Deck 10: Enterprise Funds

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/48

العب

ملء الشاشة (f)

Deck 10: Enterprise Funds

1

A developer agreed to pay for water and wastewater infrastructure associated with one of his development projects. Once the work is completed and the new lines are connected, they will become part of the city's Enterprise Fund capital assets. The entry that should be recorded by the Enterprise Fund when the project is complete would be

A) A debit to capital assets and a credit to net investment in capital assets.

B) A debit to capital assets and a credit to capital contribution.

C) A debit to capital assets and a credit to transfer in.

D) A debit to capital assets and a credit to nonoperating revenues.

A) A debit to capital assets and a credit to net investment in capital assets.

B) A debit to capital assets and a credit to capital contribution.

C) A debit to capital assets and a credit to transfer in.

D) A debit to capital assets and a credit to nonoperating revenues.

B

2

A government defeased in-substance $10 million of old Enterprise Fund bonds by paying $12 million into a qualifying trust for that purpose. The refunded bonds had an unamortized premium of $200,000 and a prepaid bond insurance balance of $50,000. Resources to finance the defeasance of the old bonds were provided by issuing $12,000,000 of new bonds issued at par. What amount of deferred interest expense adjustment should the government report?

A) $0.

B) $1,850,000 debit.

C) $1,800,000 debit.

D) $1,850,000 credit.

A) $0.

B) $1,850,000 debit.

C) $1,800,000 debit.

D) $1,850,000 credit.

B

3

When accounting for inventory in an Enterprise Fund, which of the following methods should be used for external financial reporting?

A) Acquisition method.

B) Allocation method.

C) Consumption method.

D) Purchases method.

A) Acquisition method.

B) Allocation method.

C) Consumption method.

D) Purchases method.

C

4

Listed below are selected transactions for the Rhea County Garbage Service, which is accounted for in an Enterprise Fund. All amounts are in thousands of dollars.

1. Services of $5,000 were provided and billed to outside customers.

2. Services of $750 were provided and billed to the General Fund.

3. $750 was collected from other funds, and $4,000 was collected on account.

4. $20 of accounts receivable were written off as uncollectible.

5. Estimated bad debts for the year were $100.

1. Prepare the journal entries required in the Enterprise Fund. If no entry is required, state "No entry required" and explain why.

2. Compute the amount of sales revenues that should be reported for the Enterprise Fund.

1. Services of $5,000 were provided and billed to outside customers.

2. Services of $750 were provided and billed to the General Fund.

3. $750 was collected from other funds, and $4,000 was collected on account.

4. $20 of accounts receivable were written off as uncollectible.

5. Estimated bad debts for the year were $100.

1. Prepare the journal entries required in the Enterprise Fund. If no entry is required, state "No entry required" and explain why.

2. Compute the amount of sales revenues that should be reported for the Enterprise Fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

5

A city Enterprise Fund was awarded an operating grant during the fiscal year. Assuming qualifying costs were incurred during the year and all other eligibility requirements were met, the Enterprise Fund will report this grant on the statement of revenues, expenses, and changes in net position as

A) Operating revenues.

B) Nonoperating revenues.

C) Other financing sources.

D) Other financing uses.

A) Operating revenues.

B) Nonoperating revenues.

C) Other financing sources.

D) Other financing uses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

6

A city's Enterprise Fund sold land, which rarely occurs in the government. The land was originally purchased at $35,000 and sold for $235,000. The Enterprise fund would record the sale as a

A) Debit to cash for $235,000 and credit to nonoperating revenues for $235,000.

B) Debit to cash for $235,000 and credit to operating revenues for $235,000.

C) Debit to cash for $235,000, a credit to capital assets (land) for $35,000, and a credit to non-operating revenues (gain on sale of land) for $200,000.

D) Debit to cash for $235,000, a credit to capital assets (land) for $35,000, and credit to special item (gain on sale of land) for $200,000.

A) Debit to cash for $235,000 and credit to nonoperating revenues for $235,000.

B) Debit to cash for $235,000 and credit to operating revenues for $235,000.

C) Debit to cash for $235,000, a credit to capital assets (land) for $35,000, and a credit to non-operating revenues (gain on sale of land) for $200,000.

D) Debit to cash for $235,000, a credit to capital assets (land) for $35,000, and credit to special item (gain on sale of land) for $200,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

7

An Enterprise Fund is donating equipment to a general government department. The equipment has a net book value of $25,000 (original cost was $60,000). The acquisition value of the equipment at the transaction date was $28,000. The entry that should be recorded for the Enterprise Fund would include

A) A debit to nonoperating expense of $25,000.

B) A debit to transfer out of $28,000.

C) A debit to capital contribution of $25,000.

D) A debit to nonoperating expense of $28,000.

A) A debit to nonoperating expense of $25,000.

B) A debit to transfer out of $28,000.

C) A debit to capital contribution of $25,000.

D) A debit to nonoperating expense of $28,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following statements is false concerning interest capitalization?

A) Generally accepted accounting principles require the capitalization of interest for assets constructed for an Enterprise Fund in most situations.

B) Interest cost should not be capitalized for asset acquisitions financed by restricted gifts or grants.

C) Interest capitalization is computed differently for tax-exempt versus taxable debt.

D) Interest capitalization is not allowed in Enterprise Funds.

A) Generally accepted accounting principles require the capitalization of interest for assets constructed for an Enterprise Fund in most situations.

B) Interest cost should not be capitalized for asset acquisitions financed by restricted gifts or grants.

C) Interest capitalization is computed differently for tax-exempt versus taxable debt.

D) Interest capitalization is not allowed in Enterprise Funds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

9

The following transactions occurred in the City of Jimtown Enterprise Fund:

1. Equipment belonging to the Enterprise Fund was sold for $300.

2. The proceeds from the sale of the asset were transferred to the General Fund.

3. Cash, $2,800, was paid for construction costs. The cash was paid out of unrestricted cash available for any Enterprise Fund purpose-i.e., was not set aside strictly for capital asset construction or acquisition.

4. Paid principal, $18, and interest, $59, on a mortgage note.

5. The Enterprise Fund collected $12,500 from external customers and $2,500 from the General Fund for services.

6. The City signed a lease for equipment. The present value of the future payments and fair value of the equipment is $5,000, and the City made a down payment of $500

7. Proceeds of bonds issued to refund previously outstanding bonds that had been issued to finance plant expansion several years earlier, $18,000.

8. Interest paid on the refunding bonds, $1,080.

9. Cash proceeds from sale of investments, $900. Investments were purchased with the proceeds of debt issued to finance construction of specialized equipment that is almost completed.

10. Cash received from a capital grant, $5,000.

11. Cash paid for construction costs that qualify under the capital grant, $1,500.

12. The City acquired land for future plant expansion, $750, by issuing a 10-year bond in the same amount.

13. Cash received from operating grants, $500.

14. Cash paid for salaries covered by operating grant, $85.

15. The City had an unrealized gain on investments of $12.

16. The Enterprise Fund incurred $10,000 in operating expenses, including $1,000 in depreciation, $3,000 for employees, and $6,000 paid to suppliers. All but $500 of the salary expenses were paid by year end.

17. Cash paid for equipment purchased with the proceeds of an operating grant, $34.

18. Cash received from the General Fund to cover part of the cost of plant expansion, $1,000.

19. Cash proceeds from the sale of fund capital assets, $23.

20. Cash received from another fund as a 6-month loan for the sole purpose of financing purchase of equipment, $90.

The balance of cash and cash equivalents at October 1, 20X1, was $313. The balance of cash and cash equivalents at year end (9/30/20X2) is $26,250.

Requirement: Prepare the City of Jimtown Enterprise Fund Statement of Cash Flows for the year ended September 30, 20X2. You may exclude the reconciliation of operating income to cash flows from operating activities.

1. Equipment belonging to the Enterprise Fund was sold for $300.

2. The proceeds from the sale of the asset were transferred to the General Fund.

3. Cash, $2,800, was paid for construction costs. The cash was paid out of unrestricted cash available for any Enterprise Fund purpose-i.e., was not set aside strictly for capital asset construction or acquisition.

4. Paid principal, $18, and interest, $59, on a mortgage note.

5. The Enterprise Fund collected $12,500 from external customers and $2,500 from the General Fund for services.

6. The City signed a lease for equipment. The present value of the future payments and fair value of the equipment is $5,000, and the City made a down payment of $500

7. Proceeds of bonds issued to refund previously outstanding bonds that had been issued to finance plant expansion several years earlier, $18,000.

8. Interest paid on the refunding bonds, $1,080.

9. Cash proceeds from sale of investments, $900. Investments were purchased with the proceeds of debt issued to finance construction of specialized equipment that is almost completed.

10. Cash received from a capital grant, $5,000.

11. Cash paid for construction costs that qualify under the capital grant, $1,500.

12. The City acquired land for future plant expansion, $750, by issuing a 10-year bond in the same amount.

13. Cash received from operating grants, $500.

14. Cash paid for salaries covered by operating grant, $85.

15. The City had an unrealized gain on investments of $12.

16. The Enterprise Fund incurred $10,000 in operating expenses, including $1,000 in depreciation, $3,000 for employees, and $6,000 paid to suppliers. All but $500 of the salary expenses were paid by year end.

17. Cash paid for equipment purchased with the proceeds of an operating grant, $34.

18. Cash received from the General Fund to cover part of the cost of plant expansion, $1,000.

19. Cash proceeds from the sale of fund capital assets, $23.

20. Cash received from another fund as a 6-month loan for the sole purpose of financing purchase of equipment, $90.

The balance of cash and cash equivalents at October 1, 20X1, was $313. The balance of cash and cash equivalents at year end (9/30/20X2) is $26,250.

Requirement: Prepare the City of Jimtown Enterprise Fund Statement of Cash Flows for the year ended September 30, 20X2. You may exclude the reconciliation of operating income to cash flows from operating activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

10

A government defeased in-substance $10 million of old Enterprise Fund bonds by paying $12 million into a qualifying trust for that purpose. The refunded bonds had an unamortized premium of $200,000 and a prepaid bond insurance balance of $50,000. No borrowed resources were used to accomplish the defeasance. What amount of deferred interest expense adjustment should the government report?

A) $0.

B) $1,850,000 debit.

C) $1,800,000 debit.

D) $1,850,000 credit.

A) $0.

B) $1,850,000 debit.

C) $1,800,000 debit.

D) $1,850,000 credit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

11

Using the information provided below for the Water Utility Enterprise Fund of the City of Rice, prepare a statement of revenues, expenses, and changes in fund net position for 20X3.

-

-

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

12

Over the course of one year, Obed County received two grants:

• $10,000 grant (in cash) to be used to finance half the cost of expanding the town's water treatment plant. All eligibility requirements are met once qualifying costs are incurred.

• $40 grant to educate users on water conservation measures and to monitor water usage by a study group. No cash was received upon notification of the award.

1. Received the grant to assist in expanding the water treatment plant.

2. Signed a contract with Swann & Hall Construction to build the water treatment plant expansion, $20,000. The construction project is expected to take less than one year.

3. Received a $5,000 transfer from the General Fund to cover part of the cost of expanding the treatment plant.

4. Received an invoice from S&H Construction for $6,000,000 on the project for work completed to date. Paid the contractor the invoiced amount less a 10% retainage.

5. Received the grant to do the water study, but no cash was received in advance.

6. Issued $5,000 in bonds at mid-year at par to provide part of the financing for the treatment plant expansion. The bond issue costs were 1% of the face value. The bonds bear interest at 6%, payable semiannually on January 1 and July 1.

7. Received a second invoice for $10,000,000 on the project. Paid the contractor the invoiced amount less a 10% retainage.

8. Expenses incurred and paid during the year under this second grant total $30.

9. Received the final invoice from the contractor ($4,000,000). The expansion project was finished on-time and in accordance with the contract. Paid the contractor all amounts owed.

10. Make any necessary year-end adjusting entries.

1. Prepare the journal entries required in an Enterprise. If no entry is required, state "No entry required" and explain why.

2. How would these grants be reported in the statement of revenues, expenses, and changes in net position of the Enterprise Fund?

3. Assuming year-end had occurred after transaction #4, how would the grant and transfer affect the Statement of Net Position for the Enterprise Fund.

• $10,000 grant (in cash) to be used to finance half the cost of expanding the town's water treatment plant. All eligibility requirements are met once qualifying costs are incurred.

• $40 grant to educate users on water conservation measures and to monitor water usage by a study group. No cash was received upon notification of the award.

1. Received the grant to assist in expanding the water treatment plant.

2. Signed a contract with Swann & Hall Construction to build the water treatment plant expansion, $20,000. The construction project is expected to take less than one year.

3. Received a $5,000 transfer from the General Fund to cover part of the cost of expanding the treatment plant.

4. Received an invoice from S&H Construction for $6,000,000 on the project for work completed to date. Paid the contractor the invoiced amount less a 10% retainage.

5. Received the grant to do the water study, but no cash was received in advance.

6. Issued $5,000 in bonds at mid-year at par to provide part of the financing for the treatment plant expansion. The bond issue costs were 1% of the face value. The bonds bear interest at 6%, payable semiannually on January 1 and July 1.

7. Received a second invoice for $10,000,000 on the project. Paid the contractor the invoiced amount less a 10% retainage.

8. Expenses incurred and paid during the year under this second grant total $30.

9. Received the final invoice from the contractor ($4,000,000). The expansion project was finished on-time and in accordance with the contract. Paid the contractor all amounts owed.

10. Make any necessary year-end adjusting entries.

1. Prepare the journal entries required in an Enterprise. If no entry is required, state "No entry required" and explain why.

2. How would these grants be reported in the statement of revenues, expenses, and changes in net position of the Enterprise Fund?

3. Assuming year-end had occurred after transaction #4, how would the grant and transfer affect the Statement of Net Position for the Enterprise Fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

13

When charges to external users are a principal revenue source of an activity, the use of an Enterprise Fund is required by generally accepted accounting principles in each of the following situations except

A) When user fees are charged for the majority of the activity's operations.

B) When an activity is financed with debt that is secured solely by the pledge of revenues.

C) When laws and regulations require that the activity's costs be recovered with fees and charges.

D) When pricing policies of the activity establish fees and charges are designed for cost recovery.

A) When user fees are charged for the majority of the activity's operations.

B) When an activity is financed with debt that is secured solely by the pledge of revenues.

C) When laws and regulations require that the activity's costs be recovered with fees and charges.

D) When pricing policies of the activity establish fees and charges are designed for cost recovery.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

14

Dayton County decided to refund an outstanding term bond issue in its Enterprise Fund. The old bonds have a par value of $3,200 and an unamortized premium of $120. These bonds are scheduled to mature in 6 more years.

1. On January 2, 20X2, the County issued $3,700 face value of refunding bonds at a $350 premium for a total of $4,050. The bonds bear interest at 5% payable annually and mature in 5 years. The bond issuance costs were $250.

2. On January 2, The County paid $3,800 into an irrevocable trust in order to defease in-substance the previously outstanding bonds payable of the Enterprise Fund.

3. The annual interest payment on the new bonds was made on December 31 when due.

1. Prepare the journal entries required in an Enterprise. If no entry is required, state "No entry required" and explain why.

2. Indicate how all bond and refunding related amounts should be reported at December 31, 20X2.

1. On January 2, 20X2, the County issued $3,700 face value of refunding bonds at a $350 premium for a total of $4,050. The bonds bear interest at 5% payable annually and mature in 5 years. The bond issuance costs were $250.

2. On January 2, The County paid $3,800 into an irrevocable trust in order to defease in-substance the previously outstanding bonds payable of the Enterprise Fund.

3. The annual interest payment on the new bonds was made on December 31 when due.

1. Prepare the journal entries required in an Enterprise. If no entry is required, state "No entry required" and explain why.

2. Indicate how all bond and refunding related amounts should be reported at December 31, 20X2.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which of the following conditions does not require that an activity which provides services for a user fee be reported in an Enterprise Fund?

A) Net revenues are pledged as the sole security for debt issued to finance the activity.

B) Laws or regulations require the activity to recover its costs, including capital costs.

C) Pricing policies require the activity to recover its costs, including capital costs.

D) The primary source of revenue for the activity is charges to external users.

A) Net revenues are pledged as the sole security for debt issued to finance the activity.

B) Laws or regulations require the activity to recover its costs, including capital costs.

C) Pricing policies require the activity to recover its costs, including capital costs.

D) The primary source of revenue for the activity is charges to external users.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

16

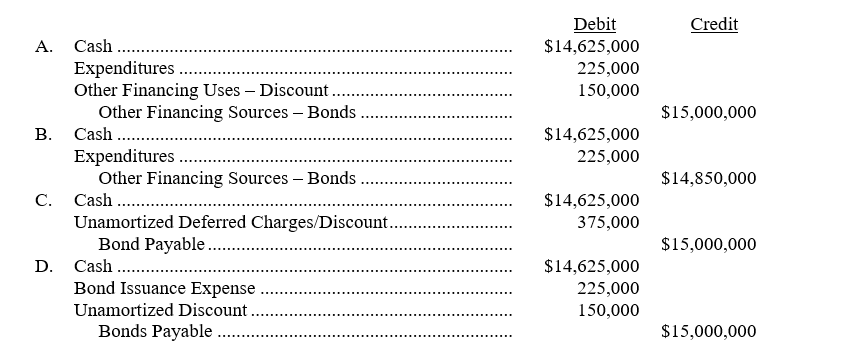

Refunding bonds were issued by an Enterprise Fund with a face value of $15,000,000 at a 1% discount. Issuance costs were $225,000. The entry to record the issuance of the refunding bonds would be

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

17

A general government department donates equipment with an original cost of $50,000 to an Enterprise Fund. The net book value as of the date of donation is $17,500, and its acquisition value is $15,000. The entry that should be recorded by the Enterprise Fund would be

A) A debit to equipment of $15,000 and a credit to transfer in of $17,500.

B) A debit to equipment of $50,000 and credits to accumulated depreciation of $32,500 and nonoperating revenues of $17,500.

C) A debit to capital assets of $15,000 and a credit to capital contribution of $17,500.

D) A debit to capital assets of $50,000 and credits to accumulated depreciation of $32,500 and capital contribution of $17,500.

A) A debit to equipment of $15,000 and a credit to transfer in of $17,500.

B) A debit to equipment of $50,000 and credits to accumulated depreciation of $32,500 and nonoperating revenues of $17,500.

C) A debit to capital assets of $15,000 and a credit to capital contribution of $17,500.

D) A debit to capital assets of $50,000 and credits to accumulated depreciation of $32,500 and capital contribution of $17,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

18

Wartrace City's Communications Enterprise Fund, which has a December 31 year end, was awarded a $400,000 federal grant for a system hardware upgrade to meet FCC requirements. The grant was awarded in June 20X7. Work began immediately on the project and qualifying costs of $200,000 were incurred prior to December 31, 20X7, however, the capital project is not expected to be completed until June 20X8. The grantor does not reimburse grantees until a project is complete. As of December 31, 20X7, the Communications Enterprise Fund should

A) Report nonoperating revenues of $400,000.

B) Report nonoperating revenues of $200,000.

C) Report a capital contribution of $400,000.

D) Report a capital contribution of $200,000.

A) Report nonoperating revenues of $400,000.

B) Report nonoperating revenues of $200,000.

C) Report a capital contribution of $400,000.

D) Report a capital contribution of $200,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

19

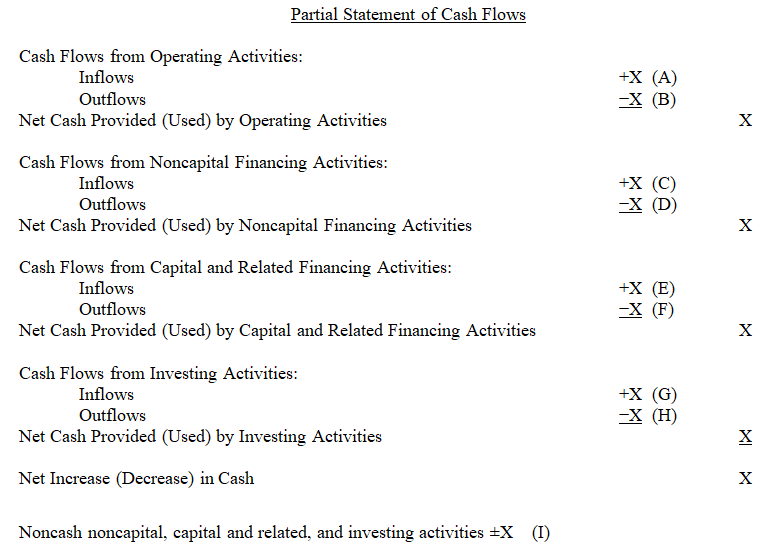

Matching Transactions and Classifications of Cash Flows

-Note that X in the following Proprietary Fund statement of cash flows identifies a dollar amount and the letters (A) through (I) identify specific items which appear in the major sections of the statement.

For each of the following items, indicate the section where the effect would be reported. Use the code (A through I) from above. Codes may be used once, more than once, or not at all. Assume that generally accepted accounting principles have been followed and that there are no short-term securities which are considered cash equivalents.

_____ 1.Interest payments on long-term obligations not related to capital assets

_____ 2.Proceeds from maturities of investments

_____ 3.Contributed capital assets

_____ 4.Investment income received

_____ 5.Cash received from operating grants

_____ 6.Transfers to other funds

_____ 7.Principal payments on capital-related long-term obligations

_____ 8.Receipts from customers and users

_____ 9.Capital purchases with notes payable

_____ 10.Payments to employees

-Note that X in the following Proprietary Fund statement of cash flows identifies a dollar amount and the letters (A) through (I) identify specific items which appear in the major sections of the statement.

For each of the following items, indicate the section where the effect would be reported. Use the code (A through I) from above. Codes may be used once, more than once, or not at all. Assume that generally accepted accounting principles have been followed and that there are no short-term securities which are considered cash equivalents.

_____ 1.Interest payments on long-term obligations not related to capital assets

_____ 2.Proceeds from maturities of investments

_____ 3.Contributed capital assets

_____ 4.Investment income received

_____ 5.Cash received from operating grants

_____ 6.Transfers to other funds

_____ 7.Principal payments on capital-related long-term obligations

_____ 8.Receipts from customers and users

_____ 9.Capital purchases with notes payable

_____ 10.Payments to employees

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

20

A city's Enterprise Fund issued revenue bonds with a face value of $10,000,000. The bonds were issued with a 2% premium and the issuance costs totaled $150,000. When the bonds are issued, the Enterprise Fund will report total other financing sources in the amount of

A) $0.

B) $9,850,000.

C) $10,000,000.

D) $10,200,000.

A) $0.

B) $9,850,000.

C) $10,000,000.

D) $10,200,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

21

Cash received from a transfer from the General Fund to subsidize operations of an Enterprise Fund is reported in which section of a statement of cash flows?

A) Cash flows from operating activities.

B) Cash flows from noncapital financing activities.

C) Cash flows from capital and related financing activities.

D) Cash flows from investing activities.

A) Cash flows from operating activities.

B) Cash flows from noncapital financing activities.

C) Cash flows from capital and related financing activities.

D) Cash flows from investing activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

22

Enterprise Fund payments in lieu of taxes to the General Fund that are not payments for services from a government's Enterprise Fund to its General Fund should be reported by the Enterprise Fund as

A) Operating expenses.

B) Nonoperating expenses.

C) Transfers out.

D) Special item.

A) Operating expenses.

B) Nonoperating expenses.

C) Transfers out.

D) Special item.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

23

Where should a cash grant received to support the operations of an Enterprise Fund be reported on that fund's statement of revenues, expenses, and changes in fund net position when it is earned?

A) Operating revenues.

B) Nonoperating revenues.

C) Reduction to operating expenses.

D) Capital contributions.

A) Operating revenues.

B) Nonoperating revenues.

C) Reduction to operating expenses.

D) Capital contributions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

24

An Enterprise Fund made a debt service payment of $75,000 ($45,000 principal, $30,000 interest). The Enterprise Fund will report

A) $0 expenses.

B) $30,000 of expense.

C) $75,000 of expense.

D) a liability reduction of $75,000.

A) $0 expenses.

B) $30,000 of expense.

C) $75,000 of expense.

D) a liability reduction of $75,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

25

An Enterprise Fund entered into a capital lease for the purchase of equipment. The capitalizable cost of the asset was $300,000 and fund made a $30,000 down payment. In the year of inception the Enterprise Fund would report

A) Expenses of $30,000.

B) Capital assets of $300,000.

C) Long-term liabilities of $300,000.

D) An other financing use of $270,000 and expenses of $30,000.

A) Expenses of $30,000.

B) Capital assets of $300,000.

C) Long-term liabilities of $300,000.

D) An other financing use of $270,000 and expenses of $30,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

26

A government was awarded a grant from another government. The $8,000,000 grant is restricted to use for construction of a facility for one of the grantee government's enterprise activities. The grant is for half the cost of the facility. The grantor will reimburse half of the costs as they are incurred. At the end of the first fiscal year, $3,000,000 has been spent on the project. $1,500,000 has been collected from the grantor. How should the grantee's Enterprise Fund statement of cash flows report the cash inflows?

A) Operating activities.

B) Noncapital financing activities.

C) Capital and related financing activities.

D) Investing activities.

A) Operating activities.

B) Noncapital financing activities.

C) Capital and related financing activities.

D) Investing activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

27

A government borrowed $20 million by issuing general obligation bonds to finance construction of a new airport terminal for its Airport Enterprise Fund. The bonds were issued at par, and the government intends to service the bonds from Enterprise Fund revenues. The proceeds of the bonds should be reported as

A) An other financing source in the Enterprise Fund statement of revenues, expenses, and changes in fund net position.

B) Capital and related financing activities in the Enterprise Fund statement of cash flows.

C) Revenues in the Enterprise Fund statement of revenues, expenses, and changes in fund net position.

D) Only in the General Long-Term Liabilities account.

A) An other financing source in the Enterprise Fund statement of revenues, expenses, and changes in fund net position.

B) Capital and related financing activities in the Enterprise Fund statement of cash flows.

C) Revenues in the Enterprise Fund statement of revenues, expenses, and changes in fund net position.

D) Only in the General Long-Term Liabilities account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

28

The Public Utilities Enterprise Fund was ordered by the court to pay environmental damages of $500,000. The fund is to pay $100,000 immediately and the remaining $400,000 in equal installments for next four years. In the year of the judgment, the Enterprise Fund would report

A) $500,000 in expenses.

B) $500,000 in liabilities.

C) $100,000 in expenses.

D) Nothing. All amounts would be recorded in General Long-term Liabilities accounts.

A) $500,000 in expenses.

B) $500,000 in liabilities.

C) $100,000 in expenses.

D) Nothing. All amounts would be recorded in General Long-term Liabilities accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which of the following is not a required financial statement of an Enterprise Fund?

A) Statement of net position.

B) Statement of revenues, expenses and changes in fund net position.

C) Statement of revenues, expenses and changes in fund net position-budget to actual (GAAP basis).

D) Statement of cash flows.

A) Statement of net position.

B) Statement of revenues, expenses and changes in fund net position.

C) Statement of revenues, expenses and changes in fund net position-budget to actual (GAAP basis).

D) Statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

30

The Utility Enterprise Fund is in Year 2 of a three-year construction project that is projected to cost $3,000,000. The fund incurred $300,000 of costs in Year 1 and $1,800,000 in Year 2. The fund will report

A) Expenses of $300,000 in Year 1 and $1,800,000 in Year 2.

B) Total construction in progress in Year 2 of $1,800,000.

C) Total construction in progress in Year 2 of $2,100,000.

D) Expenditures of $300,000 in Year 1 and $1,800,000 in Year 2.

A) Expenses of $300,000 in Year 1 and $1,800,000 in Year 2.

B) Total construction in progress in Year 2 of $1,800,000.

C) Total construction in progress in Year 2 of $2,100,000.

D) Expenditures of $300,000 in Year 1 and $1,800,000 in Year 2.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

31

An Enterprise fund receives a $100,000 capital grant and uses the funds to partially finance the purchase of a $175,000 capital asset. The Enterprise Fund will report

A) Revenues of $100,000 and expenses of $175,000.

B) Nonoperating revenues of $100,000 and capital assets of $175,000.

C) Capital contributions of $100,000 and expenses of $175,000.

D) Capital contributions of $100,000 and capital assets of $175,000.

A) Revenues of $100,000 and expenses of $175,000.

B) Nonoperating revenues of $100,000 and capital assets of $175,000.

C) Capital contributions of $100,000 and expenses of $175,000.

D) Capital contributions of $100,000 and capital assets of $175,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

32

The City of Alnwick was awarded a grant by Blount County. The $8,000,000 grant is restricted to use for construction of a facility for a city enterprise activity. The grant is for half the cost of the facility. The grantor will reimburse half of the costs as they are incurred. At the end of the first fiscal year, $3,000,000 has been spent on the project. $1,500,000 has been collected from the grantor. How should the grant be reported in the statement of revenues, expenses, and changes in net position?

A) Capital contribution of $1,500,000.

B) Operating revenues of $1,500,000.

C) Nonoperating revenues of $1,500,000.

D) Special item of $1,500,000.

A) Capital contribution of $1,500,000.

B) Operating revenues of $1,500,000.

C) Nonoperating revenues of $1,500,000.

D) Special item of $1,500,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following would be included in determining operating income of an Enterprise Fund?

A) Transfers.

B) Depreciation expense.

C) Interest expense.

D) Capital contributions.

A) Transfers.

B) Depreciation expense.

C) Interest expense.

D) Capital contributions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

34

The Water Enterprise Fund customers are billed on a monthly basis. As of the end of the fiscal year, water valued at $3,956,000 was sold. The accounts receivable for the fund was $256,000 at the beginning of the year and was $326,000 at the end of the year. Given these facts, the revenue in the Water Enterprise Fund should be

A) $3,956,000.

B) $3,886,000.

C) $3,700,000.

D) $3,630,000.

A) $3,956,000.

B) $3,886,000.

C) $3,700,000.

D) $3,630,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following statements is true about interfund transfers in an Enterprise Fund?

A) They are always reported as capital and related financing activities in the statement of cash flows.

B) They are always the last item reported immediately before the change in net position in the statement of revenues, expenses, and changes in fund net position.

C) They do not affect changes in net position of the proprietary fund.

D) They are always reported as noncapital financing activities in the statement of cash flows.

A) They are always reported as capital and related financing activities in the statement of cash flows.

B) They are always the last item reported immediately before the change in net position in the statement of revenues, expenses, and changes in fund net position.

C) They do not affect changes in net position of the proprietary fund.

D) They are always reported as noncapital financing activities in the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

36

An Enterprise Fund incurs $35,000 of interest during the current year related to its outstanding bonds. The $35,000 will be reported as

A) Operating expenses.

B) Nonoperating expenses.

C) Other financing uses.

D) Capitalized interest because all interest must be capitalized in an Enterprise fund.

A) Operating expenses.

B) Nonoperating expenses.

C) Other financing uses.

D) Capitalized interest because all interest must be capitalized in an Enterprise fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

37

A city's Enterprise Fund received $3,000,000 cash in the form of a capital grant during the fiscal year ended June 30, 20X3. The Enterprise Fund incurred and paid construction costs from that grant in the amount of $1,200,000. What amount should be reported on the Enterprise Fund Statement of Net Position as net investment in capital assets?

A) $0

B) $1,200,000

C) $1,800,000

D) $3,000,000

A) $0

B) $1,200,000

C) $1,800,000

D) $3,000,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

38

Which of the following is not a cash flow classification used in a Proprietary Fund statement of cash flows?

A) Cash flows from operating activities.

B) Cash flows from financing activities.

C) Cash flows from investing activities.

D) Cash flow from noncapital financing activities.

A) Cash flows from operating activities.

B) Cash flows from financing activities.

C) Cash flows from investing activities.

D) Cash flow from noncapital financing activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

39

A Proprietary Fund statement of cash flows reports cash flows from operating activities

A) Using the direct method.

B) Using the indirect method.

C) Equal to net income plus depreciation and plus/minus changes in appropriate current asset and current liability accounts.

D) Using either the direct or the indirect method of presentation.

A) Using the direct method.

B) Using the indirect method.

C) Equal to net income plus depreciation and plus/minus changes in appropriate current asset and current liability accounts.

D) Using either the direct or the indirect method of presentation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

40

An Enterprise Fund contributed $85,000 to the General Fund for operations. The money is not intended to be a loan. Which of the following statements is true?

A) The Enterprise Fund will report capital contributions of $85,000.

B) The Enterprise Fund will report other financing uses of $85,000.

C) The Enterprise Fund will report advances of $85,000.

D) The Enterprise Fund will report transfers out of $85,000.

A) The Enterprise Fund will report capital contributions of $85,000.

B) The Enterprise Fund will report other financing uses of $85,000.

C) The Enterprise Fund will report advances of $85,000.

D) The Enterprise Fund will report transfers out of $85,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

41

Inventory in an Enterprise Fund will most likely affect which equity classification?

A) Nonspendable net position.

B) Net investment in capital assets.

C) Restricted net position.

D) Unrestricted net position.

A) Nonspendable net position.

B) Net investment in capital assets.

C) Restricted net position.

D) Unrestricted net position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

42

Which of the following equity classifications would not apply to an Enterprise Fund?

A) Retained earnings.

B) Net investment in capital assets.

C) Unrestricted net position.

D) Restricted net position.

A) Retained earnings.

B) Net investment in capital assets.

C) Unrestricted net position.

D) Restricted net position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

43

A long-term liability for compensated absences would typically be included in which component of net position of an Enterprise Fund?

A) Unrestricted net position.

B) Restricted net position.

C) Net investment in capital assets.

D) Net position would not be affected.

A) Unrestricted net position.

B) Restricted net position.

C) Net investment in capital assets.

D) Net position would not be affected.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

44

A government borrowed $20 million by issuing general obligation bonds to finance construction of a new airport terminal for its Airport Enterprise Fund. The bonds were issued at par, and the government intends to service the bonds from Enterprise Fund revenues. At year end, none of the bond proceeds has been spent. The bonds payable would be included in which component of net position of an Enterprise Fund?

A) Unrestricted net position.

B) Restricted net position.

C) Net investment in capital assets.

D) Temporarily restricted net position.

A) Unrestricted net position.

B) Restricted net position.

C) Net investment in capital assets.

D) Temporarily restricted net position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

45

Which of the following would not be reported as a component of net position of an Enterprise Fund?

A) Unrestricted net position.

B) Restricted net position.

C) Net Investment in capital assets.

D) Permanently restricted net position.

A) Unrestricted net position.

B) Restricted net position.

C) Net Investment in capital assets.

D) Permanently restricted net position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

46

On January 1, an Enterprise Fund issues $1,000,000 of 6%, ten-year tax-exempt bonds to finance the construction of a new water treatment plant. During the year, the Enterprise Fund earned $40,000 of interest income on the bond proceeds and incurred $600,000 of construction costs. What amount of interest cost should be capitalized for the year?

A) $0.

B) $20,000.

C) $36,000.

D) $60,000.

A) $0.

B) $20,000.

C) $36,000.

D) $60,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

47

A city's Enterprise Fund received $3,000,000 cash in the form of a capital grant during the fiscal year ended June 30, 20X3. The Enterprise Fund incurred and paid construction costs from that grant in the amount of $1,200,000. What amount should be reported on the Enterprise Fund Statement of Net Position as restricted for capital outlay?

A) $0

B) $1,200,000

C) $1,800,000

D) $3,000,000

A) $0

B) $1,200,000

C) $1,800,000

D) $3,000,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

48

A transfer out would be reported in an Enterprise Fund's operating statement for

A) "Free" services provided to other departments.

B) Capital assets transferred to a general government department.

C) Interfund loans to other departments.

D) Services provided and billed to other departments.

A) "Free" services provided to other departments.

B) Capital assets transferred to a general government department.

C) Interfund loans to other departments.

D) Services provided and billed to other departments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck