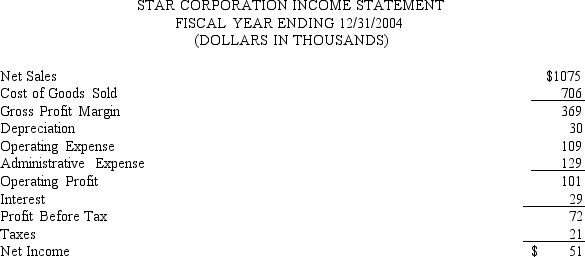

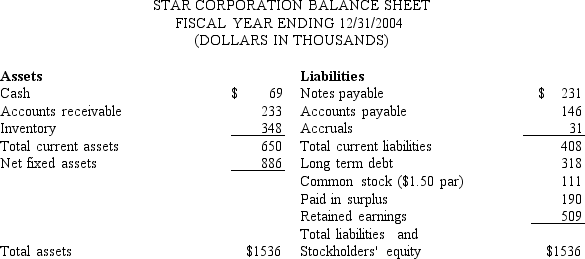

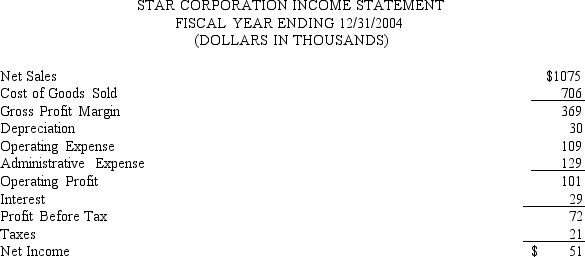

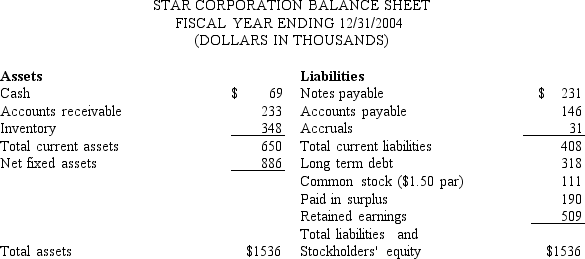

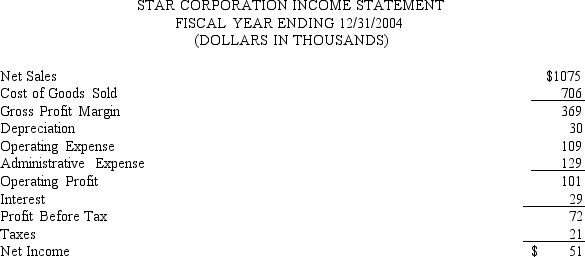

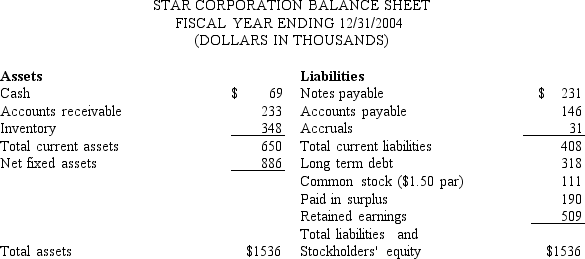

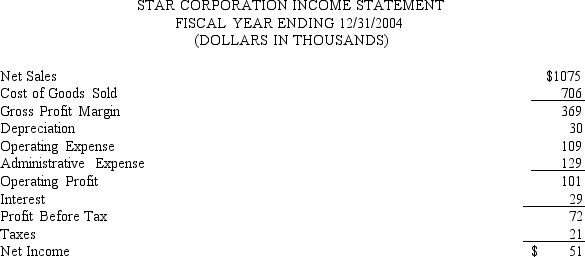

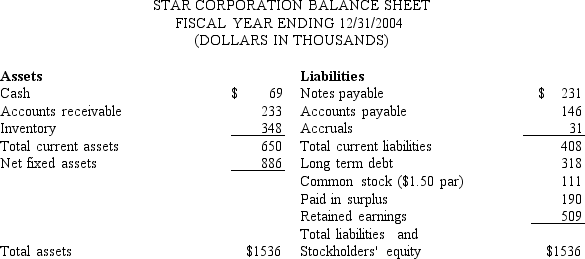

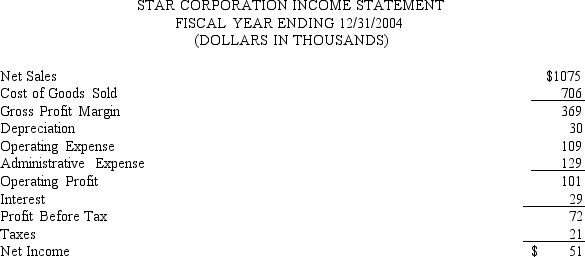

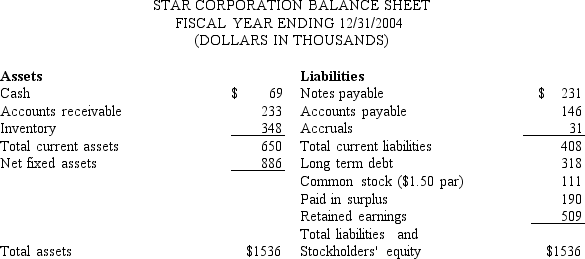

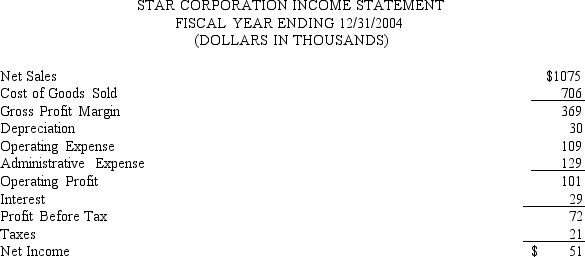

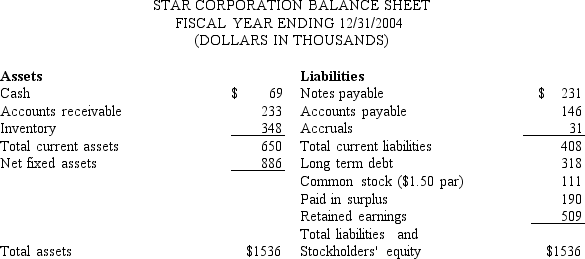

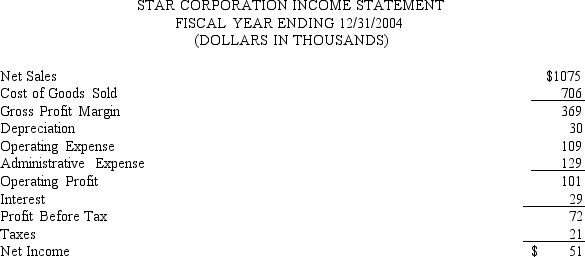

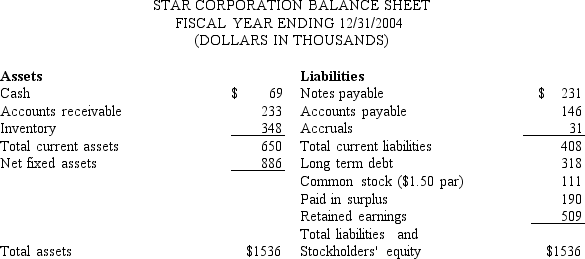

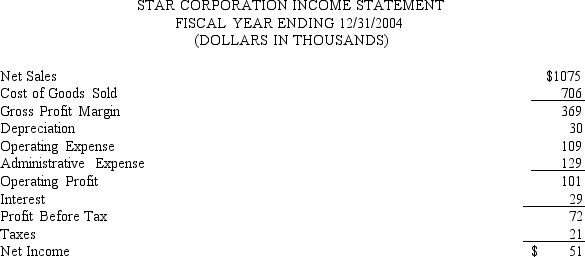

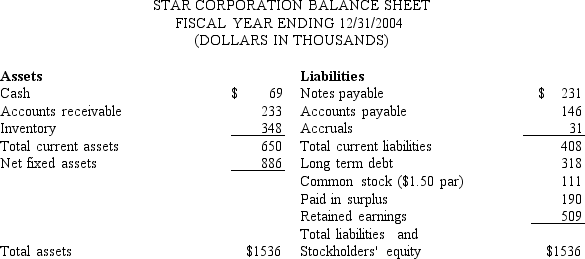

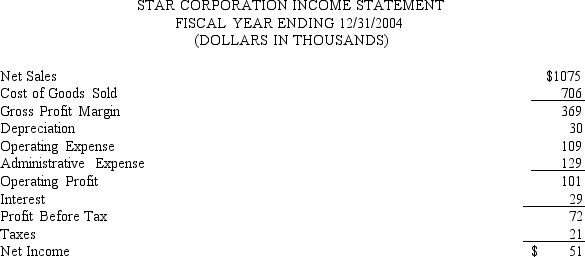

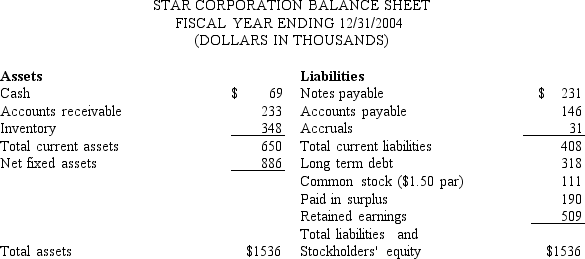

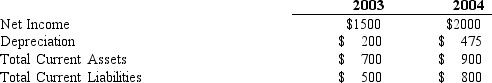

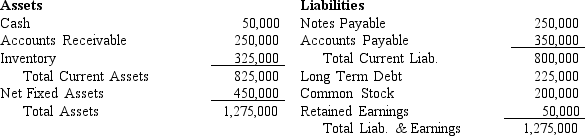

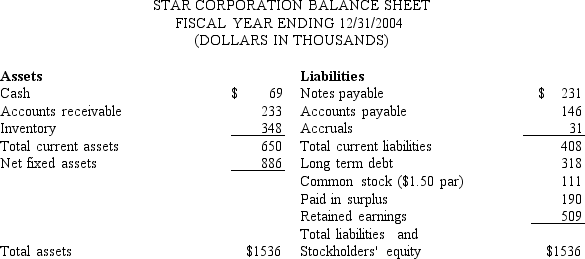

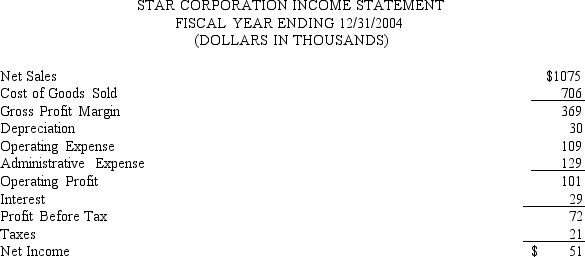

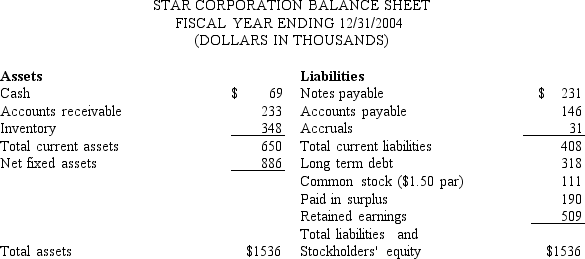

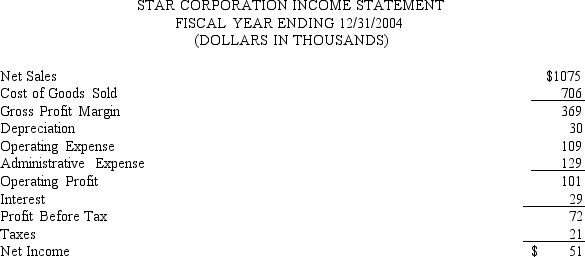

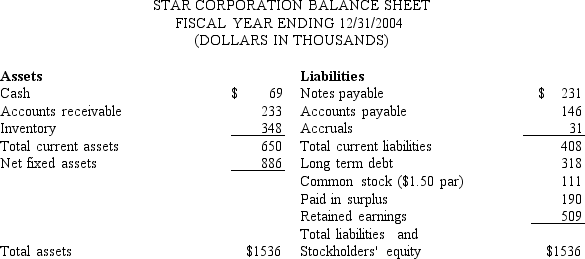

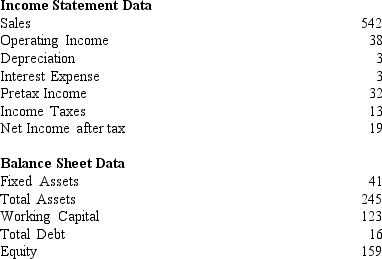

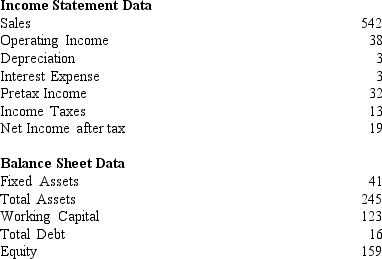

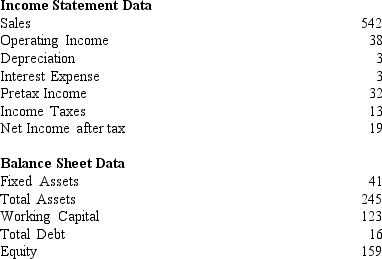

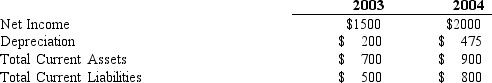

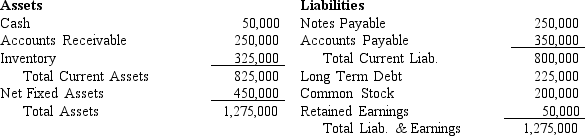

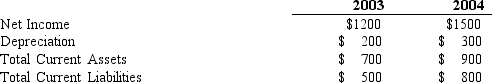

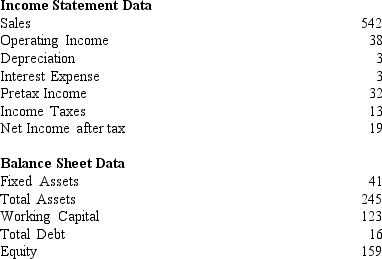

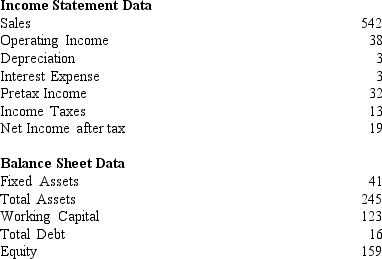

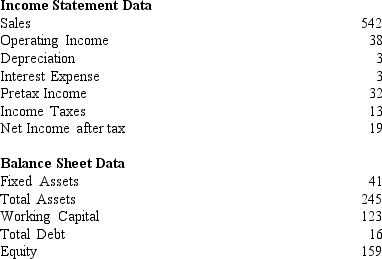

Exhibit 10.2

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 10.2. What was Star's total asset turnover for 2004?

A)1.65

B)1.21

C)0.92

D)0.033

E)0.70

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 10.2. What was Star's total asset turnover for 2004?

A)1.65

B)1.21

C)0.92

D)0.033

E)0.70

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

43

Exhibit 10.1

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 10.1. What was BMC'S quick ratio for 2004?

A)1.72

B)1.37

C)1.02

D)0.85

E)0.55

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 10.1. What was BMC'S quick ratio for 2004?

A)1.72

B)1.37

C)1.02

D)0.85

E)0.55

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

44

Exhibit 10.1

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 10.1. What was BMC'S net profit margin?

A)0.058

B)0.037

C)0.125

D)0.015

E)0.165

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 10.1. What was BMC'S net profit margin?

A)0.058

B)0.037

C)0.125

D)0.015

E)0.165

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

45

Exhibit 10.2

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 10.2. What was the financial leverage multiplier used in the Star system?

A)0.852

B)1.896

C)1.996

D)2.054

E)2.998

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 10.2. What was the financial leverage multiplier used in the Star system?

A)0.852

B)1.896

C)1.996

D)2.054

E)2.998

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

46

Exhibit 10.1

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 10.1. What was BMC'S interest coverage for 2004?

A)6.82

B)3.04

C)2.74

D)2.04

E)1.41

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 10.1. What was BMC'S interest coverage for 2004?

A)6.82

B)3.04

C)2.74

D)2.04

E)1.41

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

47

Exhibit 10.2

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 10.2. What was Star's fixed asset turnover ratio?

A)1.65

B)1.21

C)1.01

D)0.82

E)0.42

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 10.2. What was Star's fixed asset turnover ratio?

A)1.65

B)1.21

C)1.01

D)0.82

E)0.42

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

48

Exhibit 10.1

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 10.1. What was BMC'S total asset turnover for 2004?

A)0.23

B)1.28

C)1.46

D)0.87

E)0.68

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 10.1. What was BMC'S total asset turnover for 2004?

A)0.23

B)1.28

C)1.46

D)0.87

E)0.68

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

49

Exhibit 10.2

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 10.2. What was Star's quick ratio for 2004?

A)0.11

B)0.44

C)0.38

D)0.74

E)0.98

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 10.2. What was Star's quick ratio for 2004?

A)0.11

B)0.44

C)0.38

D)0.74

E)0.98

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

50

Exhibit 10.1

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 10.1. What is BMC'S traditional cash flow?

A)69

B)86

C)38

D)55

E)701

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 10.1. What is BMC'S traditional cash flow?

A)69

B)86

C)38

D)55

E)701

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

51

Financial ratios are only useful when they are compared to other ratios. All of the following are useful means of examining relative performance except

A)Aggregate economy

B)Industries

C)Competitors

D)Historical performance

E)All of the above are relevant comparison measures for financial ratios

A)Aggregate economy

B)Industries

C)Competitors

D)Historical performance

E)All of the above are relevant comparison measures for financial ratios

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

52

Exhibit 10.2

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 10.2. What was Star's net profit margin?

A)2.4%

B)3.8%

C)4.2%

D)4.7%

E)5.2%

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 10.2. What was Star's net profit margin?

A)2.4%

B)3.8%

C)4.2%

D)4.7%

E)5.2%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

53

Exhibit 10.2

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 10.2. What was Star's return on equity in 2004?

A)5.8%

B)6.3%

C)6.8%

D)7.2%

E)8.1%

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 10.2. What was Star's return on equity in 2004?

A)5.8%

B)6.3%

C)6.8%

D)7.2%

E)8.1%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

54

Exhibit 10.1

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 10.1. What was the financial leverage multiplier used in the BMC system?

A)2.058

B)2.289

C)3.014

D)1.903

E)0.904

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 10.1. What was the financial leverage multiplier used in the BMC system?

A)2.058

B)2.289

C)3.014

D)1.903

E)0.904

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

55

Exhibit 10.1

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 10.1. What was BMC'S return on equity in 2004?

A)4.8%

B)5.9%

C)6.7%

D)8.3%

E)11.6%

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 10.1. What was BMC'S return on equity in 2004?

A)4.8%

B)5.9%

C)6.7%

D)8.3%

E)11.6%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

56

Exhibit 10.2

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 10.2. What was Star's interest coverage for 2004?

A)4.99

B)2.58

C)3.48

D)5.16

E)6.02

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 10.2. What was Star's interest coverage for 2004?

A)4.99

B)2.58

C)3.48

D)5.16

E)6.02

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

57

Exhibit 10.1

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 10.1. What was BMC'S fixed asset turnover ratio?

A)0.680

B)0.780

C)1.278

D)1.874

E)8.220

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 10.1. What was BMC'S fixed asset turnover ratio?

A)0.680

B)0.780

C)1.278

D)1.874

E)8.220

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

58

Exhibit 10.2

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 10.2. What was Star's current ratio at year-end 2004?

A)1.59

B)1.00

C)0.82

D)0.74

E)0.33

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 10.2. What was Star's current ratio at year-end 2004?

A)1.59

B)1.00

C)0.82

D)0.74

E)0.33

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

59

Exhibit 10.1

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 10.1. What is BMC'S operating profit margin?

A)0.800

B)0.054

C)0.080

D)0.540

E)5.480

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 10.1. What is BMC'S operating profit margin?

A)0.800

B)0.054

C)0.080

D)0.540

E)5.480

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

60

The practice of comparing the firm to a subset of industry firms comparable in size or characteristics is referred to as

A)Common size analysis

B)Cross-sectional analysis

C)DuPont analysis

D)Proforma analysis

E)Time-series analysis

A)Common size analysis

B)Cross-sectional analysis

C)DuPont analysis

D)Proforma analysis

E)Time-series analysis

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

61

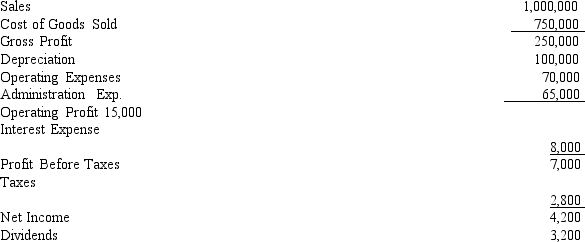

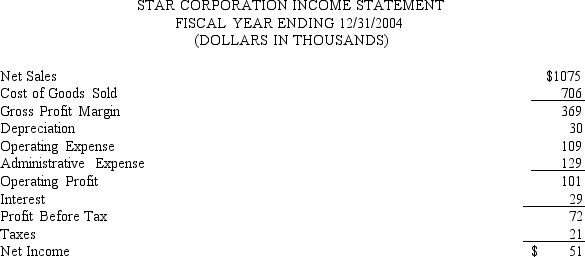

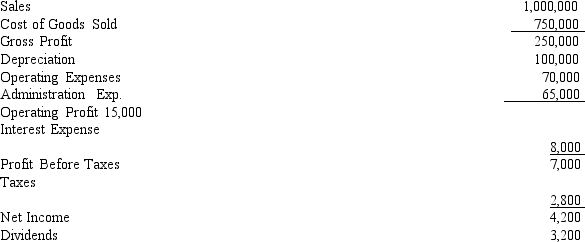

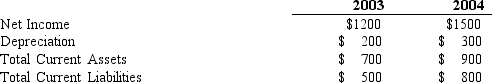

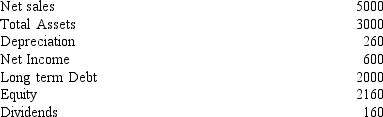

Exhibit 10.7

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

You are provided with the following information for the Nelson Corporation.

During 2004 Nelson Corp. made capital expenditures totaling $500 and disposed property worth $800.

During 2004 Nelson Corp. made capital expenditures totaling $500 and disposed property worth $800.

Refer to Exhibit 10.7. The firm's cash flow from operating activities for the year 2004 is

A)$2200

B)$2575

C)$2325

D)$2875

E)$1900

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

You are provided with the following information for the Nelson Corporation.

During 2004 Nelson Corp. made capital expenditures totaling $500 and disposed property worth $800.

During 2004 Nelson Corp. made capital expenditures totaling $500 and disposed property worth $800.Refer to Exhibit 10.7. The firm's cash flow from operating activities for the year 2004 is

A)$2200

B)$2575

C)$2325

D)$2875

E)$1900

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

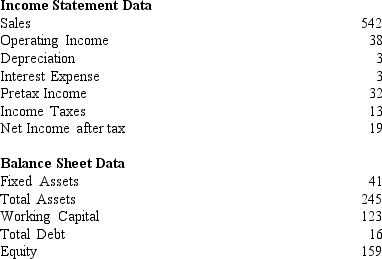

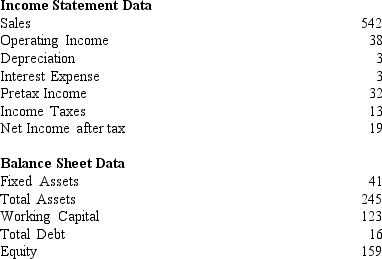

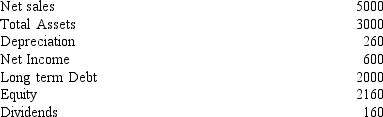

62

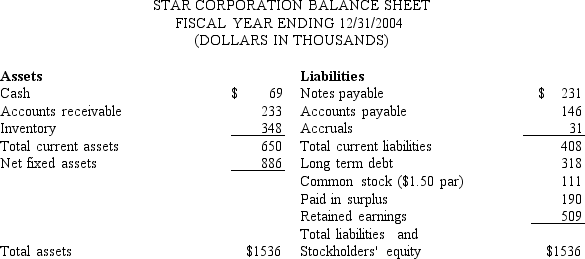

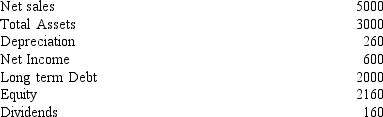

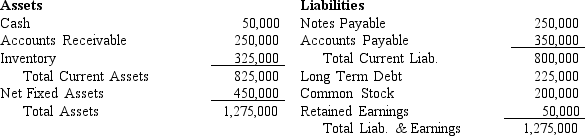

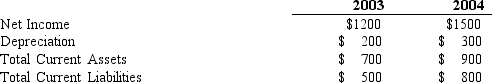

Exhibit 10.8

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Zeco Company has the following financial statements for year ending 12/31/2008.

The Zeco Company's industry averages are as follows:

The Zeco Company's industry averages are as follows:

Net Profit Margin = 4.5%; Total Asset Turnover = 0.8; Total Assets/Equity = 1.5

Refer to Exhibit 10.8. Calculate Zeco Company's Net Profit Margin.

A)0.42%

B)0.97%

C)1.50%

D)19.60%

E)25.00%

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Zeco Company has the following financial statements for year ending 12/31/2008.

The Zeco Company's industry averages are as follows:

The Zeco Company's industry averages are as follows:Net Profit Margin = 4.5%; Total Asset Turnover = 0.8; Total Assets/Equity = 1.5

Refer to Exhibit 10.8. Calculate Zeco Company's Net Profit Margin.

A)0.42%

B)0.97%

C)1.50%

D)19.60%

E)25.00%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

63

Exhibit 10.2

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 10.2. What is Star's traditional cash flow?

A)81

B)72

C)51

D)102

E)131

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 10.2. What is Star's traditional cash flow?

A)81

B)72

C)51

D)102

E)131

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

64

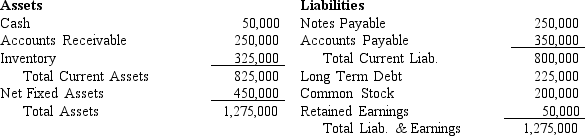

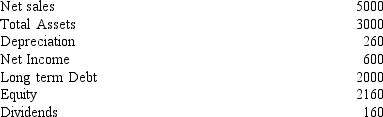

Exhibit 10.5

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

You are provided with the following information about Albermarle Corp.

Refer to Exhibit 10.5. Calculate the income tax rate.

A)40.6%

B)25.6%

C)16.8%

D)28.9%

E)44.9%

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

You are provided with the following information about Albermarle Corp.

Refer to Exhibit 10.5. Calculate the income tax rate.

A)40.6%

B)25.6%

C)16.8%

D)28.9%

E)44.9%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

65

Exhibit 10.3

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

You are provided with the following information for a company.

Refer to Exhibit 10.3. Calculate the receivables turnover ratio.

A)50

B)25

C)55

D)36

E)27

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

You are provided with the following information for a company.

Refer to Exhibit 10.3. Calculate the receivables turnover ratio.

A)50

B)25

C)55

D)36

E)27

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

66

Exhibit 10.3

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

You are provided with the following information for a company.

Refer to Exhibit 10.3. Calculate the cash conversion cycle.

A)27

B)46

C)27.

D)55

E)22

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

You are provided with the following information for a company.

Refer to Exhibit 10.3. Calculate the cash conversion cycle.

A)27

B)46

C)27.

D)55

E)22

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

67

Exhibit 10.2

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 10.2. What is Star's operating profit margin?

A)0.104

B)0.094

C)0.084

D)0.067

E)0.047

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 10.2. What is Star's operating profit margin?

A)0.104

B)0.094

C)0.084

D)0.067

E)0.047

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

68

Exhibit 10.5

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

You are provided with the following information about Albermarle Corp.

Refer to Exhibit 10.5. Calculate the financial leverage.

A)1.05

B)5.32

C)2.15

D)1.54

E)2.31

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

You are provided with the following information about Albermarle Corp.

Refer to Exhibit 10.5. Calculate the financial leverage.

A)1.05

B)5.32

C)2.15

D)1.54

E)2.31

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

69

Exhibit 10.4

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

You are provided with the following information about MaxCorp.

Refer to Exhibit 10.4. Calculate the sustainable growth rate.

A)27.8%.

B)30.4%

C)20.4%

D)27.8%

E)17.8%

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

You are provided with the following information about MaxCorp.

Refer to Exhibit 10.4. Calculate the sustainable growth rate.

A)27.8%.

B)30.4%

C)20.4%

D)27.8%

E)17.8%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

70

Exhibit 10.5

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

You are provided with the following information about Albermarle Corp.

Refer to Exhibit 10.5. Calculate the operating margin.

A)15.5%

B)5.6%

C)8.6%

D)10.6%

E)6.5%

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

You are provided with the following information about Albermarle Corp.

Refer to Exhibit 10.5. Calculate the operating margin.

A)15.5%

B)5.6%

C)8.6%

D)10.6%

E)6.5%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

71

Exhibit 10.5

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

You are provided with the following information about Albermarle Corp.

Refer to Exhibit 10.5. Calculate the return on equity (ROE).

A)15%

B)12%

C)32%

D)9%

E)7%

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

You are provided with the following information about Albermarle Corp.

Refer to Exhibit 10.5. Calculate the return on equity (ROE).

A)15%

B)12%

C)32%

D)9%

E)7%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

72

Exhibit 10.7

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

You are provided with the following information for the Nelson Corporation.

During 2004 Nelson Corp. made capital expenditures totaling $500 and disposed property worth $800.

During 2004 Nelson Corp. made capital expenditures totaling $500 and disposed property worth $800.

Refer to Exhibit 10.7. The firm's free cash flow is

A)$2200

B)$1900

C)$2875

D)$2325

E)$2575

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

You are provided with the following information for the Nelson Corporation.

During 2004 Nelson Corp. made capital expenditures totaling $500 and disposed property worth $800.

During 2004 Nelson Corp. made capital expenditures totaling $500 and disposed property worth $800.Refer to Exhibit 10.7. The firm's free cash flow is

A)$2200

B)$1900

C)$2875

D)$2325

E)$2575

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

73

Exhibit 10.8

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Zeco Company has the following financial statements for year ending 12/31/2008.

The Zeco Company's industry averages are as follows:

The Zeco Company's industry averages are as follows:

Net Profit Margin = 4.5%; Total Asset Turnover = 0.8; Total Assets/Equity = 1.5

Refer to Exhibit 10.8. Calculate Zeco Company's Total Asset Turnover.

A)0.59

B)0.78

C)1.28

D)1.70

E)1.97

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Zeco Company has the following financial statements for year ending 12/31/2008.

The Zeco Company's industry averages are as follows:

The Zeco Company's industry averages are as follows:Net Profit Margin = 4.5%; Total Asset Turnover = 0.8; Total Assets/Equity = 1.5

Refer to Exhibit 10.8. Calculate Zeco Company's Total Asset Turnover.

A)0.59

B)0.78

C)1.28

D)1.70

E)1.97

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

74

Exhibit 10.6

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

You are provided with the following information for the Klandy Corporation.

During 2004 Klandy Corp. made capital expenditures totaling $500 and disposed property worth $400.

During 2004 Klandy Corp. made capital expenditures totaling $500 and disposed property worth $400.

Refer to Exhibit 10.6. The firm's free cash flow is

A)$2100

B)$1900

C)$1800

D)$1700

E)$1600

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

You are provided with the following information for the Klandy Corporation.

During 2004 Klandy Corp. made capital expenditures totaling $500 and disposed property worth $400.

During 2004 Klandy Corp. made capital expenditures totaling $500 and disposed property worth $400.Refer to Exhibit 10.6. The firm's free cash flow is

A)$2100

B)$1900

C)$1800

D)$1700

E)$1600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

75

Exhibit 10.6

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

You are provided with the following information for the Klandy Corporation.

During 2004 Klandy Corp. made capital expenditures totaling $500 and disposed property worth $400.

During 2004 Klandy Corp. made capital expenditures totaling $500 and disposed property worth $400.

Refer to Exhibit 10.6. The firm's cash flow from operating activities for the year 2004 is

A)$2100

B)$1900

C)$1800

D)$1700

E)$1600

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

You are provided with the following information for the Klandy Corporation.

During 2004 Klandy Corp. made capital expenditures totaling $500 and disposed property worth $400.

During 2004 Klandy Corp. made capital expenditures totaling $500 and disposed property worth $400.Refer to Exhibit 10.6. The firm's cash flow from operating activities for the year 2004 is

A)$2100

B)$1900

C)$1800

D)$1700

E)$1600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

76

Exhibit 10.3

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

You are provided with the following information for a company.

Refer to Exhibit 10.3. Calculate the payables turnover ratio.

A)30.3

B)23.3

C)55.4

D)11.6

E)56.6

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

You are provided with the following information for a company.

Refer to Exhibit 10.3. Calculate the payables turnover ratio.

A)30.3

B)23.3

C)55.4

D)11.6

E)56.6

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

77

Exhibit 10.4

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

You are provided with the following information about MaxCorp.

Refer to Exhibit 10.4. Calculate the return on equity (ROE).

A)20.4%

B)17.8%

C)22.4%

D)27.8%

E)30.4%

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

You are provided with the following information about MaxCorp.

Refer to Exhibit 10.4. Calculate the return on equity (ROE).

A)20.4%

B)17.8%

C)22.4%

D)27.8%

E)30.4%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

78

Exhibit 10.5

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

You are provided with the following information about Albermarle Corp.

Refer to Exhibit 10.5. Calculate the interest expense rate.

A)7%

B)0.5%

C)1.2%

D)5%

E)2.3%

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

You are provided with the following information about Albermarle Corp.

Refer to Exhibit 10.5. Calculate the interest expense rate.

A)7%

B)0.5%

C)1.2%

D)5%

E)2.3%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

79

Exhibit 10.3

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

You are provided with the following information for a company.

Refer to Exhibit 10.3. Calculate the inventory turnover ratio.

A)27.23

B)23.3

C)55.43

D)8.67

E)11.67

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

You are provided with the following information for a company.

Refer to Exhibit 10.3. Calculate the inventory turnover ratio.

A)27.23

B)23.3

C)55.43

D)8.67

E)11.67

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

80

Exhibit 10.5

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

You are provided with the following information about Albermarle Corp.

Refer to Exhibit 10.5. Calculate the asset turnover ratio.

A)2.2

B)5.6

C)4.2

D)2.9

E)3.9

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

You are provided with the following information about Albermarle Corp.

Refer to Exhibit 10.5. Calculate the asset turnover ratio.

A)2.2

B)5.6

C)4.2

D)2.9

E)3.9

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck