Deck 11: Service Department and Joint Cost Allocation

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

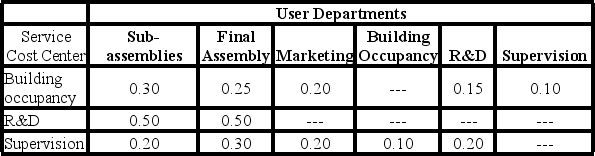

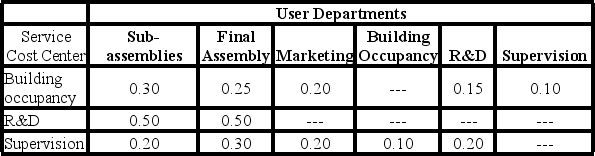

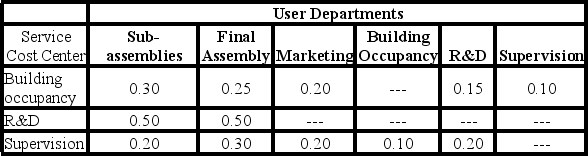

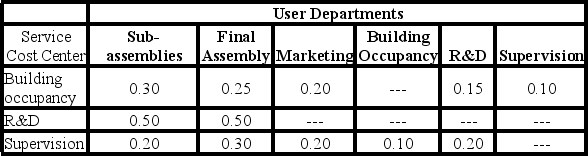

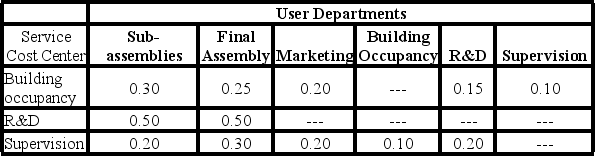

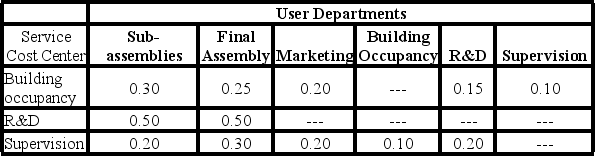

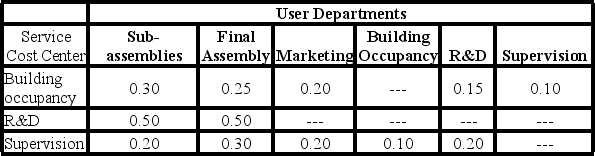

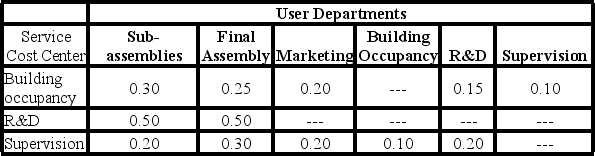

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/152

العب

ملء الشاشة (f)

Deck 11: Service Department and Joint Cost Allocation

1

In deciding whether to outsource a service department or not, the cost of the service department should be estimated using the step method of allocation.

False

2

The step method allocates some, but not all, service department costs to other service departments.

True

3

Joint costs are processing costs incurred after the split-off point in a common production process.

False

4

With the reciprocal method, the total service department costs less the direct costs of the service department equal the cost allocated to the service department.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

5

Joint products are outputs from common inputs and a common production process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

6

The estimated net realizable value for a product is its estimated selling price after processing the product beyond the split-off point.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

7

In a sell-or-process-further decision, the additional costs incurred after the split-off point are irrelevant.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

8

One potential disadvantage of the reciprocal method is it could overstate the cost of running the organization's service departments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

9

The physical quantities method allocates joint costs so that each joint product has the same gross margin as a percentage of sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

10

In general, it is better to use a product's market value at the split-off point than its estimated net realizable value in allocating joint costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

11

One advantage of the step method is that all reciprocal services are recognized between service departments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

12

The estimated net realizable value at the split-off point is calculated by taking the sales value after further processing and deducting the additional processing costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

13

Since by-products have minor sales value, alternative methods of accounting for them will not have a material effect on the financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

14

The human resource department in a manufacturing company would be considered a service department.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

15

In a sell-or-process-further decision, the common costs incurred prior to the spilt-off point are irrelevant.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

16

If a company's two joint products can be sold at the split-off point, there is no reason for allocating the joint costs to the products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

17

The physical quantities method of allocating joint costs is often used when the output sales prices are highly volatile.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

18

One reason to allocate service department costs to user departments is to encourage the user departments to monitor their use of the service department costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

19

The direct method makes no cost allocations between or among service departments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

20

The selection of an allocation base in the direct method is easier than the selection of an allocation base in the step method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

21

Veneer Company has two service departments and two producing departments. The number of employees in each department is:

The department costs of the Personnel Department are allocated on a basis of the number of employees. If these costs are budgeted at $37,125 during a given period, the amount of cost allocated (rounded to two decimal places) to Department B under the direct method would be:

A) $0.

B) $17,187.50.

C) $16,875.00.

D) $18,021.84.

The department costs of the Personnel Department are allocated on a basis of the number of employees. If these costs are budgeted at $37,125 during a given period, the amount of cost allocated (rounded to two decimal places) to Department B under the direct method would be:

A) $0.

B) $17,187.50.

C) $16,875.00.

D) $18,021.84.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

22

Tenet Engineering, Inc. operates two user divisions as separate cost objects. To determine the costs of each division, the company allocates common costs to the divisions. During the past month, the following common costs were incurred:

Computer services (85% fixed) $ 260,000

Building occupancy 600,000

Personnel costs 110,000

Total common costs $ 970,000

The following information is available concerning various activity measures and service usages by each of the divisions:

-

If all common costs are allocated using operating profit as the allocation basis, what is the total cost allocated to Division B (rounded to the nearest whole dollar)?

A) $457,286.

B) $512,714.

C) $555,000.

D) $1,087,576.

Computer services (85% fixed) $ 260,000

Building occupancy 600,000

Personnel costs 110,000

Total common costs $ 970,000

The following information is available concerning various activity measures and service usages by each of the divisions:

-

If all common costs are allocated using operating profit as the allocation basis, what is the total cost allocated to Division B (rounded to the nearest whole dollar)?

A) $457,286.

B) $512,714.

C) $555,000.

D) $1,087,576.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

23

Service department costs are allocated to user departments, in part, because:

A) it measures the use of plant capacity.

B) it helps ensure that machines are operating efficiently.

C) user departments use the functions of service departments.

D) service departments are final cost centers.

A) it measures the use of plant capacity.

B) it helps ensure that machines are operating efficiently.

C) user departments use the functions of service departments.

D) service departments are final cost centers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

24

Tenet Engineering, Inc. operates two user divisions as separate cost objects. To determine the costs of each division, the company allocates common costs to the divisions. During the past month, the following common costs were incurred:

Computer services (85% fixed) $ 260,000

Building occupancy 600,000

Personnel costs 110,000

Total common costs $ 970,000

The following information is available concerning various activity measures and service usages by each of the divisions:

-

If common computer service costs are allocated using computer time as the allocation basis, what is the computer cost allocated to Division B (rounded to the nearest whole dollar)?

A) $136,190.

B) $137,647.

C) $144,444.

D) $173,333.

Computer services (85% fixed) $ 260,000

Building occupancy 600,000

Personnel costs 110,000

Total common costs $ 970,000

The following information is available concerning various activity measures and service usages by each of the divisions:

-

If common computer service costs are allocated using computer time as the allocation basis, what is the computer cost allocated to Division B (rounded to the nearest whole dollar)?

A) $136,190.

B) $137,647.

C) $144,444.

D) $173,333.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

25

Service department costs are:

A) Generally treated as period costs rather than product costs.

B) Reported as selling and administrative expenses on the income statement.

C) Eventually applied by the user departments to the units produced.

D) Seldom found in manufacturing organizations.

A) Generally treated as period costs rather than product costs.

B) Reported as selling and administrative expenses on the income statement.

C) Eventually applied by the user departments to the units produced.

D) Seldom found in manufacturing organizations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

26

Jamison Company has two service departments and two producing departments. Square footage of space occupied by each department follows:

The department costs of Custodial Services are allocated on a basis of square footage of space. If Custodial Services costs are budgeted at $38,000, the amount of cost allocated to General Administration under the direct method would be:

A) $0.

B) $7,125.

C) $6,000.

D) $5,700.

The department costs of Custodial Services are allocated on a basis of square footage of space. If Custodial Services costs are budgeted at $38,000, the amount of cost allocated to General Administration under the direct method would be:

A) $0.

B) $7,125.

C) $6,000.

D) $5,700.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which of the following departments is not a service department in a typical manufacturing company?

A) Assembly.

B) Accounting.

C) Human resources.

D) Information processing.

A) Assembly.

B) Accounting.

C) Human resources.

D) Information processing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

28

Dreamland University has 20 departments. Two of its best departments are the (1) College of Innovation (COI) and (2) Testing Services. The College of Innovation (COI) attempts to teach students the difficult, but useful, skill of innovation. Testing Services grades examinations for professors. How would these two departments be classified?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which of the following is the least practical reason for allocating service department costs to user departments?

A) To ascertain profitability of user departments.

B) To evaluate performance of managers and divisions.

C) To make user departments aware that services are costly.

D) To provide the best possible service to users.

A) To ascertain profitability of user departments.

B) To evaluate performance of managers and divisions.

C) To make user departments aware that services are costly.

D) To provide the best possible service to users.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which of the following best describes final cost centers?

A) Any cost center whose costs are not allocated to another cost center.

B) Service departments are always final cost centers.

C) User departments cannot be final cost centers.

D) Any cost center whose costs are charged to other departments in an organization.

A) Any cost center whose costs are not allocated to another cost center.

B) Service departments are always final cost centers.

C) User departments cannot be final cost centers.

D) Any cost center whose costs are charged to other departments in an organization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which of the following methods provides no data for service departments to monitor each other's costs?

A) Direct method.

B) Reciprocal method.

C) Step method.

D) All three methods, Direct, Step and Reciprocal, provide data for monitoring costs.

A) Direct method.

B) Reciprocal method.

C) Step method.

D) All three methods, Direct, Step and Reciprocal, provide data for monitoring costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

32

Criteria for selecting allocation bases for service department allocations should not include:

A) Direct, traceable benefits from the service.

B) The extent of facilities provided.

C) The ease of making an allocation.

D) Sales dollars generated during the period.

A) Direct, traceable benefits from the service.

B) The extent of facilities provided.

C) The ease of making an allocation.

D) Sales dollars generated during the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following best describes intermediate cost centers?

A) Any cost center whose costs are not allocated to another cost center.

B) Service departments cannot be intermediate cost centers.

C) User departments cannot be intermediate cost centers.

D) Any cost center whose costs are charged to other departments in an organization.

A) Any cost center whose costs are not allocated to another cost center.

B) Service departments cannot be intermediate cost centers.

C) User departments cannot be intermediate cost centers.

D) Any cost center whose costs are charged to other departments in an organization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following is not a benefit of cost allocation?

A) Instilling responsibility for all costs of the company in division managers.

B) Constructing performance measures that may be more meaningful than contribution margins.

C) Relating indirect costs to contracts, jobs and products.

D) Additional bookkeeping costs incurred to provide cost allocation information.

A) Instilling responsibility for all costs of the company in division managers.

B) Constructing performance measures that may be more meaningful than contribution margins.

C) Relating indirect costs to contracts, jobs and products.

D) Additional bookkeeping costs incurred to provide cost allocation information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following service departments could logically use space occupied (square footage) to allocate its costs to user departments?

A) Material Handling.

B) Cafeteria.

C) Custodial Services.

D) Cost Accounting.

A) Material Handling.

B) Cafeteria.

C) Custodial Services.

D) Cost Accounting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

36

Tenet Engineering, Inc. operates two user divisions as separate cost objects. To determine the costs of each division, the company allocates common costs to the divisions. During the past month, the following common costs were incurred:

Computer services (85% fixed) $ 260,000

Building occupancy 600,000

Personnel costs 110,000

Total common costs $ 970,000

The following information is available concerning various activity measures and service usages by each of the divisions:

-

Using the most appropriate allocation basis, what is the personnel cost allocated to Division A (rounded to the nearest whole dollar)?

A) $58,143.

B) $74,643.

C) $76,463.

D) $110,000.

Computer services (85% fixed) $ 260,000

Building occupancy 600,000

Personnel costs 110,000

Total common costs $ 970,000

The following information is available concerning various activity measures and service usages by each of the divisions:

-

Using the most appropriate allocation basis, what is the personnel cost allocated to Division A (rounded to the nearest whole dollar)?

A) $58,143.

B) $74,643.

C) $76,463.

D) $110,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

37

Which of the following would be an appropriate cost-allocation base for allocating the cost of the company cafeteria?

A) Square footage occupied by departments.

B) Number of hours of use.

C) Number of meals served.

D) Salaries of personnel purchasing meals.

A) Square footage occupied by departments.

B) Number of hours of use.

C) Number of meals served.

D) Salaries of personnel purchasing meals.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

38

Which of the following statements is(are) false regarding the direct method of allocating service department costs?

(A) The selection of an allocation base in the direct method is easier than the selection of an allocation base in the step method.

(B) Once an allocation is made from a service department using the direct method, no further allocations are made back to that department.

A) Only A is false.

B) Only B is false.

C) Neither of these is false.

D) Both of these are false.

(A) The selection of an allocation base in the direct method is easier than the selection of an allocation base in the step method.

(B) Once an allocation is made from a service department using the direct method, no further allocations are made back to that department.

A) Only A is false.

B) Only B is false.

C) Neither of these is false.

D) Both of these are false.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following is not a reason to justify the allocation of support services?

A) Tax reporting requirements.

B) Influencing behavior of employees.

C) To trace costs to the activity that created the costs.

D) Cost based contracts.

A) Tax reporting requirements.

B) Influencing behavior of employees.

C) To trace costs to the activity that created the costs.

D) Cost based contracts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

40

A management purpose for allocating joint costs of a processing center to the various products produced is to:

A) Establish inventory values for unsold units.

B) Record accurate cost of sales by product line.

C) Compute total processing cost variances by product.

D) Report correct standard product costs for comparative analysis.

A) Establish inventory values for unsold units.

B) Record accurate cost of sales by product line.

C) Compute total processing cost variances by product.

D) Report correct standard product costs for comparative analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

41

There are several methods for allocating service department costs to production departments. The method which recognizes service provided by one service department to another but does not recognize reciprocal interdepartmental service is called: (CMA adapted)

A) Direct method.

B) Variable method.

C) Linear method.

D) Step method.

A) Direct method.

B) Variable method.

C) Linear method.

D) Step method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

42

Cordner Corporation has two production departments, P1 and P2, and two service departments, S1 and S2. Direct costs for each department and the proportion of service costs used by the various departments for the month of July are as follows:

-

Under the step method of cost allocation, the amount of S2 costs allocated to S1 would be:

A) $40,000.

B) $20,000.

C) $0.

D) $42,000.

-

Under the step method of cost allocation, the amount of S2 costs allocated to S1 would be:

A) $40,000.

B) $20,000.

C) $0.

D) $42,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

43

The Hsu Manufacturing Company has two service departments: Maintenance and Accounting. The Maintenance Department's costs of $300,000 are allocated on the basis of machine hours. The Accounting Department's costs of $120,000 are allocated on the basis of the number of employees within a specific department. The direct departmental costs for A and B are $300,000 and $500,000, respectively.

-

What is the Maintenance Department's cost allocated to Department A using the direct method?

A) $92,000.

B) $230,000.

C) $276,000.

D) $386,400.

-

What is the Maintenance Department's cost allocated to Department A using the direct method?

A) $92,000.

B) $230,000.

C) $276,000.

D) $386,400.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

44

Cordner Corporation has two production departments, P1 and P2, and two service departments, S1 and S2. Direct costs for each department and the proportion of service costs used by the various departments for the month of July are as follows:

-

Under the direct method of cost allocation, the amount of S1 costs allocated to S2 would be:

A) $42,000.

B) $20,000.

C) $0.

D) $6,000.

-

Under the direct method of cost allocation, the amount of S1 costs allocated to S2 would be:

A) $42,000.

B) $20,000.

C) $0.

D) $6,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

45

If two service departments service the same number of departments, which service department's costs should be allocated first when using the step method?

A) The service department that provides the most service to other service departments.

B) The service department that provides the most service to the user departments.

C) The service department with the least cost.

D) The service department that provides the least service to other service departments.

A) The service department that provides the most service to other service departments.

B) The service department that provides the most service to the user departments.

C) The service department with the least cost.

D) The service department that provides the least service to other service departments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

46

The Hsu Manufacturing Company has two service departments: Maintenance and Accounting. The Maintenance Department's costs of $300,000 are allocated on the basis of machine hours. The Accounting Department's costs of $120,000 are allocated on the basis of the number of employees within a specific department. The direct departmental costs for A and B are $300,000 and $500,000, respectively.

-

What is the cost of the Accounting Department's cost allocated to Department A (rounded to the nearest whole dollar) using the step method and assuming the Maintenance Department's costs are allocated first?

A) $81,333.

B) $81,587.

C) $80,000.

D) $68,571.

-

What is the cost of the Accounting Department's cost allocated to Department A (rounded to the nearest whole dollar) using the step method and assuming the Maintenance Department's costs are allocated first?

A) $81,333.

B) $81,587.

C) $80,000.

D) $68,571.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

47

The Hsu Manufacturing Company has two service departments: Maintenance and Accounting. The Maintenance Department's costs of $300,000 are allocated on the basis of machine hours. The Accounting Department's costs of $120,000 are allocated on the basis of the number of employees within a specific department. The direct departmental costs for A and B are $300,000 and $500,000, respectively.

-

What is the Accounting Department's cost allocated to Department B using the direct method?

A) $40,000.

B) $80,000.

C) $20,000.

D) $10,000.

-

What is the Accounting Department's cost allocated to Department B using the direct method?

A) $40,000.

B) $80,000.

C) $20,000.

D) $10,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

48

Palace Company has two service departments and two user departments. The number of employees in each department is:

The fixed costs of the Personnel Department are allocated on a basis of the number of employees. If these costs are budgeted at $37,125 during a given period, the amount of cost allocated to the Cafeteria under the step method would be:

A) $0.

B) $1,718.75.

C) $1,687.50.

D) $1,802.18.

The fixed costs of the Personnel Department are allocated on a basis of the number of employees. If these costs are budgeted at $37,125 during a given period, the amount of cost allocated to the Cafeteria under the step method would be:

A) $0.

B) $1,718.75.

C) $1,687.50.

D) $1,802.18.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

49

The following information relates to Osceola Corporation for the past accounting period.

-

Using the reciprocal (simultaneous solution) method, Department B's cost allocated to Department C (rounded to the nearest whole dollar) is:

A) $29,021

B) $14,021

C) $13,192

D) $7,794

-

Using the reciprocal (simultaneous solution) method, Department B's cost allocated to Department C (rounded to the nearest whole dollar) is:

A) $29,021

B) $14,021

C) $13,192

D) $7,794

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

50

The following information relates to Osceola Corporation for the past accounting period.

-

Using the reciprocal (simultaneous solution) method, Department A's cost allocated to Department C (rounded to the nearest whole dollar) is:

A) $48,000.

B) $58,800.

C) $60,619.

D) $98,000.

-

Using the reciprocal (simultaneous solution) method, Department A's cost allocated to Department C (rounded to the nearest whole dollar) is:

A) $48,000.

B) $58,800.

C) $60,619.

D) $98,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

51

Cordner Corporation has two production departments, P1 and P2, and two service departments, S1 and S2. Direct costs for each department and the proportion of service costs used by the various departments for the month of July are as follows:

-

Under the direct method of cost allocation, the amount of S1 costs allocated to P1 would be:

A) $20,000.

B) $6,000.

C) $30,000.

D) $62,500.

-

Under the direct method of cost allocation, the amount of S1 costs allocated to P1 would be:

A) $20,000.

B) $6,000.

C) $30,000.

D) $62,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

52

Because this allocation method recognizes that service departments often provide each other with interdepartmental service, it is theoretically considered to be the most accurate method for allocating service department costs to production departments. This method is: (CMA adapted)

A) Direct method.

B) Variable method.

C) Linear method.

D) Reciprocal method.

A) Direct method.

B) Variable method.

C) Linear method.

D) Reciprocal method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

53

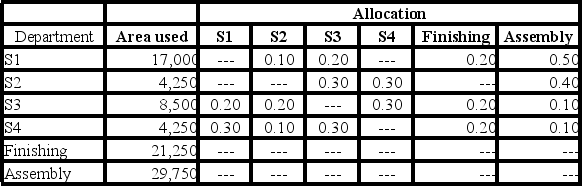

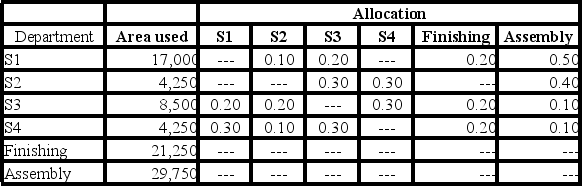

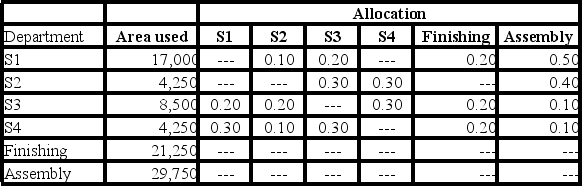

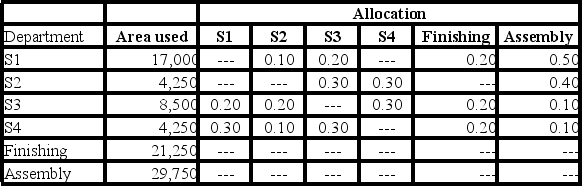

The Maryville Construction Company occupies 85,000 square feet for construction of mobile homes. There are two manufacturing departments, finishing and assembly, and four service departments labeled S1, S2, S3, and S4. Information relevant to Maryville is as follows:

Rent paid for the area used is $720,000.

-

How much rent would be charged to S4 using the step method of allocation and a S3-S4-S1-S2 sequence for the allocations?

A) $36,000.

B) $40,000.

C) $54,000.

D) $90,000.

Rent paid for the area used is $720,000.

-

How much rent would be charged to S4 using the step method of allocation and a S3-S4-S1-S2 sequence for the allocations?

A) $36,000.

B) $40,000.

C) $54,000.

D) $90,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

54

Steven Parker owns and operates Steven's Septic Service and Legal Advice. Steven's two revenue generating (production) operations are supported by two service departments: Clerical and Janitorial. Costs in the service departments are allocated in the following order using the designated allocation bases:

Clerical:

Variable cost: expected number of work orders processed

Fixed cost: long-run average number of work orders processed

Janitorial:

Variable cost: labor hours

Fixed cost: square footage of space occupied

Average and expected activity levels for next month (June) are as follows:

Expected costs in the service departments for June are as follows:

-

Under the direct method of allocation, what is the total amount of service cost allocated to the Legal Advice operation for June? (Round all calculations to the nearest whole dollar.)

A) $6,231.

B) $7,720.

C) $8,640.

D) $9,330.

Clerical:

Variable cost: expected number of work orders processed

Fixed cost: long-run average number of work orders processed

Janitorial:

Variable cost: labor hours

Fixed cost: square footage of space occupied

Average and expected activity levels for next month (June) are as follows:

Expected costs in the service departments for June are as follows:

-

Under the direct method of allocation, what is the total amount of service cost allocated to the Legal Advice operation for June? (Round all calculations to the nearest whole dollar.)

A) $6,231.

B) $7,720.

C) $8,640.

D) $9,330.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

55

The Maryville Construction Company occupies 85,000 square feet for construction of mobile homes. There are two manufacturing departments, finishing and assembly, and four service departments labeled S1, S2, S3, and S4. Information relevant to Maryville is as follows:

Rent paid for the area used is $720,000.

-

How much rent is allocable to the assembly department using the direct method of allocation?

A) $420,000.

B) $332,500.

C) $300,000.

D) $252,000.

Rent paid for the area used is $720,000.

-

How much rent is allocable to the assembly department using the direct method of allocation?

A) $420,000.

B) $332,500.

C) $300,000.

D) $252,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

56

Steven Parker owns and operates Steven's Septic Service and Legal Advice. Steven's two revenue generating (production) operations are supported by two service departments: Clerical and Janitorial. Costs in the service departments are allocated in the following order using the designated allocation bases:

Clerical:

Variable cost: expected number of work orders processed.

Fixed cost: long-run average number of work orders processed.

Janitorial:

Variable cost: labor hours.

Fixed cost: square footage of space occupied.

Average and expected activity levels for next month (June) are as follows:

Expected costs in the service departments for June are as follows:

-

Under the step method of allocation, how much Clerical Service cost should be allocated to the Septic Service operation for June? (Assume Clerical costs are allocated before Janitorial costs and round all calculations to the nearest whole dollar.)

A) $12,689.

B) $13,100.

C) $13,620.

D) $15,596.

Clerical:

Variable cost: expected number of work orders processed.

Fixed cost: long-run average number of work orders processed.

Janitorial:

Variable cost: labor hours.

Fixed cost: square footage of space occupied.

Average and expected activity levels for next month (June) are as follows:

Expected costs in the service departments for June are as follows:

-

Under the step method of allocation, how much Clerical Service cost should be allocated to the Septic Service operation for June? (Assume Clerical costs are allocated before Janitorial costs and round all calculations to the nearest whole dollar.)

A) $12,689.

B) $13,100.

C) $13,620.

D) $15,596.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

57

Cordner Corporation has two production departments, P1 and P2, and two service departments, S1 and S2. Direct costs for each department and the proportion of service costs used by the various departments for the month of July are as follows:

-

Under the step method of allocation, the total amount of service costs allocated to producing departments would be:

A) $118,000.

B) $160,000.

C) $140,000.

D) $40,000.

-

Under the step method of allocation, the total amount of service costs allocated to producing departments would be:

A) $118,000.

B) $160,000.

C) $140,000.

D) $40,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

58

Which of the following is a weakness of the step method of service cost allocations?

A) Computations are more complex than the reciprocal method.

B) All interdepartmental services are ignored.

C) All intradepartmental services are ignored.

D) The order of service department allocation has to be determined.

A) Computations are more complex than the reciprocal method.

B) All interdepartmental services are ignored.

C) All intradepartmental services are ignored.

D) The order of service department allocation has to be determined.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

59

Cordner Corporation has two production departments, P1 and P2, and two service departments, S1 and S2. Direct costs for each department and the proportion of service costs used by the various departments for the month of July are as follows:

-

Under the step-method of cost allocation, the amount of costs allocated from S2 to P2 would be:

A) $88,750.

B) $50,000.

C) $62,500.

D) $53,250.

-

Under the step-method of cost allocation, the amount of costs allocated from S2 to P2 would be:

A) $88,750.

B) $50,000.

C) $62,500.

D) $53,250.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

60

The Hsu Manufacturing Company has two service departments: Maintenance and Accounting. The Maintenance Department's costs of $300,000 are allocated on the basis of machine hours. The Accounting Department's costs of $120,000 are allocated on the basis of the number of employees within a specific department. The direct departmental costs for A and B are $300,000 and $500,000, respectively.

-

What is the Maintenance Department's cost allocated to Department B (rounded to the nearest whole dollar) using the step method and assuming the Maintenance Department's costs are allocated first?

A) $276,000.

B) $230,000.

C) $322,000.

D) $23,810.

-

What is the Maintenance Department's cost allocated to Department B (rounded to the nearest whole dollar) using the step method and assuming the Maintenance Department's costs are allocated first?

A) $276,000.

B) $230,000.

C) $322,000.

D) $23,810.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

61

Which of the following is not a step needed to maximize the profits from joint products?

A) Forecasting the sales price of each final product.

B) Identifying alternative sets and quantities of final products possible from the joint process.

C) Determining how to allocate joint costs to the final products.

D) Estimating the costs required to further process joint products into salable products.

A) Forecasting the sales price of each final product.

B) Identifying alternative sets and quantities of final products possible from the joint process.

C) Determining how to allocate joint costs to the final products.

D) Estimating the costs required to further process joint products into salable products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

62

Net realizable value at the split-off point is used to allocate:

A.

B.

C.

D.

A) Option A

B) Option B

C) Option C

D) Option D

A.

B.

C.

D.

A) Option A

B) Option B

C) Option C

D) Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

63

For the purposes of allocating joint costs to joint products, the sales price at the point of sale, reduced by the cost to complete after split-off, is assumed to be equal to the: (CPA adapted)

A) Total costs.

B) Joint costs.

C) Sales price less a normal profit margin at point of sale.

D) Net realizable value at split-off.

A) Total costs.

B) Joint costs.

C) Sales price less a normal profit margin at point of sale.

D) Net realizable value at split-off.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

64

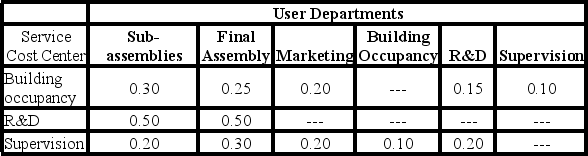

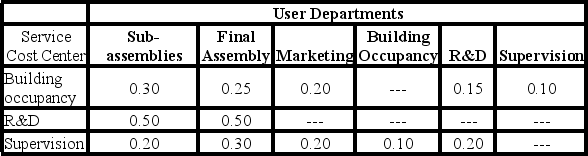

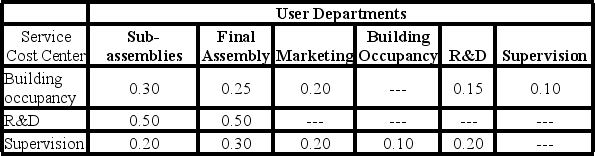

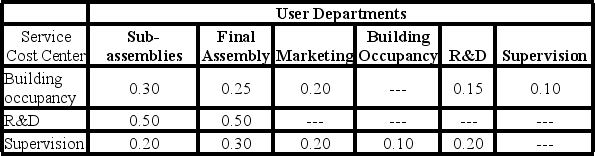

The following is a system of simultaneous linear equations to allocate costs using the reciprocal method. Matrix algebra is not required.

The following costs were incurred in three operating departments and three service departments in Westmoreland Company.

Use of services by other departments is as follows.

-

The equation for department S1 (building occupancy) is:

A) S1 = 0.10S3.

B) S1 = $85,000 + 1.00S3.

C) S1 = $85,000 + 0.10S3.

D) S1 = $85,000 + 0.90S2 + 0.10S3.

The following costs were incurred in three operating departments and three service departments in Westmoreland Company.

Use of services by other departments is as follows.

-

The equation for department S1 (building occupancy) is:

A) S1 = 0.10S3.

B) S1 = $85,000 + 1.00S3.

C) S1 = $85,000 + 0.10S3.

D) S1 = $85,000 + 0.90S2 + 0.10S3.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

65

The following is a system of simultaneous linear equations to allocate costs using the reciprocal method. Matrix algebra is not required.

The following costs were incurred in three operating departments and three service departments in Westmoreland Company.

Use of services by other departments is as follows.

-

The equation for department P1 (subassemblies) is:

A) P1 = $550,000 + 0.25P2 + 0.20P3 + 0.15S2 + 0.10S3.

B) P1 = $550,000 + 0.30S1 + 0.50S2 + 0.20S3.

C) P1 = 0.30S1 + 0.50S2 + 0.20S3.

D) P1 = 0.30S1 + 0.50S.

The following costs were incurred in three operating departments and three service departments in Westmoreland Company.

Use of services by other departments is as follows.

-

The equation for department P1 (subassemblies) is:

A) P1 = $550,000 + 0.25P2 + 0.20P3 + 0.15S2 + 0.10S3.

B) P1 = $550,000 + 0.30S1 + 0.50S2 + 0.20S3.

C) P1 = 0.30S1 + 0.50S2 + 0.20S3.

D) P1 = 0.30S1 + 0.50S.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

66

Which of the following statements is false?

A) The estimated net realizable value for a product is its estimated selling price after processing the product beyond the split-off point.

B) In general, it is better to use a product's market value at the split-off point than its estimated net realizable value.

C) The estimated net realizable value at the split-off point is calculated by taking the sales value after further processing and deducting the additional processing costs.

D) It is better to use the net realizable value method for allocating joint costs than the estimated net realizable value method.

A) The estimated net realizable value for a product is its estimated selling price after processing the product beyond the split-off point.

B) In general, it is better to use a product's market value at the split-off point than its estimated net realizable value.

C) The estimated net realizable value at the split-off point is calculated by taking the sales value after further processing and deducting the additional processing costs.

D) It is better to use the net realizable value method for allocating joint costs than the estimated net realizable value method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

67

Which of the following best describes the objective of joint cost allocation?

A) Inventory valuation.

B) Pricing goods for sale.

C) Making decisions about levels of production.

D) Making decisions about raw materials requirements.

A) Inventory valuation.

B) Pricing goods for sale.

C) Making decisions about levels of production.

D) Making decisions about raw materials requirements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

68

Allocated joint costs are useful for:

A) Setting the selling price of a product.

B) Determining whether to continue producing an item.

C) Controlling user department costs.

D) Determining inventory cost for accounting purposes.

A) Setting the selling price of a product.

B) Determining whether to continue producing an item.

C) Controlling user department costs.

D) Determining inventory cost for accounting purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

69

Which of the following cost items is not allocable as joint costs when a single manufacturing process produces several main products and several by-products?

A) Direct materials.

B) Variable overhead.

C) Direct labor.

D) Freight-out.

A) Direct materials.

B) Variable overhead.

C) Direct labor.

D) Freight-out.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

70

The following is a system of simultaneous linear equations to allocate costs using the reciprocal method. Matrix algebra is not required.

The following costs were incurred in three operating departments and three service departments in Westmoreland Company.

Use of services by other departments is as follows.

-

The equation for department S2 (research and development) is:

A) S2 = $120,000 + 0.15S1 + 0.65S2 + 0.20S3.

B) S2 = 0.15S1 + 20S3.

C) S2 = $120,000 + 0.15S1 + 0.20S3.

D) S2 = $120,000 + 0.40S1 + 0.60S3.

The following costs were incurred in three operating departments and three service departments in Westmoreland Company.

Use of services by other departments is as follows.

-

The equation for department S2 (research and development) is:

A) S2 = $120,000 + 0.15S1 + 0.65S2 + 0.20S3.

B) S2 = 0.15S1 + 20S3.

C) S2 = $120,000 + 0.15S1 + 0.20S3.

D) S2 = $120,000 + 0.40S1 + 0.60S3.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

71

The following is a system of simultaneous linear equations to allocate costs using the reciprocal method. Matrix algebra is not required.

The following costs were incurred in three operating departments and three service departments in Westmoreland Company.

Use of services by other departments is as follows.

-

The equation for department S3 (supervision) is:

A) S3 = $45,000 + 0.90S1 + 0.10S2.

B) S3 = $45,000 + 0.10S1.

C) S3 = $45,000 + 1.00S1.

D) S3 = 0.10S1.

The following costs were incurred in three operating departments and three service departments in Westmoreland Company.

Use of services by other departments is as follows.

-

The equation for department S3 (supervision) is:

A) S3 = $45,000 + 0.90S1 + 0.10S2.

B) S3 = $45,000 + 0.10S1.

C) S3 = $45,000 + 1.00S1.

D) S3 = 0.10S1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

72

Which of the following statements about maximizing the profit of joint product processes is true?

A) Joint processing costs incurred prior to split-off should be allocated before making those decisions.

B) Only additional expenditures for further processing are relevant.

C) Only revenues from selling or processing beyond the split-off point are relevant.

D) Revenues from selling or processing beyond the split-off point and additional expenditures for further processing are relevant.

A) Joint processing costs incurred prior to split-off should be allocated before making those decisions.

B) Only additional expenditures for further processing are relevant.

C) Only revenues from selling or processing beyond the split-off point are relevant.

D) Revenues from selling or processing beyond the split-off point and additional expenditures for further processing are relevant.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

73

For purposes of allocating joint costs to joint products, the estimated net realizable value at split-off is equal to:

A) Final sales price reduced by cost to complete after split-off.

B) Sales price less a normal profit margin at the point of sale.

C) Separable product cost plus a normal profit margin.

D) Total sales value less joint costs at point of split-off.

A) Final sales price reduced by cost to complete after split-off.

B) Sales price less a normal profit margin at the point of sale.

C) Separable product cost plus a normal profit margin.

D) Total sales value less joint costs at point of split-off.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

74

Products X, Y, and Z are produced from the same process at a cost of $5,200. Five thousand pounds of raw material yields 1,500 X, 2,500 Y, and 1,000 Z. Selling prices are: X $2 per unit, Y $4 per unit, and Z valueless. The ending inventory of X is 50 units. What is the value of the ending inventory if joint costs are allocated using net realizable value?

A) $21.67.

B) $31.20.

C) $40.00.

D) $42.00.

A) $21.67.

B) $31.20.

C) $40.00.

D) $42.00.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

75

Advanced Computer Solutions, Inc. has two main services: (1) time on a timeshared computer system and (2) proprietary computer programs. The operation department (Op) provides computer time and the programming department (P) writes programs.

The percentage of each service used by each department for a typical period is:

In a typical period, the operation department (Op) spends $4,500 and the programming department (P) spends $2,500.

-

Under the step method (Op first), what is the cost of the computer time and the computer programs for sale?

A.

B.

C.

D.

A) Option A

B) Option B

C) Option C

D) Option D

The percentage of each service used by each department for a typical period is:

In a typical period, the operation department (Op) spends $4,500 and the programming department (P) spends $2,500.

-

Under the step method (Op first), what is the cost of the computer time and the computer programs for sale?

A.

B.

C.

D.

A) Option A

B) Option B

C) Option C

D) Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

76

The method of accounting for joint product costs that will produce the same gross margin percentage for all products is the:

A) Replacement method.

B) Physical quantities method.

C) Net realizable value method.

D) Units produced method.

A) Replacement method.

B) Physical quantities method.

C) Net realizable value method.

D) Units produced method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

77

Advanced Computer Solutions, Inc. has two main services: (1) time on a timeshared computer system, and (2) proprietary computer programs. The operation department (Op) provides computer time and the programming department (P) writes programs.

The percentage of each service used by each department for a typical period is:

In a typical period, the operation department (Op) spends $4,500 and the programming department (P) spends $2,500.

-

Under the reciprocal method what is the algebraic solution to the cost allocation problem?

A) Op = $4,500 + 0.40P; P = $2,500 + 0.30Op.

B) Op = $4,500 + 0.70P; P = $2,500 + 0.60Op.

C) Op = $2,500 + 0.40P; P = $4,500 + 0.30Op.

D) Op = $2,500 + 0.70P; P = $4,500 + 0.60Op.

The percentage of each service used by each department for a typical period is:

In a typical period, the operation department (Op) spends $4,500 and the programming department (P) spends $2,500.

-

Under the reciprocal method what is the algebraic solution to the cost allocation problem?

A) Op = $4,500 + 0.40P; P = $2,500 + 0.30Op.

B) Op = $4,500 + 0.70P; P = $2,500 + 0.60Op.

C) Op = $2,500 + 0.40P; P = $4,500 + 0.30Op.

D) Op = $2,500 + 0.70P; P = $4,500 + 0.60Op.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

78

The following is a system of simultaneous linear equations to allocate costs using the reciprocal method. Matrix algebra is not required.

The following costs were incurred in three operating departments and three service departments in Westmoreland Company.

Use of services by other departments is as follows.

-

The equation for department P3 (marketing) is:

A) P3 = $285,000 + 0.20S1 + 0.20S3.

B) P3 = $285,000 + 0.20S1 + 0.60S2 + 0.20S3.

C) P3 = $285,000 + 0.20S1 + 0.20S2 + 0.60S3.

D) P3 = $285,000 + 0.50S1 + 0.50S3.

The following costs were incurred in three operating departments and three service departments in Westmoreland Company.

Use of services by other departments is as follows.

-

The equation for department P3 (marketing) is:

A) P3 = $285,000 + 0.20S1 + 0.20S3.

B) P3 = $285,000 + 0.20S1 + 0.60S2 + 0.20S3.

C) P3 = $285,000 + 0.20S1 + 0.20S2 + 0.60S3.

D) P3 = $285,000 + 0.50S1 + 0.50S3.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

79

Bonanza Co. manufactures products X and Y from a joint process that also yields a by-product, Z. Revenue from sales of Z is treated as a reduction of joint costs. Additional information is as follows: Joint costs were allocated using the net realizable value method at the split-off point. The joint costs allocated to product X were

A) $75,000.

B) $100,800.

C) $150,000.

D) $168,000.

A) $75,000.

B) $100,800.

C) $150,000.

D) $168,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

80

The following is a system of simultaneous linear equations to allocate costs using the reciprocal method. Matrix algebra is not required.

The following costs were incurred in three operating departments and three service departments in Westmoreland Company.

Use of services by other departments is as follows.

-

The equation for department P2 (final assembly) is:

A) P2 = 0.25S1 + 0.50S2 + 0.30S3.

B) P2 = $775,000 + 0.25P2 + 0.20P3 + 0.15S2 + 0.10S3.

C) P2 = $775,000 + 0.30S1 + 0.50S2 + 0.20S3.

D) P2 = $775,000 +0.25S1 + 0.50S2 + 0.30S3.

The following costs were incurred in three operating departments and three service departments in Westmoreland Company.

Use of services by other departments is as follows.

-

The equation for department P2 (final assembly) is:

A) P2 = 0.25S1 + 0.50S2 + 0.30S3.

B) P2 = $775,000 + 0.25P2 + 0.20P3 + 0.15S2 + 0.10S3.

C) P2 = $775,000 + 0.30S1 + 0.50S2 + 0.20S3.

D) P2 = $775,000 +0.25S1 + 0.50S2 + 0.30S3.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck