Deck 19: Options

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/74

العب

ملء الشاشة (f)

Deck 19: Options

1

Which of the following statements about portfolio insurance is false?

A) There are several methods of insuring a portfolio.

B) It seeks to provide a minimum return while offering the opportunity to participate in rising prices.

C) Futures are typically not used to hedge stock portfolios.

D) Puts and calls typically are not used to insure portfolios.

A) There are several methods of insuring a portfolio.

B) It seeks to provide a minimum return while offering the opportunity to participate in rising prices.

C) Futures are typically not used to hedge stock portfolios.

D) Puts and calls typically are not used to insure portfolios.

C

2

For Grace to maximize her potential return from a bullish view on a stock, she should:

A) buy calls on the stock.

B) write calls on the stock.

C) buy puts on the stock.

D) write puts on the stock.

A) buy calls on the stock.

B) write calls on the stock.

C) buy puts on the stock.

D) write puts on the stock.

A

3

Which of the following is not a reason for investors to trade options?

A) Options eliminate leverage.

B) Options require a smaller investment than stock investments.

C) Options allow investors to trade on overall market movements.

D) Options can reduce risk.

A) Options eliminate leverage.

B) Options require a smaller investment than stock investments.

C) Options allow investors to trade on overall market movements.

D) Options can reduce risk.

A

4

To hedge a short sale, an investor could:

A) buy a call.

B) write a call.

C) buy a put.

D) write a put.

A) buy a call.

B) write a call.

C) buy a put.

D) write a put.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

5

Options sold on exchanges are protected against:

A) stock dividends and splits.

B) cash dividends.

C) interest rate movements.

D) inflation.

A) stock dividends and splits.

B) cash dividends.

C) interest rate movements.

D) inflation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of the following is not a determinant of the value of a call option in the Black-Scholes model?

A) The interest rate

B) The exercise price of the stock

C) The price of the underlying stock

D) The beta of the underlying stock

A) The interest rate

B) The exercise price of the stock

C) The price of the underlying stock

D) The beta of the underlying stock

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which of the following statements is true regarding the writer of a call contract?

A) The call writer expects the stock to move upward.

B) The call writer expects the stock to remain the same or move down.

C) The call writer expects the stock to split.

D) The call writer expects to sell the stock prior to expiration of the option.

A) The call writer expects the stock to move upward.

B) The call writer expects the stock to remain the same or move down.

C) The call writer expects the stock to split.

D) The call writer expects to sell the stock prior to expiration of the option.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

8

One important reason for the existence of derivatives is that they:

A) help reduce market volatility by making speculation more difficult.

B) have valuable tax benefits.

C) contribute to market completeness.

D) are risk-free.

A) help reduce market volatility by making speculation more difficult.

B) have valuable tax benefits.

C) contribute to market completeness.

D) are risk-free.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

9

For Gordon to maximize his potential return from a bearish view on a stock, he should:

A) buy calls.

B) write calls.

C) buy puts.

D) write puts.

A) buy calls.

B) write calls.

C) buy puts.

D) write puts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following statements is true regarding American and European options?

A) American options can be exercised only at expiration.

B) American options can be exercised only in the last week prior to expiration.

C) European options can be exercised only at expiration.

D) European options can be exercised any time prior to expiration.

A) American options can be exercised only at expiration.

B) American options can be exercised only in the last week prior to expiration.

C) European options can be exercised only at expiration.

D) European options can be exercised any time prior to expiration.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

11

A call option written against stock owned by the writer is said to be:

A) naked. b. in the money.

C) out of the money.

D) covered.

A) naked. b. in the money.

C) out of the money.

D) covered.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

12

The writer of a naked call faces:

A) an unlimited potential loss.

B) a specified potential loss.

C) no chance of loss because this is a conservative strategy.

D) an unlimited potential gain.

A) an unlimited potential loss.

B) a specified potential loss.

C) no chance of loss because this is a conservative strategy.

D) an unlimited potential gain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

13

To provide insurance against declining prices on previously purchased stock, an investor could:

A) buy a call.

B) write a put.

C) buy a stock index option.

D) buy a put.

A) buy a call.

B) write a put.

C) buy a stock index option.

D) buy a put.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

14

A writer of a call can terminate the contract before expiration by:

A) writing a second call.

B) buying a put.

C) buying a comparable call.

D) writing a put.

A) writing a second call.

B) buying a put.

C) buying a comparable call.

D) writing a put.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

15

Put and call options on gold are considered:

A) commodity derivatives.

B) financial derivatives.

C) forward contracts.

D) futures contracts.

A) commodity derivatives.

B) financial derivatives.

C) forward contracts.

D) futures contracts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

16

Other things equal, after an option is created, its:

A) time value approaches zero as time passes.

B) time value increases into its expiration date.

C) value moves inversely with the volatility of the underlying stock.

D) value will be zero whenever it is out of the money.

A) time value approaches zero as time passes.

B) time value increases into its expiration date.

C) value moves inversely with the volatility of the underlying stock.

D) value will be zero whenever it is out of the money.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

17

LEAPS are typically:

A) more expensive than short-term options.

B) cheaper than short-term options.

C) only available for major indexes, not individual stocks.

D) long-term options, with maturities between 5 and 10 years.

A) more expensive than short-term options.

B) cheaper than short-term options.

C) only available for major indexes, not individual stocks.

D) long-term options, with maturities between 5 and 10 years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

18

The exercise price on an option is also known as the:

A) premium.

B) strike price.

C) theoretical value.

D) spot price.

A) premium.

B) strike price.

C) theoretical value.

D) spot price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

19

The standard option contract is for:

A) 10 shares of stock.

B) 50 shares of stock.

C) 100 shares of stock.

D) 1 share of stock.

A) 10 shares of stock.

B) 50 shares of stock.

C) 100 shares of stock.

D) 1 share of stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

20

John plans to acquire shares of ABC Corp. by purchasing and exercising a call option. Which of the following statements regarding John's strategy is correct?

A) John will experience no gain or loss from implementing the strategy.

B) John faces no risk from the strategy.

C) If John implements the strategy, it will not impact ABC's shares outstanding.

D) John will pay no commission to implement the strategy.

A) John will experience no gain or loss from implementing the strategy.

B) John faces no risk from the strategy.

C) If John implements the strategy, it will not impact ABC's shares outstanding.

D) John will pay no commission to implement the strategy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which of the following market participants seeks to earn a return without assuming risk by constructing riskless positions?

A) A speculator

B) A call writer

C) A put writer

D) An arbitrageur

A) A speculator

B) A call writer

C) A put writer

D) An arbitrageur

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

22

Gordon is considering purchasing either a call or a put option on XYZ stock. Each of the options has an exercise price of $40 and XYZ is trading at $44.50 per share. Which of the following statements about the options is correct?

A) The put option is in the money, whereas the call option is out of the money.

B) The call option is in the money, whereas the put option is out of the money.

C) Both the put and the call option are in the money.

D) Both the put and the call option are out of the money.

A) The put option is in the money, whereas the call option is out of the money.

B) The call option is in the money, whereas the put option is out of the money.

C) Both the put and the call option are in the money.

D) Both the put and the call option are out of the money.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

23

Gwen wrote a put option with a $15 strike price on RDX stock when the stock price was $16 per share. The option premium was $3. What is the maximum loss (per share) that Gwen could experience on her option position?

A) $3

B) $12

C) $14

D) $15

A) $3

B) $12

C) $14

D) $15

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

24

The Options Clearing Corporation (OCC):

A) always has a net position of zero.

B) acts as a dealer in options, standing ready to buy or sell from its inventory.

C) selects the broker with the largest holdings to honor the exercise of an option.

D) uses first in, first out to select a broker to honor the exercise of an option.

A) always has a net position of zero.

B) acts as a dealer in options, standing ready to buy or sell from its inventory.

C) selects the broker with the largest holdings to honor the exercise of an option.

D) uses first in, first out to select a broker to honor the exercise of an option.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which of the following is true regarding option pricing?

A) The longer the maturity of the option, the higher the premium

B) The more volatile the underlying stock, the lower the premium

C) Option prices are less volatile than equity prices

D) European options are more valuable than American options

A) The longer the maturity of the option, the higher the premium

B) The more volatile the underlying stock, the lower the premium

C) Option prices are less volatile than equity prices

D) European options are more valuable than American options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

26

The way to protect a stock portfolio from a bear market is to:

A) buy stock index calls.

B) buy stock index puts.

C) write stock index calls.

D) write stock index puts.

A) buy stock index calls.

B) buy stock index puts.

C) write stock index calls.

D) write stock index puts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

27

At expiration, the writer of a stock index call option that was written at the money will be required to:

A) deliver the underlying stocks in the index if the index value moves up.

B) deliver the underlying stocks in the index if the index value moves down.

C) deliver a cash value if the index value moves up.

D) deliver a cash value if the index value moves down.

A) deliver the underlying stocks in the index if the index value moves up.

B) deliver the underlying stocks in the index if the index value moves down.

C) deliver a cash value if the index value moves up.

D) deliver a cash value if the index value moves down.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

28

Concerning stock index options, which of the following statements is false?

A) Index options appeal to speculators due to the leverage they offer.

B) Investors can write index options.

C) If exercised, the holder of a stock index call receives the underlying stock.

D) Index options are settled in cash.

A) Index options appeal to speculators due to the leverage they offer.

B) Investors can write index options.

C) If exercised, the holder of a stock index call receives the underlying stock.

D) Index options are settled in cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which of the following statements about call options is false?

A) A call is in the money if the stock price exceeds the exercise price.

B) A call has no time value if its intrinsic value is zero.

C) If a call is out of the money, its intrinsic value is zero.

D) If a call is in the money, its intrinsic value is zero.

A) A call is in the money if the stock price exceeds the exercise price.

B) A call has no time value if its intrinsic value is zero.

C) If a call is out of the money, its intrinsic value is zero.

D) If a call is in the money, its intrinsic value is zero.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

30

Sam is considering purchasing a call option on ABC stock. The call has a premium of $3, an exercise price of $50, and ABC is trading at $51 per share. Which of the following statements about the call option is correct?

A) The call has an intrinsic value of $1 and a time value of $2.

B) The call has an intrinsic value of $0 and a time value of $3.

C) The call has an intrinsic value of $3 and a time value of $2.

D) The call has an intrinsic value of $0 and a time value of $1.

A) The call has an intrinsic value of $1 and a time value of $2.

B) The call has an intrinsic value of $0 and a time value of $3.

C) The call has an intrinsic value of $3 and a time value of $2.

D) The call has an intrinsic value of $0 and a time value of $1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

31

A stock has a price of $68 per share. A two-month put (strike price = $70) on the stock is available at a $6 premium. The intrinsic value on the put is:

A) $0 and its time value is $6.

B) $0 and its time value is $4.

C) $2 and its time value is $4.

D) $4 and its time value is $2.

A) $0 and its time value is $6.

B) $0 and its time value is $4.

C) $2 and its time value is $4.

D) $4 and its time value is $2.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

32

An option is a wasting asset because as its expiration date approaches, its:

A) intrinsic value approaches zero.

B) time value approaches zero.

C) intrinsic value approaches its time value.

D) price approaches zero.

A) intrinsic value approaches zero.

B) time value approaches zero.

C) intrinsic value approaches its time value.

D) price approaches zero.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following statements regarding options is true?

A) An American option's premium should not decline below its intrinsic value.

B) If a call is in the money, its time value is zero.

C) The speculative premium reflects the option's immediate value.

D) If a call is out of the money, its time value is zero.

A) An American option's premium should not decline below its intrinsic value.

B) If a call is in the money, its time value is zero.

C) The speculative premium reflects the option's immediate value.

D) If a call is out of the money, its time value is zero.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

34

Texa Inc. is trading at $23 per share and has options available with a $30 strike price. Which of the following options will have the highest premium?

A) A call option on Texa with a 1-month expiration

B) A put option on Texa with a 1-month expiration

C) A call option on Texa with a 3-month expiration

D) A put option on Texa with a 3-month expiration

A) A call option on Texa with a 1-month expiration

B) A put option on Texa with a 1-month expiration

C) A call option on Texa with a 3-month expiration

D) A put option on Texa with a 3-month expiration

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

35

Carl purchased a call option on Apex stock that had a premium of $4, an exercise price of $25, and six-months to expiration. When he purchased the option, Apex was selling at $27 per share. What profit (per share) would Carl earn on his option transaction if Apex sells at $31 per share at expiration?

A) $0

B) $2

C) $4

D) $6

A) $0

B) $2

C) $4

D) $6

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

36

In the Black-Scholes option pricing model:

A) all of the inputs except two are observable.

B) all of the inputs except one are observable.

C) none of the inputs in the model are observable.

D) all of the inputs in the model are observable.

A) all of the inputs except two are observable.

B) all of the inputs except one are observable.

C) none of the inputs in the model are observable.

D) all of the inputs in the model are observable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

37

If the price of a stock exceeds the exercise price of a call, the call is said to be:

A) naked.

B) out of the money.

C) in the money.

D) covered.

A) naked.

B) out of the money.

C) in the money.

D) covered.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

38

Stock A has a volatile price history, and Stock B has a stable price history. Stock A and Stock B are both trading at $25 per share. Which of the following 1-month options should sell for the highest price?

A) A call option on Stock A with a $30 exercise price.

B) A call option on Stock B with a $30 exercise price.

C) A put option on Stock A with a $30 exercise price.

D) A put option on Stock B with a $30 exercise price.

A) A call option on Stock A with a $30 exercise price.

B) A call option on Stock B with a $30 exercise price.

C) A put option on Stock A with a $30 exercise price.

D) A put option on Stock B with a $30 exercise price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

39

Walt wrote a put option that had a $15 strike price on ABC stock when the stock price was $16 per share. The option premium was $3. What is the maximum profit (per share) that Walt can make on his option position?

A) $2

B) $3

C) $15

D) $16

A) $2

B) $3

C) $15

D) $16

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

40

Which of the following statements is true regarding equity options contracts?

A) The majority of options contracts are standardized.

B) Investors typically create options contracts to trade amongst themselves.

C) Options contracts are typically customized to suit the needs of each investor.

D) Options are available on all publicly-traded U.S. stocks.

A) The majority of options contracts are standardized.

B) Investors typically create options contracts to trade amongst themselves.

C) Options contracts are typically customized to suit the needs of each investor.

D) Options are available on all publicly-traded U.S. stocks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

41

The writer of a call, like the buyer of a put, is bearish about the stock price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

42

An option buyer has three courses of action available: write a similar option to close the position, exercise the option, or let the option expire unexercised.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

43

If the price of the underlying common stock is less than the exercise price of a call, it is in the money.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

44

Helen purchased a put option that had an exercise price of $50, a premium of $2, five months to expiration, and a stock price of $52. At expiration the stock was selling at $54. What profit/loss did Helen earn? Assume the option was for one share of stock.

A) -$4

B) -$2

C) 0

D) +$2

A) -$4

B) -$2

C) 0

D) +$2

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

45

Options traded on organized exchanges are protected against cash dividends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

46

Which of the following inputs in the Black-Scholes option pricing model is not observed?

A) The interest rate

B) The time to expiration

C) The stock price

D) The variability of the stock

A) The interest rate

B) The time to expiration

C) The stock price

D) The variability of the stock

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

47

With regard to options, which of the following is not true of the hedge ratio?

A) It indicates the change in the option price for a $1 change in stock price.

B) It represents the ratio of options written to shares held long in a riskless portfolio.

C) It is frequently greater than 1.

D) It is commonly referred to as the option's delta.

A) It indicates the change in the option price for a $1 change in stock price.

B) It represents the ratio of options written to shares held long in a riskless portfolio.

C) It is frequently greater than 1.

D) It is commonly referred to as the option's delta.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

48

A technology stock and a public utility stock are both selling at $40 per share. Which of the following options should sell for the highest price?

A) A put on the technology stock that has an exercise price of $30.

B) A put on the utility stock that has an exercise price of $30.

C) A call on the technology stock that has an exercise price of $30.

D) A call on the utility stock that has an exercise price of $30.

A) A put on the technology stock that has an exercise price of $30.

B) A put on the utility stock that has an exercise price of $30.

C) A call on the technology stock that has an exercise price of $30.

D) A call on the utility stock that has an exercise price of $30.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

49

Options can be purchased on margin.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

50

The Options Clearing Corporation does not ensure fulfillment of option obligations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

51

A protective put is a strategy in which an investor with a long position in stock buys one or more puts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

52

According to the Black Scholes option pricing model, option value is a function of stock price, exercise price, time to maturity, interest rate, and volatility of the underlying asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

53

If the price of the underlying stock equals the strike price of the call option at maturity, the call buyer has a breakeven transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

54

Using portfolio insurance with options relies on the use of put options.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

55

There is a positive relationship between the price of a put option and the volatility of the underlying common stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

56

What organizational feature of options trading prevents individual traders from having to worry about defaults if options are exercised?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

57

For a dividend paying stock, an investor may be wise to exercise an American call option before its expiration date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

58

An investor applying a protective put strategy is hoping that the price of the underlying stock falls.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

59

What is meant by portfolio insurance?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

60

Writing a naked call is potentially riskier than writing a naked put.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

61

What are the variables in the Black-Scholes option pricing model? How is each related to the price of the call option?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

62

An investor wants to hedge the Apple stock he holds in his portfolio. How can he use a covered call to do this?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

63

What is put-call parity? How is it related to arbitrage?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

64

An investor wants to hedge the Microsoft stock he holds in his portfolio. How can he use a protective put to do this?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

65

How can the owner of a large stock portfolio use options on individual stocks to enhance the income from the portfolio?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

66

An investor has the alternative of buying 100 shares of XYZ at $50 per share or investing the same amount of money in XYZ 6-month calls priced at $5. Calculate the profit or loss from each strategy if XYZ rises to $60 in 6 months.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

67

List five options exchanges.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

68

How could an investor create 100 shares of artificial stock (i.e., a portfolio with the same payoffs as 100 shares of common stock)?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

69

What type of equity derivatives are created by corporations?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

70

Use the Black-Scholes model to calculate the theoretical value of a DBA December 45 call option. Assume that the risk free rate is 6 percent, the stock has a variance of 36 percent, there are 91 days until expiration of the contract, and DBA stock is currently selling at $50 in the market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

71

What is a hedge ratio?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

72

Fred wrote a naked call option on Mitrosoft stock. When written the call had a premium of $6, an expiration of one month, an exercise price of $40, and the stock was selling at $36. At expiration, Mitrosoft was selling at $43. What profit/loss did Fred earn? Assume the option was for one share of stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

73

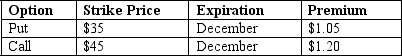

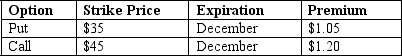

Assume CSC stock is selling at $40 in June and Hal places a collar on 1,000 shares of CSC stock by buying a protective put and simultaneously writing a covered call. Hal intends to sell the stock in December regardless of its price.

(a) What net amount did Hal pay or receive when he entered the collar?

(a) What net amount did Hal pay or receive when he entered the collar?

(b) If CSC is selling at $47.50 at expiration, find Hal's cash flow at expiration.

(c) If CSC is selling at $30 at expiration, find Hal's cash flow at expiration.

(a) What net amount did Hal pay or receive when he entered the collar?

(a) What net amount did Hal pay or receive when he entered the collar?(b) If CSC is selling at $47.50 at expiration, find Hal's cash flow at expiration.

(c) If CSC is selling at $30 at expiration, find Hal's cash flow at expiration.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

74

What makes the risk-expected return profile attractive to speculators who purchase put and call options? What is the risk-expected return profile for writers of naked put and call options?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck