Deck 5: Communicating and Interpreting Accounting Information

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/107

العب

ملء الشاشة (f)

Deck 5: Communicating and Interpreting Accounting Information

1

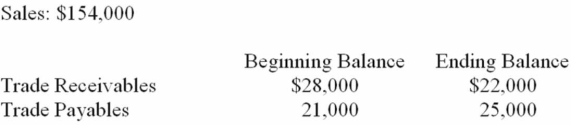

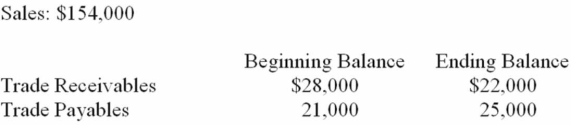

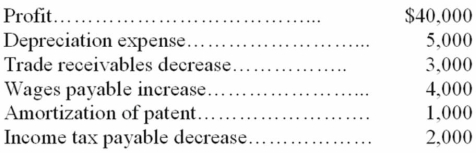

The financial statements of Juliet Company show the following:  How much cash was collected from customers?

How much cash was collected from customers?

A) $154,000.

B) $160,000.

C) $150,000.

D) $148,000.

How much cash was collected from customers?

How much cash was collected from customers?A) $154,000.

B) $160,000.

C) $150,000.

D) $148,000.

B

2

Which one of the following items is not generally used in preparing a statement of cash flows?

A) Current Statement of earnings

B) Comparative statements of financial position

C) Additional information

D) Adjusted trial balance

A) Current Statement of earnings

B) Comparative statements of financial position

C) Additional information

D) Adjusted trial balance

D

3

Typical financing activities do NOT include the following:

A) Proceeds from issuance of short- and long-term borrowings.

B) Principal payments on short- and long-term borrowings.

C) Purchase of shares for retirement.

D) Purchase of short- or long-term investments for cash.

A) Proceeds from issuance of short- and long-term borrowings.

B) Principal payments on short- and long-term borrowings.

C) Purchase of shares for retirement.

D) Purchase of short- or long-term investments for cash.

D

4

The statement of cash flows (indirect method) reports depreciation expense as an addition to profit because depreciation does which of the following?

A) Causes an inflow of funds for the replacement of assets.

B) Is a direct use of cash.

C) Reduces reported profit of the period but does not involve an outflow of cash for that period.

D) Reduces reported profit and causes an inflow of cash.

A) Causes an inflow of funds for the replacement of assets.

B) Is a direct use of cash.

C) Reduces reported profit of the period but does not involve an outflow of cash for that period.

D) Reduces reported profit and causes an inflow of cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

5

Travis Company reported a profit for 20B of $20,000, building depreciation expense of $6,000, and amortization expense (patent) of $5,000. Also, trade payables increased by

$7,000 and inventory decreased by $2,000. What was the amount of "cash flows from operating activities" for 20B?

A) $40,000.

B) $36,000.

C) $34,000.

D) $35,000.

$7,000 and inventory decreased by $2,000. What was the amount of "cash flows from operating activities" for 20B?

A) $40,000.

B) $36,000.

C) $34,000.

D) $35,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

6

The cash flow statement will not report the

A) change in the cash balance for the current period.

B) uses of cash in the current period.

C) amount of cheques outstanding at the end of the period.

D) sources of cash in the current period.

A) change in the cash balance for the current period.

B) uses of cash in the current period.

C) amount of cheques outstanding at the end of the period.

D) sources of cash in the current period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

7

WT Company reported sales revenue of $100,000 and total expenses of $90,000 (including depreciation) for the year ended December 31, 20A. During 20A, trade receivables decreased by $4,000, merchandise inventory increased by $3,000, trade payables increased by $2,000, and depreciation expense of $6,000 was recorded. Assuming no other data are needed, what was the net cash inflow from operating activities for 20A?

A) $20,000.

B) $24,000.

C) $19,000.

D) $21,000.

A) $20,000.

B) $24,000.

C) $19,000.

D) $21,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

8

In the indirect method, a gain on sale of equipment is reported as:

A) a decrease to net earnings.

B) a decrease to equipment purchases.

C) an increase to revenues.

D) an increase to cash provided by investing activities.

A) a decrease to net earnings.

B) a decrease to equipment purchases.

C) an increase to revenues.

D) an increase to cash provided by investing activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

9

Preferred shares issued in exchange for land would be reported on the statement of cash flows in

A) the notes to the financial statements.

B) the cash flows from operating activities section.

C) the cash flows from financing activities section.

D) the cash flows from investing activities section.

A) the notes to the financial statements.

B) the cash flows from operating activities section.

C) the cash flows from financing activities section.

D) the cash flows from investing activities section.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

10

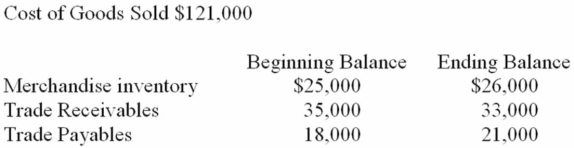

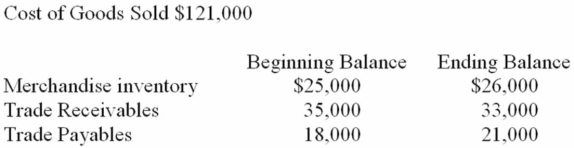

The financial statements for Ozzie Company show the following:  How much cash was paid for merchandise?

How much cash was paid for merchandise?

A) $124,000.

B) $117,000.

C) $121,000.

D) $119,000.

How much cash was paid for merchandise?

How much cash was paid for merchandise?A) $124,000.

B) $117,000.

C) $121,000.

D) $119,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

11

A company acquired some land (independently appraised at $12,000) and paid for it by issuing 1,000 shares of its common shares (par $10 per share; no market price was quoted). How should this be reported on the statement of cash flows?

A) Report $12,000 as inflow and outflow of cash.

B) Report on a schedule of significant noncash transactions if it is material.

C) Report $12,000 as an inflow of cash.

D) Should not be reported on the statement of cash flows.

A) Report $12,000 as inflow and outflow of cash.

B) Report on a schedule of significant noncash transactions if it is material.

C) Report $12,000 as an inflow of cash.

D) Should not be reported on the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

12

For an investment to qualify as a cash equivalent, it must be readily convertible to a known amount of cash and which of the following is correct?

A) It must mature within 4 months.

B) Must be sufficiently close to its maturity date so that its market value is relatively insensitive to interest rate changes.

C) The investment must have a known foreign exchange rate.

D) It must be identified as a cash equivalent on the statement of earnings.

A) It must mature within 4 months.

B) Must be sufficiently close to its maturity date so that its market value is relatively insensitive to interest rate changes.

C) The investment must have a known foreign exchange rate.

D) It must be identified as a cash equivalent on the statement of earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which of the following transactions is not a direct use of cash?

A) Cash dividend paid.

B) Acquisition of inventory for cash.

C) Exchange of bonds payable for land.

D) Purchase of treasury shares with cash.

A) Cash dividend paid.

B) Acquisition of inventory for cash.

C) Exchange of bonds payable for land.

D) Purchase of treasury shares with cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

14

In calculating cash flows from operating activities using the indirect method, a loss on the sale of equipment is

A) not reported on a cash flow statement.

B) added to net earnings.

C) ignored because it does not affect cash.

D) deducted from net earnings.

A) not reported on a cash flow statement.

B) added to net earnings.

C) ignored because it does not affect cash.

D) deducted from net earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

15

In the indirect method, an increase in trade receivables is reported on the statement of cash flows as:

A) an increase to sales.

B) a decrease to sales.

C) an increase to cash.

D) a decrease to cash.

A) an increase to sales.

B) a decrease to sales.

C) an increase to cash.

D) a decrease to cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

16

ABC Company reported total sales revenue of $80,000 and total expenses of $72,000 for the year ended December 31, 20X. During 20X, trade receivables increased by $3,000, merchandise inventory decreased by $2,000, trade payables increased by $1,000, and $5,000 in depreciation expense was recorded. Assuming no other adjustments to profit are needed, what was the net cash inflow from operating activities?

A) $10,000.

B) $13,000.

C) $11,000.

D) $19,000.

A) $10,000.

B) $13,000.

C) $11,000.

D) $19,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

17

The indirect method starts with net earnings and converts them to net cash provided by operating activities. This means that:

A) the indirect method starts with net earnings and adds back all of the expenses relating to operating activities.

B) the indirect method adjusts net earnings for contra account balances.

C) the indirect method calculates net earnings as the difference between net assets and net liabilities.

D) the indirect method adjusts net earnings, for items that affected reported net earnings but did not affect cash.

A) the indirect method starts with net earnings and adds back all of the expenses relating to operating activities.

B) the indirect method adjusts net earnings for contra account balances.

C) the indirect method calculates net earnings as the difference between net assets and net liabilities.

D) the indirect method adjusts net earnings, for items that affected reported net earnings but did not affect cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

18

The differences in the indirect method and the direct method of the statement of cash flows are evident in which section?

A) Financing activities

B) Cash reconciliation section

C) Investing activities

D) Operating activities

A) Financing activities

B) Cash reconciliation section

C) Investing activities

D) Operating activities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

19

Winn Company's 20B income statement reported total revenues, $110,000, and total expenses (including $10,000 depreciation), $70,000 . The 20B balance sheet reported the following: trade receivables--beginning balance, $16,000 and ending balance, $14,000; wages payable--beginning balance, $2,000 and ending balance, $1,500. Therefore, based only on this information, the 20B net cash inflow from operating activities was which of the following?

A) $59,500.

B) $51,500.

C) $48,500.

D) $50,000.

A) $59,500.

B) $51,500.

C) $48,500.

D) $50,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

20

Mason Corporation reported a net loss of $12,000 for the year ended December 31, 2013. During the year, accounts receivable decreased $5,000, merchandise inventory increased $4,000, accounts payable increased by $13,000, and depreciation expense of $7,000 was recorded. During 2013, operating activities using the indirect method

A) provided net cash of $9,000.

B) used net cash of $23,000.

C) used net cash of $33,000.

D) provided net cash of $7,000.

A) provided net cash of $9,000.

B) used net cash of $23,000.

C) used net cash of $33,000.

D) provided net cash of $7,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

21

The information in statement of cash flows should help investors and creditors evaluate:

A) the company's ability to collect dividends and pay obligations.

B) the reasons for the difference between net liabilities and net cash provided or used by operating activities.

C) the investing and financing transactions during the period.

D) the company's ability to generate past cash flows.

A) the company's ability to collect dividends and pay obligations.

B) the reasons for the difference between net liabilities and net cash provided or used by operating activities.

C) the investing and financing transactions during the period.

D) the company's ability to generate past cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

22

Trade receivables arising from sales to customers amounted to $35,000 and $40,000 at the beginning and end of the year, respectively. Profit reported on the income statement for the year was $120,000. Exclusive of the effect of other adjustments, the cash flows from operating activities, prepared using the indirect method, is

A) $155,000.

B) $125,000.

C) $120,000.

D) $115,000.

A) $155,000.

B) $125,000.

C) $120,000.

D) $115,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

23

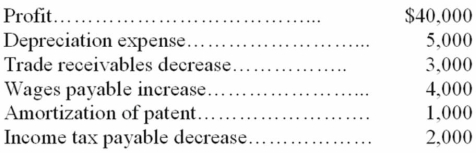

Jackson Company gathered the following data to prepare its 20B statement of cash flows:  Based only on the above data, the net cash inflow from operating activities during 20B was which of the following?

Based only on the above data, the net cash inflow from operating activities during 20B was which of the following?

A) $51,000.

B) $43,000.

C) $45,000.

D) $53,000.

Based only on the above data, the net cash inflow from operating activities during 20B was which of the following?

Based only on the above data, the net cash inflow from operating activities during 20B was which of the following?A) $51,000.

B) $43,000.

C) $45,000.

D) $53,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

24

Financing activities involve

A) acquiring investments.

B) acquiring long-lived assets.

C) lending money.

D) issuing debt.

A) acquiring investments.

B) acquiring long-lived assets.

C) lending money.

D) issuing debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

25

Toga Corporation reported profit of $50,000 for the year. During the year, trade receivables increased by $8,000, trade payables decreased by $4,000 and depreciation expense of $6,000 was recorded. Net cash provided by operating activities for the year, using the indirect method, is

A) $54,000.

B) $44,000.

C) $50,000.

D) $56,000.

A) $54,000.

B) $44,000.

C) $50,000.

D) $56,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following is a cash inflow from financing activities?

A) Proceeds from selling equipment.

B) Proceeds from selling investments in equity securities of another company.

C) Receipt of interest payments.

D) Proceeds from issuance of bonds payable.

A) Proceeds from selling equipment.

B) Proceeds from selling investments in equity securities of another company.

C) Receipt of interest payments.

D) Proceeds from issuance of bonds payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

27

Restless Company's 20B income statement reported total sales revenue of $100,000. The 20A-20B, comparative statements of financial position showed that trade receivables decreased by $10,000. What were the 20B "cash receipts from customers"?

A) $90,000.

B) $110,000.

C) $80,000.

D) $100,000.

A) $90,000.

B) $110,000.

C) $80,000.

D) $100,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which of the following statements about the quality of earnings ratio is false?

A) An increase in operating assets and a decrease in liabilities will reduce operating cash flows, thereby reducing the ratio.

B) Seasonal variations in sales have no impact on the quality of earnings ratio.

C) Seasonal variations in sales and purchases of inventory can cause wide deviations in the quality of earnings ratio.

D) When sales are growing, receivables and inventory normally increase at a faster rate than trade payables often causing operating cash flows to be less than profit.

A) An increase in operating assets and a decrease in liabilities will reduce operating cash flows, thereby reducing the ratio.

B) Seasonal variations in sales have no impact on the quality of earnings ratio.

C) Seasonal variations in sales and purchases of inventory can cause wide deviations in the quality of earnings ratio.

D) When sales are growing, receivables and inventory normally increase at a faster rate than trade payables often causing operating cash flows to be less than profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which of the following statements about the quality of earnings ratio is true?

A) Failure to accrue appropriate expenses will inflate net earnings and increase the quality of earnings ratio.

B) When sales are growing, receivables and inventory normally increase faster than trade payables so the ratio increases.

C) Failure to accrue appropriate expenses will inflate net earnings and reduce the quality of earnings ratio.

D) Seasonal variations in sales have no impact on the quality of earnings ratio.

A) Failure to accrue appropriate expenses will inflate net earnings and increase the quality of earnings ratio.

B) When sales are growing, receivables and inventory normally increase faster than trade payables so the ratio increases.

C) Failure to accrue appropriate expenses will inflate net earnings and reduce the quality of earnings ratio.

D) Seasonal variations in sales have no impact on the quality of earnings ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

30

In 2013, C Co. reported a quality of earnings ratio of 1.60. In 2012 and 2011 the ratio was .97 and .98 respectively. Which of the following was the most likely cause of the large increase in the ratio?

A) An increase in trade payables and accrued liabilities.

B) An increase in current assets such as receivables and inventory.

C) An increase in sales revenue while net earnings remained the same.

D) A decrease in expense while net earnings remained the same.

A) An increase in trade payables and accrued liabilities.

B) An increase in current assets such as receivables and inventory.

C) An increase in sales revenue while net earnings remained the same.

D) A decrease in expense while net earnings remained the same.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

31

Investing activities include

A) repaying money previously borrowed.

B) collecting the principal on loans made.

C) obtaining cash from creditors.

D) obtaining capital from owners.

A) repaying money previously borrowed.

B) collecting the principal on loans made.

C) obtaining cash from creditors.

D) obtaining capital from owners.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

32

If a loss of $20,000 is incurred in selling (for cash) office equipment that cost $90,000 and had accumulated depreciation of $22,500, the total amount reported in the investing activities section of the statement of cash flows is

A) $87,500.

B) $47,500.

C) $67,500.

D) $70,000.

A) $87,500.

B) $47,500.

C) $67,500.

D) $70,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

33

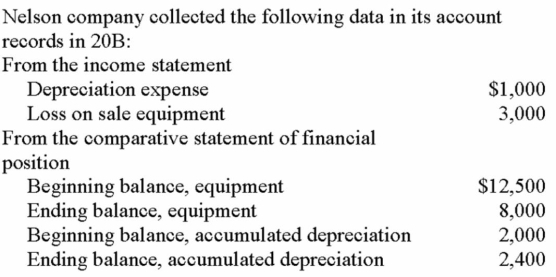

Nelson Company collected the following data in its accounting records in 20B:  No new equipment was purchased during the year. What was the cash inflow from the sale of equipment in 20B?

No new equipment was purchased during the year. What was the cash inflow from the sale of equipment in 20B?

A) $600.

B) $1,000.

C) $3,900.

D) $900.

No new equipment was purchased during the year. What was the cash inflow from the sale of equipment in 20B?

No new equipment was purchased during the year. What was the cash inflow from the sale of equipment in 20B?A) $600.

B) $1,000.

C) $3,900.

D) $900.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

34

Allen Company reported total sales revenue of $150,000 and total expenses of $152,000 for the year ended December 31, 20D. During 20D, trade receivables decreased by $1,000, trade payables increased by $5,000, wages payable increased by $3,000, and $18,000 in depreciation expense was recorded. Assuming no other adjustments are needed, what was the "net cash flow from operating activities" for 20D (parentheses indicate net cash outflow)?

A) $25,000.

B) $29,000.

C) ($1,000).

D) $23,000.

A) $25,000.

B) $29,000.

C) ($1,000).

D) $23,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

35

Assume the 20D income statement reported total sales revenue of $160,000. The 20C-20D, comparative statements of financial position showed that trade receivables increased by $10,000. What was the "cash inflow from customers" for 20D?

A) $160,000.

B) $140,000.

C) $170,000.

D) $150,000.

A) $160,000.

B) $140,000.

C) $170,000.

D) $150,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

36

In 2013, The W D Company reported net earnings of $1.3 billion and cash flow from operations of $5.6 billion. In 2012, it's net earnings was $1.9 billion and cash flow from operations was $5.1 billion. What were their quality of earnings ratios for 2013 and 2012 respectively?

A) .23 and .37

B) 4.31 and 2.68

C) 1.10 and .68

D) .91 and 1.46

A) .23 and .37

B) 4.31 and 2.68

C) 1.10 and .68

D) .91 and 1.46

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

37

How should the statement of cash flows be dated?

A) At Year-End December 31, 20X.

B) At December 31, 20X.

C) For the Year Ended December 31, 20X.

D) December 31, 20X.

A) At Year-End December 31, 20X.

B) At December 31, 20X.

C) For the Year Ended December 31, 20X.

D) December 31, 20X.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

38

The 20B income statement of Dunn Company reported total sales revenue of $106,000 and total expenses of $108,000 . Expenses were: building depreciation, $10,000 and patent amortization, $5,000. There was an increase in inventory of $1,000. What was cash flow from operating activities during 20B (parentheses indicate outflow)?

A) ($3,000).

B) $12,000.

C) $7,000.

D) $14,000.

A) ($3,000).

B) $12,000.

C) $7,000.

D) $14,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following transactions is not a direct source of cash?

A) Borrowing cash.

B) Disposal of inventory for cash.

C) Sale and issuance of shares for cash.

D) Sale of services on credit.

A) Borrowing cash.

B) Disposal of inventory for cash.

C) Sale and issuance of shares for cash.

D) Sale of services on credit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

40

Lori Company sold an operational asset, a machine, for cash. It originally cost $20,000. The accumulated depreciation at the date of disposal was $15,000. A gain on the disposal of $2,000 was reported. What was the cash inflow from this transaction?

A) $4,000.

B) $3,000.

C) $5,000.

D) $7,000.

A) $4,000.

B) $3,000.

C) $5,000.

D) $7,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

41

Which of the following transactions does not affect cash during a period?

A) Redemption of bonds

B) Write-off of an uncollectible account

C) Sale of common shares

D) Collection of an accounts receivable

A) Redemption of bonds

B) Write-off of an uncollectible account

C) Sale of common shares

D) Collection of an accounts receivable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

42

The statement of cash flows is the only financial statement prepared on the cash basis of accounting rather than on the accrual basis of accounting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

43

Matlock Company reported total sales revenue of $55,000 and total expenses amounting to $45,000 on its income statement for the year ended December 31, 20B. During 20B, trade receivables decreased by $4,000, merchandise inventory decreased by $6,000, trade payables increased by $2,000 and depreciation of $8,000 was recorded. Therefore, based only on this information, the net cash flow from operating activities for 20B was which of the following?

A) $30,000.

B) $18,000.

C) $19,000.

D) $10,000.

A) $30,000.

B) $18,000.

C) $19,000.

D) $10,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

44

In 2013, C Co. disclosed cash paid for property, plant and equipment of $1.069 million and cash flow from operations of $3.883 million. Their average property, plant and equipment from the comparative statement of financial position was $3.968 million. Compute C Co.'s capital expenditures ratio for 2013.

A) .28

B) 3.63

C) .98

D) .77

A) .28

B) 3.63

C) .98

D) .77

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

45

The payment of interest on a note payable is a cash flow from an operating activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

46

Which of the following is not true of the direct method of preparing a statement of cash flows?

A) It has a different net cash inflow (outflow) from operating activities than the indirect method.

B) It reports the same net increase or decrease in cash as the indirect method.

C) It gives the user a sense of the magnitude of gross dollars flowing in and out of the company.

D) It has the same cash flows from investing and financing activities as the indirect method.

A) It has a different net cash inflow (outflow) from operating activities than the indirect method.

B) It reports the same net increase or decrease in cash as the indirect method.

C) It gives the user a sense of the magnitude of gross dollars flowing in and out of the company.

D) It has the same cash flows from investing and financing activities as the indirect method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

47

Green Corporation reported net earnings of $50,000 for the year. During the year, trade receivables increased by $8,000, trade payables decreased by $4,000 and depreciation expense of $6,000 was recorded. Net cash provided by operating activities for the year, using the indirect method, is

A) $54,000.

B) $50,000.

C) $44,000.

D) $56,000.

A) $54,000.

B) $50,000.

C) $44,000.

D) $56,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

48

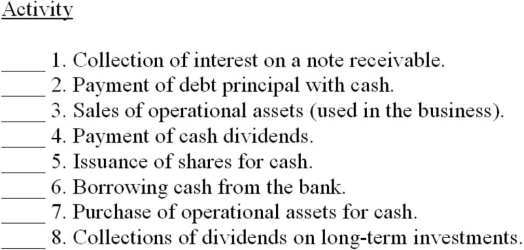

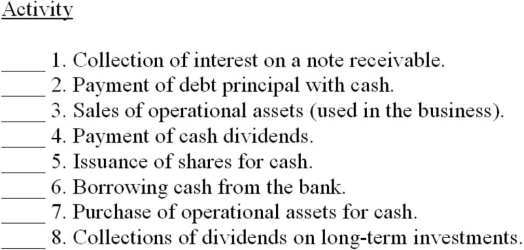

Match each activity below with the proper classification by inserting the proper capital letter in the space to the left.

Classification of Activity

I. Investing

F. Financing

O. Operating

Classification of Activity

I. Investing

F. Financing

O. Operating

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

49

Investing activities reported on the statement of cash flows include cash payments to acquire property, plant, and equipment, and short-term and long-term investments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

50

In the years 2006-2009, B Co.'s capital expenditures ratio was 2.74 and from 2010-2013, it was 1.24. From 2010-2013, R Co.'s ratio was .30. Which of the following statements about B Co.'s capital expenditures ratio is correct?

A) B Co.'s ratio has improved in the period 2010-2013.

B) It appears that R Co. is more aggressive about investing in additional property, plant and equipment than is B Co.

C) It appears that B Co. is more aggressive about investing in additional property, plant and equipment than is R Co.

D) B Co.'s capital expenditures ratio is relatively low and indicates inability to finance property, plant and equipment with cash flow from operations.

A) B Co.'s ratio has improved in the period 2010-2013.

B) It appears that R Co. is more aggressive about investing in additional property, plant and equipment than is B Co.

C) It appears that B Co. is more aggressive about investing in additional property, plant and equipment than is R Co.

D) B Co.'s capital expenditures ratio is relatively low and indicates inability to finance property, plant and equipment with cash flow from operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

51

The date in the heading of a statement of cash flows should say, "At December 31, 20A," rather than "For the Year Ended December 31, 20A."

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

52

A statement of cash flows indicates the sources and uses of cash during a specific period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

53

Short-term investments in marketable equity securities are considered the equivalent of cash (i.e., they are combined with cash) in preparing the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

54

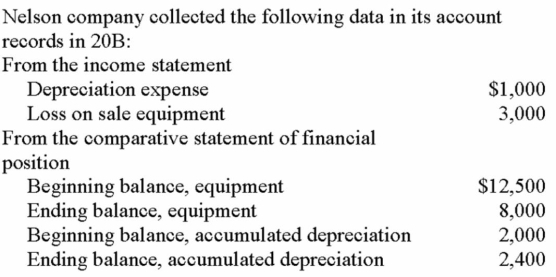

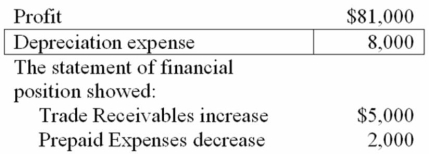

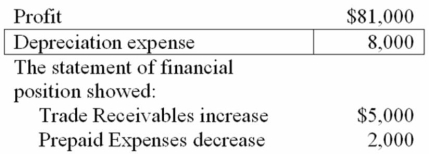

The 20B income statement for Ryan Corporation showed the following:  What was the cash flow from operating activities?

What was the cash flow from operating activities?

A) $82,000.

B) $86,000.

C) $70,000.

D) $66,000.

What was the cash flow from operating activities?

What was the cash flow from operating activities?A) $82,000.

B) $86,000.

C) $70,000.

D) $66,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

55

The payment to shareholders for repurchase of treasury shares is a cash flow from a financing activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

56

Randy, Inc., issued $50,000 of bonds, paid cash dividends of $8,000, sold long-term investments for $12,000, received $5,000 of dividend revenue, purchased treasury shares for $15,000, and purchased new equipment for $19,000. What is the net cash flow from financing activities?

A) $80,000.

B) $70,000.

C) $27,000.

D) ($20,000).

A) $80,000.

B) $70,000.

C) $27,000.

D) ($20,000).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

57

Wish Corporation acquired a computer for $15,000 and paid for it in full by issuing 1,000 shares of its own common shares, par $10 (current market price $15 share). This transaction should not be reported on the statement of cash flows because cash was neither paid out nor received.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

58

The category that is generally considered to be the best measure of a company's ability to continue as a going concern is

A) cash flows from financing activities.

B) usually different from year to year.

C) cash flows from operating activities.

D) cash flows from investing activities.

A) cash flows from financing activities.

B) usually different from year to year.

C) cash flows from operating activities.

D) cash flows from investing activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

59

The capital expenditures ratio (Cash Flow from Operating Activities ÷ Cash Paid for Property, Plant, and Equipment) reflects the portion of purchases of property, plant, and equipment financed from operating activities without the need for outside debt or equity financing or the sale of other investments or other long-term assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

60

Selected transactions of Horner Inc. are listed below.

1. Common shares are sold for cash.

2. Bonds payable are issued for cash at a discount.

3. Interest on a short-term note receivable is collected.

4. Merchandise is sold to customers for cash.

5. Cash is paid to purchase inventory.

6. Equipment is purchased by signing a 3-year, 5% note payable.

7. Cash dividends on common shares are declared and paid.

8. One hundred XYZ common shares are purchased for cash.

9. Land is sold for cash at book value.

10. Recorded an increase in the market value of available-for-sale securities.

Classify each transaction as either (a) an operating activity, (b) an investing activit

(c) a financing activity, or (d) a noncash investing and financing activity.

1. Common shares are sold for cash.

2. Bonds payable are issued for cash at a discount.

3. Interest on a short-term note receivable is collected.

4. Merchandise is sold to customers for cash.

5. Cash is paid to purchase inventory.

6. Equipment is purchased by signing a 3-year, 5% note payable.

7. Cash dividends on common shares are declared and paid.

8. One hundred XYZ common shares are purchased for cash.

9. Land is sold for cash at book value.

10. Recorded an increase in the market value of available-for-sale securities.

Classify each transaction as either (a) an operating activity, (b) an investing activit

(c) a financing activity, or (d) a noncash investing and financing activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

61

When a cash dividend is paid, the cash outflow is classified as an operating activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

62

The statement of cash flows and the statement of financial position both report on the causes of the changes in the cash of the business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

63

Cash flow from investing activities is considered the most important category on the cash flow statement because it is considered the best measure of expected earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

64

The acquisition of a building by issuing a mortgage note payable would be considered an investing and financing activity that did not affect cash and would be reported in the notes to the financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

65

Collection of principal on a note receivable is a cash flow from investing activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

66

When the statement of cash flows is prepared in conformity with IFRS there is only one acceptable way to measure and report cash flows from operating activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

67

A primary objective of the statement of cash flows is to show the earnings or loss on investing and financing transactions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

68

A transaction that does not cause an inflow or outflow of cash should be reported on the statement of cash flows only if it is an adjustment to convert accrual profit to the cash basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

69

The statement of cash flows is dated exactly like the income statement but unlike the statement of financial position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

70

The net increase (or decrease) in cash that is reported on the statement of cash flows should be the same as the change in the balance of the cash account for the two most recent years on the comparative statements of financial position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

71

Any item that appears on the statement of earnings would be considered either a cash inflow or cash outflow from operating activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

72

The purchase of a piece of equipment in exchange for common shares must be reported on the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

73

Only investments with original maturities of less than three months at the date of purchase qualify as cash equivalents.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

74

Cash equivalents are defined as short-term, highly liquid investments that are readily convertible into known amounts of cash and are so near their maturity that there is insignificant risk of changes in their value due to interest rate changes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

75

For external reporting, a company must prepare either a statement of earnings or a cash flow statement, but not both.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

76

Under the indirect method, noncash expenses are added to net earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

77

Dividends collected from a long-term investment are cash flows from investing activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

78

Cash collected from customers is a cash flow from a financing activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

79

The amortization of a patent is treated in a similar manner to depreciation of a building when preparing the operating activities section of the statement of cash flows using the indirect method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

80

The primary objective of statement of cash flows is to provide information about a company's cash receipts and cash payments during an accounting period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck