Deck 4: Time Value of Money

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/89

العب

ملء الشاشة (f)

Deck 4: Time Value of Money

1

All else equal, a dollar received sooner is worth more than a dollar received at some later date, because the sooner the dollar is received the more quickly it can be invested to earn a positive return.

True

2

The effective annual rate is always greater than the simple rate as a result of compounding effects.

False

3

When a loan is amortized, the largest portion of the periodic payment goes to reduce principal in the early years of the loan such that the accumulated interest can be spread out over the life of the loan.

False

4

Compounding is the process of converting today's values, which are termed present value, to future value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

5

The difference between the PV of an annuity due and the PV of an ordinary annuity is that each of the payments of the annuity due is discounted by one more year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

6

Because we usually assume positive interest rates in time value analyses, the present value of a three-year annuity will always be less than the future value of a single lump sum, if the sum of the annuity payments equals the original lump sum investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

7

The greater the number of compounding periods within a year, the greater the future value of a lump sum invested initially, and the greater the present value of a given lump sum to be received at maturity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

8

Cash flow time lines are used primarily for decisions involving paying off debt or investing in financial securities.

They cannot be used when making decisions about investments in physical assets.

They cannot be used when making decisions about investments in physical assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

9

Suppose an investor can earn a steady 5% annually with investment A, while investment B will yield a constant 12% annually.Within 11 years time, the compounded value of investment B will be more than twice the compounded value of investment A (ignore risk).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

10

The coupon rate is the rate of return you could earn on alternative investments of similar risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

11

Solving for the interest rate associated with a stream of uneven cash flows, without the use of a calculator, usually involves a trial and error process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

12

One of the potential benefits of investing early for retirement is that an investor can receive greater benefits from the compounding of interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

13

The effective annual rate is less than the simple rate when we have monthly compounding.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

14

An annuity is a series of equal payments made at fixed equal-length intervals for a specified number of periods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

15

Given some amount to be received several years in the future, if the interest rate increases, the present value of the future amount will

A)Be higher.

B)Be lower.

C)Stay the same.

D)Cannot tell.

E)Be variable.

A)Be higher.

B)Be lower.

C)Stay the same.

D)Cannot tell.

E)Be variable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

16

A perpetuity is an annuity with perpetual payments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

17

An amortized loan is a loan that requires equal payments over its life; its payments include both interest and repayment of the debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

18

Of all the techniques used in finance, the least important is the concept of the time value of money.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

19

The difference between an ordinary annuity and an annuity due is that each of the payments of the annuity due earns interest for one additional year (period).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

20

You have determined the profitability of a planned project by finding the present value of all the cash flows form that project.Which of the following would cause the project to look more appealing in terms of the present value of those cash flows?

A)The discount rate decreases.

B)The cash flows are extended over a longer period of time, but the total amount of the cash flows remains the same.

C)The discount rate increases.

D)Answers b and c above.

E)Answers a and b above.

A)The discount rate decreases.

B)The cash flows are extended over a longer period of time, but the total amount of the cash flows remains the same.

C)The discount rate increases.

D)Answers b and c above.

E)Answers a and b above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

21

By definition, what type of annuity best describes payments such as rent and magazine subscriptions (assuming the costs do not change over time)?

A)ordinary annuity

B)annuity due

C)nonconstant annuity

D)annuity in arrears

A)ordinary annuity

B)annuity due

C)nonconstant annuity

D)annuity in arrears

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

22

What is the effective annual return (EAR) for an investment that pays 10 percent compounded annually?

A)equal to 10 percent

B)greater than 10 percent

C)less than 10 percent

D)This question cannot be answered without knowing the dollar amount of the investment.

E)None of the above is correct.

A)equal to 10 percent

B)greater than 10 percent

C)less than 10 percent

D)This question cannot be answered without knowing the dollar amount of the investment.

E)None of the above is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following statements is correct?

A)For all positive values of r and n, FVIFr, n ≥ 1.0 and PVIFAr, n ≥ n.

B)You may use the PVIF tables to find the present value of an uneven series of payments.However, the PVIFA tables can never be of use, even if some of the payments constitute an annuity (for example, $100 each year for Years 3, 4, and 5), because the entire series does not constitute an annuity.

C)If a bank uses quarterly compounding for saving accounts, the simple rate will be greater than the effective annual rate.

D)The present value of a future sum decreases as either the simple interest rate or the number of discount periods per year increases.

E)All of the above statements are false.

A)For all positive values of r and n, FVIFr, n ≥ 1.0 and PVIFAr, n ≥ n.

B)You may use the PVIF tables to find the present value of an uneven series of payments.However, the PVIFA tables can never be of use, even if some of the payments constitute an annuity (for example, $100 each year for Years 3, 4, and 5), because the entire series does not constitute an annuity.

C)If a bank uses quarterly compounding for saving accounts, the simple rate will be greater than the effective annual rate.

D)The present value of a future sum decreases as either the simple interest rate or the number of discount periods per year increases.

E)All of the above statements are false.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

24

What is the term used to describe an annuity with an infinite life?

A)perpetuity

B)infinuity

C)infinity due

D)There is no special term for an infinite annuity.

A)perpetuity

B)infinuity

C)infinity due

D)There is no special term for an infinite annuity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

25

All else equal, the future value of a lump-sum amount invested today will increase if the

A)interest rate that is earned is lowered.

B)number of compounding periods is increased.

C)investment time period is shortened.

D)amount initially invested is lowered.

E)Two or more of the above answers are correct.

A)interest rate that is earned is lowered.

B)number of compounding periods is increased.

C)investment time period is shortened.

D)amount initially invested is lowered.

E)Two or more of the above answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

26

Suppose that the present value of receiving a guaranteed $450 in two years is $385.80.The opportunity rate of return on similar risk investments is 8 percent.According to this information, all else equal, which of the following statements is correct?

A)It always would be preferable to wait two years to receive the $450 because this value is greater than the present value.

B)Risk averse investors always would prefer to take the $385.80 today because it is a guaranteed amount whereas there is uncertainty as to whether the future amount will be paid.

C)No investor should be willing to pay more than $385.80 for such an investment.

D)It is apparent the present value was computed incorrectly because the present value of a future amount always should be greater than the future value.

E)None of the above is a correct answer.

A)It always would be preferable to wait two years to receive the $450 because this value is greater than the present value.

B)Risk averse investors always would prefer to take the $385.80 today because it is a guaranteed amount whereas there is uncertainty as to whether the future amount will be paid.

C)No investor should be willing to pay more than $385.80 for such an investment.

D)It is apparent the present value was computed incorrectly because the present value of a future amount always should be greater than the future value.

E)None of the above is a correct answer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which of the following statements is most correct?

A)If annual compounding is used, the effective annual rate equals the simple rate.

B)If annual compounding is used, the effective annual rate equals the periodic rate.

C)If a loan has a 12 percent simple rate with semiannual compounding, its effective annual rate is equal to 11.66 percent.

D)Both answers a and b are correct.

E)Both answers a and c are correct.

A)If annual compounding is used, the effective annual rate equals the simple rate.

B)If annual compounding is used, the effective annual rate equals the periodic rate.

C)If a loan has a 12 percent simple rate with semiannual compounding, its effective annual rate is equal to 11.66 percent.

D)Both answers a and b are correct.

E)Both answers a and c are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

28

Suppose someone offered you your choice of two equally risky annuities, each paying $5,000 per year for 5 years. One is an annuity due, while the other is a regular (or deferred) annuity.If you are a rational wealth-maximizing investor which annuity would you choose?

A)The annuity due.

B)The deferred annuity.

C)Either one, because as the problem is set up, they have the same present value.

D)Without information about the appropriate interest rate, we cannot find the values of the two annuities, hence we cannot tell which is better.

E)The annuity due; however, if the payments on both were doubled to $10,000, the deferred annuity would be preferred.

A)The annuity due.

B)The deferred annuity.

C)Either one, because as the problem is set up, they have the same present value.

D)Without information about the appropriate interest rate, we cannot find the values of the two annuities, hence we cannot tell which is better.

E)The annuity due; however, if the payments on both were doubled to $10,000, the deferred annuity would be preferred.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

29

You plan to invest an amount of money in five-year certificate of deposit (CD) at your bank.The stated interest rate applied to the CD is 12 percent, compounded monthly.How much must you invest if you want the balance in the CD account to be $8,500 in five years?

A)$4,678.82

B)$4,823.13

C)$13,600.00

D)$14,979.90

E)$7,589.29

A)$4,678.82

B)$4,823.13

C)$13,600.00

D)$14,979.90

E)$7,589.29

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

30

Susan just signed a long-term lease on a townhouse in New York City (near Central Park) that requires her to make equal monthly payments for the next five years.The payments Susan has promised to make represent a(n)

the landlord.

the landlord.

A)ordinary annuity

B)annuity due

C)series of uneven cash flows

D)perpetuity

the landlord.

the landlord.A)ordinary annuity

B)annuity due

C)series of uneven cash flows

D)perpetuity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

31

A $10,000 loan is to be amortized over 5 years, with annual end-of-year payments.Given the following facts, which of these statements is correct?

A)The annual payments would be larger if the interest rate were lower.

B)If the loan were amortized over 10 years rather than 5 years, and if the interest rate were the same in either case, the first payment would include more dollars of interest under the 5-year amortization plan.

C)The last payment would have a higher proportion of interest than the first payment.

D)The proportion of interest versus principal repayment would be the same for each of the 5 payments.

E)The proportion of each payment that represents interest as opposed to repayment of principal would be higher if the interest rate were higher.

A)The annual payments would be larger if the interest rate were lower.

B)If the loan were amortized over 10 years rather than 5 years, and if the interest rate were the same in either case, the first payment would include more dollars of interest under the 5-year amortization plan.

C)The last payment would have a higher proportion of interest than the first payment.

D)The proportion of interest versus principal repayment would be the same for each of the 5 payments.

E)The proportion of each payment that represents interest as opposed to repayment of principal would be higher if the interest rate were higher.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

32

Why is the present value of an amount to be received (paid) in the future less than the future amount?

A)Deflation causes investors to lose purchasing power when their dollars are invested for greater than one year.

B)Investors have the opportunity to earn positive rates of return, so any amount invested today should grow to a larger amount in the future.

C)Investments generally are not as good as those who sell them suggest, so investors usually are not willing to pay full face value for such investments, thus the price is discounted.

D)Because investors are taxed on the income received from investments they never will buy an investment for the amount expected to be received in the future.

E)None of the above is a correct answer.

A)Deflation causes investors to lose purchasing power when their dollars are invested for greater than one year.

B)Investors have the opportunity to earn positive rates of return, so any amount invested today should grow to a larger amount in the future.

C)Investments generally are not as good as those who sell them suggest, so investors usually are not willing to pay full face value for such investments, thus the price is discounted.

D)Because investors are taxed on the income received from investments they never will buy an investment for the amount expected to be received in the future.

E)None of the above is a correct answer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

33

All else equal, if you expect to receive a certain amount in the future, say, $500 in ten (10) years, the present value of that future amount will be lowest if the interest earned on such investments is compounded

A)daily

B)weekly

C)monthly

D)quarterly

E)annually

A)daily

B)weekly

C)monthly

D)quarterly

E)annually

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

34

Alice's investment advisor is trying to convince her to purchase an investment that pays $250 per year.The investment has no maturity; therefore the $250 payment will continue every year forever.Alice has determined that her required rate of return for such an investment should be 14 percent and that she would hold the investment for 10 years and then sell it.If Alice decides to buy the investment, she would receive the first $250 payment one year from today.How much should Alice be willing to pay for this investment?

A)$1,304.03, because this is the present value of an ordinary annuity that pays $250 a year for 10 years at 14 percent.

B)$1,486.59, because this is the present value of an annuity due that pays $250 a year for 10 years at 14 percent.

C)$1,785.71, because this is the present value of a $250 perpetuity at 14 percent.

D)There is not enough information to answer this question, because the selling price of the investment in 10 years is not known today.

E)None of the above is correct.

A)$1,304.03, because this is the present value of an ordinary annuity that pays $250 a year for 10 years at 14 percent.

B)$1,486.59, because this is the present value of an annuity due that pays $250 a year for 10 years at 14 percent.

C)$1,785.71, because this is the present value of a $250 perpetuity at 14 percent.

D)There is not enough information to answer this question, because the selling price of the investment in 10 years is not known today.

E)None of the above is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following payments (receipts) would probably not be considered an annuity due? Based on your knowledge and using logic, think about the timing of the payments.

A)rent payments associated with a five-year lease

B)payments for a magazine subscription for a two-year period where the payments are made annually

C)interest payments associated with a corporate bond that was issued today

D)annual payments associated with lottery winnings that are paid out as an annuity

A)rent payments associated with a five-year lease

B)payments for a magazine subscription for a two-year period where the payments are made annually

C)interest payments associated with a corporate bond that was issued today

D)annual payments associated with lottery winnings that are paid out as an annuity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which of the following statements is correct?

A)Simple rates can't be used in present value or future value calculations because they fail to account for compounding effects.

B)The periodic interest rate can be used directly in calculations as long as the number of payments per year is greater than or equal to the number of compounding periods per year.

C)In all cases where interest is added or payments are made more frequently than annually, the periodic rate is less than the annual rate.

D)Generally, the APR is greater than the EAR as a result of compounding effects.

E)If the compounding period is semiannual then the periodic rate will equal the effective annual rate divided by two.

A)Simple rates can't be used in present value or future value calculations because they fail to account for compounding effects.

B)The periodic interest rate can be used directly in calculations as long as the number of payments per year is greater than or equal to the number of compounding periods per year.

C)In all cases where interest is added or payments are made more frequently than annually, the periodic rate is less than the annual rate.

D)Generally, the APR is greater than the EAR as a result of compounding effects.

E)If the compounding period is semiannual then the periodic rate will equal the effective annual rate divided by two.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

37

Everything else equal, which of the following conditions will result in the lowest present value of an amount to be received in the future?

A)annual compounding

B)quarterly compounding

C)monthly compounding

D)daily compounding

A)annual compounding

B)quarterly compounding

C)monthly compounding

D)daily compounding

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

38

Which of the following statements is correct?

A)Other things held constant, an increase in the number of discounting periods per year increases the present value of a given annual annuity.

B)Other things held constant, an increase in the number of discounting periods per year increases the present value of a lump sum to be received in the future.

C)The payment made each period under an amortized loan is constant, and it consists of some interest and some principal.The later we are is the loan's life, the smaller the interest portion of the payment.

D)There is an inverse relationship between the present value interest factor of an annuity and the future value interest factor of an annuity, (i.e., one is the reciprocal of the other).

E)Each of the above statements is true.

A)Other things held constant, an increase in the number of discounting periods per year increases the present value of a given annual annuity.

B)Other things held constant, an increase in the number of discounting periods per year increases the present value of a lump sum to be received in the future.

C)The payment made each period under an amortized loan is constant, and it consists of some interest and some principal.The later we are is the loan's life, the smaller the interest portion of the payment.

D)There is an inverse relationship between the present value interest factor of an annuity and the future value interest factor of an annuity, (i.e., one is the reciprocal of the other).

E)Each of the above statements is true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

39

As the discount rate increases without limit, the present value of the future cash inflows

A)Gets larger without limit.

B)Stays unchanged.

C)Approaches zero.

D)Gets smaller without limit, i.e., approaches minus infinity.

E)Goes to ern.

A)Gets larger without limit.

B)Stays unchanged.

C)Approaches zero.

D)Gets smaller without limit, i.e., approaches minus infinity.

E)Goes to ern.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

40

Vegit Corporation needs to borrow funds to support operations during the summer.Vegit's CFO is trying to decide whether to borrow from the Bank of Florida or the Bank of Georgia.The loan offered by Bank of Florida has a 12.5 percent simple interest rate with annual interest payments, whereas the loan offered by the Bank of Georgia has a 12 percent simple interest rate with monthly payments.Which bank should Vegit use for the loan?

A)Bank of Georgia, because the 12 percent simple interest is cheaper than the 12.5 percent simple interest at Bank of Florida.

B)Bank of Georgia, because the effective interest rate on the loan is less than 12 percent, whereas the effective interest rate on the loan at the Bank of Florida is greater than 12.5 percent.

C)Bank of Florida, because the simple interest rate is higher, which means that Vegit will be able to invest the proceeds from the loan at a higher rate of return.

D)Bank of Florida, because the effective interest rate on the loan is 12.5 percent, which is less than the 12.7 percent effective interest rate on the loan offered by the Bank of Georgia.

E)There is not enough information to answer this question.

A)Bank of Georgia, because the 12 percent simple interest is cheaper than the 12.5 percent simple interest at Bank of Florida.

B)Bank of Georgia, because the effective interest rate on the loan is less than 12 percent, whereas the effective interest rate on the loan at the Bank of Florida is greater than 12.5 percent.

C)Bank of Florida, because the simple interest rate is higher, which means that Vegit will be able to invest the proceeds from the loan at a higher rate of return.

D)Bank of Florida, because the effective interest rate on the loan is 12.5 percent, which is less than the 12.7 percent effective interest rate on the loan offered by the Bank of Georgia.

E)There is not enough information to answer this question.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

41

You want to buy a Nissan 350Z on your 27th birthday.You have priced these cars and found that they currently sell for $30,000.You believe that the price will increase by 5 percent per year until you are ready to buy.You can presently invest to earn 14 percent.If you just turned 20 years old, how much must you invest at the end of each of the next 7 years to be able to purchase the Nissan in 7 years?

A)$4,945.57

B)$3,933.93

C)$7,714.72

D)$3,450.82

E)$6,030.43

A)$4,945.57

B)$3,933.93

C)$7,714.72

D)$3,450.82

E)$6,030.43

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

42

As the winning contestant in a television game show, you are considering the prizes to be awarded.You must indicat sponsor which of the following two choices you prefer, assuming you want to maximize your wealth.Assume it is no January 1, and there is no danger whatever that the sponsor won't pay off. (1)

$1,000 now and another $1,000 at the beginning of each of the 11 subsequent months during the remainder of the year, to be deposited in an account paying 12 percent simple annual rate, but compounded monthly (to be left on deposit for the year).

(2) $12,750 at the end of the year.

Which one would you choose?

A)Choice 1

B)Choice 2

C)Choice 1, if the payments were made at the end of the year.

D)The choice would depend on how soon you need the money.

E)Either one, since they have the same present value.

$1,000 now and another $1,000 at the beginning of each of the 11 subsequent months during the remainder of the year, to be deposited in an account paying 12 percent simple annual rate, but compounded monthly (to be left on deposit for the year).

(2) $12,750 at the end of the year.

Which one would you choose?

A)Choice 1

B)Choice 2

C)Choice 1, if the payments were made at the end of the year.

D)The choice would depend on how soon you need the money.

E)Either one, since they have the same present value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

43

What is the future value of a 5-year ordinary annuity with annual payments of $200, evaluated at a 15 percent interest rate?

A)$670.44

B)$842.91

C)$1,169.56

D)$1,522.64

E)$1,348.48

A)$670.44

B)$842.91

C)$1,169.56

D)$1,522.64

E)$1,348.48

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

44

At an inflation rate of 9 percent, the purchasing power of $1 would be cut in half in 8.04 years.How long to the nearest year would it take the purchasing power of $1 to be cut in half if the inflation rate were only 4%?

A)12 years

B)15 years

C)18 years

D)20 years

E)23 years

A)12 years

B)15 years

C)18 years

D)20 years

E)23 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

45

If a 5-year regular annuity has a present value of $1,000, and if the interest rate is 10 percent, what is the amount of each annuity payment?

A)$240.42

B)$263.80

C)$300.20

D)$315.38

E)$346.87

A)$240.42

B)$263.80

C)$300.20

D)$315.38

E)$346.87

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

46

At an effective annual interest rate of 20 percent, how many years will it take a given amount to triple in value? (Round to the closest year.)

A)5

B)8

C)6

D)10

E)9

A)5

B)8

C)6

D)10

E)9

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

47

Sarah is thinking about purchasing an investment from HiBond Investing.If she buys the investment, Sarah will receive $100 every three months for five years.The first $100 payment will be made as soon as she purchases the investment.If Sarah's required rate of return is 16 percent, to the nearest dollar, how much should she be willing to pay for this investment?

A)$1,359

B)$1,413

C)$1,112

D)$1,519

E)$1,310

A)$1,359

B)$1,413

C)$1,112

D)$1,519

E)$1,310

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

48

Assume you are to receive a 20-year annuity with annual payments of $50.The first payment will be received at the end of Year 1, and the last payment will be received at the end of Year 20.You will invest each payment in an account that pays 10 percent.What will be the value in your account at the end of Year 30?

A)$6,354.81

B)$7,427.83

C)$7,922.33

D)$8,591.00

E)$6,752.46

A)$6,354.81

B)$7,427.83

C)$7,922.33

D)$8,591.00

E)$6,752.46

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

49

You deposited $1,000 in a savings account that pays 8 percent interest, compounded quarterly, planning to use it to finish your last year in college.Eighteen months later, you decide to go to the Rocky Mountains to become a ski instructor rather than continue in school, so you close out your account.How much money will you receive?

A)$1,171

B)$1,126

C)$1,082

D)$1,163

E)$1,008

A)$1,171

B)$1,126

C)$1,082

D)$1,163

E)$1,008

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

50

Assume that you will receive $2,000 a year in Years 1 through 5, $3,000 a year in Years 6 through 8, and $4,000 in Y all cash flows to be received at the end of the year.If you require a 14 percent rate of return, what is the present val cash flows?

A)$9,851

B)$13,250

C)$11,714

D)$15,129

E)$17,353

A)$9,851

B)$13,250

C)$11,714

D)$15,129

E)$17,353

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

51

Assume that you can invest to earn a stated annual rate of return of 12 percent, but where interest is compounded semiannually.If you make 20 consecutive semiannual deposits of $500 each, with the first deposit being made today, what will your balance be at the end of Year 20?

A)$52,821.19

B)$57,900.83

C)$58,988.19

D)$62,527.47

E)$64,131.50

A)$52,821.19

B)$57,900.83

C)$58,988.19

D)$62,527.47

E)$64,131.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

52

You expect to receive $1,000 at the end of each of the next 3 years.You will deposit these payments into an account which pays 10 percent compounded semiannually.What is the future value of these payments, that is, the value at the end of the third year?

A)$3,000

B)$3,310

C)$3,318

D)$3,401

E)$3,438

A)$3,000

B)$3,310

C)$3,318

D)$3,401

E)$3,438

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

53

A recent advertisement in the financial section of a magazine carried the following claim: "Invest your money with us at 14 percent, compounded annually, and we guarantee to double your money sooner than you imagine." Ignoring taxes, how long would it take to double your money at a simple rate of 14 percent, compounded annually?

A)Approximately 3.5 years

B)Approximately 5 years

C)Exactly 7 years

D)Approximately 10 years

E)Exactly 14 years

A)Approximately 3.5 years

B)Approximately 5 years

C)Exactly 7 years

D)Approximately 10 years

E)Exactly 14 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

54

At approximately what rate would you have to invest a lump-sum amount today if you need the amount to triple in six years? Assume interest is compounded annually.

A)20%

B)12%

C)24%

D)Not enough information is provided to answer the question.

E)None of the above is a correct answer.

A)20%

B)12%

C)24%

D)Not enough information is provided to answer the question.

E)None of the above is a correct answer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

55

In 1958 the average tuition for one year at an Ivy League school was $1,800.Thirty years later, in 1988, the average cost was $13,700.What was the growth rate in tuition over the 30-year period?

A)12%

B)9%

C)6%

D)7%

E)8%

A)12%

B)9%

C)6%

D)7%

E)8%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

56

You just graduated, and you plan to work for 10 years and then to leave for the Australian "Outback" bush country. You figure you can save $1,000 a year for the first 5 years and $2,000 a year for the next 5 years.These savings cash flows will start one year from now.In addition, your family has just given you a $5,000 graduation gift.If you put the gift now, and your future savings when they start, into an account which pays 8 percent compounded annually, what will your financial "stake" be when you leave for Australia 10 years from now?

A)$21,432

B)$28,393

C)$16,651

D)$31,148

E)$20,000

A)$21,432

B)$28,393

C)$16,651

D)$31,148

E)$20,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

57

You have the opportunity to buy a perpetuity which pays $1,000 annually.Your required rate of return on this investment is 15 percent.You should be essentially indifferent to buying or not buying the investment if it were offered at a price of

A)$5,000.00

B)$6,000.00

C)$6,666.67

D)$7,500.00

E)$8,728.50

A)$5,000.00

B)$6,000.00

C)$6,666.67

D)$7,500.00

E)$8,728.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

58

Which of the following statements is most correct?

A)The first payment under a 3-year, annual payment, amortized loan for $1,000 will include a smaller percentage (or fraction) of interest if the interest rate is 5 percent than if it is 10 percent.

B)If you are lending money, then, based on effective interest rates, you should prefer to lend at a 10 percent simple, or quoted, rate but with semiannual payments, rather than at a 10.1 percent simple rate with annual payments.However, as a borrower you should prefer the annual payment loan.

C)The value of a perpetuity (say for $100 per year) will approach infinity as the interest rate used to evaluate the perpetuity approaches zero.

D)Statements a, b, and c are all true.

E)Only statements b and c are true.

A)The first payment under a 3-year, annual payment, amortized loan for $1,000 will include a smaller percentage (or fraction) of interest if the interest rate is 5 percent than if it is 10 percent.

B)If you are lending money, then, based on effective interest rates, you should prefer to lend at a 10 percent simple, or quoted, rate but with semiannual payments, rather than at a 10.1 percent simple rate with annual payments.However, as a borrower you should prefer the annual payment loan.

C)The value of a perpetuity (say for $100 per year) will approach infinity as the interest rate used to evaluate the perpetuity approaches zero.

D)Statements a, b, and c are all true.

E)Only statements b and c are true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

59

If $100 is placed in an account that earns a simple 4 percent, compounded quarterly, what will it be worth in 5 years?

A)$122.02

B)$105.10

C)$135.41

D)$120.90

E)$117.48

A)$122.02

B)$105.10

C)$135.41

D)$120.90

E)$117.48

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

60

Gomez Electronics needs to arrange financing for its expansion program.Bank A offers to lend Gomez the required funds on a loan where interest must be paid monthly, and the quoted rate is 8 percent.Bank B will charge 9 percent, with interest due at the end of the year.What is the difference in the effective annual rates charged by the two banks?

A)0.25%

B)0.50%

C)0.70%

D)1.00%

E)1.25%

A)0.25%

B)0.50%

C)0.70%

D)1.00%

E)1.25%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

61

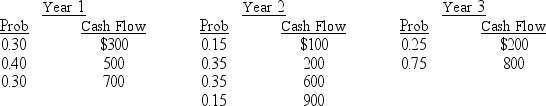

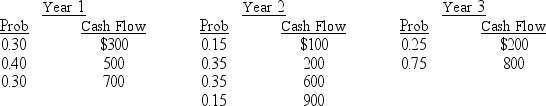

A project with a 3-year life has the following probability distributions for possible end of year cash flows in each of the next three years:  Using an interest rate of 8 percent, find the expected present value of these uncertain cash flows.(Hint: Find the expected cash flow in each year, then evaluate those cash flows.)

Using an interest rate of 8 percent, find the expected present value of these uncertain cash flows.(Hint: Find the expected cash flow in each year, then evaluate those cash flows.)

A)$1,204.95

B)$835.42

C)$1,519.21

D)$1,580.00

E)$1,347.61

Using an interest rate of 8 percent, find the expected present value of these uncertain cash flows.(Hint: Find the expected cash flow in each year, then evaluate those cash flows.)

Using an interest rate of 8 percent, find the expected present value of these uncertain cash flows.(Hint: Find the expected cash flow in each year, then evaluate those cash flows.)A)$1,204.95

B)$835.42

C)$1,519.21

D)$1,580.00

E)$1,347.61

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

62

Assume that you inherited some money.A friend of yours is working as an unpaid intern at a local brokerage firm, and her boss is selling some securities which call for four payments, $50 at the end of each of the next 3 years, plus a payment of $1,050 at the end of Year 4.Your friend says she can get you some of these securities at a cost of $900 each.Your money is now invested in a bank that pays an 8 percent simple (quoted) interest rate, but with quarterly compounding.You regard the securities as being just as safe, and as liquid, as your bank deposit, so your required effective annual rate of return on the securities is the same as that on your bank deposit.You must calculate the value of the securities to decide whether they are a good investment.What is their present value to you?

A)$1,000

B)$866

C)$1,050

D)$901

E)$893

A)$1,000

B)$866

C)$1,050

D)$901

E)$893

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

63

Your company is planning to borrow $1,000,000 on a 5-year, 15 percent, annual payment, fully amortized term loan. What fraction of the payment made at the end of the second year will represent repayment of principal?

A)29.83%

B)57.18%

C)35.02%

D)64.45%

E)72.36%

A)29.83%

B)57.18%

C)35.02%

D)64.45%

E)72.36%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

64

Assume that you are graduating, that you plan to work for 4 years, and then to go to law school for 3 years.Right now, going to law school would require $17,000 per year (for tuition, books, living expenses, etc.), but you expect this cost to rise by 8 percent per year in all future years.You now have $25,000 invested in an investment account which pays a simple annual rate of 9 percent, quarterly compounding, and you expect that rate of return to continue into the future.You want to maintain the same standard of living while in law school that $17,000 per year would currently provide.You plan to save and to make 4 equal payments (deposits) which will be added to your account at the end of each of the next 4 years; these new deposits will earn the same rate as your investment account currently earns. How large must each of the 4 payments be in order to permit you to make 3 withdrawals, at the beginning of each of your 3 years in law school? (Note: (1) The first payment is made a year from today and the last payment 4 years from today, (2) the first withdrawal is made 4 years from today, and (3) the withdrawals will not be of a constant amount.)

A)$13,242.67

B)$6,562.13

C)$10,440.00

D)$7,153.56

E)$14,922.85

A)$13,242.67

B)$6,562.13

C)$10,440.00

D)$7,153.56

E)$14,922.85

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

65

Bank A offers a 2-year certificate of deposit (CD) that pays 10 percent compounded annually.Bank B offers a 2- year CD that is compounded semi-annually.The CDs have identical risk.What is the stated, or simple, rate that Bank B would have to offer to make you indifferent between the two investments?

A)9.67%

B)9.76%

C)9.83%

D)9.87%

E)9.93%

A)9.67%

B)9.76%

C)9.83%

D)9.87%

E)9.93%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

66

Steaks Galore needs to arrange financing for its expansion program.One bank offers to lend the required $1,000,000 on a loan which requires interest to be paid at the end of each quarter.The quoted rate is 10 percent, and the principal must be repaid at the end of the year.A second lender offers 9 percent, daily compounding (365-day year), with interest and principal due at the end of the year.What is the difference in the effective annual rates (EFF%) charged by the two banks?

A)0.31%

B)0.53%

C)0.75%

D)0.96%

E)1.25%

A)0.31%

B)0.53%

C)0.75%

D)0.96%

E)1.25%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

67

If you buy a factory for $250,000 and the terms are 20 percent down, the balance to be paid off over 30 years at a 1 rate of interest on the unpaid balance, what are the 30 equal annual payments?

A)$20,593

B)$31,036

C)$24,829

D)$50,212

E)$6,667

A)$20,593

B)$31,036

C)$24,829

D)$50,212

E)$6,667

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

68

You want to borrow $1,000 from a friend for one year, and you propose to pay her $1,120 at the end of the year. She agrees to lend you the $1,000, but she wants you to pay her $10 of interest at the end of each of the first 11 months plus $1,010 at the end of the 12th month.How much higher is the effective annual rate under your friend's proposal than under your proposal?

A)0.00%

B)0.45%

C)0.68%

D)0.89%

E)1.00%

A)0.00%

B)0.45%

C)0.68%

D)0.89%

E)1.00%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

69

The Desai Company just borrowed $1,000,000 for 3 years at a quoted rate of 8 percent, quarterly compounding.The loan is to be amortized in end-of-quarter payments over its 3-year life.How much interest (in dollars) will your company have to pay during the second quarter?

A)$15,675.19

B)$18,508.81

C)$21,205.33

D)$24,678.89

E)$28,111.66

A)$15,675.19

B)$18,508.81

C)$21,205.33

D)$24,678.89

E)$28,111.66

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

70

You have just borrowed $20,000 to buy a new car.The loan agreement calls for 60 monthly payments of $444.89 ea to begin one month from today.If the interest is compounded monthly, then what is the effective annual rate on this loan?

A)12.68%

B)14.12%

C)12.00%

D)13.25%

E)15.08%

A)12.68%

B)14.12%

C)12.00%

D)13.25%

E)15.08%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

71

You are given the following cash flow information.The appropriate discount rate is 12 percent for Years 1-5 and 10 percent for Years 6-10.Payments are received at the end of the year. Year Amount

1-5 $20,000

6-10 $25,000

What should you be willing to pay right now to receive the income stream above?

A)$166,866

B)$158,791

C)$225,000

D)$125,870

E)$198,433

1-5 $20,000

6-10 $25,000

What should you be willing to pay right now to receive the income stream above?

A)$166,866

B)$158,791

C)$225,000

D)$125,870

E)$198,433

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

72

In its first year of operations, 2002, the Gourmet Cheese Shoppe had earnings per share (EPS) of $0.26.Four years l in 2006, EPS was up to $0.38, and 7 years after that, in 2013, EPS was up to $0.535.It appears that the first 4 years represented a supernormal growth situation and since then a more normal growth rate has been sustained.What are rates of growth for the earlier period and for the later period?

A)6%; 5%

B)6%; 3%

C)10%; 8%

D)10%; 5%

E)12%; 7%

A)6%; 5%

B)6%; 3%

C)10%; 8%

D)10%; 5%

E)12%; 7%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

73

You are currently at time period 0, and you will receive the first payment on an annual payment annuity of $100 in perpetuity at the end of this year.Six full years from now you will receive the first payment on an additional $150 in perpetuity, and at the end of time period 10 you will receive the first payment on an additional $200 in perpetuity.If you require a 10 percent rate of return, what is the combined present value of these three perpetuities?

A)$2,349.50

B)$2,526.85

C)$2,685.42

D)$2,779.58

E)$2,975.40

A)$2,349.50

B)$2,526.85

C)$2,685.42

D)$2,779.58

E)$2,975.40

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

74

You have just taken out a 30-year, $120,000 mortgage on your new home.This mortgage is to be repaid in 360 equal of-month installments.If each of the monthly installments is $1,500, what is the effective annual interest rate on this mortgage?

A)15.87%

B)14.75%

C)13.38%

D)16.25%

E)16.49%

A)15.87%

B)14.75%

C)13.38%

D)16.25%

E)16.49%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

75

Suppose you put $100 into a savings account today, the account pays a simple annual interest rate of 6 percent, but compounded semiannually, and you withdraw $100 after 6 months.What would your ending balance be 20 years afte initial $100 deposit was made?

A)$226.20

B)$115.35

C)$62.91

D)$9.50

E)$3.00

A)$226.20

B)$115.35

C)$62.91

D)$9.50

E)$3.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

76

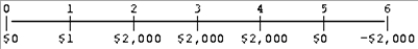

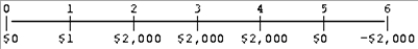

Assume that your required rate of return is 12 percent and you are given the following stream of cash flows: If payments are made at the end of each period, what is the present value of the cash flow stream?

A)$66,909

B)$57,323

C)$61,815

D)$52,345

E)$62,029

A)$66,909

B)$57,323

C)$61,815

D)$52,345

E)$62,029

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

77

You can deposit your savings at the Darlington National Bank, which offers to pay 12.6 percent interest compounded monthly, or at the Bartlett Bank, which will pay interest of 11.5 percent compounded daily.(Assume 365 days in a year.) Which bank offers the higher effective annual rate?

A)Darlington National Bank.

B)Bartlett Bank.

C)Both banks offer the same effective rate.

D)Cannot be determined from the information provided.

E)Workable only if the banks use the same compounding period.

A)Darlington National Bank.

B)Bartlett Bank.

C)Both banks offer the same effective rate.

D)Cannot be determined from the information provided.

E)Workable only if the banks use the same compounding period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

78

You are given the following cash flows.What is the present value (t = 0) if the discount rate is 12 percent?

A)$3,277

B)$4,804

C)$5,302

D)$4,289

E)$2,804

A)$3,277

B)$4,804

C)$5,302

D)$4,289

E)$2,804

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

79

Find the present value of an income stream which has a negative flow of $100 per year for 3 years, a positive flow o $200 in the 4th year, and a positive flow of $300 per year in Years 5 through 8.The appropriate discount rate is 4 percent for each of the first 3 years and 5 percent for each of the later years.Thus, a cash flow accruing in Year 8 should be discounted at 5 percent for some years and 4 percent in other years.All payments occur at year-end.

A)$528.21

B)$1,329.00

C)$792.49

D)$1,046.41

E)$875.18

A)$528.21

B)$1,329.00

C)$792.49

D)$1,046.41

E)$875.18

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

80

A bank pays a quoted annual (simple) interest rate of 8 percent.However, it pays interest (compounds) daily using a 365-day year.What is the effective annual rate of return?

A)7.86%

B)7.54%

C)8.57%

D)8.33%

E)9.21%

A)7.86%

B)7.54%

C)8.57%

D)8.33%

E)9.21%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck