Deck 11: Evaluating Performance: Earnings Quality, the Income Statement, Statement of Comprehensive Income

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/119

العب

ملء الشاشة (f)

Deck 11: Evaluating Performance: Earnings Quality, the Income Statement, Statement of Comprehensive Income

1

A corporation's net income receives more attention than any other financial statement item because an upward trend in net income usually:

A)leads to dividends in the future.

B)leads to higher stock prices in the future.

C)ensures that there is no financial fraud within the corporation.

D)A and B.

A)leads to dividends in the future.

B)leads to higher stock prices in the future.

C)ensures that there is no financial fraud within the corporation.

D)A and B.

D

2

The newly adopted revenue recognition standard, issued by the FASB and IASB, has very little impact on the retail industry because the standards for revenue recognition in that industry were already closely aligned globally.

True

3

Roughly half of all financial statement frauds over the past two decades have involved improper ________ recognition.

A)expense

B)revenue

C)asset

D)liability

A)expense

B)revenue

C)asset

D)liability

B

4

A type of financial statement fraud that is accomplished by shipping more to customers than they ordered, with the expectation that they may return some or all of the items is called:

A)improper asset recognition.

B)improper expense recognition.

C)channel stuffing.

D)cooking the books.

A)improper asset recognition.

B)improper expense recognition.

C)channel stuffing.

D)cooking the books.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

5

If net sales are $1,200,000; cost of goods sold is $400,000; and operating expenses are $100,000, gross profit is $700,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

6

For a retailer, there will be positive income from operations if:

A)revenues are greater than cost of goods sold.

B)revenues are greater than operating expenses.

C)gross profit is greater than operating expenses.

D)cost of goods sold is greater than operating expenses.

A)revenues are greater than cost of goods sold.

B)revenues are greater than operating expenses.

C)gross profit is greater than operating expenses.

D)cost of goods sold is greater than operating expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

7

A sign(s)of increasing earnings quality is(are):

A)improving gross margin/sales ratio.

B)declining operating expenses compared to sales.

C)improving operating earnings/sales ratio.

D)all of the above.

A)improving gross margin/sales ratio.

B)declining operating expenses compared to sales.

C)improving operating earnings/sales ratio.

D)all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

8

Components of increasing earnings quality include all of the following EXCEPT:

A)declining or stable operating expenses compared to sales.

B)improving gross margin compared to sales.

C)increasing cost of goods sold to sales ratio.

D)proper revenue and expense recognition.

A)declining or stable operating expenses compared to sales.

B)improving gross margin compared to sales.

C)increasing cost of goods sold to sales ratio.

D)proper revenue and expense recognition.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

9

Gross profit percentage is calculated by dividing cost of goods sold by net sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

10

Ongoing expenses incurred by the entity, other than the direct expenses for merchandise, are called:

A)other expenses.

B)extraordinary items.

C)cost of goods sold.

D)operating expenses.

A)other expenses.

B)extraordinary items.

C)cost of goods sold.

D)operating expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

11

The purpose of channel stuffing is to ensure that all customer orders are properly filled before the end of the seller's fiscal year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

12

The revenue recognition principle requires that sales revenue be recognized when it is earned.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

13

A sign of decreasing earnings quality is:

A)declining cost of goods sold/sales ratio.

B)declining gross margin/sales ratio.

C)declining operating expenses/sales ratio.

D)increasing operating income/sales ratio.

A)declining cost of goods sold/sales ratio.

B)declining gross margin/sales ratio.

C)declining operating expenses/sales ratio.

D)increasing operating income/sales ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

14

Examples of fraud involving improper revenue recognition include:

A)recording revenue when significant services are still to be performed.

B)channel stuffing.

C)sales to nonexistent customers.

D)all of the above.

A)recording revenue when significant services are still to be performed.

B)channel stuffing.

C)sales to nonexistent customers.

D)all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

15

Recognizing revenue before it is earned is a major source of financial statement fraud.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

16

Steadily decreasing cost of goods sold as a percentage of net sales is a sign of:

A)increasing earnings quality.

B)decreasing earnings quality.

C)financial statement fraud involving expense recognition.

D)financial statement fraud involving revenue recognition.

A)increasing earnings quality.

B)decreasing earnings quality.

C)financial statement fraud involving expense recognition.

D)financial statement fraud involving revenue recognition.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

17

A company with low earnings quality is more likely to report ________ than a company with high earnings quality.

A)high earnings in the future

B)low earnings in the future

C)high revenue levels in the future

D)decreasing operating expenses, compared to sales, in the future

A)high earnings in the future

B)low earnings in the future

C)high revenue levels in the future

D)decreasing operating expenses, compared to sales, in the future

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

18

Sales revenue less cost of goods sold is called:

A)gross profit.

B)gross margin percentage.

C)net profit.

D)net operating profit.

A)gross profit.

B)gross margin percentage.

C)net profit.

D)net operating profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

19

WorldCom committed financial statement fraud by deliberately overstating expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

20

The operating expense section of an income statement would NOT include ________ expense.

A)salaries

B)utilities

C)supplies

D)interest

A)salaries

B)utilities

C)supplies

D)interest

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

21

On June 15, Copps Stores sold twenty-five computers, on account, to a company located in Argentina for 2,600,000 pesos. On that date the peso is worth $0.079. On July 15, when the peso was worth $0.070, payment was received. The journal entry on July 15 by Copps Stores would include a:

A)credit to Cash $205,400.

B)credit to Accounts Receivable $182,000.

C)debit to Foreign-Currency Transaction Loss $23,400.

D)credit to Sales $182,000.

A)credit to Cash $205,400.

B)credit to Accounts Receivable $182,000.

C)debit to Foreign-Currency Transaction Loss $23,400.

D)credit to Sales $182,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

22

The net of foreign-currency transaction gains and losses will appear on the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

23

When a U.S.-based company has a payable denominated in a foreign currency, the U.S. company wants the foreign currency to ________ and the U.S. dollar to ________.

A)strengthen; strengthen

B)strengthen; weaken

C)weaken; strengthen

D)weaken; weaken

A)strengthen; strengthen

B)strengthen; weaken

C)weaken; strengthen

D)weaken; weaken

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

24

On August 1, Steffen Computers, Inc. purchased thirty computer chips, on account, from a company located in Taiwan for 530,000 Taiwan dollars. On that date the Taiwan dollar is worth $0.034. On September 1, when the Taiwan dollar was worth $0.036, payment was made. The journal entry on September 1 by Steffen Computers, Inc. would include a: (Round your final answer to the nearest dollar.)

A)debit to Accounts Payable $19,080.

B)debit to Foreign-Currency Transaction Loss -$1060.

C)credit to Foreign-Currency Transaction Gain -$1060.

D)credit to Cash $18,020.

A)debit to Accounts Payable $19,080.

B)debit to Foreign-Currency Transaction Loss -$1060.

C)credit to Foreign-Currency Transaction Gain -$1060.

D)credit to Cash $18,020.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

25

Santa Barbara Company, a U.S. company, purchased merchandise on account from a company in England. The price was 1300 British pounds. At the time of the purchase, the exchange rate for a British pound was $1.54. At the time Santa Barbara Company paid for the merchandise, the exchange rate for a British pound was $1.58. What is the amount of the gain or loss recorded by the Santa Barbara Company upon payment?

A)Foreign currency transaction gain $52

B)Foreign currency transaction loss $52

C)Foreign currency translation gain $2054

D)Foreign currency translation loss $2054

A)Foreign currency transaction gain $52

B)Foreign currency transaction loss $52

C)Foreign currency translation gain $2054

D)Foreign currency translation loss $2054

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

26

In a foreign-currency transaction, foreign currencies must be converted to U.S. dollars for financial reporting purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

27

A U.S.-based company sells merchandise on account to a company in Mexico. The Mexican company wants to pay for the merchandise in pesos. If the peso decreases in value relative to the dollar, the seller will record a ________. The peso ________ relative to the dollar.

A)Foreign Currency Transaction Gain; weakens

B)Foreign Currency Transaction Gain; strengthens

C)Foreign Currency Transaction Loss; weakens

D)Foreign Currency Transaction Loss; strengthens

A)Foreign Currency Transaction Gain; weakens

B)Foreign Currency Transaction Gain; strengthens

C)Foreign Currency Transaction Loss; weakens

D)Foreign Currency Transaction Loss; strengthens

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

28

On June 15, Blonski Computer Company sold twenty-five computers on account to a company located in Argentina for 2,600,000 pesos. On that date, the peso is worth $0.084. On July 15, when the peso was worth $0.080, payment was received. Blonski Computer Company uses the perpetual inventory system. Ignoring Cost of Goods Sold, the journal entry on June 15 by Blonski Computer Company would be:

A)debit Accounts Receivable $218,400 and credit Sales Revenue $218,400

B)debit Accounts Receivable $208,000 and credit Sales Revenue $208,000

C)debit Accounts Receivable $208,000, debit to Foreign-Currency Transaction Loss $10,400 and credit Sales Revenue $218,400

D)debit Accounts Receivable $218,400, credit Sales $208,000, and credit Foreign Currency Transaction Gain $10,400

A)debit Accounts Receivable $218,400 and credit Sales Revenue $218,400

B)debit Accounts Receivable $208,000 and credit Sales Revenue $208,000

C)debit Accounts Receivable $208,000, debit to Foreign-Currency Transaction Loss $10,400 and credit Sales Revenue $218,400

D)debit Accounts Receivable $218,400, credit Sales $208,000, and credit Foreign Currency Transaction Gain $10,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

29

A U.S.-based company purchases merchandise on account from a company in Mexico. The purchase contract is denominated in pesos. If the peso decreases in value relative to the dollar, the purchaser will record a ________. The peso ________ relative to the dollar.

A)Foreign Currency Transaction Loss; weakens

B)Foreign Currency Transaction Loss; strengthens

C)Foreign Currency Transaction Gain; weakens

D)Foreign Currency Transaction Gain; strengthens

A)Foreign Currency Transaction Loss; weakens

B)Foreign Currency Transaction Loss; strengthens

C)Foreign Currency Transaction Gain; weakens

D)Foreign Currency Transaction Gain; strengthens

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

30

The foreign-currency transaction gain account holds gains and losses on transactions settled in a foreign currency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

31

When a U.S.-based company holds a receivable denominated in a foreign currency, the U.S. company wants the foreign currency to ________ against the U.S. dollar so that the foreign currency can be converted into ________.

A)weaken; fewer dollars

B)weaken; more dollars

C)strengthen; fewer dollars

D)strengthen; more dollars

A)weaken; fewer dollars

B)weaken; more dollars

C)strengthen; fewer dollars

D)strengthen; more dollars

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

32

A company has a foreign-currency transaction loss of $1400 and a foreign-currency transaction gain of $9800. How is this information reported on the income statement?

A)Other Losses: Foreign-Currency Transaction Loss $1400 and Other Gains: Foreign-Currency Transaction Gain $9800

B)Other Gains: Foreign-Currency Transaction Gain, net $8400

C)Other Comprehensive Income: Foreign-Currency Transaction Gain $9800 and Other Comprehensive Loss: Foreign-Currency Transaction Loss $1400

D)Other Comprehensive Income: Foreign-Currency Transaction Gain, net $8400

A)Other Losses: Foreign-Currency Transaction Loss $1400 and Other Gains: Foreign-Currency Transaction Gain $9800

B)Other Gains: Foreign-Currency Transaction Gain, net $8400

C)Other Comprehensive Income: Foreign-Currency Transaction Gain $9800 and Other Comprehensive Loss: Foreign-Currency Transaction Loss $1400

D)Other Comprehensive Income: Foreign-Currency Transaction Gain, net $8400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

33

A company has a foreign-currency transaction gain of $500 and a foreign-currency transaction loss of $9500. How is this information reported on the income statement?

A)Other Losses: Foreign-Currency Transaction Loss $9500 and Other Gains: Foreign-Currency Transaction Gain $500

B)Other Losses: Foreign-Currency Transaction Loss, net $9000

C)Other Comprehensive Loss: Foreign-Currency Transaction Loss $9500 and Other Comprehensive Income: Foreign-Currency Transaction Gain $500

D)Other Comprehensive Loss: Foreign-Currency Transaction Loss, net $9000

A)Other Losses: Foreign-Currency Transaction Loss $9500 and Other Gains: Foreign-Currency Transaction Gain $500

B)Other Losses: Foreign-Currency Transaction Loss, net $9000

C)Other Comprehensive Loss: Foreign-Currency Transaction Loss $9500 and Other Comprehensive Income: Foreign-Currency Transaction Gain $500

D)Other Comprehensive Loss: Foreign-Currency Transaction Loss, net $9000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

34

A company with a payable denominated in a foreign currency wants the dollar to become weaker because the payment then costs fewer dollars when the transaction is settled.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

35

Hedging enables an entity to protect itself from losing money in a foreign transaction by engaging in a counterbalancing transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

36

Foreign-currency transaction gains and losses are reported as part of operating income because they arise from the company's main business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

37

Foreign-currency transaction losses can be avoided if international transactions are settled in U.S. dollars instead of the foreign currency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

38

Maintaining control of costs is usually accomplished through each of the following EXCEPT:

A)development of effective marketing strategies.

B)establishment of a consistent supply chain for inventory purchases.

C)constantly changing vendors in search for the lowest prices.

D)effectively negotiating leases for new and established retail store locations.

A)development of effective marketing strategies.

B)establishment of a consistent supply chain for inventory purchases.

C)constantly changing vendors in search for the lowest prices.

D)effectively negotiating leases for new and established retail store locations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

39

Financial statement fraud involving expense recognition involves:

A)understating the amount of expenses.

B)failure to record and disclose some expenses.

C)delaying the proper recognition of expenses.

D)all of the above.

A)understating the amount of expenses.

B)failure to record and disclose some expenses.

C)delaying the proper recognition of expenses.

D)all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

40

On August 1, Deluka Computers, Inc. purchased thirty computer chips, on account, from a company located in Taiwan for 520,000 Taiwan dollars. On that date the Taiwan dollar is worth $0.038. On September 1, when the Taiwan dollar was worth $0.04, payment was made. Deluka Computers uses the perpetual inventory system. The journal entry on August 1 by Deluka Computers, Inc. would be: (Round your final answer to the nearest dollar.)

A)debit Inventory $20,800 and credit Accounts Payable $20,800.

B)debit Inventory $19,760 and credit Accounts Payable $19,760.

C)debit Inventory $19,760, credit Foreign-Currency Transaction Gain -$1040, and credit Accounts Payable $20,800.

D)debit Inventory $19,760 and credit Cash $19,760.

A)debit Inventory $20,800 and credit Accounts Payable $20,800.

B)debit Inventory $19,760 and credit Accounts Payable $19,760.

C)debit Inventory $19,760, credit Foreign-Currency Transaction Gain -$1040, and credit Accounts Payable $20,800.

D)debit Inventory $19,760 and credit Cash $19,760.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

41

Hedging foreign currency transactions can be accomplished by:

A)maintaining equal amounts of receivables and payables in foreign currencies.

B)purchasing future contracts.

C)purchase foreign currencies to be received in the future.

D)all of the above.

A)maintaining equal amounts of receivables and payables in foreign currencies.

B)purchasing future contracts.

C)purchase foreign currencies to be received in the future.

D)all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

42

The estimated value of a share of a company's stock is less than the current market price per share. Based on this information, the investment decision rule is to:

A)buy the company's stock.

B)hold the company's stock.

C)sell the company's stock.

D)sell the company's stock on the margin.

A)buy the company's stock.

B)hold the company's stock.

C)sell the company's stock.

D)sell the company's stock on the margin.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

43

Income tax payable is computed by multiplying income before income taxes, from the income statement, by the income tax rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

44

When a company discontinues a segment of its business, the income statement should report income (loss)from continuing operations and income (loss)from discontinued operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

45

Taxable income should always equal pretax accounting income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

46

One reason why taxable income and pretax accounting income may not be equal is due to the difference in depreciation methods used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

47

A prior-period adjustment is made to the ending balance of retained earnings in the current period's statement of stockholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

48

Financial analysts typically include discontinued operations in predictions of future corporate income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

49

Income tax payable appears on the:

A)statement of retained earnings.

B)statement of stockholders' equity.

C)income statement.

D)balance sheet.

A)statement of retained earnings.

B)statement of stockholders' equity.

C)income statement.

D)balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

50

Western Corporation has taxable income of $420,000 and pretax accounting income of $200,000. The company's income tax rate is 20%. The journal entry to record the income tax includes a:

A)debit to Income Tax Expense $84,000.

B)credit to Deferred Tax Asset $44,000.

C)debit to Deferred Tax Asset $44,000.

D)credit to Income Tax Payable $40,000.

A)debit to Income Tax Expense $84,000.

B)credit to Deferred Tax Asset $44,000.

C)debit to Deferred Tax Asset $44,000.

D)credit to Income Tax Payable $40,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

51

Income tax expense appears on the:

A)tax return.

B)statement of stockholders' equity.

C)income statement.

D)balance sheet.

A)tax return.

B)statement of stockholders' equity.

C)income statement.

D)balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

52

Income tax expense is a component of income from operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

53

The weighted-average cost of capital is influenced by the risk that a company might not be able to sustain a certain rate of return into the indefinite future.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

54

Eastwich Corporation has pretax accounting income of $5,900,000 and taxable income of $5,820,000. The company's income tax rate is 20%. The journal entry to record the income tax includes a:

A)debit to Deferred Tax Asset $16,000.

B)credit Income Tax Payable $1,180,000.

C)credit to Deferred Tax Liability $16,000.

D)debit Income Tax Expense $1,164,000.

A)debit to Deferred Tax Asset $16,000.

B)credit Income Tax Payable $1,180,000.

C)credit to Deferred Tax Liability $16,000.

D)debit Income Tax Expense $1,164,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

55

Income tax payable is the amount of tax to be paid to the government based on the income tax return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

56

Which of the following statements is TRUE?

A)Income tax payable is the amount of tax to be paid to the government based on the company's financial statements.

B)When income tax payable exceeds income tax expense, the company debits a Deferred Tax Asset.

C)Deferred Tax Liability is usually shown on the balance sheet as a current liability.

D)The income tax return and the income statement are identical.

A)Income tax payable is the amount of tax to be paid to the government based on the company's financial statements.

B)When income tax payable exceeds income tax expense, the company debits a Deferred Tax Asset.

C)Deferred Tax Liability is usually shown on the balance sheet as a current liability.

D)The income tax return and the income statement are identical.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

57

The formula to determine income tax payable is:

A)taxable income (from the income tax return)multiplied by the income tax rate.

B)taxable income(from the income statement)multiplied by the income tax rate.

C)income before income tax expense (from the tax return)multiplied by the income tax rate.

D)income before income tax expense (from the income statement)multiplied by the income tax rate.

A)taxable income (from the income tax return)multiplied by the income tax rate.

B)taxable income(from the income statement)multiplied by the income tax rate.

C)income before income tax expense (from the tax return)multiplied by the income tax rate.

D)income before income tax expense (from the income statement)multiplied by the income tax rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

58

Assume it is the first year of operations. When pretax accounting income exceeds taxable income, a:

A)Deferred Tax Asset is debited.

B)Deferred Tax Liability is credited.

C)Deferred Tax Asset is credited.

D)Deferred Tax Liability is debited.

A)Deferred Tax Asset is debited.

B)Deferred Tax Liability is credited.

C)Deferred Tax Asset is credited.

D)Deferred Tax Liability is debited.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

59

Common stock should be purchased if the estimated value of a company exceeds its current market value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

60

The formula to determine income tax expense is:

A)taxable income (from the income tax return)multiplied by the income tax rate.

B)taxable income(from the income statement)multiplied by the income tax rate.

C)income before income tax expense (from the tax return)multiplied by the income tax rate.

D)income before income tax expense (from the income statement)multiplied by the income tax rate.

A)taxable income (from the income tax return)multiplied by the income tax rate.

B)taxable income(from the income statement)multiplied by the income tax rate.

C)income before income tax expense (from the tax return)multiplied by the income tax rate.

D)income before income tax expense (from the income statement)multiplied by the income tax rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

61

The estimated value of a company is $18 million. The company has 2 million shares outstanding at a market price of $10 per share. You already own 1,000 shares of the stock. Based on this information, the investment decision rule is:

A)You should buy more shares of the stock.

B)You should hold the stock for now.

C)You should sell the stock.

D)There is not enough information to make a decision.

A)You should buy more shares of the stock.

B)You should hold the stock for now.

C)You should sell the stock.

D)There is not enough information to make a decision.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

62

Which of the following statements is INCORRECT?

A)The balance sheet caption "Discontinued Operations" includes both operating income or loss of the segment during the divestiture period and gains or losses on the transaction at the point of sale of the segment.

B)Income from discontinued operations is a component of net income.

C)All gains and losses from discontinued operations are shown "net of tax."

D)Financial analysts typically do not include discontinued operations in predictions of future corporate income because the discontinued segments will not continue to generate income for the business.

A)The balance sheet caption "Discontinued Operations" includes both operating income or loss of the segment during the divestiture period and gains or losses on the transaction at the point of sale of the segment.

B)Income from discontinued operations is a component of net income.

C)All gains and losses from discontinued operations are shown "net of tax."

D)Financial analysts typically do not include discontinued operations in predictions of future corporate income because the discontinued segments will not continue to generate income for the business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

63

Earnings per share is used to help determine the value of a share of common stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

64

Earnings per share is calculated:

A)only for preferred stock.

B)only for common stock.

C)for common and preferred stock.

D)only for treasury stock.

A)only for preferred stock.

B)only for common stock.

C)for common and preferred stock.

D)only for treasury stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

65

Earnings per share shows how much income a company earned for each share of common stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

66

Katherine's Fashions is going to discontinue one of its manufacturing divisions. The division's assets with a book value of $1,010,000 are sold for $80,000. The division generated an operating loss of $1,480,000 after the decision was made to discontinue the segment. Ignoring income taxes, what total amount should be reported on the income statement as discontinued operations?

A)$550,000 loss

B)$930,000 loss

C)$2,410,000 loss

D)$1,480,000 gain

A)$550,000 loss

B)$930,000 loss

C)$2,410,000 loss

D)$1,480,000 gain

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

67

Accounting changes:

A)make it difficult to compare one period with preceding periods.

B)require detailed information to keep investors from being misled.

C)may result when companies discover errors they have made in applying accounting principles that must be corrected.

D)all of the above statements are correct.

A)make it difficult to compare one period with preceding periods.

B)require detailed information to keep investors from being misled.

C)may result when companies discover errors they have made in applying accounting principles that must be corrected.

D)all of the above statements are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

68

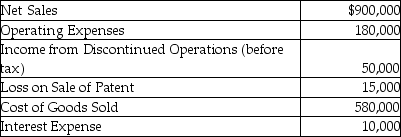

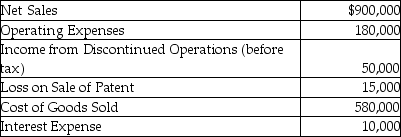

Prepare a multistep income statement for Sterner Corporation for the year ending December 31, 2017. The tax rate for Sterner Corporation is 30%. Omit earnings per share. The following information is available:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

69

The loss incurred as a result of the impairment of goodwill should be reported as:

A)part of discontinued operations.

B)an operating expense.

C)other expenses and losses.

D)an extraordinary item.

A)part of discontinued operations.

B)an operating expense.

C)other expenses and losses.

D)an extraordinary item.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

70

For a retailer, how is Interest Expense classified on a multistep income statement?

A)Operating Expenses

B)Selling Expense

C)Financing Expense

D)Other Expenses and Losses

A)Operating Expenses

B)Selling Expense

C)Financing Expense

D)Other Expenses and Losses

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

71

Changes in accounting principles include changes:

A)from FIFO to average cost for inventory.

B)required because the FASB issues new accounting pronouncements.

C)to the estimated useful life of a building.

D)A and B.

A)from FIFO to average cost for inventory.

B)required because the FASB issues new accounting pronouncements.

C)to the estimated useful life of a building.

D)A and B.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

72

Earnings per share (EPS)is calculated as:

A)net income divided by the number of shares of common stock issued at the end of the year.

B)net income divided by the number of shares of common stock outstanding at the end of the year.

C)net income divided by the weighted-average number of shares of common stock outstanding throughout the year.

D)net income divided by the weighted-average number of shares of common stock issued throughout the year.

A)net income divided by the number of shares of common stock issued at the end of the year.

B)net income divided by the number of shares of common stock outstanding at the end of the year.

C)net income divided by the weighted-average number of shares of common stock outstanding throughout the year.

D)net income divided by the weighted-average number of shares of common stock issued throughout the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

73

Assume it is the first year of operations. When taxable income exceeds pretax accounting income, accountants record a(n):

A)Deferred Tax Asset.

B)Deferred Tax Liability.

C)Income Tax Payable.

D)Prepaid Income Taxes.

A)Deferred Tax Asset.

B)Deferred Tax Liability.

C)Income Tax Payable.

D)Prepaid Income Taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

74

The weighted-average number of shares of common stock outstanding takes into account the changes that might occur in:

A)treasury stock purchases or reissuances.

B)the acquisition of stock classified as trading securities.

C)the issuance of additional shares of preferred stock.

D)none of the above.

A)treasury stock purchases or reissuances.

B)the acquisition of stock classified as trading securities.

C)the issuance of additional shares of preferred stock.

D)none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

75

Diluted earnings per share takes into account potential decreases in outstanding shares of common stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

76

Following U.S. Generally Accepted Accounting Principles, how is a change in accounting estimate handled?

A)The new estimate must be used in the current and future years only.

B)The new estimate must be used in the prior year financial statements only.

C)The new estimate must be used in the future years only.

D)The new estimate must be used in the prior, current and future years.

A)The new estimate must be used in the current and future years only.

B)The new estimate must be used in the prior year financial statements only.

C)The new estimate must be used in the future years only.

D)The new estimate must be used in the prior, current and future years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

77

When calculating earnings per share, preferred dividends are:

A)added to net income in the numerator of the EPS calculation.

B)added to common shares in the denominator of the EPS calculation.

C)subtracted from common shares in the denominator of the EPS calculation.

D)subtracted from net income in the numerator of the EPS calculation.

A)added to net income in the numerator of the EPS calculation.

B)added to common shares in the denominator of the EPS calculation.

C)subtracted from common shares in the denominator of the EPS calculation.

D)subtracted from net income in the numerator of the EPS calculation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

78

The gain or loss on the disposal of a business segment is shown on the income statement as:

A)part of comprehensive income.

B)part of discontinued operations

C)part of continuing operations.

D)other gains or losses.

A)part of comprehensive income.

B)part of discontinued operations

C)part of continuing operations.

D)other gains or losses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

79

For a merchandiser, how is Interest Revenue classified on the income statement?

A)Income from Discontinued Operations

B)Income from Financing Activities

C)Other Revenues and Gains

D)As a component of Net Sales Revenue

A)Income from Discontinued Operations

B)Income from Financing Activities

C)Other Revenues and Gains

D)As a component of Net Sales Revenue

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

80

The loss from discontinued operations includes:

A)operating loss of discontinued segment during divestiture period.

B)loss on sale of discontinued segment.

C)unusual and infrequent losses.from other segments of the company.

D)A and B.

A)operating loss of discontinued segment during divestiture period.

B)loss on sale of discontinued segment.

C)unusual and infrequent losses.from other segments of the company.

D)A and B.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck