Deck 9: General Capital Assets; General Long-Term Liabilities; Permanent Fundsintroduction to Interfund-Gca-Gltl Accounting

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/50

العب

ملء الشاشة (f)

Deck 9: General Capital Assets; General Long-Term Liabilities; Permanent Fundsintroduction to Interfund-Gca-Gltl Accounting

1

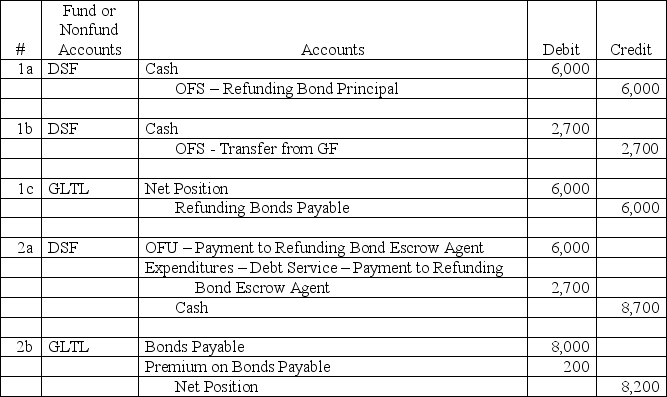

The City of Armona has decided to refinance $8,000 of par value, general government, general obligation bonds outstanding. The bonds had a related unamortized bond premium of $200. The city issues $6,000 of refunding bonds at par and transfers $2,700 from the General Fund to the Debt Service Fund. The city paid $8,700 from the Debt Service Fund into an irrevocable trust to cover future payments on the original bonds.

Prepare the general journal entries using standard fund-type terminology, identifying the fund or nonfund accounts for which the entry is being prepared. Appropriate abbreviations are acceptable (e.g., GF, SRF, CPF, DSF, GCA, GLTL, OFS, or OFU). If no entry is required, write "No Entry Required" and briefly explain why. Do include formal entry explanations or dates, but include any important assumptions made and calculations.

2

Which of the following comments best describes the accounting and financial reporting guidelines for works of art and historical treasures?

A) Governments should depreciate capitalized works of art and historical treasures that are considered exhaustible.

B) Works of art and historical treasures may be capitalized, but they should never be depreciated under any circumstances.

C) Works of art and historical treasures that must be held for public exhibition, must be protected, and the proceeds of any sales must be used to acquire more collections are always capitalized and depreciated.

D) Works of art should only be valued at historical cost at the time of receipt.

A) Governments should depreciate capitalized works of art and historical treasures that are considered exhaustible.

B) Works of art and historical treasures may be capitalized, but they should never be depreciated under any circumstances.

C) Works of art and historical treasures that must be held for public exhibition, must be protected, and the proceeds of any sales must be used to acquire more collections are always capitalized and depreciated.

D) Works of art should only be valued at historical cost at the time of receipt.

A

3

The general capital assets balances for the City of Sugarland as end of the December 31, 20X1 fiscal year are:

The following events related to the city's capital assets occurred during fiscal year 20X2:

1. A pickup truck purchased for $30 was sold. It had accumulated depreciation of $21.

2. Land purchased many years ago for $140 was sold.

3. A new police car was purchased for $50 (5 year useful life) as was a new fire truck for $250 (10 year useful life). Both were purchased at the beginning of the fiscal year. Depreciation on all new buildings, vehicles, and equipment is for the nearest full year, using the straight-line method with zero salvage value.

4. A new civic center was started in the previous fiscal year. Costs were $2,200 in the previous year. It cost $2,800 to finish it in the current fiscal year. The center was ready for use just in time for a Christmas pageant on December 20, 20X2.

5. New roads costing $550 were built during the year. Depreciation on new roads starts the following fiscal year.

6. Depreciation expenses for FY 20X2 on capital assets on hand at the beginning of the year are: Building, $500; Infrastructure, $2,500; Vehicles, $415; and Equipment, $200.

7. Depreciation on all capital assets except infrastructure is allocated to government functions as follows: general government, 30%; public safety, 50%; streets and roads, 20%. Infrastructure depreciation is charged to the function responsible for maintaining it.

Using the information presented above, complete the general capital asset note disclosure for FY 20X2.

The following events related to the city's capital assets occurred during fiscal year 20X2:

1. A pickup truck purchased for $30 was sold. It had accumulated depreciation of $21.

2. Land purchased many years ago for $140 was sold.

3. A new police car was purchased for $50 (5 year useful life) as was a new fire truck for $250 (10 year useful life). Both were purchased at the beginning of the fiscal year. Depreciation on all new buildings, vehicles, and equipment is for the nearest full year, using the straight-line method with zero salvage value.

4. A new civic center was started in the previous fiscal year. Costs were $2,200 in the previous year. It cost $2,800 to finish it in the current fiscal year. The center was ready for use just in time for a Christmas pageant on December 20, 20X2.

5. New roads costing $550 were built during the year. Depreciation on new roads starts the following fiscal year.

6. Depreciation expenses for FY 20X2 on capital assets on hand at the beginning of the year are: Building, $500; Infrastructure, $2,500; Vehicles, $415; and Equipment, $200.

7. Depreciation on all capital assets except infrastructure is allocated to government functions as follows: general government, 30%; public safety, 50%; streets and roads, 20%. Infrastructure depreciation is charged to the function responsible for maintaining it.

Using the information presented above, complete the general capital asset note disclosure for FY 20X2.

General Capital Asset Note Disclosure for FY 20X2:

The general capital assets balances for the City of Sugarland as of the end of the December 31, 20X1 fiscal year are as follows:

Nondepreciable Capital Assets:

- Land: $1,350

- Construction in Progress: $2,200

Depreciable Capital Assets:

- Buildings: $16,500

Accumulated Depreciation: $7,500

- Infrastructure: $186,000

Accumulated Depreciation: $103,000

- Vehicles: $8,500

Accumulated Depreciation: $2,600

- Equipment: $3,450

Accumulated Depreciation: $2,800

Events Related to Capital Assets during FY 20X2:

1. A pickup truck purchased for $30 was sold. It had accumulated depreciation of $21.

2. Land purchased many years ago for $140 was sold.

3. A new police car was purchased for $50 (5-year useful life) and a new fire truck for $250 (10-year useful life) at the beginning of the fiscal year. Both were purchased at the beginning of the fiscal year. Depreciation on all new buildings, vehicles, and equipment is for the nearest full year, using the straight-line method with zero salvage value.

4. A new civic center was started in the previous fiscal year, with costs of $2,200. It cost $2,800 to finish it in the current fiscal year. The center was ready for use just in time for a Christmas pageant on December 20, 20X2.

5. New roads costing $550 were built during the year. Depreciation on new roads starts the following fiscal year.

6. Depreciation expenses for FY 20X2 on capital assets on hand at the beginning of the year are: Building, $500; Infrastructure, $2,500; Vehicles, $415; and Equipment, $200.

7. Depreciation on all capital assets except infrastructure is allocated to government functions as follows: general government, 30%; public safety, 50%; streets and roads, 20%. Infrastructure depreciation is charged to the function responsible for maintaining it.

In accordance with the above information, the general capital asset note disclosure for FY 20X2 is as follows:

- The city sold a pickup truck with a net book value of $8.8 ($30 - $21.2) and land with a net book value of $140.

- The new police car and fire truck were added to the capital assets at a cost of $50 and $250, respectively, at the beginning of the fiscal year.

- The new civic center's total cost of $5,000 ($2,200 + $2,800) was completed and ready for use by December 20, 20X2.

- New roads with a cost of $550 were added to the capital assets during the year.

- Depreciation expenses for FY 20X2 on capital assets on hand at the beginning of the year are as follows: Building, $500; Infrastructure, $2,500; Vehicles, $415; and Equipment, $200.

The city also allocated depreciation on all capital assets except infrastructure to government functions as follows: general government, 30%; public safety, 50%; streets and roads, 20%.

This information provides a comprehensive overview of the city's capital assets and their related transactions and events for FY 20X2.

The general capital assets balances for the City of Sugarland as of the end of the December 31, 20X1 fiscal year are as follows:

Nondepreciable Capital Assets:

- Land: $1,350

- Construction in Progress: $2,200

Depreciable Capital Assets:

- Buildings: $16,500

Accumulated Depreciation: $7,500

- Infrastructure: $186,000

Accumulated Depreciation: $103,000

- Vehicles: $8,500

Accumulated Depreciation: $2,600

- Equipment: $3,450

Accumulated Depreciation: $2,800

Events Related to Capital Assets during FY 20X2:

1. A pickup truck purchased for $30 was sold. It had accumulated depreciation of $21.

2. Land purchased many years ago for $140 was sold.

3. A new police car was purchased for $50 (5-year useful life) and a new fire truck for $250 (10-year useful life) at the beginning of the fiscal year. Both were purchased at the beginning of the fiscal year. Depreciation on all new buildings, vehicles, and equipment is for the nearest full year, using the straight-line method with zero salvage value.

4. A new civic center was started in the previous fiscal year, with costs of $2,200. It cost $2,800 to finish it in the current fiscal year. The center was ready for use just in time for a Christmas pageant on December 20, 20X2.

5. New roads costing $550 were built during the year. Depreciation on new roads starts the following fiscal year.

6. Depreciation expenses for FY 20X2 on capital assets on hand at the beginning of the year are: Building, $500; Infrastructure, $2,500; Vehicles, $415; and Equipment, $200.

7. Depreciation on all capital assets except infrastructure is allocated to government functions as follows: general government, 30%; public safety, 50%; streets and roads, 20%. Infrastructure depreciation is charged to the function responsible for maintaining it.

In accordance with the above information, the general capital asset note disclosure for FY 20X2 is as follows:

- The city sold a pickup truck with a net book value of $8.8 ($30 - $21.2) and land with a net book value of $140.

- The new police car and fire truck were added to the capital assets at a cost of $50 and $250, respectively, at the beginning of the fiscal year.

- The new civic center's total cost of $5,000 ($2,200 + $2,800) was completed and ready for use by December 20, 20X2.

- New roads with a cost of $550 were added to the capital assets during the year.

- Depreciation expenses for FY 20X2 on capital assets on hand at the beginning of the year are as follows: Building, $500; Infrastructure, $2,500; Vehicles, $415; and Equipment, $200.

The city also allocated depreciation on all capital assets except infrastructure to government functions as follows: general government, 30%; public safety, 50%; streets and roads, 20%.

This information provides a comprehensive overview of the city's capital assets and their related transactions and events for FY 20X2.

4

Assume that the fiscal year-end for all the transactions below is June 30.

1. The General Fund paid $12 to a Special Revenue Fund to repay it for General Fund employee salaries that were inadvertently recorded as expenditures in the Special Revenue Fund.

2. The government decided to settle a lawsuit on the advice of its legal counsel. The lawsuit came about because of damage to a citizen's property caused by a garbage service employee. The garbage operation is accounted for in the General Fund. The government settled the suit for $300, paying $100 on June 1, 20X1, and $50 on July 1 for each of the next 4 fiscal years. For these types of lawsuits, the government is self-insured for the first $50 and 100% insured for the remaining payments. Because of a cash flow issue, the government borrowed $200 on a 6 month, 3% note that comes due 2 months after year end. No money was received from the insurance company by year end, but the total amount due was expected by August 15. Prepare all journal entries required through the end of the 20X1 fiscal year.

3. The government's employees earned $25 in compensated absences during the year. Of this amount, $10 was paid during the year and another $8 is due to be paid in the first 45 days of the following fiscal year. In addition, $5 due at the end of last year was paid at the beginning of this year. Finally, $2 earned in earlier years came due and was paid this year.

4. The government contributed $5 to its OPEB Plan trust for the year. The net OPEB liability, none of which was due and payable either at the beginning or at the end of the year, increased $15.

Prepare the general journal entries using standard fund-type terminology, identifying the fund or nonfund accounts for which the entry is being prepared. Appropriate abbreviations are acceptable (e.g., GF, SRF, CPF, DSF, GCA, GLTL, OFS, OFU). If no entry is required, write "No Entry Required" and briefly explain why. Do include formal entry explanations or dates, but include any important assumptions made and calculations.

1. The General Fund paid $12 to a Special Revenue Fund to repay it for General Fund employee salaries that were inadvertently recorded as expenditures in the Special Revenue Fund.

2. The government decided to settle a lawsuit on the advice of its legal counsel. The lawsuit came about because of damage to a citizen's property caused by a garbage service employee. The garbage operation is accounted for in the General Fund. The government settled the suit for $300, paying $100 on June 1, 20X1, and $50 on July 1 for each of the next 4 fiscal years. For these types of lawsuits, the government is self-insured for the first $50 and 100% insured for the remaining payments. Because of a cash flow issue, the government borrowed $200 on a 6 month, 3% note that comes due 2 months after year end. No money was received from the insurance company by year end, but the total amount due was expected by August 15. Prepare all journal entries required through the end of the 20X1 fiscal year.

3. The government's employees earned $25 in compensated absences during the year. Of this amount, $10 was paid during the year and another $8 is due to be paid in the first 45 days of the following fiscal year. In addition, $5 due at the end of last year was paid at the beginning of this year. Finally, $2 earned in earlier years came due and was paid this year.

4. The government contributed $5 to its OPEB Plan trust for the year. The net OPEB liability, none of which was due and payable either at the beginning or at the end of the year, increased $15.

Prepare the general journal entries using standard fund-type terminology, identifying the fund or nonfund accounts for which the entry is being prepared. Appropriate abbreviations are acceptable (e.g., GF, SRF, CPF, DSF, GCA, GLTL, OFS, OFU). If no entry is required, write "No Entry Required" and briefly explain why. Do include formal entry explanations or dates, but include any important assumptions made and calculations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

5

A city recently ordered a new fire truck. The base cost of the truck is $250,000. In addition, the city will be paying $1,000 in delivery charges and $5,000 for necessary calibrations once it is delivered; and the city will also have the necessary logos added at a cost $2,500. The capitalizable cost of the fire truck in the General Fund will be

A) $0.

B) $251,000.

C) $256,000.

D) $258,500.

A) $0.

B) $251,000.

C) $256,000.

D) $258,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

6

A government entered into a general government capital lease in the prior year. During the current year, a lease payment of $50,000, which includes implicit interest of $12,000, was made from the General Fund. What effect does the $50,000 payment have on the General Capital Assets and General Long-Term Liabilities accounts?

A) Increases net position by $38,000.

B) Increases capital assets $50,000.

C) Increases capital assets by $38,000.

D) Decrease capital lease liability by $50,000.

A) Increases net position by $38,000.

B) Increases capital assets $50,000.

C) Increases capital assets by $38,000.

D) Decrease capital lease liability by $50,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

7

Assume that a governmental entity acquires a new garbage truck. The garbage truck normally costs $189,000. The vendor allowed a $30,000 allowance with the trade-in of the entity's old garbage truck, which had a net book value of $42,000. The government financed the balance with a short-term bank note. The new garbage truck would be recorded in the General Capital Assets account at

A) $147,000.

B) $159,000.

C) $189,000.

D) $201,000.

A) $147,000.

B) $159,000.

C) $189,000.

D) $201,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

8

Assume that the city foreclosed on a piece of property it intends to keep for a government use. The property has an estimated fair market value (and acquisition value) of $5,000. It has an assessed value for taxes of $4,000. The outstanding amount of taxes and penalties due on the property totals $3,500. Normally, the city would value the foreclosed property at

A) $0.

B) $3,500.

C) $4,000.

D) $5,000.

A) $0.

B) $3,500.

C) $4,000.

D) $5,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

9

Prepare the general journal entries to properly record each of the following transactions and events in the appropriate general ledger accounts of the appropriate funds for the year ended June 30, 2011. The City of Middlesettlements uses a series of each type of nominal account (e.g., Revenues-Property Taxes, Revenues-Other, Expenditures-Operations, Expenditures-Capital Outlay, Expenditures-Debt Service-Interest, OFS-Bond Principal, OFU-Transfer to GF, etc.), except for budgetary entries where no additional detail is required. The General Capital Assets and General Long-term Liability accounts are updated whenever a relevant transaction occurs.

ADDITIONAL INFORMATION:

•The fiscal year for the City is July 1 to June 30.

• All premiums on bonds payable, net of bond issue costs, are transferred to the DSF that will be used to service the debt. The amounts transferred are used for future bond interest payments.

• When bonds are issued at a discount or bond issue costs are incurred, a special transfer is made from the GF to the fund used to account for the bond proceeds to reimburse it for the discount and issue costs. This transfer is over and above any previously authorized transfers from the GF to that fund.

• The City uses the consumption method / periodic inventory system to account for supplies.

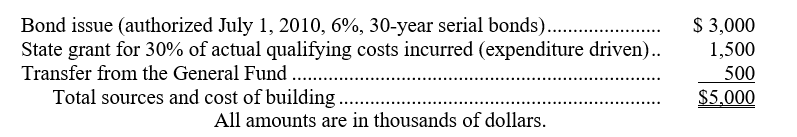

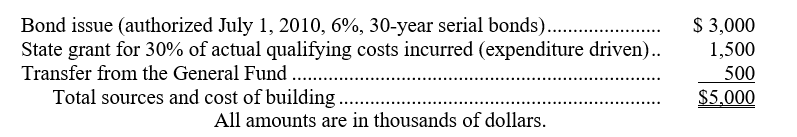

The City is constructing a new municipal building. Capital Projects Fund #1 will be used to account for this construction. The expected cost of and the sources of proportional financing for the municipal building are:

1. A computer has been leased for the City for its accounting and payroll operations. The lease has a capitalizable cost (and a net present value) of $2,000. The lease will be serviced through the General Fund.

2. A contract for the construction of the new municipal building was accepted by Swann & Hall (S&H) Construction Company for $4,500. The required transfer from the General Fund to the Capital Projects Fund was made.

3. $400 in 6-month, 4%, bond anticipation notes (BANs) were issued to finance expenditures in advance of the bond issue. The BANs are to be repaid from the proceeds of the previously authorized bond issue-as required by the debt covenant-by CPF #1. All legal steps have been taken to refinance the BANs and the City has the ability to consummate the refinancing.

4. The City accounts for its supplies in the General Fund. The City started the year with $100 in its supply account and purchased $200 in supplies to augment its inventory.

5. The first capital lease payment on the computer, $150 (including $100 in interest), was paid. (See entry 1)

6. 5 acres of land were purchased for $200 for the new municipal building. This purchase had not been previously encumbered, but it is included in the budget for the project.

7. The bonds authorized on July 1, 2010, were issued at 103 on October 1, 20X1. Bond issue costs were $20. The bonds pay interest on March 31 and September 30. Principal payments occur evenly over the life of the bonds each year (1/30 each September 30). DSF #1 was established to service this debt. (See entries 3 & 8)

8. The BANs were paid when due. (See entries 3 and 7)

9. The City issued $125 in supplies to its departments.

10. Expenditures totaling $2,500 were made for the construction project. These expenditures had originally been encumbered for $2,600. The amount was vouchered for payment to S&H Construction net of a 10% retainage. (See entry 2)

11. Sufficient funds were transferred from the General Fund to the DSF #1 to finance one year's principal retirement, interest, and fiscal agent fees ($10) for the municipal building bonds. (See entries 7 and 13)

12. The City issued another $100 in supplies to its departments.

13. DSF #1 made the required March 31 bond payments. (See entries 7 and 11)

14. At year end an inventory of supplies revealed that $80 were on hand. The appropriate adjustments were made.

Prepare the general journal entries for the City of Middlesettlements, using standard fund-type terminology, identifying the fund or list for which the entry is being prepared. Appropriate abbreviations are acceptable (e.g., GF, SRF, CPF, DSF, GCA, GLTL, OFS, OFU). If no entry is required, write "No Entry Required" and briefly explain why. Do not include formal entry explanations or dates, but include any important assumptions made and all calculations. If an amount is not given in the exam, you must show your work to demonstrate how you determined the amount.

ADDITIONAL INFORMATION:

•The fiscal year for the City is July 1 to June 30.

• All premiums on bonds payable, net of bond issue costs, are transferred to the DSF that will be used to service the debt. The amounts transferred are used for future bond interest payments.

• When bonds are issued at a discount or bond issue costs are incurred, a special transfer is made from the GF to the fund used to account for the bond proceeds to reimburse it for the discount and issue costs. This transfer is over and above any previously authorized transfers from the GF to that fund.

• The City uses the consumption method / periodic inventory system to account for supplies.

The City is constructing a new municipal building. Capital Projects Fund #1 will be used to account for this construction. The expected cost of and the sources of proportional financing for the municipal building are:

1. A computer has been leased for the City for its accounting and payroll operations. The lease has a capitalizable cost (and a net present value) of $2,000. The lease will be serviced through the General Fund.

2. A contract for the construction of the new municipal building was accepted by Swann & Hall (S&H) Construction Company for $4,500. The required transfer from the General Fund to the Capital Projects Fund was made.

3. $400 in 6-month, 4%, bond anticipation notes (BANs) were issued to finance expenditures in advance of the bond issue. The BANs are to be repaid from the proceeds of the previously authorized bond issue-as required by the debt covenant-by CPF #1. All legal steps have been taken to refinance the BANs and the City has the ability to consummate the refinancing.

4. The City accounts for its supplies in the General Fund. The City started the year with $100 in its supply account and purchased $200 in supplies to augment its inventory.

5. The first capital lease payment on the computer, $150 (including $100 in interest), was paid. (See entry 1)

6. 5 acres of land were purchased for $200 for the new municipal building. This purchase had not been previously encumbered, but it is included in the budget for the project.

7. The bonds authorized on July 1, 2010, were issued at 103 on October 1, 20X1. Bond issue costs were $20. The bonds pay interest on March 31 and September 30. Principal payments occur evenly over the life of the bonds each year (1/30 each September 30). DSF #1 was established to service this debt. (See entries 3 & 8)

8. The BANs were paid when due. (See entries 3 and 7)

9. The City issued $125 in supplies to its departments.

10. Expenditures totaling $2,500 were made for the construction project. These expenditures had originally been encumbered for $2,600. The amount was vouchered for payment to S&H Construction net of a 10% retainage. (See entry 2)

11. Sufficient funds were transferred from the General Fund to the DSF #1 to finance one year's principal retirement, interest, and fiscal agent fees ($10) for the municipal building bonds. (See entries 7 and 13)

12. The City issued another $100 in supplies to its departments.

13. DSF #1 made the required March 31 bond payments. (See entries 7 and 11)

14. At year end an inventory of supplies revealed that $80 were on hand. The appropriate adjustments were made.

Prepare the general journal entries for the City of Middlesettlements, using standard fund-type terminology, identifying the fund or list for which the entry is being prepared. Appropriate abbreviations are acceptable (e.g., GF, SRF, CPF, DSF, GCA, GLTL, OFS, OFU). If no entry is required, write "No Entry Required" and briefly explain why. Do not include formal entry explanations or dates, but include any important assumptions made and all calculations. If an amount is not given in the exam, you must show your work to demonstrate how you determined the amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following capital assets would not be considered a general capital asset?

A) Land at the local municipal park

B) A highway bridge maintained by a city government

C) Infrastructure associated with the local water system

D) Public safety vehicles

A) Land at the local municipal park

B) A highway bridge maintained by a city government

C) Infrastructure associated with the local water system

D) Public safety vehicles

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

11

New municipal building office equipment costs $400,000 and is being financed with a capital lease. If the government makes a $40,000 down payment, which of the following best describes the external financial reporting effects?

A) The General Fund statements will report expenditures of $400,000 and other financing sources of $360,000. The General Long-Term Liabilities accounts will report a liability of $360,000 and the General Capital Assets accounts will report an asset of $400,000.

B) The General Fund statements will report expenditures of $40,000 and other financing sources of $360,000. The General Long-Term Liabilities accounts will report a liability of $400,000 and the General Capital Assets accounts will report an asset of $360,000.

C) The General Fund statements will report expenditures of $360,000 and other financing sources of $400,000. The General Long-Term Liabilities accounts will report a liability of $360,000 and the General Capital Assets accounts will report an asset of $360,000.

D) The General Fund statements will report expenditures and other financing sources of $40,000. The General Long-Term Liabilities accounts will report a liability of $360,000 and the General Capital Assets accounts will report an asset of $360,000.

A) The General Fund statements will report expenditures of $400,000 and other financing sources of $360,000. The General Long-Term Liabilities accounts will report a liability of $360,000 and the General Capital Assets accounts will report an asset of $400,000.

B) The General Fund statements will report expenditures of $40,000 and other financing sources of $360,000. The General Long-Term Liabilities accounts will report a liability of $400,000 and the General Capital Assets accounts will report an asset of $360,000.

C) The General Fund statements will report expenditures of $360,000 and other financing sources of $400,000. The General Long-Term Liabilities accounts will report a liability of $360,000 and the General Capital Assets accounts will report an asset of $360,000.

D) The General Fund statements will report expenditures and other financing sources of $40,000. The General Long-Term Liabilities accounts will report a liability of $360,000 and the General Capital Assets accounts will report an asset of $360,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

12

1. A pickup truck purchased seven years ago for $30 with General Fund money was sold for $5. The government's proprietary funds usually depreciate this type of asset over a 10-year period using straight-line depreciation with zero (0) salvage value and disposes of assets at the end of its useful life.

2. Sold land for $300, which had been used many years ago as a public park. The land had been purchased for $140.

3. The county purchased a police vehicle for $22 and paid cash.

4. The government signed a contract for $5,000 for construction of an addition to the jail.

5. The contractor billed the county for 40% of the work on the jail addition. The actual cost of the work was $2,200. The county paid all but 10% of the amount billed. The balance is to be paid upon completion and approval of the project. The state was billed for its 30% of the project based on an expenditure-driven grant. (See entry #4 and #6)

6. The contractor billed the county $2,800 for the remainder of the work on the jail. The county approved the facility and paid the contractor all amounts owed. The state was billed for its portion of the work. (See entries #4, #5, and #7)

7. The state reimbursed only $1,400. Other costs were disallowed for reimbursement. (See entries #5 and #6)

Prepare the general journal entries using standard fund-type terminology, identifying the fund or nonfund accounts for which the entry is being prepared. Appropriate abbreviations are acceptable (e.g., GF, SRF, CPF, DSF, GCA, GLTL, OFS, OFU). If no entry is required, write "No Entry Required" and briefly explain why. Do not include formal entry explanations or dates, but include any important assumptions made and all calculations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

13

1. A government Special Revenue Fund leased specialized equipment under a multi-year, noncancelable lease agreement that qualifies as a capital lease. The lease required a down payment of $500 and the present value of the minimum lease payments including the down payment (i.e., the capitalizable cost of the leased asset) was $5,000. The implicit rate of interest on the lease is 10%.

2. The government made the first annual lease payment of $750.

3. The government made the second annual lease payment of $750.

Prepare the general journal entries using standard fund-type terminology, identifying the fund or nonfund accounts for which the entry is being prepared. Appropriate abbreviations are acceptable (e.g., GF, SRF, CPF, DSF, GCA, GLTL, OFS, or OFU). If no entry is required, write "No Entry Required" and briefly explain why. Do not include formal entry explanations or dates, but include any important assumptions made and all calculations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

14

A county government sold two of its emergency vehicles for a total of $35,000. The vehicles had a collective net book value of $46,000 (total original cost = $150,000; accumulated depreciation = $104,000). The entry that would be made in the General Fund at the time of the transaction would be

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

15

The parks and recreation department, which is accounted for within the General Fund, purchased a new athletic field mower at a cost of $25,000. The mower has an estimated useful life of 5 years. The General Fund would report depreciation expense at the end of Year 2 in the amount of

A) $0.

B) $5,000.

C) $10,000.

D) $25,000.

A) $0.

B) $5,000.

C) $10,000.

D) $25,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

16

1. The government issued $2,500 of 8-month, 9% bond anticipation notes. The notes meet the requirements to be accounted for as long-term debt. The proceeds are to be used to begin construction of a recently approved addition to the county jail.

2. The government issued $5,000 of 10-year, 8% bonds at par. Bond issue costs of $50 were withheld from the proceeds. Interest and one-tenth of the principal are payable annually on the bonds. The bond proceeds are to be used to repay the bond anticipation notes and to finance construction of the jail addition. (See entries #1 and #3)

3. The BANs and interest were paid on their due date. (See entries #1 and #2)

4. The semiannual payment of interest on bonds issued several years ago by a Capital Projects Fund came due and was paid. The outstanding principal of these 20-year, 4%, term bonds is $3,000. The unamortized discount on these bonds is $100. The bonds were issued 15 years ago on this date. The payment includes fiscal agent fees of $10.

5. The annual payment of serial bonds issued 10 years ago by the government came due. The amount owed is $1,250 in principal, $20 interest, and $5 in fiscal agent fees. The amount due was paid.

6. Another term bond issued 20 years ago by the government came due and was paid. The face amount and rate was $3,200 and 3%, respectively, and pays interest semiannually. The fiscal agent fees were $60.

7. A serial bond issued in the current year has its first annual payment of principal and interest due on the third day of the next fiscal year. As is required by the debt covenant and following the general procedures for all debt issues of the county, $1,200 ($1,000 for principal, $180 for interest, and $20 for fiscal agent fees) has been transferred from the General Fund to the Debt Service Fund to make this payment.

Prepare the general journal entries using standard fund-type terminology, identifying the fund or nonfund accounts for which the entry is being prepared. Appropriate abbreviations are acceptable (e.g., GF, SRF, CPF, DSF, GCA, GLTL, OFS, OFU). If no entry is required, write "No Entry Required" and briefly explain why. Do include formal entry explanations or dates, but include any important assumptions made and calculations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

17

1. A loan of $50 was made from the General Fund to the Gasoline Tax Fund (GTF), which is accounted for as a Special Revenue Fund. The loan will be repaid in five years.

2. The General Fund loaned $320 to the Capital Projects Fund (CPF #9)-to be repaid in 90 days.

Prepare the general journal entries using standard fund-type terminology, identifying the fund or nonfund accounts for which the entry is being prepared. Appropriate abbreviations are acceptable (e.g., GF, SRF, CPF, DSF, GCA, GLTL, OFS, or OFU). If no entry is required, write "No Entry Required" and briefly explain why. Do not include formal entry explanations or dates, but include any important assumptions made and all calculations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which of the following methods of capital asset valuation is consistent with generally accepted accounting principles for a donated capital asset?

A) Original cost

B) Fair value

C) Acquisition value

D) Book value to donor.

A) Original cost

B) Fair value

C) Acquisition value

D) Book value to donor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

19

1. The $10 of remaining assets (cash) from a terminated Capital Projects Fund (CPF #1) were received by the General Fund.

2. General Fund resources of $250 were paid to a newly established Capital Projects Fund (CPF #2). The resources will not be repaid to the General Fund.

3. The government ordered that $140 be paid from its General Fund to the fund that services the principal and interest payments on its long-term debt.

4. The government directed that $200 be moved from the General Fund to the Jail Addition Capital Projects Fund (CPF-JA) to provide additional funding for the project. The actual payment will occur at the beginning of the next fiscal year.

Prepare the general journal entries using standard fund-type terminology, identifying the fund or nonfund accounts for which the entry is being prepared. Appropriate abbreviations are acceptable (e.g., GF, SRF, CPF, DSF, GCA, GLTL, OFS, or OFU). If no entry is required, write "No Entry Required" and briefly explain why. Do not include formal entry explanations or dates, but include any important assumptions made and all calculations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

20

A local citizen donated land to the county government. It estimates that it could have purchased the same or similar land for $500,000. The donor had paid $550,000 for the land five years ago. The county incurred $150,000 in development costs to convert the land into a public park. The county should capitalize the new public park in the General Capital Assets accounts in the amount of

A) $500,000.

B) $550,000.

C) $650,000.

D) $700,000.

A) $500,000.

B) $550,000.

C) $650,000.

D) $700,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

21

A government may elect not to report depreciation expense on which type of exhaustible capital assets?

A) Capital assets with original useful lives in excess of 25 years.

B) Qualifying infrastructure capital assets.

C) Capital assets acquired by the General Fund.

D) Qualifying donated capital assets.

A) Capital assets with original useful lives in excess of 25 years.

B) Qualifying infrastructure capital assets.

C) Capital assets acquired by the General Fund.

D) Qualifying donated capital assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

22

A local industry donated one of its properties to the Anywhere School District. The school district plans to convert it to needed classroom space. In the year of the donation, the transaction will affect

A) The government-wide statements only.

B) The General Fund and General Capital Assets accounts.

C) The General Fund, the General Capital Assets accounts, and the government-wide financial statements.

D) The General Capital Assets accounts and the government-wide financial statements.

A) The government-wide statements only.

B) The General Fund and General Capital Assets accounts.

C) The General Fund, the General Capital Assets accounts, and the government-wide financial statements.

D) The General Capital Assets accounts and the government-wide financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

23

A fire destroyed one of Government A's fire stations, which had a net book value of $635,000. The government received an insurance settlement of $400,000 in the same fiscal year the fire had occurred. Which of the following best describes the external financial reporting in the year of the fire?

A) A special item in the amount of $635,000 should be reported in government-wide financial statements only.

B) A loss of $235,000 should be reported in the government-wide financial statements.

C) A loss of $235,000 should be reported in both the General Fund and the government-wide financial statements.

D) An other financing use of $236,000 should be reported in the General Fund.

A) A special item in the amount of $635,000 should be reported in government-wide financial statements only.

B) A loss of $235,000 should be reported in the government-wide financial statements.

C) A loss of $235,000 should be reported in both the General Fund and the government-wide financial statements.

D) An other financing use of $236,000 should be reported in the General Fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which of the following statements is true concerning intragovernmental transfers of capital assets?

A) If a proprietary fund is donating a capital asset to a general government department, the proprietary fund will debit capital contribution for the net book value of the donated capital asset.

B) If a proprietary fund donates a capital asset to a general government department, it will be reported as a nonoperating expense in the proprietary fund but as a transfer between activities at the government-wide level.

C) If a general government department donates a capital asset to an Enterprise Fund, the General Fund will debit transfer out for the net book value of the donated asset.

D) If a general government department donates a capital asset to an Enterprise Fund, the General Fund will debit capital contribution for the original cost of the capital asset.

A) If a proprietary fund is donating a capital asset to a general government department, the proprietary fund will debit capital contribution for the net book value of the donated capital asset.

B) If a proprietary fund donates a capital asset to a general government department, it will be reported as a nonoperating expense in the proprietary fund but as a transfer between activities at the government-wide level.

C) If a general government department donates a capital asset to an Enterprise Fund, the General Fund will debit transfer out for the net book value of the donated asset.

D) If a general government department donates a capital asset to an Enterprise Fund, the General Fund will debit capital contribution for the original cost of the capital asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

25

A government entered into a general government capital lease at mid-year. The capitalizable cost of the leased asset was $200,000, including a $30,000 down payment at the inception of the lease. The implicit rate of interest in the lease agreement is 6% and annual payments of $50,000 are due each year during the lease term beginning one year from the inception of the lease. What accounting entities are most likely affected by this transaction?

A) General Fund, Debt Service Fund and General Capital Assets and General Long-Term Liabilities accounts.

B) Capital Projects Fund and General Long-Term Liabilities accounts.

C) General Capital Assets and General Long-Term Liabilities accounts.

D) General Fund, and General Capital Assets and General Long-Term Liabilities accounts.

A) General Fund, Debt Service Fund and General Capital Assets and General Long-Term Liabilities accounts.

B) Capital Projects Fund and General Long-Term Liabilities accounts.

C) General Capital Assets and General Long-Term Liabilities accounts.

D) General Fund, and General Capital Assets and General Long-Term Liabilities accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

26

Jamestown has decided to enter into a capital lease for the purchase of its new recycling truck. The capitalizable cost of the capital asset is $175,000 and Jamestown made a $30,000 down payment at the inception of the lease agreement. The estimated useful life of the truck is ten years with $0 salvage value. Which of the following statements is false?

A) General Fund fund balance will be reduced by $175,000.

B) Other financing sources of $145,000 will be reported in Year 1.

C) Expenditures of $175,000 will be reported in Year 1.

D) Depreciation expense on the truck will be $17,500 per year.

A) General Fund fund balance will be reduced by $175,000.

B) Other financing sources of $145,000 will be reported in Year 1.

C) Expenditures of $175,000 will be reported in Year 1.

D) Depreciation expense on the truck will be $17,500 per year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

27

A government has a general government capital project underway. In the first year of the project, the government paid $75,000 for land to be used as a building site; signed a contract with a contractor for $8,000,000; was billed $4,500,000 by the contractor for work completed during the year; and paid the contractor $4,050,000. At the end of the first year, what amount of assets should be included in General Capital Assets accounts as a result of this activity?

A) $75,000.

B) $4,125,000.

C) $4,575,000.

D) $8,075,000.

A) $75,000.

B) $4,125,000.

C) $4,575,000.

D) $8,075,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

28

Assume that inspection services were performed by the General Fund department on a capital project that is being accounting for in a Capital Project Fund. The inspection is being charged to the project. The entry to record this transaction in the Capital Project Fund would be

A) Debit expenditures and credit due to General Fund.

B) Debit capital asset and credit due to General Fund.

C) Debit other financing uses and credit due to General Fund.

D) Debit expenditures and credit revenues.

A) Debit expenditures and credit due to General Fund.

B) Debit capital asset and credit due to General Fund.

C) Debit other financing uses and credit due to General Fund.

D) Debit expenditures and credit revenues.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

29

A bridge construction project, accounted for in a Capital Projects Fund, is in Year 2 of an anticipated three year construction period. In Year 1, costs of $300,000 were incurred. In Year 2, $1,530,000 of costs were incurred. What entry would be necessary in the General Capital Assets accounts for Year 2?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

30

Accumulated depreciation is not reported on which of the following financial statements?

A) Government-wide statement of net position.

B) General Fund balance sheet.

C) Enterprise Fund statement of net position.

D) Private-Purpose Trust Fund statement of fiduciary fund net position.

A) Government-wide statement of net position.

B) General Fund balance sheet.

C) Enterprise Fund statement of net position.

D) Private-Purpose Trust Fund statement of fiduciary fund net position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

31

Land was donated to a government for use in a general government activity. The land should be reported in

A) The General Fund at its acquisition value when donated.

B) The General Capital Assets accounts at the cost incurred by the donor to acquire the land originally.

C) The General Capital Assets accounts at the acquisition value of the land on the date it was donated to the government.

D) The Capital Projects Fund since it is not a depreciable asset.

A) The General Fund at its acquisition value when donated.

B) The General Capital Assets accounts at the cost incurred by the donor to acquire the land originally.

C) The General Capital Assets accounts at the acquisition value of the land on the date it was donated to the government.

D) The Capital Projects Fund since it is not a depreciable asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

32

A local government purchased land to be used for a new city hall to be built within the next five years. The purchase price was for the land's fair value, $1,500,000. The government financed the required $150,000 down payment by securing a short-term note with a local lending institution. The remaining $1,350,000 was financed by issuing certificates of participation. Costs incurred in issuing the certificates of participation totaled $60,000. The land should be capitalized in the General Capital Assets account in the amount of

A) $1,350,000.

B) $1,410,000.

C) $1,500,000.

D) $1,560,000.

A) $1,350,000.

B) $1,410,000.

C) $1,500,000.

D) $1,560,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

33

Heimbaugh County recently lost a lawsuit that it had been defending in court for two years relating to an incident involving one of the county's police officers. The county had always deemed a loss to be improbable. However, a judgment was ultimately rendered against the county and, immediately prior to the current fiscal year end, the county was ordered to pay a total of $300,000. $75,000 is due at year end but payment had not been completed. The remainder is to be paid in installments of $75,000 for an additional three years. How will the external financial statements of the county be affected in the year the court case was settled?

A) The General Fund statements should report both expenditures and a claims and judgments liability of $300,000.

B) The General Long-Term Liabilities accounts should report a $300,000 liability.

C) The General Fund statements should report expenditures and a current liability of $75,000 and the General Long-Term Liabilities accounts should report a liability of $225,000.

D) The General Fund statements should report a prior period adjustment for $75,000 and General Long-Term Liabilities liability of $225,000.

A) The General Fund statements should report both expenditures and a claims and judgments liability of $300,000.

B) The General Long-Term Liabilities accounts should report a $300,000 liability.

C) The General Fund statements should report expenditures and a current liability of $75,000 and the General Long-Term Liabilities accounts should report a liability of $225,000.

D) The General Fund statements should report a prior period adjustment for $75,000 and General Long-Term Liabilities liability of $225,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

34

The city's new tax collector foreclosed on a piece of land. The fair market value of the land at the time of foreclosure was $9,000. The taxpayer had acquired the property at a cost of $11,000. The past due taxes on the property totaled $4,000. The city plans to retain the land for its use. The land should be recorded in the General Capital Assets accounts in the amount of

A) $0.

B) $4,000.

C) $9,000.

D) $11,000.

A) $0.

B) $4,000.

C) $9,000.

D) $11,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

35

If a government issues bonds with a face value of $5,000,000 at a 2% discount and incurs $55,000 of issuance costs, the General Long-Term Liabilities accounts will report a liability of

A) $4,845,000.

B) $4,900,000.

C) $5,000,000.

D) $5,100,000.

A) $4,845,000.

B) $4,900,000.

C) $5,000,000.

D) $5,100,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

36

The Town of Nowhere purchased a new telecommunications system for the police department. The town entered into a capital lease to finance the system. In the year of acquisition, entries will be necessary in

A) The General Fund, Debt Service Fund, and General Capital Assets accounts.

B) The Debt Service Fund, the General Capital Assets accounts, and the General Long-Term Liabilities accounts.

C) The General Capital Assets accounts and the General Long-Term Liabilities accounts.

D) The General Fund, the General Capital Assets accounts, and the General Long-Term Liabilities accounts.

A) The General Fund, Debt Service Fund, and General Capital Assets accounts.

B) The Debt Service Fund, the General Capital Assets accounts, and the General Long-Term Liabilities accounts.

C) The General Capital Assets accounts and the General Long-Term Liabilities accounts.

D) The General Fund, the General Capital Assets accounts, and the General Long-Term Liabilities accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

37

Cash payments for compensated absences were $685,000 for the year. The current portion of the compensated absences liability decreased by $62,000 during the year, but the noncurrent portion of the liability increased by $32,000. How will the General Long-Term Liabilities accounts be affected?

A) Increase of $32,000.

B) Decrease of $30,000.

C) Decrease of $655,000.

D) Net decrease of $685,000.

A) Increase of $32,000.

B) Decrease of $30,000.

C) Decrease of $655,000.

D) Net decrease of $685,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

38

A local town received a donation of $300,000. The donor stipulated that the money be invested. The investment earnings are to be used to provide funding for the town's recreation programs but the principal is to remain intact. The town should record the $300,000 as

A) an other financing source in the General Fund.

B) an other financing source in a Permanent Fund.

C) a revenue in a Permanent Fund.

D) a Capital Contribution in a Permanent Fund.

A) an other financing source in the General Fund.

B) an other financing source in a Permanent Fund.

C) a revenue in a Permanent Fund.

D) a Capital Contribution in a Permanent Fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

39

A city receives a donation of land from one of its citizens to be used as a park. How should the donation be recognized by the government?

A) In the General Fund as a Special Item-Donation and in the General Capital Assets accounts.

B) In the General Fund an Other Financing Source-Donation and in the General Capital Assets accounts.

C) Only in the General Fund as Revenues-Other.

D) Only in the General Capital Assets accounts.

A) In the General Fund as a Special Item-Donation and in the General Capital Assets accounts.

B) In the General Fund an Other Financing Source-Donation and in the General Capital Assets accounts.

C) Only in the General Fund as Revenues-Other.

D) Only in the General Capital Assets accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

40

If a government forecloses on property because of unpaid taxes in the General Fund and retains it for general government use, which of the following funds and/or accounts would most likely be affected by the transaction?

A) General Fund only.

B) General Capital Assets accounts only.

C) General Fund and General Capital Assets accounts.

D) General Capital Assets and General Long-Term Liabilities accounts.

A) General Fund only.

B) General Capital Assets accounts only.

C) General Fund and General Capital Assets accounts.

D) General Capital Assets and General Long-Term Liabilities accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

41

The Village of Wisteria Lane purchased 10 new police cruisers on January 1 at a total cost of $240,000. An additional $60,000 is being spent to paint the village's name and logo and vehicle number on the vehicles and add necessary lighting and other equipment. The cruisers will have an anticipated useful life of six years with no salvage value. As of the end of the first fiscal year (December 31), the depreciation expense in the government-wide statement of activities should be

A) $0.

B) $40,000.

C) $50,000.

D) $60,000.

A) $0.

B) $40,000.

C) $50,000.

D) $60,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

42

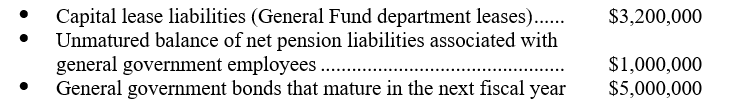

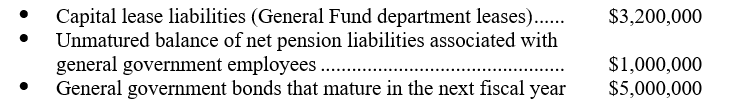

A government has the following debt:

What amount of debt should be reported in the General Long-Term Liabilities accounts?

A) $1,000,000.

B) $3,200,000.

C) $4,200,000.

D) $9,200,000.

What amount of debt should be reported in the General Long-Term Liabilities accounts?

A) $1,000,000.

B) $3,200,000.

C) $4,200,000.

D) $9,200,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which of the following accounts would not be included in a government's General Capital Assets accounts?

A) Infrastructure.

B) Accumulated depreciation.

C) Unrestricted net position.

D) Net investment in capital assets.

A) Infrastructure.

B) Accumulated depreciation.

C) Unrestricted net position.

D) Net investment in capital assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

44

Mountain City received insurance proceeds of $35,000 in the General Fund for water and smoke damage that occurred at City Hall. What journal entry best describes the accounting treatment in the General Fund for the receipt of these funds?

A) Debit cash and credit revenues.

B) Debit cash and credit other financing sources.

C) Debit cash and credit expenditures.

D) Debit cash and credit other financing uses.

A) Debit cash and credit revenues.

B) Debit cash and credit other financing sources.

C) Debit cash and credit expenditures.

D) Debit cash and credit other financing uses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

45

A government establishes a Permanent Fund to account for a donation. The earnings from the donation are to be used to purchase books for the library but the donated amount must be maintained intact. How should the donation be reported in the Permanent Fund statement of revenues, expenditures and changes in fund balance?

A) Special Item.

B) Revenue.

C) Other financing source.

D) Capital contribution.

A) Special Item.

B) Revenue.

C) Other financing source.

D) Capital contribution.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

46

A government has the following general government capital assets:

What is the minimum amount of general capital assets the government may report under GAAP?

A) $42,000

B) $41,000

C) $25,000

D) $24,000

What is the minimum amount of general capital assets the government may report under GAAP?

A) $42,000

B) $41,000

C) $25,000

D) $24,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

47

A general government department of a county government contributed a capital asset with an original cost of $40,000 and accumulated depreciation of $15,000 to one of the county's proprietary funds. The proprietary fund would record the transaction as a

A) Debit to capital assets of $40,000 and a credit to revenue.

B) Debit to capital assets of $25,000 and a credit to capital contribution.

C) Debit to capital assets of $25,000 and a credit to revenue.

D) Debit to capital assets of $40,000, and credits to accumulated depreciation and capital contribution for $15,000 and $25,000, respectively.

A) Debit to capital assets of $40,000 and a credit to revenue.

B) Debit to capital assets of $25,000 and a credit to capital contribution.

C) Debit to capital assets of $25,000 and a credit to revenue.

D) Debit to capital assets of $40,000, and credits to accumulated depreciation and capital contribution for $15,000 and $25,000, respectively.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

48

If the governing body contributes $65,000 from the General Fund to a Debt Service Fund, the General Fund statements should report

A) A debt service expenditure of $65,000.

B) An other financing use of $65,000.

C) A capital contribution of $65,000.

D) A reimbursement of $65,000.

A) A debt service expenditure of $65,000.

B) An other financing use of $65,000.

C) A capital contribution of $65,000.

D) A reimbursement of $65,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

49

An enterprise fund in Bobby County donated a vehicle that had an original cost of $50,000 to one of the County's general government departments. The net book value of the vehicle as of the date of donation was $15,000. The enterprise fund would record the transaction as a

A) Debits to transfer out of $15,000 and to accumulated depreciation of $35,000, and credit to capital assets of $50,000

B) Debit to transfer out of $15,000 and credit to capital assets of $15,000

C) Debits to nonoperating expense of $15,000 and to accumulated depreciation of $35,000, and credit to capital assets of $50,000

D) Debit to capital contribution of $15,000 and credit to capital assets of $15,000

A) Debits to transfer out of $15,000 and to accumulated depreciation of $35,000, and credit to capital assets of $50,000

B) Debit to transfer out of $15,000 and credit to capital assets of $15,000

C) Debits to nonoperating expense of $15,000 and to accumulated depreciation of $35,000, and credit to capital assets of $50,000

D) Debit to capital contribution of $15,000 and credit to capital assets of $15,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which of the following accounts would not be included in a government's General Capital Assets accounts?

A) Assets acquired under capital leases.

B) Internal Service Fund equipment.

C) Infrastructure.

D) Accumulated depreciation.

A) Assets acquired under capital leases.

B) Internal Service Fund equipment.

C) Infrastructure.

D) Accumulated depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck