Deck 3: Operating Decisions and the Accounting System

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/109

العب

ملء الشاشة (f)

Deck 3: Operating Decisions and the Accounting System

1

If total revenues are the same as total expenses, then a company has which of the following?

A) a decrease in shareholders' equity.

B) a loss.

C) neither a profit nor a loss.

D) a profit.

A) a decrease in shareholders' equity.

B) a loss.

C) neither a profit nor a loss.

D) a profit.

C

2

Accrued expenses are

A) paid and recorded in an asset account after they are used or consumed.

B) paid and recorded in an asset account before they are used or consumed.

C) incurred but not yet paid or recorded.

D) incurred and already paid or recorded.

A) paid and recorded in an asset account after they are used or consumed.

B) paid and recorded in an asset account before they are used or consumed.

C) incurred but not yet paid or recorded.

D) incurred and already paid or recorded.

C

3

A company receives a $25,000 cash deposit from a customer on March 15 but will not deliver the goods until April 20. Which of the following statements is false?

A) Cash will be reported on the statement of cash flows for the month of March.

B) Revenue will be recorded and reported on the statement of earnings for March.

C) Revenue will be recorded and reported on the statement of earnings for April.

D) A liability will be reported on the statement of financial position at the end of March.

A) Cash will be reported on the statement of cash flows for the month of March.

B) Revenue will be recorded and reported on the statement of earnings for March.

C) Revenue will be recorded and reported on the statement of earnings for April.

D) A liability will be reported on the statement of financial position at the end of March.

B

4

Tony's Tune-Up Shop Ltd. follows the revenue recognition principle. Tony services a car on May 31. The customer picks up the vehicle on June 1 and mails the payment to Tony on June 5. Tony receives the cheque in the mail on June 6. When should Tony show that the revenue was earned?

A) June 5

B) May 31

C) June 1

D) June 6

A) June 5

B) May 31

C) June 1

D) June 6

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

5

The operating cycle of a business is best defined as which of the following?

A) one year

B) the length of time over which our plant and equipment assets are expected to be used by the company in generating revenues

C) the time it takes for a company to purchase and pay for goods or services from suppliers, sell those goods or services to customers and collect cash from the customers

D) the period of time for which we prepare our financial statements

A) one year

B) the length of time over which our plant and equipment assets are expected to be used by the company in generating revenues

C) the time it takes for a company to purchase and pay for goods or services from suppliers, sell those goods or services to customers and collect cash from the customers

D) the period of time for which we prepare our financial statements

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

6

In applying the revenue principle to a given transaction, the most important moment or period in time is when which of the following happens?

A) sales transaction is completed (i.e., ownership passes) or services are rendered.

B) related cash inflows occur.

C) the service contract is signed regarding service to be performed.

D) related expenses are incurred.

A) sales transaction is completed (i.e., ownership passes) or services are rendered.

B) related cash inflows occur.

C) the service contract is signed regarding service to be performed.

D) related expenses are incurred.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which of the following items has no effect on retained earnings?

A) dividends

B) expense

C) revenue

D) hiring a new employee

A) dividends

B) expense

C) revenue

D) hiring a new employee

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

8

The purchase of an asset for cash

A) decreases assets and increases liabilities.

B) leaves total assets unchanged.

C) increases assets and liabilities.

D) increases assets and shareholders' equity.

A) decreases assets and increases liabilities.

B) leaves total assets unchanged.

C) increases assets and liabilities.

D) increases assets and shareholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

9

Under the accrual basis of accounting

A) cash must be received before revenue is recognized.

B) profit is calculated by matching cash outflows against cash inflows.

C) events that change a company's financial statements are recognized in the period they occur rather than in the period in which cash is paid or received.

D) the ledger accounts must be adjusted to reflect a cash basis of accounting before financial statements are prepared.

A) cash must be received before revenue is recognized.

B) profit is calculated by matching cash outflows against cash inflows.

C) events that change a company's financial statements are recognized in the period they occur rather than in the period in which cash is paid or received.

D) the ledger accounts must be adjusted to reflect a cash basis of accounting before financial statements are prepared.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

10

A payment of a portion of accounts payable will

A) decrease net earnings.

B) not affect total assets.

C) increase liabilities.

D) not affect shareholders' equity.

A) decrease net earnings.

B) not affect total assets.

C) increase liabilities.

D) not affect shareholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

11

The matching principle states that expenses should be matched with revenues because

A) assets should be matched with liabilities.

B) dividends should be matched with shareholder investments.

C) cash payments should be matched with cash receipts.

D) efforts should be matched with accomplishments.

A) assets should be matched with liabilities.

B) dividends should be matched with shareholder investments.

C) cash payments should be matched with cash receipts.

D) efforts should be matched with accomplishments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following expenses is usually listed last on the statement of earnings?

A) Cost of sales

B) General administrative expenses

C) Income tax expense

D) Advertising expense

A) Cost of sales

B) General administrative expenses

C) Income tax expense

D) Advertising expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

13

Asset turnover measures

A) the portion of the assets that have been financed by creditors.

B) the overall rate of return on assets.

C) how often a company replaces its assets.

D) how efficiently a company uses its assets to generate sales.

A) the portion of the assets that have been financed by creditors.

B) the overall rate of return on assets.

C) how often a company replaces its assets.

D) how efficiently a company uses its assets to generate sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of the following activities will most likely result in a reported loss on the statement of earnings?

A) Interest expense

B) The sale of old equipment

C) The wages and benefits paid to employees

D) The sale of inventory to customers

A) Interest expense

B) The sale of old equipment

C) The wages and benefits paid to employees

D) The sale of inventory to customers

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which of the following is not normally a condition that must be met for revenue to be recognized (recorded) under the revenue principle?

A) The amount of revenue can be measured reliably.

B) Collection of receivables from credit sales is reasonably assured.

C) The promise to perform an exchange in the future has been made.

D) The earnings process is complete or nearly complete.

A) The amount of revenue can be measured reliably.

B) Collection of receivables from credit sales is reasonably assured.

C) The promise to perform an exchange in the future has been made.

D) The earnings process is complete or nearly complete.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

16

On January 1, 20B, Grover Inc., started the year with a $22,000 credit balance in its retained earnings account. During 20B, the company earned profit of $40,000 and declared and paid dividends of $10,000. Also, the company received cash of $15,000 as an additional investment by its owners. Therefore, the balance in retained earnings on December 31, 20B, would be which of the following?

A) $67,000.

B) $57,000.

C) $52,000.

D) $42,000.

A) $67,000.

B) $57,000.

C) $52,000.

D) $42,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

17

The right side of an account

A) is used to record decreases.

B) is the credit side.

C) is used to record increases.

D) shows all the balances of the accounts in the system.

A) is used to record decreases.

B) is the credit side.

C) is used to record increases.

D) shows all the balances of the accounts in the system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

18

Accrued revenues are

A) earned and recorded as liabilities before they are received.

B) earned but not yet received or recorded.

C) received and recorded as liabilities before they are earned.

D) earned and already received and recorded.

A) earned and recorded as liabilities before they are received.

B) earned but not yet received or recorded.

C) received and recorded as liabilities before they are earned.

D) earned and already received and recorded.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

19

The periodicity assumption is the basis for which of the following?

A) keeping the company's transactions separate from the owners' transactions.

B) the cut-off of expense recognition only.

C) the cut-off of revenue recognition only.

D) dividing the activities of a business into a series of time periods for accounting and reporting purposes.

A) keeping the company's transactions separate from the owners' transactions.

B) the cut-off of expense recognition only.

C) the cut-off of revenue recognition only.

D) dividing the activities of a business into a series of time periods for accounting and reporting purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

20

During 20B, New Company earned service revenues amounting to $200,000, of which $120,000 were collected in cash; the balance will be collected in January 20C. The 20B statement of earnings of the company should report which of the following amounts for service revenues?

A) $120,000.

B) $200,000.

C) $320,000.

D) $80,000.

A) $120,000.

B) $200,000.

C) $320,000.

D) $80,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

21

If Pizza Pizza reports an asset turnover ratio of 2.34 for 2013 and their competitor Pizza Hut reports 3.79 for their 2013 ratio, it means which of the following?

A) Pizza Pizza is less able to pay off their current obligations with their current assets.

B) Pizza Pizza is better able to pay their current obligations with their current assets.

C) Pizza Pizza has been less effective in managing the use and level of its assets.

D) Pizza Pizza has been more effective in managing the use and level of its assets.

A) Pizza Pizza is less able to pay off their current obligations with their current assets.

B) Pizza Pizza is better able to pay their current obligations with their current assets.

C) Pizza Pizza has been less effective in managing the use and level of its assets.

D) Pizza Pizza has been more effective in managing the use and level of its assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

22

Recording revenue

A) has no effect on total assets.

B) increases assets and shareholders' equity.

C) increases assets and liabilities.

D) increases assets and decreases shareholders' equity.

A) has no effect on total assets.

B) increases assets and shareholders' equity.

C) increases assets and liabilities.

D) increases assets and decreases shareholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

23

Financial analysts look to the statement of earnings to determine which of the following?

A) whether the company has generated sufficient cash to pay its bills

B) whether the company has generated earnings from operations

C) if the company is collecting its receivables on time

D) if the company has invested too much cash in its inventory

A) whether the company has generated sufficient cash to pay its bills

B) whether the company has generated earnings from operations

C) if the company is collecting its receivables on time

D) if the company has invested too much cash in its inventory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

24

Revenue is always recognized when which of the following occurs?

A) cash is collected.

B) the end of the period arrives.

C) it is earned.

D) expenses are paid.

A) cash is collected.

B) the end of the period arrives.

C) it is earned.

D) expenses are paid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which of the following costs is most likely to be the largest expense item on the statement of earnings of a merchandising chain such as Walmart?

A) Income tax expense

B) Wage, salary and benefits expense

C) Advertising

D) Cost of Sales

A) Income tax expense

B) Wage, salary and benefits expense

C) Advertising

D) Cost of Sales

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following liability accounts is likely to be satisfied with other than payment of cash?

A) Income taxes payable

B) Deferred subscriptions revenue

C) Wages payable

D) Accounts Payable

A) Income taxes payable

B) Deferred subscriptions revenue

C) Wages payable

D) Accounts Payable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

27

At the end of December, the owner of an apartment complex realized that the December rent had not been collected from one of the tenants. December 31 was the end of the accounting year; therefore, the owner made the appropriate adjusting entry at that time. When the December rent was collected in January of the following year, the entry made by the apartment owner should include which of the following?

A) debit to Rent revenue collected in advance.

B) credit to Rent revenue.

C) credit to Rent receivable.

D) debit to Rent receivable.

A) debit to Rent revenue collected in advance.

B) credit to Rent revenue.

C) credit to Rent receivable.

D) debit to Rent receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which of the following is not an example of the application of the revenue principle?

A) Recording the sale of merchandise on credit in sales revenue.

B) Recording accrued interest revenue on a loan made to another party.

C) Recording rent received in advance as rent revenue.

D) Recording the sale of merchandise for cash in sales revenue.

A) Recording the sale of merchandise on credit in sales revenue.

B) Recording accrued interest revenue on a loan made to another party.

C) Recording rent received in advance as rent revenue.

D) Recording the sale of merchandise for cash in sales revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which of the following activities does not violate the revenue recognition principle?

A) Recording cash received in advance from customers as revenue when the product is not yet shipped

B) Recording cash received in advance from customers as a liability when the product is not yet shipped

C) Recording revenue in December 2013 for units manufactured but not yet sold to customers

D) Not recording interest earned in 2013 until the cash is received in 2014

A) Recording cash received in advance from customers as revenue when the product is not yet shipped

B) Recording cash received in advance from customers as a liability when the product is not yet shipped

C) Recording revenue in December 2013 for units manufactured but not yet sold to customers

D) Not recording interest earned in 2013 until the cash is received in 2014

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

30

Operating cash inflows and outflows are primarily connected to which of the following?

A) acquisitions and sale of long lived assets

B) purchase and sale of long-term investments

C) issuance of shares, bank borrowings and repayments, and dividend payments

D) the sale of goods and services to customers and costs incurred to operate the business

A) acquisitions and sale of long lived assets

B) purchase and sale of long-term investments

C) issuance of shares, bank borrowings and repayments, and dividend payments

D) the sale of goods and services to customers and costs incurred to operate the business

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which of the following businesses would most likely have the shortest operating cycle?

A) A pizza franchise such as Pizza Pizza

B) A grocery chain such as Loblaws

C) A retail chain such as Walmart

D) A jewellery manufacturer such as Mappins

A) A pizza franchise such as Pizza Pizza

B) A grocery chain such as Loblaws

C) A retail chain such as Walmart

D) A jewellery manufacturer such as Mappins

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

32

Accrued expenses which must be recorded in adjusting entries represent which of the following?

A) expenses paid in advance.

B) expenses incurred but not yet paid.

C) expenses paid in advance and not recorded.

D) expenses incurred but not yet recorded or paid.

A) expenses paid in advance.

B) expenses incurred but not yet paid.

C) expenses paid in advance and not recorded.

D) expenses incurred but not yet recorded or paid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

33

An account will have a credit balance if the

A) last transaction entered was a credit.

B) first transaction entered was a credit.

C) debits exceed the credits.

D) credits exceed the debits.

A) last transaction entered was a credit.

B) first transaction entered was a credit.

C) debits exceed the credits.

D) credits exceed the debits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

34

The category that is generally considered to be the best measure of a company's ability to continue as a going concern is

A) cash flows from operating activities.

B) usually different from year to year.

C) cash flows from investing activities.

D) cash flows from financing activities.

A) cash flows from operating activities.

B) usually different from year to year.

C) cash flows from investing activities.

D) cash flows from financing activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

35

The equality of debits and credits is the basis for

A) the T account.

B) all accounting systems.

C) the single-entry accounting system.

D) the double-entry accounting system.

A) the T account.

B) all accounting systems.

C) the single-entry accounting system.

D) the double-entry accounting system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which principle holds that all of the expenses incurred in earning revenue should be identified with the revenue recognized and reported for the same period?

A) liability principle.

B) revenue principle.

C) matching principle.

D) timing principle.

A) liability principle.

B) revenue principle.

C) matching principle.

D) timing principle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

37

A company reports sales revenue of $120 million this year and $110 million last year. Their total assets in the current year are $80 million and last year's total assets were $75 million. What is the current year's asset turnover ratio?

A) 1.61

B) 1.55

C) 1.40

D) 1.46

A) 1.61

B) 1.55

C) 1.40

D) 1.46

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

38

Collection of a $600 accounts receivable

A) has no effect on total assets.

B) decreases a liability $600; increases shareholders' equity $600.

C) increases an asset $600; decreases a liability $600.

D) decreases an asset $600; decreases a liability $600.

A) has no effect on total assets.

B) decreases a liability $600; increases shareholders' equity $600.

C) increases an asset $600; decreases a liability $600.

D) decreases an asset $600; decreases a liability $600.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which one of the following represents the expanded basic accounting equation?

A) Assets = Liabilities + Contributed Capital + Retained Earnings + Revenues - Expenses - Dividends

B) Assets + Liabilities = Dividends + Expenses + Contributed Capital + Revenues

C) Assets = Revenues + Expenses - Liabilities

D) Assets - Liabilities - Dividends = Contributed Capital + Revenues - Expenses

A) Assets = Liabilities + Contributed Capital + Retained Earnings + Revenues - Expenses - Dividends

B) Assets + Liabilities = Dividends + Expenses + Contributed Capital + Revenues

C) Assets = Revenues + Expenses - Liabilities

D) Assets - Liabilities - Dividends = Contributed Capital + Revenues - Expenses

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

40

Golden Company had these transactions during the accounting period: Sold merchandise for $600; its cost was $400. Collected $400 from a trade receivable. The account was established in the previous year. Used office supplies of $50.

Golden's profit for the period would be which of the following?

A) $150.

B) $50.

C) $900.

D) $600.

Golden's profit for the period would be which of the following?

A) $150.

B) $50.

C) $900.

D) $600.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

41

Calculate the effective tax rate for a company that reports an income tax expense of $3.0 million, profit of $7.5 million, and income before taxes of $10.5 million.

A) 35%

B) 40%

C) 28.6%

D) It cannot be computed with the above information

A) 35%

B) 40%

C) 28.6%

D) It cannot be computed with the above information

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

42

Which of the following statements is true?

A) Debits increase assets and increase liabilities.

B) Credits decrease assets and increase liabilities.

C) Credits decrease assets and decrease liabilities.

D) Debits increase liabilities and decrease assets.

A) Debits increase assets and increase liabilities.

B) Credits decrease assets and increase liabilities.

C) Credits decrease assets and decrease liabilities.

D) Debits increase liabilities and decrease assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

43

The statement of earnings provides investors with information about a company's investing activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

44

The statement of earnings reports profit or loss at a point in time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

45

An increase in an asset is recorded by a debit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

46

An accountant has debited an asset account for $500 and credited a revenue account for $1,000. What can be done to complete the recording of the transaction?

A) Debit another asset account for $500.

B) Debit a shareholders' equity account for $500.

C) Nothing further must be done.

D) Credit a different asset account for $500.

A) Debit another asset account for $500.

B) Debit a shareholders' equity account for $500.

C) Nothing further must be done.

D) Credit a different asset account for $500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

47

According to the periodicity assumption, to measure and report financial information periodically, we assume the long life of the company can be cut into shorter periods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

48

For a merchandising company, the largest operating cash outflow would result from which of the following?

A) payments to suppliers from whom we have purchased inventory on credit

B) payment of interest on notes payable

C) payment of wages and benefits to employees

D) payment of taxes to the various government entities

A) payments to suppliers from whom we have purchased inventory on credit

B) payment of interest on notes payable

C) payment of wages and benefits to employees

D) payment of taxes to the various government entities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

49

Revenue accounts normally have debit balances because they represent assets received while expense accounts normally have credit balances because they represent assets used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

50

Cash receipts from interest are classified as

A) financing activities.

B) operating activities.

C) investing activities.

D) either financing or investing activities.

A) financing activities.

B) operating activities.

C) investing activities.

D) either financing or investing activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

51

An expense account is a subdivision of the retained earnings account and decreases shareholder's equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

52

The payment of a liability

A) decreases assets and increases liabilities.

B) decreases assets and shareholders' equity.

C) decreases assets and liabilities.

D) increases assets and decreases liabilities.

A) decreases assets and increases liabilities.

B) decreases assets and shareholders' equity.

C) decreases assets and liabilities.

D) increases assets and decreases liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

53

In a well-run business, creditors expect the total asset turnover ratio to fluctuate due to seasonal upswings and downturns.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

54

The normal balance of all accounts is a debit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

55

Accrued in the case of expenses means paid in advance, and deferred in the case of expenses means not yet paid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

56

The profit of a business is computed by subtracting revenues from expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

57

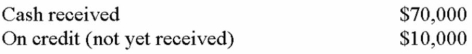

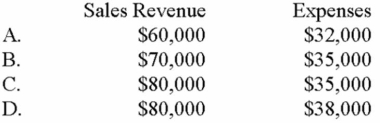

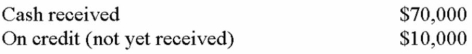

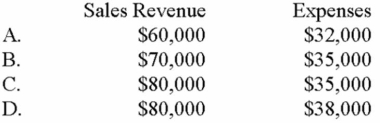

During the accounting period, Luxor Company had the following data: Sales of products:  Expenses:

Expenses:

This is the first year of business.

This is the first year of business.

What were the sales revenue and expenses?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

Expenses:

Expenses: This is the first year of business.

This is the first year of business.What were the sales revenue and expenses?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

58

Collection of a customer's account has an impact on total assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

59

Expenses are recognized when an exchange takes place of productive assets, the earnings process is complete or nearly complete, and collection is likely.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

60

What would be the effect on December's statement of earnings of a utility bill received on December 27, 2013 but which will not be paid until January 10, 2014?

A) Profit will be decreased when we pay the bill in January

B) No expense will be recognized until the bill is paid in January

C) We would cause an increase in profit by recording the expense in December

D) Recording the expense in December when it is incurred will increase expenses

A) Profit will be decreased when we pay the bill in January

B) No expense will be recognized until the bill is paid in January

C) We would cause an increase in profit by recording the expense in December

D) Recording the expense in December when it is incurred will increase expenses

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

61

The revenue principle recognizes revenue from the sale of goods when ownership passes from the seller to the buyer. In the sale of services, revenue is recognized when the services are rendered.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

62

Accrual basis accounting recognizes revenues when cash is received from the customer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

63

Losses are decreases in assets or increases in liabilities from peripheral activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

64

The double-entry accounting system records the dual effect of each transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

65

When a growing company finds it needs to buy more inventory before cash has been collected from customers, they often use short term credit such as trade or notes payable to finance the inventory purchases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

66

Using the accrual basis of accounting, a company recognizes expenses when they are paid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

67

A decrease in a liability account is recorded by a debit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

68

Income tax expense will appear on the statement of financial position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

69

The revenue principle recognizes revenues when the earnings process is complete or nearly complete, an exchange has taken place, and collection is probable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

70

Cost of sales is usually the largest expense for manufacturing or merchandising companies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

71

Accrual basis accounting records revenues when earned and expenses when incurred, regardless of when the related cash is received or paid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

72

Operating revenues result from the sale of goods or services.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

73

The normal balance of an asset is a credit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

74

The sale of merchandise on credit and the collection from the customer ten days later constitutes one transaction for accounting purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

75

A credit means that an account has been increased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

76

The matching process recognizes liabilities when incurred in earning revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

77

The operating cycle is of a similar duration for most companies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

78

The operating cycle is the time it takes for a company to purchase goods, pay for the goods, sell them to customers, and collect the cash from the customers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

79

We record insurance as an expense when we pay for a three year policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

80

A Taco Bell restaurant would most likely have a longer operating cycle than Walmart.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck