Deck 9: Making Capital Investment Decisions

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/116

العب

ملء الشاشة (f)

Deck 9: Making Capital Investment Decisions

1

Dismal Outlook is unable to obtain financing for any new projects under any circumstances.This company is faced with:

A)contingency planning.

B)soft rationing.

C)hard rationing.

D)real options.

E)sunk costs.

A)contingency planning.

B)soft rationing.

C)hard rationing.

D)real options.

E)sunk costs.

hard rationing.

2

Which one of the following terms is most commonly used to describe the cash flows of a new project that are simply an offset of reduced cash flows for a current project?

A)Opportunity cost

B)Sunk cost

C)Erosion

D)Replicated flows

E)Pirated flows

A)Opportunity cost

B)Sunk cost

C)Erosion

D)Replicated flows

E)Pirated flows

Erosion

3

Kate is analyzing a proposed project to determine how changes in the sales quantity would affect the project's net present value.What type of analysis is being conducted?

A)Sensitivity analysis

B)Erosion planning

C)Scenario analysis

D)Benefit-cost analysis

E)Opportunity cost analysis

A)Sensitivity analysis

B)Erosion planning

C)Scenario analysis

D)Benefit-cost analysis

E)Opportunity cost analysis

Sensitivity analysis

4

A pro forma financial statement is a financial statement that:

A)expresses all values as a percentage of either total assets or total sales.

B)compares actual results to the budgeted amounts.

C)compares the performance of a firm to its industry.

D)projects future years' operating results.

E)values all assets based on their current market values.

A)expresses all values as a percentage of either total assets or total sales.

B)compares actual results to the budgeted amounts.

C)compares the performance of a firm to its industry.

D)projects future years' operating results.

E)values all assets based on their current market values.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

5

Northern Companies has three separate divisions.Each year, the company determines the amount it can afford to spend in total for capital expenditures and then allocates one-third of that amount to each division.This allocation process is called:

A)soft rationing.

B)hard rationing.

C)opportunity cost allocation.

D)divisional separation.

E)strategic planning.

A)soft rationing.

B)hard rationing.

C)opportunity cost allocation.

D)divisional separation.

E)strategic planning.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

6

The opportunities that a manager has to modify a project once the project has started are called:

A)sensitivity choices.

B)managerial options.

C)scenario adjustments.

D)restructuring options.

E)erosion control measures.

A)sensitivity choices.

B)managerial options.

C)scenario adjustments.

D)restructuring options.

E)erosion control measures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

7

Forecasting risk is best defined as:

A)reality risk.

B)value risk.

C)potential risk.

D)management risk.

E)estimation risk.

A)reality risk.

B)value risk.

C)potential risk.

D)management risk.

E)estimation risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

8

Jamie is analyzing the estimated net present value of a project under various conditions by revising the sales quantity, sales price, and the cost estimates.The type of analysis that Jamie is doing is best described as:

A)sensitivity analysis.

B)erosion planning.

C)scenario analysis.

D)benefit planning.

E)opportunity evaluation.

A)sensitivity analysis.

B)erosion planning.

C)scenario analysis.

D)benefit planning.

E)opportunity evaluation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

9

Kyle Electric has three positive net present value opportunities.Unfortunately, the firm has not been able to find financing for any of these projects.Which one of the following terms best fits the situation facing the firm?

A)Sensitivity analysis

B)Capital rationing

C)Soft rationing

D)Contingency planning

E)Sunk cost

A)Sensitivity analysis

B)Capital rationing

C)Soft rationing

D)Contingency planning

E)Sunk cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which one of the following refers to the option to expand into related businesses in the future?

A)Strategic option

B)Contingency option

C)Soft rationing

D)Hard rationing

E)Capital rationing option

A)Strategic option

B)Contingency option

C)Soft rationing

D)Hard rationing

E)Capital rationing option

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

11

Contingency planning focuses on the:

A)opportunity costs involved with a project.

B)sunk costs related to a project.

C)economic effects on a project's profitability.

D)managerial options implicit in a project.

E)optional capital requirements of a project.

A)opportunity costs involved with a project.

B)sunk costs related to a project.

C)economic effects on a project's profitability.

D)managerial options implicit in a project.

E)optional capital requirements of a project.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which one of the following principles refers to the assumption that a project will be evaluated based on its incremental cash flows?

A)Forecast assumption principle

B)Base assumption principle

C)Fallacy principle

D)Erosion principle

E)Stand-alone principle

A)Forecast assumption principle

B)Base assumption principle

C)Fallacy principle

D)Erosion principle

E)Stand-alone principle

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

13

The Corner Market has decided to expand its retail store by building on a vacant lot it currently owns.This lot was purchased four years ago at a cost of $299,000, which the firm paid in cash.To date, the firm has spent another $38,000 on land improvements, all of which was also paid in cash.Today, the lot has a market value of $329,000.What value should be included in the analysis of the expansion project for the cost of the land?

A)The sum of the cash paid to date for both the lot and the improvements

B)The original purchase price only

C)The current market value of the land plus the cash paid for the improvements

D)The current market value of the land

E)Zero because the land and the improvements were previously purchased with cash

A)The sum of the cash paid to date for both the lot and the improvements

B)The original purchase price only

C)The current market value of the land plus the cash paid for the improvements

D)The current market value of the land

E)Zero because the land and the improvements were previously purchased with cash

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

14

Any changes to a firm's projected future cash flows that are caused by adding a new project are referred to as:

A)eroded cash flows.

B)deviated projections.

C)incremental cash flows.

D)directly impacted flows.

E)opportunity cash flows.

A)eroded cash flows.

B)deviated projections.

C)incremental cash flows.

D)directly impacted flows.

E)opportunity cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which one of the following refers to a method of increasing the rate at which an asset is depreciated?

A)Noncash expense

B)Straight-line depreciation

C)Depreciation tax shield

D)Accelerated cost recovery system

E)Market-based depreciation

A)Noncash expense

B)Straight-line depreciation

C)Depreciation tax shield

D)Accelerated cost recovery system

E)Market-based depreciation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

16

The Shoe Box is considering adding a new line of winter footwear to its product lineup.When analyzing the viability of this addition, the company should include all of the following in its analysis with the exception of:

A)any expected changes in the sales levels of current products caused by adding the new product line.

B)cost of new display counters for the additional winter footwear.

C)increased taxes from winter footwear profits.

D)the research and development costs to produce the current winter footwear samples.

E)the expected revenue from winter footwear sales.

A)any expected changes in the sales levels of current products caused by adding the new product line.

B)cost of new display counters for the additional winter footwear.

C)increased taxes from winter footwear profits.

D)the research and development costs to produce the current winter footwear samples.

E)the expected revenue from winter footwear sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

17

A cost that should be ignored when evaluating a project because that cost has already been incurred and cannot be recouped is referred to as a(n):

A)fixed cost.

B)forgotten cost.

C)variable cost.

D)opportunity cost.

E)sunk cost.

A)fixed cost.

B)forgotten cost.

C)variable cost.

D)opportunity cost.

E)sunk cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which one of the following terms refers to the best option that was foregone when a particular investment is selected?

A)Side effect

B)Erosion

C)Sunk cost

D)Opportunity cost

E)Marginal cost

A)Side effect

B)Erosion

C)Sunk cost

D)Opportunity cost

E)Marginal cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

19

The amount by which a firm's tax bill is reduced as a result of the depreciation expense is referred to as the depreciation:

A)tax shield.

B)credit.

C)erosion.

D)opportunity cost.

E)adjustment.

A)tax shield.

B)credit.

C)erosion.

D)opportunity cost.

E)adjustment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

20

Lake City Plastics currently produces plastic plates and silverware.The company is considering expanding its product offerings to include plastic serving trays.All of the following are relevant costs to this project with the exception of:

A)the cost of additional utilities required to operate the serving tray production operation.

B)any change in the expected sales of plates and silverware gained from offering trays also.

C)a percentage of the current operating overhead.

D)the additional plastic raw materials that would be required.

E)the cost to acquire the forms needed to mold the trays.

A)the cost of additional utilities required to operate the serving tray production operation.

B)any change in the expected sales of plates and silverware gained from offering trays also.

C)a percentage of the current operating overhead.

D)the additional plastic raw materials that would be required.

E)the cost to acquire the forms needed to mold the trays.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

21

Flo is considering three mutually exclusive options for the additional space she plans to add to her specialty women's store.The cost of the expansion will be $148,000.She can use this additional space to add children's clothing, an exclusive gifts department, or a home décor section.She estimates the present value of the cash inflows from these projects are $121,000 for children's clothing, $178,000 for exclusive gifts, and $145,000 for decorator items.Which option(s), if any, should she accept?

A)None of these options

B)Children's clothing only

C)Exclusive gifts only

D)Exclusive gifts and decorator items only

E)All three options

A)None of these options

B)Children's clothing only

C)Exclusive gifts only

D)Exclusive gifts and decorator items only

E)All three options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

22

Scenario analysis is best described as the determination of the:

A)most likely outcome for a project.

B)reasonable range of project outcomes.

C)variable that has the greatest effect on a project's outcome.

D)effect that a project's initial cost has on the project's net present value.

E)change in a project's net present value given a stated change in projected sales.

A)most likely outcome for a project.

B)reasonable range of project outcomes.

C)variable that has the greatest effect on a project's outcome.

D)effect that a project's initial cost has on the project's net present value.

E)change in a project's net present value given a stated change in projected sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

23

Scenario analysis asks questions such as:

A)How will changing the number of units sold affect the outcome of this project?

B)What is the best outcome that should reasonably be expected?

C)How much will a $1 increase in the variable cost per unit change the net present value?

D)Will the net present value increase or decrease if the quantity sold increases by 100 units?

E)How will the operating cash flow change if the depreciation method is changed?

A)How will changing the number of units sold affect the outcome of this project?

B)What is the best outcome that should reasonably be expected?

C)How much will a $1 increase in the variable cost per unit change the net present value?

D)Will the net present value increase or decrease if the quantity sold increases by 100 units?

E)How will the operating cash flow change if the depreciation method is changed?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

24

Firm A uses straight-line depreciation.Firm B uses MACRS depreciation.Both firms bought $75,000 worth of equipment last year that has a tax life of 5 years.The 5-year MACRS percentage rates, starting with Year 1, are: 20, 32, 19.2, 11.52, 11.52, and 5.76.Both firms have a marginal tax rate of 34 percent and identical operating cash flows except for the depreciation effects.Given this, you know the:

A)depreciation expense for Firm A will be greater than Firm B's expense every year.

B)equipment has a higher value on Firm B's books than on Firm A's at the end of Year 2.

C)operating cash flow of Firm A is greater than that of Firm B for Year 3.

D)market value of Firm A's equipment is greater than the market value of Firm B's at end the first year.

E)market value of Firm B's equipment is greater than the market value of Firm A's equipment at the end of Year 2.

A)depreciation expense for Firm A will be greater than Firm B's expense every year.

B)equipment has a higher value on Firm B's books than on Firm A's at the end of Year 2.

C)operating cash flow of Firm A is greater than that of Firm B for Year 3.

D)market value of Firm A's equipment is greater than the market value of Firm B's at end the first year.

E)market value of Firm B's equipment is greater than the market value of Firm A's equipment at the end of Year 2.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which one of the following will increase the operating cash flow as computed using the tax shield approach?

A)Decrease in depreciation

B)Decrease in sales

C)Increase in variable costs

D)Decrease in fixed costs

E)Increase in the tax rate

A)Decrease in depreciation

B)Decrease in sales

C)Increase in variable costs

D)Decrease in fixed costs

E)Increase in the tax rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which one of the following is a correct value to use if you are conducting a best-case scenario analysis?

A)Sales price that is most likely to occur

B)Lowest expected level of sales quantity

C)Lowest expected salvage value

D)Highest expected need for net working capital

E)Lowest expected value for fixed costs

A)Sales price that is most likely to occur

B)Lowest expected level of sales quantity

C)Lowest expected salvage value

D)Highest expected need for net working capital

E)Lowest expected value for fixed costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

27

Weston Steel purchased a new coal furnace six years ago at a cost of $2.2 million.Last year, the government changed the emission requirements and this furnace cannot meet those standards.Thus, the company can no longer use the furnace, nor has it been able to locate anyone willing to purchase the furnace.Given the current situation, the furnace is best described as which type of cost?

A)Erosion

B)Book

C)Sunk

D)Market

E)Opportunity

A)Erosion

B)Book

C)Sunk

D)Market

E)Opportunity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

28

Assume an all-equity firm has positive net earnings.The operating cash flow of this firm:

A)ignores both depreciation and taxes.

B)is unaffected by the depreciation expense.

C)must be negative.

D)increases when the tax rate decreases.

E)is equal to net income minus depreciation.

A)ignores both depreciation and taxes.

B)is unaffected by the depreciation expense.

C)must be negative.

D)increases when the tax rate decreases.

E)is equal to net income minus depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

29

Bruce Moneybags owns several restaurants and hotels near a local interstate.One restaurant, Beef and More, originally cost $1.8 million, is currently fully paid for, but needs modernized.Bruce is trying to decide whether to accept an offer and sell Beef and More, as is, for the offer price of $1.1 million or renovate the restaurant himself.The projected renovation cost is $1.3 million.The restaurant would need to be shut down completely during the renovation which would cause an aftertax net loss of $90,000 in today's dollars.The estimated present value of the cash inflows from the renovated restaurant is $3.2 million.When analyzing the renovation project, what cost, if any, should be included for the current restaurant?

A)$0

B)$1.1 million

C)$1.1 million + $90,000

D)$1.8 million + 1.3 million + 90,000

E)$3.2 million -($1.8 million + 1.3 million + 90,000)

A)$0

B)$1.1 million

C)$1.1 million + $90,000

D)$1.8 million + 1.3 million + 90,000

E)$3.2 million -($1.8 million + 1.3 million + 90,000)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

30

The net working capital invested in a project is generally:

A)a sunk cost.

B)an opportunity cost.

C)recouped in the first year of the project.

D)recouped at the end of the project.

E)depreciated to a zero balance over the life of the project.

A)a sunk cost.

B)an opportunity cost.

C)recouped in the first year of the project.

D)recouped at the end of the project.

E)depreciated to a zero balance over the life of the project.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

31

A proposed project will increase a firm's accounts payables.This increase is generally:

A)treated as an erosion cost.

B)treated as an opportunity cost.

C)a sunk cost and should be ignored.

D)a cash outflow at Time zero and a cash inflow at the end of the project.

E)a cash inflow at Time zero and a cash outflow at the end of the project.

A)treated as an erosion cost.

B)treated as an opportunity cost.

C)a sunk cost and should be ignored.

D)a cash outflow at Time zero and a cash inflow at the end of the project.

E)a cash inflow at Time zero and a cash outflow at the end of the project.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

32

The pro forma income statements for a proposed investment should include all of the following except:

A)fixed costs.

B)forecasted sales.

C)depreciation expense.

D)taxes.

E)changes in net working capital.

A)fixed costs.

B)forecasted sales.

C)depreciation expense.

D)taxes.

E)changes in net working capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following create cash inflows from net working capital?

A)Decrease in accounts payable and increase in accounts receivable

B)Decrease in both accounts receivable and accounts payable

C)Increase in accounts payable and decrease in inventory

D)Increase in both accounts receivable and inventory

E)Increase in inventory and decrease in cash

A)Decrease in accounts payable and increase in accounts receivable

B)Decrease in both accounts receivable and accounts payable

C)Increase in accounts payable and decrease in inventory

D)Increase in both accounts receivable and inventory

E)Increase in inventory and decrease in cash

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

34

The operating cash flows of a project:

A)are unaffected by the depreciation method selected.

B)are equal to the project's total projected net income.

C)decrease when net working capital increases.

D)include any aftertax salvage values.

E)include erosion effects.

A)are unaffected by the depreciation method selected.

B)are equal to the project's total projected net income.

C)decrease when net working capital increases.

D)include any aftertax salvage values.

E)include erosion effects.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

35

CrossTown Builders is considering remodeling an old building it currently owns.The building was purchased ten years ago for $1.2 million.Over the past ten years, the firm rented out the building and used the rent to pay off the mortgage.The building is now owned free and clear and has a current market value of $1.9 million.The company is considering remodeling the building into industrial-type apartments at an estimated cost of $1.6 million.The estimated present value of the future income from these apartments is $4.1 million.Which one of the following defines the opportunity cost of the remodeling project?

A)Present value of the future income

B)Cost of the remodeling

C)Current market value of the building

D)Initial cost of the building plus the remodeling costs

E)Current market value of the building plus the remodeling costs

A)Present value of the future income

B)Cost of the remodeling

C)Current market value of the building

D)Initial cost of the building plus the remodeling costs

E)Current market value of the building plus the remodeling costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

36

Valley Forge and Metal purchased a truck five years ago for local deliveries.Which one of the following costs related to this truck is the best example of a sunk cost? Assume the truck has a usable life of five years.

A)New tires that will be purchased this winter

B)Costs of repairs needed so the truck can pass inspection next month

C)Money spent last month repairing a damaged front fender

D)Engine tune-up that is scheduled for this afternoon

E)Cost for a truck driver for the remainder of the truck's useful life

A)New tires that will be purchased this winter

B)Costs of repairs needed so the truck can pass inspection next month

C)Money spent last month repairing a damaged front fender

D)Engine tune-up that is scheduled for this afternoon

E)Cost for a truck driver for the remainder of the truck's useful life

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

37

The analysis of a new project should exclude:

A)tax effects.

B)erosion effects.

C)side effects.

D)sunk costs.

E)opportunity costs.

A)tax effects.

B)erosion effects.

C)side effects.

D)sunk costs.

E)opportunity costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

38

The tax shield approach to computing the operating cash flow, given a tax-paying firm:

A)ignores both interest expense and taxes.

B)separates cash inflows from cash outflows.

C)considers the changes in net working capital resulting from a new project.

D)ignores all noncash expenses and their effects.

E)recognizes that depreciation creates a cash inflow.

A)ignores both interest expense and taxes.

B)separates cash inflows from cash outflows.

C)considers the changes in net working capital resulting from a new project.

D)ignores all noncash expenses and their effects.

E)recognizes that depreciation creates a cash inflow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

39

Thrill Rides is considering adding a new roller coaster to its amusement park.The addition is expected to increase its overall ticket sales.In particular, the company expects to sell more tickets for its current roller coaster and experience extremely high demand for its new coaster.Sales for its boat ride are expected to decline but food and beverage sales are expected to increase significantly.All of the following are side effects associated with the new roller coaster with the exception of the:

A)increased food sales.

B)additional sales for the existing coaster.

C)increased food costs.

D)reduced sales for the boat ride.

E)ticket sales for the new coaster.

A)increased food sales.

B)additional sales for the existing coaster.

C)increased food costs.

D)reduced sales for the boat ride.

E)ticket sales for the new coaster.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

40

Ed owns a store that caters primarily to men.Each of the answer options represents an item related to a planned store expansion.Each of these items should be included in the expansion analysis with the exception of the cost:

A)of the property insurance premium increase.

B)of the exterior landscaping that will be required once the expansion is complete.

C)of the additional sales person that will be required.

D)of the inventory required to fill the additional retail space.

E)of the blueprints that have been drawn of the expansion area.

A)of the property insurance premium increase.

B)of the exterior landscaping that will be required once the expansion is complete.

C)of the additional sales person that will be required.

D)of the inventory required to fill the additional retail space.

E)of the blueprints that have been drawn of the expansion area.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

41

The ability to delay an investment:

A)is commonly referred to as the best-case scenario.

B)is valuable provided there are conditions under which the investment will have a positive net present value.

C)ensures that the investment will have an expected net present value that is positive.

D)offsets the need to conduct sensitivity analysis.

E)is referred to as the option to abandon.

A)is commonly referred to as the best-case scenario.

B)is valuable provided there are conditions under which the investment will have a positive net present value.

C)ensures that the investment will have an expected net present value that is positive.

D)offsets the need to conduct sensitivity analysis.

E)is referred to as the option to abandon.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

42

Which one of these has the least potential to increase the net present value of a proposed investment? Assume the project has a positive net present value in at least one set of circumstances.

A)Ability to wait until the economy improves before making the investment

B)Ability to immediately shut down a project should the project become unprofitable

C)Option to increase production beyond that initially projected

D)Option to place the investment on hold until a more favorable discount rate becomes available

E)Option to discontinue a project at the end of its intended life

A)Ability to wait until the economy improves before making the investment

B)Ability to immediately shut down a project should the project become unprofitable

C)Option to increase production beyond that initially projected

D)Option to place the investment on hold until a more favorable discount rate becomes available

E)Option to discontinue a project at the end of its intended life

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

43

Sherpa Outfitters sells specialty equipment for mountain climbers.Its sales for last year included $488,500 of tents and $ 800,000 of climbing gear.For next year, management has decided to sell specialty sleeping bags also.As a result of this change, sales projections for next year are $537,350 of tents, $880,000 of climbing gear, and $150,000 of sleeping bags.How much of next year's sales are derived from the side effects of adding the new product to its sales offerings?

A)$0

B)$145,650

C)$128,850

D)$278,850

E)$256,850

A)$0

B)$145,650

C)$128,850

D)$278,850

E)$256,850

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

44

Jim's Hardware is adding a new product to its sales lineup.Initially, the firm will stock $36,000 of the new inventory, which will be purchased on 30 days' credit from a supplier.The firm will also invest $13,000 in accounts receivable and $11,000 in equipment.What amount should be included in the initial project costs for net working capital?

A)-$49,000

B)-$47,000

C)-$3,000

D)-$13,000

E)-$24,000

A)-$49,000

B)-$47,000

C)-$3,000

D)-$13,000

E)-$24,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

45

When a firm faces hard rationing,:

A)all positive net present value projects will be accepted.

B)each division within a firm will be allocated an amount for capital expenditures that will be less than the total value of its positive net present value projects.

C)there will be no available funds for capital expenditures.

D)the firm will fund only those projects that create value for its shareholders.

E)the firm will finance only the projects that have the highest profitability index values.

A)all positive net present value projects will be accepted.

B)each division within a firm will be allocated an amount for capital expenditures that will be less than the total value of its positive net present value projects.

C)there will be no available funds for capital expenditures.

D)the firm will fund only those projects that create value for its shareholders.

E)the firm will finance only the projects that have the highest profitability index values.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

46

Sensitivity analysis:

A)looks at the most reasonably optimistic and pessimistic results for a project.

B)helps identify the variable within a project that presents the greatest forecasting risk.

C)is used for projects that cannot be analyzed by scenario analysis because the cash flows are unconventional.

D)is generally conducted prior to scenario analysis just to determine if the range of potential outcomes is acceptable.

E)illustrates how an increase in operating cash flow caused by changing both the revenue and the costs simultaneously will change the net present value for a project.

A)looks at the most reasonably optimistic and pessimistic results for a project.

B)helps identify the variable within a project that presents the greatest forecasting risk.

C)is used for projects that cannot be analyzed by scenario analysis because the cash flows are unconventional.

D)is generally conducted prior to scenario analysis just to determine if the range of potential outcomes is acceptable.

E)illustrates how an increase in operating cash flow caused by changing both the revenue and the costs simultaneously will change the net present value for a project.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

47

Logan Hunting has a proposed project that will generate sales of 2,200 units annually at a selling price of $29.95 each.The fixed costs are $15,000 and the variable costs per unit are $6.95.The project requires $42,000 of fixed assets that will be depreciated on a straight-line basis to a zero book value over the four-year life of the project.The salvage value of the fixed assets is $5,500 and the tax rate is 21 percent.What is the operating cash flow for Year 4?

A)$ 30,329

B)$ 19,829

C)$ 21,124

D)$ 42,179

E)$ 22,564

A)$ 30,329

B)$ 19,829

C)$ 21,124

D)$ 42,179

E)$ 22,564

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

48

Floral Shoppes has a new project in mind that will increase accounts receivable by $19,000, decrease accounts payable by $4,000, increase fixed assets by $27,000, and decrease inventory by $2,000.What is the amount the firm should use as the initial cash flow attributable to net working capital when it analyzes this project?

A)-$25,000

B)-$17,000

C)-$21,000

D)-$12,000

E)-$52,000

A)-$25,000

B)-$17,000

C)-$21,000

D)-$12,000

E)-$52,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

49

Ignoring the option to wait:

A)may overestimate the internal rate of return on a project.

B)may underestimate the net present value of a project.

C)ignores the ability of a manager to increase output after a project has been implemented.

D)is the same as ignoring all strategic options.

E)ignores the value of discontinuing a project early.

A)may overestimate the internal rate of return on a project.

B)may underestimate the net present value of a project.

C)ignores the ability of a manager to increase output after a project has been implemented.

D)is the same as ignoring all strategic options.

E)ignores the value of discontinuing a project early.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

50

A five-year project is expected to generate annual revenues of $159,000, variable costs of $72,500, and fixed costs of $15,000.The annual depreciation is $19,500 and the tax rate is 21 percent.What is the annual operating cash flow?

A)$71,500

B)$117,855

C)$72.430

D)$41,080

E)$60,580

A)$71,500

B)$117,855

C)$72.430

D)$41,080

E)$60,580

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

51

The Market Farms purchased a parcel of land six years ago for $200,000.At that time, the firm invested $75,000 grading the site so that it would be usable.Since the firm wasn't ready to use the site itself at that time, it decided to lease the land for $40,000 a year.The Green Tomato is now considering building a hotel on the site as the rental lease is expiring.The current value of the land is $225,000.The firm has no loans or mortgages secured by the property.What value should be included in the initial cost of the hotel project for the use of this land?

A)$0

B)$200,000

C)$225,000

D)$229,000

E)$101,900

A)$0

B)$200,000

C)$225,000

D)$229,000

E)$101,900

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

52

Nu Tek is comprised of four separate operating divisions.For this year, the firm has decided to allocate capital funds using a soft rationing approach.Which one of the following applies to this situation?

A)Division managers will be limited to accepting a single new project each.

B)Division managers are being given blanket approval to accept all positive net present value projects.

C)Division managers should expect to be treated equally, at least initially, in the capital distribution process.

D)Division managers will not receive any funding for new projects but will be allowed to expand current operations.

E)Division managers will not receive capital funding for any project.

A)Division managers will be limited to accepting a single new project each.

B)Division managers are being given blanket approval to accept all positive net present value projects.

C)Division managers should expect to be treated equally, at least initially, in the capital distribution process.

D)Division managers will not receive any funding for new projects but will be allowed to expand current operations.

E)Division managers will not receive capital funding for any project.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

53

A debt-free firm has net income of $142,658, taxes of $37,921.75, and depreciation of $27,500.What is the operating cash flow?

A)$131,458

B)$142,658

C)$166,958

D)$170,158

E)$162,358

A)$131,458

B)$142,658

C)$166,958

D)$170,158

E)$162,358

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

54

Six years ago, China Exporters paid cash for a new packaging machine that cost $347,000.Three years ago, the firm spent $14,300 on repairs and modifications to the machine.The machine is now fully depreciated and has just sat idly in a back corner of the shop for the past seven months.The estimated value of the machine today is $157,500.The firm is considering using this machine in a new project.If it does so, what value should be assigned to this machine and included in the initial costs of the new project?

A)$0

B)$361,300

C)$157,500

D)$128,900

E)$171,800

A)$0

B)$361,300

C)$157,500

D)$128,900

E)$171,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

55

Turner Industries started a new project three months ago.Sales arising from this project are significantly less than anticipated.Given this, which one of the following is management most apt to implement?

A)Option to wait

B)Soft rationing

C)Option to delay

D)Option to expand

E)Option to abandon

A)Option to wait

B)Soft rationing

C)Option to delay

D)Option to expand

E)Option to abandon

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

56

Left Eye Promotions is a specialty retailer offering T-shirts, sweatshirts, and caps.Its most recent annual sales consisted of $27,000 of T-shirts, $21,000 of sweatshirts, and $3,500 of caps.The company is adding polo shirts to the lineup and projects that this addition will result in sales next year of $25,000 of T-shirts, $17,000 of sweatshirts, $14,000 of Polo shirts, and $3,000 of caps.What sales amount should be used when evaluating the Polo shirt project?

A)$13,300

B)$7,500

C)$6,700

D)$6,800

E)$7,900

A)$13,300

B)$7,500

C)$6,700

D)$6,800

E)$7,900

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

57

Shannon's Irish Cookware is implementing a project that will initially increase accounts payable by $5,000, increase inventory by $3,200, and decrease accounts receivable by $1,800.All net working capital will be recouped when the project terminates.What is the cash flow related to the net working capital for the last year of the project?

A)$500,00

B)$600

C)-$3,600

D)$2,500

E)$5,600

A)$500,00

B)$600

C)-$3,600

D)$2,500

E)$5,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

58

The Tattle Teller has a printing press sitting idly in its back room.The press has no market value to another printer because the machine utilizes old technology.The firm could get $480 for the press as scrap metal.The press is six years old and originally cost $174,000.The current book value is $3,570.The president of the firm is considering a new project and feels he can use this press for that project.What value, if any, should be assigned to the press as an initial cost of the new project?

A)$0

B)$480

C)$3,570

D)$3,090

E)$4,050

A)$0

B)$480

C)$3,570

D)$3,090

E)$4,050

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

59

Scenario analysis:

A)determines the impact a $1 change in sales has on a project's internal rate of return.

B)determines which variable has the greatest impact on a project's net present value.

C)helps determine the reasonable range of expectations for a project's anticipated outcome.

D)evaluates a project's net present value while sensitivity analysis evaluates a project's internal rate of return.

E)determines the absolute worst and absolute best outcome that could ever occur.

A)determines the impact a $1 change in sales has on a project's internal rate of return.

B)determines which variable has the greatest impact on a project's net present value.

C)helps determine the reasonable range of expectations for a project's anticipated outcome.

D)evaluates a project's net present value while sensitivity analysis evaluates a project's internal rate of return.

E)determines the absolute worst and absolute best outcome that could ever occur.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

60

British Metals is reviewing its current accounts to determine how a proposed project might affect the account balances.The firm estimates the project will initially require $81,000 in additional current assets and $57,000 in additional current liabilities.The firm also estimates the project will require an additional $8,000 a year in current assets in each of the first three of the four years of the project.How much net working capital will the firm recoup at the end of the project assuming that all net working capital can be recaptured?

A)$105,000

B)$24,000

C)$48,000

D)$68,000

E)$81,000

A)$105,000

B)$24,000

C)$48,000

D)$68,000

E)$81,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

61

Classic Cars is considering a project that requires $311,250 of fixed assets that are classified as five-year property for MACRS.What is the book value of these assets at the end of Year 3? The MACRS allowance percentages are as follows, commencing with Year 1: 20.00, 32.00, 19.20, 11.52, 11.52, and 5.76 percent.

A)$153,742

B)$136,811

C)$89,640

D)$93,450

E)$144,504

A)$153,742

B)$136,811

C)$89,640

D)$93,450

E)$144,504

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

62

A cost-cutting project will decrease costs by $52,000 a year.The annual depreciation on the project's fixed assets will be $5,000 and the tax rate is 21 percent.What is the amount of the change in the firm's operating cash flow resulting from this project?

A)$37,130

B)$52,000

C)$41,080

D)$46,080

E)$42,130

A)$37,130

B)$52,000

C)$41,080

D)$46,080

E)$42,130

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

63

Phil's Diner, a sole proprietorship purchased some new equipment two years ago for $32,600.Today, it is selling this equipment for $22,000.What is the aftertax cash flow from this sale if the tax rate is 35 percent? The applicable MACRS allowance percentages are as follows, commencing with Year 1: 20.00, 32.00, 19.20, 11.52, 11.52, and 5.76 percent.

A)$19,776.80

B)$18,846.67

C)$24,223.20

D)$20,408.20

E)$25,153.33

A)$19,776.80

B)$18,846.67

C)$24,223.20

D)$20,408.20

E)$25,153.33

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

64

What is the Year 2 depreciation on equipment costing $148,315 if it is classified as five-year property for MACRS purposes? The MACRS allowance percentages are as follows, commencing with Year 1: 20.00, 32.00, 19.20, 11.52, 11.52, and 5.76 percent.

A)$37,968.64

B)$38,201.50

C)$41,984.30

D)$48,398.80

E)$47,460.80

A)$37,968.64

B)$38,201.50

C)$41,984.30

D)$48,398.80

E)$47,460.80

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

65

Northern Lighting purchased some three-year MACRS property three years ago.What is the current book value of this equipment if the original cost was $385,000? The MACRS allowance percentages are as follows, commencing with Year 1: 33.33, 44.45, 14.81, and 7.41 percent.

A)$0

B)$57,037.75

C)$28,528.50

D)$85,547.00

E)$96,250.00

A)$0

B)$57,037.75

C)$28,528.50

D)$85,547.00

E)$96,250.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

66

Woodland Lake Manufacturing has a new project that requires $652,000 of equipment.What is the depreciation in Year 5 of this project if the equipment is classified as seven-year property for MACRS purposes? The MACRS allowance percentages are as follows, commencing with year 1: 14.29, 24.49, 17.49, 12.49, 8.93, 8.92, 8.93, and 4.46 percent.

A)$81,434.80

B)$58,158.40

C)$93,170.80

D)$58,223.60

E)$74,749.60

A)$81,434.80

B)$58,158.40

C)$93,170.80

D)$58,223.60

E)$74,749.60

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

67

A project will reduce costs by $62,750 but increase depreciation by $14,812.What is the operating cash flow of this project based on the tax shield approach if the tax rate is 34 percent?

A)$41,415.00

B)$31,639.08

C)$38,211.19

D)$42,006.20

E)$46,451.08

A)$41,415.00

B)$31,639.08

C)$38,211.19

D)$42,006.20

E)$46,451.08

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

68

An all-equity firm has net income of $78,500, depreciation of $6,250, and taxes of $20,867.What is the firm's operating cash flow?

A)$50,965

B)$72,250

C)$46,250

D)$84,750

E)$78,500

A)$50,965

B)$72,250

C)$46,250

D)$84,750

E)$78,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

69

Sandy Bottom, Inc., purchased some seven-year MACRS welding equipment six years ago at a cost of $60,000.Today, the company is selling this equipment for $10,000.The tax rate is 21 percent.What is the aftertax cash flow from this sale? The MACRS allowance percentages are as follows, commencing with Year 1: 14.29, 24.49, 17.49, 12.49, 8.93, 8.92, 8.93, and 4.46 percent.

A)$6,212.86

B)$8.461.96

C)$9,587.14

D)$10,711.06

E)$11,824.41

A)$6,212.86

B)$8.461.96

C)$9,587.14

D)$10,711.06

E)$11,824.41

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

70

Your local athletic center is planning a $1.2 million expansion to its current facility.This cost will be depreciated on a straight-line basis over a 20-year period.The expanded area is expected to generate $745,000in additional annual sales.Variable costs are 39* percent of sales, the annual fixed costs are $140,000, and the tax rate is 21percent.What is the operating cash flow for the first year of this project?

A)$218,336.00

B)$201,015.00

C)$261,015.50

D)$371,615.50

E)$314,450.00

A)$218,336.00

B)$201,015.00

C)$261,015.50

D)$371,615.50

E)$314,450.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

71

Kite Flite is considering making and selling custom kites in two sizes.The small kites would be priced at $12 and the large kites would be $39.The variable cost per unit is $5 and $14, respectively.Jill, the owner, feels that she can sell 1,900 of the small kites and 1,400 of the large kites each year.The fixed costs would be only $1,890 a year and the tax rate is 34 percent.What is the annual operating cash flow if the annual depreciation expense is $380?

A)$26,064.12

B)$30,759.80

C)$29,848.20

D)$28,309.40

E)$30,630.60

A)$26,064.12

B)$30,759.80

C)$29,848.20

D)$28,309.40

E)$30,630.60

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

72

The Outpost, a sole proprietorship currently sells short leather jackets for $369 each.The firm is considering selling long coats also.The long coats would sell for $719 each and the company expects to sell 820 a year.If the company decides to carry the long coat, management feels that the annual sales of the short jacket will decline from 1,120 to 1,040 units.Variable costs on the jacket are $228 and $435 on the long coat.The fixed costs for this project are $23,100, depreciation is $10,400 a year, and the tax rate is 34 percent.What is the projected operating cash flow for this project?

A)$134,546

B)$131,264

C)$112,212

D)$131,062

E)$128,749

A)$134,546

B)$131,264

C)$112,212

D)$131,062

E)$128,749

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

73

Burke's Corner currently sells blue jeans and T-shirts.Management is considering adding fleece tops to its inventory.The tops would sell for $49 each with expected sales of 3,200 tops annually.By adding the fleece tops, management feels the company will sell an additional 150 pairs of jeans at $79 a pair and 220 fewer T-shirts at $18 each.The variable cost per unit is $36 on the jeans, $7 on the T-shirts, and $21 on the fleece tops.The project's depreciation expense is $23,000 a year and the fixed costs are $21,000 annually.The tax rate is 34 percent.What is the project's operating cash flow?

A)$47,935.80

B)$52,201.20

C)$55,755.80

D)$43,209.90

E)$38,419.70

A)$47,935.80

B)$52,201.20

C)$55,755.80

D)$43,209.90

E)$38,419.70

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

74

Great Western Southern purchased $525,000 of equipment four years ago.The equipment is seven-year MACRS property.The firm is selling this equipment today for $150,000.What is the aftertax cash flow from this sale if the tax rate is 27 percent? The MACRS allowance percentages are as follows, commencing with Year 1: 14.29, 24.49, 17.49, 12.49, 8.93, 8.92, 8.93, and 4.46 percent.

A)$166,712.33

B)$ 152,941.10

C)$143,096.78

D)$168,825.81

E)$147,057.90

A)$166,712.33

B)$ 152,941.10

C)$143,096.78

D)$168,825.81

E)$147,057.90

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

75

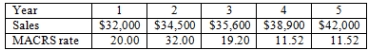

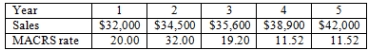

The Blue Lagoon is considering a project with a five-year life.The project requires $32,000 of fixed assets that are classified as five-year property for MACRS.Variable costs equal 67 percent of sales, fixed costs are $12,600, and the tax rate is 34 percent.What is the operating cash flow for Year 4 given the following sales estimates and MACRS depreciation allowance percentages?

A)-$1,806.67

B)$640.89

C)$1,311.16

D)$1,409.80

E)-$2,276.60

A)-$1,806.67

B)$640.89

C)$1,311.16

D)$1,409.80

E)-$2,276.60

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

76

A project has annual depreciation of $15,028, costs of $82,592, and sales of $138,765.The applicable tax rate is 34 percent.What is the operating cash flow according to the tax shield approach?

A)$21,540.09

B)$27,666.67

C)$27,157.02

D)$42,183.70

E)$39,878.84

A)$21,540.09

B)$27,666.67

C)$27,157.02

D)$42,183.70

E)$39,878.84

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

77

A project has sales of $600,000, costs of $366,500, depreciation of $34,500, interest expense of $5,500, and a tax rate of 21 percent.What is the value of the depreciation tax shield?

A)$7,245.00

B)$7,645.00

C)$6,200.00

D)$98,800.00

E)$10,810,200.00a

A)$7,245.00

B)$7,645.00

C)$6,200.00

D)$98,800.00

E)$10,810,200.00a

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

78

A project requires $428,000 of equipment that is classified as seven-year property.What is the depreciation expense in Year 3 given the following MACRS depreciation allowances, starting with Year 1: 14.29, 24.49, 17.49, 12.49, 8.93, 8.92, 8.93, and 4.46 percent?

A)$89,038.42

B)$48,447.30

C)$56,038.15

D)$74,857.20

E)$104,817.20

A)$89,038.42

B)$48,447.30

C)$56,038.15

D)$74,857.20

E)$104,817.20

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

79

A new project is expected to generate an operating cash flow of $75,560 and will initially free up $12,250 in net working capital.Purchases of fixed assets costing $75,000 will be required to start up the project.What is the total cash flow for this project at Time zero?

A)-$64,410

B)- $62,750

C)-$75,000

D)-87,250

E)$62,250

A)-$64,410

B)- $62,750

C)-$75,000

D)-87,250

E)$62,250

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

80

A project has an annual operating cash flow of $52,620.Initially, this four-year project required $5,160 in net working capital, which is recoverable when the project ends.The firm also spent $39,700 on equipment to start the project.This equipment will have a book value of $17,014 at the end of Year 4.What is the cash flow for Year 4 of the project if the equipment can be sold for $15,900 and the tax rate is 35 percent?

A)$63,749.90

B)$73,680.00

C)$74,069.90

D)$73,862.00

E)$73,290.10

A)$63,749.90

B)$73,680.00

C)$74,069.90

D)$73,862.00

E)$73,290.10

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck