Deck 6: Expenditure Accountinggovernmental Funds

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

Match between columns

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/39

العب

ملء الشاشة (f)

Deck 6: Expenditure Accountinggovernmental Funds

1

A city government purchased a new fire truck in Year 1 for $270,000. The city incurred an additional $30,000 in transportation and calibration costs to ready it for use. It has an estimated useful life of 20 years, though it is being financed over a 15 year period. The amount of depreciation that will be reported each year in the General Fund will be

A) $0.

B) $13,500.

C) $15,000.

D) $18,000.

A) $0.

B) $13,500.

C) $15,000.

D) $18,000.

A

2

The General Fund reported a beginning balance of inventory of materials and supplies of $122,000. The ending balance was $150,000. Supplies purchased during the year totaled $600,000. The county uses the consumption method. The General Fund should report expenditures for materials and supplies for the year of

A) $450,000.

B) $572,000.

C) $600,000.

D) $628,000.

A) $450,000.

B) $572,000.

C) $600,000.

D) $628,000.

B

3

Listed below are various transactions affecting the City of Highland Flats General Fund for the fiscal year ending June 30, 20X4.

Transactions:

1. Near the beginning of the year, the City was sued by one of its residents claiming that the resident was injured due to a hazardous sidewalk. The resident is asking for damages of $500,000. The City expects to win the case.

2. Later in the year, the City decided to settle the aforementioned lawsuit on the advice of its legal counsel. The government settled the suit for $300,000, paying $100,000 now, and $50,000 on August 1 for each of the next 4 years. For these types of lawsuits, the City is self-insured for the first $50,000 and 100% insured for the remaining payments. Because of a cash flow issue, the city borrowed $50,000 on a 6 month, 3% note that comes due 2 months after year end. No money was received from the insurance company by year end, but the total amount due was expected by August 15.

3. The city's employees earned $25,000 in compensated absences during the year. Of this amount, $10,000 was paid during the year, and another $7,500 is due and payable in the first 45 days of the following year. In addition, $5,000 due at the end of previous year was paid in the current year. Finally, $7,000 earned in earlier years became due and payable and was paid this year.

4. The City's OPEB Plan's net OPEB liability, none of which is due and payable, increased $15,000 during the year. $5,000-the approximate amount of retiree healthcare costs paid for the year-was paid to the plan.

Requirements:

1. Prepare the journal entries for the above events, including any necessary year-end adjusting entries. If a transaction requires no entry, state "No entry required" and explain why.

2. Demonstrate the effects of these transactions on the accounting equation for the General Fund and the General Capital Assets and General Long-term Liabilities accounts.

Transactions:

1. Near the beginning of the year, the City was sued by one of its residents claiming that the resident was injured due to a hazardous sidewalk. The resident is asking for damages of $500,000. The City expects to win the case.

2. Later in the year, the City decided to settle the aforementioned lawsuit on the advice of its legal counsel. The government settled the suit for $300,000, paying $100,000 now, and $50,000 on August 1 for each of the next 4 years. For these types of lawsuits, the City is self-insured for the first $50,000 and 100% insured for the remaining payments. Because of a cash flow issue, the city borrowed $50,000 on a 6 month, 3% note that comes due 2 months after year end. No money was received from the insurance company by year end, but the total amount due was expected by August 15.

3. The city's employees earned $25,000 in compensated absences during the year. Of this amount, $10,000 was paid during the year, and another $7,500 is due and payable in the first 45 days of the following year. In addition, $5,000 due at the end of previous year was paid in the current year. Finally, $7,000 earned in earlier years became due and payable and was paid this year.

4. The City's OPEB Plan's net OPEB liability, none of which is due and payable, increased $15,000 during the year. $5,000-the approximate amount of retiree healthcare costs paid for the year-was paid to the plan.

Requirements:

1. Prepare the journal entries for the above events, including any necessary year-end adjusting entries. If a transaction requires no entry, state "No entry required" and explain why.

2. Demonstrate the effects of these transactions on the accounting equation for the General Fund and the General Capital Assets and General Long-term Liabilities accounts.

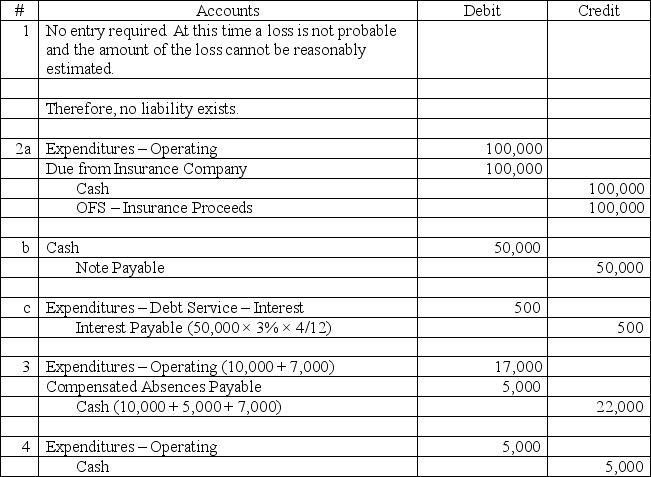

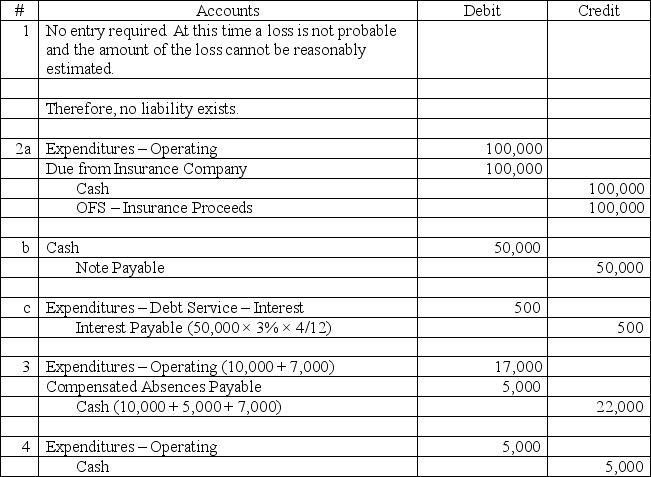

"1. Journal entries:

"

"

"2. Effects on accounting equations for the General Fund (Deferred Outflows and Deferred Inflows have been excluded since all are no effect) and the General Capital Assets and General Long-Term Liabilities accounts.

"

"

""2. Effects on accounting equations for the General Fund (Deferred Outflows and Deferred Inflows have been excluded since all are no effect) and the General Capital Assets and General Long-Term Liabilities accounts.

"

4

Assume that the Village of Hannah uses the purchases method of inventory accounting. At the end of the year, the inventory levels have increased. What entry would be made to reflect the inventory increase?

A) Debit Expenditures, Credit Inventory of Supplies.

B) Debit Inventory of Supplies, Credit Other Financing Sources.

C) Debit Expenditures, Credit Other Financing Sources.

D) Debit Inventory of Supplies, Credit Expenditures.

A) Debit Expenditures, Credit Inventory of Supplies.

B) Debit Inventory of Supplies, Credit Other Financing Sources.

C) Debit Expenditures, Credit Other Financing Sources.

D) Debit Inventory of Supplies, Credit Expenditures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

5

The purchases method of accounting is permitted for

A) Materials and supplies, but not for prepaid insurance.

B) Prepaid insurance, but not for materials and supplies.

C) Neither prepaid insurance nor materials and supplies.

D) Both prepaid insurance and materials and supplies.

A) Materials and supplies, but not for prepaid insurance.

B) Prepaid insurance, but not for materials and supplies.

C) Neither prepaid insurance nor materials and supplies.

D) Both prepaid insurance and materials and supplies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

6

Expenditures in a governmental fund are recognized when due for

A) Interest on general long-term debt.

B) Salaries and wages.

