Deck 17: Governmental Entities: Introduction and General Fund Accounting

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/79

العب

ملء الشاشة (f)

Deck 17: Governmental Entities: Introduction and General Fund Accounting

1

In accounting for governmental funds, which of the following items could appear only on government-wide financial statements?

I) Fixed assets

II) Long-term debt

III) Investments

A) I only

B) I and II

C) I and III

D) I, II, III

I) Fixed assets

II) Long-term debt

III) Investments

A) I only

B) I and II

C) I and III

D) I, II, III

B

2

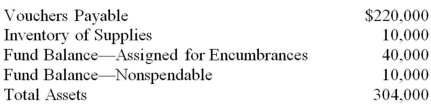

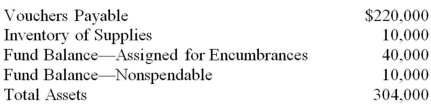

The following information was obtained from the general fund balance sheet of Lima Village on June 30, 20X9, the close of its fiscal year:  On June 30, 20X9, what was Lima's unassigned fund balance in its general fund?

On June 30, 20X9, what was Lima's unassigned fund balance in its general fund?

A) $84,000

B) $44,000

C) $34,000

D) $24,000

On June 30, 20X9, what was Lima's unassigned fund balance in its general fund?

On June 30, 20X9, what was Lima's unassigned fund balance in its general fund?A) $84,000

B) $44,000

C) $34,000

D) $24,000

C

3

According to the latest GASB exposure draft, which of the following is the only governmental fund type that may report an unassigned fund balance?

A) General fund

B) Special revenue fund

C) Capital projects fund

D) Permanent fund

A) General fund

B) Special revenue fund

C) Capital projects fund

D) Permanent fund

A

4

Which of the following characteristics are emphasized in the accounting for state and local government entities?

I) Revenues should be matched with expenditures to measure success or failure of the government entity.

II) There is an emphasis on expendability of resources to accomplish objectives of the governmental entity.

A) I only

B) II only

C) I and II

D) Neither I nor II

I) Revenues should be matched with expenditures to measure success or failure of the government entity.

II) There is an emphasis on expendability of resources to accomplish objectives of the governmental entity.

A) I only

B) II only

C) I and II

D) Neither I nor II

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following statements best describes the reporting process for profit seeking and governmental entities?

A) In profit-seeking enterprises the measurement focus is on the flow of all economic resources of the firm, whereas the focus for governmental funds is on current financial resources.

B) In profit-seeking enterprises the measurement focus is on the flow of current financial resources, whereas the focus for government funds is on all economic resources.

C) Both Profit-seeking enterprises and governmental entities have an objective to measure profitability.

D) Both Profit-seeking enterprises and governmental entities use the accrual or cash basis of accounting to record and report transactions.

A) In profit-seeking enterprises the measurement focus is on the flow of all economic resources of the firm, whereas the focus for governmental funds is on current financial resources.

B) In profit-seeking enterprises the measurement focus is on the flow of current financial resources, whereas the focus for government funds is on all economic resources.

C) Both Profit-seeking enterprises and governmental entities have an objective to measure profitability.

D) Both Profit-seeking enterprises and governmental entities use the accrual or cash basis of accounting to record and report transactions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

6

At the end of the fiscal year, uncollected property taxes in the general fund should be:

A) reclassified from current to delinquent.

B) written off as uncollectible.

C) charged against unassigned fund balance.

D) reclassified from current to noncurrent.

A) reclassified from current to delinquent.

B) written off as uncollectible.

C) charged against unassigned fund balance.

D) reclassified from current to noncurrent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

7

In a statement of revenues, expenditures, and changes in fund balance, the unassigned fund balance will be increased by:

I) a decrease in the fund balance-Nonspendable

II) an excess of other financing sources over other financing uses.

A) I only

B) II only

C) Both I and II

D) Neither I nor II

I) a decrease in the fund balance-Nonspendable

II) an excess of other financing sources over other financing uses.

A) I only

B) II only

C) Both I and II

D) Neither I nor II

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the financial statements described below is prepared by the general fund of a state or local government?

A) A statement of cash flows.

B) An income statement.

C) A statement of revenues, expenses, and changes in retained earnings.

D) A statement of revenues, expenditures, and changes in fund balance.

A) A statement of cash flows.

B) An income statement.

C) A statement of revenues, expenses, and changes in retained earnings.

D) A statement of revenues, expenditures, and changes in fund balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which accounts described below would have non-zero balances after the accounts are closed in the general fund of a state or local government?

I) Estimated Revenues Control.

II) Appropriations Control.

III) Budgetary Fund Balance Unreserved.

IV) Deferred Revenue.

V) Due to Internal Service Fund.

VI) Fund Balance-Reserved for Inventories.

A) I, II, III.

B) I, II, IV.

C) IV, V, VI.

D) III, IV, V.

I) Estimated Revenues Control.

II) Appropriations Control.

III) Budgetary Fund Balance Unreserved.

IV) Deferred Revenue.

V) Due to Internal Service Fund.

VI) Fund Balance-Reserved for Inventories.

A) I, II, III.

B) I, II, IV.

C) IV, V, VI.

D) III, IV, V.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following funds are classified as governmental funds?

A) Internal service and capital projects funds.

B) Internal service and debt service funds.

C) Enterprise and agency funds.

D) The general and special revenue funds.

A) Internal service and capital projects funds.

B) Internal service and debt service funds.

C) Enterprise and agency funds.

D) The general and special revenue funds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which of the following statements is(are) correct about the funds used by governmental entities?

I) Funds are fiscal entities.

II) Funds are accounting entities.

A) I only

B) II only

C) I and II

D) Neither I nor II

I) Funds are fiscal entities.

II) Funds are accounting entities.

A) I only

B) II only

C) I and II

D) Neither I nor II

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following funds are classified as fiduciary funds?

A) Agency and Special revenue funds.

B) Internal service and Enterprise funds.

C) Private-purpose trust and Agency funds.

D) Capital projects and Debt service funds.

A) Agency and Special revenue funds.

B) Internal service and Enterprise funds.

C) Private-purpose trust and Agency funds.

D) Capital projects and Debt service funds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which organization has the authority to establish generally accepted accounting principles for state and local government entities?

A) The National Council on Governmental Accounting

B) The Governmental Accounting Standards Board

C) The Financial Accounting Standards Board

D) The Municipal Officers Finance Organization

A) The National Council on Governmental Accounting

B) The Governmental Accounting Standards Board

C) The Financial Accounting Standards Board

D) The Municipal Officers Finance Organization

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of the following funds provides goods and services only to other departments or agencies of the government on a cost-reimbursement basis?

A) Internal service funds

B) Enterprise funds

C) Special revenue funds

D) The general fund

A) Internal service funds

B) Enterprise funds

C) Special revenue funds

D) The general fund

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

15

All of the following funds have a financial resources measurement focus with the exception of which fund?

A) debt service fund

B) special revenue fund

C) capital projects fund

D) private-purpose trust fund

A) debt service fund

B) special revenue fund

C) capital projects fund

D) private-purpose trust fund

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which governmental fund includes resources that are legally restricted so that the governmental entity must maintain the principal and can use only the earnings from the fund's resources to benefit the government's programs for all of its citizens?

A) General fund

B) Special revenue fund

C) Capital projects fund

D) Permanent fund

A) General fund

B) Special revenue fund

C) Capital projects fund

D) Permanent fund

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of the following items should not be included as revenue for a state government?

A) Property taxes levied in the current fiscal year.

B) Private property for which a state takes custody when the legal owner cannot be found.

C) Amounts received from other financing sources.

D) Fines and licensing fees for which amounts cannot be budgeted.

A) Property taxes levied in the current fiscal year.

B) Private property for which a state takes custody when the legal owner cannot be found.

C) Amounts received from other financing sources.

D) Fines and licensing fees for which amounts cannot be budgeted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

18

All of the following are elements of the statement of financial condition for state and local governments with the exception of:

A) Assets and Liabilities

B) Deferred inflow and outflow of resources

C) Net position

D) Inflow and outflow of resources

A) Assets and Liabilities

B) Deferred inflow and outflow of resources

C) Net position

D) Inflow and outflow of resources

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

19

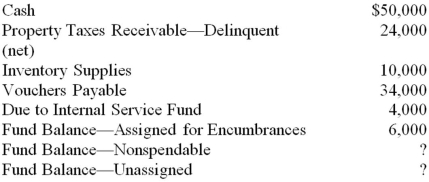

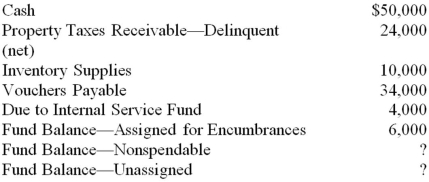

The Town of Baker reported the following items on the June 30, 20X9, balance sheet of its general fund:  At June 30, 20X9, what amount should be reported for Fund Balance-Unassigned?

At June 30, 20X9, what amount should be reported for Fund Balance-Unassigned?

A) $46,000

B) $40,000

C) $30,000

D) $16,000

At June 30, 20X9, what amount should be reported for Fund Balance-Unassigned?

At June 30, 20X9, what amount should be reported for Fund Balance-Unassigned?A) $46,000

B) $40,000

C) $30,000

D) $16,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which of the following funds are classified as proprietary funds?

A) Agency and special revenue funds.

B) Enterprise and internal service funds.

C) Debt service and capital projects funds.

D) Agency and pension trust funds.

A) Agency and special revenue funds.

B) Enterprise and internal service funds.

C) Debt service and capital projects funds.

D) Agency and pension trust funds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

21

Assuming there is a budget surplus, which of the following accounts are credited when the general fund records its operating budget at the beginning of the year?

A) Appropriations Control and Budgetary Fund Balance-Unassigned.

B) Estimated Revenues Control and Estimated Residual Equity Transfer Out.

C) Budgetary Fund Balance-Assigned For Encumbrances and Expenditures.

D) Estimated Residual Equity Transfer Out and Estimated Transfer In.

A) Appropriations Control and Budgetary Fund Balance-Unassigned.

B) Estimated Revenues Control and Estimated Residual Equity Transfer Out.

C) Budgetary Fund Balance-Assigned For Encumbrances and Expenditures.

D) Estimated Residual Equity Transfer Out and Estimated Transfer In.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

22

Revenues from parking meters and parking fines should be reported in the general fund when:

A) received.

B) measurable and available.

C) measurable and earned.

D) available.

A) received.

B) measurable and available.

C) measurable and earned.

D) available.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

23

Note: This is a Kaplan CPA Review Question

The Board of Commissioners of Vane City adopted its budget for the year ending July 31, comprising estimated revenues of $30,000,000 and appropriations of $29,000,000. Vane formally integrates its budget into the accounting records. What entry should be made for budgeted revenues?

A) Memorandum entry only.

B) Debit ESTIMATED REVENUES CONTROL, $30,000,000.

C) Debit ESTIMATED REVENUES RECEIVABLE CONTROL, $30,000,000.

D) Credit ESTIMATED REVENUES CONTROL, $30,000,000.

The Board of Commissioners of Vane City adopted its budget for the year ending July 31, comprising estimated revenues of $30,000,000 and appropriations of $29,000,000. Vane formally integrates its budget into the accounting records. What entry should be made for budgeted revenues?

A) Memorandum entry only.

B) Debit ESTIMATED REVENUES CONTROL, $30,000,000.

C) Debit ESTIMATED REVENUES RECEIVABLE CONTROL, $30,000,000.

D) Credit ESTIMATED REVENUES CONTROL, $30,000,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which of the following items is not recognized as revenue by a governmental unit?

A) sales tax proceeds

B) property tax levies

C) bond proceeds

D) grants received from other governmental units

A) sales tax proceeds

B) property tax levies

C) bond proceeds

D) grants received from other governmental units

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

25

Under the modified accrual basis of accounting, revenue should be recognized when it is:

A) measurable and earned.

B) received in cash.

C) available and earned.

D) measurable and available.

A) measurable and earned.

B) received in cash.

C) available and earned.

D) measurable and available.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following funds should use the accrual basis of accounting?

A) Enterprise and private-purpose trust funds.

B) Permanent funds and internal service funds.

C) Debt service and agency funds.

D) Special revenue and capital projects funds.

A) Enterprise and private-purpose trust funds.

B) Permanent funds and internal service funds.

C) Debt service and agency funds.

D) Special revenue and capital projects funds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

27

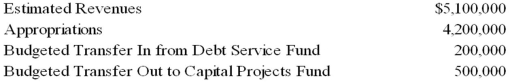

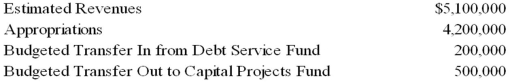

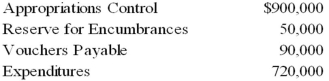

The general fund of Caldwell had the following operating budget for the fiscal year beginning July 1, 20X9:  When the general fund records its operating budget on July 1, 20X9, Budgetary Fund Balance-Unassigned should be

When the general fund records its operating budget on July 1, 20X9, Budgetary Fund Balance-Unassigned should be

A) credited for $600,000.

B) debited for $900,000.

C) debited for $600,000.

D) credited for $900,000.

When the general fund records its operating budget on July 1, 20X9, Budgetary Fund Balance-Unassigned should be

When the general fund records its operating budget on July 1, 20X9, Budgetary Fund Balance-Unassigned should beA) credited for $600,000.

B) debited for $900,000.

C) debited for $600,000.

D) credited for $900,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

28

Note: This is a Kaplan CPA Review Question

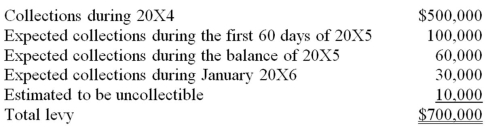

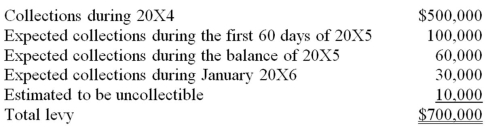

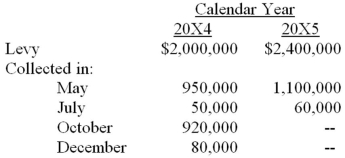

The following information pertains to property taxes levied by Oak City for 20X4:

What amount should Oak report for 20X4 net property tax revenues?

A) $690,000

B) $700,000

C) $600,000

D) $500,000

The following information pertains to property taxes levied by Oak City for 20X4:

What amount should Oak report for 20X4 net property tax revenues?

A) $690,000

B) $700,000

C) $600,000

D) $500,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

29

Note: This is a Kaplan CPA Review Question

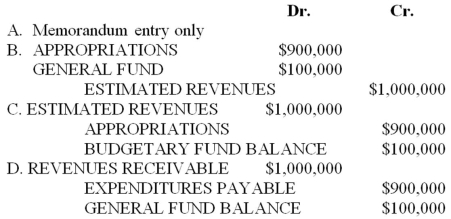

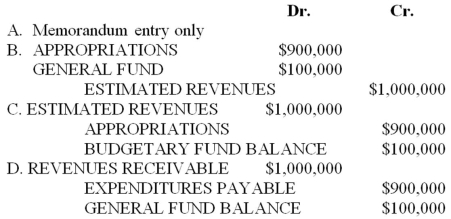

The Board of Commissioners of the City of Rockton adopted its budget for the year ending July 31, 20X2, which indicated revenues of $1,000,000 and appropriations of $900,000. If the budget is formally integrated into the accounting records, what is the required journal entry?

A) Option A

B) Option B

C) Option C

D) Option D

The Board of Commissioners of the City of Rockton adopted its budget for the year ending July 31, 20X2, which indicated revenues of $1,000,000 and appropriations of $900,000. If the budget is formally integrated into the accounting records, what is the required journal entry?

A) Option A

B) Option B

C) Option C

D) Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

30

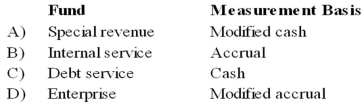

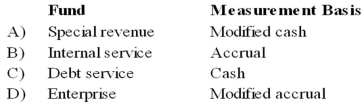

Which combination of fund and measurement basis is correct?

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

31

The general fund of the City of Atlanta received a check for $10,000 from an Atlanta resident on July 1, 20X8. Of the amount received, $4,800 represented full payment of property taxes for 20X8, and the remaining $5,200 represented an advance payment for property taxes of 20X9. On July 1, 20X8, the general fund should record the receipt by debiting Cash for $10,000 and by crediting

A) Revenue-Property Tax for $10,000.

B) Property Taxes Receivable-Current for $4,800 and Deferred Revenue for $5,200.

C) Revenue-Property Tax for $4,800 and Deferred Revenue for $5,200.

D) Property Taxes Receivable-Current for $4,800 and Revenue- Property Tax for $5,200.

A) Revenue-Property Tax for $10,000.

B) Property Taxes Receivable-Current for $4,800 and Deferred Revenue for $5,200.

C) Revenue-Property Tax for $4,800 and Deferred Revenue for $5,200.

D) Property Taxes Receivable-Current for $4,800 and Revenue- Property Tax for $5,200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

32

Under the modified accrual basis of accounting for the general fund, expenditures should be recognized in the period in which the related liability is:

I) paid.

II) incurred.

A) I only

B) II only

C) Both I and II

D) Neither I nor II

I) paid.

II) incurred.

A) I only

B) II only

C) Both I and II

D) Neither I nor II

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

33

What is the correct sequence in the expenditure process in governmental accounting?

A) Appropriation, Encumbrance, Expenditure, and Disbursement.

B) Encumbrance, Expenditure, Disbursement, and Appropriation.

C) Expenditure, Encumbrance, Disbursement, and Appropriation.

D) Appropriation, Expenditure, Encumbrance, and Disbursement.

A) Appropriation, Encumbrance, Expenditure, and Disbursement.

B) Encumbrance, Expenditure, Disbursement, and Appropriation.

C) Expenditure, Encumbrance, Disbursement, and Appropriation.

D) Appropriation, Expenditure, Encumbrance, and Disbursement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

34

The general fund of Gillette levied property taxes of $400,000 on November 1, 20X8. However, the property taxes are not collectible until May and August of 20X9. Assume Gillette reports on the calendar year. On Gillette's general fund balance sheet at December 31, 20X8, the property taxes levied on November 1 should:

A) be reported as an asset and as a decrease in unassigned fund balance.

B) be reported as an asset and as an increase in unassigned fund balance.

C) be reported as an asset and as a reservation of fund balance.

D) be reported as an asset and as a deferred revenue.

A) be reported as an asset and as a decrease in unassigned fund balance.

B) be reported as an asset and as an increase in unassigned fund balance.

C) be reported as an asset and as a reservation of fund balance.

D) be reported as an asset and as a deferred revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following funds should use the modified accrual basis of accounting?

A) Private-purpose trust and agency funds.

B) Capital projects and special revenue funds.

C) Internal service and enterprise funds.

D) Debt service and private-purpose trust funds.

A) Private-purpose trust and agency funds.

B) Capital projects and special revenue funds.

C) Internal service and enterprise funds.

D) Debt service and private-purpose trust funds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

36

In a town's general fund operating budget for the year, the amount of its estimated revenues exceeded the amount of its appropriations. This excess should be:

A) credited to Budgetary Fund Balance-Unassigned.

B) debited to Budgetary Fund Balance-Unassigned.

C) credited to Fund Balance-Unassigned.

D) debited to Fund Balance-Unassigned.

A) credited to Budgetary Fund Balance-Unassigned.

B) debited to Budgetary Fund Balance-Unassigned.

C) credited to Fund Balance-Unassigned.

D) debited to Fund Balance-Unassigned.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

37

Note: This is a Kaplan CPA Review Question

A budgetary fund balance - assigned in excess of a balance of encumbrances indicates

A) A recording error.

B) An excess of vouchers payable over encumbrances.

C) An excess of purchase orders over invoices received.

D) An excess of appropriations over encumbrances.

A budgetary fund balance - assigned in excess of a balance of encumbrances indicates

A) A recording error.

B) An excess of vouchers payable over encumbrances.

C) An excess of purchase orders over invoices received.

D) An excess of appropriations over encumbrances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

38

The general fund of the Town of Dean levied property taxes of $3,000,000 for the fiscal year beginning on January 1, 20X8. It was estimated that 1% of the levy would be uncollectible. During the period January 1, 20X8, through December 31, 20X8, $2,960,000 of the property tax levy was collected. At December 31, 20X8, Dean estimated that $10,000 of property taxes levied in 20X8 would be collected during the first 60 days of 20X9. What amount of property tax revenue should be reported by the general fund for the year ended December 31, 20X8?

A) $2,960,000

B) $3,000,000

C) $2,970,000

D) $2,990,000

A) $2,960,000

B) $3,000,000

C) $2,970,000

D) $2,990,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

39

Note: This is a Kaplan CPA Review Question

When the budget of a governmental unit, for which the estimated revenues exceed the appropriations, is adopted and recorded in the general ledger at the beginning of the year, the budgetary fund balance account is

A) Credited at the beginning of the year and debited at the end of the year.

B) Credited at the beginning of the year and no entry made at the end of the year.

C) Debited at the beginning of the year and no entry made at the end of the year.

D) Debited at the beginning of the year and credited at the end of the year.

When the budget of a governmental unit, for which the estimated revenues exceed the appropriations, is adopted and recorded in the general ledger at the beginning of the year, the budgetary fund balance account is

A) Credited at the beginning of the year and debited at the end of the year.

B) Credited at the beginning of the year and no entry made at the end of the year.

C) Debited at the beginning of the year and no entry made at the end of the year.

D) Debited at the beginning of the year and credited at the end of the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

40

Note: This is a Kaplan CPA Review Question

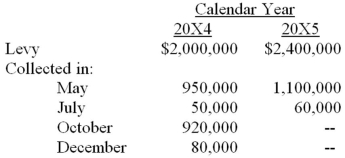

Pine City's year end is June 30. Pine levies property taxes in January of each year for the calendar year. One-half of the levy is due in May and one-half is due in October. Property tax revenue is budgeted for the period in which payment is due. The following information pertains to Pine's property taxes for the period from July 1, 20X4, to June 30, 20X5:

The $40,000 balance due for the May 20X5 installments was expected to be collected in August 20X5. What amount should Pine recognize for property tax revenue for the year ended June 30, 20X5?

A) $2,160,000

B) $2,200,000

C) $2,360,000

D) $2,400,000

Pine City's year end is June 30. Pine levies property taxes in January of each year for the calendar year. One-half of the levy is due in May and one-half is due in October. Property tax revenue is budgeted for the period in which payment is due. The following information pertains to Pine's property taxes for the period from July 1, 20X4, to June 30, 20X5:

The $40,000 balance due for the May 20X5 installments was expected to be collected in August 20X5. What amount should Pine recognize for property tax revenue for the year ended June 30, 20X5?

A) $2,160,000

B) $2,200,000

C) $2,360,000

D) $2,400,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

41

The general fund of Loveland ordered a new fire truck on November 12, 20X8, for $150,000. The order was appropriately encumbered on this date. Loveland received the fire truck on January 15, 20X9, and issued a voucher to the manufacturer for $148,600. Loveland uses the calendar year for reporting, and outstanding encumbrances at December 31, 20X8, are lapsing. On January 15, 20X9, the general fund of Loveland should debit:

A) Fund Balance-assigned for Encumbrances for $148,600.

B) Expenditures for $148,600.

C) Expenditures-20X8 for $148,600.

D) Encumbrances for $148,600.

A) Fund Balance-assigned for Encumbrances for $148,600.

B) Expenditures for $148,600.

C) Expenditures-20X8 for $148,600.

D) Encumbrances for $148,600.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

42

Due to an error, the general fund of Pueblo did not record an encumbrance for police equipment which had been ordered but not received on June 30, 20X9, the end of its fiscal year. Pueblo's outstanding encumbrances at year-end are nonlapsing. What was the effect of this error on the balance sheet of Pueblo's general fund?

A) Assets are overstated.

B) Liabilities are understated.

C) Total fund balance is overstated.

D) Unassigned fund balance is overstated.

A) Assets are overstated.

B) Liabilities are understated.

C) Total fund balance is overstated.

D) Unassigned fund balance is overstated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

43

On July 25, 20X8, the city of Pullman, which reports on a calendar-year basis, ordered five police cars at an estimated cost of $200,000. On August 26, 20X8, the police cars were received, and the actual cost amounted to $197,000. Pullman encumbered the appropriation for police cars in its general fund when the cars were ordered. When the police cars were received, the general fund of Pullman should:

A) Credit Budgetary Fund Balance Assigned for Encumbrances for $197,000.

B) Debit Encumbrances for $200,000.

C) Debit Expenditures for $197,000.

D) Credit Budgetary Fund Balance Assigned for Expenditures for $200,000.

A) Credit Budgetary Fund Balance Assigned for Encumbrances for $197,000.

B) Debit Encumbrances for $200,000.

C) Debit Expenditures for $197,000.

D) Credit Budgetary Fund Balance Assigned for Expenditures for $200,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

44

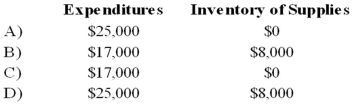

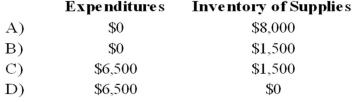

Gotham City acquires $25,000 of inventory on November 1, 20X7, having held no inventory previously. On December 31, 20X7, the end of Gotham City's fiscal year, a physical count shows $8,000 still in stock. During 20X8, $6,500 of this inventory is used, resulting in a $1,500 remaining balance of supplies on December 31, 20X8.

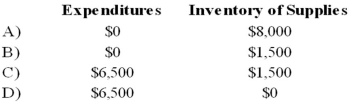

Based on the preceding information, which of the following would be the correct account balances for 20X7 if Gotham City used the purchase method of accounting for inventories?

A) Option A

B) Option B

C) Option C

D) Option D

Based on the preceding information, which of the following would be the correct account balances for 20X7 if Gotham City used the purchase method of accounting for inventories?

A) Option A

B) Option B

C) Option C

D) Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

45

Identify the legal term that allows the general fund to make expenditures.

A) Exceptions

B) Appropriations

C) Encumbrances

D) Consumption

A) Exceptions

B) Appropriations

C) Encumbrances

D) Consumption

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

46

The general fund of Athens ordered computer equipment on December 1, 20X8, for $32,000. The order was appropriately encumbered on this date. Athens received the computer equipment on January 25, 20X9, and issued a voucher to pay the vendor $32,400. Athens uses the calendar year for reporting, and all outstanding encumbrances lapse at year-end. Athens' governing board honors all outstanding encumbrances by including them in the following year's appropriations. On January 25, 20X9, the general fund of Athens should debit:

A) Encumbrances for $32,000.

B) Fund Balance-assigned for Encumbrances for $32,400.

C) Expenditures-20X8 for $32,400.

D) Expenditures for $32,400.

A) Encumbrances for $32,000.

B) Fund Balance-assigned for Encumbrances for $32,400.

C) Expenditures-20X8 for $32,400.

D) Expenditures for $32,400.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

47

GASB 31 "Accounting for Financial Reporting for Certain Investments and for External Reporting Investment Pools," establishes a general rule that government entities value investments in option contracts, open-ended mutual funds, and debt securities for balance sheet presentation at:

A) lower of cost or market.

B) fair value.

C) cost.

D) amortized cost.

A) lower of cost or market.

B) fair value.

C) cost.

D) amortized cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

48

The Town of Pasco has no supplies inventory in its general fund on January 1, 20X8. During 20X8, Pasco incurred expenditures of $200,000 for the acquisition of supplies. On December 31, 20X8, Pasco's inventory of supplies amounted to $30,000. Assume Pasco uses the purchase method of accounting for supplies in its general fund and that the village reports on the calendar year. On December 31, 20X8, the general fund of Pasco should credit:

A) Expenditures for $170,000.

B) Fund Balance-Unassigned for $170,000.

C) Fund Balance-Nonspendable for $30,000.

D) Expenditures for $30,000.

A) Expenditures for $170,000.

B) Fund Balance-Unassigned for $170,000.

C) Fund Balance-Nonspendable for $30,000.

D) Expenditures for $30,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

49

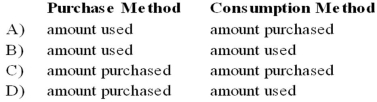

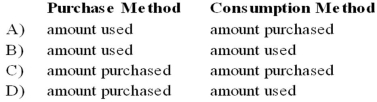

What amount should be reported as expenditures for the current fiscal year when accounting for inventories of supplies under the purchase method and under the consumption method?

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

50

Works of art and historical treasures purchased by the general fund should be reported as:

I) an expenditure in the general fund.

II) assets in the government-wide financial statements.

A) I only

B) II only

C) Both I and II

D) Neither I nor II

I) an expenditure in the general fund.

II) assets in the government-wide financial statements.

A) I only

B) II only

C) Both I and II

D) Neither I nor II

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

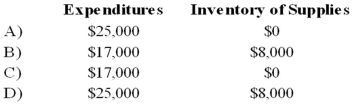

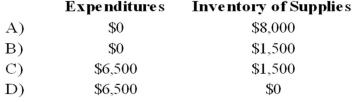

51

Gotham City acquires $25,000 of inventory on November 1, 20X7, having held no inventory previously. On December 31, 20X7, the end of Gotham City's fiscal year, a physical count shows $8,000 still in stock. During 20X8, $6,500 of this inventory is used, resulting in a $1,500 remaining balance of supplies on December 31, 20X8.

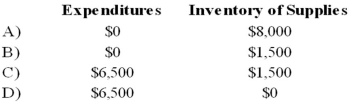

Based on the preceding information, which of the following would be the correct account balances for 20X8 if Gotham City used the purchase method of accounting for inventories?

A) Option A

B) Option B

C) Option C

D) Option D

Based on the preceding information, which of the following would be the correct account balances for 20X8 if Gotham City used the purchase method of accounting for inventories?

A) Option A

B) Option B

C) Option C

D) Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

52

Gotham City acquires $25,000 of inventory on November 1, 20X7, having held no inventory previously. On December 31, 20X7, the end of Gotham City's fiscal year, a physical count shows $8,000 still in stock. During 20X8, $6,500 of this inventory is used, resulting in a $1,500 remaining balance of supplies on December 31, 20X8.

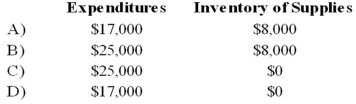

Based on the preceding information, which of the following would be the correct account balances for 20X8 if Gotham City used the consumption method of accounting for inventories?

A) Option A

B) Option B

C) Option C

D) Option D

Based on the preceding information, which of the following would be the correct account balances for 20X8 if Gotham City used the consumption method of accounting for inventories?

A) Option A

B) Option B

C) Option C

D) Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

53

The general fund of Hatteras acquired a fire truck during the fiscal year ended June 30, 20X9. The purchase order for the fire truck was recorded on February 15, 20X9. Hatteras' acquisition of the fire truck required which of the following sequences of accounting activities?

I) Appropriation

II) Encumbrance

III) Expenditure

A) II, I, III.

B) I, III, II.

C) III, II, I.

D) I, II, III.

I) Appropriation

II) Encumbrance

III) Expenditure

A) II, I, III.

B) I, III, II.

C) III, II, I.

D) I, II, III.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

54

Gotham City acquires $25,000 of inventory on November 1, 20X7, having held no inventory previously. On December 31, 20X7, the end of Gotham City's fiscal year, a physical count shows $8,000 still in stock. During 20X8, $6,500 of this inventory is used, resulting in a $1,500 remaining balance of supplies on December 31, 20X8.

Which of the following accounts are debited when closing entries are made for the general fund (assume outstanding encumbrances lapse at year-end)?

I) Appropriations Control.

II) Estimated Revenues Control.

III) Encumbrances.

IV) Budgetary Fund Balance-Reserved for Encumbrances.

V) Estimated Other Financing Uses-Transfer Out.

VI) Revenue-Property Tax.

A) I, II, III, VI.

B) I, II, IV.

C) I, IV, V, VI.

D) III, IV, V.

Which of the following accounts are debited when closing entries are made for the general fund (assume outstanding encumbrances lapse at year-end)?

I) Appropriations Control.

II) Estimated Revenues Control.

III) Encumbrances.

IV) Budgetary Fund Balance-Reserved for Encumbrances.

V) Estimated Other Financing Uses-Transfer Out.

VI) Revenue-Property Tax.

A) I, II, III, VI.

B) I, II, IV.

C) I, IV, V, VI.

D) III, IV, V.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

55

The City of Ames uses the consumption method to report its inventory of supplies on its general fund balance sheet. What account is debited in the general fund when Ames acquires supplies?

A) Expenditures

B) Inventory of Supplies

C) Supplies Expense

D) Fund Balance-Nonspendable

A) Expenditures

B) Inventory of Supplies

C) Supplies Expense

D) Fund Balance-Nonspendable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

56

Gotham City acquires $25,000 of inventory on November 1, 20X7, having held no inventory previously. On December 31, 20X7, the end of Gotham City's fiscal year, a physical count shows $8,000 still in stock. During 20X8, $6,500 of this inventory is used, resulting in a $1,500 remaining balance of supplies on December 31, 20X8.

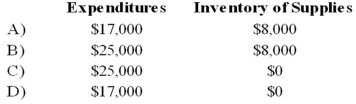

Based on the preceding information, which of the following would be the correct account balances for 20X7 if Gotham City used the consumption method of accounting for inventories?

A) Option A

B) Option B

C) Option C

D) Option D

Based on the preceding information, which of the following would be the correct account balances for 20X7 if Gotham City used the consumption method of accounting for inventories?

A) Option A

B) Option B

C) Option C

D) Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

57

Blue Ridge Township uses the consumption method of accounting for its inventory of supplies. On the December 31, 20X7 balance sheet for the general fund, the township reported $10,000 of supplies inventory. During 20X8, expenditures for supplies amounted to $40,000, and, at December 31, 20X8, unused supplies totaled $7,000. In the adjusting entry for supplies at December 31, 20X8,

A) Expenditures should be credited for $3,000.

B) Expenditures should be debited for $3,000.

C) Fund Balance-Nonspendable should be debited for $7,000.

D) Fund Balance-Nonspendable should be credited for $7,000.

A) Expenditures should be credited for $3,000.

B) Expenditures should be debited for $3,000.

C) Fund Balance-Nonspendable should be debited for $7,000.

D) Fund Balance-Nonspendable should be credited for $7,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

58

Which of the following observations concerning encumbrances is NOT true?

A) Their purpose is to ensure that the expenditures within a period do not exceed the budgeted appropriations.

B) They provide a control system and safeguard for governmental unit administrators.

C) They are a unique element of governmental accounting.

D) They are recognized only at the time disbursements are made.

A) Their purpose is to ensure that the expenditures within a period do not exceed the budgeted appropriations.

B) They provide a control system and safeguard for governmental unit administrators.

C) They are a unique element of governmental accounting.

D) They are recognized only at the time disbursements are made.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

59

The general fund of Wold Township ordered office furniture for the mayor's office on August 1, 20X8. The office furniture was estimated to cost $12,000. The office furniture was received on September 1, 20X8, with the actual cost being $11,800. Which of the following accounts decreased on September 1, 20X8?

A) Encumbrances only.

B) Expenditures only.

C) Encumbrances and Budgetary Fund Balance-Assigned for Encumbrances.

D) Expenditures and Budgetary Fund Balance-Assigned for Encumbrances.

A) Encumbrances only.

B) Expenditures only.

C) Encumbrances and Budgetary Fund Balance-Assigned for Encumbrances.

D) Expenditures and Budgetary Fund Balance-Assigned for Encumbrances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

60

The general fund of Park City acquired computer equipment at a cost of $50,000 on May 18, 20X9. To record acquisition of this equipment, the general fund of Park City should debit:

A) expenditures.

B) encumbrances.

C) equipment.

D) vouchers payable.

A) expenditures.

B) encumbrances.

C) equipment.

D) vouchers payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

61

Note: This is a Kaplan CPA Review Question

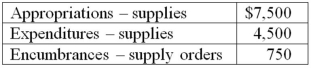

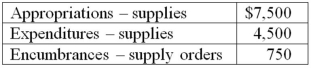

The following balances are included in the subsidiary records of Burwood Village's Parks and Recreation Department at March 31st:

How much does the Department have available for additional purchases of supplies?

A) $0

B) $2,250

C) $3,000

D) $6,750

The following balances are included in the subsidiary records of Burwood Village's Parks and Recreation Department at March 31st:

How much does the Department have available for additional purchases of supplies?

A) $0

B) $2,250

C) $3,000

D) $6,750

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

62

Discuss major differences between a governmental entity's uses of the modified accrual method and a for-profit corporation's use of the accrual method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

63

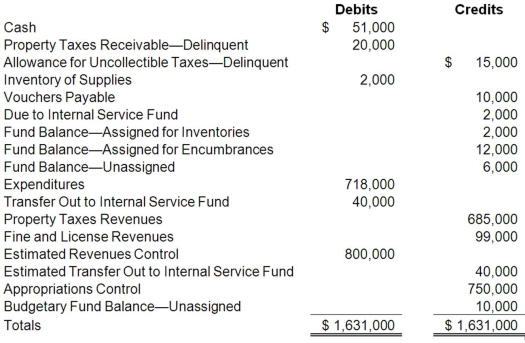

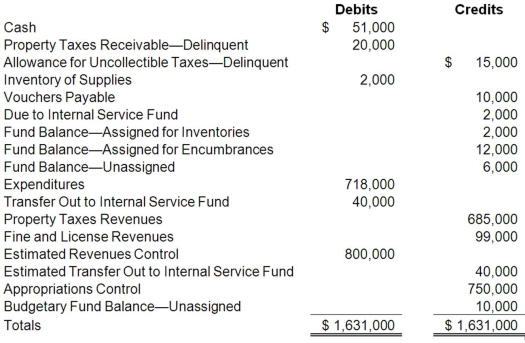

The adjusted trial balance for White River for the fiscal year ended June 30, 20X9, is presented below.

Required:

a. Prepare a statement of revenues, expenditures, and changed in fund balance for White River for the year ended June 30, 20X9. Assume there were no supplies or outstanding encumbrances at the beginning of the year.

b. Prepare a balance sheet for White River at June 30, 20X9.

Required:

a. Prepare a statement of revenues, expenditures, and changed in fund balance for White River for the year ended June 30, 20X9. Assume there were no supplies or outstanding encumbrances at the beginning of the year.

b. Prepare a balance sheet for White River at June 30, 20X9.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

64

The town of Stow was incorporated and began governmental operations on July 1, 20X8. Stow's transactions and events for the fiscal year ended June 30, 20X9, are listed below. Stow uses the consumption method of accounting for purchases of supplies. Encumbrances do not lapse at year end.

Required:

Prepare the journal entry(ies) required in the general fund for each of the following transactions or events.

a. The town budget was approved, providing for revenues of $800,000, a $40,000 transfer to establish an internal service fund (ISF), and expenditures of $750,000.

b. Property taxes were levied in the amount of $700,000, with 4 percent of the total estimated to be uncollectible.

c. Purchase orders were issued in the amount of $90,000 for equipment, and $635,000 for other goods and services.

d. Collections for fines and licenses totaled $99,000 for the year.

e. Property taxes collected amounted to $680,000; the balance was reclassified as delinquent, and the allowance for uncollectible taxes was reduced to $15,000.

f. The equipment ordered was received, and a voucher was issued for the final invoice cost of $91,000.

g. All but $12,000 of the other goods and services ordered was received. Vouchers were issued for the invoice cost of $622,000.

h. All but $10,000 of the vouchers issued during the year was paid.

i. A transfer in the amount of $40,000 was made to establish an internal service fund for the town. The general fund received services of $7,000 from the internal service fund during the year, with $2,000 remaining unpaid at year end.

j. Expenditures recorded for the year included the purchase of supplies. The estimated balance of supplies on hand at year end was $2,000.

k. A reserve was established at year end for the outstanding encumbrances, all of which will be honored in the next fiscal year.

l. Closing entries were made.

Required:

Prepare the journal entry(ies) required in the general fund for each of the following transactions or events.

a. The town budget was approved, providing for revenues of $800,000, a $40,000 transfer to establish an internal service fund (ISF), and expenditures of $750,000.

b. Property taxes were levied in the amount of $700,000, with 4 percent of the total estimated to be uncollectible.

c. Purchase orders were issued in the amount of $90,000 for equipment, and $635,000 for other goods and services.

d. Collections for fines and licenses totaled $99,000 for the year.

e. Property taxes collected amounted to $680,000; the balance was reclassified as delinquent, and the allowance for uncollectible taxes was reduced to $15,000.

f. The equipment ordered was received, and a voucher was issued for the final invoice cost of $91,000.

g. All but $12,000 of the other goods and services ordered was received. Vouchers were issued for the invoice cost of $622,000.

h. All but $10,000 of the vouchers issued during the year was paid.

i. A transfer in the amount of $40,000 was made to establish an internal service fund for the town. The general fund received services of $7,000 from the internal service fund during the year, with $2,000 remaining unpaid at year end.

j. Expenditures recorded for the year included the purchase of supplies. The estimated balance of supplies on hand at year end was $2,000.

k. A reserve was established at year end for the outstanding encumbrances, all of which will be honored in the next fiscal year.

l. Closing entries were made.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

65

Note: This is a Kaplan CPA Review Question

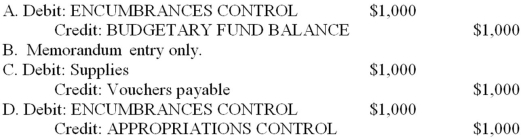

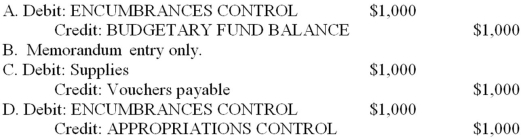

Albee Township's fiscal year ends on June 30. Albee uses encumbrance accounting. On April 5, 20X5, an approved $1,000 purchase order was issued for supplies. Albee received these supplies on May 2, 20X5, and the $1,000 invoice was approved for payment. What journal entry should Albee make on April 5, 20X5, to record the approved purchase order?

A) Option A

B) Option B

C) Option C

D) Option D

Albee Township's fiscal year ends on June 30. Albee uses encumbrance accounting. On April 5, 20X5, an approved $1,000 purchase order was issued for supplies. Albee received these supplies on May 2, 20X5, and the $1,000 invoice was approved for payment. What journal entry should Albee make on April 5, 20X5, to record the approved purchase order?

A) Option A

B) Option B

C) Option C

D) Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

66

The general fund of Battle Creek budgeted a transfer to its capital projects fund for $110,000 to be used in operations during the year ended June 20, 20X9. On September 15, 20X8, the general fund transferred $110,000 to the capital projects fund. What account should be debited in the general fund on September 15 to record this transfer?

A) Appropriations

B) Expenditures

C) Budgetary Fund Balance-Assigned For Encumbrances

D) Other Financing Uses-Transfer Out to Capital Projects Fund

A) Appropriations

B) Expenditures

C) Budgetary Fund Balance-Assigned For Encumbrances

D) Other Financing Uses-Transfer Out to Capital Projects Fund

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

67

The general fund of the City of Columbia transferred money to establish an internal service fund for the city's data processing needs. The general fund of Columbia should account for this transaction as a(n):

A) expenditure.

B) interfund transfer.

C) interfund reimbursement.

D) loan.

A) expenditure.

B) interfund transfer.

C) interfund reimbursement.

D) loan.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

68

Accounting processes differ between a for-profit entity and a governmental entity. Discuss three differences between a governmental entity and a for-profit entity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

69

The general fund of Sun City was billed $7,000 for using the services of one of its internal service funds. The general fund should account for this transaction as a(n)

A) interfund transfer.

B) interfund loan.

C) interfund service.

D) interfund reimbursement for services rendered.

A) interfund transfer.

B) interfund loan.

C) interfund service.

D) interfund reimbursement for services rendered.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

70

Which of the following describes how a governmental fund (e.g. general fund) accounts for a capital lease:

A) noncurrent liability

B) bond accounting

C) an asset and a lease liability

D) none of these identifies the appropriate way to account for a capital lease.

A) noncurrent liability

B) bond accounting

C) an asset and a lease liability

D) none of these identifies the appropriate way to account for a capital lease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

71

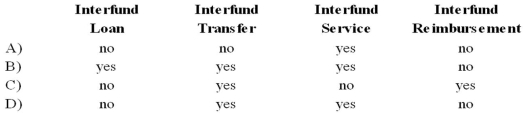

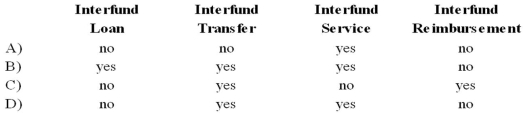

GASB 34 established four types of interfund activities. Interfund activities are recognized as revenue in a governmental fund for an:

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

72

The general fund of Richmond was billed $22,000 on August 15, 20X8, for using the services of one of its internal service funds (ISF). What accounts should be debited and credited, respectively, in the general fund on August 15, 20X8, to record this transaction?

A) Expenditures and Transfer Out to ISF

B) Expenditures and Due to ISF

C) Encumbrances and Due to ISF

D) Encumbrances and Transfer Out to ISF

A) Expenditures and Transfer Out to ISF

B) Expenditures and Due to ISF

C) Encumbrances and Due to ISF

D) Encumbrances and Transfer Out to ISF

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

73

Note: This is a Kaplan CPA Review Question

Elm City issued a purchase order for supplies with an estimated cost of $5,000. When the supplies were received, the accompanying invoice indicated an actual price of $4,950. What amount should Elm debit (credit) to the budgetary fund balance account after the supplies and invoice were received?

A) $4,950

B) ($50)

C) $50

D) $5,000

Elm City issued a purchase order for supplies with an estimated cost of $5,000. When the supplies were received, the accompanying invoice indicated an actual price of $4,950. What amount should Elm debit (credit) to the budgetary fund balance account after the supplies and invoice were received?

A) $4,950

B) ($50)

C) $50

D) $5,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

74

Briefly discuss the various types of governmental funds and proprietary funds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

75

Which of the following observations concerning interfund transfers is true?

A) They are expected to be repaid.

B) They are classified as fund revenues or expenditures.

C) The receiving fund recognizes these transfers as revenue.

D) These transfers are classified under "Other Financing Sources or Uses."

A) They are expected to be repaid.

B) They are classified as fund revenues or expenditures.

C) The receiving fund recognizes these transfers as revenue.

D) These transfers are classified under "Other Financing Sources or Uses."

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

76

Note: This is a Kaplan CPA Review Question

The following related entries were recorded in sequence in the general fund of a municipality:

The sequence of entries indicates that

A) Encumbrances were anticipated but later failed to materialize and were reversed. A liability of $12,350 was incurred.

B) An adverse event was foreseen and a reserve of $12,000 was created; later the reserve was cancelled and a liability for the item was acknowledged.

C) An order was placed for goods or services estimated to cost $12,000; the actual cost was $12,350 for which a liability was acknowledged upon receipt.

D) The first entry was erroneous and was reversed; a liability of $12,350 was acknowledged.

The following related entries were recorded in sequence in the general fund of a municipality:

The sequence of entries indicates that

A) Encumbrances were anticipated but later failed to materialize and were reversed. A liability of $12,350 was incurred.

B) An adverse event was foreseen and a reserve of $12,000 was created; later the reserve was cancelled and a liability for the item was acknowledged.

C) An order was placed for goods or services estimated to cost $12,000; the actual cost was $12,350 for which a liability was acknowledged upon receipt.

D) The first entry was erroneous and was reversed; a liability of $12,350 was acknowledged.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

77

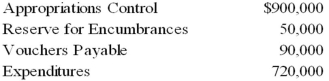

The general ledger of Broadway contains the following selected account balances:  Broadway wants to order additional goods and services before the fiscal year end. What is the unencumbered balance of the budget that may be expended by Broadway?

Broadway wants to order additional goods and services before the fiscal year end. What is the unencumbered balance of the budget that may be expended by Broadway?

A) $850,000

B) $760,000

C) $180,000

D) $130,000

Broadway wants to order additional goods and services before the fiscal year end. What is the unencumbered balance of the budget that may be expended by Broadway?

Broadway wants to order additional goods and services before the fiscal year end. What is the unencumbered balance of the budget that may be expended by Broadway?A) $850,000

B) $760,000

C) $180,000

D) $130,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

78

At any time, the remaining appropriating authority available to the fund managers is equal to:

A) Appropriations minus Expenditures

B) Appropriations minus (Encumbrances + Expenditures)

C) Appropriations minus (Encumbrances - Expenditures)

D) Appropriations minus Encumbrances

A) Appropriations minus Expenditures

B) Appropriations minus (Encumbrances + Expenditures)

C) Appropriations minus (Encumbrances - Expenditures)

D) Appropriations minus Encumbrances

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

79

When an internal service fund (ISF) enters into a capital lease the transaction is recorded in the:

I) fixed assets of the ISF.

II) long-term debt of the ISF.

A) I only

B) II only

C) Both I and II

D) Neither I nor II

I) fixed assets of the ISF.

II) long-term debt of the ISF.

A) I only

B) II only

C) Both I and II

D) Neither I nor II

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck