Deck 20: Risk Management in Financial Institutions

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/58

العب

ملء الشاشة (f)

Deck 20: Risk Management in Financial Institutions

1

One of the most popular methods of neutralizing duration gap risks is to buy and sell financial futures contracts.

True

2

As interest rates increase, a long call option position on a bond decreases in value.

True

3

A rate sensitive asset is one that either matures within the maturity bucket or one that will have a payment change within the maturity bucket if interest rates change.

True

4

A U.S. company has a euro denominated loan it must repay in 6 months. A short position in euro futures could help offset the corporation's foreign exchange risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

5

Value at risk (VaR) is to measure price or market risk of a portfolio of assets and attempt to determine the maximum loss they might sustain over a designated period of time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

6

The number of futures contracts needed to hedge a position increases as the bank's duration gap increases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

7

In the typical quality swap a borrower with a negative duration gap is more likely to pay all or part of the other swap party's long-term interest rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

8

Swaps are usually the best hedging tool to use to hedge short term risks in a half year or less.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

9

Insolvency occurs when an institution's duration gap becomes positive.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

10

Writing a call option on a bond pays off if interest rates decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

11

A bank's financing gap is calculated as average loans minus average deposits plus liquid assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

12

If a bank has a positive repricing gap, falling interest rates increase profitability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

13

A firm informs the bank they will immediately draw down the maximum amount on their credit line. This is an example of liability side risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

14

The buyer of a loan in participation has a double risk exposure, one to the borrower and one to the selling bank.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

15

If duration of asset is less than the liability leverage times the duration of liability, then falling interest rates will cause the market value of equity to rise.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

16

The sensitivity of the market price of a financial futures contract depends upon the duration of the security to be delivered under the futures contract.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

17

Large banks tend to rely more on deposits and small banks tend to rely more on purchased liquidity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

18

Basis risk is the risk that the prices or value of the underlying spot and the derivatives instrument used to hedge do not move predictably relative to one another.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

19

The VaR are most effective in assessing potential risk for the non-traded assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

20

Maximizing a bank's profit, providing liquidity, and maintaining solvency are goals of a consistent direction for bankers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which one of the following is a source of liquidity risk for a bank?

A) Predicted increase in net deposit withdraws before holidays

B) A natural disaster in the bank's community

C) Corporation calls in a bond the bank is holding

D) Maturation of notes payable

A) Predicted increase in net deposit withdraws before holidays

B) A natural disaster in the bank's community

C) Corporation calls in a bond the bank is holding

D) Maturation of notes payable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

22

The number of futures contracts that a bank will need in order to fully hedge the bank's overall interest rate risk exposure and protect the bank's net worth depends upon (among other factors):

A) The relative duration of bank assets and liabilities.

B) The duration of the underlying security named in the futures contract.

C) The price of the futures contract.

D) All of the above.

E) None of the above.

A) The relative duration of bank assets and liabilities.

B) The duration of the underlying security named in the futures contract.

C) The price of the futures contract.

D) All of the above.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

23

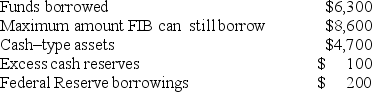

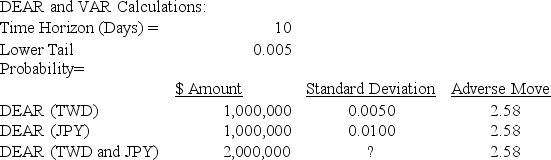

If the coefficient of correlation between USD/TWD and USD/JPN is 0.25. Please calculate the DEAR for this 2-million USD portfolio.

A) $29,892.55

B) $21,842.32

C) $15,672.22

D) $31,579.78

E) $25,784.66

A) $29,892.55

B) $21,842.32

C) $15,672.22

D) $31,579.78

E) $25,784.66

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

24

In 2008, many banks encounter liquidity issues and experienced deposit withdrawal or bank run. Which one of the following alternatives is an appropriate way to deal with deposit withdrawal?

A) Increasing in Euro dollar deposits

B) Contacting an investment banker to find new corporate deposits

C) Increasing Fed funds borrowed

D) Issuance of a negotiable CD

E) Selling the bank's holdings of T-bills

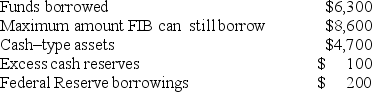

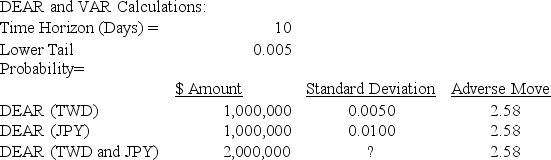

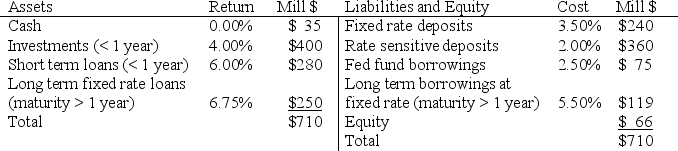

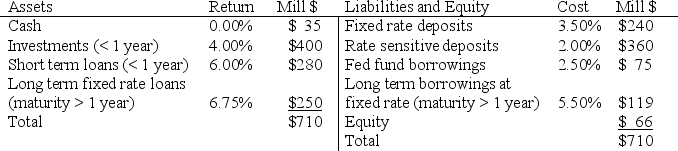

Refer to the information below for questions 6-8:

Formosa International Bank (FIB) (mill$)

A) Increasing in Euro dollar deposits

B) Contacting an investment banker to find new corporate deposits

C) Increasing Fed funds borrowed

D) Issuance of a negotiable CD

E) Selling the bank's holdings of T-bills

Refer to the information below for questions 6-8:

Formosa International Bank (FIB) (mill$)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

25

ABC Bank has $39 million invested in T-Bonds with a 16-year duration, $39 million in 6 month maturity T-Bills, and $75 million invested in consumer loans with a 3 year duration. If they are all portfolios of this bank, what is the duration of the bank's asset portfolio in years?

A) 5.95 years

B) 6.50 years

C) 7.23 years

D) 8.78 years

E) 9.51 years

Refer to the information below for questions 15-17:

As a portfolio manager of Asian Investments and Co., you like to evaluate the Value-at-Risk of your currency holding of Taiwanese and Japanese assets. Use the historical data in the past 20 years, you obtain the following information regarding the exchange rate between USD ($) with Taiwanese Dollar (TWD) and Japanese Yen (JPY):

where DEAR is daily earnings-at-risk, standard deviation is the volatility calculated by the historical data, adverse move is the t-value of the lower bound of the distribution of asset value.

where DEAR is daily earnings-at-risk, standard deviation is the volatility calculated by the historical data, adverse move is the t-value of the lower bound of the distribution of asset value.

A) 5.95 years

B) 6.50 years

C) 7.23 years

D) 8.78 years

E) 9.51 years

Refer to the information below for questions 15-17:

As a portfolio manager of Asian Investments and Co., you like to evaluate the Value-at-Risk of your currency holding of Taiwanese and Japanese assets. Use the historical data in the past 20 years, you obtain the following information regarding the exchange rate between USD ($) with Taiwanese Dollar (TWD) and Japanese Yen (JPY):

where DEAR is daily earnings-at-risk, standard deviation is the volatility calculated by the historical data, adverse move is the t-value of the lower bound of the distribution of asset value.

where DEAR is daily earnings-at-risk, standard deviation is the volatility calculated by the historical data, adverse move is the t-value of the lower bound of the distribution of asset value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

26

What is Formosa International Bank's total net liquidity?

A) $4,520

B) $6,500

C) $5,200

D) $7,280

E) $6,900

Refer to the information below for questions 9-10:

Formosa Independence Bank has the following balance sheet:

A) $4,520

B) $6,500

C) $5,200

D) $7,280

E) $6,900

Refer to the information below for questions 9-10:

Formosa Independence Bank has the following balance sheet:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

27

Bank A has a loan to deposit ratio of 75%, core deposits equal 62% of total assets and borrowed funds are 5% of assets. Bank B has a loan to deposit ratio of 120%. Core deposits are 55% of assets and borrowed funds are 20% of assets. Which bank has more liquidity risk? Ceteris paribus, which bank will probably be more profitable when interest rates are low?

A) Bank A; Bank A

B) Bank A; Bank B

C) Bank B; Bank A

D) Bank B; Bank B

A) Bank A; Bank A

B) Bank A; Bank B

C) Bank B; Bank A

D) Bank B; Bank B

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

28

The bank's one-year gap between assets and liabilities is (Mill $)

A) $425

B) $245

C) $174

D) $140

E) $126

A) $425

B) $245

C) $174

D) $140

E) $126

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which one of the following situations creates the most liquidity risk?

A) Long term assets funded by short term liabilities

B) Short term assets funded by short term liabilities

C) Long term assets funded by long term liabilities

D) Short term assets funded by long term liabilities

E) Long term liabilities funded by short term assets

A) Long term assets funded by short term liabilities

B) Short term assets funded by short term liabilities

C) Long term assets funded by long term liabilities

D) Short term assets funded by long term liabilities

E) Long term liabilities funded by short term assets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

30

Please calculate the 10-day Value-at-Risk (VaR) for this 2-million USD portfolio.

A) $ 99,864.02

B) $111,842.52

C) $115,627.25

D) $131,529.81

E) $135,784.62

A) $ 99,864.02

B) $111,842.52

C) $115,627.25

D) $131,529.81

E) $135,784.62

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

31

A bond has a face value of $1,000 and five years to maturity. This bond has a coupon rate of 13 percent and is selling in the market today for $902. Coupon payments are made annually on this bond. What is the yield to maturity (YTM) for this bond? A) 13.25%

B) 12.75%

C) 16.00%

D) 11.45%

B) 12.75%

C) 16.00%

D) 11.45%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which of the following results in a net liquidity drain?

A) Demand deposits increase $120; loans increase $80

B) Reverse repurchase agreements increase $50; demand deposit decrease $50

C) Repurchase agreements increase $100; Demand deposit decrease $50

D) Demand deposits decrease $120; loan repayments are $250

E) Demand deposits increase $10; loans decrease $10

A) Demand deposits increase $120; loans increase $80

B) Reverse repurchase agreements increase $50; demand deposit decrease $50

C) Repurchase agreements increase $100; Demand deposit decrease $50

D) Demand deposits decrease $120; loan repayments are $250

E) Demand deposits increase $10; loans decrease $10

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

33

What is Formosa International Bank's total uses of liquidity?

A) $6,500

B) $14,500

C) $14,900

D) $16,280

E) $15,760

A) $6,500

B) $14,500

C) $14,900

D) $16,280

E) $15,760

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

34

What is Formosa International Bank's total sources of liquidity?

A) $16,520

B) $13,400

C) $14,200

D) $12,280

E) $15,760

A) $16,520

B) $13,400

C) $14,200

D) $12,280

E) $15,760

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

35

A bank has Federal funds totaling $25 million with an interest rate sensitivity weight of 1.0. This bank also has loans of $105 million and investments of $65 million with interest rate sensitivity weights of 1.40 and 1.15 respectively. This bank also has $135 million in interest-bearing deposits with an interest rate sensitivity weight of 0.90 and other money market borrowings of $75 million with an interest rate sensitivity weight of 1.0. What is the weighted interest-sensitive gap for this bank?

A) $50.25

B) $-15

C) -$50.25

D) $34.25

A) $50.25

B) $-15

C) -$50.25

D) $34.25

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

36

Please calculate the DEARs for TWD and JPN in USD.

A) $9,892.55; $22,544.78

B) $11,842.32; $22,784.71

C) $15,672.22; $14,784.56

D) $11,928.93; $52, 874.78

E) $12,892.39; $25,784.78

Hint: DEAR =$ Value of Position Price Sensitivity Adverse Movement

A) $9,892.55; $22,544.78

B) $11,842.32; $22,784.71

C) $15,672.22; $14,784.56

D) $11,928.93; $52, 874.78

E) $12,892.39; $25,784.78

Hint: DEAR =$ Value of Position Price Sensitivity Adverse Movement

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

37

If all interest rates on the two sides of balance sheet decline by 65 basis points, when other things are equal, what is the change in net interest income for Formosa Independence Bank over the year?

A) $0

B) $1,400,000

C) -$1,400,000

D) $1,592,500

E) -$1,592,500

A) $0

B) $1,400,000

C) -$1,400,000

D) $1,592,500

E) -$1,592,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

38

Microhedging is to use risk-management instruments such as futures and options to reduce the interest rate risk of banks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

39

The gain or loss to a bank from the use of a financial futures contract depends upon:

A) The duration of the underlying security named in the futures contract

B) The initial futures price

C) The change expected in interest rates divided by 1 + the original interest rate.

D) All of the above.

E) None of the above.

A) The duration of the underlying security named in the futures contract

B) The initial futures price

C) The change expected in interest rates divided by 1 + the original interest rate.

D) All of the above.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

40

A bank has a positive gap and estimates that the spread between risk-sensitive assets and risk-sensitive liabilities will move directly with interest rates. If interest rates fall the bank's overall NII will

A) Fall

B) Rise

C) Necessarily be unchanged

D) Rise or fall depending on the size of the spread affect relative to the size of the CGAP effect

A) Fall

B) Rise

C) Necessarily be unchanged

D) Rise or fall depending on the size of the spread affect relative to the size of the CGAP effect

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

41

DCB bank has an assets size $1,200 million, with duration DA = 2.5 years, DL = 0.80 years. In addition, the total liability is $1,104 million. According to the duration gap model, what size interest rate change would make the institution insolvent if rates are currently 5%?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

42

Suppose a T-Bond futures contract has a duration of 9 years and has a current market price of $98,750. Market interest rates are 6 percent today but are expected to rise to 7.5 percent. What is the change in this futures contract's market price from this change in interest rates?

A) +$12,577

B) -$12,577

C) +$62,883

D) -$62,883

E) -$33,578

A) +$12,577

B) -$12,577

C) +$62,883

D) -$62,883

E) -$33,578

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

43

The average durations and dollar amounts of assets and liabilities held in Freedom Bank are shown as the below:

What is the weighted average duration of Freedom Bank's asset portfolio? What is the weighted average duration of Freedom Bank's liability portfolio? What is the leverage-adjusted duration gap?

What is the weighted average duration of Freedom Bank's asset portfolio? What is the weighted average duration of Freedom Bank's liability portfolio? What is the leverage-adjusted duration gap?

What is the weighted average duration of Freedom Bank's asset portfolio? What is the weighted average duration of Freedom Bank's liability portfolio? What is the leverage-adjusted duration gap?

What is the weighted average duration of Freedom Bank's asset portfolio? What is the weighted average duration of Freedom Bank's liability portfolio? What is the leverage-adjusted duration gap?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

44

What is the bank's duration gap in years?

A) 1.432

B) 1.488

C) 1.587

D) 1.656

E) 1.722

A) 1.432

B) 1.488

C) 1.587

D) 1.656

E) 1.722

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

45

A bank with a positive interest-sensitive gap will have a decrease in net interest income when interest rates in the market:

A) Rise

B) Unchange

C) Fall

D) A bank with a positive interest-sensitive gap will never have a decrease in net interest income

A) Rise

B) Unchange

C) Fall

D) A bank with a positive interest-sensitive gap will never have a decrease in net interest income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

46

A bond portfolio manager has a $25 million market value bond portfolio with a 6 year duration. The manager believes interest rates may increase 50 basis points. Which of the following could be used to help limit his risk? I. Sell the bonds forward.

II) Buy bond futures contracts.

III) Buy call options on the bonds.

IV) Buy put options on the bonds.

A) I only

B) II only

C) I and III only

D) II and III only

E) I and IV only

II) Buy bond futures contracts.

III) Buy call options on the bonds.

IV) Buy put options on the bonds.

A) I only

B) II only

C) I and III only

D) II and III only

E) I and IV only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

47

A macro hedge is a

A) Hedge of a particular asset or liability

B) Hedge using futures on macroeconomic variables

C) Hedge using options in liabilities

D) Hedge without basis risk

E) Hedge of an entire balance sheet

Refer to the information below for questions 30-32:

XYZ Bank has DA = 2.4 years and DL = 0.9 years. The bank has total equity of $82 million and total assets of $850 million. Currently, interest rates are at 6%.

A) Hedge of a particular asset or liability

B) Hedge using futures on macroeconomic variables

C) Hedge using options in liabilities

D) Hedge without basis risk

E) Hedge of an entire balance sheet

Refer to the information below for questions 30-32:

XYZ Bank has DA = 2.4 years and DL = 0.9 years. The bank has total equity of $82 million and total assets of $850 million. Currently, interest rates are at 6%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

48

Why the capital in a financial institution can protect against credit risk and interest rate risk?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

49

To get DE to equal zero to protect the equity value in the event of an interest rate change, the bank could

A) Reduce DA to 1.2 years

B) Increase DL to 2.5 years

C) Increase DL to 2.77 years

D) Reduce DA to zero

E) Increase DL to 3.10 years

ESSAY QUESTIONS

A) Reduce DA to 1.2 years

B) Increase DL to 2.5 years

C) Increase DL to 2.77 years

D) Reduce DA to zero

E) Increase DL to 3.10 years

ESSAY QUESTIONS

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

50

A microhedge is a

A) Hedge against a change in a particular macro variable

B) Hedge of a particular asset or liability

C) Hedge of an entire balance sheet

D) Hedge using options

E) Hedge without basis risk

A) Hedge against a change in a particular macro variable

B) Hedge of a particular asset or liability

C) Hedge of an entire balance sheet

D) Hedge using options

E) Hedge without basis risk

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

51

Formosa Independence Bank has DA = 2.45 years and DL = 1.08 years. In addition, this bank has total assets of $375 million and liabilities of $337.5 million. The CFO of Formosa Independence Bank wishes to effectively reduce the duration gap to one year by hedging with T-Bond futures that have a market value of $115,000 and a DFut = 8 years. How many contracts are needed and should the bank buy or sell them? If D stands for duration.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

52

If interest rates increase 100 basis points the predicted dollar change in equity value will equal

A) $10,171,698

B) -$10,171,698

C) $12,724,528

D) -$12,724,528

E) $4,928,756

A) $10,171,698

B) -$10,171,698

C) $12,724,528

D) -$12,724,528

E) $4,928,756

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

53

A bank has an average asset duration of 1.15 years and an average liability duration of 2.70 years. This bank has $250 million in total assets and $225 million in total liabilities. This bank has:

A) A negative duration gap of 1.55 years.

B) A positive duration gap of 1.28 years.

C) A negative duration gap of 3.85 years.

D) A negative duration gap of 1.28 years.

A) A negative duration gap of 1.55 years.

B) A positive duration gap of 1.28 years.

C) A negative duration gap of 3.85 years.

D) A negative duration gap of 1.28 years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

54

A bond has a duration of 7.5 years. Its current market price is $1125. Interest rates in the market are 7% today. It has been forecasted that interest rates will rise to 9% over the next couple of weeks. How will this bank's price change in percentage terms?

A) This bond's price will rise by 2 percent.

B) This bond's price will fall by 2 percent.

C) This bond's price will not change

D) This bond's price will rise by 14.02 percent

E) This bond's price will fall by 14 .02 percent

A) This bond's price will rise by 2 percent.

B) This bond's price will fall by 2 percent.

C) This bond's price will not change

D) This bond's price will rise by 14.02 percent

E) This bond's price will fall by 14 .02 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

55

Explain the dilemma between liquidity, solvency and profitability. Why liquidity risk can lead to insolvency risk?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

56

A bank has an average asset duration of 5 years and an average liability duration of 3 years. This bank has total assets of $500 million and total liabilities of $250 million. Currently, market interest rates are 10 percent. If interest rates fall to 8 percent, what is this bank's change in net worth?

A) Net worth will decrease by $31.81 million

B) Net worth will increase by $31.81 million

C) Net worth will increase by $27.27 million

D) Net worth will decrease by $27.27 million

E) Net worth will not change at all

A) Net worth will decrease by $31.81 million

B) Net worth will increase by $31.81 million

C) Net worth will increase by $27.27 million

D) Net worth will decrease by $27.27 million

E) Net worth will not change at all

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

57

A bank wishing to avoid higher borrowing costs would be most likely to use:

A) A short or selling hedge in futures.

B) A long or buying hedge in futures.

C) A call option on futures contracts.

D) B and C above.

A) A short or selling hedge in futures.

B) A long or buying hedge in futures.

C) A call option on futures contracts.

D) B and C above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

58

Suppose a bank has an asset duration of 5 years and a liability duration of 2.5 years. This bank has $1000 million in assets and $750 million in liabilities. They are planning on trading in a Treasury bond future which has a duration of 8.5 years and which is selling right now for $99,000 for a $100,000 contract. How many futures contracts does this bank need to fully hedge itself against interest rate risk?

A) 3714 contracts

B) 3125 contracts

C) 2971 contracts

D) 371 contracts

E) 37 contacts

A) 3714 contracts

B) 3125 contracts

C) 2971 contracts

D) 371 contracts

E) 37 contacts

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck