Deck 20: Life, Fire and Auto Insurance

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/57

العب

ملء الشاشة (f)

Deck 20: Life, Fire and Auto Insurance

1

Universal life provides whole life protection.

True

2

Permanent protection is provided by term insurance.

False

3

Term insurance builds up no cash value.

True

4

Reduced paid-up insurance means the policy continues for life at a reduced face amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

5

All premiums for universal life remain the same.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

6

The face amount is the amount stated in the policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

7

The short rate cancellation table is used if the insured cancels the policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

8

The cash value of a life insurance policy is a cheap source of money.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

9

Premiums for straight-life insurance are higher than premiums for term insurance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

10

The premium for fire insurance is found by the insured value divided by 100 times the table rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

11

Buying flight insurance at an airport is an example of straight-life insurance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

12

Nonforfeiture values could result in the insured being paid the cash value of the policy and the policy being terminated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

13

The beneficiary pays the insurance to the insured.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

14

Extended term insurance means the policy continues but at a face amount that is less than the original policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

15

The premium is the payment(s) that is made to pay for the cost of an insurance policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

16

If the insurance company cancels a fire insurance policy, the refund to the insured will be less than if the insured cancels the policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

17

The one receiving the insurance coverage is the insured.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

18

Twenty-payment life requires premiums for 20 years although the insured is protected till death.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

19

A 20-year endowment does not build up any cash value by the end of year 5.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

20

Term insurance would pay the face amount of the policy in case of the death of the insured.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

21

A falling object that dents a car would be covered under comprehensive insurance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

22

Reduced paid-up insurance:

A)Buys protection with paying new premiums

B)Continues for 20 years

C)Results in a face amount less than the original amount

D)Means original face amount is continued for a certain number of years

E)None of these

A)Buys protection with paying new premiums

B)Continues for 20 years

C)Results in a face amount less than the original amount

D)Means original face amount is continued for a certain number of years

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

23

Term insurance:

A)Is more expensive than straight-life

B)Builds up cash value

C)Pays more than the face amount

D)Provides temporary protection

E)None of these

A)Is more expensive than straight-life

B)Builds up cash value

C)Pays more than the face amount

D)Provides temporary protection

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

24

As a result of few suits as well as high operating costs, no-fault has reduced some premium costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

25

In terms of premium cost, the most expensive type of insurance is:

A)Term

B)Straight-life

C)20-payment life

D)20-year endowment

E)None of these

A)Term

B)Straight-life

C)20-payment life

D)20-year endowment

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

26

If the insured cancels a fire insurance policy after seven months, the refund will be (use table in handbook):

A)67%

B)7/12 of policy

C)5/12 of policy

D)33%

E)None of these

A)67%

B)7/12 of policy

C)5/12 of policy

D)33%

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

27

An auto insurance premium may be partially based on:

A)Attitude of driver

B)Expected life of car

C)Make of car

D)Number of years one expects to drive a car

E)None of these

A)Attitude of driver

B)Expected life of car

C)Make of car

D)Number of years one expects to drive a car

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

28

Abby Kaminsky, age 32, has decided to take out a limited payment life policy. She chose this since she expects her income to decline in future years. Abby has decided to take out a 20-year payment life policy with a coverage amount of $200,000. Using the tables in the handbook, her annual premium will be:

A)$1,158

B)$2,316

C)$2,136

D)$1,518

E)None of these

A)$1,158

B)$2,316

C)$2,136

D)$1,518

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

29

Compulsory liability insurance includes bodily injury and property damage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which one of the following builds up no cash value?

A)Universal life

B)Straight-life

C)Term

D)20-payment life

E)None of these

A)Universal life

B)Straight-life

C)Term

D)20-payment life

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

31

All states have the same compulsory insurance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

32

Insurance required to meet coinsurance is the coinsurance rate times the replacement value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

33

The insurance required to meet coinsurance is:

A)80% × face value

B)80% × replacement value

C)80% × actual loss

D)Insurance carried divided by 80%

E)None of these

A)80% × face value

B)80% × replacement value

C)80% × actual loss

D)Insurance carried divided by 80%

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

34

A premium for fire insurance could be lower than someone else's if:

A)Building is wood

B)Roof is not fire resistant

C)Building is close to a fire hydrant

D)Goods within store are flammable

E)None of these

A)Building is wood

B)Roof is not fire resistant

C)Building is close to a fire hydrant

D)Goods within store are flammable

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

35

Lowering deductibles for collision will result in increased premiums.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

36

The one named in the policy to receive the insurance proceeds in case of the death of the one taking out the policy is the:

A)Insured

B)Insurer

C)Beneficiary

D)Both insured and beneficiary

E)None of these

A)Insured

B)Insurer

C)Beneficiary

D)Both insured and beneficiary

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

37

As a result of coinsurance, the insurance company might pay more than face value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

38

Collision and comprehensive:

A)Only pay the insurer

B)Only pay the insured

C)Are compulsory insurance

D)Have no deductibles

E)None of these

A)Only pay the insurer

B)Only pay the insured

C)Are compulsory insurance

D)Have no deductibles

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

39

The actual amount of insurance carried is called the face value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

40

No-fault insurance does not reduce premiums for collision, property damage, or comprehensive.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

41

The property of Lance's Garage is worth $90,000. Lance has a fire insurance policy of $40,000 that contains an 80% coinsurance clause. On a fire that causes $60,000 of damage, the insurance company pays:

A)$27,777.78

B)$27,777.87

C)$33,333.33

D)$33,334. 00

E)None of these

A)$27,777.78

B)$27,777.87

C)$33,333.33

D)$33,334. 00

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

42

Maryville University purchased building insurance for a temporary bookstore for a total annual charge of $1,600. It closed the facility after five months. What is the refund?

A)$768

B)$976

C)$624

D)$832

E)None of these

A)$768

B)$976

C)$624

D)$832

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

43

Jay Miller insured his pizza shop for $200,000 for fire insurance at an annual rate per $100 of $.49. At the end of 10 months, Jay canceled the policy since his pizza shop went out of business. Using the table in the handbook, the refund to Jay is:

A)$980

B)$852.60

C)$127.40

D)$186.20

E)None of these

A)$980

B)$852.60

C)$127.40

D)$186.20

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

44

Howard Hane had taken out a $130,000 fire insurance policy for his new restaurant at a rate of $.82 per $100. Nine months later, Howard canceled the policy and decided to move his store to a new location. The cost of the premium to Howard is (use the table in the handbook):

A)$1,066

B)$863.46

C)$1,606

D)$836.64

E)None of these

A)$1,066

B)$863.46

C)$1,606

D)$836.64

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

45

Al Smith, who lives in territory 5, carries 10/20/5 compulsory liability insurance along with optional collision that has a $300 deductible. Al, who was at fault in an accident, caused $4,000 damage to the other auto as well as $900 damage to his own car. Also, the courts awarded $15,000 and $7,000, respectively, to the two passengers in the other car for personal injuries. Al is responsible to pay a total of:

A)$5,000

B)$5,600

C)$600

D)$3,000

E)None of these

A)$5,000

B)$5,600

C)$600

D)$3,000

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

46

Matt Miller, age 28, takes out $50,000 of straight-life insurance. His annual premium is $418.20. At the end of 20 years, the cash value of his policy is (use the tables in the handbook):

A)$13,250

B)$26,000

C)$26,500

D)$30,000

E)None of these

A)$13,250

B)$26,000

C)$26,500

D)$30,000

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

47

Melissa Toby, age 36, bought a straight-life insurance policy for $80,000. Calculate her annual premium. If after 20 years she no longer pays premiums, what nonforfeiture options are available to her?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

48

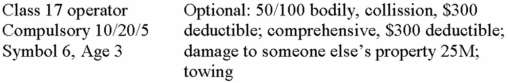

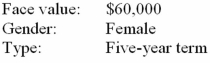

Using the tables in the handbook, calculate Joe Brake's auto premium.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

49

The property of Vin's Garage is worth $400,000. Vin has a fire insurance policy of $160,000 that contains an 80% coinsurance clause. What will the insurance company pay on a fire that causes $180,000 of damage? If Vin met the coinsurance, how much would the insurance company pay?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

50

Given the following information and using the tables in the handbook, the total annual premium is:

Sam Montgomery: territory 5

Classified driver 17

Car age 4 Symbol 5

State has compulsory insurance and the following options:

A)$791

B)$918

C)$971

D)$298

E)None of these

Sam Montgomery: territory 5

Classified driver 17

Car age 4 Symbol 5

State has compulsory insurance and the following options:

A)$791

B)$918

C)$971

D)$298

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

51

Bill Blum insured his hardware store with a fire insurance policy for $88,000 at a cost of $.84 per $100. Ten months later his insurance company canceled his policy as a result of failure to correct a fire hazard. The cost of the policy to Bill was:

A)$739.20

B)$793.20

C)$591.36

D)$616.00

E)None of these

A)$739.20

B)$793.20

C)$591.36

D)$616.00

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

52

Calculate the optional bodily injury cost for the following: Class 10; optional bodily Injury: 100/300/50

A)$94

B)$144

C)$108

D)$187

E)None of these

A)$94

B)$144

C)$108

D)$187

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

53

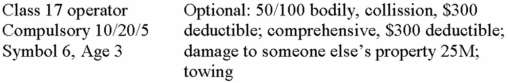

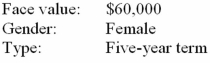

Using the tables in the handbook, calculate Joe Wheel's auto premium:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

54

Ann Rill insured her dress shop for $75,000 of fire insurance at an annual rate per $100 of $.63. At the end of nine months, Ann canceled the policy since her dress shop went out of business. What was the cost of Ann's premium as well as her refund?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

55

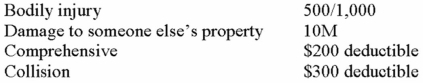

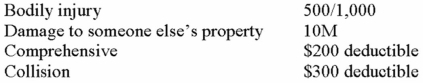

Calculate the annual premium by using the table lookup for:

A)$7,920

B)$787.20

C)$675.60

D)$600.00

E)None of these

A)$7,920

B)$787.20

C)$675.60

D)$600.00

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

56

Jim opened a new pizza shop. He insures his store for $90,000 for fire. What is his premium if the rate per $100 is $.83?

A)$74.70

B)$74,700

C)$700

D)$747.00

E)None of these

A)$74.70

B)$74,700

C)$700

D)$747.00

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

57

Lee's toy store is worth $400,000 and is insured for $300,000. Assuming an 80% coinsurance clause and a fire that caused $190,000 of damage, the liability of the insurance company is:

A)$142,500

B)$124,500

C)$187,125

D)$178,125

E)None of these

A)$142,500

B)$124,500

C)$187,125

D)$178,125

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck