Deck 15: Income Inequality and Poverty

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/105

العب

ملء الشاشة (f)

Deck 15: Income Inequality and Poverty

1

When a person who receives welfare benefits earns income, those benefits are reduced as earned income rises. This is referred to as

A) an implicit marginal tax.

B) the opportunity cost of income.

C) the work-leisure trade-off.

D) reverse discrimination.

A) an implicit marginal tax.

B) the opportunity cost of income.

C) the work-leisure trade-off.

D) reverse discrimination.

an implicit marginal tax.

2

Data on the distribution of income among individuals and families in the United States indicate that

A) the power of labor unions and corporations is the major determinant of income inequality.

B) the rich stay rich and the poor stay poor from one generation to another.

C) much of the inequality in annual income emanates from differences in education, age, hours worked, and family size.

D) the difference in annual income emanating from ownership of capital assets is the major source of economic inequality.

A) the power of labor unions and corporations is the major determinant of income inequality.

B) the rich stay rich and the poor stay poor from one generation to another.

C) much of the inequality in annual income emanates from differences in education, age, hours worked, and family size.

D) the difference in annual income emanating from ownership of capital assets is the major source of economic inequality.

much of the inequality in annual income emanates from differences in education, age, hours worked, and family size.

3

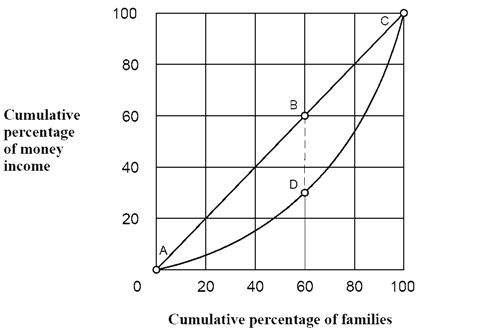

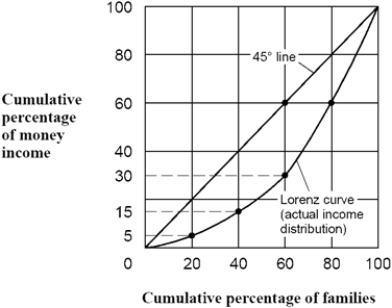

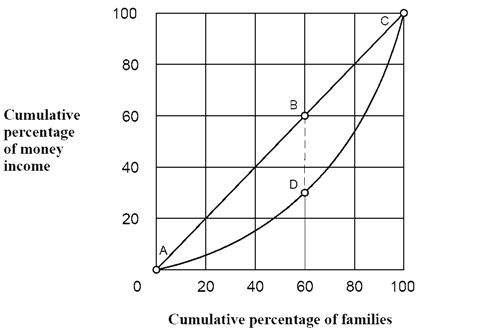

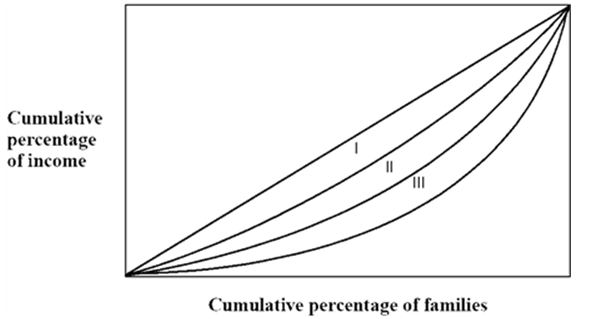

As shown in Figure 15-1, the distance between points B and D means that 60 percent of families earn less of total income than required for perfect equality.

A) 30 percent

B) 60 percent

C) 90 percent

D) insufficient information to answer question.

30 percent

4

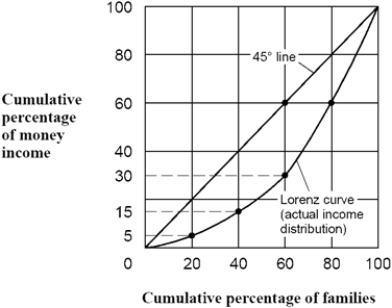

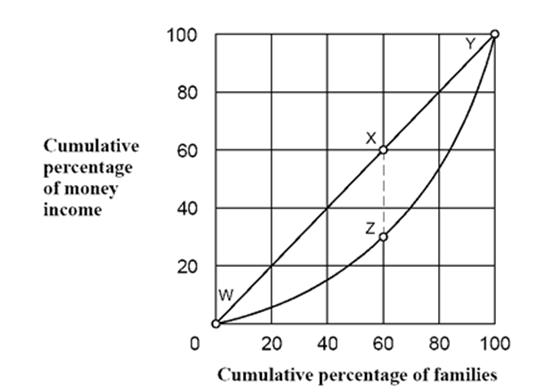

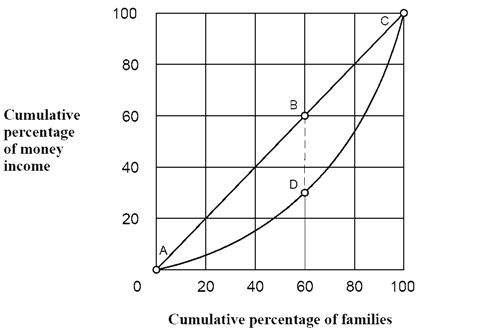

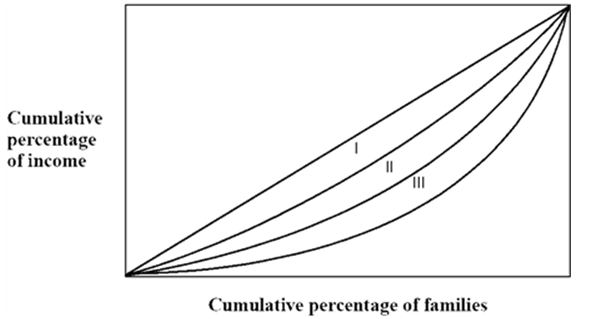

Figure 15-2

According to the Lorenz curve shown in Figure 15-2, what percentage of total income is earned by the richest 20 percent of families?

A) 20 percent.

B) 40 percent.

C) 60 percent.

D) 80 percent.

According to the Lorenz curve shown in Figure 15-2, what percentage of total income is earned by the richest 20 percent of families?

A) 20 percent.

B) 40 percent.

C) 60 percent.

D) 80 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following would cause the poverty threshold income level for a given family to increase by 20 percent from one year to another?

A) a 20 percent increase in the family's income

B) a 20 percent decrease in the family's income

C) a 20 percent increase in the general level of prices

D) a 20 percent increase in real national income

A) a 20 percent increase in the family's income

B) a 20 percent decrease in the family's income

C) a 20 percent increase in the general level of prices

D) a 20 percent increase in real national income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

6

Figure 15-2

If this economy's distribution of income becomes more equal, then the Lorenz curve shown in Figure 15-2 will

A) move closer to the 45° line.

B) become more bowed outward.

C) lie above the 45° line.

D) shift down and to the right.

If this economy's distribution of income becomes more equal, then the Lorenz curve shown in Figure 15-2 will

A) move closer to the 45° line.

B) become more bowed outward.

C) lie above the 45° line.

D) shift down and to the right.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which of the following is true?

A) There is a fixed size of economic pie available for the government to allocate among individuals.

B) In a market economy, the link between productivity and income provides individuals with an incentive to provide resources that are highly valued by others.

C) Taxes and transfers do not affect the amount of income that is created.

D) How income is distributed exerts little impact on the total amount of income generated.

A) There is a fixed size of economic pie available for the government to allocate among individuals.

B) In a market economy, the link between productivity and income provides individuals with an incentive to provide resources that are highly valued by others.

C) Taxes and transfers do not affect the amount of income that is created.

D) How income is distributed exerts little impact on the total amount of income generated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

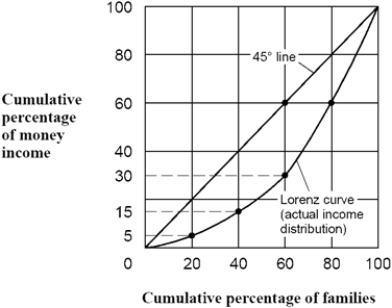

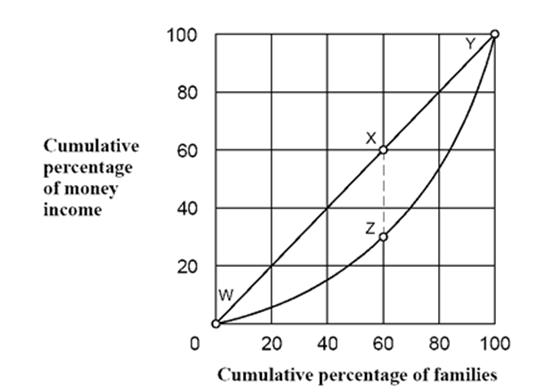

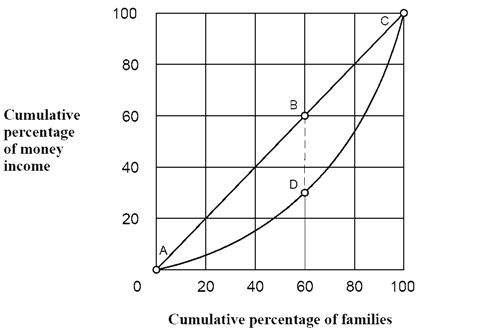

8

As shown in Figure 15-3, 40 percent of families earned a cumulative share of about ____ percent of income.

A) 5

B) 15

C) 30

D) 50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

9

As shown in Figure 15-3, 20 percent of families earned a cumulative share of about ____ percent of income.

A) 5

B) 10

C) 30

D) 50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

10

As shown in Figure 15-1, the degree of unequal income distribution is measured by the area between the

A) Lorenz curve and the horizontal axis.

B) Lorenz curve and the vertical axis.

C) Perfect equality line and the origin.

D) Perfect equality line and the Lorenz curve.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

11

If complete equality of income were legislated, which of the following would economics predict?

A) People would become richer.

B) Society would gain utility from the extra goods produced.

C) Individuals would willingly work longer hours and thus produce more.

D) The incentive to produce and perform efficiently would be virtually eliminated.

A) People would become richer.

B) Society would gain utility from the extra goods produced.

C) Individuals would willingly work longer hours and thus produce more.

D) The incentive to produce and perform efficiently would be virtually eliminated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following best explains why so many persons with incomes below the poverty threshold income level work very little or not at all?

A) They confront high implicit marginal tax rates.

B) They do not enjoy income as much as other people.

C) There are no jobs for low-skill workers.

D) They often face very low explicit marginal tax rates.

A) They confront high implicit marginal tax rates.

B) They do not enjoy income as much as other people.

C) There are no jobs for low-skill workers.

D) They often face very low explicit marginal tax rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

13

As shown in Figure 15-1, 80 percent of families earned a cumulative share of about ____ of income.

A) 5 percent

B) 15 percent

C) 30 percent

D) 50 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

14

As shown in Figure 15-1, the perfect equality line is drawn between points

A) A and B.

B) B and D.

C) A and C along the straight line.

D) A and C along the curve.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

15

As shown in Figure 15-1, 60 percent of families earned a cumulative share of about ____ of income.

A) 5 percent

B) 15 percent

C) 30 percent

D) 50 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

16

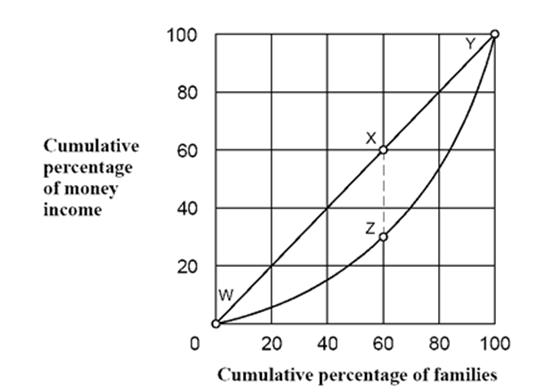

As shown in Figure 15-3, the perfect equality line is drawn between points

A) W and Y along the curve.

B) X and Z.

C) W and Y along the straight line.

D) W and X.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

17

Imagine two cities, Hometown and Visitorsville, where the rich, middle, and poor income recipients in one city have annual incomes identical to their counterparts' incomes in the other city. In Hometown, the poorest families one year almost always end up as the richest families the next year and become middle-income families the year after that. In Visitorsville, however, the poor remain poor and the rich remain rich. Which of the following is true about the two cities?

A) Annual data on the distribution of income will indicate that the degree of income inequality in the two cities is identical.

B) The degree of lifetime income inequality in the two cities is identical.

C) The income mobility of people in the two cities is identical.

D) The distribution of annual income is more unequal in Visitorsville.

A) Annual data on the distribution of income will indicate that the degree of income inequality in the two cities is identical.

B) The degree of lifetime income inequality in the two cities is identical.

C) The income mobility of people in the two cities is identical.

D) The distribution of annual income is more unequal in Visitorsville.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

18

(I) Positive economics cannot determine how much income inequality should be present in a country. (II) Critics of government action to reduce income inequality argue that modifying the market process of income determination may create perverse incentives and hurt wealth creation.

A) Both I and II are true.

B) Both I and II are false.

C) I is true; II is false.

D) I is false; II is true.

A) Both I and II are true.

B) Both I and II are false.

C) I is true; II is false.

D) I is false; II is true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

19

In 2010, high-income families (the top 20 percent) in the United States earned approximately ____ percent of the total before-tax income.

A) 34

B) 48

C) 62

D) 79

A) 34

B) 48

C) 62

D) 79

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

20

Compared to low-income families, a larger proportion of high-income families

A) is headed by a person with a college degree.

B) has both a husband and a wife who work full time.

C) is headed by a person between the ages of 35 and 64.

D) is all of the above.

A) is headed by a person with a college degree.

B) has both a husband and a wife who work full time.

C) is headed by a person between the ages of 35 and 64.

D) is all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

21

Some people inherit money and wealth that they did nothing to earn. Why don't we tax inheritance at 100 percent?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

22

Income inequality exists in the United States. Is this necessarily a bad thing? Explain how our assessment of income inequality depends crucially on the source of that inequality.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

23

The mythical country of Quitar has just established a policy to give very generous in-kind benefits to the nation's poor, currently defined as those earning less than $10,000 a year. Several years later, the poverty rate has not fallen. Why not?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

24

Measuring poverty using an absolute income scale like the poverty line can be misleading because

A) income measures do not include the value of in-kind transfers.

B) money is valued less highly by the poor than by the rich.

C) the poor are not likely to participate in the labor market.

D) income measures are adjusted for the effects of labor-market discrimination.

A) income measures do not include the value of in-kind transfers.

B) money is valued less highly by the poor than by the rich.

C) the poor are not likely to participate in the labor market.

D) income measures are adjusted for the effects of labor-market discrimination.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

25

Why don't we divide the economic pie evenly so that each person receives the same income?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

26

The poverty threshold income level equals the

A) average income of the bottom one-tenth of all income recipients.

B) cost of an economical and nutritional food plan for a family multiplied by six.

C) cost of an economical and nutritional food plan for a family multiplied by three.

D) average income of a family headed by a worker who has been unemployed for six months or more.

A) average income of the bottom one-tenth of all income recipients.

B) cost of an economical and nutritional food plan for a family multiplied by six.

C) cost of an economical and nutritional food plan for a family multiplied by three.

D) average income of a family headed by a worker who has been unemployed for six months or more.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

27

Suppose you had the choice of attending two universities. University A pays all of its professors the same wage and awards the same raises. University B pays each professor according to market wages and productivity. Which university would you rather attend and why?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

28

Andy observes that the income distribution between the richest and poorest people in the population has remained fixed for decades. He concludes that the rich stay rich and the poor stay poor. Is this a valid conclusion, or has Andy missed something?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

29

The poverty threshold income level is

A) an absolute amount that applies to all families equally .

B) variable with respect to family size and composition.

C) adjusted once each decade, with the census numbers.

D) all of the above.

A) an absolute amount that applies to all families equally .

B) variable with respect to family size and composition.

C) adjusted once each decade, with the census numbers.

D) all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

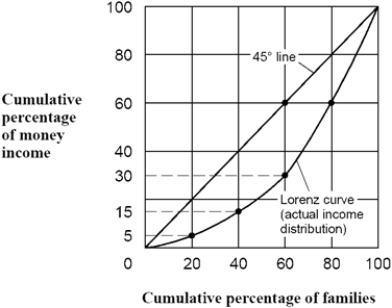

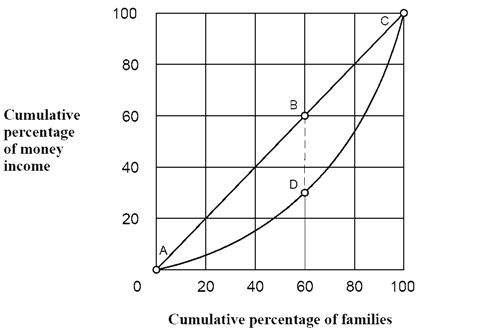

30

Figure 15-4 shows the Lorenz Curve for three countries, I, II, and III. Which of the following statements is true?

A) Country I has the most unequal income distribution.

B) Country II has the most unequal income distribution.

C) Country I has the most equal income distribution.

D) Country III has the most equal income distribution.

E) Country II has a more equal income distribution than Country I.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which of the following is true of the tax and transfer programs of the United States?

A) Tax-transfer programs persistently redistribute income from the rich to the poor.

B) Social Security, the largest transfer program, redirects income toward the elderly, a group with above-average levels of both income and wealth.

C) The bulk of agriculture subsidies go to large farmers with above-average incomes.

D) Taxes generally take a larger share of the income of the poor than is true for those with higher incomes.

E) Both b and c are true.

A) Tax-transfer programs persistently redistribute income from the rich to the poor.

B) Social Security, the largest transfer program, redirects income toward the elderly, a group with above-average levels of both income and wealth.

C) The bulk of agriculture subsidies go to large farmers with above-average incomes.

D) Taxes generally take a larger share of the income of the poor than is true for those with higher incomes.

E) Both b and c are true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

32

Why not designate the poorest 10 percent of the population as the official measure of poverty?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

33

Figure 15-4 shows the Lorenz Curve for three countries, I, II, and III. Of the three countries shown,

A) country III has the most unequal income distribution.

B) country II has the most unequal income distribution.

C) country I has the most unequal income distribution.

D) country III has the most equal income distribution.

E) country II has a more equal income distribution than Country I.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

34

Regarding income distribution, which of the following is true?

A) The size of the economic pie to be divided among a country's residents is fixed.

B) Government tax and transfer programs have exerted a strong equalizing impact on the distribution of income in the United States.

C) The method of allocating income is relevant to the issue of fairness as well as the pattern of income distribution.

D) The optimal distribution of income can be determined by objective economic criteria.

A) The size of the economic pie to be divided among a country's residents is fixed.

B) Government tax and transfer programs have exerted a strong equalizing impact on the distribution of income in the United States.

C) The method of allocating income is relevant to the issue of fairness as well as the pattern of income distribution.

D) The optimal distribution of income can be determined by objective economic criteria.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following programs is most clearly advantageous to those with lower levels of income?

A) Farm subsidy programs.

B) The Social Security retirement program.

C) The Earned Income Tax Credit.

D) Credit subsidies provided by the Import-Export bank to business firms that sell goods abroad.

A) Farm subsidy programs.

B) The Social Security retirement program.

C) The Earned Income Tax Credit.

D) Credit subsidies provided by the Import-Export bank to business firms that sell goods abroad.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which of the following contributed most to the large increases in poverty since 1960?

A) Increases in air pollution and other externalities.

B) Federal government budget deficits.

C) The increase in the number of elderly individuals.

D) Rising poverty rates among households headed by females.

E) The increase in the number of households headed by females.

A) Increases in air pollution and other externalities.

B) Federal government budget deficits.

C) The increase in the number of elderly individuals.

D) Rising poverty rates among households headed by females.

E) The increase in the number of households headed by females.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

37

The level of money income below which a family is considered poor is called the

A) bottom 20 percent of the income distribution.

B) poverty threshold income level.

C) guaranteed income level.

D) subsistence income level.

A) bottom 20 percent of the income distribution.

B) poverty threshold income level.

C) guaranteed income level.

D) subsistence income level.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

38

Which of the following is true about income distribution?

A) The best distribution of income can be determined objectively.

B) The transfer of income from one group to another is costly; it will generally reduce total output.

C) Positive economics can determine the variation in incomes that would be best for an economy.

D) The fairness of an income distribution is determined by its pattern (the measured degree of income inequality).

E) All of the above are true.

A) The best distribution of income can be determined objectively.

B) The transfer of income from one group to another is costly; it will generally reduce total output.

C) Positive economics can determine the variation in incomes that would be best for an economy.

D) The fairness of an income distribution is determined by its pattern (the measured degree of income inequality).

E) All of the above are true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

39

Why does the government provide benefits in-kind? Why don't we just give money to low-income people?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

40

Which of the following is true concerning the distribution of income?

A) Various measures of income inequality can be used to objectively determine the fairness of an income distribution.

B) When the political process is democratic, income transfer programs will redistribute income from the rich to the poor.

C) The fairness of an income distribution is a normative concept; it cannot be determined objectively by economic criteria.

D) Income inequality is the fairest method to allocate income.

A) Various measures of income inequality can be used to objectively determine the fairness of an income distribution.

B) When the political process is democratic, income transfer programs will redistribute income from the rich to the poor.

C) The fairness of an income distribution is a normative concept; it cannot be determined objectively by economic criteria.

D) Income inequality is the fairest method to allocate income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

41

Assume that DeShawn is a single parent who is in poverty. He receives food stamps and Medicaid. For every $100 that he earns, DeShawn loses $35 of his food stamp benefits and $20 in his Medicaid benefits. Also, DeShawn's income is taxed at a rate of 10 percent. Then, Peter's effective marginal tax rate is

A) 45 percent.

B) 55 percent.

C) 65 percent.

D) 70 percent.

A) 45 percent.

B) 55 percent.

C) 65 percent.

D) 70 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

42

During 1959 through 2014, the percent of poor families headed by an elderly person

A) rose.

B) steadily declined.

C) remained virtually unchanged.

D) steadily increased until 1980 when it began to decline.

A) rose.

B) steadily declined.

C) remained virtually unchanged.

D) steadily increased until 1980 when it began to decline.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

43

Poor people, who receive income assistance from the government, often do not work because

A) they face very high implicit marginal tax rates.

B) they are usually not physically able to work.

C) they have no desire for additional money.

D) the government forces them to stay at home and take care of their children.

A) they face very high implicit marginal tax rates.

B) they are usually not physically able to work.

C) they have no desire for additional money.

D) the government forces them to stay at home and take care of their children.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

44

Data indicate that the large increase in government spending on income transfers that started with the War on Poverty during the latter half of the 1960s has resulted in

A) a substantial reduction in the poverty rate.

B) a more equal distribution of income.

C) fewer single-parent families because a married couple receives benefits twice as large.

D) little change in the official poverty rate.

A) a substantial reduction in the poverty rate.

B) a more equal distribution of income.

C) fewer single-parent families because a married couple receives benefits twice as large.

D) little change in the official poverty rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

45

In 2014, the proportion of all poverty-level families headed by a female was

A) approximately one-fourth.

B) approximately one-third.

C) approximately half.

D) more than three-fourths.

A) approximately one-fourth.

B) approximately one-third.

C) approximately half.

D) more than three-fourths.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

46

Which of the following is not counted as income when the official poverty rate is calculated?

A) Medicaid benefits.

B) Dividends derived from the ownership of stock.

C) Earnings derived from a part-time job.

D) Money income derived from transfer payments.

A) Medicaid benefits.

B) Dividends derived from the ownership of stock.

C) Earnings derived from a part-time job.

D) Money income derived from transfer payments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

47

Analysis of the economic status of poor people reveals that

A) most are poor because they did not have the opportunity to obtain training and a quality education.

B) most had poor parents, grandparents, and great-grandparents, suggesting that poverty is inherited.

C) the poverty population is very homogeneous regarding opportunity, cultural disadvantages, alcoholism, and other personal contributing factors.

D) poverty is a complex issue; the poor are a heterogeneous population, and the causes of poverty are multidimensional.

A) most are poor because they did not have the opportunity to obtain training and a quality education.

B) most had poor parents, grandparents, and great-grandparents, suggesting that poverty is inherited.

C) the poverty population is very homogeneous regarding opportunity, cultural disadvantages, alcoholism, and other personal contributing factors.

D) poverty is a complex issue; the poor are a heterogeneous population, and the causes of poverty are multidimensional.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

48

Assume that Ava is a single parent who is in poverty. She receives food stamps and Medicaid. For every $100 that she earns, Ava loses $20 of her food stamp benefits and $15 in her Medicaid benefits. Ava's implicit marginal tax rate from these two programs is

A) 20 percent.

B) 30 percent.

C) 35 percent.

D) 45 percent.

A) 20 percent.

B) 30 percent.

C) 35 percent.

D) 45 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which of the following statements regarding poverty in the United States is correct?

A) There are as many poor African Americans as there are poor whites.

B) The incidence of poverty is lower among females than among males.

C) The incidence of poverty is higher among African Americans than among whites.

D) Most of the poor people in the United States are elderly (over age 65).

A) There are as many poor African Americans as there are poor whites.

B) The incidence of poverty is lower among females than among males.

C) The incidence of poverty is higher among African Americans than among whites.

D) Most of the poor people in the United States are elderly (over age 65).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

50

What percent of the families classified as poor in 2014 were headed by an elderly (age 65 and over) person?

A) approximately two-thirds

B) approximately 11 percent

C) approximately 32 percent

D) approximately 50 percent

A) approximately two-thirds

B) approximately 11 percent

C) approximately 32 percent

D) approximately 50 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

51

Which of the following limits the ability of the current system of transfer programs to increase the incomes of the able-bodied poor?

A) The high implicit marginal tax rates that accompany the current income transfer programs reduce the incentive of the poor to earn.

B) The transfer programs encourage the poor to marry and form dual-earner families.

C) The transfer programs tend to increase the wages that employers are required by law to pay for low-skill labor.

D) The transfer programs reduce the likelihood of single-parent families.

A) The high implicit marginal tax rates that accompany the current income transfer programs reduce the incentive of the poor to earn.

B) The transfer programs encourage the poor to marry and form dual-earner families.

C) The transfer programs tend to increase the wages that employers are required by law to pay for low-skill labor.

D) The transfer programs reduce the likelihood of single-parent families.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

52

How do the high implicit marginal tax rates that often occur when transfer payments are inversely linked to earnings affect the incentive of poor people to work and earn?

A) A poor person's incentive to earn is increased.

B) A poor person's incentive to earn is reduced.

C) The incentive of the poor to earn is unaffected.

D) The incentive of the poor to earn reported income is increased, but the incentive to earn unreported income is reduced.

A) A poor person's incentive to earn is increased.

B) A poor person's incentive to earn is reduced.

C) The incentive of the poor to earn is unaffected.

D) The incentive of the poor to earn reported income is increased, but the incentive to earn unreported income is reduced.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

53

Means-tested income transfers refer to

A) the average amount of the annual governmental transfers.

B) transfers that are limited to families with an income below a certain cutoff point.

C) income transfers that are specifically paid for by the top 1 percent (wealthiest) of tax payers.

D) none of the above.

A) the average amount of the annual governmental transfers.

B) transfers that are limited to families with an income below a certain cutoff point.

C) income transfers that are specifically paid for by the top 1 percent (wealthiest) of tax payers.

D) none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

54

The phenomenon that describes how transfer programs, which significantly reduce the adversities of poverty, also reduce the opportunity cost of choices that often lead to poverty is known as

A) the implicit marginal tax rate.

B) Gibson's paradox.

C) the Phillips curve

D) the Samaritan's dilemma.

A) the implicit marginal tax rate.

B) Gibson's paradox.

C) the Phillips curve

D) the Samaritan's dilemma.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

55

Programs that limit the eligibility of transfer recipients to those with low income are called

A) social security programs.

B) means-tested programs.

C) single-parent family programs.

D) social insurance programs.

A) social security programs.

B) means-tested programs.

C) single-parent family programs.

D) social insurance programs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

56

In 2014, the percentage of all U.S. families officially considered to be in poverty was approximately

A) 5 percent.

B) 12 percent.

C) 22 percent.

D) 31 percent.

A) 5 percent.

B) 12 percent.

C) 22 percent.

D) 31 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

57

The amount of additional earnings that must be paid explicitly in taxes or implicitly in the form of a reduction in income supplements is known as the

A) marginal income tax rate.

B) implicit marginal tax rate.

C) explicit benefit-reduction rate.

D) supplemental income tax rate.

A) marginal income tax rate.

B) implicit marginal tax rate.

C) explicit benefit-reduction rate.

D) supplemental income tax rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

58

Which one of the following groups has a below-average incidence of poverty?

A) Persons who are divorced or separated from their spouse.

B) Families headed by a female.

C) Persons 18 to 24 years of age.

D) Married-couple families.

A) Persons who are divorced or separated from their spouse.

B) Families headed by a female.

C) Persons 18 to 24 years of age.

D) Married-couple families.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

59

As the War on Poverty programs were instituted and transfer payments expanded in the last half of the 1960s, what happened to the poverty rate?

A) After rising for several decades, the official poverty rate has been declining since 1968.

B) After falling for several decades, the official poverty rate leveled off in the 1970s, and it has been relatively stable since that time.

C) The poverty rate declined prior to the War on Poverty period, and it has continued to decline.

D) The poverty rate rose prior to the War on Poverty period and has continued to rise.

A) After rising for several decades, the official poverty rate has been declining since 1968.

B) After falling for several decades, the official poverty rate leveled off in the 1970s, and it has been relatively stable since that time.

C) The poverty rate declined prior to the War on Poverty period, and it has continued to decline.

D) The poverty rate rose prior to the War on Poverty period and has continued to rise.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

60

The official poverty rate of elderly families

A) has been virtually unchanged for the last four decades.

B) increased as the elderly became a larger proportion of the U.S. population during the 1970s.

C) rose prior to the War on Poverty programs of the late 1960s, but it has declined steadily since.

D) has declined during the last four decades.

A) has been virtually unchanged for the last four decades.

B) increased as the elderly became a larger proportion of the U.S. population during the 1970s.

C) rose prior to the War on Poverty programs of the late 1960s, but it has declined steadily since.

D) has declined during the last four decades.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

61

This year, Tyrone earned a total of $9,000. As a result, he received $9,000 less in government transfers. Therefore, his implicit marginal tax rate is

A) zero.

B) 25 percent.

C) 50 percent.

D) 100 percent.

A) zero.

B) 25 percent.

C) 50 percent.

D) 100 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

62

Which of the following is true about income mobility?

A) With time, most of those with low incomes at a point in time move up the income ladder only to be replaced by others who are youthful, inexperienced, or the victim of current misfortune.

B) Recent studies indicate that there is virtually no relationship between the relative income position of grandparents and their grandchildren.

C) Both a and b are true.

D) Neither a nor b is true.

A) With time, most of those with low incomes at a point in time move up the income ladder only to be replaced by others who are youthful, inexperienced, or the victim of current misfortune.

B) Recent studies indicate that there is virtually no relationship between the relative income position of grandparents and their grandchildren.

C) Both a and b are true.

D) Neither a nor b is true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

63

A valid argument against redistributing income to achieve complete equality is that

A) income equality would destroy the social cohesiveness that exists among different income groupings.

B) this would eliminate the monetary incentives to work and produce.

C) the cost of obtaining the equality would be so deflationary as to promote economic instability.

D) income equality would imply class segregation based on factors such as sex or race since income would be constant.

A) income equality would destroy the social cohesiveness that exists among different income groupings.

B) this would eliminate the monetary incentives to work and produce.

C) the cost of obtaining the equality would be so deflationary as to promote economic instability.

D) income equality would imply class segregation based on factors such as sex or race since income would be constant.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

64

The Samaritan's dilemma describes the problem that exists when transfer programs, designed to help the poor, encourage choices that can promote or perpetuate

A) poverty.

B) healthier lifestyles.

C) reduced birth rates.

D) increased life expectancy.

A) poverty.

B) healthier lifestyles.

C) reduced birth rates.

D) increased life expectancy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

65

This year Terrance earned $3,000 more than last year. As a result, he received $2,500 less in government transfers. Therefore, Terrance's implicit marginal tax rate is about

A) 16 percent

B) 25 percent

C) 66 percent

D) 83 percent

A) 16 percent

B) 25 percent

C) 66 percent

D) 83 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

66

Income mobility

A) is a term used to characterize the ease of establishing residence or a business in a new area of the country.

B) has increased in recent years because of reductions in transportation cost.

C) is the term used to describe the movements up and down the economic ladder.

D) is present only when the general level of prices is rising.

A) is a term used to characterize the ease of establishing residence or a business in a new area of the country.

B) has increased in recent years because of reductions in transportation cost.

C) is the term used to describe the movements up and down the economic ladder.

D) is present only when the general level of prices is rising.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

67

Income mobility studies suggest that poverty

A) cannot be alleviated by privately sponsored anti-poverty programs.

B) cannot be alleviated by government sponsored anti-poverty programs.

C) is a long-term problem for a relatively large number of families.

D) is not a long-term problem for most families.

A) cannot be alleviated by privately sponsored anti-poverty programs.

B) cannot be alleviated by government sponsored anti-poverty programs.

C) is a long-term problem for a relatively large number of families.

D) is not a long-term problem for most families.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

68

Data on income inequality in the United States indicate that

A) rich families stay rich and poor families stay poor.

B) most poor families never significantly rise above the poverty level, but rich families tend to become less wealthy over time.

C) there is substantial movement among income groupings in the United States.

D) the inequality between the rich and poor in annual consumption expenditures is greater than the parallel inequality in annual income.

A) rich families stay rich and poor families stay poor.

B) most poor families never significantly rise above the poverty level, but rich families tend to become less wealthy over time.

C) there is substantial movement among income groupings in the United States.

D) the inequality between the rich and poor in annual consumption expenditures is greater than the parallel inequality in annual income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

69

This year, Abigail earned $15,000 and she paid 15 percent in income and payroll taxes. She qualified for Medicaid and food stamps. For every $100 that she earns, Abigail loses $35 in Medicaid benefits and $15 in food stamps. Abigail faces an effective marginal tax rate of

A) 15 percent.

B) 35 percent.

C) 50 percent.

D) 65 percent.

A) 15 percent.

B) 35 percent.

C) 50 percent.

D) 65 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

70

The poverty threshold income level is

A) adjusted annually for increases in real per capita income.

B) adjusted annually for changes in prices.

C) invariant to differences in the size and composition of families.

D) the highest income level that would leave one in the bottom quintile of income recipients.

A) adjusted annually for increases in real per capita income.

B) adjusted annually for changes in prices.

C) invariant to differences in the size and composition of families.

D) the highest income level that would leave one in the bottom quintile of income recipients.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

71

Annual income data would be a better index of economic inequality if

A) all households filed tax returns revealing their real income.

B) households were more different with regard to age and size characteristics.

C) all households were more similar with regard to size, age, education, and other major factors that are linked to income.

D) mathematicians could grasp the complexities of the calculations.

A) all households filed tax returns revealing their real income.

B) households were more different with regard to age and size characteristics.

C) all households were more similar with regard to size, age, education, and other major factors that are linked to income.

D) mathematicians could grasp the complexities of the calculations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

72

If substantial income mobility is present,

A) there is considerable movement of individuals up and down the income ladder when income comparisons among the same individuals or households are made at different points in time.

B) annual income data are an accurate indicator of the long-term economic status of individuals and families.

C) the rich tend to stay rich and the poor tend to stay poor.

D) individuals and families move quite often among the geographic regions of a country but not among income groups.

A) there is considerable movement of individuals up and down the income ladder when income comparisons among the same individuals or households are made at different points in time.

B) annual income data are an accurate indicator of the long-term economic status of individuals and families.

C) the rich tend to stay rich and the poor tend to stay poor.

D) individuals and families move quite often among the geographic regions of a country but not among income groups.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

73

If a family earned an additional $6,000 and, as a consequence, sustained a reduction of $3,600 in government benefits, the implicit marginal tax rate for this family would be

A) zero.

B) 45 percent.

C) 60 percent.

D) 75 percent.

A) zero.

B) 45 percent.

C) 60 percent.

D) 75 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

74

If a family earned $10,000 and, as a consequence, sustained a reduction of $4,000 in government benefits, the family's implicit marginal tax rate would be

A) 10 percent.

B) 40 percent.

C) 60 percent.

D) 75 percent.

A) 10 percent.

B) 40 percent.

C) 60 percent.

D) 75 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

75

Redistribution through the public sector tends to lower economic prosperity because

A) it weakens the link between productive activity and the reward derived from it.

B) it encourages resources to flow into wasteful rent-seeking activities.

C) the higher tax rates required to finance redistribution result in resources being devoted toward tax avoidance activities.

D) all of the above are true.

A) it weakens the link between productive activity and the reward derived from it.

B) it encourages resources to flow into wasteful rent-seeking activities.

C) the higher tax rates required to finance redistribution result in resources being devoted toward tax avoidance activities.

D) all of the above are true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

76

Assume that Jamal is a single parent who is in poverty. He receives food stamps and Medicaid. For every $100 that he earns, Jamal loses $35 in food stamps and $20 in Medicaid benefits. Also, Jamal's income is taxed at a rate of 10%. Then, Jamal's total tax rate is

A) 45 percent

B) 55 percent

C) 65 percent

D) 70 percent

A) 45 percent

B) 55 percent

C) 65 percent

D) 70 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

77

When determining whether an income places a family or individual in poverty, the official poverty rate excludes

A) money income derived from sources other than labor.

B) money income received from transfer programs.

C) noncash benefits derived from programs supplying recipients with food, housing, and medical benefits.

D) noncash benefits that are provided the non-elderly, but it counts these benefits when they are supplied to the elderly.

A) money income derived from sources other than labor.

B) money income received from transfer programs.

C) noncash benefits derived from programs supplying recipients with food, housing, and medical benefits.

D) noncash benefits that are provided the non-elderly, but it counts these benefits when they are supplied to the elderly.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

78

Which one of the following groups has a below-average incidence of poverty?

A) Divorced or separated persons.

B) African Americans and other minorities.

C) Families headed by a female.

D) Persons between the ages of 35 and 54.

A) Divorced or separated persons.

B) African Americans and other minorities.

C) Families headed by a female.

D) Persons between the ages of 35 and 54.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

79

This year, Emily earned $2,000 more than last year. As a result, she received $500 less in government transfers. Therefore, Emily's implicit marginal tax rate is

A) 15 percent.

B) 25 percent.

C) 40 percent.

D) 75 percent.

A) 15 percent.

B) 25 percent.

C) 40 percent.

D) 75 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck

80

Economic analysis indicates that

A) unorganized groups of taxpayers and consumers will be better able to secure redistribution through the political process than well-organized interest groups.

B) rent-seeking activities are beneficial to a nation's prosperity because they alter public policy.

C) most income transfers in the United States are directed toward the poor.

D) market adjustments and competition for transfers will erode much of the gain of transfer recipients.

A) unorganized groups of taxpayers and consumers will be better able to secure redistribution through the political process than well-organized interest groups.

B) rent-seeking activities are beneficial to a nation's prosperity because they alter public policy.

C) most income transfers in the United States are directed toward the poor.

D) market adjustments and competition for transfers will erode much of the gain of transfer recipients.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 105 في هذه المجموعة.

فتح الحزمة

k this deck