Deck 7: Plant Assets, Natural Resources, Intangibles

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/194

العب

ملء الشاشة (f)

Deck 7: Plant Assets, Natural Resources, Intangibles

1

If a company buys a building and the surrounding land for cash, total assets increase.

False

2

Which of the following should be included in the cost of land improvements?

A)fencing

B)sprinkler system for the landscaping

C)driveways

D)all of the above

A)fencing

B)sprinkler system for the landscaping

C)driveways

D)all of the above

D

3

Leasehold improvements are not subject to depreciation or amortization.

False

4

Which of the following statements is INCORRECT?

A)The cost of land includes fencing and paving.

B)The cost of any asset is the sum of all the costs incurred to bring the asset to its intended use.

C)The cost of leasehold improvements should be amortized over the shorter of the useful life or the term of the lease.

D)All of the above statements are correct.

A)The cost of land includes fencing and paving.

B)The cost of any asset is the sum of all the costs incurred to bring the asset to its intended use.

C)The cost of leasehold improvements should be amortized over the shorter of the useful life or the term of the lease.

D)All of the above statements are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

5

Major Company purchased equipment to be used in its distribution center. All of the following should be included in the cost of the equipment EXCEPT for:

A)insurance while in transit.

B)wages of workers who test the equipment before it is placed in service.

C)employee training costs before the equipment is placed in service.

D)insurance costs after the equipment is up and running.

A)insurance while in transit.

B)wages of workers who test the equipment before it is placed in service.

C)employee training costs before the equipment is placed in service.

D)insurance costs after the equipment is up and running.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

6

Land, a building and equipment are acquired for a lump sum of $6,000,000. The market values of the land, building and equipment are $400,000, $800,000 and $300,000, respectively. What is the cost assigned to the equipment? (Do not round any intermediary calculations, and round your final answer to the nearest dollar.)

A)$500,000

B)$1,200,000

C)$300,000

D)$2,000,000

A)$500,000

B)$1,200,000

C)$300,000

D)$2,000,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

7

Land is purchased for $400,000. Back taxes paid by the purchaser were $6900; total costs to demolish an existing building were $13,000 and the cost to clear the land was $18,000. The cost of paving the parking lot was $7200. The cost of land is ________ and the cost of land improvements is ________.

A)$419,900; $25,200

B)$437,900; $7200

C)$445,100; $0

D)$438,200; $6900

A)$419,900; $25,200

B)$437,900; $7200

C)$445,100; $0

D)$438,200; $6900

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

8

The cost of land includes the cost of any back property taxes that the purchaser pays.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

9

The long-term asset that is not depreciated or amortized is:

A)land improvement.

B)leasehold improvement.

C)office computers.

D)land.

A)land improvement.

B)leasehold improvement.

C)office computers.

D)land.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

10

The cost of installing lights in a company's parking lot should be recorded as a cost of:

A)land.

B)land improvements.

C)leasehold improvements.

D)leaseholds.

A)land.

B)land improvements.

C)leasehold improvements.

D)leaseholds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

11

The ________ method is used to allocate the cost of multiple assets acquired in a basket purchase.

A)book-value

B)cost

C)gross margin ratio

D)relative-sales-value

A)book-value

B)cost

C)gross margin ratio

D)relative-sales-value

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

12

The installation costs for a new machine should be part of the cost of the machine and should be depreciated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

13

Jimmy Company leased a delivery van for payments of $6000 per year for three years. In addition, Jimmy Company also paid $1300 for new larger windows in the van and spent $4400 for special storage racks for the van. Leasehold Improvements equal:

A)$6000.

B)$1300.

C)$4400.

D)$5700.

A)$6000.

B)$1300.

C)$4400.

D)$5700.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

14

Minor Company purchased land and which is being prepared for the construction of a new office building. Which of the following should be included in the cost of the land?

A)cost of removing an old building

B)cost of clearing and grading the land

C)cost of the fence which surrounds the property

D)A and B

A)cost of removing an old building

B)cost of clearing and grading the land

C)cost of the fence which surrounds the property

D)A and B

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

15

The costs assigned to the Land account include legal fees, survey fees, and expenditures for grading and clearing the land.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

16

Gengler Company acquired three pieces of equipment for $1,600,000. Equipment #1 is appraised at $740,000, equipment #2 is appraised at $560,000 and equipment #3 is appraised for $720,000. The cost of equipment #1 is: (Do not round any intermediary calculations, and round your final answer to the nearest dollar.)

A)$342,250.

B)$271,089.

C)$586,139.

D)$740,000.

A)$342,250.

B)$271,089.

C)$586,139.

D)$740,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

17

ABC Company purchased land with an old building. ABC plans to demolish the old building and then construct a new, modern building. The cost of demolishing the building will be part of the cost of the:

A)new building.

B)old building.

C)land.

D)land improvements.

A)new building.

B)old building.

C)land.

D)land improvements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

18

A lump-sum purchase of multiple, long-term plant assets requires the company to:

A)record the assets purchased as a single asset.

B)divide the total cost among the various assets according to values estimated by the company's management.

C)divide the total cost among the various assets according to their market values.

D)divide the total cost among the various assets according to their book values.

A)record the assets purchased as a single asset.

B)divide the total cost among the various assets according to values estimated by the company's management.

C)divide the total cost among the various assets according to their market values.

D)divide the total cost among the various assets according to their book values.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

19

The cost of land includes the cost of fencing the property and paving the parking lot on the land.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

20

The cost of a new building includes the cost to demolish and remove an old building on the same site as the new building.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

21

A machine is purchased for $80,000. The transportation from the seller was $1000, installation costs were $1000 and taxes on the purchase price were $400. Testing runs of the new machine cost $2000. What is the cost of the machine?

A)$80,000

B)$82,000

C)$82,400

D)$84,400

A)$80,000

B)$82,000

C)$82,400

D)$84,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

22

Expenditures that extend a plant asset's useful life should be capitalized.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

23

The distinction between a capital expenditure and an immediate expense for a plant asset requires judgment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

24

Capital expenditures are not immediately expensed because these items:

A)extend the useful life of a plant asset.

B)return a plant asset to its prior condition.

C)decrease the plant asset's capacity.

D)maintain a plant asset in working condition.

A)extend the useful life of a plant asset.

B)return a plant asset to its prior condition.

C)decrease the plant asset's capacity.

D)maintain a plant asset in working condition.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

25

On January 1, 2017, Roadway Delivery Company purchased a truck for $20,000. Depreciation Expense is $2000 per year. During the first year of use, the company paid $2000 to repaint the truck and $1100 for new tires. What is the total expense for the year ended December 31, 2017?

A)$2000

B)$4000

C)$3100

D)$5100

A)$2000

B)$4000

C)$3100

D)$5100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

26

On June 1, Roadway's Trucking Company paid $7000 to overhaul the engine on a delivery truck to allow it to be used for two additional years. It also paid $8500 to change the storage capacity of the truck so that it could haul more merchandise. Which of the following statements is TRUE?

A)The $7000 is a capital expenditure and the $8500 is an expense.

B)The $7000 is an expense and the $8500 is a capital expenditure.

C)Both items are capital expenditures.

D)Both items are expenses.

A)The $7000 is a capital expenditure and the $8500 is an expense.

B)The $7000 is an expense and the $8500 is a capital expenditure.

C)Both items are capital expenditures.

D)Both items are expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which of the following is NOT included in the cost of a building that was constructed by the company?

A)interest on money borrowed to finance the construction

B)cost of removing an unwanted building from the property

C)architectural fees

D)payments for material, labor and overhead

A)interest on money borrowed to finance the construction

B)cost of removing an unwanted building from the property

C)architectural fees

D)payments for material, labor and overhead

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

28

Barbarino Corporation purchased land and a building for $1,200,000. An appraisal indicates that the land's market value is $500,000 and the building's market value is $1,000,000. When recording this transaction Barbarino should debit: (Do not round any intermediary calculations, and round your final answer to the nearest dollar.)

A)Land for $500,000.

B)Land for $400,000.

C)Building for $1,000,000.

D)Building for $1,200,000.

A)Land for $500,000.

B)Land for $400,000.

C)Building for $1,000,000.

D)Building for $1,200,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

29

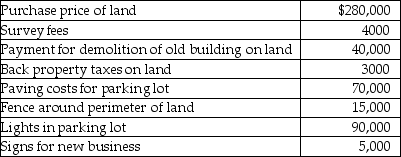

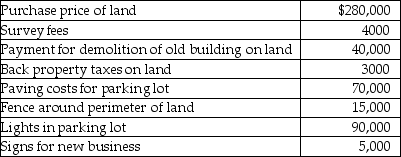

A company incurred the following costs:  What is the cost of the land?

What is the cost of the land?

A)$280,000

B)$327,000

C)$397,000

D)$324,000

What is the cost of the land?

What is the cost of the land?A)$280,000

B)$327,000

C)$397,000

D)$324,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

30

Pat's Pets recently paid $15,000 to have the engine in its delivery van overhauled. The estimated useful life of the van was originally estimated to be 4 years. The overhaul is expected to extend the useful life of the van to 10 years. The overhaul is regarded as a(n):

A)revenue expenditure.

B)capital expenditure.

C)equity expenditure.

D)The answer depends on management's judgment.

A)revenue expenditure.

B)capital expenditure.

C)equity expenditure.

D)The answer depends on management's judgment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

31

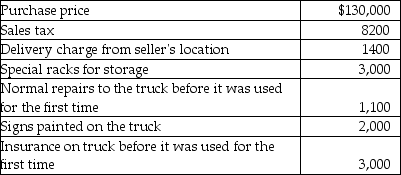

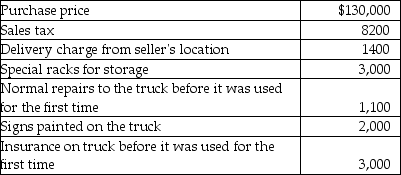

A company incurred the following costs for a new delivery truck:  What is the cost of the delivery truck?

What is the cost of the delivery truck?

A)$139,600

B)$141,600

C)$144,600

D)$148,700

What is the cost of the delivery truck?

What is the cost of the delivery truck?A)$139,600

B)$141,600

C)$144,600

D)$148,700

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

32

Auto Shop, Inc., incurred the following costs in acquiring plant assets:

a. Purchased land with a $100,000 down payment and signed a $75,000 note payable for the balance.

b. Delinquent property tax of $2,500 and legal fees of $1,000 had to be paid before the land could be purchased.

c. $12,000 was paid to demolish an unwanted building on the land.

d. Architect fee of $7,000 was paid for the design of a new office building.

e. An office building was constructed at a cost of $500,000. A long-term note payable was used to pay for the cost.

f. $17,500 was paid for fencing around the new building. $55,000 was paid for paving the parking lot by the new building.

g. $20,000 was paid for lights in the new parking lot.

h. $10,000 was paid for a sprinkler system for the bushes and grass.

Required:

Prepare journal entries for the above transactions. Explanations are not required.

a. Purchased land with a $100,000 down payment and signed a $75,000 note payable for the balance.

b. Delinquent property tax of $2,500 and legal fees of $1,000 had to be paid before the land could be purchased.

c. $12,000 was paid to demolish an unwanted building on the land.

d. Architect fee of $7,000 was paid for the design of a new office building.

e. An office building was constructed at a cost of $500,000. A long-term note payable was used to pay for the cost.

f. $17,500 was paid for fencing around the new building. $55,000 was paid for paving the parking lot by the new building.

g. $20,000 was paid for lights in the new parking lot.

h. $10,000 was paid for a sprinkler system for the bushes and grass.

Required:

Prepare journal entries for the above transactions. Explanations are not required.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

33

The Manson Company purchased assets for a lump-sum price of $1,000,000. An appraisal indicates the following market prices:

Equipment $560,000

Land $210,000

Building $630,000

Prepare the appropriate journal entry if Manson Company paid cash for this transaction.

Equipment $560,000

Land $210,000

Building $630,000

Prepare the appropriate journal entry if Manson Company paid cash for this transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

34

Costs that do not extend a plant asset's capacity or its useful life, but merely maintain the asset or restore it to working order are recorded as:

A)capital expenditures.

B)expenses.

C)extraordinary repairs.

D)modification of assets.

A)capital expenditures.

B)expenses.

C)extraordinary repairs.

D)modification of assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

35

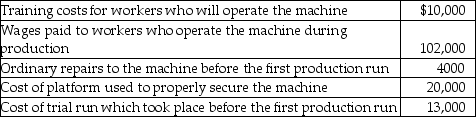

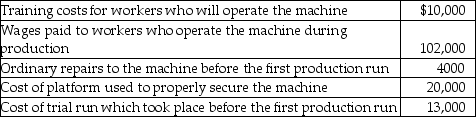

Dorman Company purchased a new machine for its production process. The following costs were incurred for the new machine:  Which costs should be added to the cost of the machine?

Which costs should be added to the cost of the machine?

A)$10,000

B)$30,000

C)$47,000

D)$149,000

Which costs should be added to the cost of the machine?

Which costs should be added to the cost of the machine?A)$10,000

B)$30,000

C)$47,000

D)$149,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

36

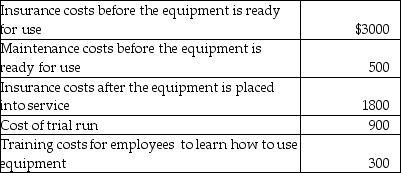

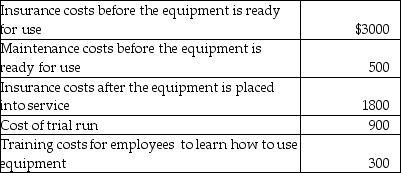

Miscellaneous costs associated with the purchase of new equipment include:  What is the amount assigned to the new equipment?

What is the amount assigned to the new equipment?

A)$4200

B)$4400

C)$4700

D)$6500

What is the amount assigned to the new equipment?

What is the amount assigned to the new equipment?A)$4200

B)$4400

C)$4700

D)$6500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

37

Morgan Oaks Company replaced the windshields and painted several of its vehicles during the year. These costs should be:

A)debited to Equipment.

B)depreciated over the life of the vehicles.

C)credited to Accumulated Depreciation.

D)debited to Repair Expense.

A)debited to Equipment.

B)depreciated over the life of the vehicles.

C)credited to Accumulated Depreciation.

D)debited to Repair Expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

38

The journal entry to record an addition to an office building would include:

A)credit to Depreciation Expense.

B)credit to Accumulated Depreciation.

C)debit to Repair Expense.

D)debit to Office Building.

A)credit to Depreciation Expense.

B)credit to Accumulated Depreciation.

C)debit to Repair Expense.

D)debit to Office Building.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

39

Land improvements include expenditures for:

A)paving the parking lot.

B)grading and clearing the land.

C)removing an unwanted building.

D)all of the above.

A)paving the parking lot.

B)grading and clearing the land.

C)removing an unwanted building.

D)all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

40

Which of the following costs associated with a delivery van should NOT be capitalized?

A)The van's engine is overhauled and this will extend the useful life by five years.

B)The van is modified so it can be used for multiple purposes in the business.

C)The van is repainted.

D)All of the above items should be capitalized.

A)The van's engine is overhauled and this will extend the useful life by five years.

B)The van is modified so it can be used for multiple purposes in the business.

C)The van is repainted.

D)All of the above items should be capitalized.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

41

A conservative policy with regard to capitalizing or expensing costs associated with plant assets avoids ________.

A)understating profits and assets

B)overstating profits and assets

C)overstating profits and understating assets

D)understating profits and overstating assets

A)understating profits and assets

B)overstating profits and assets

C)overstating profits and understating assets

D)understating profits and overstating assets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

42

If a company capitalizes a cost that should have been expensed:

A)expenses and net income will be overstated in the year of the error.

B)expenses and net income will be understated in the year of the error.

C)expenses will be overstated and net income will be understated in the year of the error.

D)expenses will be understated and net income will be overstated in the year of the error.

A)expenses and net income will be overstated in the year of the error.

B)expenses and net income will be understated in the year of the error.

C)expenses will be overstated and net income will be understated in the year of the error.

D)expenses will be understated and net income will be overstated in the year of the error.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

43

Under the double-declining-balance method of depreciation, residual value is initially ignored.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

44

Costs that maintain a plant asset in its present condition should be ________. Costs that restore a plant asset to working order or its prior condition should be ________.

A)capitalized; capitalized

B)capitalized; expensed

C)expensed; capitalized

D)expensed; expensed

A)capitalized; capitalized

B)capitalized; expensed

C)expensed; capitalized

D)expensed; expensed

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

45

The normal balance of the Accumulated Depreciation account is a debit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

46

When compared to the accelerated depreciation methods, the use of the straight-line method increases a company's tax liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

47

State the general rule that is used to determine whether costs relating to plant assets should be capitalized or expensed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

48

WorldCom's fraudulent scheme of capitalizing telephone line costs instead of expensing them was discovered by:

A)external auditors.

B)astute investors.

C)U.S. Securities and Exchange Commission.

D)internal auditors.

A)external auditors.

B)astute investors.

C)U.S. Securities and Exchange Commission.

D)internal auditors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

49

The Accumulated Depreciation account is an income statement account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

50

Obsolescence may cause an asset's useful life to be longer than the asset's physical life.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

51

Book value of a plant asset equals the cost of the asset less the current year's depreciation expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

52

Treating a capital expenditure as an immediate expense:

A)overstates assets and stockholders' equity in the year of the error.

B)understates assets and stockholders' equity in the year of the error.

C)understates assets and overstates stockholders' equity in the year of the error.

D)overstates assets and understates stockholders' equity in the year of the error.

A)overstates assets and stockholders' equity in the year of the error.

B)understates assets and stockholders' equity in the year of the error.

C)understates assets and overstates stockholders' equity in the year of the error.

D)overstates assets and understates stockholders' equity in the year of the error.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

53

In the units-of-production method, a fixed amount of depreciation expense is assigned to each unit of output.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

54

Which of the following statements is INCORRECT?

A)The rules for determining whether a cost should be expensed or capitalized are so complete and clear that judgment is not needed.

B)Capital expenditures are capitalized when the cost is added to an asset account.

C)Most companies expense all small (immaterial)costs regardless of whether the costs are capital in nature.

D)An expense merely maintains the asset in its present condition or restores it to working order.

A)The rules for determining whether a cost should be expensed or capitalized are so complete and clear that judgment is not needed.

B)Capital expenditures are capitalized when the cost is added to an asset account.

C)Most companies expense all small (immaterial)costs regardless of whether the costs are capital in nature.

D)An expense merely maintains the asset in its present condition or restores it to working order.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

55

At the end of its useful life, the book value of an asset must be zero.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

56

The depreciation process follows the ________ principle.

A)revenue recognition

B)expense recognition

C)disclosure

D)consistency

A)revenue recognition

B)expense recognition

C)disclosure

D)consistency

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

57

The book value of an asset cannot be less than its residual value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

58

Which of the following costs for a delivery vehicle should NOT be capitalized?

A)repair dented fender

B)service air conditioning system

C)repair air conditioning system

D)all of the above

A)repair dented fender

B)service air conditioning system

C)repair air conditioning system

D)all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

59

The depreciation process follows the revenue recognition principle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

60

Depreciation expense decreases both assets and stockholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

61

When compared to the other methods of depreciation, the double-declining-balance method of depreciation gives depreciation expense that is:

A)less in the earlier periods.

B)higher in the earlier periods.

C)approximately the same in earlier periods as with other methods.

D)the same from year to year.

A)less in the earlier periods.

B)higher in the earlier periods.

C)approximately the same in earlier periods as with other methods.

D)the same from year to year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

62

A depreciation method in which an equal amount of depreciation expense is assigned to each year of the asset's use is the:

A)units-of-production method.

B)straight-line method.

C)accelerated depreciation method.

D)estimated residual value method.

A)units-of-production method.

B)straight-line method.

C)accelerated depreciation method.

D)estimated residual value method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

63

When using straight-line depreciation to compute depreciation for a partial year:

A)compute depreciation for a full year under straight-line depreciation and multiply it by 50%.

B)compute depreciation for a full year under straight-line depreciation and use that amount.

C)the straight-line method automatically adjusts for partial periods, so no adjustments are needed.

D)compute depreciation for a full year under straight-line depreciation and multiply it by the fraction of the year that you held the asset.

A)compute depreciation for a full year under straight-line depreciation and multiply it by 50%.

B)compute depreciation for a full year under straight-line depreciation and use that amount.

C)the straight-line method automatically adjusts for partial periods, so no adjustments are needed.

D)compute depreciation for a full year under straight-line depreciation and multiply it by the fraction of the year that you held the asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

64

Cost minus residual value divided by useful life, in years, is the formula for the:

A)straight-line method.

B)units-of-production method.

C)double-declining-balance method.

D)modified accelerated cost recovery method.

A)straight-line method.

B)units-of-production method.

C)double-declining-balance method.

D)modified accelerated cost recovery method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

65

The depreciable cost of a plant asset equals the:

A)historical cost of the asset plus the estimated residual value.

B)historical cost of the asset minus the estimated residual value.

C)historical cost of the asset minus accumulated depreciation.

D)current replacement cost minus accumulated depreciation.

A)historical cost of the asset plus the estimated residual value.

B)historical cost of the asset minus the estimated residual value.

C)historical cost of the asset minus accumulated depreciation.

D)current replacement cost minus accumulated depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

66

On January 2, 2017, Konrad Corporation acquired equipment for $760,000. The estimated life of the equipment is 5 years or 37,000 hours. The estimated residual value is $20,000. If Konrad Corporation uses the units of production method of depreciation, what will be the debit to Depreciation Expense for the year ended December 31, 2018, assuming that during this period, the asset was used 5000 hours?

A)$102,703

B)$148,000.00

C)$100,000.00

D)$105,405

A)$102,703

B)$148,000.00

C)$100,000.00

D)$105,405

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

67

On January 2, 2017, Kaiman Corporation acquired equipment for $700,000. The estimated life of the equipment is 5 years or 100,000 hours. The estimated residual value is $10,000. What is the balance in Accumulated Depreciation on December 31, 2018, if Kaiman Corporation uses the straight-line method of depreciation?

A)$140,000

B)$138,000

C)$276,000

D)$280,000

A)$140,000

B)$138,000

C)$276,000

D)$280,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

68

Which of the following depreciation methods best applies to those assets that generate greater revenue earlier in their useful lives?

A)straight-line method

B)depletion method

C)double-declining-balance method

D)units-of-production method

A)straight-line method

B)depletion method

C)double-declining-balance method

D)units-of-production method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

69

The book value of a plant asset is defined as:

A)historical cost minus estimated residual value.

B)historical cost minus accumulated deprecation.

C)current sales value minus historical cost.

D)replacement cost minus accumulated depreciation.

A)historical cost minus estimated residual value.

B)historical cost minus accumulated deprecation.

C)current sales value minus historical cost.

D)replacement cost minus accumulated depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

70

Which of the following is an accurate statement regarding financial statement and income tax depreciation methods?

A)Straight-line depreciation is the most popular method for income tax purposes.

B)The IRS has its own set of rules to compute depreciation for income tax purposes.

C)The Modified Accelerated Cost Recovery System can be used for both financial statement and income tax purposes.

D)If an accelerated depreciation method is used for income tax purposes, a company will pay more in income taxes.

A)Straight-line depreciation is the most popular method for income tax purposes.

B)The IRS has its own set of rules to compute depreciation for income tax purposes.

C)The Modified Accelerated Cost Recovery System can be used for both financial statement and income tax purposes.

D)If an accelerated depreciation method is used for income tax purposes, a company will pay more in income taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

71

As a plant asset is used in operations:

A)accumulated depreciation increases and the book value of the asset increases.

B)accumulated depreciation increases and the book value of the asset decreases.

C)accumulated depreciation remains the same and the book value of the asset decreases.

D)accumulated depreciation increases and the book value of the asset remains the same.

A)accumulated depreciation increases and the book value of the asset increases.

B)accumulated depreciation increases and the book value of the asset decreases.

C)accumulated depreciation remains the same and the book value of the asset decreases.

D)accumulated depreciation increases and the book value of the asset remains the same.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

72

The expected cash value of a plant asset at the end of its useful life is known as:

A)scrap value.

B)salvage value.

C)estimated residual value.

D)all of the above.

A)scrap value.

B)salvage value.

C)estimated residual value.

D)all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

73

Double-declining-balance depreciation:

A)is an accelerated depreciation method.

B)ignores the residual value in computing depreciation, except during the last year.

C)is based on the book value of the plant asset.

D)is all of the above.

A)is an accelerated depreciation method.

B)ignores the residual value in computing depreciation, except during the last year.

C)is based on the book value of the plant asset.

D)is all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

74

On January 2, 2017, Kellogg Corporation acquired equipment for $800,000. The estimated life of the equipment is 5 years or 80,000 hours. The estimated residual value is $10,000. What is the book value of the asset on December 31, 2018, if Kellogg Corporation uses the straight-line method of depreciation? (Round any intermediary calculations to two decimal places and your final answer to the nearest dollar.)

A)$642,000

B)$484,000

C)$800,000

D)$790,000

A)$642,000

B)$484,000

C)$800,000

D)$790,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

75

The journal entry to record depreciation expense is:

A)debit Depreciation Expense, credit the asset account.

B)debit Accumulated Depreciation, credit the asset account.

C)debit the asset account, credit Accumulated Depreciation.

D)debit Depreciation Expense, credit Accumulated Depreciation.

A)debit Depreciation Expense, credit the asset account.

B)debit Accumulated Depreciation, credit the asset account.

C)debit the asset account, credit Accumulated Depreciation.

D)debit Depreciation Expense, credit Accumulated Depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

76

When computing depreciation using the units-of-production method:

A)a variable amount of depreciation is assigned to each unit of output.

B)a fixed amount of depreciation is assigned to each unit of output.

C)the depreciation expense depends directly on the amount of output or usage.

D)B and C.

A)a variable amount of depreciation is assigned to each unit of output.

B)a fixed amount of depreciation is assigned to each unit of output.

C)the depreciation expense depends directly on the amount of output or usage.

D)B and C.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

77

When a plant asset is fully depreciated:

A)the asset's accumulated depreciation is higher than the historical cost of the asset.

B)the book value is equal to the salvage value.

C)the depreciable cost is equal to the estimated residual value, and the asset is of no further use to the company.

D)the book value is zero and the asset has no market value.

A)the asset's accumulated depreciation is higher than the historical cost of the asset.

B)the book value is equal to the salvage value.

C)the depreciable cost is equal to the estimated residual value, and the asset is of no further use to the company.

D)the book value is zero and the asset has no market value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

78

All of the following are needed to measure depreciation, EXCEPT for:

A)cost.

B)market value.

C)estimated useful life.

D)estimated residual value.

A)cost.

B)market value.

C)estimated useful life.

D)estimated residual value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

79

On January 2, 2017, Kornis Corporation acquired equipment for $800,000. The estimated life of the equipment is 5 years or 100,000 hours. The estimated residual value is $30,000. What is the balance in Accumulated Depreciation on December 31, 2017, if Kornis Corporation uses the double-declining-balance method of depreciation?

A)$154,000

B)$160,000

C)$308,000

D)$320,000

A)$154,000

B)$160,000

C)$308,000

D)$320,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck

80

An asset is ________ when another asset can do the job more efficiently.

A)fully depreciated

B)deteriorated

C)physically worn

D)obsolete

A)fully depreciated

B)deteriorated

C)physically worn

D)obsolete

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 194 في هذه المجموعة.

فتح الحزمة

k this deck