Deck 6: Inventory Cost of Goods Sold

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/168

العب

ملء الشاشة (f)

Deck 6: Inventory Cost of Goods Sold

1

A company will include goods out on consignment in its ending inventory.

True

2

The financial statements of a merchandising company will show:

A)the same accounts as the financial statements of a service company.

B)gross profit after operating expenses on the income statement.

C)inventory as a current asset on the balance sheet.

D)cost of goods sold as a contra revenue account on the income statement.

A)the same accounts as the financial statements of a service company.

B)gross profit after operating expenses on the income statement.

C)inventory as a current asset on the balance sheet.

D)cost of goods sold as a contra revenue account on the income statement.

C

3

The inventory system that uses computer software to keep a running record of inventory on hand is the:

A)cost of goods sold inventory system.

B)periodic inventory system.

C)perpetual inventory system.

D)hybrid inventory system.

A)cost of goods sold inventory system.

B)periodic inventory system.

C)perpetual inventory system.

D)hybrid inventory system.

C

4

Cost of Goods Sold is an operating expense on the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

5

Roadway Company purchases inventory from Fedway Company with the shipping terms FOB destination. This means that:

A)Roadway Company owns the goods while they are in transit.

B)Legal title passes to Roadway Company when the goods leave Fedway's shipping dock.

C)Fedway Company will pay the freight on this transaction.

D)Roadway Company will include the goods in their inventory as soon as they leave Fedway's shipping dock.

A)Roadway Company owns the goods while they are in transit.

B)Legal title passes to Roadway Company when the goods leave Fedway's shipping dock.

C)Fedway Company will pay the freight on this transaction.

D)Roadway Company will include the goods in their inventory as soon as they leave Fedway's shipping dock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

6

The cost of inventory that is still on hand is called:

A)cost of goods sold, an expense that appears on the balance sheet.

B)inventory, a long-term asset that appears on the balance sheet.

C)inventory, a current asset that appears on the balance sheet.

D)purchases, a current asset that appears on the balance sheet.

A)cost of goods sold, an expense that appears on the balance sheet.

B)inventory, a long-term asset that appears on the balance sheet.

C)inventory, a current asset that appears on the balance sheet.

D)purchases, a current asset that appears on the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

7

In a perpetual inventory system, a business maintains a running record of the number of units bought, sold and on hand for each inventory item.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

8

Freight in is accounted for as a delivery expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

9

Another term for gross profit is:

A)gross income.

B)gross sales.

C)gross margin.

D)gross operating income.

A)gross income.

B)gross sales.

C)gross margin.

D)gross operating income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

10

The cost of the inventory that a business has sold to customers is called:

A)inventory.

B)cost of goods sold.

C)purchases.

D)gross profit.

A)inventory.

B)cost of goods sold.

C)purchases.

D)gross profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

11

Inventory is reported on the balance sheet at the selling price of the inventory still on hand.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which is the CORRECT order for items to appear on the income statement?

A)sales revenue, operating expenses, gross profit, net income

B)sales revenue, gross profit, net income, operating expenses

C)sales revenue, gross profit, cost of goods sold, operating expenses

D)sales revenue, cost of goods sold, gross profit, operating expenses

A)sales revenue, operating expenses, gross profit, net income

B)sales revenue, gross profit, net income, operating expenses

C)sales revenue, gross profit, cost of goods sold, operating expenses

D)sales revenue, cost of goods sold, gross profit, operating expenses

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

13

Sales revenue is based on the ________ of the inventory, while cost of goods sold is based on the ________ of the inventory.

A)cost; sale price

B)cost; fair market value

C)sale price; retail price

D)sale price; cost

A)cost; sale price

B)cost; fair market value

C)sale price; retail price

D)sale price; cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

14

The cost of inventory shifts from asset to expense when the seller fulfills its contract with the customer, delivers the goods to the buyer and recognizes revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

15

Since a perpetual inventory system continuously updates the inventory account, a physical inventory count is not necessary to prove the inventory records.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

16

A purchase discount decreases the cost of the inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

17

A periodic inventory system:

A)is used for inexpensive goods.

B)is not expensive to maintain.

C)does not keep a running record of inventory on hand.

D)is all of the above.

A)is used for inexpensive goods.

B)is not expensive to maintain.

C)does not keep a running record of inventory on hand.

D)is all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

18

Service entities report cost of goods sold on the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

19

Two accounts that appear on the financial statements of a merchandising company but are not needed by a service company are:

A)cost of goods sold and depreciation.

B)cost of goods sold and net income.

C)cost of goods sold and inventory.

D)inventory and depreciation.

A)cost of goods sold and depreciation.

B)cost of goods sold and net income.

C)cost of goods sold and inventory.

D)inventory and depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

20

To document approval of purchase returns, management issues a credit memorandum meaning that accounts payable are reduced for the amount of the return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

21

On June 1, Neighbor Company purchased inventory on account with a cost of $5000. The credit terms were 2/10, net 30. On June 2, Neighbor returned 60 percent of the inventory. Neighbor uses the perpetual inventory system. On June 8, Neighbor paid for the inventory. What journal entry did Neighbor Company prepare on June 8?

A)debit Purchase Discount for $40, debit Cash for $1960 and credit Accounts Payable for $2000

B)debit Accounts Payable for $3000 and credit Cash for $3000

C)debit Accounts Payable for $2000 credit Purchase Discount for $40 and credit Cash for $1960

D)debit Accounts Payable for $2000, credit Inventory for $40 and credit Cash for $1960

A)debit Purchase Discount for $40, debit Cash for $1960 and credit Accounts Payable for $2000

B)debit Accounts Payable for $3000 and credit Cash for $3000

C)debit Accounts Payable for $2000 credit Purchase Discount for $40 and credit Cash for $1960

D)debit Accounts Payable for $2000, credit Inventory for $40 and credit Cash for $1960

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

22

Under a perpetual inventory system, when a sale is made, the seller needs to prepare:

A)no journal entry.

B)one journal entry only.

C)two journal entries.

D)three journal entries.

A)no journal entry.

B)one journal entry only.

C)two journal entries.

D)three journal entries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

23

How do purchase returns and allowances and purchase discounts affect gross purchases?

A)Both are added to purchases.

B)Both are subtracted from purchases.

C)Purchase returns and allowances are added to purchases; purchase discounts are subtracted from purchases.

D)Purchase returns and allowances are subtracted from purchases; purchase discounts are added to purchases.

A)Both are added to purchases.

B)Both are subtracted from purchases.

C)Purchase returns and allowances are added to purchases; purchase discounts are subtracted from purchases.

D)Purchase returns and allowances are subtracted from purchases; purchase discounts are added to purchases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

24

Boston Company sells twenty items for $1100 per unit, and has a cost of goods sold percentage of 60%. The gross profit to be reported for selling 20 items is:

A)$440.

B)$8800.

C)$13,200.

D)$22,000.

A)$440.

B)$8800.

C)$13,200.

D)$22,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

25

In 2017, the following transactions occurred for Marjorie's Jewelry Store:

A. On May 1, the business purchased 10 rings on account at $6,000 each. Credit terms were 2/10, net/30.

B. On May 2, the business returned one ring because of a defect.

C. On May 3, three of the rings were sold on account at $8,000 each, to one customer. Credit terms were n/30. No sales returns were expected.

D. On May 9, the accounts payable was paid in full.

E. On May 10, the customer paid for one ring sold on May 3.

F. On May 31, the business paid rent of $4,000 for the month of May and wages of $5,000.

Required:

1. Journalize the above transactions for Marjorie's Jewelry Store. The store uses the perpetual inventory system. Explanations are not required.

2. Prepare the income statement for the month ending May 31, 2017. Use the multistep format and ignore taxes.

A. On May 1, the business purchased 10 rings on account at $6,000 each. Credit terms were 2/10, net/30.

B. On May 2, the business returned one ring because of a defect.

C. On May 3, three of the rings were sold on account at $8,000 each, to one customer. Credit terms were n/30. No sales returns were expected.

D. On May 9, the accounts payable was paid in full.

E. On May 10, the customer paid for one ring sold on May 3.

F. On May 31, the business paid rent of $4,000 for the month of May and wages of $5,000.

Required:

1. Journalize the above transactions for Marjorie's Jewelry Store. The store uses the perpetual inventory system. Explanations are not required.

2. Prepare the income statement for the month ending May 31, 2017. Use the multistep format and ignore taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

26

Company A has inventory out on consignment and held for sale by Company B. Which company will include the goods in their inventory?

A)Company A

B)Company B

C)either Company A or Company B

D)cannot be determined from the facts

A)Company A

B)Company B

C)either Company A or Company B

D)cannot be determined from the facts

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which statement is TRUE?

A)Most businesses use the periodic inventory system.

B)The excess of sales revenue over cost of goods sold is called gross profit because operating expenses have not yet been subtracted.

C)Most companies use the specific identification method.

D)Most companies in the United States follow International Financial Reporting Standards.

A)Most businesses use the periodic inventory system.

B)The excess of sales revenue over cost of goods sold is called gross profit because operating expenses have not yet been subtracted.

C)Most companies use the specific identification method.

D)Most companies in the United States follow International Financial Reporting Standards.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which of the following is NOT used to determine the cost of net purchases?

A)freight-out

B)freight-in

C)purchase returns

D)purchase discounts

A)freight-out

B)freight-in

C)purchase returns

D)purchase discounts

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

29

On July 1, Corrao Company purchased $1600 of inventory on account with credit terms of 2/10, net 30. Corrao Company uses the perpetual inventory system. On July 5, Corrao Company paid the amount due. What journal entry did they prepare on July 5?

A)debit Accounts Receivable for $1600 and credit Cash for $1600

B)debit Accounts Payable for $1600, credit Inventory for $32 and credit Cash for $1568

C)debit Purchase Discount for $32, debit Accounts Payable for $1536 and credit Cash for $1568

D)debit Accounts Payable for $1568 and credit Cash for $1568

A)debit Accounts Receivable for $1600 and credit Cash for $1600

B)debit Accounts Payable for $1600, credit Inventory for $32 and credit Cash for $1568

C)debit Purchase Discount for $32, debit Accounts Payable for $1536 and credit Cash for $1568

D)debit Accounts Payable for $1568 and credit Cash for $1568

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

30

To determine the cost of goods sold, to report on the income statement, multiply the number of units of inventory:

A)sold times the retail price per unit.

B)sold times the cost per unit.

C)purchased times the retail price per unit.

D)purchased times the cost per unit.

A)sold times the retail price per unit.

B)sold times the cost per unit.

C)purchased times the retail price per unit.

D)purchased times the cost per unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

31

On May 1, Santelle Company purchased $700 of inventory on account with credit terms of 2/10, net 30. Santelle uses the perpetual inventory system. On May 2, the seller gave Santelle a $100 allowance due to a product defect. What journal entry did Santelle Company prepare on May 2?

A)debit Accounts Payable for $100 and credit Purchase Returns and Allowances for $100

B)debit Accounts Payable for $100 and credit Purchase Discounts for $100

C)debit Cash for $100 and credit Accounts Payable for $100

D)debit Accounts Payable for $100 and credit Inventory for $100

A)debit Accounts Payable for $100 and credit Purchase Returns and Allowances for $100

B)debit Accounts Payable for $100 and credit Purchase Discounts for $100

C)debit Cash for $100 and credit Accounts Payable for $100

D)debit Accounts Payable for $100 and credit Inventory for $100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

32

Grogan Company purchases inventory on account with a cost of $1300 and a retail price of $2600. Grogan Company uses the perpetual inventory method. What journal entry is required on the date of purchase?

A)debit Purchases for $1300 and credit Accounts Payable for $1300

B)debit Purchases for $2600 and credit Cash for $2600

C)debit Inventory for $1300 and credit Accounts Payable for $1300

D)debit Accounts Receivable for $2600 and credit Purchases for $2600

A)debit Purchases for $1300 and credit Accounts Payable for $1300

B)debit Purchases for $2600 and credit Cash for $2600

C)debit Inventory for $1300 and credit Accounts Payable for $1300

D)debit Accounts Receivable for $2600 and credit Purchases for $2600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

33

The selling price of a television is $1600 and the cost to the retailer is $225. What is the retailer's gross profit from the sale of the television?

A)$0

B)$1375

C)$225

D)$1600

A)$0

B)$1375

C)$225

D)$1600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

34

When inventory is shipped from the seller to the buyer with shipping terms of FOB destination:

A)title passes from the seller to the buyer when the goods leave the seller's shipping dock.

B)the goods will be included in the inventory of the buyer while in transit.

C)the seller has title to the goods while they are in transit.

D)the buyer will pay the transportation costs associated with the purchase.

A)title passes from the seller to the buyer when the goods leave the seller's shipping dock.

B)the goods will be included in the inventory of the buyer while in transit.

C)the seller has title to the goods while they are in transit.

D)the buyer will pay the transportation costs associated with the purchase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

35

Sanfran Company purchased inventory for $110,000. In addition they had purchase returns of $5000 and paid freight-in of $10,000. Sanfran Company's net cost of purchases would be:

A)$95,000.

B)$105,000.

C)$115,000.

D)$125,000.

A)$95,000.

B)$105,000.

C)$115,000.

D)$125,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

36

On August 1, Savage Company purchased $2200 of inventory on account with credit terms of 4/10, net 30. Savage Company uses the perpetual inventory system. On August 15, Savage Company paid the amount due. What journal entry did they prepare on August 15?

A)debit Inventory for $2200 and credit Accounts Payable for $2200

B)debit Accounts Payable for $2200, credit Purchase Discounts for $88 and credit Cash for $2112

C)debit Accounts Payable for $2200 and credit Cash for $2200

D)debit Accounts Payable for $2112 and credit Cash for $2112

A)debit Inventory for $2200 and credit Accounts Payable for $2200

B)debit Accounts Payable for $2200, credit Purchase Discounts for $88 and credit Cash for $2112

C)debit Accounts Payable for $2200 and credit Cash for $2200

D)debit Accounts Payable for $2112 and credit Cash for $2112

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

37

Using a perpetual inventory system, which journal entry(ies)is(are)prepared when two units of merchandise are sold on account?

A)debit Accounts Receivable and credit Sales Revenue only

B)debit Cash and credit Sales Revenue; debit Cost of Goods Sold and credit Inventory

C)debit Accounts Receivable and credit Sales Revenue; debit Cost of Goods Sold and credit Inventory

D)debit Accounts Receivable and credit Sales Revenue; debit Inventory and credit Cost of Goods Sold

A)debit Accounts Receivable and credit Sales Revenue only

B)debit Cash and credit Sales Revenue; debit Cost of Goods Sold and credit Inventory

C)debit Accounts Receivable and credit Sales Revenue; debit Cost of Goods Sold and credit Inventory

D)debit Accounts Receivable and credit Sales Revenue; debit Inventory and credit Cost of Goods Sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

38

On June 1, Nicholson Company purchased inventory on account with a cost of $1300. Credit terms were 2/10, net 30. On June 2, Nicholson Company returned 40 percent of the inventory. Nicholson Company uses the perpetual inventory system. What journal entry did Nicholson Company prepare on June 2?

A)debit Purchase Returns for $1300 and credit Accounts Payable for $1300

B)debit Cash for $1300 and credit Accounts Payable for $1300

C)debit Purchase Returns for $520 and credit Accounts Payable for $520

D)debit Accounts Payable for $520 and credit Inventory for $520

A)debit Purchase Returns for $1300 and credit Accounts Payable for $1300

B)debit Cash for $1300 and credit Accounts Payable for $1300

C)debit Purchase Returns for $520 and credit Accounts Payable for $520

D)debit Accounts Payable for $520 and credit Inventory for $520

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

39

Under a perpetual inventory system, the journal entry to record the purchase of inventory on account will include a:

A)debit to Inventory and a credit to Cash

B)debit to Inventory and a credit to Accounts Payable

C)debit to Accounts Payable and a credit to Inventory

D)debit to Purchases and a credit to Accounts Payable

A)debit to Inventory and a credit to Cash

B)debit to Inventory and a credit to Accounts Payable

C)debit to Accounts Payable and a credit to Inventory

D)debit to Purchases and a credit to Accounts Payable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

40

A company purchased inventory for $700 per unit. The company later sold one unit of the inventory for cash of $2400. Under the perpetual inventory system, which accounts will be debited to record the sale?

A)Cash, $2400; Inventory, $700

B)Cash, $2400; Cost of Goods Sold, $700

C)Cash, $2400; Cost of Goods Sold, $1700

D)Cash, $2400; Inventory, $1700

A)Cash, $2400; Inventory, $700

B)Cash, $2400; Cost of Goods Sold, $700

C)Cash, $2400; Cost of Goods Sold, $1700

D)Cash, $2400; Inventory, $1700

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

41

When comparing the results of LIFO and FIFO when inventory costs are decreasing:

A)cost of goods sold will be lower using FIFO.

B)ending inventory will be higher using FIFO.

C)cost of goods sold will be higher using LIFO.

D)ending inventory will be higher using LIFO.

A)cost of goods sold will be lower using FIFO.

B)ending inventory will be higher using FIFO.

C)cost of goods sold will be higher using LIFO.

D)ending inventory will be higher using LIFO.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

42

When inventory costs are rising, FIFO allows managers to manipulate net income by timing the purchases of inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

43

When inventory costs are rising, a company using the LIFO costing method will generally pay less taxes than if the company had been using the FIFO method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

44

ABC Furniture Unlimited sells antique furniture. ABC will most likely use the ________ method to cost its ending inventory.

A)First-in, first-out

B)Last-in, first-out

C)Specific-unit-cost

D)Average

A)First-in, first-out

B)Last-in, first-out

C)Specific-unit-cost

D)Average

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

45

The average cost per unit is calculated as the cost of goods available for sale divided by the number of units sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

46

When inventory costs are increasing, the FIFO costing method will generally yield a cost of goods sold that is:

A)higher than cost of goods sold under the LIFO method.

B)lower than cost of goods sold under the LIFO method.

C)equal to the gross profit under the LIFO method.

D)equal to cost of goods sold under the LIFO method.

A)higher than cost of goods sold under the LIFO method.

B)lower than cost of goods sold under the LIFO method.

C)equal to the gross profit under the LIFO method.

D)equal to cost of goods sold under the LIFO method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

47

The LIFO method assigns the most recent inventory cost to cost of goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

48

To determine the cost of ending inventory using the LIFO method:

A)the latest purchase costs are used.

B)the specific unit cost of the inventory is used.

C)the average cost of the inventory is used.

D)the beginning inventory and earliest purchase costs are used.

A)the latest purchase costs are used.

B)the specific unit cost of the inventory is used.

C)the average cost of the inventory is used.

D)the beginning inventory and earliest purchase costs are used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

49

Under the average-cost inventory method, to determine the average cost per unit:

A)the cost of beginning inventory is divided by the number of units available.

B)the cost of beginning inventory plus the cost of purchases is divided by the number of units sold.

C)the cost of purchases for the period are divided by the number of units available.

D)the cost of beginning inventory plus the cost of purchases is divided by the number of units available.

A)the cost of beginning inventory is divided by the number of units available.

B)the cost of beginning inventory plus the cost of purchases is divided by the number of units sold.

C)the cost of purchases for the period are divided by the number of units available.

D)the cost of beginning inventory plus the cost of purchases is divided by the number of units available.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

50

Steve's Hardware Store uses the perpetual inventory system. The business incurred the following transactions:

A. On November 1, 10 snow blowers were purchased on account at $1,000 each. Credit terms were 2/10, net 30.

B. On November 2, the business returned two snow blowers due to damage incurred in shipping.

C. On November 3, the supplier granted Steve's Hardware an allowance of $80 because one of the snow blowers was missing an attachment.

D. On November 10, the business sold three of the snow blowers on account at $1,500 each. The credit terms were 2/10, net 30. No sales returns are expected.

E. On November 12, the business paid for the snow blowers.

F. On November 30, business paid wages of $2,000.

Required:

Journalize the above transactions for Steve's Hardware Store. Explanations are not required.

A. On November 1, 10 snow blowers were purchased on account at $1,000 each. Credit terms were 2/10, net 30.

B. On November 2, the business returned two snow blowers due to damage incurred in shipping.

C. On November 3, the supplier granted Steve's Hardware an allowance of $80 because one of the snow blowers was missing an attachment.

D. On November 10, the business sold three of the snow blowers on account at $1,500 each. The credit terms were 2/10, net 30. No sales returns are expected.

E. On November 12, the business paid for the snow blowers.

F. On November 30, business paid wages of $2,000.

Required:

Journalize the above transactions for Steve's Hardware Store. Explanations are not required.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

51

Under the ________ method, ending inventory is based on the costs of the most recent purchases.

A)average-cost

B)FIFO

C)LIFO

D)specific-identification

A)average-cost

B)FIFO

C)LIFO

D)specific-identification

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

52

The choice of an inventory costing method does not impact a company's balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

53

The use of the FIFO method generally increases taxable income:

A)when inventory costs are constant.

B)when inventory costs are declining.

C)when inventory costs are increasing.

D)under all circumstances.

A)when inventory costs are constant.

B)when inventory costs are declining.

C)when inventory costs are increasing.

D)under all circumstances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

54

The inventory cost under the average cost per unit method will generally fall in between the inventory cost using the LIFO and FIFO methods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

55

If inventory costs are rising and a company is using LIFO, large purchases of inventory near the end of the year will:

A)increase income taxes paid.

B)decrease income taxes paid.

C)not change the amount of income taxes paid.

D)cannot be determined.

A)increase income taxes paid.

B)decrease income taxes paid.

C)not change the amount of income taxes paid.

D)cannot be determined.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

56

The inventory method used by a company affects:

A)net income on the income statement.

B)the income taxes to be paid.

C)the ending inventory on the balance sheet.

D)all of the above.

A)net income on the income statement.

B)the income taxes to be paid.

C)the ending inventory on the balance sheet.

D)all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

57

An auto dealer uses a perpetual inventory system. The dealer incurred the following transactions during the month of May:

1. On May 1, the dealer purchased 10 vehicles on account at $20,000 each, with credit terms of 2/10, net 30.

2. On May 2, the dealer returned one vehicle due to a product defect.

3. On May 3, the dealer sold 5 vehicles for $25,000 each on account. The credit terms are n/30. No sales returns are expected.

4. On May 9, the dealer paid for the vehicles purchased less the return on May 2.

5. On May 31, the dealer collected one-half of the amount due from the May 3 sale.

6. On May 31, the dealer paid the rent for the next month of $2,500.

Required:

Prepare the journal entries for the dealer during the month of May. Explanations are not required.

1. On May 1, the dealer purchased 10 vehicles on account at $20,000 each, with credit terms of 2/10, net 30.

2. On May 2, the dealer returned one vehicle due to a product defect.

3. On May 3, the dealer sold 5 vehicles for $25,000 each on account. The credit terms are n/30. No sales returns are expected.

4. On May 9, the dealer paid for the vehicles purchased less the return on May 2.

5. On May 31, the dealer collected one-half of the amount due from the May 3 sale.

6. On May 31, the dealer paid the rent for the next month of $2,500.

Required:

Prepare the journal entries for the dealer during the month of May. Explanations are not required.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

58

When inventory costs are decreasing, the LIFO costing method will generally result in:

A)a higher gross profit than under FIFO.

B)a lower gross profit than under FIFO.

C)a lower inventory value than under FIFO.

D)the same inventory value as FIFO.

A)a higher gross profit than under FIFO.

B)a lower gross profit than under FIFO.

C)a lower inventory value than under FIFO.

D)the same inventory value as FIFO.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

59

If a company uses LIFO for tax purposes, they must use LIFO for financial reporting purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

60

All of the following costs would be included in the cost of inventory EXCEPT for:

A)insurance while in transit from seller.

B)costs to get inventory ready for sale.

C)taxes paid on the purchase price.

D)sales commission paid to salesperson when the inventory is sold.

A)insurance while in transit from seller.

B)costs to get inventory ready for sale.

C)taxes paid on the purchase price.

D)sales commission paid to salesperson when the inventory is sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

61

A company has a beginning inventory of $50,000 and purchases during the year of $110,000 The beginning inventory consisted of 1000 units and 7000 units were purchased during the year. The company has 5000 units left at year-end. Under average-cost, what is Cost of Goods Sold? (Round any intermediary calculations to two decimal places and your final answer to the nearest dollar.)

A)$140,000

B)$60,000

C)$110,000

D)$160,000

A)$140,000

B)$60,000

C)$110,000

D)$160,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

62

Which inventory costing method provides the most current, up-to-date cost of inventory on the balance sheet?

A)FIFO

B)LIFO

C)average cost

D)specific identification

A)FIFO

B)LIFO

C)average cost

D)specific identification

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

63

When inventory costs are falling, which inventory costing method minimizes the taxes paid?

A)FIFO

B)LIFO

C)average cost

D)specific identification

A)FIFO

B)LIFO

C)average cost

D)specific identification

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

64

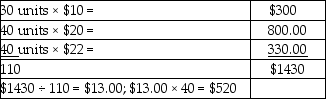

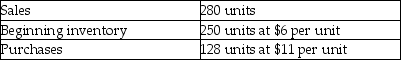

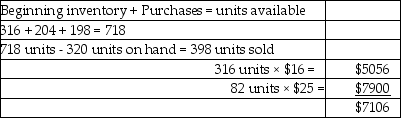

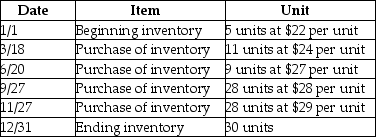

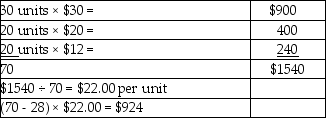

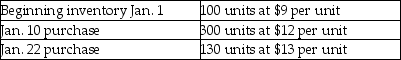

Given the following data, calculate the cost of goods sold using the average-cost method. Round average cost per unit calculations to two decimal places. Round final answer to the nearest dollar.

A)$1276

B)$924

C)$1540

D)$2310

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

65

Which of the following is not an issue in keeping track of perpetual inventories under LIFO and weighted-average-cost methods?

A)The LIFO cost-flow assumption does not follow the logical flow of goods.

B)Many companies keep track of perpetual inventories in quantities only during the year, making year-end adjusting entries to apply either LIFO or weighted-average-cost to both ending inventory and cost of goods sold.

C)When costs are changing, it is physically impossible to apply LIFO unit costs to units purchased and sold, as the transactions are happening, using a perpetual inventory accounting system.

D)All of the above statements are issues in keeping track of perpetual inventories under LIFO and weighted-average-cost methods.

A)The LIFO cost-flow assumption does not follow the logical flow of goods.

B)Many companies keep track of perpetual inventories in quantities only during the year, making year-end adjusting entries to apply either LIFO or weighted-average-cost to both ending inventory and cost of goods sold.

C)When costs are changing, it is physically impossible to apply LIFO unit costs to units purchased and sold, as the transactions are happening, using a perpetual inventory accounting system.

D)All of the above statements are issues in keeping track of perpetual inventories under LIFO and weighted-average-cost methods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

66

Which inventory costing method provides the most realistic measure of net income?

A)FIFO

B)LIFO

C)average cost

D)specific identification

A)FIFO

B)LIFO

C)average cost

D)specific identification

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

67

A LIFO liquidation occurs when ________ fall(s)below the ending inventory quantities in the previous period.

A)beginning inventory quantities

B)ending inventory quantities

C)beginning inventory costs

D)ending inventory retail value

A)beginning inventory quantities

B)ending inventory quantities

C)beginning inventory costs

D)ending inventory retail value

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

68

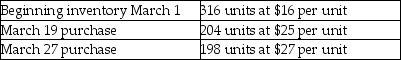

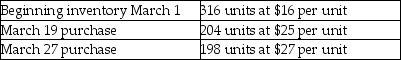

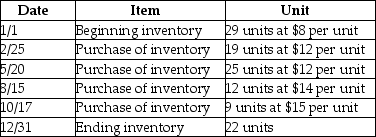

Summertime had the following data for the month of March:  On March 31, 320 units are still on hand. Determine the cost of goods sold for March if Summertime uses the FIFO method.

On March 31, 320 units are still on hand. Determine the cost of goods sold for March if Summertime uses the FIFO method.

A)$11,488

B)$8640

C)$7106

D)$8546

On March 31, 320 units are still on hand. Determine the cost of goods sold for March if Summertime uses the FIFO method.

On March 31, 320 units are still on hand. Determine the cost of goods sold for March if Summertime uses the FIFO method.A)$11,488

B)$8640

C)$7106

D)$8546

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

69

Given the following data, what is cost of goods sold as determined by the FIFO method?

A)$1680

B)$1830

C)$2320

D)$3080

A)$1680

B)$1830

C)$2320

D)$3080

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

70

Which statement is FALSE?

A)LIFO is not allowed in several countries outside the United States.

B)IFRS does not permit the use of LIFO.

C)FIFO and average cost are allowed in Australia and the United Kingdom.

D)If LIFO is no longer allowed to be used in the United States, the tax burden on many companies will be lower.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

71

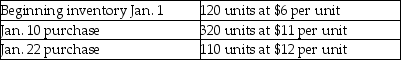

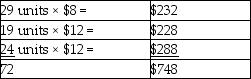

Given the following data, calculate cost of goods sold using the FIFO costing method.

A)$748

B)$976

C)$915

D)$1215

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

72

When comparing the FIFO and LIFO inventory methods:

A)LIFO reports inventory at net realizable value.

B)LIFO reports the most up-to-date inventory cost on the balance sheet.

C)FIFO results in the most realistic net income figure.

D)FIFO matches old inventory costs against revenue.

A)LIFO reports inventory at net realizable value.

B)LIFO reports the most up-to-date inventory cost on the balance sheet.

C)FIFO results in the most realistic net income figure.

D)FIFO matches old inventory costs against revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

73

A company has a beginning inventory of $60,000 and purchases during the year of $160,000. The beginning inventory consisted of 2000 units and 8000 units were purchased during the year. 4080 units remain in ending inventory. The cost of the ending inventory using the average-cost method will be: (Round any intermediary calculations to two decimal places and your final answer to the nearest dollar.)

A)$130,240.

B)$220,000.

C)$89,760.

D)$309,760.

A)$130,240.

B)$220,000.

C)$89,760.

D)$309,760.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

74

Gross profit will be the:

A)highest if LIFO is used and inventory costs are decreasing.

B)lowest if LIFO is used and inventory costs are increasing.

C)highest if FIFO is used and inventory costs are increasing.

D)all of the above.

A)highest if LIFO is used and inventory costs are decreasing.

B)lowest if LIFO is used and inventory costs are increasing.

C)highest if FIFO is used and inventory costs are increasing.

D)all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

75

If inventory costs are decreasing over time, the income taxes paid using FIFO will ________ the income taxes paid using LIFO.

A)exceed

B)equal

C)be less than

D)none of the above

A)exceed

B)equal

C)be less than

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

76

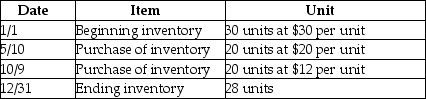

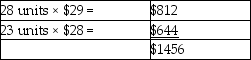

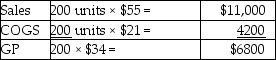

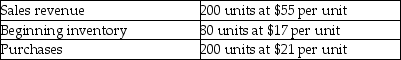

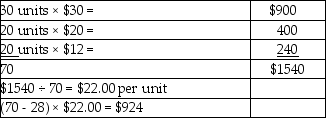

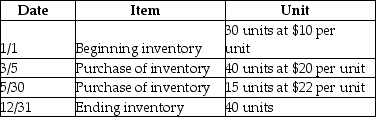

The following data was extracted from the records of Today Company:

What is the gross profit using the LIFO method?

What is the gross profit using the LIFO method?A)$6800

B)$9640

C)$4200

D)$11,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

77

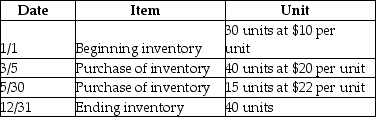

Thelen's inventory records show the following data at January 31:

At January 31, 240 units are still on hand. What is the cost of the ending inventory at January 31 if Thelen uses the LIFO method?

At January 31, 240 units are still on hand. What is the cost of the ending inventory at January 31 if Thelen uses the LIFO method?A)$1440

B)$2040

C)$2880

D)$2160

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

78

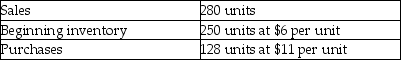

Given the following data, calculate the cost of goods sold using the LIFO costing method.

A)$2068

B)$1461

C)$1456

D)$1122

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

79

Tomasino's inventory records show the following data at January 31:

At January 31, 230 units are still on hand. What is the cost of the ending inventory at January 31 if Tomasino uses the FIFO method?

At January 31, 230 units are still on hand. What is the cost of the ending inventory at January 31 if Tomasino uses the FIFO method?A)$2070

B)$2200

C)$2890

D)$2460

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck

80

Given the following data, calculate the cost of ending inventory using the average cost method. (Round any intermediary and final answers to two decimal places.)

A)$693.20

B)$672.94

C)$800.00

D)$330.00

A)$693.20

B)$672.94

C)$800.00

D)$330.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 168 في هذه المجموعة.

فتح الحزمة

k this deck