C) Capital outlay.

D) Rent.

A) Interest on general long-term debt.

B) Salaries and wages.

C) Capital outlay.

D) Rent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which of the following governmental fund expenditures would not be considered a current operating expenditure?

A) Capital outlay.

B) Rent.

C) Salaries and wages.

D) Employee benefits.

A) Capital outlay.

B) Rent.

C) Salaries and wages.

D) Employee benefits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following is a typical governmental fund liability, and thus not an expenditure that is recognized when the liability is incurred?

A) Accounts payable.

B) Long-term note payable.

C) Salaries payable.

D) Rent payable.

A) Accounts payable.

B) Long-term note payable.

C) Salaries payable.

D) Rent payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

9

If a government uses a perpetual inventory system for its General Fund and there is an inventory overage at the end of the year, the inventory asset account should

A) Be increased and the expenditure account decreased.

B) Be decreased and the expenditure account increased.

C) Remain the same. The expenditure account will be decreased, offset by an allowance for inventory overage account.

D) Remain the same. The expenditure account will be increased, offset by an allowance for inventory overage account.

A) Be increased and the expenditure account decreased.

B) Be decreased and the expenditure account increased.

C) Remain the same. The expenditure account will be decreased, offset by an allowance for inventory overage account.

D) Remain the same. The expenditure account will be increased, offset by an allowance for inventory overage account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

10

Assume that General Fund employees accrued $125,000 of compensated absences liability during the year. Compensated absences liability, which is considered to be a long-term liability, decreased $30,000 from the beginning of the year to the end of the year. The fund also actually paid $550,000 in salaries and wages during the year. At the end of the fiscal year, salaries and wages payable was $12,000. The General Fund would report salaries and wages expenditures for the year of

A) $532,000.

B) $550,000.

C) $562,000.

D) $592,000.

A) $532,000.

B) $550,000.

C) $562,000.

D) $592,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

11

The General Fund reported a beginning balance of inventory of materials and supplies of $122,000. The ending balance was $150,000. Supplies received during the year (purchases) totaled $600,000. The county uses the purchases method. The General Fund should report expenditures for materials and supplies for the year of

A) $450,000.

B) $572,000.

C) $600,000.

D) $628,000.

A) $450,000.

B) $572,000.

C) $600,000.

D) $628,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

12

A government with a beginning inventory of supplies of $100 in its General Fund and had the following transactions during the year (all amounts are in thousands).

Transactions:

1. Ordered supplies with an estimated cost of $3,150.

2. Received supplies with an actual invoice cost of $2,920. No payment was made upon receipt; $2,950 was the encumbered amount.

3. Paid $2,300 on account for supplies received in #2.

4. During the year, the inventory warehouse issued $2,900 in supplies to general government departments.

5. The ending physical inventory of General Fund supplies found $150 on hand at year end.

Requirements:

A. Consumption method of accounting for inventory

1. Prepare the general journal entries required to account for the previous information.

2. Indicate the effects of the general journal entries on the Balance Sheet equation.

3. Indicate amounts reported on Balance Sheet and Statement of Revenues, Expenditures, and Changes in Fund Balance with respect to the Inventory of Supplies.

B. Purchases method of accounting for inventory

1. Prepare the general journal entries required to account for the previous information.

2. Indicate the effects of the general journal entries on the Balance Sheet equation.

3. Indicate amounts reported on Balance Sheet and Statement of Revenues, Expenditures, and Changes in Fund Balance with respect to the Inventory of Supplies.

Transactions:

1. Ordered supplies with an estimated cost of $3,150.

2. Received supplies with an actual invoice cost of $2,920. No payment was made upon receipt; $2,950 was the encumbered amount.

3. Paid $2,300 on account for supplies received in #2.

4. During the year, the inventory warehouse issued $2,900 in supplies to general government departments.

5. The ending physical inventory of General Fund supplies found $150 on hand at year end.

Requirements:

A. Consumption method of accounting for inventory

1. Prepare the general journal entries required to account for the previous information.

2. Indicate the effects of the general journal entries on the Balance Sheet equation.

3. Indicate amounts reported on Balance Sheet and Statement of Revenues, Expenditures, and Changes in Fund Balance with respect to the Inventory of Supplies.

B. Purchases method of accounting for inventory

1. Prepare the general journal entries required to account for the previous information.

2. Indicate the effects of the general journal entries on the Balance Sheet equation.

3. Indicate amounts reported on Balance Sheet and Statement of Revenues, Expenditures, and Changes in Fund Balance with respect to the Inventory of Supplies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

13

Rutherford County uses the consumption method to account for General Fund materials and supplies. The beginning inventory of materials and supplies was $122,000. The ending inventory was $150,000. The beginning balance of reserve for encumbrances (for supplies ordered but not received at the beginning of the year) was $50,000; the ending balance was $20,000. Supplies purchased during the year totaled $750,000. The county General Fund should report expenditures for materials and supplies for the year of

A) $722,000.

B) $750,000.

C) $752,000.

D) $780,000.

A) $722,000.

B) $750,000.

C) $752,000.

D) $780,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

14

The minimum amount of detail permitted by GAAP for governmental fund expenditure classifications in the basic financial statements is by

A) Fund.

B) Function (or program).

C) Fund and function (or program).

D) Fund, function (or program), organizational unit, and activity.

A) Fund.

B) Function (or program).

C) Fund and function (or program).

D) Fund, function (or program), organizational unit, and activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

15

The village of Bear Creek uses General Fund resources to pay debt service payments for its sole outstanding general obligation bonds, which were issued to finance the new Village Hall. Which of the following statements is false?

A) GAAP require the village to use a Debt Service Fund to account for the payment of principal and interest on the long-term debt if the debt covenant calls for it.

B) GAAP permit but do not require the village to use a Debt Service Fund to account for the payment of principal and interest on the long-term debt.

C) The General Fund would record an expenditure for both the principal and interest portions of the debt service payment.

D) The General Fund may record an expenditure for only the interest portion of the debt service payment.

A) GAAP require the village to use a Debt Service Fund to account for the payment of principal and interest on the long-term debt if the debt covenant calls for it.

B) GAAP permit but do not require the village to use a Debt Service Fund to account for the payment of principal and interest on the long-term debt.

C) The General Fund would record an expenditure for both the principal and interest portions of the debt service payment.

D) The General Fund may record an expenditure for only the interest portion of the debt service payment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

16

Assume that a government purchases $85,000 of inventory for the General Fund during the year. The General Fund began the year with an inventory balance of $15,000 and ended the year with a balance of $35,000. The General Fund uses the consumption method of inventory accounting and a perpetual inventory system. The General Fund should report

A) Expenditures of $85,000 for the year.

B) Expenditures of $65,000 for the year.

C) Other financing source of $20,000 for the year.

D) Other financing use of $20,000 for the year.

A) Expenditures of $85,000 for the year.

B) Expenditures of $65,000 for the year.

C) Other financing source of $20,000 for the year.

D) Other financing use of $20,000 for the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of the following is not a managerial problem associated with expenditures?

A) Misapplication of assets.

B) Overspending of appropriations.

C) Misapplication of the availability criterion.

D) Misallocation or poor allotments of appropriations.

A) Misapplication of assets.

B) Overspending of appropriations.

C) Misapplication of the availability criterion.

D) Misallocation or poor allotments of appropriations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

18

A general government department of the City of Rocky Flats leased specialized equipment under a multi-year, noncancelable lease agreement that qualifies as a capital lease. The lease required a down payment of $500 and the present value of the minimum lease payments (i.e., the capitalizable cost of the leased asset) was $5,000. The implicit rate of interest on the lease is 10%. Subsequent lease payments of $750 are required annually beginning in 20X2. All amounts are in thousands of dollars.

Transactions:

1. The lease was signed on March 1, 20X1.

2. Prepare any adjusting entries required at December 31, 20X1, the end of Rocky Flats fiscal year.

3. The City made the required payment on February 28, 20X2.

Requirements:

1. Prepare the general ledger journal entries for the transactions for the General Fund. If no entry is required, do not leave it blank. State "No Entry Required" and briefly explain why.

2. Indicate the effects of the transaction on the accounting equations for the General Fund and the General Capital Assets and General Long-Term Liabilities accounts. Do not leave a cell blank.

3. How will the capital lease be reported on the General Fund financial statements for the year ended December 31, 20X1?

Transactions:

1. The lease was signed on March 1, 20X1.

2. Prepare any adjusting entries required at December 31, 20X1, the end of Rocky Flats fiscal year.

3. The City made the required payment on February 28, 20X2.

Requirements:

1. Prepare the general ledger journal entries for the transactions for the General Fund. If no entry is required, do not leave it blank. State "No Entry Required" and briefly explain why.

2. Indicate the effects of the transaction on the accounting equations for the General Fund and the General Capital Assets and General Long-Term Liabilities accounts. Do not leave a cell blank.

3. How will the capital lease be reported on the General Fund financial statements for the year ended December 31, 20X1?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

19

Expenditures are defined as

A) Costs expired.

B) Uses of current financial resources other than for capital asset purchases and transfers.

C) Decreases in net current financial resources other than from specified transactions.

D) Changes in liabilities and deferred inflows.

A) Costs expired.

B) Uses of current financial resources other than for capital asset purchases and transfers.

C) Decreases in net current financial resources other than from specified transactions.

D) Changes in liabilities and deferred inflows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

20

City of Alnwick makes pension contributions on behalf of its employees to both a defined benefit plan and a defined contribution plan. Assume that the employer contributions for the fiscal year totaled $55,000 for the defined benefit plan and $35,000 for the defined contribution plan. The net pension liability grew by $70,000 during the fiscal year. None of the liability was due and payable either at the beginning of the year or at the end of the year. The General Fund will report

A) Total expenditures of $90,000.

B) Expenditures of $55,000 and transfers out of $35,000.

C) Transfers out of $90,000.

D) Transfers out of $55,000 and expenditures of $35,000.

A) Total expenditures of $90,000.

B) Expenditures of $55,000 and transfers out of $35,000.

C) Transfers out of $90,000.

D) Transfers out of $55,000 and expenditures of $35,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

21

Interest expenditures of a governmental fund should include

A) Interest paid during the year, only.

B) Interest paid during the year plus any interest that matured but was not paid during the year.

C) Interest paid during the year, any interest that matured but was not paid during the year, and accrued interest on short-term debt recorded as a fund liability.

D) Interest paid during the year, any interest that matured but was not paid during the year, and accrued interest on all general long-term liabilities.

A) Interest paid during the year, only.

B) Interest paid during the year plus any interest that matured but was not paid during the year.

C) Interest paid during the year, any interest that matured but was not paid during the year, and accrued interest on short-term debt recorded as a fund liability.

D) Interest paid during the year, any interest that matured but was not paid during the year, and accrued interest on all general long-term liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

22

A county uses the consumption method in accounting for insurance premium prepayments. At the beginning of the fiscal year, the county paid a $24,000 insurance premium to cover the current year and the subsequent fiscal year. At the end of the current year, the county will report in its General Fund

A) Expenditures of $24,000.

B) Expenditures of $12,000 and a $12,000 prepaid asset.

C) A $24,000 prepaid asset.

D) Other financing use of $24,000.

A) Expenditures of $24,000.

B) Expenditures of $12,000 and a $12,000 prepaid asset.

C) A $24,000 prepaid asset.

D) Other financing use of $24,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

23

A city does not choose to advance fund its OPEB plan but instead will continue to pay these postretirement benefits as they come due. The current year's benefit payments total $2,500. The total OPEB liability increased from $14,000 to $16,500 during the year. The General Fund would recognize an expenditure of

A) $0.

B) $2,500.

C) $14,000.

D) $16,500.

A) $0.

B) $2,500.

C) $14,000.

D) $16,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

24

A county accounts for its debt service payments in the General Fund. The amount of unmatured, unpaid interest on general long-term liabilities at the beginning of the year was $122,000. The ending balance was $165,000. The General Fund also made principal payments of $600,000 and interest payments of $150,000 during the year. The General Fund should report expenditures for debt service for the year of

A) $150,000.

B) $722,000.

C) $750,000.

D) $793,000.

A) $150,000.

B) $722,000.

C) $750,000.

D) $793,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

25

Nathan Township financed emergency repairs on the Township Hall by borrowing on a $200,000, 6-month short-term note. The interest rate on the note was 6% and it was issued 2 months prior to the end of the fiscal year. Which of the following statements accurately reflects how the General Fund will be affected in the year the financing was acquired?

A) The General Fund will report an other financing source of $200,000.

B) The General Fund will report a Note Payable of $200,000.

C) The General Fund will report interest expenditures of $12,000.

D) The General Fund will report interest expense of $4,000.

A) The General Fund will report an other financing source of $200,000.

B) The General Fund will report a Note Payable of $200,000.

C) The General Fund will report interest expenditures of $12,000.

D) The General Fund will report interest expense of $4,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

26

A city entered into a general government capital lease for equipment on July 1, 20X7. The capitalizable cost of the equipment was $400,000. A down payment of $40,000 was made. The next lease payment of $100,000 is due July 1, 20X8. The implicit rate of interest on the lease agreement is 10%. The amount of expenditures that the city should report in its General Fund statement of revenues, expenditures, and changes in fund balance for the year ended December 31, 20X7 is

A) $40,000.

B) $58,000.

C) $400,000.

D) $418,000.

A) $40,000.

B) $58,000.

C) $400,000.

D) $418,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

27

Clinch River Authority has a defined contribution pension plan. How should the Authority report its General Fund contributions to the pension plan in its financial statements?

A) As expenses.

B) As transfers out.

C) As expenditures.

D) As other financing uses.

A) As expenses.

B) As transfers out.

C) As expenditures.

D) As other financing uses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

28

A government has claims and judgments outstanding at the beginning of 20X5 of $1,000,000. These claims and judgments are expected to result in awards against the government of $800,000. $75,000 of these claims were due and payable from the General Fund at December 31, 20X4. At the end of 20X5, the government has claims and judgments outstanding of $2,000,000. These claims and judgments are expected to result in awards against the government of $1,200,000. None of these claims is due and payable from the General Fund at December 31, 20X5. The government paid claims and judgments of $400,000 during 20X5. General Fund expenditures for claims and judgments for 20X5 should be reported at what amount?

A) $325,000.

B) $400,000.

C) $725,000.

D) $800,000.

A) $325,000.

B) $400,000.

C) $725,000.

D) $800,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

29

A government has a principal and interest payment on long-term debt coming due in the next fiscal year. Which condition must hold true for the government to treat the payment as an expenditure in the current fiscal year?

A) The payment must come due in the first month of the next fiscal year, and the government must transfer the cash for the payment to the debt service fund consistently from year-to-year.

B) The payment comes due in the first 60 days of the next fiscal year, and the government must transfer the cash for the payment to the debt service fund consistently from year-to-year.

C) The payment must come due in the first 60 days of the next fiscal year, but the government has some flexibility on when the cash for the payment is transferred to the debt service fund.

D) The payment can come due at any time, and the government can make the payments from the General Fund so long as the resources are available at the time of the payment.

A) The payment must come due in the first month of the next fiscal year, and the government must transfer the cash for the payment to the debt service fund consistently from year-to-year.

B) The payment comes due in the first 60 days of the next fiscal year, and the government must transfer the cash for the payment to the debt service fund consistently from year-to-year.

C) The payment must come due in the first 60 days of the next fiscal year, but the government has some flexibility on when the cash for the payment is transferred to the debt service fund.

D) The payment can come due at any time, and the government can make the payments from the General Fund so long as the resources are available at the time of the payment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

30

As payments are being made for debt service payments related to a capital lease, a General Fund will report

A) An increase in capital assets equal to the amount of principal retired.

B) Expenditures for interest only.

C) Expenditures for principal reduction only.

D) Expenditures for the full amount of the debt service payment.

A) An increase in capital assets equal to the amount of principal retired.

B) Expenditures for interest only.

C) Expenditures for principal reduction only.

D) Expenditures for the full amount of the debt service payment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

31

The following benefits are examples of other postemployment benefits (OPEB) except for

A) Health care insurance.

B) Pension benefits.

C) Vision insurance.

D) Life insurance.

A) Health care insurance.

B) Pension benefits.

C) Vision insurance.

D) Life insurance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

32

A government entered into a general government capital lease for equipment during the year. The capitalizable cost of the equipment was $400,000. A down payment of $40,000 was made. The General Fund should report in its statement of revenues, expenditures, and changes in fund balance an

A) Other financing use of $400,000.

B) Expenditure of $360,000.

C) Other financing source of $400,000.

D) Other financing source of $360,000.

A) Other financing use of $400,000.

B) Expenditure of $360,000.

C) Other financing source of $400,000.

D) Other financing source of $360,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

33

Assume that Onyx County $10,000 to its OPEB plan for the current year. The net OPEB liability, none of which is due and payable at year end, increase from $25,000 to $45,000 during the year. The General Fund, which is the only fund with employees, would recognize expenditures in the current year of

A) $45,000.

B) $35,000.

C) $25,000.

D) $10,000.

A) $45,000.

B) $35,000.

C) $25,000.

D) $10,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

34

In the year a city enters into a capital lease to finance a new sanitation truck, the General Fund will report

A) An increase in capital assets.

B) A decrease in fund balance equal to the cost of the new sanitation truck.

C) An other financing use.

D) A decrease in fund balance equal to the amount of any down payment required.

A) An increase in capital assets.

B) A decrease in fund balance equal to the cost of the new sanitation truck.

C) An other financing use.

D) A decrease in fund balance equal to the amount of any down payment required.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

35

The General Fund borrowed $10,000 on a six-month note, with 5% interest, on April 1. As of the June 30 fiscal year end, the General Fund would report accrued interest payable in the amount of

A) $0.

B) $125.

C) $250.

D) $500.

A) $0.

B) $125.

C) $250.

D) $500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

36

Carter County entered into a capital lease to finance an Emergency-911 telecommunications system. The capitalizable cost of the equipment was $185,000. The county made a required down payment of $25,000. The first debt service payment will not be due until the next fiscal year. The entry to record the inception of this lease in the General Fund would be

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

37

A government has a liability for accrued compensated absences at the beginning of 20X5 of $500,000. This liability did not mature in 20X4. At the end of 20X5, the government has a liability for accrued compensated absences (not due and payable) of $600,000. In addition, the government had $10,000 of matured compensated absences to be paid in early 20X6 from existing fund assets. The government paid compensated absences of $400,000 during 20X5. The General Fund expenditures for compensated absences for 20X5 should be reported at what amount?

A) $400,000.

B) $410,000.

C) $500,000.

D) $510,000.

A) $400,000.

B) $410,000.

C) $500,000.

D) $510,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

38

A court judgment was rendered against a county in which they were ordered to pay $500,000 in equal installments over a five-year period to the plaintiff. The county's General Fund will

A) Report a fund liability of $500,000 in Year 1.

B) Report expenditures of $500,000 in Year 1.

C) Report expenditures of $100,000 in Year 1.

D) Report expenditures of $100,000 in Year 1 and a fund liability of $400,000.

A) Report a fund liability of $500,000 in Year 1.

B) Report expenditures of $500,000 in Year 1.

C) Report expenditures of $100,000 in Year 1.

D) Report expenditures of $100,000 in Year 1 and a fund liability of $400,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

39

Match between columns

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck