Deck 18: Inventory and Overhead

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/56

العب

ملء الشاشة (f)

Deck 18: Inventory and Overhead

1

A company can change from LIFO to FIFO without notifying the Internal Revenue Service.

False

2

Cost of goods sold equals cost of goods available for sale plus cost of ending inventory.

False

3

The specific identification method might be used by companies with high-cost items.

True

4

Weighted-average unit cost is total cost of goods available for sale divided by beginning number of units available for sale.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

5

To use the retail method of estimating ending inventory, the figure for net sales at retail must be known.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

6

The gross profit method is a way to estimate the cost of ending inventory without a physical count.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

7

In valuing inventory, the flow of costs does not always match the flow of goods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

8

A perpetual inventory system continually updates inventory records.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

9

A cost ratio of $.68 means that for each $1 of retail inventory it costs the store $.68.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

10

During inflation, LIFO produces the highest possible income for a company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

11

Under certain circumstances, ending inventory could be valued at less than cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

12

In the specific identification method, the flow of goods and the flow of costs are not the same.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

13

In FIFO, the most recent cost is assigned to the inventory sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

14

A periodic inventory system requires a physical count of its inventory once a month.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

15

LIFO doesn't always match the physical flow of goods but still can be used to calculate the flow of costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

16

The cost flow tends to follow the physical flow when FIFO is used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

17

Companies with homogeneous products might use the weighted-average method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

18

The cost ratio times ending inventory at cost equals ending inventory at retail.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

19

The specific identification method is able to identify in the ending inventory the actual invoice cost associated with it.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

20

In the specific identification method, the total cost of ending inventory is equal to the number of units not sold times the actual cost per unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

21

The cost ratio in the retail method is found by the cost of goods available for sale at cost divided by:

A)Net sales

B)Ending inventory at retail

C)Cost of goods available for sale at retail

D)Net purchases at cost

E)None of these

A)Net sales

B)Ending inventory at retail

C)Cost of goods available for sale at retail

D)Net purchases at cost

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

22

FIFO assumes all but one of the following:

A)Sell the old inventory first

B)Recent cost assigned to inventory not sold

C)Sell the new inventory first

D)Cost flow tends to follow physical flow

E)None of these

A)Sell the old inventory first

B)Recent cost assigned to inventory not sold

C)Sell the new inventory first

D)Cost flow tends to follow physical flow

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

23

During inflation, the best method to use in inventory valuation that produces the smallest amount of profit is:

A)LIFO

B)FIFO

C)Specific invoice

D)Weighted average

E)None of these

A)LIFO

B)FIFO

C)Specific invoice

D)Weighted average

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

24

The weighted-average method is best used:

A)For heterogeneous product

B)For homogeneous products

C)Only for grains

D)Only for fuels

E)None of these

A)For heterogeneous product

B)For homogeneous products

C)Only for grains

D)Only for fuels

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

25

Inventory turnover at cost is net sales divided by average inventory at retail.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

26

Overhead expense can be allocated to particular departments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

27

All but which one of the following is information needed to calculate inventory valuation by the retail method?

A)Beginning inventory at cost and retail

B)Cost of net purchases at cost and retail

C)Net sales at cost

D)Net sales at retail

E)None of these

A)Beginning inventory at cost and retail

B)Cost of net purchases at cost and retail

C)Net sales at cost

D)Net sales at retail

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

28

Overhead expenses are:

A)Directly related to a specific department

B)Directly related to a specific product

C)Contributing directly to the running of a business

D)Contributing indirectly to the running of a business

E)None of these

A)Directly related to a specific department

B)Directly related to a specific product

C)Contributing directly to the running of a business

D)Contributing indirectly to the running of a business

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

29

In specific identification, which one is not true?

A)The specific purchase invoice prices are used

B)Flow of goods and flow of cost are the same

C)Ending inventory is associated with specific purchase prices

D)Low-cost items are often used in this method

E)None of these

A)The specific purchase invoice prices are used

B)Flow of goods and flow of cost are the same

C)Ending inventory is associated with specific purchase prices

D)Low-cost items are often used in this method

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

30

Cost of goods sold is equal to cost of goods available for sale:

A)Plus cost of ending inventory

B)Minus cost of ending inventory

C)Divided by cost of ending inventory

D)Multiplied by cost of ending inventory

E)None of these

A)Plus cost of ending inventory

B)Minus cost of ending inventory

C)Divided by cost of ending inventory

D)Multiplied by cost of ending inventory

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

31

With Department A sales of $200,000, Department B sales of $600,000, and overhead expense to be allocated of $25,000, the distribution of overhead to Department A based on sales is:

A)$18,750

B)$25,000

C)$2,600

D)$6,250

E)None of these

A)$18,750

B)$25,000

C)$2,600

D)$6,250

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

32

The retail method:

A)Is not an estimate

B)Does not require a cost ratio

C)Eliminates any need ever to take a physical inventory

D)Aids a company in not having to calculate an inventory cost for each individual item

E)None of these

A)Is not an estimate

B)Does not require a cost ratio

C)Eliminates any need ever to take a physical inventory

D)Aids a company in not having to calculate an inventory cost for each individual item

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

33

With beginning inventory at cost of $9,000, ending inventory at cost of $7,000, net sales of $51,000, and cost of goods sold of $46,000, the inventory turnover at cost to the nearest hundredth is:

A)5.75

B)7.55

C)5.57

D)7.57

E)None of these

A)5.75

B)7.55

C)5.57

D)7.57

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

34

With net sales of $40,000, beginning inventory at retail of $14,000, ending inventory at retail of $20,000, and cost of goods sold of $19,500, the inventory turnover at retail is (to the nearest hundredth):

A)5.15

B)3.25

C)2.35

D)5.23

E)None of these

A)5.15

B)3.25

C)2.35

D)5.23

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

35

Compared with cost due to theft, spoilage, etc., inventory turnover at retail is usually:

A)Higher

B)Much higher

C)Lower

D)Much lower

E)None of these

A)Higher

B)Much higher

C)Lower

D)Much lower

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

36

Overhead expenses are allocated to particular departments:

A)Strictly on floor space

B)Strictly on sales volume

C)Based on a ratio of space to sales volume

D)By floor space or sales volume

E)None of these

A)Strictly on floor space

B)Strictly on sales volume

C)Based on a ratio of space to sales volume

D)By floor space or sales volume

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

37

Perpetual inventory does not have this characteristic:

A)High price, limited inventory

B)Verified at some point by a physical count

C)Low price, large inventory

D)Utilizes scanners, computers, etc.

E)None of these

A)High price, limited inventory

B)Verified at some point by a physical count

C)Low price, large inventory

D)Utilizes scanners, computers, etc.

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

38

Inventory turnover at retail is equal to net sales divided by:

A)Beginning inventory at retail

B)Average inventory at retail

C)Beginning inventory at cost

D)Average inventory at cost

E)None of these

A)Beginning inventory at retail

B)Average inventory at retail

C)Beginning inventory at cost

D)Average inventory at cost

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

39

In the retail method the ending inventory at cost is calculated by multiplying the cost ratio times:

A)Beginning inventory at retail

B)Ending inventory at retail

C)Cost of goods available for sale

D)Net sales for the month

E)None of these

A)Beginning inventory at retail

B)Ending inventory at retail

C)Cost of goods available for sale

D)Net sales for the month

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

40

Given: Department A 8,000 sq. ft., Department B 5,000 sq. ft., and Department C 6,000 sq. ft. The percent of overhead expense applied to Department C to the nearest whole percent will be:

A)68%

B)32%

C)26%

D)42%

E)None of these

A)68%

B)32%

C)26%

D)42%

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

41

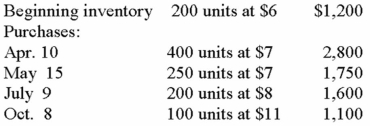

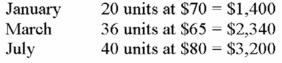

Given the following:

LIFO method 250 units left in inventory The cost of ending inventory is:

The cost of ending inventory is:

A)$1,550

B)$2,300

C)$1,200

D)$3,200

E)None of these

LIFO method 250 units left in inventory

The cost of ending inventory is:

The cost of ending inventory is:A)$1,550

B)$2,300

C)$1,200

D)$3,200

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

42

Jones Co. uses the retail inventory method. Given the following data, what is the ending inventory at cost? Sales at retail $80,000, net purchases at cost $41,200, net purchases at retail $66,800, beginning inventory at cost $22,400, beginning inventory at retail $36,800. Round cost ratio to the nearest whole percent.

A)$23,600

B)$63,600

C)$14,936

D)$14,396

E)None of these

A)$23,600

B)$63,600

C)$14,936

D)$14,396

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

43

Mac's Hardware's gross profit on sales is 40%. At the beginning of January, cost of inventory was $18,000. During one month, Mac had net purchases of $42,000. Net sales at retail for the month were $49,000. The estimated cost of ending inventory using the gross profit method is:

A)$30,600

B)$29,400

C)$60,000

D)$42,000

E)None of these

A)$30,600

B)$29,400

C)$60,000

D)$42,000

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

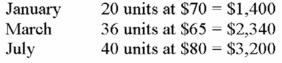

44

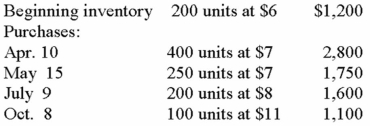

Moss Co. uses the FIFO method to calculate ending inventory. Assuming 300 units are not sold, the cost of goods sold is:

A)$7,600

B)$7,280

C)$3,120

D)$3,400

E)None of these

A)$7,600

B)$7,280

C)$3,120

D)$3,400

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

45

Crestwood Paint Supply had a beginning inventory of 10 cans of paint at $25.00 per can. They purchased 20 cans during the month at $30.00 per can. They had an ending inventory valued at $500. How much paint in dollars was used for the month?

A)$250

B)$850

C)$350

D)$1,350

E)None of these

A)$250

B)$850

C)$350

D)$1,350

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

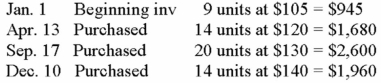

46

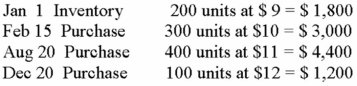

Stone Company uses the LIFO method. At the end of the period there are 22 units left in inventory. Given the following, the cost of ending inventory is:

A)$1,400

B)$3,200

C)$1,530

D)$3,150

E)None of these

A)$1,400

B)$3,200

C)$1,530

D)$3,150

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

47

Melissa's Dress Shop's inventory at cost on January 1 was $19,400. Its retail value was $36,000. During the year, additional net purchases at a cost of $42,600 were brought in. Its retail value was $64,000. The net sales for the year were $70,000. Melissa's inventory at cost by the retail method is:

A)$30,000

B)$18,600

C)$18,000

D)$12,400

E)None of these

A)$30,000

B)$18,600

C)$18,000

D)$12,400

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

48

Johnson Co. uses the retail inventory method. From the following data what is the estimated ending inventory at cost? Net purchases at cost $33,000, beginning inventory at cost $27,000, beginning inventory at retail $35,000, net purchases at retail $45,000, retail sales $70,000.

A)$7,500

B)$30,000

C)$22,500

D)$12,500

E)None of these

A)$7,500

B)$30,000

C)$22,500

D)$12,500

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

49

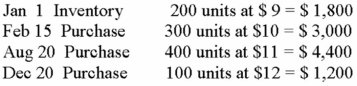

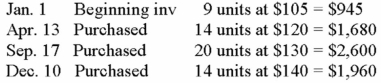

Given the following:

FIFO method: 16 units left in inventory The cost of goods sold is:

The cost of goods sold is:

A)$5,000

B)$10,000

C)$4,965

D)$5,225

E)None of these

FIFO method: 16 units left in inventory

The cost of goods sold is:

The cost of goods sold is:A)$5,000

B)$10,000

C)$4,965

D)$5,225

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

50

Bauer Supply had total cost of goods sold of $1,400 with 140 units available for sales. What was the average cost per unit?

A)$10

B)$14

C)$140

D)14.10

E)None of these

A)$10

B)$14

C)$140

D)14.10

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

51

Clay's Fishing Shop's beginning inventory is $70,000 and ending inventory is $36,500. What was Clay's average inventory?

A)$53,250

B)$48,000

C)$35,000

D)$18,250

E)None of these

A)$53,250

B)$48,000

C)$35,000

D)$18,250

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

52

Joy Co. allocates overhead expenses to all departments on the basis of floor space (sq. ft.) occupied by each department. This year total overhead expenses were $22,000. Department A occupied 15,000 sq. ft., Department B 18,000 sq. ft., and Department C 9,000 sq. ft. The amount of overhead allocated to Department B is (round to the nearest dollar):

A)$1,800

B)$9,429

C)$9,900

D)$39,600

E)None of these

A)$1,800

B)$9,429

C)$9,900

D)$39,600

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

53

Assume Staley's had net sales of $72,000 per day, beginning inventory of $22,000, and ending inventory at retail of $18,900. What was the inventory turnover at retail?

A)3.57

B)3.5

C)5.5

D)3.0

E)None of these

A)3.57

B)3.5

C)5.5

D)3.0

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

54

Belle Co. has beginning inventory of 12 sets of paints at a cost of $1.50 each. During the year, the store purchased 7 at $3.00, 8 at $3.25, and 12 at $3.50. By the end of the year 31 sets were sold. Using the LIFO method, the cost of ending inventory is:

A)$28.00

B)$12.00

C)$21.00

D)$3.50

E)None of these

A)$28.00

B)$12.00

C)$21.00

D)$3.50

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

55

Finney's MMA Gym had a total of $1,300 worth of boxing gloves on June 1. The ending inventory for the month was $524. What was their cost of goods sold for June?

A)$524

B)$1,352

C)$1,824

D)$776

E)None of these

A)$524

B)$1,352

C)$1,824

D)$776

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

56

Allison Co. has a beginning inventory costing $90,000 and an ending inventory costing $120,000. Sales were $380,000. Assume Allison's markup rate is 40%. Based on the selling price, the inventory turnover at cost (to the nearest hundredth) is:

A)2.17

B)2.22

C)1.47

D)1.58

E)None of these

A)2.17

B)2.22

C)1.47

D)1.58

E)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck