Deck 13: Analyzing Financial Statements

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/126

العب

ملء الشاشة (f)

Deck 13: Analyzing Financial Statements

1

Calculate C Co's current ratio for 2012 and 2011 respectively.

A) .60 and .70

B) .54 and .59

C) .63 and .72

D) .66 and .74

A) .60 and .70

B) .54 and .59

C) .63 and .72

D) .66 and .74

D

2

Financial leverage will always be which of the following?

A) Positive, negative, or zero.

B) Positive.

C) Either positive or negative.

D) Negative.

A) Positive, negative, or zero.

B) Positive.

C) Either positive or negative.

D) Negative.

A

3

At the end of 20B, Storage Company reported 15,000 outstanding common shares. Total liabilities were $440,000 and total assets were $860,000. The company had no preferred shares. What was the book value per share of common share?

A) $28.00

B) $13.90

C) $14.00

D) $29.00

A) $28.00

B) $13.90

C) $14.00

D) $29.00

A

4

A general rule to use in assessing the average collection period is that it

A) should not greatly exceed the discount period.

B) should not exceed 30 days.

C) can be any length as long as the customer continues to buy merchandise.

D) should not greatly exceed the credit term period.

A) should not greatly exceed the discount period.

B) should not exceed 30 days.

C) can be any length as long as the customer continues to buy merchandise.

D) should not greatly exceed the credit term period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

5

Matt Company paid out $2.30 in dividends per share during 20B. The market price of the share on December 31, 20B was $21.00 per share. There were 15,000 shares of share outstanding for the entire year. What was the dividend yield as of December 31, 20B?

A) 10.95%

B) 913.04%

C) 16.43%

D) 9.13%

A) 10.95%

B) 913.04%

C) 16.43%

D) 9.13%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

6

Calculate C Co's debt to equity ratio for 2012 and 2011 respectively.

A) .79 and .78

B) .56 and .56

C) .66 and .66

D) 1.27 and 1.28

A) .79 and .78

B) .56 and .56

C) .66 and .66

D) 1.27 and 1.28

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

7

The ratio that is calculated by dividing cash dividends declared on common shares by net earnings is called the:

A) dividend yield ratio.

B) payout ratio.

C) common dividend ratio.

D) earnings per share ratio.

A) dividend yield ratio.

B) payout ratio.

C) common dividend ratio.

D) earnings per share ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

8

Strait Company has outstanding shares as follows: 16,000 common shares and 5,000 preferred shares. What is the number of shares that should be used in the denominator to compute earnings per share?

A) 5,000

B) 16,000

C) 21,000

D) 11,000

A) 5,000

B) 16,000

C) 21,000

D) 11,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

9

In 2012, C Co's gross profit ratio was 70.4% and their profit margin was 18.8%. In 2012, P Co's gross profit ratio was 58.3% and their profit margin was 8.9%. Which of the following is false?

A) C Co looks to be a better investment than P Co.

B) The major reason for P Co's lower profit margin is that their selling, general and administrative expenses were double the percentage of sales compared to C Co's percentage.

C) C Co's cost of goods sold was a lower percentage of sales than P Co's.

D) In 2012, C Co's profit margin was 111.2% greater than P Co's which would contribute to a higher return on total investment.

A) C Co looks to be a better investment than P Co.

B) The major reason for P Co's lower profit margin is that their selling, general and administrative expenses were double the percentage of sales compared to C Co's percentage.

C) C Co's cost of goods sold was a lower percentage of sales than P Co's.

D) In 2012, C Co's profit margin was 111.2% greater than P Co's which would contribute to a higher return on total investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

10

A company has a receivables turnover ratio of 12. The average gross accounts receivable during the period is $360,000. What is the amount of net credit sales for the period?

A) $432,000.

B) $3,000,000.

C) $4,320,000.

D) Cannot be determined from the information given.

A) $432,000.

B) $3,000,000.

C) $4,320,000.

D) Cannot be determined from the information given.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

11

Some of the ratios that are used to determine a company's short-term debt paying ability are

A) current ratio, receivables turnover, and inventory turnover.

B) times interest earned, current ratio, and inventory turnover.

C) asset turnover, times interest earned, current ratio, and receivables turnover.

D) times interest earned, inventory turnover, current ratio, and receivables turnover.

A) current ratio, receivables turnover, and inventory turnover.

B) times interest earned, current ratio, and inventory turnover.

C) asset turnover, times interest earned, current ratio, and receivables turnover.

D) times interest earned, inventory turnover, current ratio, and receivables turnover.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

12

A liquidity ratio measures the

A) number of times interest is earned.

B) short-term ability of the company to pay its maturing obligations and to meet unexpected needs for cash.

C) ability of the company to survive over a long period of time.

D) earnings or operating success of a company over a period of time.

A) number of times interest is earned.

B) short-term ability of the company to pay its maturing obligations and to meet unexpected needs for cash.

C) ability of the company to survive over a long period of time.

D) earnings or operating success of a company over a period of time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

13

All of the following ratios are investor measures of profitability except

A) payout ratio.

B) return on assets.

C) price-earnings ratio.

D) dividend yield.

A) payout ratio.

B) return on assets.

C) price-earnings ratio.

D) dividend yield.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

14

The inventory turnover ratio is calculated by dividing

A) cost of goods sold by the ending inventory.

B) cost of goods sold by the average inventory.

C) average inventory by cost of goods sold.

D) cost of goods sold by the beginning inventory.

A) cost of goods sold by the ending inventory.

B) cost of goods sold by the average inventory.

C) average inventory by cost of goods sold.

D) cost of goods sold by the beginning inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

15

Calculate C Co's financial leverage and identify whether it was positive or negative.

A) 15.2% positive

B) 14.1% positive

C) 17.8% negative

D) 19.9% negative

A) 15.2% positive

B) 14.1% positive

C) 17.8% negative

D) 19.9% negative

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

16

Profit margin is calculated by dividing

A) sales by cost of goods sold.

B) net earnings by net sales.

C) net earnings by shareholders' equity.

D) gross profit by net sales.

A) sales by cost of goods sold.

B) net earnings by net sales.

C) net earnings by shareholders' equity.

D) gross profit by net sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

17

A common measure of profitability is the

A) return on common shareholders' equity ratio.

B) current ratio.

C) debt to total assets ratio.

D) cash current debt coverage ratio.

A) return on common shareholders' equity ratio.

B) current ratio.

C) debt to total assets ratio.

D) cash current debt coverage ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which of the following ratios is not a test of solvency?

A) Debt to equity ratio.

B) Cash coverage ratio.

C) Times interest earned ratio.

D) Earnings per share ratio.

A) Debt to equity ratio.

B) Cash coverage ratio.

C) Times interest earned ratio.

D) Earnings per share ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

19

A company has an average inventory on hand of $40,000 and its average days in inventory are 26.4 days. What is the cost of goods sold?

A) $553,030.

B) $1,056,000.

C) $486,667.

D) $480,000.

A) $553,030.

B) $1,056,000.

C) $486,667.

D) $480,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

20

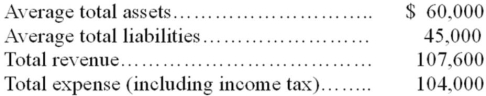

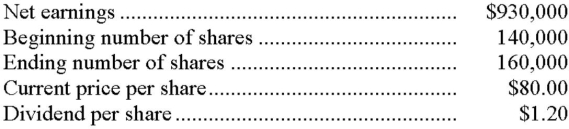

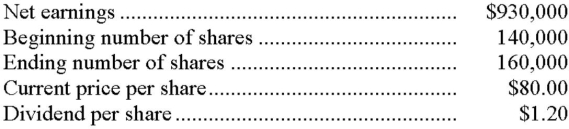

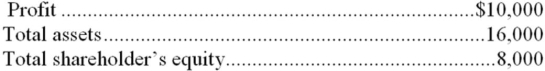

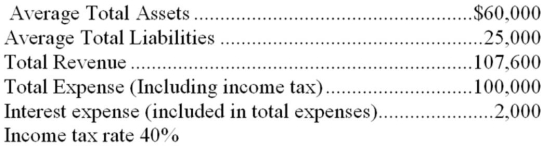

The records of ZZZZ Better Corporation include the following:  What is the return on equity?

What is the return on equity?

A) 16%

B) 6%

C) 13%

D) 24%

What is the return on equity?

What is the return on equity?A) 16%

B) 6%

C) 13%

D) 24%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

21

If the components of price/earnings ratio are inverted, the resulting percent is referred to as which of the following?

A) Capitalization rate.

B) Dividend yield ratio.

C) Multiple.

D) Book value per share.

A) Capitalization rate.

B) Dividend yield ratio.

C) Multiple.

D) Book value per share.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

22

Net sales are $2,700,000, beginning total assets are $750,000, and the asset turnover is 3.0. What is the ending total asset balance?

A) $1,050,000.

B) $900,000.

C) $600,000.

D) $1,125,000.

A) $1,050,000.

B) $900,000.

C) $600,000.

D) $1,125,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

23

Calculate C Co's times interest earned ratio for 2012 and 2011 respectively.

A) 12.33 and 19.77

B) 11.82 and 17.93

C) 11.33 and 18.77

D) 7.21 and 12.75

A) 12.33 and 19.77

B) 11.82 and 17.93

C) 11.33 and 18.77

D) 7.21 and 12.75

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which of the following statements is true?

A) Liquidity focuses on the ability of a company to pay their long- and short-term debts.

B) The inventory turnover ratio is an important solvency test for retail companies.

C) Tests of profitability focus on measuring the adequacy of profit.

D) The debt to equity ratio is a measure of liquidity.

A) Liquidity focuses on the ability of a company to pay their long- and short-term debts.

B) The inventory turnover ratio is an important solvency test for retail companies.

C) Tests of profitability focus on measuring the adequacy of profit.

D) The debt to equity ratio is a measure of liquidity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

25

A company that is leveraged is one that

A) contains equity financing.

B) has a high current ratio.

C) contains debt financing.

D) has a high earnings per share.

A) contains equity financing.

B) has a high current ratio.

C) contains debt financing.

D) has a high earnings per share.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

26

Calculate P Co's price earnings ratios for 2012 and 2011 respectively.

A) 29.7% and 26.5%

B) 3.2% and 3.9%

C) 29.7 and 26.5 times

D) 30.9 and 25.5 times

A) 29.7% and 26.5%

B) 3.2% and 3.9%

C) 29.7 and 26.5 times

D) 30.9 and 25.5 times

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

27

In 2012, C Co's receivables turnover ratio and days' sales in receivables was 11.43 times and 31.9 days. In 2012, P Co's receivables turnover ratio and days' sales in receivables was 9.71 times and 37.6 days. Which of the following statements is false?

A) P Co's lower turnover ratio has an inverse relationship to its days' sales tied up in receivables.

B) C Co's management has done a better job of managing their receivables.

C) C Co appears to be more profitable than P Co.

D) The higher turnover ratio for C Co hurts their liquidity.

A) P Co's lower turnover ratio has an inverse relationship to its days' sales tied up in receivables.

B) C Co's management has done a better job of managing their receivables.

C) C Co appears to be more profitable than P Co.

D) The higher turnover ratio for C Co hurts their liquidity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

28

A successful grocery store would probably have

A) zero profit margin.

B) low volume.

C) a high inventory turnover.

D) a low inventory turnover.

A) zero profit margin.

B) low volume.

C) a high inventory turnover.

D) a low inventory turnover.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

29

Hayes Company had an average age of accounts receivable of 25 days and net credit sales of $31,000. Assume a 365 day year. What was the amount of the average net receivables?

A) $5,760

B) $1,152

C) $2,123

D) $4,000

A) $5,760

B) $1,152

C) $2,123

D) $4,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

30

If the average collection period is 45 days, what is the receivables turnover?

A) 18.0 times

B) 12.0 times

C) 8.1 times

D) None of these

A) 18.0 times

B) 12.0 times

C) 8.1 times

D) None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

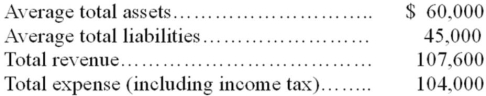

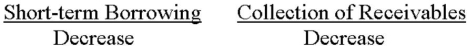

31

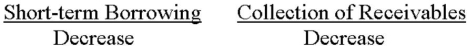

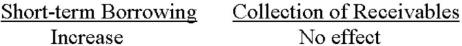

If a company has a current ratio of 1.3:1, what respective effects will the borrowing of cash by short-term debt and collection of trade receivables have on the ratio?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

32

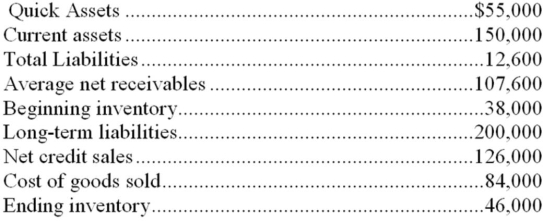

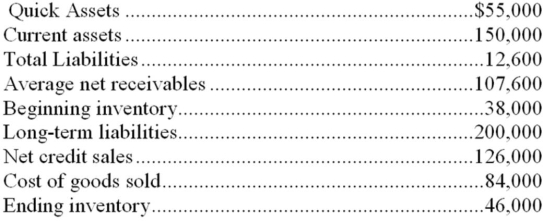

Nunn Company reported the following data:  What was the current ratio?

What was the current ratio?

A) 0.75 to 1

B) 0.5 to 1

C) 1.5 to 1

D) 2.5 to 1

What was the current ratio?

What was the current ratio?A) 0.75 to 1

B) 0.5 to 1

C) 1.5 to 1

D) 2.5 to 1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

33

Calculate C Co's fixed asset turnover ratio for 2012.

A) 3.79

B) 4.87

C) .97

D) 4.99

A) 3.79

B) 4.87

C) .97

D) 4.99

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

34

Calculate C Co's return on equity (ROE) for 2012.

A) 25.6%

B) 31.8%

C) 27.1%

D) 30.9%

A) 25.6%

B) 31.8%

C) 27.1%

D) 30.9%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following regarding book value per common share is true?

A) It is not widely used in assessing the future dividend potential of the corporation.

B) It is a good measure of management performance.

C) It is a measure of liquidity.

D) It is usually greater than the market value per share.

A) It is not widely used in assessing the future dividend potential of the corporation.

B) It is a good measure of management performance.

C) It is a measure of liquidity.

D) It is usually greater than the market value per share.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

36

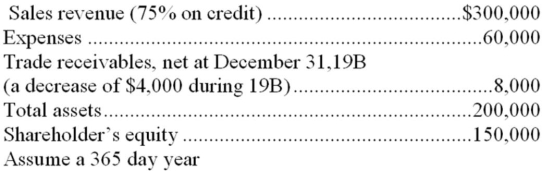

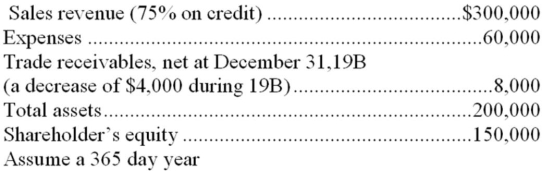

Box Company reported the following data at the end of 20B:  What was the average number of days to collect receivables during 20B?

What was the average number of days to collect receivables during 20B?

A) 16.2

B) 21.9

C) 36.5

D) 14.3

What was the average number of days to collect receivables during 20B?

What was the average number of days to collect receivables during 20B?A) 16.2

B) 21.9

C) 36.5

D) 14.3

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

37

When are ratios most useful for analysis?

A) When compared with both historical ratios of the same company and ratios for other companies in the industry.

B) When compared with historical ratios of the same company.

C) When used alone.

D) When compared with ratios for other companies in the industry.

A) When compared with both historical ratios of the same company and ratios for other companies in the industry.

B) When compared with historical ratios of the same company.

C) When used alone.

D) When compared with ratios for other companies in the industry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

38

Calculate P Co's book value per share in 2012 and 2011 respectively.

A) 4.21 and cannot compute 2012's book value

B) 4.21 and 4.42

C) 4.14 and 4.49

D) 4.14 and cannot compute 2012's book value

A) 4.21 and cannot compute 2012's book value

B) 4.21 and 4.42

C) 4.14 and 4.49

D) 4.14 and cannot compute 2012's book value

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

39

In 2012, C Co's return on owners' equity (ROE) was 45.1%, and return on assets (ROA) was 19.6%. In 2012, P Co's return on owners' equity (ROE) was 29.9% while return on assets was 9.3%. Which of the following statements is false?

A) C Co. is considerably more liquid than P Co.

B) P Co's ROE was 222% greater than their ROA while C Co's ROE was only 130% greater than their ROA. This difference is caused by P Co's higher use of debt financing to leverage their assets.

C) C Co provided higher positive financial leverage for their shareholders compared to P Co.

D) P Co's return on assets (ROA) was less than half of C Co's ROA.

A) C Co. is considerably more liquid than P Co.

B) P Co's ROE was 222% greater than their ROA while C Co's ROE was only 130% greater than their ROA. This difference is caused by P Co's higher use of debt financing to leverage their assets.

C) C Co provided higher positive financial leverage for their shareholders compared to P Co.

D) P Co's return on assets (ROA) was less than half of C Co's ROA.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

40

May Company's return on equity was 21% and the financial leverage ratio was 13% (positive). What was the return on assets?

A) 34%

B) 21%

C) 13%

D) 8%

A) 34%

B) 21%

C) 13%

D) 8%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

41

A quality of earnings ratio higher than one is an indicator of which of the following?

A) That a company has too many fixed assets.

B) That fixed assets are the company's most important resources.

C) A company's high debt position.

D) That a company has cash generated by operations higher than the amount of profit.

A) That a company has too many fixed assets.

B) That fixed assets are the company's most important resources.

C) A company's high debt position.

D) That a company has cash generated by operations higher than the amount of profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

42

In 2012, C Co's total liabilities were $10,742 million and shareholders' equity was $8,403 million. In 2012, P Co's total liabilities were $16,259 million and their shareholders' equity was $6,401 million. Which of the following statements is false?

A) C Co's debt to equity ratio was 1.28 and P Co's was 2.54.

B) C Co has only about 56.1% of its assets financed by debt while P Co has about 71.8% of assets financed by debt.

C) C Co is more profitable than P Co.

D) P Co is a much higher leveraged company providing greater financial risk for investors but potential higher return on owners' investment to its shareholders.

A) C Co's debt to equity ratio was 1.28 and P Co's was 2.54.

B) C Co has only about 56.1% of its assets financed by debt while P Co has about 71.8% of assets financed by debt.

C) C Co is more profitable than P Co.

D) P Co is a much higher leveraged company providing greater financial risk for investors but potential higher return on owners' investment to its shareholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

43

Calculate C Co's receivables turnover ratio and the days' sales in receivables for 2012.

A) 11.15 times and 32.7 days

B) 11.43 times and 31.9 days

C) 3.47 times and 105.2 days

D) 11.02 times and 33.1 days

A) 11.15 times and 32.7 days

B) 11.43 times and 31.9 days

C) 3.47 times and 105.2 days

D) 11.02 times and 33.1 days

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following accounting ratios considers the importance of cash flows relating to required interest payments?

A) receivables turnover

B) cash coverage ratio

C) debt/equity ratio

D) times interest earned ratio

A) receivables turnover

B) cash coverage ratio

C) debt/equity ratio

D) times interest earned ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

45

The Able Company had profit of $47,500 and earnings per share of $3.17 during 20B. On December 31, 20B, the shares had a market price of $18.50 per share. What is Able's price/earnings ratio?

A) 25.70

B) 5.84

C) 0.17

D) 8.11

A) 25.70

B) 5.84

C) 0.17

D) 8.11

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

46

Teel Company's working capital was $40,000 and total current liabilities were 1/4 of that amount. What was the current (working capital) ratio?

A) 1 to 1

B) 7 to 1

C) 5 to 1

D) 3 to 1

A) 1 to 1

B) 7 to 1

C) 5 to 1

D) 3 to 1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

47

A supplier to a company would be most interested in the

A) profit margin ratio.

B) asset turnover ratio.

C) free cash flow.

D) current ratio.

A) profit margin ratio.

B) asset turnover ratio.

C) free cash flow.

D) current ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

48

A company with $60,000 in current assets and $40,000 in current liabilities pays a $1,000 current liability. As a result of this transaction, the current ratio and working capital will

A) remain the same and decrease, respectively.

B) increase and remain the same, respectively.

C) both increase.

D) both decrease.

A) remain the same and decrease, respectively.

B) increase and remain the same, respectively.

C) both increase.

D) both decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

49

Consider the following information:

A) 6.2%

B) 8.6%

C) 50.0%

D) 1.5%

A) 6.2%

B) 8.6%

C) 50.0%

D) 1.5%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

50

Perot Company had profit before interest and taxes of $120,000. Interest expense for the period was $17,000 and income taxes amounted to $28,500. The average shareholders' equity was $680,000. What is Perot's return on equity?

A) 13.46%

B) 17.65%

C) 15.15%

D) 10.96%

A) 13.46%

B) 17.65%

C) 15.15%

D) 10.96%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

51

Calculate C Co's gross profit ratio for 2012 and 2011 respectively.

A) 40.6% and 45.7%

B) 30.3% and 29.6%

C) 20.1% and 26.4%

D) 69.7% and 70.4%

A) 40.6% and 45.7%

B) 30.3% and 29.6%

C) 20.1% and 26.4%

D) 69.7% and 70.4%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

52

Calculate P Co's dividend yield for 2012 and 2011 respectively.

A) 39.3% and 33.8%

B) 38.6% and 34.5%

C) 3.5% and 3.6%

D) 1.3% and 1.3%

A) 39.3% and 33.8%

B) 38.6% and 34.5%

C) 3.5% and 3.6%

D) 1.3% and 1.3%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which of the following ratios usually is not considered to be a test of profitability?

A) Current ratio.

B) Earnings per share.

C) Net profit margin.

D) Return on assets.

A) Current ratio.

B) Earnings per share.

C) Net profit margin.

D) Return on assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

54

Beta Limited had a current ratio of 0.8:1 before borrowing $50,000 from the bank with a 3-month note payable. What effect did the borrowing transaction have on Beta's current ratio?

A) The ratio decreased.

B) The ratio increased.

C) The ratio remained unchanged.

D) Cannot be determined.

A) The ratio decreased.

B) The ratio increased.

C) The ratio remained unchanged.

D) Cannot be determined.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

55

Calculate P Co's dividend payout for 2012 and 2011 respectively.

A) 39.3% and 33.8%

B) 3.5% and 3.6%

C) 38.6% and 34.5%

D) 1.3% and 1.3%

A) 39.3% and 33.8%

B) 3.5% and 3.6%

C) 38.6% and 34.5%

D) 1.3% and 1.3%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

56

Which one of the following ratios would not likely be used by a short-term creditor in evaluating whether to sell on credit to a company?

A) Asset turnover

B) Receivables turnover

C) Dividend yield

D) Current ratio

A) Asset turnover

B) Receivables turnover

C) Dividend yield

D) Current ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

57

If trade receivables are collected quickly, it may indicate which of the following?

A) Credit is often granted to poor credit risks.

B) The trade receivables turnover is low.

C) The company is becoming more profitable.

D) The company's credit policies may be overly stringent.

A) Credit is often granted to poor credit risks.

B) The trade receivables turnover is low.

C) The company is becoming more profitable.

D) The company's credit policies may be overly stringent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

58

Bailey Corporation reported the following information for 20A:  Bailey's debt/equity ratio was

Bailey's debt/equity ratio was

A) 1.25 or 125 %.

B) 1.0 or 100%.

C) .33 or 33%.

D) 3.0 or 300%.

Bailey's debt/equity ratio was

Bailey's debt/equity ratio wasA) 1.25 or 125 %.

B) 1.0 or 100%.

C) .33 or 33%.

D) 3.0 or 300%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

59

Short-term creditors are usually most interested in assessing

A) solvency.

B) marketability.

C) liquidity.

D) profitability.

A) solvency.

B) marketability.

C) liquidity.

D) profitability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

60

Calculate C Co's profit margin ratio for 2012 and 2011 respectively. 47)

A) 12.3% and 18.8%

B) 20.1% and 26.4%

C) 69.7% and 70.4%

D) 19.3% and 27.6%

A) 12.3% and 18.8%

B) 20.1% and 26.4%

C) 69.7% and 70.4%

D) 19.3% and 27.6%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

61

Calculate C Co's quick ratio for 2012 and 2011 respectively.

A) .55 and .64

B) .37 and .40

C) .56 and .54

D) .30 and .32

A) .55 and .64

B) .37 and .40

C) .56 and .54

D) .30 and .32

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

62

Liquidity refers to the ability of a company to meet its currently maturing obligations, and solvency refers to the ability of a company to meet its long-term obligations on a continuing basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

63

To compute component percentages for the statement of earnings, the base amount is profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

64

Match the ratio computation with the ratio.

Ratio Computation

A. Profit ÷ Net sales revenue

B. Net credit sales ÷ Average net receivables

C. Return on equity - Return on assets

D. Sales revenue ÷ Total operating expenses

E. Total liabilities ÷ Shareholders' Equity

F. Market price per share ÷ EPS

G. Profit ÷ Average shareholders' equity

H. Creditors' equity ÷ Total equities

I. Income tax expense ÷ Pretax income

J. Quick assets ÷ Current liabilities

K. Sales revenue ÷ Total assets

L. Dividends per share ÷ Market price per share

M. Shareholders' equity ÷ Total equities

N. Cost of goods sold ÷ Average inventory

O. (Income + After-tax interest expense) ÷ Total assets

P. Current assets ÷ Current liabilities

Q. Profit ÷ Average number of shares of common share outstanding

R. (Cash + Cash equivalents) ÷ Current liabilities

S. Cash Flows from Operating Activities ÷ Profit

T. (Profit + Interest + Income Tax Expense) ÷ Interest Expense

U. Net Sales Revenue ÷ Net Fixed Assets

V. Cash Flows from Operating Activities (before interest and tax expense) ÷ Interest Paid

W. Not given above.

Ratio Designation

____ 1. Return on equity

____ 2. Return on assets

____ 3. Financial leverage

____ 4. EPS

____ 5. Profit margin

6. Current ratio

7. Quick ratio

8. Receivables turnover ratio

____ 9. Inventory turnover ratio

___ 10. Debt/equity ratio

___ 11. Owners' equity to total equities

12. Creditors' equity to total equities

___ 13. Price/earnings ratio

___ 14. Dividend yield ratio

___ 15. Book value per common share

___ 16. Cash coverage ratio

_ 17. Cash ratio

_ 18. Quality of earnings

19. Times interest earned

___ 20. Fixed asset turnover ratio

Ratio Computation

A. Profit ÷ Net sales revenue

B. Net credit sales ÷ Average net receivables

C. Return on equity - Return on assets

D. Sales revenue ÷ Total operating expenses

E. Total liabilities ÷ Shareholders' Equity

F. Market price per share ÷ EPS

G. Profit ÷ Average shareholders' equity

H. Creditors' equity ÷ Total equities

I. Income tax expense ÷ Pretax income

J. Quick assets ÷ Current liabilities

K. Sales revenue ÷ Total assets

L. Dividends per share ÷ Market price per share

M. Shareholders' equity ÷ Total equities

N. Cost of goods sold ÷ Average inventory

O. (Income + After-tax interest expense) ÷ Total assets

P. Current assets ÷ Current liabilities

Q. Profit ÷ Average number of shares of common share outstanding

R. (Cash + Cash equivalents) ÷ Current liabilities

S. Cash Flows from Operating Activities ÷ Profit

T. (Profit + Interest + Income Tax Expense) ÷ Interest Expense

U. Net Sales Revenue ÷ Net Fixed Assets

V. Cash Flows from Operating Activities (before interest and tax expense) ÷ Interest Paid

W. Not given above.

Ratio Designation

____ 1. Return on equity

____ 2. Return on assets

____ 3. Financial leverage

____ 4. EPS

____ 5. Profit margin

6. Current ratio

7. Quick ratio

8. Receivables turnover ratio

____ 9. Inventory turnover ratio

___ 10. Debt/equity ratio

___ 11. Owners' equity to total equities

12. Creditors' equity to total equities

___ 13. Price/earnings ratio

___ 14. Dividend yield ratio

___ 15. Book value per common share

___ 16. Cash coverage ratio

_ 17. Cash ratio

_ 18. Quality of earnings

19. Times interest earned

___ 20. Fixed asset turnover ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

65

Indicate the proper category for each ratio.

Primary Category Test of:

A. Profitability

B. Liquidity

C. Solvency

D. Market

E. Miscellaneous ratio Ratio

____ 1. Earnings per share

2. Current ratio

____ 3. Debt/equity ratio

____ 4. Dividend yield ratio

5. Receivables turnover ratio

____ 6. Return on equity

____ 7. Price/earnings ratio

8. Creditors' equity to total equities

____ 9. Profit margin

___ 10. Inventory turnover ratio

___ 11. Owners' equity to total equities

12. Quick ratio

___ 13. Return on assets

___ 14. Financial leverage

___ 15. Book value per common share

_ 16. Quality of earnings

___ 17. Fixed asset turnover ratio

18. Cash coverage

_ 19. Cash ratio

20. Times interest earned

Primary Category Test of:

A. Profitability

B. Liquidity

C. Solvency

D. Market

E. Miscellaneous ratio Ratio

____ 1. Earnings per share

2. Current ratio

____ 3. Debt/equity ratio

____ 4. Dividend yield ratio

5. Receivables turnover ratio

____ 6. Return on equity

____ 7. Price/earnings ratio

8. Creditors' equity to total equities

____ 9. Profit margin

___ 10. Inventory turnover ratio

___ 11. Owners' equity to total equities

12. Quick ratio

___ 13. Return on assets

___ 14. Financial leverage

___ 15. Book value per common share

_ 16. Quality of earnings

___ 17. Fixed asset turnover ratio

18. Cash coverage

_ 19. Cash ratio

20. Times interest earned

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

66

A solvency ratio measures the earnings or operating success of a company for a given period of time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

67

Lyceum Co. reported profit of $8.3 million, interest expense of $.5 million and they are in a 30% tax rate bracket. Their average total assets are $65.8 million and average shareholders' equity is $48.6 million. What is Lyceum's financial leverage advantage or disadvantage?

A) 3.7%

B) 4.0%

C) 4.7%

D) 3.9%

A) 3.7%

B) 4.0%

C) 4.7%

D) 3.9%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

68

Calculate C Co's inventory turnover ratio and the days' sales in inventory for 2012.

A) 6.11 times and 59.7 days

B) 5.89 times and 62.0 days

C) 18.41 times and 19.8 days

D) 5.58 times and 65.4 days

A) 6.11 times and 59.7 days

B) 5.89 times and 62.0 days

C) 18.41 times and 19.8 days

D) 5.58 times and 65.4 days

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

69

Solvency is of most interest to:

A) long-term creditors.

B) short-term creditors.

C) customers.

D) competitors.

A) long-term creditors.

B) short-term creditors.

C) customers.

D) competitors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

70

An aircraft company would most likely have

A) a low inventory turnover.

B) a low profit margin.

C) a high inventory turnover.

D) high volume.

A) a low inventory turnover.

B) a low profit margin.

C) a high inventory turnover.

D) high volume.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

71

Management's success at containing the effects of uncontrollable risks and managing in the face of uncertainties plays a role in analysts' predictions of the future economic health of a specific company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

72

The inventory turnover ratio measures the number of times, on average, the inventory was sold during the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

73

Calculate C Co's return on assets (ROA) for 2012.

A) 13.0%

B) 13.6%

C) 11.9%

D) 17.7%

A) 13.0%

B) 13.6%

C) 11.9%

D) 17.7%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

74

Match the characteristic that is reflected best by the indicators.

Characteristic

A. Solvency

B. Global performance

C. Market performance

D. Profitability

E. Liquidity Indicator

____ 1. Working capital

____ 2. Debt/equity ratio

____ 3. Earnings per share

____ 4. Return on assets

5. Current ratio

____ 6. Price/earnings ratio

____ 7. Financial leverage

Characteristic

A. Solvency

B. Global performance

C. Market performance

D. Profitability

E. Liquidity Indicator

____ 1. Working capital

____ 2. Debt/equity ratio

____ 3. Earnings per share

____ 4. Return on assets

5. Current ratio

____ 6. Price/earnings ratio

____ 7. Financial leverage

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

75

Which of the following is an important measure of the average movement of goods "on and off the shelf" of a company?

A) Profit margin.

B) Gross inventory ratio.

C) Price/earnings ratio.

D) Inventory turnover ratio.

A) Profit margin.

B) Gross inventory ratio.

C) Price/earnings ratio.

D) Inventory turnover ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

76

Since inventory is a significant current asset for most retail organizations, the inventory turnover ratio would be of significance to investors and analysts in terms of assessing liquidity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

77

The inventory turnover ratio is a measure of liquidity that focuses on efficient use of inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

78

Return on assets (ROA) is usually viewed as a realistic measure of management's performance in using all of the resources available to the company regardless of how the assets are financed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

79

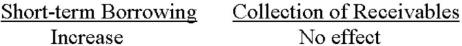

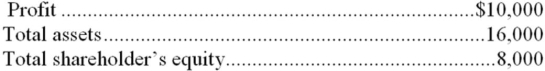

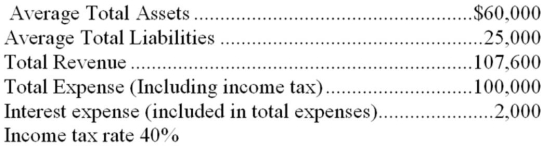

The records of Twain Company include the following:  What is the financial leverage percentage (rounded to the nearest percent)?

What is the financial leverage percentage (rounded to the nearest percent)?

A) 9%

B) 4%

C) 5%

D) 7%

What is the financial leverage percentage (rounded to the nearest percent)?

What is the financial leverage percentage (rounded to the nearest percent)?A) 9%

B) 4%

C) 5%

D) 7%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck

80

A high inventory turnover ratio indicates a large supply of inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 126 في هذه المجموعة.

فتح الحزمة

k this deck