Deck 9: Forecasting Exchange Rates

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

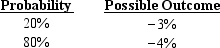

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

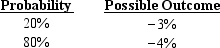

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/96

العب

ملء الشاشة (f)

Deck 9: Forecasting Exchange Rates

1

9)Which of the following is true?

A) Forecast errors cannot be negative.

B) Forecast errors are negative when the forecasted rate exceeds the realized rate.

C) Absolute forecast errors are negative when the forecasted rate exceeds the realized rate.

D) None of the above.

A) Forecast errors cannot be negative.

B) Forecast errors are negative when the forecasted rate exceeds the realized rate.

C) Absolute forecast errors are negative when the forecasted rate exceeds the realized rate.

D) None of the above.

D

2

16)Assume that the forward rate is used to forecast the spot rate. The forward rate of the Canadian dollar contains a 6% discount. Today's spot rate of the Canadian dollar is $.80. The spot rate forecasted for one year ahead is:

A) $.860.

B) $.848.

C) $.740.

D) $.752.

E) none of the above

A) $.860.

B) $.848.

C) $.740.

D) $.752.

E) none of the above

D

$.80 × [1 + (-6%)] = $.752

$.80 × [1 + (-6%)] = $.752

3

18)According to the text, research generally supports ____ in foreign exchange markets.

A) weak-form efficiency

B) semistrong-form efficiency

C) strong-form efficiency

D) A and B

E) B and C

A) weak-form efficiency

B) semistrong-form efficiency

C) strong-form efficiency

D) A and B

E) B and C

D

4

6)According to the text, the analysis of currencies forecasted with use of the forward rate suggests that:

A) currencies exhibited about the same mean forecast errors as a percent of the realized value.

B) the Canadian dollar can be forecasted by U.S. firms with greater accuracy than other currencies.

C) the Swiss franc can be forecasted by U.S. firms with greater accuracy than other currencies.

D) none of the above

A) currencies exhibited about the same mean forecast errors as a percent of the realized value.

B) the Canadian dollar can be forecasted by U.S. firms with greater accuracy than other currencies.

C) the Swiss franc can be forecasted by U.S. firms with greater accuracy than other currencies.

D) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

5

19)Assume that the U.S. interest rate is 11 percent, while Australia's one-year interest rate is 12 percent. Assume interest rate parity holds. If the one-year forward rate of the Australian dollar was used to forecast the future spot rate, the forecast would reflect an expectation of:

A) depreciation in the Australian dollar's value over the next year.

B) appreciation in the Australian dollar's value over the next year.

C) no change in the Australian dollar's value over the next year.

D) information on future interest rates is needed to answer this question.

A) depreciation in the Australian dollar's value over the next year.

B) appreciation in the Australian dollar's value over the next year.

C) no change in the Australian dollar's value over the next year.

D) information on future interest rates is needed to answer this question.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

6

20)If the forward rate was expected to be an unbiased estimate of the future spot rate, and interest rate parity holds, then:

A) covered interest arbitrage is feasible.

B) the international Fisher effect (IFE) is supported.

C) the international Fisher effect (IFE) is refuted.

D) the average absolute error from forecasting would equal zero.

A) covered interest arbitrage is feasible.

B) the international Fisher effect (IFE) is supported.

C) the international Fisher effect (IFE) is refuted.

D) the average absolute error from forecasting would equal zero.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

7

13)Assume a forecasting model uses inflation differentials and interest rate differentials to forecast the exchange rate. Assume the regression coefficient of the interest rate differential variable is -.5, and the coefficient of the inflation differential variable is .4. Which of the following is true?

A) The interest rate variable is inversely related to the exchange rate, and the inflation variable is directly (positively) related to the interest rate variable.

B) The interest rate variable is inversely related to the exchange rate, and the inflation variable is directly related to the exchange rate.

C) The interest rate variable is directly related to the exchange rate, and the inflation variable is directly related to the exchange rate.

D) The interest rate variable is directly related to the exchange rate, and the inflation variable is directly related to the interest rate variable.

A) The interest rate variable is inversely related to the exchange rate, and the inflation variable is directly (positively) related to the interest rate variable.

B) The interest rate variable is inversely related to the exchange rate, and the inflation variable is directly related to the exchange rate.

C) The interest rate variable is directly related to the exchange rate, and the inflation variable is directly related to the exchange rate.

D) The interest rate variable is directly related to the exchange rate, and the inflation variable is directly related to the interest rate variable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

8

1)Which of the following forecasting techniques would best represent the use of today's forward exchange rate to forecast the future exchange rate?

A) fundamental forecasting.

B) market-based forecasting.

C) technical forecasting.

D) mixed forecasting.

A) fundamental forecasting.

B) market-based forecasting.

C) technical forecasting.

D) mixed forecasting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

9

3)Which of the following forecasting techniques would best represent the use of relationships between economic factors and exchange rate movements to forecast the future exchange rate?

A) fundamental forecasting.

B) market-based forecasting.

C) technical forecasting.

D) mixed forecasting.

A) fundamental forecasting.

B) market-based forecasting.

C) technical forecasting.

D) mixed forecasting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

10

Assume the following information:

Given this information, the mean absolute forecast error as a percentage of the realized value is about:

A) 1.5%.

B) 26%.

C) 6%.

D) 6.5%.

E) none of the above

Given this information, the mean absolute forecast error as a percentage of the realized value is about:

A) 1.5%.

B) 26%.

C) 6%.

D) 6.5%.

E) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

11

14)Which of the following is not a limitation of fundamental forecasting?

A) uncertain timing of impact.

B) forecasts are needed for factors that have a lagged impact.

C) omission of other relevant factors from the model.

D) possible change in sensitivity of the forecasted variable to each factor over time.

E) none of the above

A) uncertain timing of impact.

B) forecasts are needed for factors that have a lagged impact.

C) omission of other relevant factors from the model.

D) possible change in sensitivity of the forecasted variable to each factor over time.

E) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

12

5)If a particular currency is consistently declining substantially over time, then a market-based forecast will usually have:

A) underestimated the future exchange rates over time.

B) overestimated the future exchange rates over time.

C) forecasted future exchange rates accurately.

D) forecasted future exchange rates inaccurately but without any bias toward consistent underestimating or overestimating.

A) underestimated the future exchange rates over time.

B) overestimated the future exchange rates over time.

C) forecasted future exchange rates accurately.

D) forecasted future exchange rates inaccurately but without any bias toward consistent underestimating or overestimating.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

13

11)A fundamental forecast that uses multiple values of the influential factors is an example of:

A) sensitivity analysis.

B) discriminant analysis.

C) technical analysis.

D) factor analysis.

A) sensitivity analysis.

B) discriminant analysis.

C) technical analysis.

D) factor analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

14

12)When the value from the prior period of an influential factor affects the forecast in the future period, this is an example of a(n):

A) lagged input.

B) instantaneous input.

C) simultaneous input.

D) B and C

A) lagged input.

B) instantaneous input.

C) simultaneous input.

D) B and C

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

15

15)Assume that interest rate parity holds. The U.S. five-year interest rate is 5% annualized, and the Mexican five-year interest rate is 8% annualized. Today's spot rate of the Mexican peso is $.20. What is the approximate five-year forecast of the peso's spot rate if the five-year forward rate is used as a forecast?

A) $.131.

B) $.226.

C) $.262.

D) $.140.

E) $.174.

A) $.131.

B) $.226.

C) $.262.

D) $.140.

E) $.174.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

16

8)If it was determined that the movement of exchange rates was not related to previous exchange rate values, this implies that a ____ is not valuable for speculating on expected exchange rate movements.

A) technical forecast technique

B) fundamental forecast technique

C) all of the above

D) none of the above

A) technical forecast technique

B) fundamental forecast technique

C) all of the above

D) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

17

17)If today's exchange rate reflects all relevant public information about the euro's exchange rate, but not all relevant private information, then ____ would be refuted.

A) weak-form efficiency

B) semistrong-form efficiency

C) strong-form efficiency

D) A and B

E) B and C

A) weak-form efficiency

B) semistrong-form efficiency

C) strong-form efficiency

D) A and B

E) B and C

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

18

4)Which of the following forecasting techniques would best represent the sole use of the pattern of historical currency values of the euro to predict the euro's future currency value?

A) fundamental forecasting.

B) market-based forecasting.

C) technical forecasting.

D) mixed forecasting.

A) fundamental forecasting.

B) market-based forecasting.

C) technical forecasting.

D) mixed forecasting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

19

2)Which of the following forecasting techniques would best represent sole use of today's spot exchange rate of the euro to forecast the euro's future exchange rate?

A) fundamental forecasting.

B) market-based forecasting.

C) technical forecasting.

D) mixed forecasting.

A) fundamental forecasting.

B) market-based forecasting.

C) technical forecasting.

D) mixed forecasting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

20

10)Which of the following is true according to the text?

A) Forecasts in recent years have been very accurate.

B) Use of the absolute forecast error as a percent of the realized value is a good measure to use in detecting a forecast bias.

C) Forecasting errors are smaller when focused on longer term periods.

D) None of the above.

A) Forecasts in recent years have been very accurate.

B) Use of the absolute forecast error as a percent of the realized value is a good measure to use in detecting a forecast bias.

C) Forecasting errors are smaller when focused on longer term periods.

D) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

21

22)The following regression model was estimated to forecast the value of the Malaysian ringgit (MYR):

MYRt = a? + a?INCt ? ? + a?INFt ? ? + mt,

Where MYR is the quarterly change in the ringgit, INF is the previous quarterly percentage change in the inflation differential, and INC is the previous quarterly percentage change in the income growth differential. Regression results indicate coefficients of a? = .005; a? = .4; and a? = .7. The most recent quarterly percentage change in the inflation differential is -5%, while the most recent quarterly percentage change in the income differential is 3%. Using this information, the forecast for the percentage change in the ringgit is:

A) 4.60%.

B) -1.80%.

C) 5.2%.

D) -4.60%.

E) none of the above

MYRt = a? + a?INCt ? ? + a?INFt ? ? + mt,

Where MYR is the quarterly change in the ringgit, INF is the previous quarterly percentage change in the inflation differential, and INC is the previous quarterly percentage change in the income growth differential. Regression results indicate coefficients of a? = .005; a? = .4; and a? = .7. The most recent quarterly percentage change in the inflation differential is -5%, while the most recent quarterly percentage change in the income differential is 3%. Using this information, the forecast for the percentage change in the ringgit is:

A) 4.60%.

B) -1.80%.

C) 5.2%.

D) -4.60%.

E) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

22

36)Factors such as economic growth, inflation, and interest rates are an integral part of ____ forecasting.

A) technical

B) fundamental

C) market-based

D) none of the above

A) technical

B) fundamental

C) market-based

D) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

23

Sulsa Inc. uses fundamental forecasting. Using regression analysis, it has determined the following equation for the euro:

The most recent quarterly percentage change in the inflation differential between the U.S. and Europe was 2 percent, while the most recent quarterly percentage change in the income growth differential between the U.S. and Europe was -1 percent. Based on this information, the forecast for the euro is a(n) ____ of ____%.

A) appreciation; 3.4

B) depreciation; 3.4

C) appreciation; 0.7

D) appreciation; 1.2

The most recent quarterly percentage change in the inflation differential between the U.S. and Europe was 2 percent, while the most recent quarterly percentage change in the income growth differential between the U.S. and Europe was -1 percent. Based on this information, the forecast for the euro is a(n) ____ of ____%.

A) appreciation; 3.4

B) depreciation; 3.4

C) appreciation; 0.7

D) appreciation; 1.2

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

24

21)Which of the following is not a forecasting technique mentioned in your text?

A) accounting-based forecasting.

B) technical forecasting.

C) fundamental forecasting.

D) market-based forecasting.

A) accounting-based forecasting.

B) technical forecasting.

C) fundamental forecasting.

D) market-based forecasting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

25

39)If the foreign exchange market is ____ efficient, then historical and current exchange rate information is not useful for forecasting exchange rate movements.

A) weak-form

B) semistrong-form

C) strong form

D) all of the above

A) weak-form

B) semistrong-form

C) strong form

D) all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

26

The following regression model was estimated to forecast the value of the Indian rupee (INR):

INRt = a0 + a1INTt + a2INFt -1 + mt,

Where INR is the quarterly change in the rupee, INT is the real interest rate differential in period t between the U.S. and India, and INF is the inflation rate differential between the U.S. and India in the previous period. Regression results indicate coefficients of a0 = .003; a1 = -.5; and a2 = .8. Assume that INFt -1 = 2%. However, the interest rate differential is not known at the beginning of period t and must be estimated. You have developed the following probability distribution:

The expected change in the Indian rupee in period t is:

A) 3.40%.

B) 0.40%.

C) 3.10%.

D) 1.70%.

E) none of the above

INRt = a0 + a1INTt + a2INFt -1 + mt,

Where INR is the quarterly change in the rupee, INT is the real interest rate differential in period t between the U.S. and India, and INF is the inflation rate differential between the U.S. and India in the previous period. Regression results indicate coefficients of a0 = .003; a1 = -.5; and a2 = .8. Assume that INFt -1 = 2%. However, the interest rate differential is not known at the beginning of period t and must be estimated. You have developed the following probability distribution:

The expected change in the Indian rupee in period t is:

A) 3.40%.

B) 0.40%.

C) 3.10%.

D) 1.70%.

E) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

27

38)The absolute forecast error of a currency is ____, on average, in periods when the currency is more ____.

A) lower; volatile

B) higher; stable

C) lower; stable

D) none of the above

A) lower; volatile

B) higher; stable

C) lower; stable

D) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

28

40)Foreign exchange markets are generally found to be at least ____ efficient.

A) weak-form

B) semistrong-form

C) strong form

D) none of the above

A) weak-form

B) semistrong-form

C) strong form

D) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

29

Huge Corporation has just initiated a market-based forecast system using the forward rate as an estimate of the future spot rate of the Japanese yen (¥) and the Australian dollar (A$). Listed below are the forecasted and realized values for the last period:

According to this information and using the absolute forecast error as a percentage of the realized value, the forecast of the yen by Huge Corp. is ____ the forecast of the Australian dollar.

A) more accurate than

B) less accurate than

C) more biased than

D) the same as

According to this information and using the absolute forecast error as a percentage of the realized value, the forecast of the yen by Huge Corp. is ____ the forecast of the Australian dollar.

A) more accurate than

B) less accurate than

C) more biased than

D) the same as

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

30

25)Gamma Corporation has incurred large losses over the last ten years due to exchange rate fluctuations of the Egyptian pound (EGP), even though the company has used a market-based forecast based on the forward rate. Consequently, management believes its forecasts to be biased. The following regression model was estimated to determine if the forecasts over the last ten years were biased:

St = a? + a?Ft ? ? + mt,

Where St is the spot rate of the pound in year t and Ft ? ? is the forward rate of the pound in year t - 1. Regression results reveal coefficients of a? = 0 and a? = 1.3. Thus, Gamma has reason to believe that its past forecasts have ____ the realized spot rate.

A) overestimated

B) underestimated

C) correctly estimated

D) none of the above

St = a? + a?Ft ? ? + mt,

Where St is the spot rate of the pound in year t and Ft ? ? is the forward rate of the pound in year t - 1. Regression results reveal coefficients of a? = 0 and a? = 1.3. Thus, Gamma has reason to believe that its past forecasts have ____ the realized spot rate.

A) overestimated

B) underestimated

C) correctly estimated

D) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

31

37)Silicon Co. has forecasted the Canadian dollar for the most recent period to be $0.73. The realized value of the Canadian dollar in the most recent period was $0.80. Thus, the absolute forecast error as a percentage of the realized value was ____%.

A) 9.6

B) -9.6

C) 8.8

D) -8.8

A) 9.6

B) -9.6

C) 8.8

D) -8.8

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

32

35)If a foreign country's interest rate is similar to the U.S. rate, the forward rate premium or discount will be ____, meaning that the forward rate and spot rate will provide ____ forecasts.

A) substantial; similar

B) substantial; very different

C) close to zero; similar

D) close to zero; very different

A) substantial; similar

B) substantial; very different

C) close to zero; similar

D) close to zero; very different

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

33

34)If both interest rate parity and the international Fisher effect hold, then between the forward rate and the spot rate, the ____ rate should provide more accurate forecasts for currencies in ____-inflation countries.

A) spot; high

B) spot; low

C) forward; high

D) forward; low

A) spot; high

B) spot; low

C) forward; high

D) forward; low

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

34

32)The U.S. inflation rate is expected to be 4 percent over the next year, while the European inflation rate is expected to be 3 percent. The current spot rate of the euro is $1.03. Using purchasing power parity, the expected spot rate at the end of one year is $____.

A) 1.02

B) 1.03

C) 1.04

D) none of the above

A) 1.02

B) 1.03

C) 1.04

D) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

35

26)Which of the following is not a method of forecasting exchange rate volatility?

A) using the absolute forecast error as a percentage of the realized value.

B) using the volatility of historical exchange rate movements as a forecast for the future.

C) using a time series of volatility patterns in previous periods.

D) deriving the exchange rate's implied standard deviation from the currency option pricing model.

A) using the absolute forecast error as a percentage of the realized value.

B) using the volatility of historical exchange rate movements as a forecast for the future.

C) using a time series of volatility patterns in previous periods.

D) deriving the exchange rate's implied standard deviation from the currency option pricing model.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

36

29)Severus Co. has to pay 5 million Canadian dollars for supplies it recently received from Canada. Today, the Canadian dollar has appreciated by 2 percent against the U.S. dollar. Severus has determined that whenever the Canadian dollar appreciates against the U.S. dollar by more than 1 percent, it experiences a reversal of 40 percent on the following day. Based on this information, the Canadian dollar is expected to ____ tomorrow, and Severus would prefer to make payment ____.

A) depreciate by .8%; today

B) depreciate by .8%; tomorrow

C) appreciate by .8%; today

D) appreciate by .8%; tomorrow

A) depreciate by .8%; today

B) depreciate by .8%; tomorrow

C) appreciate by .8%; today

D) appreciate by .8%; tomorrow

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

37

30.Corporations tend to make only limited use of technical forecasting because it typically focuses on the near future, which is not very helpful for developing corporate policies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

38

28)If an MNC invests excess cash in a foreign county, it would like the foreign currency to ____; if an MNC issues bonds denominated in a foreign currency, it would like the foreign currency to ____.

A) appreciate; depreciate

B) appreciate; appreciate

C) depreciate; depreciate

D) depreciate; appreciate

A) appreciate; depreciate

B) appreciate; appreciate

C) depreciate; depreciate

D) depreciate; appreciate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

39

33)If the one-year forward rate for the euro is $1.07, while the current spot rate is $1.05, the expected percentage change in the euro is ____%.

A) 1.90

B) 2.00

C) -1.87

D) none of the above

A) 1.90

B) 2.00

C) -1.87

D) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

40

27)If a foreign currency is expected to ____ substantially against the parent's currency, the parent may prefer to ____ the remittance of subsidiary earnings.

A) weaken; delay

B) weaken; expedite

C) appreciate; expedite

D) none of the above

A) weaken; delay

B) weaken; expedite

C) appreciate; expedite

D) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

41

56.Usually, fundamental forecasting is used for short-term forecasts, while technical forecasting is used for longer-term forecasts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

42

59.Exchange rates one year in advance are typically forecasted with almost perfect accuracy for the major currencies, but not for currencies of smaller countries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

43

42.If the pattern of currency values over time appears random, then technical forecasting is appropriate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

44

49.The closer graphical points are to the perfect forecast line, the better is the forecast.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

45

60.The potential forecast error is larger for currencies that are more volatile.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

46

57.If points are scattered evenly on both sides of the perfect forecast line, then the forecast appears to be very accurate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

47

46.If the forward rate is used as an indicator of the future spot rate, the spot rate is expected to appreciate or depreciate by the same amount as the forward premium or discount, respectively.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

48

55.A forecasting technique based on fundamental relationships between economic variables and exchange rates, such as inflation, is referred to as technical forecasting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

49

48.When measuring forecast performance of different currencies, it is often useful to adjust for their relative sizes. Thus, percentages, rather than nominal amounts, are often used to compute forecast errors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

50

54.Fundamental models examine moving averages over time and thus allow the development of a forecasting rule.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

51

47.Research indicates that currency forecasting services almost always outperform forecasts based on the forward rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

52

52.Two methods to assess exchange rate volatility are the volatility of historical exchange rate movements and the exchange rate's implied standard deviation from the currency option pricing model.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

53

44.A regression analysis of the Australian dollar value on the inflation differential between the U.S. and Australia produced a coefficient of .8. Thus, for every 1% increase in the inflation differential, the Australian dollar is expected to depreciate by .8%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

54

53.Market-based forecasting involves the use of historical exchange rate data to predict future values.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

55

58.If foreign exchange markets are strong-form efficient, then all relevant public and private information is already reflected in today's exchange rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

56

51.A motivation for forecasting exchange rate volatility is to obtain a range surrounding the forecast.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

57

43.Inflation and interest rate differentials between the U.S. and foreign countries are examples of variables that could be used in fundamental forecasting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

58

45.The most sophisticated forecasting techniques provide consistently accurate forecasts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

59

50.Foreign exchange markets appear to be strong-form efficient.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

60

41.MNCs can forecast exchange rate volatility to determine the potential range surrounding their exchange rate forecast.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

61

71)Assume that U.S. interest rates are 6%, while British interest rates are 7%. If the international Fisher effect holds and is used to determine the future spot rate, the forecast would reflect an expectation of:

A) appreciation of pound's value over the next year.

B) depreciation of pound's value over the next year.

C) no change in pound's value over the next year.

D) not enough information to answer this question.

A) appreciation of pound's value over the next year.

B) depreciation of pound's value over the next year.

C) no change in pound's value over the next year.

D) not enough information to answer this question.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

62

61.A forecast of a currency one year in advance is typically more accurate than a forecast one week in advance since the currency reverts to equilibrium over a longer term period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

63

76)Which of the following is not one of the major reasons for MNCs to forecast exchange rates?

A) to decide in which foreign market to invest the excess cash.

B) to decide where to borrow at the lowest cost.

C) to determine whether to require the subsidiary to remit the funds or invest them locally.

D) to speculate on the exchange rate movements.

A) to decide in which foreign market to invest the excess cash.

B) to decide where to borrow at the lowest cost.

C) to determine whether to require the subsidiary to remit the funds or invest them locally.

D) to speculate on the exchange rate movements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

64

63)Monson Co., based in the U.S., exports products to Japan denominated in yen. If the forecasted value of the yen is substantially ____ than the forward rate, Monson Co. will likely decide ____ the payments.

A) higher; to hedge

B) lower; not to hedge

C) higher; not to hedge

D) none of the above

A) higher; to hedge

B) lower; not to hedge

C) higher; not to hedge

D) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

65

69)If speculators expect the spot rate of the Canadian dollar in 30 days to be ____ than the 30-day forward rate on Canadian dollars, they will ____ Canadian dollars forward and put ____ pressure on the Canadian dollar forward rate.

A) lower; sell; upward

B) lower; sell; downward

C) higher; sell; upward

D) higher; sell; downward

A) lower; sell; upward

B) lower; sell; downward

C) higher; sell; upward

D) higher; sell; downward

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

66

62.In general, any key managerial decision that is based on forecasted exchange rates should rely completely on one forecast rather than alternative exchange rate scenarios.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

67

66)The following regression model was estimated to forecast the percentage change in the Australian Dollar (AUD):

AUDt = a? + a?INTt + a?INFt ? ? + mt,

Where AUD is the quarterly change in the Australian Dollar, INT is the real interest rate differential in period t between the U.S. and Australia, and INF is the inflation rate differential between the U.S. and Australia in the previous period. Regression results indicate coefficients of a? = .001; a? = -.8; and a? = .5. Assume that INFt ? ? = 4%. However, the interest rate differential is not known at the beginning of period t and must be estimated. You have developed the following probability distribution:

There is a 20% probability that the Australian dollar will change by ____, and an 80% probability it will change by ____.

A) 4.5%; 6.1%;

B) 6.1%; 4.5%

C) 4.5%; 5.3%

D) None of the above

AUDt = a? + a?INTt + a?INFt ? ? + mt,

Where AUD is the quarterly change in the Australian Dollar, INT is the real interest rate differential in period t between the U.S. and Australia, and INF is the inflation rate differential between the U.S. and Australia in the previous period. Regression results indicate coefficients of a? = .001; a? = -.8; and a? = .5. Assume that INFt ? ? = 4%. However, the interest rate differential is not known at the beginning of period t and must be estimated. You have developed the following probability distribution:

There is a 20% probability that the Australian dollar will change by ____, and an 80% probability it will change by ____.

A) 4.5%; 6.1%;

B) 6.1%; 4.5%

C) 4.5%; 5.3%

D) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

68

77)Sensitivity analysis allows for all of the following except:

A) accountability for uncertainty.

B) focus on a single point estimate of future exchange rates.

C) development of a range of possible future values.

D) consideration of alternative scenarios.

A) accountability for uncertainty.

B) focus on a single point estimate of future exchange rates.

C) development of a range of possible future values.

D) consideration of alternative scenarios.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

69

74)Leila Corporation used the following regression model to determine if the forecasts over the last ten years were biased:

St = a? + a?Ft ? ? + mt,

Where St is the spot rate of the yen in year t and Ft ? ? is the forward rate of the yen in year t - 1. Regression results reveal coefficients of a? = 0 and a? = .30. Thus, Leila Corporation has reason to believe that its past forecasts have ____ the realized spot rate.

A) overestimated

B) underestimated

C) correctly estimated

D) none of the above

St = a? + a?Ft ? ? + mt,

Where St is the spot rate of the yen in year t and Ft ? ? is the forward rate of the yen in year t - 1. Regression results reveal coefficients of a? = 0 and a? = .30. Thus, Leila Corporation has reason to believe that its past forecasts have ____ the realized spot rate.

A) overestimated

B) underestimated

C) correctly estimated

D) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

70

65)The following is not a limitation of technical forecasting:

A) It's not suitable for long-term forecasts of exchange rates.

B) It doesn't provide point estimates or a range of possible future values.

C) It cannot be applied to currencies that exhibit random movements.

D) It cannot be applied to currencies that exhibit a continuous trend for short-term forecast.

A) It's not suitable for long-term forecasts of exchange rates.

B) It doesn't provide point estimates or a range of possible future values.

C) It cannot be applied to currencies that exhibit random movements.

D) It cannot be applied to currencies that exhibit a continuous trend for short-term forecast.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

71

73)If today's exchange rate reflects any historical trends in Canadian dollar exchange rate movements, but not all relevant public information, then the Canadian dollar market is:

A) weak-form efficient.

B) semistrong-form efficient.

C) strong-form efficient.

D) all of the above.

A) weak-form efficient.

B) semistrong-form efficient.

C) strong-form efficient.

D) all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

72

68)If speculators expect the spot rate of the yen in 60 days to be ____ than the 60-day forward rate on the yen, they will ____ the yen forward and put ____ pressure on the yen's forward rate.

A) higher; buy; upward

B) higher; sell; downward

C) higher; sell; upward

D) lower; buy; upward

A) higher; buy; upward

B) higher; sell; downward

C) higher; sell; upward

D) lower; buy; upward

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

73

80.If the pattern of currency values over time appears random, then technical forecasting is appropriate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

74

78.If graphical points lie above the perfect forecast line, than the forecast overestimated the future value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

75

75)Assume that U.S. interest rate for the next three years is 5%, 6%, and 7% respectively. Also assume that Canadian interest rates for the next three years are 3%, 6%, 9%. The current Canadian spot rate is $.840. What is the approximate three-year forecast of Canadian dollar spot rate if the three-year forward rate is used as a forecast?

A) $.840

B) $.890

C) $.856

D) $.854

A) $.840

B) $.890

C) $.856

D) $.854

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

76

64.When a U.S.-based MNC wants to determine whether to establish a subsidiary in a foreign country, it will always accept that project if the foreign currency is expected to appreciate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

77

67)Purchasing power parity is used in:

A) technical forecasting.

B) fundamental forecasting.

C) market-based accounting.

D) all of the above.

A) technical forecasting.

B) fundamental forecasting.

C) market-based accounting.

D) all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

78

79)A regression model was applied to explain movements in the Canadian dollar's value over time. The coefficient for the inflation differential between the U.S. and Canada was -0.2. The coefficient of the interest rate differential between the U.S. and Canada produced a coefficient of 0.8. Thus, the Canadian dollar depreciates when the inflation differential ____ and the interest rate differential ____.

A) increases; increases

B) decreases; increases

C) increases; decreases

D) increases; decreases

A) increases; increases

B) decreases; increases

C) increases; decreases

D) increases; decreases

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

79

72)If the foreign exchange market is ____ efficient, then technical analysis is not useful in forecasting exchange rate movements.

A) weak-form

B) semistrong-form

C) strong form

D) all of the above

A) weak-form

B) semistrong-form

C) strong form

D) all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

80

70)Assume that U.S. annual inflation equals 8%, while Japanese annual inflation equals 5%. If purchasing power parity is used to forecast the future spot rate, the forecast would reflect an expectation of:

A) appreciation of yen's value over the next year.

B) depreciation of yen's value over the next year.

C) no change in yen's value over the next year.

D) information about interest rates is needed to answer this question.

A) appreciation of yen's value over the next year.

B) depreciation of yen's value over the next year.

C) no change in yen's value over the next year.

D) information about interest rates is needed to answer this question.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck