Deck 10: Reporting and Interpreting Bond Securities

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/112

العب

ملء الشاشة (f)

Deck 10: Reporting and Interpreting Bond Securities

1

On the company's 20A year-end statement of financial position, the liability related to this note should be reported as which of the following?

A) A $12,480 current liability.

B) A $12,000 current liability.

C) A $12,480 long-term liability.

D) A $12,000 long-term liability.

A) A $12,480 current liability.

B) A $12,000 current liability.

C) A $12,480 long-term liability.

D) A $12,000 long-term liability.

B

2

Future income tax obligations should be reported on which of the following?

A) Statement of changes in equity.

B) A corporation's statement of financial position.

C) A corporation's income statement.

D) A corporation's income tax return.

A) Statement of changes in equity.

B) A corporation's statement of financial position.

C) A corporation's income statement.

D) A corporation's income tax return.

B

3

Freeman Inc. reported a profit of $40,000 for 20A. The income tax return excluded a revenue item of $3,000 (reported on the income statement) because under the tax laws the $3,000 would not be reported for tax purposes until 20B. Assuming a 30% income tax rate, this situation would cause a 20A future tax amount of which of the following?

A) $3,000 (debit)

B) $900 (credit)

C) $900 (debit)

D) $3,000 (credit)

A) $3,000 (debit)

B) $900 (credit)

C) $900 (debit)

D) $3,000 (credit)

B

4

Income tax expense reported on the income statement is $45,000 for 20A, and the tax return for 20A (the first year) shows an income tax liability of $42,000 because of a deduction that cannot be taken until 20B. The future income tax amount on the statement of financial position at the end of 20A will be which of the following?

A) credit of $45,000

B) credit of $42,000

C) credit of $3,000

D) debit of $3,000

A) credit of $45,000

B) credit of $42,000

C) credit of $3,000

D) debit of $3,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

5

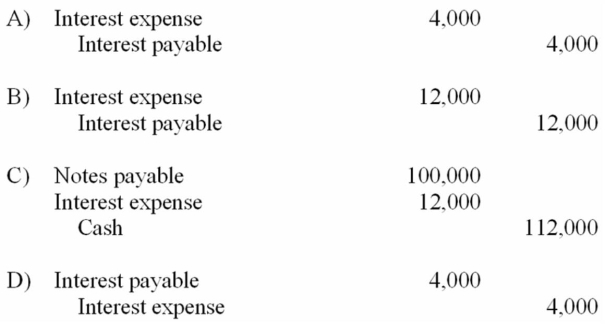

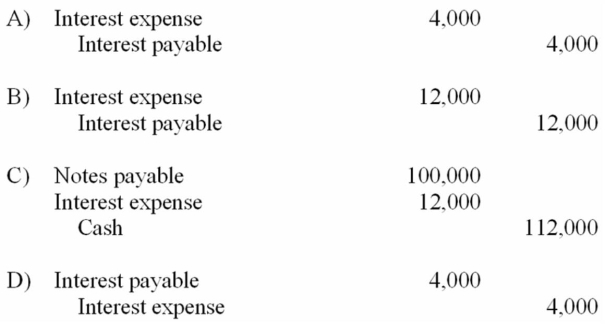

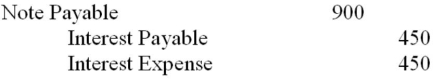

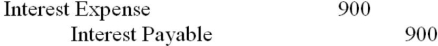

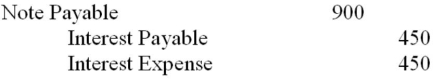

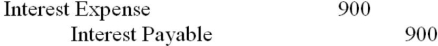

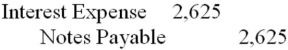

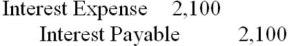

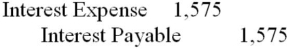

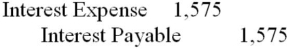

Goodman Company borrowed $100,000 cash on September 1, 20B, and signed a one-year, 12%, interest-bearing note payable. What would be the required adjusting entry at the end of the accounting period, December 31, 20B?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

A) Choice A

B) Choice B

C) Choice C

D) Choice D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

6

The current portion of long-term debt should be

A) removed from the long-term portion of debt with a journal entry.

B) classified as a current liability on the statement of financial position.

C) classified as a long-term liability on the statement of financial position.

D) paid immediately.

A) removed from the long-term portion of debt with a journal entry.

B) classified as a current liability on the statement of financial position.

C) classified as a long-term liability on the statement of financial position.

D) paid immediately.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

7

In 2013, C Co reported a trade payables turnover ratio of 1.85 and a current ratio of 0.66. Their statement of financial position shows $2.1 billion in marketable securities not included in their current assets and cash flow from operations. Which of the following interpretations is most likely?

A) Since both these ratios are low, it might indicate poor liquidity and inability to pay vendors in a timely manner.

B) C Co practices aggressive cash management policies including investing excess cash and using vendors to finance operations by making slow payment to them.

C) C Co must be carrying a low amount of current liabilities in comparison to its total liabilities.

D) Since the two ratios are fairly high, it indicates C Co has little difficulty paying its bills in a timely manner.

A) Since both these ratios are low, it might indicate poor liquidity and inability to pay vendors in a timely manner.

B) C Co practices aggressive cash management policies including investing excess cash and using vendors to finance operations by making slow payment to them.

C) C Co must be carrying a low amount of current liabilities in comparison to its total liabilities.

D) Since the two ratios are fairly high, it indicates C Co has little difficulty paying its bills in a timely manner.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

8

A company receives $99, of which $9 is for PST (provincial sales tax). The journal entry to record the sale would include a

A) debit to Cash for $90.

B) debit to PST Expense for $9.

C) credit to PST Payable for $9.

D) debit to Sales for $99.

A) debit to Cash for $90.

B) debit to PST Expense for $9.

C) credit to PST Payable for $9.

D) debit to Sales for $99.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

9

Deferred revenue is another term for which of the following?

A) Trade payables

B) Sales revenue

C) Unearned revenue

D) Prepaid expenses

A) Trade payables

B) Sales revenue

C) Unearned revenue

D) Prepaid expenses

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

10

GST (goods and services tax) collected by a retailer are expenses

A) of the customers.

B) of the government.

C) that are not recognized by the retailer until they are submitted to the government.

D) of the retailer.

A) of the customers.

B) of the government.

C) that are not recognized by the retailer until they are submitted to the government.

D) of the retailer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

11

Situations which require that future income tax be reported involve a difference that is called which of the following?

A) A temporary difference.

B) A reversing tax inverse difference.

C) A permanent difference.

D) A contingent liability.

A) A temporary difference.

B) A reversing tax inverse difference.

C) A permanent difference.

D) A contingent liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

12

A contingent liability is recorded in the accounting records

A) if it will possibly become an actual liability, and the exact amount is unknown.

B) if the contingency has not already been disclosed in the notes to the financial statements.

C) under no circumstances.

D) if a reasonable estimate of the expected loss can be determined and if it is probable.

A) if it will possibly become an actual liability, and the exact amount is unknown.

B) if the contingency has not already been disclosed in the notes to the financial statements.

C) under no circumstances.

D) if a reasonable estimate of the expected loss can be determined and if it is probable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

13

On January 1, 2013, Osler Limited, a calendar-year company, issued $160,000 of notes payable, of which $40,000 is due on January 1 for each of the next four years. The proper balance sheet presentation on December 31, 2013, is

A) Current Liabilities, $120,000; Long-term Debt, $40,000.

B) Long-term Debt, $160,000.

C) Current Liabilities, $160,000.

D) Current Liabilities, $40,000; Long-term Debt, $120,000.

A) Current Liabilities, $120,000; Long-term Debt, $40,000.

B) Long-term Debt, $160,000.

C) Current Liabilities, $160,000.

D) Current Liabilities, $40,000; Long-term Debt, $120,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

14

In 2013, Toys 4 U had a trade payables turnover ratio of 6.08; in 2012, 5.87; and 5.45 in 2011. Which statement is true about what the ratios indicate?

A) Toys 4 U is taking longer to pay its vendors in 2013 versus 2012.

B) Toys 4 U has been increasing its average payables at a faster rate than its cost of goods sold has increased.

C) Toys 4 U is taking less time to pay vendors in 2013 than it took in both 2012 and 2011.

D) Toys 4 U is taking less time to collect from its customers.

A) Toys 4 U is taking longer to pay its vendors in 2013 versus 2012.

B) Toys 4 U has been increasing its average payables at a faster rate than its cost of goods sold has increased.

C) Toys 4 U is taking less time to pay vendors in 2013 than it took in both 2012 and 2011.

D) Toys 4 U is taking less time to collect from its customers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

15

Purchase of inventory for cash will:

A) increase the quick ratio.

B) increase the current ratio.

C) decrease the current ratio.

D) decrease the quick ratio.

A) increase the quick ratio.

B) increase the current ratio.

C) decrease the current ratio.

D) decrease the quick ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

16

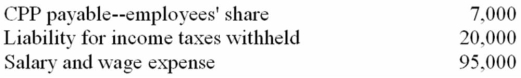

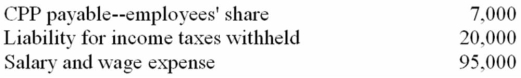

Site Company had the following account balances related to payroll at the end of the period:  Without considering any employer payroll taxes, Site would record Salaries Payable for the pay period amounting to which of the following?

Without considering any employer payroll taxes, Site would record Salaries Payable for the pay period amounting to which of the following?

A) $75,000

B) $95,000

C) $61,000

D) $68,000

Without considering any employer payroll taxes, Site would record Salaries Payable for the pay period amounting to which of the following?

Without considering any employer payroll taxes, Site would record Salaries Payable for the pay period amounting to which of the following?A) $75,000

B) $95,000

C) $61,000

D) $68,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of the following is not a typical current liability?

A) Unearned revenue

B) Income tax payable

C) Sales taxes payable

D) Bonds payable

A) Unearned revenue

B) Income tax payable

C) Sales taxes payable

D) Bonds payable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

18

Liquidity ratios measure a company's

A) short-term debt paying ability.

B) revenue-producing ability.

C) operating cycle.

D) long-range solvency.

A) short-term debt paying ability.

B) revenue-producing ability.

C) operating cycle.

D) long-range solvency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

19

Which of the following is correct with respect to a contingent liability that is "reasonably possible" but "cannot reasonably be estimated"?

A) It must be recorded and reported as a liability.

B) It does not need to be recorded or reported as a liability.

C) It must be reported as a liability, but not recorded.

D) It must only be disclosed as a note to the financial statements.

A) It must be recorded and reported as a liability.

B) It does not need to be recorded or reported as a liability.

C) It must be reported as a liability, but not recorded.

D) It must only be disclosed as a note to the financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

20

The journal entry required on the company's books to record the note payable on July 1, 20A would include which of the following?

A) A credit to notes payable for $12,960.

B) A debit to cash for $11,040.

C) A debit to interest expense for $960.

D) A credit to notes payable for $12,000.

A) A credit to notes payable for $12,960.

B) A debit to cash for $11,040.

C) A debit to interest expense for $960.

D) A credit to notes payable for $12,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

21

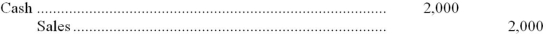

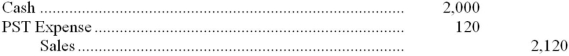

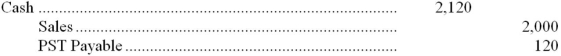

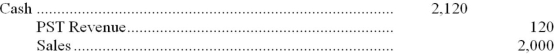

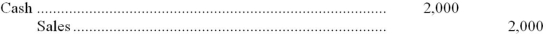

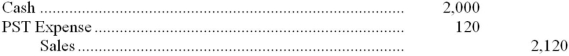

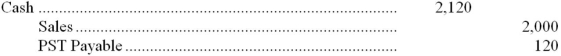

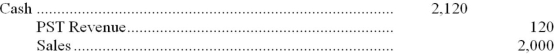

A cash register tape shows cash sales of $2,000 and provincial sales tax (PST) of $120. The journal entry to record this information is

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

22

GST (goods and services tax) collected by a retailer is recorded by

A) crediting GST Revenue.

B) debiting GST Expense.

C) debiting GST Payable.

D) crediting GST Payable.

A) crediting GST Revenue.

B) debiting GST Expense.

C) debiting GST Payable.

D) crediting GST Payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following most likely would be classified as a current liability?

A) Three-year notes payable

B) Dividends payable

C) Mortgage payable

D) Bonds payable

A) Three-year notes payable

B) Dividends payable

C) Mortgage payable

D) Bonds payable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

24

The amount of sales tax collected by a retail store when making sales is

A) a miscellaneous revenue for the store.

B) recorded as an operating expense.

C) not recorded because it is a tax paid by the customer.

D) a current liability.

A) a miscellaneous revenue for the store.

B) recorded as an operating expense.

C) not recorded because it is a tax paid by the customer.

D) a current liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

25

How should the amount of federal income tax that is withheld from employees' paychecks by the employer be recorded?

A) On the employer's books as revenue.

B) On the employer's books as a current liability.

C) On the employer's books as an asset.

D) It should not be recorded on the employer's books.

A) On the employer's books as revenue.

B) On the employer's books as a current liability.

C) On the employer's books as an asset.

D) It should not be recorded on the employer's books.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

26

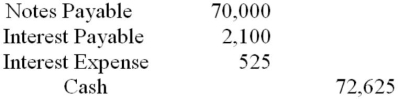

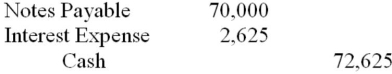

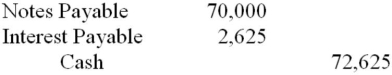

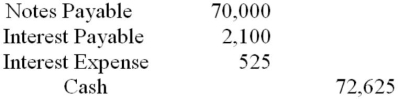

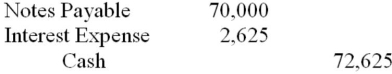

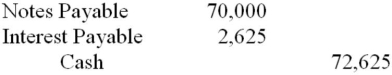

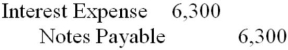

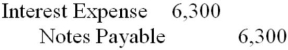

On September 1, Linwell Corp. borrowed $70,000 from the Highland Bank for five months at 9%. Interest is due at maturity. The company's year-end is December 31, at which time any outstanding interest was accrued. The entry to record payment of the note and accrued interest on February 1, the due date, is:

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

27

Most companies pay current liabilities

A) out of current assets.

B) by issuing shares.

C) by issuing interest-bearing notes payable.

D) by creating long-term liabilities.

A) out of current assets.

B) by issuing shares.

C) by issuing interest-bearing notes payable.

D) by creating long-term liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

28

The relationship between current assets and current liabilities is

A) called the matching principle.

B) useful in determining the amount of a company's long-term debt.

C) useful in determining profit.

D) useful in evaluating a company's liquidity.

A) called the matching principle.

B) useful in determining the amount of a company's long-term debt.

C) useful in determining profit.

D) useful in evaluating a company's liquidity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

29

G Co and A Co are both in the biotechnology industry. In 2013, G Co reported a trade payables turnover of 7.71 and A Co reported a ratio of 3.06. Which of the following is an incorrect reason for the difference in ratios?

A) A Co has a lower average trade payables in comparison to G co.

B) G Co has a better payment record in terms of timely payment to vendors.

C) A Co is taking longer to pay vendors.

D) A Co has a higher average trade payables in comparison to G co.

A) A Co has a lower average trade payables in comparison to G co.

B) G Co has a better payment record in terms of timely payment to vendors.

C) A Co is taking longer to pay vendors.

D) A Co has a higher average trade payables in comparison to G co.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

30

Alamo Autoworks, Inc. is involved in a lawsuit. Their lawyers state that it is probable that the jury will find in favour of the plaintiff and Alamo will owe two million dollars. Even though the lawsuit is not yet settled, Alamo should record a liability in the statement of financial position and which of the following?

A) A loss

B) A prepaid expense

C) Deferred revenue

D) A contra-asset

A) A loss

B) A prepaid expense

C) Deferred revenue

D) A contra-asset

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

31

A Co, a biotechnology company, reported cost of goods sold of $345.2 million and trade payables of $121.6 million for 2013. In 2012, cost of goods sold was $300.8 million and trade payable was $103.9 million. What was A Co's trade payables turnover ratio in 2013?

A) 2.90

B) 2.84

C) 3.06

D) 2.86

A) 2.90

B) 2.84

C) 3.06

D) 2.86

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

32

Carly Design Inc. received its annual property tax bill for $8,400 in January. It was paid when due on March 31. Carly Design's year end is Dec 31. The Dec 31 account balances should be

A) $0 for Prepaid Property Tax, $0 for Property Tax Payable

B) $2,100 for Prepaid Property Tax, $6,300 for Property Tax Expense

C) $2,100 for Prepaid Property Tax, $2,100 for Property Tax Payable

D) $700 for Prepaid Property Tax, $7,700 for Property Tax Expense

A) $0 for Prepaid Property Tax, $0 for Property Tax Payable

B) $2,100 for Prepaid Property Tax, $6,300 for Property Tax Expense

C) $2,100 for Prepaid Property Tax, $2,100 for Property Tax Payable

D) $700 for Prepaid Property Tax, $7,700 for Property Tax Expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

33

The federal government requires which of the following?

A) Only the employer to pay CPP contributions.

B) Only the employee to pay CPP contributions.

C) Neither the employer nor the employee to pay CPP contributions.

D) Both the employer and the employee to pay CPP contributions.

A) Only the employer to pay CPP contributions.

B) Only the employee to pay CPP contributions.

C) Neither the employer nor the employee to pay CPP contributions.

D) Both the employer and the employee to pay CPP contributions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

34

A customer paid a total of $84,000 for a purchase, including 5% PST (provincial sales tax). What was the PST amount?

A) $4,000

B) $4,200

C) $84,000

D) $80,000

A) $4,000

B) $4,200

C) $84,000

D) $80,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

35

In 2013, Toys 4 U reported inventory of $1,902 million and trade payables of $1,415 million. In 2012, the company reported inventory of $2,464 million and trade payables of $1,280 million. What was the effect on the 2013 cash flow from operating activities?

A) A decrease in cash of $427 million.

B) A decrease in cash of $697 million.

C) An increase in cash of $697 million.

D) An increase in cash of $427 million.

A) A decrease in cash of $427 million.

B) A decrease in cash of $697 million.

C) An increase in cash of $697 million.

D) An increase in cash of $427 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

36

Cress Company is involved in a lawsuit. Note disclosure of the contingent liability which could arise does NOT have to be presented if the probability of Cress owing money as a result of the lawsuit is which of the following?

A) Reasonably possible and the amount cannot be reasonably estimated.

B) Probable and the amount cannot be reasonably estimated.

C) Reasonably possible and the amount can be reasonably estimated.

D) Remote and the amount cannot be reasonably estimated.

A) Reasonably possible and the amount cannot be reasonably estimated.

B) Probable and the amount cannot be reasonably estimated.

C) Reasonably possible and the amount can be reasonably estimated.

D) Remote and the amount cannot be reasonably estimated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

37

Failure to make a necessary adjusting entry for accrued interest on a note payable would cause which of the following?

A) An understatement of liabilities and shareholders' equity.

B) An overstatement of profit, an understatement of liabilities, and an overstatement of shareholders' equity.

C) Profit to be understated and liabilities to be understated.

D) Profit to be overstated and assets to be understated.

A) An understatement of liabilities and shareholders' equity.

B) An overstatement of profit, an understatement of liabilities, and an overstatement of shareholders' equity.

C) Profit to be understated and liabilities to be understated.

D) Profit to be overstated and assets to be understated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

38

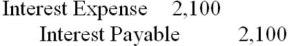

A 9% six-month note for $10,000 was recorded on October 1. What journal entry would be recorded at the year end of December 31 if interest is payable at maturity?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following method of ordering is normally used to present current liabilities on the statement of financial position?

A) In alphabetical order

B) In order of their magnitude

C) In order of their liquidity (due date)

D) In order of reverse liquidity

A) In alphabetical order

B) In order of their magnitude

C) In order of their liquidity (due date)

D) In order of reverse liquidity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

40

Interest rates on notes are usually stated as a(n)

A) semi-annual rate.

B) annual rate.

C) monthly rate.

D) daily rate.

A) semi-annual rate.

B) annual rate.

C) monthly rate.

D) daily rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

41

Notes payable usually require the borrower to pay interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

42

When a company increases trade payables from one year to the next, what is the effect on cash flows?

A) An increase in cash because we have not paid cash for all the inventory and services purchased on credit during the period.

B) A decrease to cash because we will have to pay these liabilities in the future.

C) A decrease in cash caused by paying down our debt to vendors.

D) An increase to cash because we have received cash from vendors.

A) An increase in cash because we have not paid cash for all the inventory and services purchased on credit during the period.

B) A decrease to cash because we will have to pay these liabilities in the future.

C) A decrease in cash caused by paying down our debt to vendors.

D) An increase to cash because we have received cash from vendors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

43

The "trade payables" account should generally be used only for trade payables (obligations owed to suppliers in the normal course of business) which relate to the purchase of goods and services.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

44

An employee receives a bi-weekly gross salary of $2,000. Income tax is $218, CPP is $99, EI is $36, and union dues are $50. What is the amount of the employee's take home pay (net pay) on a bi-weekly basis?

A) $2,000

B) $1,732

C) $1,782

D) $1,597

A) $2,000

B) $1,732

C) $1,782

D) $1,597

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

45

Match the liabilities with their usual classification on the statement of financial position by entering the appropriate letters in the spaces.

Usual Classification

A. Current liability

B. Long-term liability

C. Current or long-term liability

D. None of the above Liabilities

Usual Classification

A. Current liability

B. Long-term liability

C. Current or long-term liability

D. None of the above Liabilities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

46

An accrued expense arises because an expense item has been prepaid, but the related expense has not been incurred as yet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

47

A company's quick ratio:

A) indicates the length of time the company takes to pay its short-term creditors.

B) indicates how quickly the company converts its current assets to cash.

C) is computed by dividing current assets by current liabilities, excluding accounts payable for inventory purchases.

D) can never be larger than its current ratio at the same date.

A) indicates the length of time the company takes to pay its short-term creditors.

B) indicates how quickly the company converts its current assets to cash.

C) is computed by dividing current assets by current liabilities, excluding accounts payable for inventory purchases.

D) can never be larger than its current ratio at the same date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

48

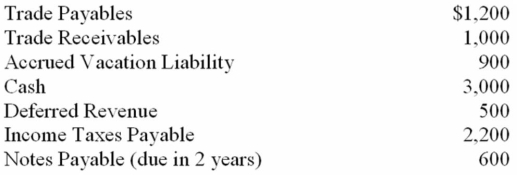

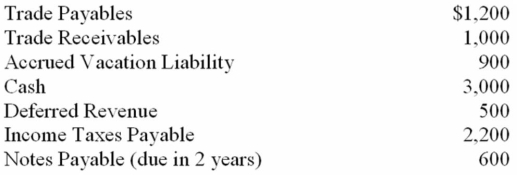

The following is a partial list of account balances from the books of Ellsworth Enterprise at the end of 20B:

Based solely upon these balances, what amount of current liabilities should appear on Ellsworth's 20B year-end statement of financial position?

Based solely upon these balances, what amount of current liabilities should appear on Ellsworth's 20B year-end statement of financial position?

A) $5,400

B) $4,800

C) $4,300

D) $3,900

Based solely upon these balances, what amount of current liabilities should appear on Ellsworth's 20B year-end statement of financial position?

Based solely upon these balances, what amount of current liabilities should appear on Ellsworth's 20B year-end statement of financial position? A) $5,400

B) $4,800

C) $4,300

D) $3,900

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

49

Bison Corp. issues a 5 year 8%, $60,000 note payable on March 1. The terms of the note include monthly blended principal and interest payments of $1,217. The entry to record the second instalment payment will show a:

A) debit to Interest Expense for $400.

B) credit to Interest Expense for $395.

C) debit to Notes Payable of $822.

D) debit to Cash for $1,217.

A) debit to Interest Expense for $400.

B) credit to Interest Expense for $395.

C) debit to Notes Payable of $822.

D) debit to Cash for $1,217.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

50

Jake Company is involved in a lawsuit. The liability which could arise as a result of this lawsuit should be recorded on the books if the probability of Jake owing money as a result of the lawsuit is which of the following?

A) Probable and the amount can be reasonably estimated.

B) Reasonably possible and the amount can be reasonably estimated.

C) Probable and the amount cannot be reasonably estimated.

D) Remote and the amount can be reasonably estimated.

A) Probable and the amount can be reasonably estimated.

B) Reasonably possible and the amount can be reasonably estimated.

C) Probable and the amount cannot be reasonably estimated.

D) Remote and the amount can be reasonably estimated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

51

In 2013, P Co reported an increase in trade receivables of $303 million, and an increase in inventory of $284 million. They also experienced an increase in short-term borrowings of $3,921 million and an increase in trade payables of $253 million. Calculate the net cash effect of these changes.

A) $4,761 million decrease

B) $4,761 million increase

C) $3,587 million increase

D) $3,587 million decrease

A) $4,761 million decrease

B) $4,761 million increase

C) $3,587 million increase

D) $3,587 million decrease

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

52

Future Income taxes are caused by which of the following?

A) Differences in IFRS and ITA rules pertaining to when revenue and expenses should be recognized.

B) Accounting errors.

C) The fact that the value of one country's currency relative to that of another can change over time.

D) A company's inability to pay income tax due in a particular tax year.

A) Differences in IFRS and ITA rules pertaining to when revenue and expenses should be recognized.

B) Accounting errors.

C) The fact that the value of one country's currency relative to that of another can change over time.

D) A company's inability to pay income tax due in a particular tax year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

53

Current liabilities are short-term obligations that will be paid within the current operating cycle of the business or within two years of the statement of financial position date, whichever is longer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

54

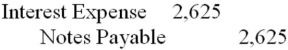

On September 1, Hauser Corp. borrowed $70,000 from the Metro Bank for five months at 9%. Interest is payable at maturity. The entry Hauser must make on December 31, its year-end, assuming no prior accruals is:

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

55

A current liability is a debt that can reasonably be expected to be paid

A) out of cash currently on hand.

B) within one year.

C) out of currently recognized revenues.

D) between 6 months and 18 months.

A) out of cash currently on hand.

B) within one year.

C) out of currently recognized revenues.

D) between 6 months and 18 months.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

56

Changes in trade payables and accrued liabilities affect cash flows from operating activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

57

Property tax payable is classified as a long-term liability because it is related to property, a noncurrent asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

58

If a company intends to refinance a liability that is due within one year, that liability should not be classified as a current liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

59

In 2013, P Co reported a trade payables turnover ratio of 2.49 and C Co reported a turnover ratio of 1.74 for that same year. Which of the following statements is true?

A) On a comparative basis to cost of goods sold, P Co carries more in average payables than does C Co.

B) C Co pays their vendors in a more timely manner than P Co pays their vendors.

C) It is unclear if P Co pays their vendors in a more timely manner than C Co.

D) P Co took approximately 147 days while C Co took about 210 days to pay vendors.

A) On a comparative basis to cost of goods sold, P Co carries more in average payables than does C Co.

B) C Co pays their vendors in a more timely manner than P Co pays their vendors.

C) It is unclear if P Co pays their vendors in a more timely manner than C Co.

D) P Co took approximately 147 days while C Co took about 210 days to pay vendors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

60

A note payable must always be paid before an account payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

61

Interest expense on a note payable is only recorded at maturity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

62

A commitment is a contractual agreement to enter into a transaction with another party in the future.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

63

With an interest-bearing note, the amount of cash received upon issue of the note generally exceeds the note's face value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

64

G Co, a biotechnology company, reported current assets of $1,326.5 million and current liabilities of $484.1 million in 2013 and in 2012, current assets of $1,242.0 million and

$291.3 million of current liabilities. Therefore, working capital for G Co. increased from 2012 to 2013.

$291.3 million of current liabilities. Therefore, working capital for G Co. increased from 2012 to 2013.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

65

A low trade payables turnover ratio caused by an aggressive cash management strategy, while the quick ratio is adequate, would be perceived by analysts as a weakness.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

66

When the current assets of a company such as trade receivables or inventory increase during the year, the increase provides additional cash inflow from operating activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

67

All contingent liabilities should be classified as either current or long-term liabilities on the statement of financial position for the current period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

68

A company whose current liabilities exceed its current assets may have a liquidity problem.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

69

A current liability must be paid out of current earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

70

Simple interest is calculated as: Principal x Time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

71

Most notes are not interest bearing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

72

A contingent liability that is "probable" and can be "reasonably estimated" must be accrued and reported as a liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

73

A contingent liability that has a remote probability of occurrence must be disclosed in a note to the financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

74

A company that sells primarily on a cash basis could support a lower quick ratio because their cash inflow is faster than a company selling on credit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

75

The amount of salary expense that a company records for a pay period will usually be less than the amount of salary payable that it records.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

76

The time value of money refers to the fact that interest accrues on borrowed money with the passage of time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

77

Analysts use the quick ratio to assess the profitability of a company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

78

Notes payable are sometimes used instead of trade payables.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

79

Liabilities represent an obligation to pay that the company must satisfy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

80

Payroll liabilities include the employer's share of CPP contributions and EI premiums.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck