Deck 12: Compensation

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/99

العب

ملء الشاشة (f)

Deck 12: Compensation

1

One purpose of Form W-4 is to determine an employee's withholding.

True

2

Employers receive a deduction for compensation paid to and employment taxes paid on behalf of employees.

True

3

Employer's expense for stock options is typically recognized earlier for book than tax purposes.

True

4

The date on which stock options are given to the employee is called the exercise date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

5

Employees complete a Form W-2 to specify their income tax withholding.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

6

An employer always receives a deduction for total compensation paid to a CEO.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

7

An employee's income with respect to restricted stock is the fair market value on the vesting date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

8

Employees will always prefer to receive incentive stock options over nonqualified stock options.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

9

On Form W-4, an employee can only claim one allowance for each personal or dependency exemption that will be claimed on the employee's income tax return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

10

One primary purpose of equity compensation is to motivate employees.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

11

When stock options are exercised they are converted into actual employer stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

12

Employers always prefer to award incentive stock options rather than nonqualified stock options.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

13

The use of restricted stock is increasing relative to the use of stock options.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

14

Stock options will always provide employees with future compensation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

15

The date on which stock options are no longer subject to forfeiture is called the vesting date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

16

Without an election, the income from an employee's restricted stock is measured on the grant date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

17

An employee can indicate whether they want an additional amount withheld for payroll taxes on the Form W-4.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

18

Employers computing taxable income under the accrual method to unrelated taxpayers may deduct wages accrued as compensation expense in one year and paid in the subsequent year, as long as the company makes the payment within two and a half months after the employer's year-end.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

19

Employers computing taxable income receive a deduction for reasonable salary and wages paid to employees.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

20

Current compensation is usually comprised of salary, wages, and bonuses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

21

Up to $5,250 of educational benefits can be excluded from an employee's compensation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

22

Group-term life insurance is a fringe benefit that can be partially taxable and partially tax-free.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

23

Fringe benefits are generally a form of noncash compensation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

24

Taxable fringe benefits include automobile allowances, gym memberships, and personal-use tickets to the theater or sporting events.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

25

Employers cannot discriminate between highly and non-highly compensated employees when providing taxable fringe benefits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

26

Up to $10,000 of dependent care expenses can be excluded from an employee's compensation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

27

Cornhusker Bank reimburses employees for dues to the local banker's association. The reimbursement is includible in the employee's income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

28

Employers sometimes pay a "gross-up" to employees to cover taxes associated with taxable fringe benefits they provide.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which of the following statements regarding compensation is false?

A)Wages are usually paid by the hour.

B)Salary is usually a form of fixed compensation.

C)Bonuses are a form of compensation obtained if certain criteria are met.

D)Bonuses paid within two and a half months of year-end are included in employee's compensation in the year they were earned.

A)Wages are usually paid by the hour.

B)Salary is usually a form of fixed compensation.

C)Bonuses are a form of compensation obtained if certain criteria are met.

D)Bonuses paid within two and a half months of year-end are included in employee's compensation in the year they were earned.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

30

Employees may exclude from income items such as occasional theater tickets, T-shirts, or a Thanksgiving turkey.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

31

Health insurance is an example of a nontaxable fringe benefit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

32

Qualified employee discounts allow employees to purchase employer goods at a discount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following items is not included on an employee's Form W-2?

A)Taxable wages, tips, and compensation.

B)Social Security withholding.

C)Value of stock options granted during the year.

D)Federal and state income tax withholding.

A)Taxable wages, tips, and compensation.

B)Social Security withholding.

C)Value of stock options granted during the year.

D)Federal and state income tax withholding.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

34

A section 83(b)election freezes the value of restricted stock for compensation purposes on the vesting date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

35

For 2019, up to $300 of transportation fringe benefits can be excluded from income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

36

Hotel employees can receive free lodging on a space-available basis without incurring compensation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

37

Which of the following forms is used to determine income tax withholding for an employment relationship?

A)Form Q-2.

B)Form W-2.

C)Form W-4.

D)Form 1099.

A)Form Q-2.

B)Form W-2.

C)Form W-4.

D)Form 1099.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

38

A cafeteria plan provides employees discounted meals at a company-sponsored dining room.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

39

If certain conditions are met, an apartment manager can exclude the fair market value of free rent from his or her income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

40

Flexible spending accounts allow employees to set aside before-tax dollars for medical and dependent care expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

41

How is the bargain element for a stock option calculated?

A)The difference between the strike price and the market price on the date of grant.

B)The difference between the market price on the exercise date and the market price on the date of grant.

C)The difference between the market price on the exercise date and the strike price.

D)The difference between the market price on the sale date and the strike price.

A)The difference between the strike price and the market price on the date of grant.

B)The difference between the market price on the exercise date and the market price on the date of grant.

C)The difference between the market price on the exercise date and the strike price.

D)The difference between the market price on the sale date and the strike price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

42

Maren received 10 NQOs (each option gives her the right to purchase 10 shares of stock for $8 per share)at the time she started working when the stock price was $6 per share. When the share price was $15 per share, she exercised all of her options. Eighteen months later she sold all of the shares for $20 per share. How much gain will Maren recognize on the sale of the shares and how much tax will she pay assuming her marginal tax rate is 37 percent?

A)$0 gain and $0 tax.

B)$500 gain and $100 tax.

C)$500 gain and $185 tax.

D)$1,200 gain and $240 tax.

A)$0 gain and $0 tax.

B)$500 gain and $100 tax.

C)$500 gain and $185 tax.

D)$1,200 gain and $240 tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which of the following refers to the date stock options are awarded to an employee?

A)Grant date.

B)Exercise date.

C)Lapse date.

D)Vesting date.

A)Grant date.

B)Exercise date.

C)Lapse date.

D)Vesting date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following statements regarding restricted stock is false?

A)Like stock options, restricted stock has to vest before it can be sold.

B)Like nonqualified stock options, the employee's income inclusion for restricted stock is the bargain element.

C)Even if the value of restricted stock decreases from the price on the grant date, it retains some value to the employee.

D)There are no effective tax planning elections for restricted stock.

A)Like stock options, restricted stock has to vest before it can be sold.

B)Like nonqualified stock options, the employee's income inclusion for restricted stock is the bargain element.

C)Even if the value of restricted stock decreases from the price on the grant date, it retains some value to the employee.

D)There are no effective tax planning elections for restricted stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

45

Maren received 10 NQOs (each option gives her the right to purchase 10 shares of stock for $8 per share)at the time she started working when the stock price was $6 per share. When the share price was $15 per share, she exercised all of her options. Eighteen months later she sold all of the shares for $20 per share. What is the amount of Maren's bargain element?

A)$0.

B)$700.

C)$900.

D)$1,500.

E)None of the choices are correct.

A)$0.

B)$700.

C)$900.

D)$1,500.

E)None of the choices are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

46

Which of the following pairs of items is not needed to calculate the after-tax proceeds for a same-day sale?

A)Strike price and market price on exercise date.

B)Strike price and market price on grant date.

C)Market price on sale date and market price on exercise date.

D)Market price on sale date and marginal tax rate.

A)Strike price and market price on exercise date.

B)Strike price and market price on grant date.

C)Market price on sale date and market price on exercise date.

D)Market price on sale date and marginal tax rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

47

Stevie recently received 1,000 shares of restricted stock from her employer, Nicks Corporation, when the share price was $8 per share. Stevie's restricted shares vested three years later when the market price was $11. Stevie held the shares for a little more than a year and sold them when the market price was $16. Assuming Stevie made a section 83(b)election, what is the amount of Stevie's ordinary income with respect to the restricted stock?

A)$0.

B)$5,000.

C)$8,000.

D)$11,000.

A)$0.

B)$5,000.

C)$8,000.

D)$11,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

48

Bad Brad received 20 NQOs (each option gives him the right to purchase 30 shares of stock for $12 per share)from his employer. At the time he started working, the stock price was $11 per share. Now that the share price is $25 per share, he exercises all of the options. Two years later Bad Brad sells the stock for $27 per share. What is Bad Brad's basis in his stock for purposes of calculating the gain or loss at the time of the sale?

A)$7,200.

B)$7,800.

C)$15,000.

D)$16,200.

A)$7,200.

B)$7,800.

C)$15,000.

D)$16,200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which of the following regarding the Form W-4 is incorrect?

A)Determines an employee's income tax withholding.

B)Employees can claim more allowances than personal exemptions that will be claimed.

C)Employees can specify additional amounts to be withheld each month.

D)The form can only be adjusted at the beginning of the year or start of employment.

A)Determines an employee's income tax withholding.

B)Employees can claim more allowances than personal exemptions that will be claimed.

C)Employees can specify additional amounts to be withheld each month.

D)The form can only be adjusted at the beginning of the year or start of employment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which of the following is not a purpose of equity-based compensation?

A)Provides both risk and incentives to employees.

B)Motivates employees by aligning employee and employer incentives.

C)Avoids compensation limits for certain publicly traded company executives.

D)Provides a low- or no-cost form of compensation.

A)Provides both risk and incentives to employees.

B)Motivates employees by aligning employee and employer incentives.

C)Avoids compensation limits for certain publicly traded company executives.

D)Provides a low- or no-cost form of compensation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

51

For compensation plans adopted by a company in 2019, when a publicly traded CEO's salary exceeds $1,000,000, the employee ________ taxed on the entire amount, and the employer ________ allowed a deduction on the entire amount.

A)is; is

B)is; is not

C)is not; is

D)is not; is not

A)is; is

B)is; is not

C)is not; is

D)is not; is not

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

52

Which of the following isn't reported on the Form W-2?

A)The employee's taxable salary and wages.

B)Annual federal and state withholding information.

C)Indication as to whether an employee had more than one employer during the year.

D)Annual amount of Social Security and Medicare tax withholding information.

A)The employee's taxable salary and wages.

B)Annual federal and state withholding information.

C)Indication as to whether an employee had more than one employer during the year.

D)Annual amount of Social Security and Medicare tax withholding information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

53

Aharon exercises 10 stock options awarded several years ago. The following information pertains to the options: (1)each option gives the employee the right to buy 10 shares, (2)the market price on the grant date was $7, (3)the strike price is $10, and (4)the market price on the exercise date was $15. How much will it cost Aharon to purchase the options on the exercise date?

A)$90.

B)$500.

C)$700.

D)$1,000.

A)$90.

B)$500.

C)$700.

D)$1,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

54

Which of the following is false regarding a section 83(b)election?

A)The election freezes the value of the employee's compensation as of the grant date.

B)The election is an important tax-planning tool if the stock is expected to increase in value.

C)The election must be made within 30 days of the grant date.

D)If an employee leaves before the vesting date, any loss is limited to $3,000.

A)The election freezes the value of the employee's compensation as of the grant date.

B)The election is an important tax-planning tool if the stock is expected to increase in value.

C)The election must be made within 30 days of the grant date.

D)If an employee leaves before the vesting date, any loss is limited to $3,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

55

Stevie recently received 1,000 shares of restricted stock from her employer, Nicks Corporation, when the share price was $8 per share. Stevie's restricted shares vested three years later when the market price was $11. Stevie held the shares for a little more than a year and sold them when the market price was $16. What is the amount of Stevie's ordinary income with respect to the restricted stock?

A)$0.

B)$5,000.

C)$8,000.

D)$11,000.

A)$0.

B)$5,000.

C)$8,000.

D)$11,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

56

Which of the following statements is true regarding the $1,000,000 limit on covered employees for publicly traded companies?

A)The limitation applies to all employees.

B)The limitation applies to all officers.

C)The limitation applies only to the CEO and three other highest compensated officers.

D)The limitation applies only to the CEO, CFO, and three other highest compensated officers and all covered employees from previous years.

A)The limitation applies to all employees.

B)The limitation applies to all officers.

C)The limitation applies only to the CEO and three other highest compensated officers.

D)The limitation applies only to the CEO, CFO, and three other highest compensated officers and all covered employees from previous years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which of the following is not an example of a taxable fringe benefit?

A)Personal use of corporate jet.

B)$1,000,000 group-term life insurance policy.

C)$225 of employer-provided parking.

D)Automobile allowance.

A)Personal use of corporate jet.

B)$1,000,000 group-term life insurance policy.

C)$225 of employer-provided parking.

D)Automobile allowance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

58

Which of the following is true regarding stock options?

A)A loss is realized when stock options lapse.

B)There is typically no tax effect on the grant date.

C)Income recognized on the exercise date is greater for incentive stock options than nonqualified options.

D)The bargain element on a nonqualified option is taxed to employees at capital gain rates.

A)A loss is realized when stock options lapse.

B)There is typically no tax effect on the grant date.

C)Income recognized on the exercise date is greater for incentive stock options than nonqualified options.

D)The bargain element on a nonqualified option is taxed to employees at capital gain rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

59

Tom recently received 2,000 shares of restricted stock from his employer, Independence Corporation, when the share price was $10 per share. Tom's restricted shares vested three years later when the market price was $14. Tom held the shares for a little more than a year and sold them when the market price was $12. What is the amount of Tom's income or loss on the sale?

A)$0.

B)$2,000 loss.

C)$4,000 gain.

D)$4,000 loss.

A)$0.

B)$2,000 loss.

C)$4,000 gain.

D)$4,000 loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

60

Tom recently received 2,000 shares of restricted stock from his employer, Independence Corporation, when the share price was $10 per share. Tom's restricted shares vested three years later when the market price was $14. Tom held the shares for a little more than a year and sold them when the market price was $20. What is the amount of Tom's income or loss on the vesting date?

A)$0.

B)$10,000.

C)$20,000.

D)$28,000.

A)$0.

B)$10,000.

C)$20,000.

D)$28,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

61

Tanya's employer offers a cafeteria plan that allows employees to choose among a number of benefits. Each employee is allowed $6,000 in benefits. For 2019, Tanya selected $3,420 ($285 per month)of parking, $1,780 in 401(k)contributions, and $800 of cash. How much must Tanya include in taxable income?

A)$0.

B)$1,040.

C)$3,420.

D)$4,220.

A)$0.

B)$1,040.

C)$3,420.

D)$4,220.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

62

Lara, a single taxpayer with a 32 percent marginal tax rate, desires health insurance. The health insurance would cost Lara $5,000 to purchase if she pays for it herself (Lara's AGI is too high to receive any tax deduction for the insurance as a medical expense). Lara's employer has a 21 percent marginal tax rate. Ignoring payroll taxes, what is the maximum amount of before-tax salary Lara would give up to receive health insurance? (Round your answer to the nearest whole number.)

A)$1,600.

B)$5,000.

C)$7,353.

D)$15,625.

A)$1,600.

B)$5,000.

C)$7,353.

D)$15,625.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

63

Francis works for a local fly-fishing shop. The shop allows employees to purchase two fly rods per year at a discount. This year, Francis purchased one rod. The rod normally retails for $300, was purchased for $225, was sold to Francis for $250, and the employer's average gross profit percentage is 30 percent. What amount of the discount must be included in Francis's income?

A)$0.

B)$25.

C)$40.

D)Some other amount.

A)$0.

B)$25.

C)$40.

D)Some other amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

64

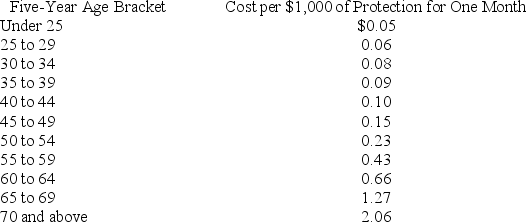

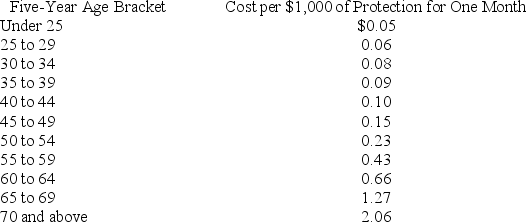

Grace's employer is now offering group-term life insurance. The company will provide each employee with $200,000 of group-term life insurance. It costs Grace's employer $700 to provide this amount of insurance to Grace each year. Assuming that Grace is 43 years old, use the table to determine the monthly premium that Grace must include in income as a result of receiving the group-term life benefit. Uniform Premiums for $1,000 of Group-Term Life Insurance Protection

A)$0.

B)$15.00.

C)$22.00.

D)$58.33.

A)$0.

B)$15.00.

C)$22.00.

D)$58.33.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

65

Which of the following benefits cannot be excluded as a no-additional-cost service fringe benefit?

A)Free tax return preparation from a client.

B)Complimentary dry cleaning for employees at a laundry company.

C)A car wash at an automobile dealership.

D)Free local phone service for phone company employees.

A)Free tax return preparation from a client.

B)Complimentary dry cleaning for employees at a laundry company.

C)A car wash at an automobile dealership.

D)Free local phone service for phone company employees.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

66

Leesburg paid its employee $200,000 of compensation for the year. What is the after-tax cost of paying the salary assuming a 21 percent marginal tax rate (ignore payroll taxes)?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

67

Rachel receives employer-provided health insurance. The employer's cost of the health insurance is $6,000 annually. What is her employer's after-tax cost of providing the health insurance, assuming that the employer's marginal tax rate is 21 percent and the employer is profitable?

A)$0.

B)$1,260.

C)$4,740.

D)$6,000.

A)$0.

B)$1,260.

C)$4,740.

D)$6,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

68

Hazel received 20 NQOs (each option gives her the right to purchase 10 shares of stock for $7 per share)at the time she started working, when the stock price was $14 per share. Now that the share price is $20 per share, she intends to exercise all of her options. How much cash will Hazel need on the exercise date to exercise the stock option?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

69

Which of the following is false regarding dependent-care expenses?

A)Up to $5,000 of reimbursed expenses can qualify.

B)Employers may discriminate among employees.

C)Dependent children under 13 qualify.

D)Spouses who are physically or mentally unable to care for themselves qualify.

A)Up to $5,000 of reimbursed expenses can qualify.

B)Employers may discriminate among employees.

C)Dependent children under 13 qualify.

D)Spouses who are physically or mentally unable to care for themselves qualify.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

70

Which of the following is not an example of a nontaxable fringe benefit?

A)Monthly employer-provided transit benefit of $100.

B)Group-term life insurance policy providing $100,000 of coverage.

C)Employer-provided parking of $100 per month.

D)Qualified employee discounts.

A)Monthly employer-provided transit benefit of $100.

B)Group-term life insurance policy providing $100,000 of coverage.

C)Employer-provided parking of $100 per month.

D)Qualified employee discounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

71

Tasha receives reimbursement from her employer for dependent-care expenses for up to $8,000. Tasha applies for and receives reimbursement of $6,000 for her 10-year-old son. How much, if any, is includible in her income?

A)$0.

B)$1,000.

C)$3,000.

D)$6,000.

A)$0.

B)$1,000.

C)$3,000.

D)$6,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

72

Big Bucks, a publicly traded corporation, paid its CEO $1,500,000 of base compensation for the year. What is the after-tax cost of paying the salary assuming a 21 percent marginal tax rate?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

73

Which of the following is not a requirement of a "qualified employee discount"?

A)The discount relates to goods or services of the employer.

B)The discount on services doesn't exceed 20 percent of the price offered to customers.

C)The discount can be elected up to five times annually.

D)The employee discount on goods is not greater than employer's average gross profit.

A)The discount relates to goods or services of the employer.

B)The discount on services doesn't exceed 20 percent of the price offered to customers.

C)The discount can be elected up to five times annually.

D)The employee discount on goods is not greater than employer's average gross profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

74

Hazel received 20 NQOs (each option gives her the right to purchase 10 shares of stock for $7 per share)at the time she started working, when the stock price was $14 per share. Now that the share price is $20 per share, she intends to exercise all of her options. If Hazel holds the shares for two years after exercise and sells them when the market price is $25, how much gain will Hazel recognize on the sale and how much tax will she pay, assuming her marginal tax rate is 37 percent?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

75

Bonnie's employer provides her with an annual dinner club membership costing $5,000. Her marginal tax rate is 24 percent. Her employer has a marginal tax rate of 21 percent. What is Bonnie's after-tax benefit?

A)$0.

B)$1,200.

C)$3,800.

D)$5,000.

A)$0.

B)$1,200.

C)$3,800.

D)$5,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

76

Which of the following statements concerning cafeteria plans is true?

A)Allows employees to choose from a menu of fringe benefits or to choose cash.

B)Most of the menu choices are nontaxable fringe benefits.

C)Any receipt of cash option that is elected is treated as taxable compensation.

D)All of the statements are true.

A)Allows employees to choose from a menu of fringe benefits or to choose cash.

B)Most of the menu choices are nontaxable fringe benefits.

C)Any receipt of cash option that is elected is treated as taxable compensation.

D)All of the statements are true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

77

Which of the following statements regarding employer-provided educational benefits is true?

A)All undergraduate tuition expenses can be excluded.

B)Only educational benefits from public universities can be excluded.

C)Up to $5,250 in tuition benefits can be excluded.

D)All graduate tuition expenses are included.

A)All undergraduate tuition expenses can be excluded.

B)Only educational benefits from public universities can be excluded.

C)Up to $5,250 in tuition benefits can be excluded.

D)All graduate tuition expenses are included.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

78

Hazel received 20 NQOs (each option gives her the right to purchase 10 shares of stock for $7 per share)at the time she started working, when the stock price was $14 per share. Now that the share price is $20 per share, she intends to exercise all of her options. How much income will Hazel recognize on the exercise date and how much tax will she pay, assuming her marginal tax rate is 24 percent?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

79

Which of the following is a fringe benefit that allows employers to discriminate among employees when providing it?

A)No-additional-cost service.

B)Qualified employee discount.

C)Qualified transportation fringe.

D)Employee educational assistance.

A)No-additional-cost service.

B)Qualified employee discount.

C)Qualified transportation fringe.

D)Employee educational assistance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

80

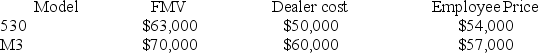

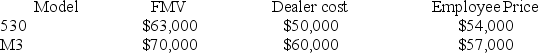

Kevin is the financial manager of Levingston BMW. The shop allows employees to purchase up to two vehicles per year at a discount. Levingston's average gross profit percentage is 15 percent. This year Kevin purchased a 530 model and a new M3.  What amount must Kevin include in income?

What amount must Kevin include in income?

A)$0.

B)$2,500.

C)$2,950.

D)$22,000.

What amount must Kevin include in income?

What amount must Kevin include in income?A)$0.

B)$2,500.

C)$2,950.

D)$22,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck