Deck 14: Decision Analysis

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/102

العب

ملء الشاشة (f)

Deck 14: Decision Analysis

1

Decision analysis supports all but one of the following goals. Which goal is not supported?

A) Help make good decisions.

B) Help ensure selection of good outcomes.

C) Analyze decision problems logically.

D) Incorporate problem uncertainty.

A) Help make good decisions.

B) Help ensure selection of good outcomes.

C) Analyze decision problems logically.

D) Incorporate problem uncertainty.

B

2

The ____ correspond to future events that are not under the control of the decision maker.

A) payoffs

B) states of nature

C) criteria

D) alternatives

A) payoffs

B) states of nature

C) criteria

D) alternatives

B

3

A payoff matrix depicts ____ versus ____ with payoffs for each intersection cell.

A) decision criteria; states of nature.

B) decision alternatives; potential outcomes.

C) decision alternatives; states of nature.

D) decision criteria; potential outcomes.

A) decision criteria; states of nature.

B) decision alternatives; potential outcomes.

C) decision alternatives; states of nature.

D) decision criteria; potential outcomes.

C

4

How are states of nature assigned probabilities?

A) Use historical data.

B) Use best judgements.

C) Use interview results.

D) All of these.

A) Use historical data.

B) Use best judgements.

C) Use interview results.

D) All of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which decision rule optimistically assumes that nature will always be "on our side" regardless of what decision we make?

A) maximax decision rule.

B) maximin decision rule.

C) minimax regret decision rule.

D) minimin decision rule.

A) maximax decision rule.

B) maximin decision rule.

C) minimax regret decision rule.

D) minimin decision rule.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

6

The decision rule which determines the maximum payoff for each alternative and then selects the alternative associated with the largest payoff is the

A) maximax decision rule.

B) maximin decision rule.

C) minimax regret decision rule.

D) minimin decision rule.

A) maximax decision rule.

B) maximin decision rule.

C) minimax regret decision rule.

D) minimin decision rule.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which of the following summarizes the final outcome for each decision alternative?

A) payoff matrix

B) outcome matrix

C) yield matrix

D) performance matrix

A) payoff matrix

B) outcome matrix

C) yield matrix

D) performance matrix

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

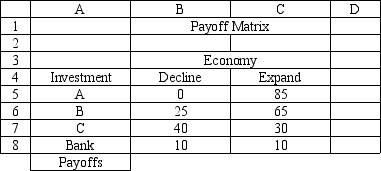

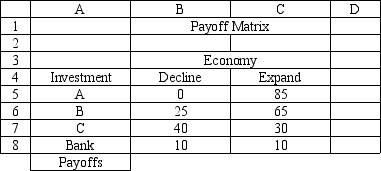

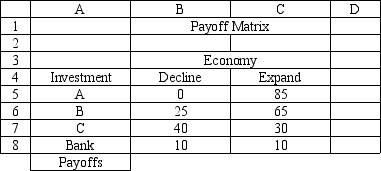

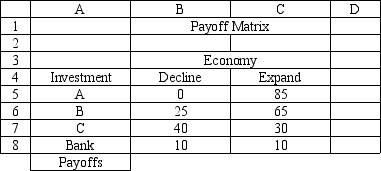

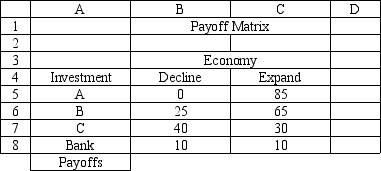

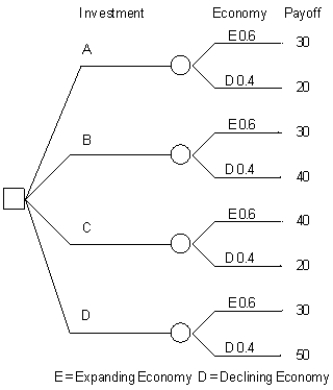

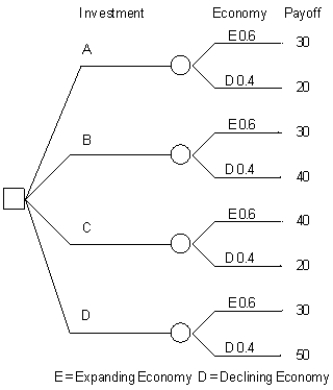

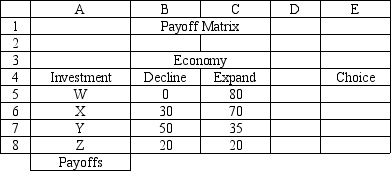

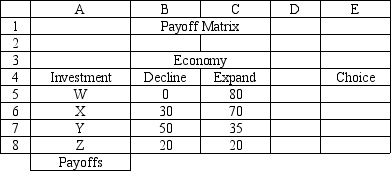

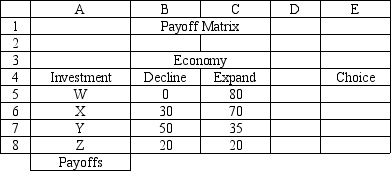

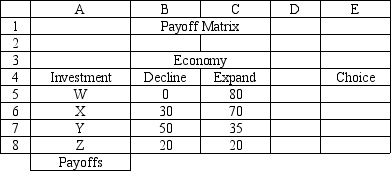

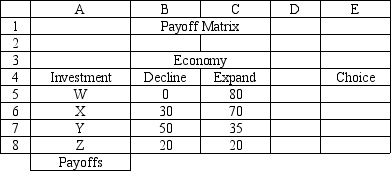

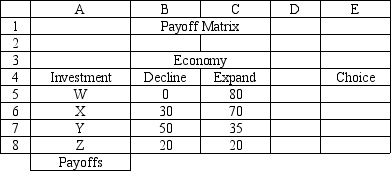

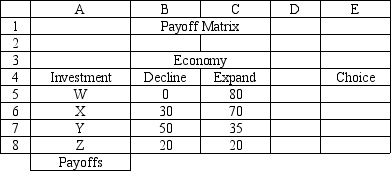

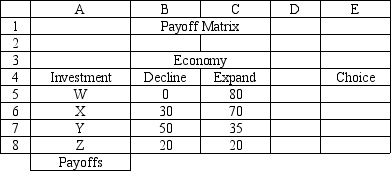

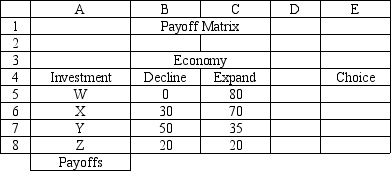

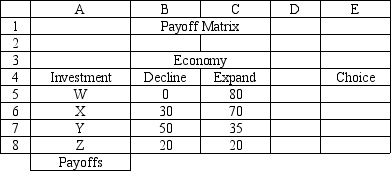

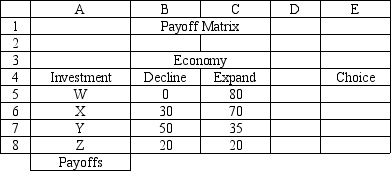

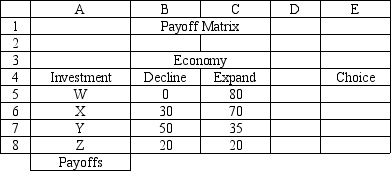

8

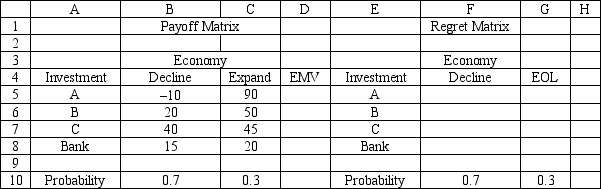

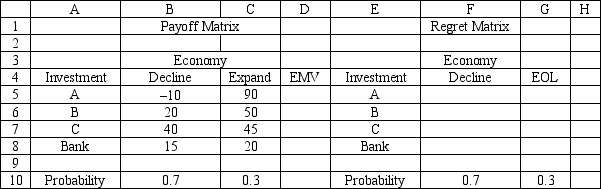

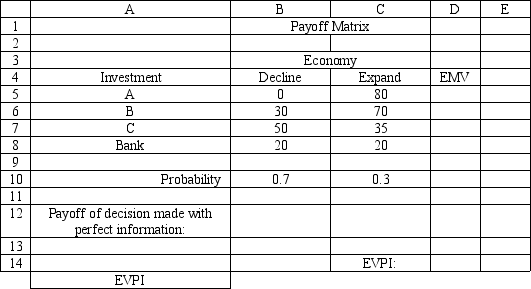

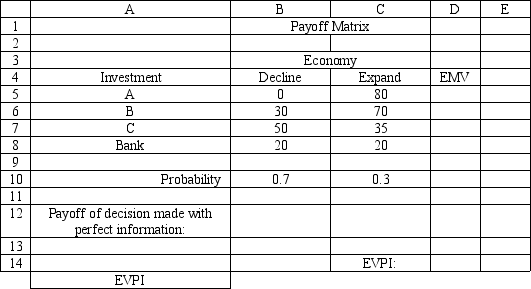

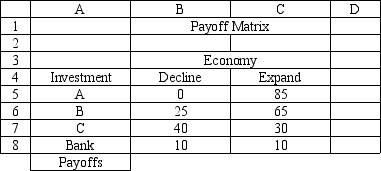

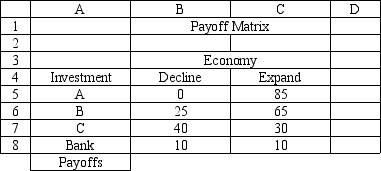

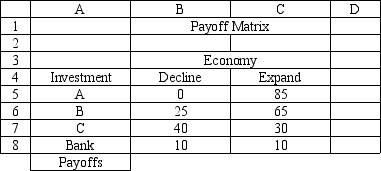

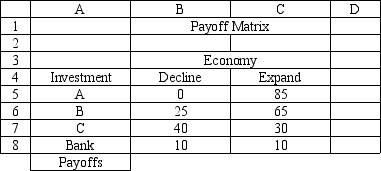

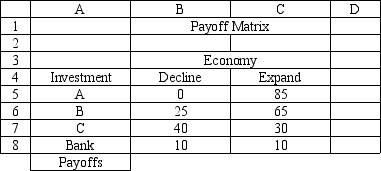

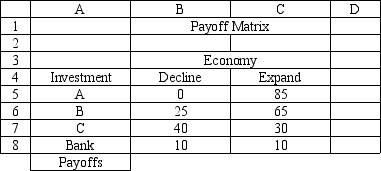

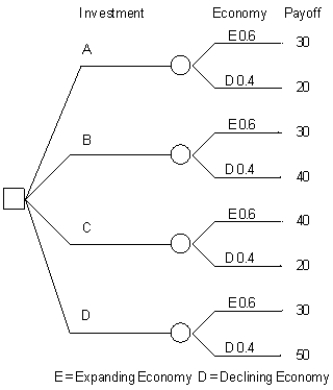

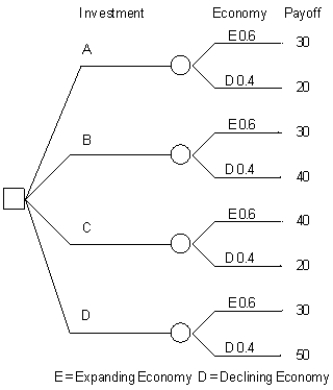

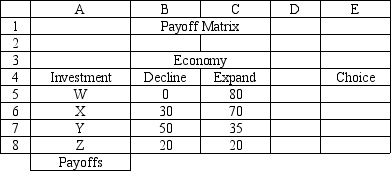

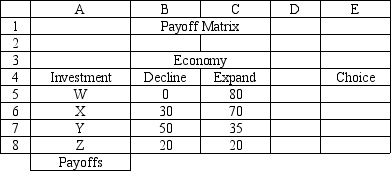

Exhibit 14.1

The following questions are based on the information below.

An investor is considering 4 investments, A, B, C and leaving his money in the bank. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following payoff matrix has been developed for the decision problem.

Refer to Exhibit 14.1. What decision should be made according to the maximax decision rule?

A) A

B) B

C) C

D) Bank

The following questions are based on the information below.

An investor is considering 4 investments, A, B, C and leaving his money in the bank. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following payoff matrix has been developed for the decision problem.

Refer to Exhibit 14.1. What decision should be made according to the maximax decision rule?

A) A

B) B

C) C

D) Bank

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which decision rule pessimistically assumes that nature will always be "against us" regardless of what decision we make?

A) maximax decision rule.

B) maximin decision rule.

C) minimax regret decision rule.

D) minimin decision rule.

A) maximax decision rule.

B) maximin decision rule.

C) minimax regret decision rule.

D) minimin decision rule.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

10

The category of decision rules that contains the maximax decision rule is the

A) optimistic category.

B) non-probabilistic category.

C) probabilistic category.

D) optimality category.

A) optimistic category.

B) non-probabilistic category.

C) probabilistic category.

D) optimality category.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

11

A(n) ____ is a course of action intended to solve a problem.

A) decision

B) criteria

C) state of nature

D) alternative

A) decision

B) criteria

C) state of nature

D) alternative

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

12

The decision rule which determines the minimum payoff for each alternative and then selects the alternative associated with the largest minimum payoff is the

A) maximax decision rule.

B) maximin decision rule.

C) minimax regret decision rule.

D) minimin decision rule.

A) maximax decision rule.

B) maximin decision rule.

C) minimax regret decision rule.

D) minimin decision rule.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

13

Every nonprobabilistic method has a weakness for decision making. Which of the following is incorrect regarding a method and its weakness?

A) The maximax method ignores potentially large losses.

B) The maximin method ignores potentially large payoffs.

C) The minimax regret method can lead to inconsistent decisions.

D) All of these are correct.

A) The maximax method ignores potentially large losses.

B) The maximin method ignores potentially large payoffs.

C) The minimax regret method can lead to inconsistent decisions.

D) All of these are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

14

A course of action intended to solve a problem is called a(n)

A) alternative.

B) option.

C) decision.

D) criteria.

A) alternative.

B) option.

C) decision.

D) criteria.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which of the following is a goal of decision analysis?

A) Help individuals make good decisions.

B) Ensure decisions lead to good outcomes.

C) Avoiding decisions leading to bad outcomes.

D) Reduce the role of luck in a decision.

A) Help individuals make good decisions.

B) Ensure decisions lead to good outcomes.

C) Avoiding decisions leading to bad outcomes.

D) Reduce the role of luck in a decision.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

16

Decision Analysis techniques provide modeling techniques to help decision makers make decisions. Which of the following is not typically a benefit of decision analysis?

A) Incorporating uncertainty via probabilities.

B) Incorporating risk via utility theory functions.

C) Incorporating uncertainty via exponential distributions.

D) Structuring decision strategies via decision trees.

A) Incorporating uncertainty via probabilities.

B) Incorporating risk via utility theory functions.

C) Incorporating uncertainty via exponential distributions.

D) Structuring decision strategies via decision trees.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

17

The amount of opportunity lost in making a decision is called

A) loss.

B) frustration.

C) negative profit.

D) regret.

A) loss.

B) frustration.

C) negative profit.

D) regret.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

18

The ____ in a decision problem represent factors that are important to the decision maker.

A) payoffs

B) states of nature

C) criteria

D) alternatives

A) payoffs

B) states of nature

C) criteria

D) alternatives

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

19

The decision rule which selects the alternative associated with the smallest maximum opportunity loss is the

A) maximax decision rule.

B) maximin decision rule.

C) minimax regret decision rule.

D) minimin decision rule.

A) maximax decision rule.

B) maximin decision rule.

C) minimax regret decision rule.

D) minimin decision rule.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

20

Although modeling provides valuable insight to decision makers, decision making remains a difficult task. Which of the following is not a primary cause for this difficulty discussed in the Decision Analysis chapter?

A) Uncertainty regarding the future.

B) Models provide decisions for the decision maker.

C) Conflicting values.

D) Conflicting objectives.

A) Uncertainty regarding the future.

B) Models provide decisions for the decision maker.

C) Conflicting values.

D) Conflicting objectives.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

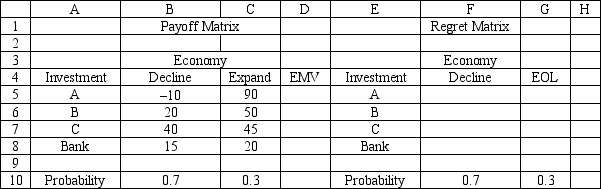

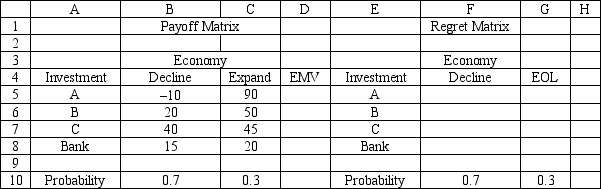

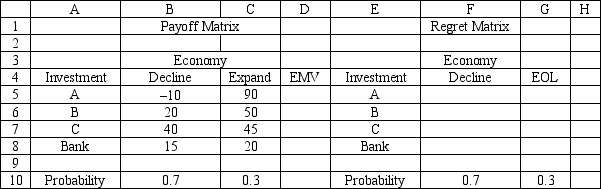

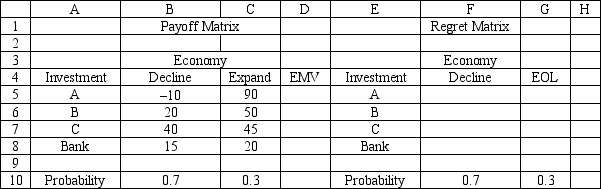

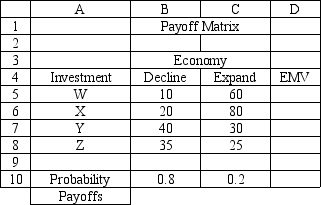

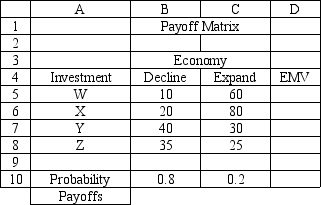

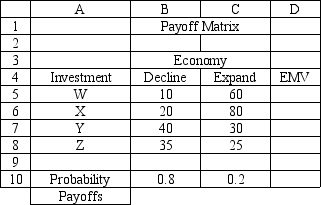

21

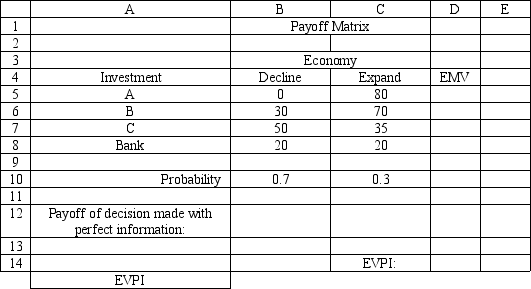

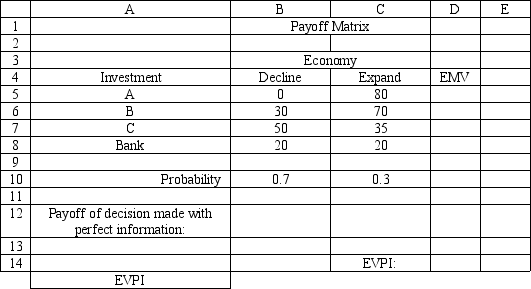

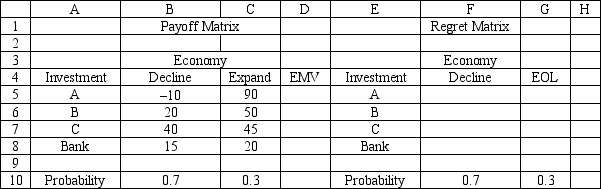

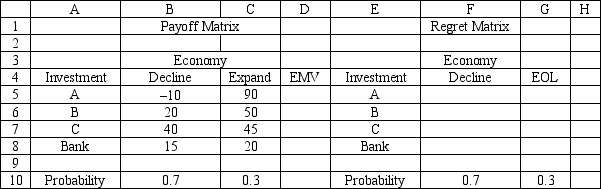

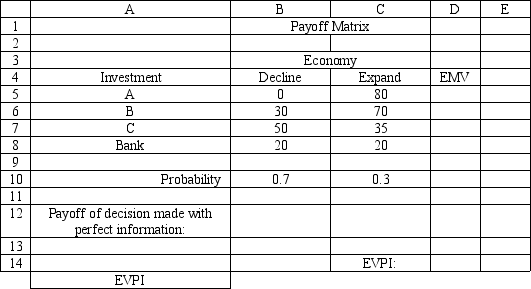

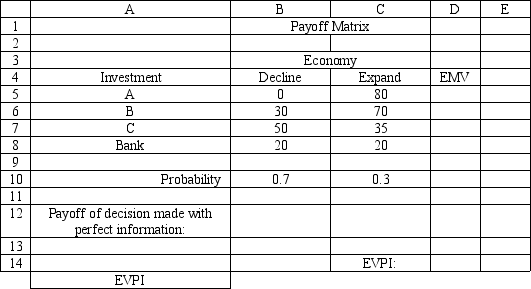

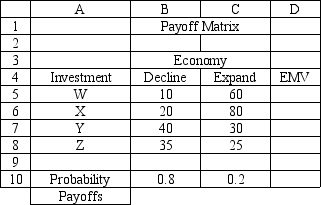

Exhibit 14.3

The following questions are based on the information below.

An investor is considering 4 investments, A, B, C and leaving his money in the bank. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following payoff matrix has been developed for the decision problem. The investor has estimated the probability of a declining economy at 70% and an expanding economy at 30%.

Refer to Exhibit 14.3. What is the expected monetary value of Investment A?

A)34.

B)30.

C)20.

D) 15.

The following questions are based on the information below.

An investor is considering 4 investments, A, B, C and leaving his money in the bank. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following payoff matrix has been developed for the decision problem. The investor has estimated the probability of a declining economy at 70% and an expanding economy at 30%.

Refer to Exhibit 14.3. What is the expected monetary value of Investment A?

A)34.

B)30.

C)20.

D) 15.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

22

Exhibit 14.3

The following questions are based on the information below.

An investor is considering 4 investments, A, B, C and leaving his money in the bank. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following payoff matrix has been developed for the decision problem. The investor has estimated the probability of a declining economy at 70% and an expanding economy at 30%.

Refer to Exhibit 14.3. What formula should go in cell F5 and copied to F6:F8 of the spreadsheet if the expected regret decision rule is to be used?

A) =B$5-MAX(B$5:B$8)

B) =MAX(B$5:B$8)-MAX(B5)

C) =MAX(B$5:B$8)-MIN(B$5:B$8)

D) =MAX(B$5:B$8)-B5

The following questions are based on the information below.

An investor is considering 4 investments, A, B, C and leaving his money in the bank. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following payoff matrix has been developed for the decision problem. The investor has estimated the probability of a declining economy at 70% and an expanding economy at 30%.

Refer to Exhibit 14.3. What formula should go in cell F5 and copied to F6:F8 of the spreadsheet if the expected regret decision rule is to be used?

A) =B$5-MAX(B$5:B$8)

B) =MAX(B$5:B$8)-MAX(B5)

C) =MAX(B$5:B$8)-MIN(B$5:B$8)

D) =MAX(B$5:B$8)-B5

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

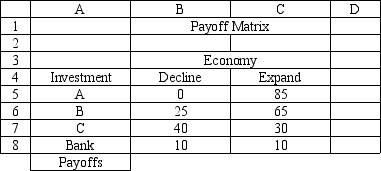

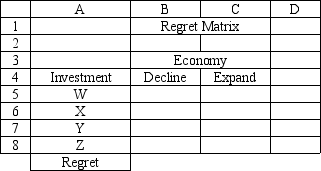

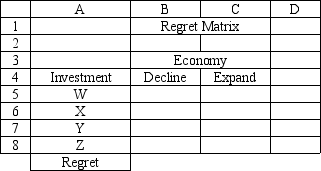

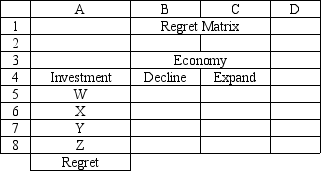

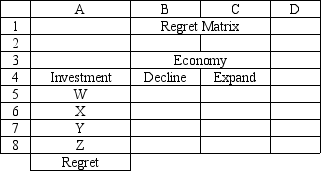

23

Exhibit 14.2

The following questions are based on the information below.

An investor is considering 4 investments, A, B, C and leaving his money in the bank. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following payoff matrix has been developed for the decision problem.

-Refer to Exhibit 14.2. What formula should go in cell F5 of the Regret Matrix above to compute the regret value?

A) =B$5-MAX(B$5:B$8)

B) =MAX(B$5:B$8)-MAX(B5)

C) =MAX(B$5:B$8)-MIN(B$5:B$8)

D) =MAX(B$5:B$8)-B5

The following questions are based on the information below.

An investor is considering 4 investments, A, B, C and leaving his money in the bank. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following payoff matrix has been developed for the decision problem.

-Refer to Exhibit 14.2. What formula should go in cell F5 of the Regret Matrix above to compute the regret value?

A) =B$5-MAX(B$5:B$8)

B) =MAX(B$5:B$8)-MAX(B5)

C) =MAX(B$5:B$8)-MIN(B$5:B$8)

D) =MAX(B$5:B$8)-B5

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

24

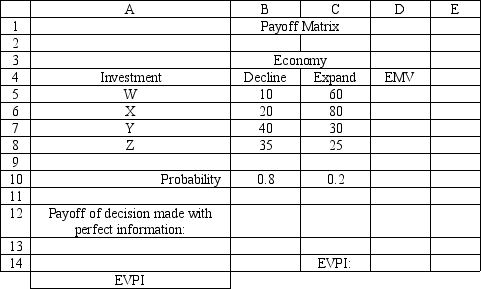

Exhibit 14.4

The following questions are based on the information below.

Refer to Exhibit 14.4. What is the expected value of perfect information for the investor?

A) 13.5

B) 20

C) 45.5

D) 59

The following questions are based on the information below.

Refer to Exhibit 14.4. What is the expected value of perfect information for the investor?

A) 13.5

B) 20

C) 45.5

D) 59

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

25

The decision with the smallest expected opportunity loss (EOL) will also have the

A) smallest EMV.

B) largest EMV.

C) smallest regret.

D) largest regret.

A) smallest EMV.

B) largest EMV.

C) smallest regret.

D) largest regret.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

26

Exhibit 14.4

The following questions are based on the information below.

Refer to Exhibit 14.4. What is the expected value with perfect information for the investor?

A) 13.5

B) 45.5

C) 59

D) 80

The following questions are based on the information below.

Refer to Exhibit 14.4. What is the expected value with perfect information for the investor?

A) 13.5

B) 45.5

C) 59

D) 80

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

27

Exhibit 14.3

The following questions are based on the information below.

An investor is considering 4 investments, A, B, C and leaving his money in the bank. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following payoff matrix has been developed for the decision problem. The investor has estimated the probability of a declining economy at 70% and an expanding economy at 30%.

Refer to Exhibit 14.3. What decision should be made according to the expected monetary value decision rule?

A) A

B) B

C) C

D) Bank

The following questions are based on the information below.

An investor is considering 4 investments, A, B, C and leaving his money in the bank. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following payoff matrix has been developed for the decision problem. The investor has estimated the probability of a declining economy at 70% and an expanding economy at 30%.

Refer to Exhibit 14.3. What decision should be made according to the expected monetary value decision rule?

A) A

B) B

C) C

D) Bank

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

28

Exhibit 14.1

The following questions are based on the information below.

An investor is considering 4 investments, A, B, C and leaving his money in the bank. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following payoff matrix has been developed for the decision problem.

Refer to Exhibit 14.1. What formula should go in cell D5 to implement the maximin decision rule?

A) =MAX(MIN(B5:C5))

B) =MIN(B5:C5)

C) =AVERAGE(B5:C5)

D) =MAX(B5:C5)

The following questions are based on the information below.

An investor is considering 4 investments, A, B, C and leaving his money in the bank. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following payoff matrix has been developed for the decision problem.

Refer to Exhibit 14.1. What formula should go in cell D5 to implement the maximin decision rule?

A) =MAX(MIN(B5:C5))

B) =MIN(B5:C5)

C) =AVERAGE(B5:C5)

D) =MAX(B5:C5)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

29

Exhibit 14.3

The following questions are based on the information below.

An investor is considering 4 investments, A, B, C and leaving his money in the bank. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following payoff matrix has been developed for the decision problem. The investor has estimated the probability of a declining economy at 70% and an expanding economy at 30%.

Refer to Exhibit 14.3. What decision should be made according to the expected regret decision rule?

A) A

B) B

C) C

D) Bank

The following questions are based on the information below.

An investor is considering 4 investments, A, B, C and leaving his money in the bank. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following payoff matrix has been developed for the decision problem. The investor has estimated the probability of a declining economy at 70% and an expanding economy at 30%.

Refer to Exhibit 14.3. What decision should be made according to the expected regret decision rule?

A) A

B) B

C) C

D) Bank

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

30

Expected regret is also called

A) EMV.

B) EOL.

C) EPA.

D) EOQ.

A) EMV.

B) EOL.

C) EPA.

D) EOQ.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

31

Leaves of a decision tree are also called ____ nodes.

A) end

B) terminal

C) decision

D) payoff

A) end

B) terminal

C) decision

D) payoff

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

32

Exhibit 14.1

The following questions are based on the information below.

An investor is considering 4 investments, A, B, C and leaving his money in the bank. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following payoff matrix has been developed for the decision problem.

Refer to Exhibit 14.1. What formula should go in cell D5 to implement the maximax decision rule?

A) =MAX(MAX(B5:C5))

B) =MIN(B5:C5)

C) =AVERAGE(B5:C5)

D) =MAX(B5:C5)

The following questions are based on the information below.

An investor is considering 4 investments, A, B, C and leaving his money in the bank. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following payoff matrix has been developed for the decision problem.

Refer to Exhibit 14.1. What formula should go in cell D5 to implement the maximax decision rule?

A) =MAX(MAX(B5:C5))

B) =MIN(B5:C5)

C) =AVERAGE(B5:C5)

D) =MAX(B5:C5)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

33

A square node in a decision tree is called a(n) ____ node.

A) chance

B) random

C) decision

D) event

A) chance

B) random

C) decision

D) event

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

34

Exhibit 14.2

The following questions are based on the information below.

An investor is considering 4 investments, A, B, C and leaving his money in the bank. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following payoff matrix has been developed for the decision problem.

-Refer to Exhibit 14.2. What formula should go in cell H5 and copied to H6:H8 of the Regret Table above to implement the minimax regret decision rule?

A) =MAX(MAX(F5:G5))

B) =MIN(F5:G5)

C) =AVERAGE(F5:G5)

D) =MAX(F5:G5)

The following questions are based on the information below.

An investor is considering 4 investments, A, B, C and leaving his money in the bank. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following payoff matrix has been developed for the decision problem.

-Refer to Exhibit 14.2. What formula should go in cell H5 and copied to H6:H8 of the Regret Table above to implement the minimax regret decision rule?

A) =MAX(MAX(F5:G5))

B) =MIN(F5:G5)

C) =AVERAGE(F5:G5)

D) =MAX(F5:G5)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

35

The minimum EOL in a decision problem will always

A) exceed the EVPI.

B) be less than the EVPI.

C) equal the EVPI.

D) equal the EMV.

A) exceed the EVPI.

B) be less than the EVPI.

C) equal the EVPI.

D) equal the EMV.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

36

Exhibit 14.1

The following questions are based on the information below.

An investor is considering 4 investments, A, B, C and leaving his money in the bank. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following payoff matrix has been developed for the decision problem.

Probabilistic decision rules can be used if the states of nature in a decision problem can be assigned probabilities that represent their likelihood of occurrence. Which of the following is not true regarding the probabilities employed?

A) The probabilities are always obtained from historical data.

B) The probabilities must always be unbiased.

C) The probabilities can be assigned subjectively.

D) Subjective probabilities obtained can be accurate and unbiased.

The following questions are based on the information below.

An investor is considering 4 investments, A, B, C and leaving his money in the bank. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following payoff matrix has been developed for the decision problem.

Probabilistic decision rules can be used if the states of nature in a decision problem can be assigned probabilities that represent their likelihood of occurrence. Which of the following is not true regarding the probabilities employed?

A) The probabilities are always obtained from historical data.

B) The probabilities must always be unbiased.

C) The probabilities can be assigned subjectively.

D) Subjective probabilities obtained can be accurate and unbiased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

37

A circular node in a decision tree is called a(n) ____ node.

A) chance

B) random

C) decision

D) event

A) chance

B) random

C) decision

D) event

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

38

Exhibit 14.1

The following questions are based on the information below.

An investor is considering 4 investments, A, B, C and leaving his money in the bank. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following payoff matrix has been developed for the decision problem.

Refer to Exhibit 14.1. What decision should be made according to the maximin decision rule?

A) A

B) B

C) C

D) Bank

The following questions are based on the information below.

An investor is considering 4 investments, A, B, C and leaving his money in the bank. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following payoff matrix has been developed for the decision problem.

Refer to Exhibit 14.1. What decision should be made according to the maximin decision rule?

A) A

B) B

C) C

D) Bank

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

39

Exhibit 14.4

The following questions are based on the information below.

Refer to Exhibit 14.4. What formula should go in cell D14 of the spreadsheet to compute the EVPI?

A) MAX(D5:D8)-D12

B) D12-MIN(D5:D8)

C) SUMPRODUCT(B12:C12,B10:C10)-MAX(D5:D8)

D) D12-MAX(D5:D8)

The following questions are based on the information below.

Refer to Exhibit 14.4. What formula should go in cell D14 of the spreadsheet to compute the EVPI?

A) MAX(D5:D8)-D12

B) D12-MIN(D5:D8)

C) SUMPRODUCT(B12:C12,B10:C10)-MAX(D5:D8)

D) D12-MAX(D5:D8)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

40

Exhibit 14.1

The following questions are based on the information below.

An investor is considering 4 investments, A, B, C and leaving his money in the bank. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following payoff matrix has been developed for the decision problem.

Refer to Exhibit 14.1. What decision should be made according to the minimax regret decision rule?

A) A

B) B

C) C

D) Bank

The following questions are based on the information below.

An investor is considering 4 investments, A, B, C and leaving his money in the bank. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following payoff matrix has been developed for the decision problem.

Refer to Exhibit 14.1. What decision should be made according to the minimax regret decision rule?

A) A

B) B

C) C

D) Bank

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

41

What is the formula for the weighted average score for alternative j when using a multi-criteria scoring model?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

42

What is the formula for the exponential utility function U(x)?

A) ex/R

B) 1 + ex/R

C) 1 ex/R

D) 1 ex/R

A) ex/R

B) 1 + ex/R

C) 1 ex/R

D) 1 ex/R

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

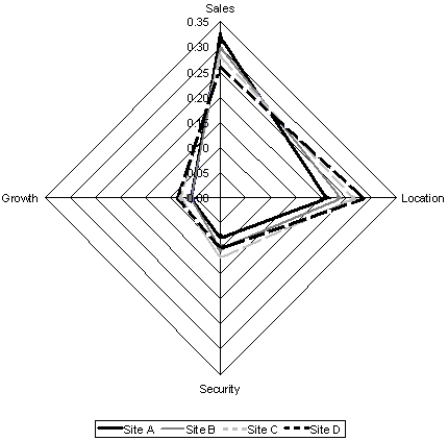

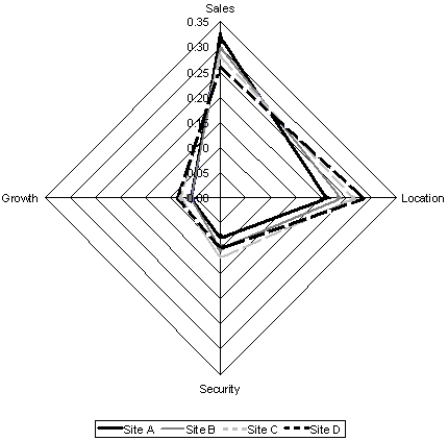

43

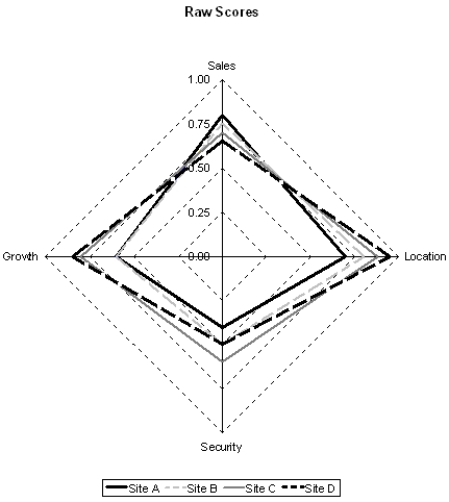

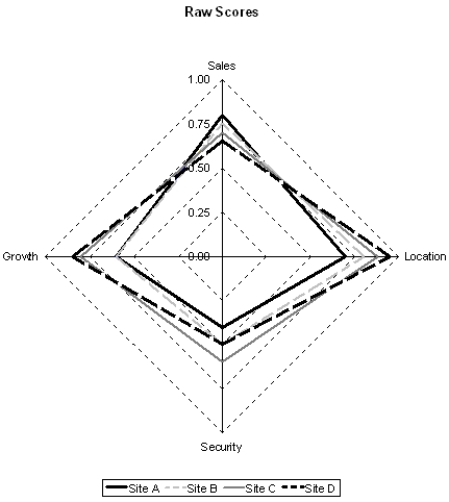

Based on the radar chart of the weighted scores provided below, which of the following interpretations is incorrect?

A) Site A wins on the Sales criteria but is last on the Location criteria.

B) Site C wins on the Security criteria and scores high on the remaining three criteria.

C) Site B scores lowest on each of the four criteria.

D) No site dominates on each of the four criteria.

A) Site A wins on the Sales criteria but is last on the Location criteria.

B) Site C wins on the Security criteria and scores high on the remaining three criteria.

C) Site B scores lowest on each of the four criteria.

D) No site dominates on each of the four criteria.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

44

A fast food restaurant is considering opening a new store at one of four locations. They have developed the following multi-criteria scoring model for this problem. What location should they choose based on this information?

A) A

B) B

C) C

D) D

A) A

B) B

C) C

D) D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

45

Exhibit 14.6

The following questions use the information below.

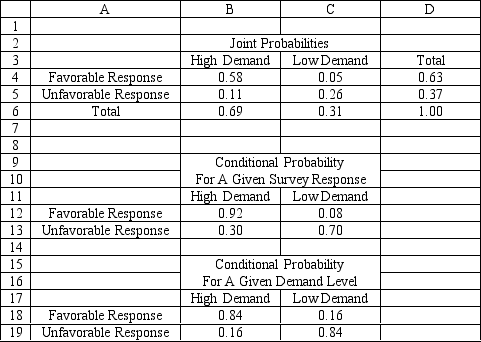

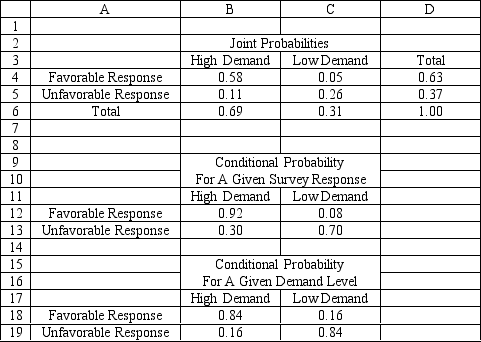

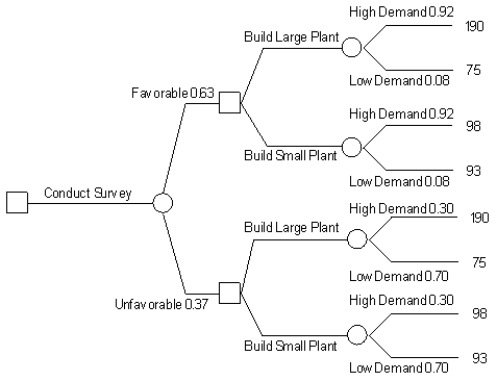

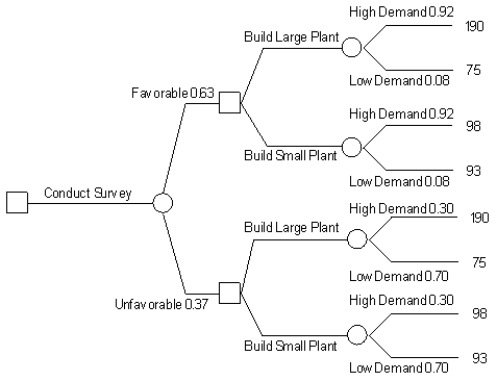

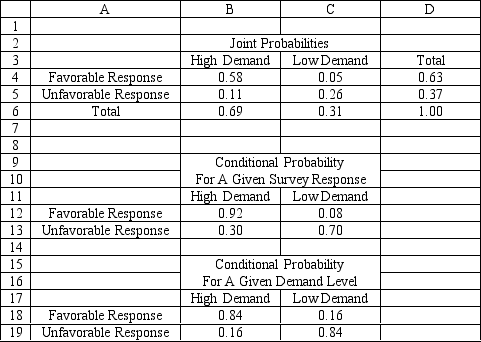

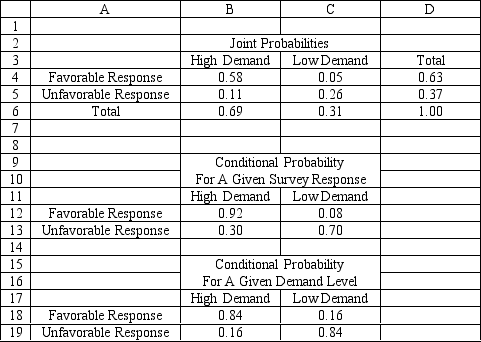

A company is planning a plant expansion. They can build a large or small plant. The payoffs for the plant depend on the level of consumer demand for the company's products. The company believes that there is an 69% chance that demand for their products will be high and a 31% chance that it will be low. The company can pay a market research firm to survey consumer attitudes towards the company's products. There is a 63% chance that the customers will like the products and a 37% chance that they won't. The payoff matrix and costs of the two plants are listed below. The company believes that if the survey is favorable there is a 92% chance that demand will be high for the products. If the survey is unfavorable there is only a 30% chance that the demand will be high. The following decision tree has been built for this problem. The company has computed that the expected monetary value of the best decision without sample information is 154.35 million. The company has developed the following conditional probability table for their decision problem.

Refer to Exhibit 14.6. What is P(FH), where F = favorable response and H = high demand?

A) .58

B) .63

C) .84

D) .92

The following questions use the information below.

A company is planning a plant expansion. They can build a large or small plant. The payoffs for the plant depend on the level of consumer demand for the company's products. The company believes that there is an 69% chance that demand for their products will be high and a 31% chance that it will be low. The company can pay a market research firm to survey consumer attitudes towards the company's products. There is a 63% chance that the customers will like the products and a 37% chance that they won't. The payoff matrix and costs of the two plants are listed below. The company believes that if the survey is favorable there is a 92% chance that demand will be high for the products. If the survey is unfavorable there is only a 30% chance that the demand will be high. The following decision tree has been built for this problem. The company has computed that the expected monetary value of the best decision without sample information is 154.35 million. The company has developed the following conditional probability table for their decision problem.

Refer to Exhibit 14.6. What is P(FH), where F = favorable response and H = high demand?

A) .58

B) .63

C) .84

D) .92

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

46

A company is planning a plant expansion. They can build a large or small plant. The payoffs for the plant depend on the level of consumer demand for the company's products. The company believes that there is an 69% chance that demand for their products will be high and a 31% chance that it will be low. The company can pay a market research firm to survey consumer attitudes towards the company's products. There is a 63% chance that the customers will like the products and a 37% chance that they won't. The payoff matrix and costs of the two plants are listed below. The company believes that if the survey is favorable there is a 92% chance that demand will be high for the products. If the survey is unfavorable there is only a 30% chance that the demand will be high. The following decision tree has been built for this problem. The company has computed that the expected monetary value of the best decision without sample information is 154.35 million. What is the EVSI for this problem (in $ million)?

A) 0.07

B) 26.38

C) 109.5

D) 180.8

A) 0.07

B) 26.38

C) 109.5

D) 180.8

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

47

Exhibit 14.7

The following questions use the information below.

A decision maker is faced with two alternatives. The decision maker has determined that she is indifferent between the two alternatives when p = 0.45.

-Refer to Exhibit 14.7. What is the decision maker's certainty equivalent for this problem?

A) ?$15,000

B) $82,000

C) $56,100

D) $82,000.

The following questions use the information below.

A decision maker is faced with two alternatives. The decision maker has determined that she is indifferent between the two alternatives when p = 0.45.

-Refer to Exhibit 14.7. What is the decision maker's certainty equivalent for this problem?

A) ?$15,000

B) $82,000

C) $56,100

D) $82,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

48

The total worth, value or desirability of a decision alternative is called its

A) usefulness.

B) worthiness.

C) utility.

D) risk.

A) usefulness.

B) worthiness.

C) utility.

D) risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

49

Exhibit 14.7

The following questions use the information below.

A decision maker is faced with two alternatives. The decision maker has determined that she is indifferent between the two alternatives when p = 0.45.

-Refer to Exhibit 14.7. What is the decision maker's risk premium for this problem?

A) ?$20,000

B) ?$25,900

C) $70,000

D) $80,000

The following questions use the information below.

A decision maker is faced with two alternatives. The decision maker has determined that she is indifferent between the two alternatives when p = 0.45.

-Refer to Exhibit 14.7. What is the decision maker's risk premium for this problem?

A) ?$20,000

B) ?$25,900

C) $70,000

D) $80,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

50

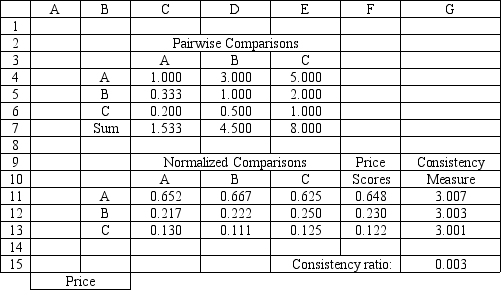

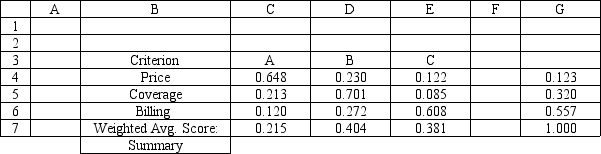

Exhibit 14.8

The following questions use the information below.

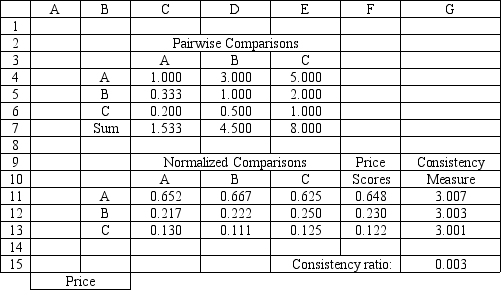

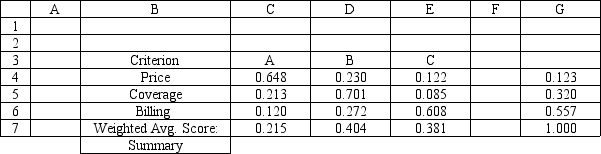

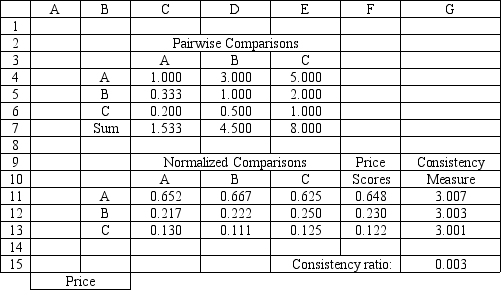

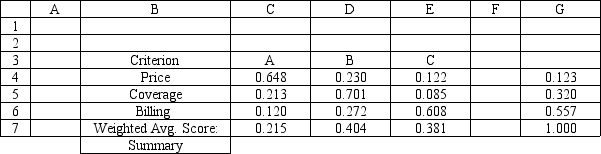

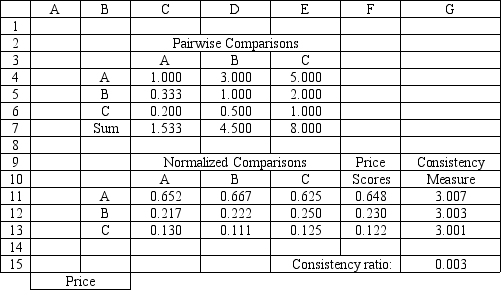

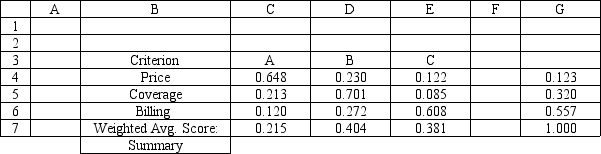

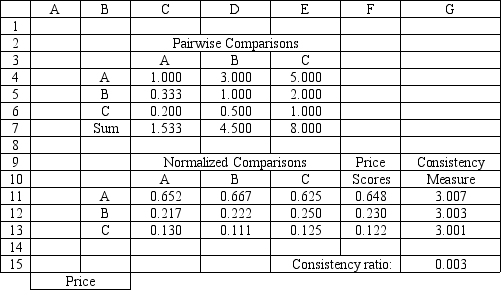

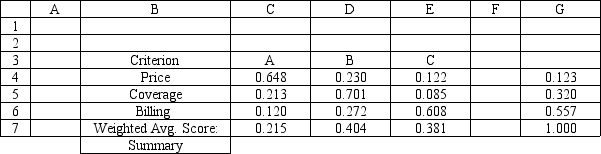

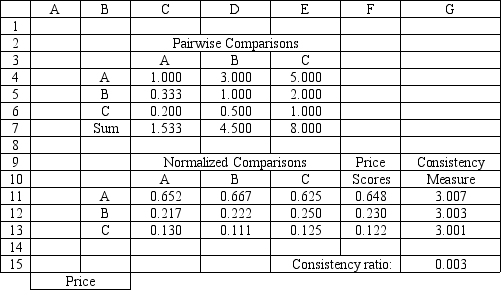

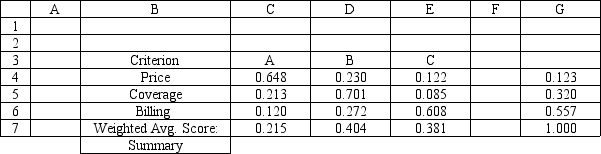

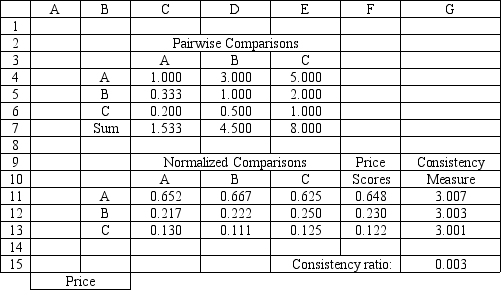

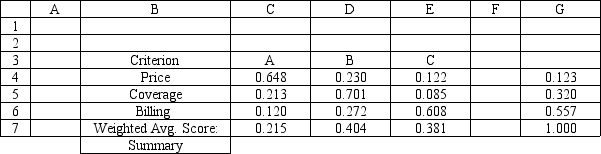

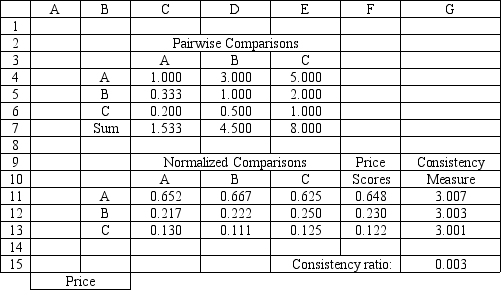

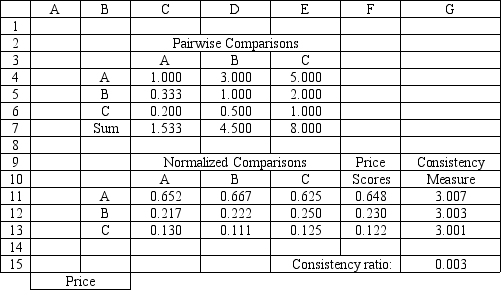

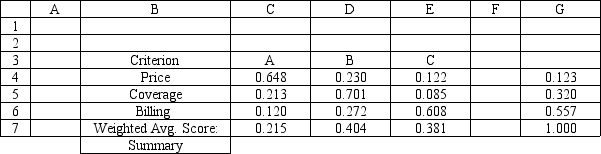

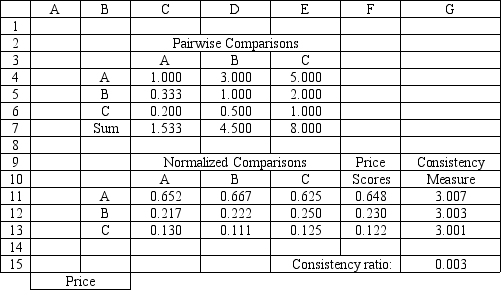

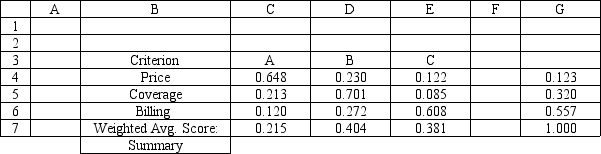

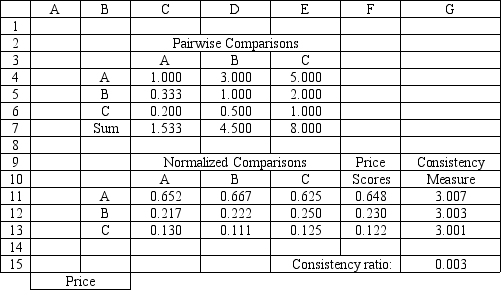

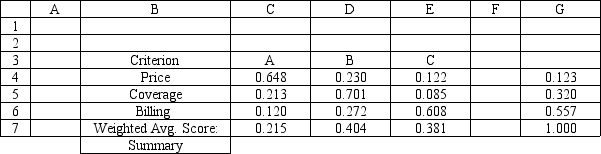

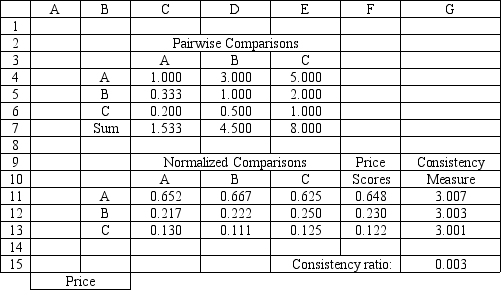

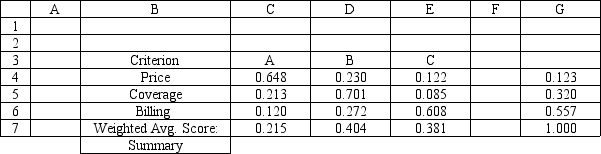

A company needs to buy a new insurance policy. They have three policies to choose from, A, B and C. The policies differ with respect to price, coverage and ease of billing. The company has developed the following AHP tables for price and summary. The other tables are not shown due to space limitations.

Refer to Exhibit 14.8. What formula should go in cell F11 and get copied to F12:F13 of the Price worksheet to compute the Price Score?

A) =AVERAGE(C4:C6)

B) =AVERAGE(C11:E11)

C) =AVERAGE(G11:G13)

D) =AVERAGE(C7:E7)

The following questions use the information below.

A company needs to buy a new insurance policy. They have three policies to choose from, A, B and C. The policies differ with respect to price, coverage and ease of billing. The company has developed the following AHP tables for price and summary. The other tables are not shown due to space limitations.

Refer to Exhibit 14.8. What formula should go in cell F11 and get copied to F12:F13 of the Price worksheet to compute the Price Score?

A) =AVERAGE(C4:C6)

B) =AVERAGE(C11:E11)

C) =AVERAGE(G11:G13)

D) =AVERAGE(C7:E7)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

51

The scores in a scoring model can be thought of as subjective assessments of

A) usefulness.

B) worthiness.

C) utility.

D) payoff.

A) usefulness.

B) worthiness.

C) utility.

D) payoff.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

52

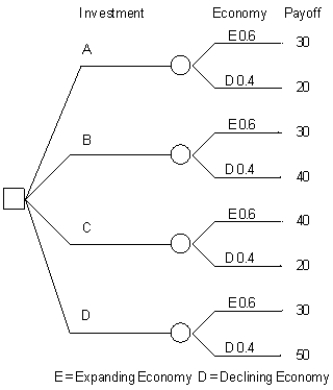

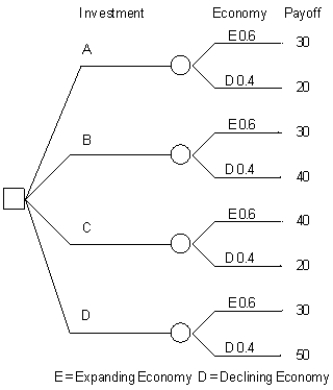

Exhibit 14.5

The following questions are based on the information below.

An investor is considering 4 investments, A, B, C, D. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following decision tree has been developed for the problem. The investor has estimated the probability of a declining economy at 40% and an expanding economy at 60%.

Refer to Exhibit 14.5. What is the expected monetary value for the investor's problem?

A) 32

B) 36

C) 38

D) 42

The following questions are based on the information below.

An investor is considering 4 investments, A, B, C, D. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following decision tree has been developed for the problem. The investor has estimated the probability of a declining economy at 40% and an expanding economy at 60%.

Refer to Exhibit 14.5. What is the expected monetary value for the investor's problem?

A) 32

B) 36

C) 38

D) 42

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

53

Exhibit 14.7

The following questions use the information below.

A decision maker is faced with two alternatives. The decision maker has determined that she is indifferent between the two alternatives when p = 0.45.

-Refer to Exhibit 14.7. What is the expected value of Alternative 2 for this decision maker?

A) $82,000

B) $56,100

C) $64,350

D) $72,600

The following questions use the information below.

A decision maker is faced with two alternatives. The decision maker has determined that she is indifferent between the two alternatives when p = 0.45.

-Refer to Exhibit 14.7. What is the expected value of Alternative 2 for this decision maker?

A) $82,000

B) $56,100

C) $64,350

D) $72,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

54

Exhibit 14.5

The following questions are based on the information below.

An investor is considering 4 investments, A, B, C, D. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following decision tree has been developed for the problem. The investor has estimated the probability of a declining economy at 40% and an expanding economy at 60%.

Refer to Exhibit 14.5. What is the correct decision for this investor based on an expected monetary value criteria?

A) A

B) B

C) C

D) D

The following questions are based on the information below.

An investor is considering 4 investments, A, B, C, D. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following decision tree has been developed for the problem. The investor has estimated the probability of a declining economy at 40% and an expanding economy at 60%.

Refer to Exhibit 14.5. What is the correct decision for this investor based on an expected monetary value criteria?

A) A

B) B

C) C

D) D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

55

A "risk averse" decision maker assigns the ____ relative utility to any payoff but has a(n) ____ marginal utility for increased payoffs.

A) largest; increasing

B) largest; diminishing

C) smallest; diminishing

D) smallest; increasing

A) largest; increasing

B) largest; diminishing

C) smallest; diminishing

D) smallest; increasing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

56

Exhibit 14.6

The following questions use the information below.

A company is planning a plant expansion. They can build a large or small plant. The payoffs for the plant depend on the level of consumer demand for the company's products. The company believes that there is an 69% chance that demand for their products will be high and a 31% chance that it will be low. The company can pay a market research firm to survey consumer attitudes towards the company's products. There is a 63% chance that the customers will like the products and a 37% chance that they won't. The payoff matrix and costs of the two plants are listed below. The company believes that if the survey is favorable there is a 92% chance that demand will be high for the products. If the survey is unfavorable there is only a 30% chance that the demand will be high. The following decision tree has been built for this problem. The company has computed that the expected monetary value of the best decision without sample information is 154.35 million. The company has developed the following conditional probability table for their decision problem.

Refer to Exhibit 14.6. What formula should go in cell C13 of the probability table?

A) =C5/$D4

B) =C5/C$6

C) =C5/$D5

D) =C4/$D4

The following questions use the information below.

A company is planning a plant expansion. They can build a large or small plant. The payoffs for the plant depend on the level of consumer demand for the company's products. The company believes that there is an 69% chance that demand for their products will be high and a 31% chance that it will be low. The company can pay a market research firm to survey consumer attitudes towards the company's products. There is a 63% chance that the customers will like the products and a 37% chance that they won't. The payoff matrix and costs of the two plants are listed below. The company believes that if the survey is favorable there is a 92% chance that demand will be high for the products. If the survey is unfavorable there is only a 30% chance that the demand will be high. The following decision tree has been built for this problem. The company has computed that the expected monetary value of the best decision without sample information is 154.35 million. The company has developed the following conditional probability table for their decision problem.

Refer to Exhibit 14.6. What formula should go in cell C13 of the probability table?

A) =C5/$D4

B) =C5/C$6

C) =C5/$D5

D) =C4/$D4

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

57

The scores in a scoring model range from

A) 0 to 1

B) 1 to +1

C) 0 to 5

D) 0 to 10

A) 0 to 1

B) 1 to +1

C) 0 to 5

D) 0 to 10

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

58

Based on the radar chart of raw scores provided below, why is this decision complex?

A) The chart is hard to read.

B) No site wins on all four criteria.

C) No site achieves a perfect score of 1.0 on a criteria.

D) No sites have sufficient security.

A) The chart is hard to read.

B) No site wins on all four criteria.

C) No site achieves a perfect score of 1.0 on a criteria.

D) No sites have sufficient security.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

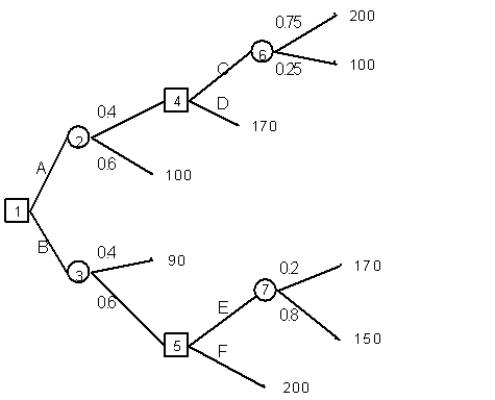

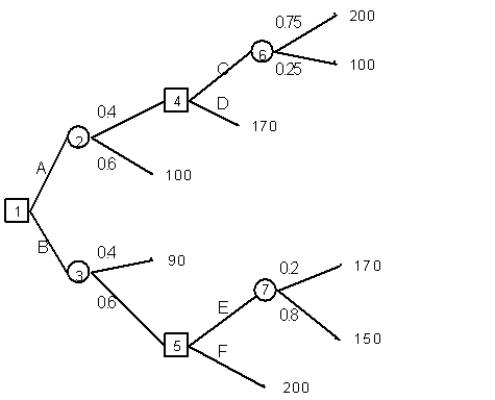

59

An investor is considering 2 investments, A, B, which can be made now. After these investments are made he can pursue choices C, D, E and F depending on whether he chose A or B originally. He has developed the following decision tree to aid in his selection process. What are the correct original and subsequent decisions based on an expected monetary value criteria?

A) A, C

B) A, D

C) B, E

D) B, F

A) A, C

B) A, D

C) B, E

D) B, F

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

60

Exhibit 14.5

The following questions are based on the information below.

An investor is considering 4 investments, A, B, C, D. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following decision tree has been developed for the problem. The investor has estimated the probability of a declining economy at 40% and an expanding economy at 60%.

Refer to Exhibit 14.5. How high can P(E) go before the investor's decision, based on expected monetary value criteria, changes?

A) 0.65

B) 0.70

C) 0.75

D) 0.80

The following questions are based on the information below.

An investor is considering 4 investments, A, B, C, D. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following decision tree has been developed for the problem. The investor has estimated the probability of a declining economy at 40% and an expanding economy at 60%.

Refer to Exhibit 14.5. How high can P(E) go before the investor's decision, based on expected monetary value criteria, changes?

A) 0.65

B) 0.70

C) 0.75

D) 0.80

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

61

Exhibit 14.9

The following questions are based on the information below.

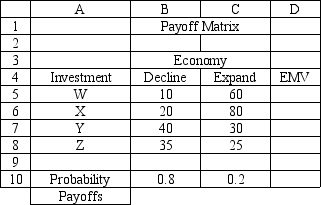

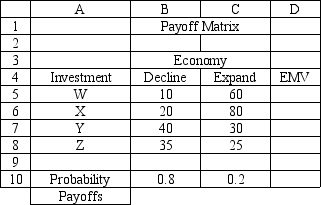

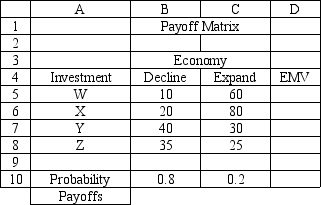

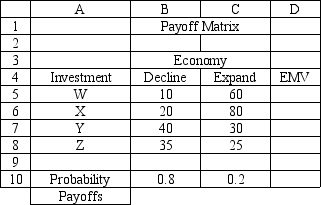

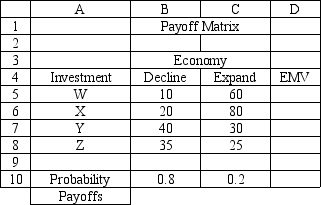

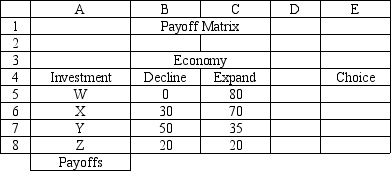

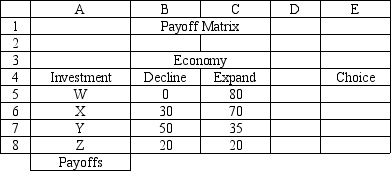

An investor is considering 4 investments, W, X, Y, and Z. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following payoff matrix has been developed for the investment decision problem.

Refer to Exhibit 14.9. What formula should go in cell D5 and get copied to D6:D8 to implement the maximin decision rule?

The following questions are based on the information below.

An investor is considering 4 investments, W, X, Y, and Z. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following payoff matrix has been developed for the investment decision problem.

Refer to Exhibit 14.9. What formula should go in cell D5 and get copied to D6:D8 to implement the maximin decision rule?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

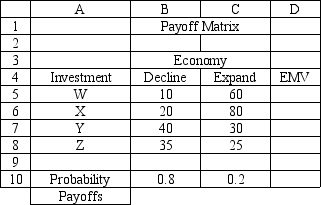

62

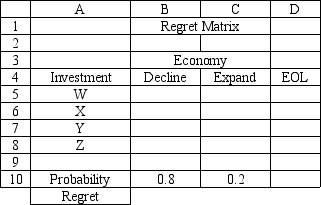

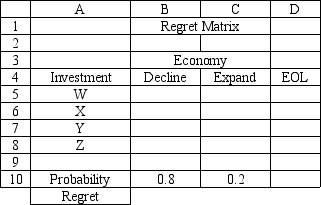

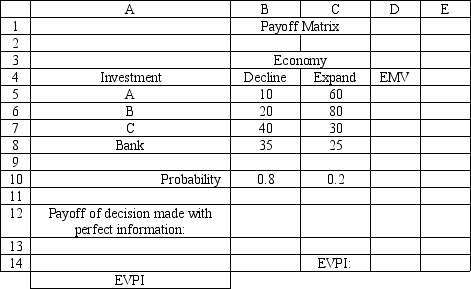

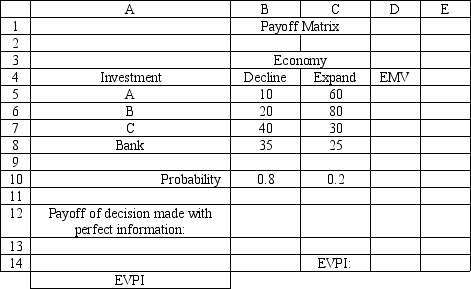

Exhibit 14.10

The following questions are based on the information below.

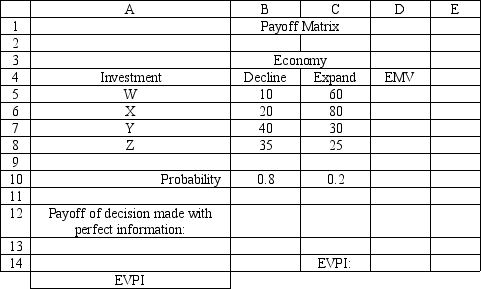

An investor is considering 4 investments, W, X, Y, and Z. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following payoff matrix has been developed for the decision problem. The investor has estimated the probability of a declining economy at 80% and an expanding economy at 20%.

Refer to Exhibit 14.10. Complete the table using the expected monetary value decision rule and indicate which decision should be made according to that rule.

The following questions are based on the information below.

An investor is considering 4 investments, W, X, Y, and Z. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following payoff matrix has been developed for the decision problem. The investor has estimated the probability of a declining economy at 80% and an expanding economy at 20%.

Refer to Exhibit 14.10. Complete the table using the expected monetary value decision rule and indicate which decision should be made according to that rule.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

63

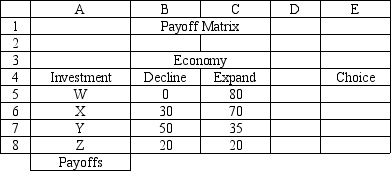

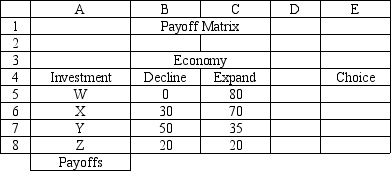

Exhibit 14.10

The following questions are based on the information below.

An investor is considering 4 investments, W, X, Y, and Z. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following payoff matrix has been developed for the decision problem. The investor has estimated the probability of a declining economy at 80% and an expanding economy at 20%.

Refer to Exhibit 14.10. The original payoff data is in the worksheet above called "Payoffs". What formula should go in cell B5 of the spreadsheet if the expected regret decision rule is to be used?

The following questions are based on the information below.

An investor is considering 4 investments, W, X, Y, and Z. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following payoff matrix has been developed for the decision problem. The investor has estimated the probability of a declining economy at 80% and an expanding economy at 20%.

Refer to Exhibit 14.10. The original payoff data is in the worksheet above called "Payoffs". What formula should go in cell B5 of the spreadsheet if the expected regret decision rule is to be used?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

64

Exhibit 14.9

The following questions are based on the information below.

An investor is considering 4 investments, W, X, Y, and Z. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following payoff matrix has been developed for the investment decision problem.

Refer to Exhibit 14.9. Assume the formula =MIN(B5:C5) was entered in cell D5 and copied to cells D6:D8. What formula should go in cell E5 and get copied to cells E6:E8 to place a "<==" to indicate the choice according to the maximin decision rule?

The following questions are based on the information below.

An investor is considering 4 investments, W, X, Y, and Z. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following payoff matrix has been developed for the investment decision problem.

Refer to Exhibit 14.9. Assume the formula =MIN(B5:C5) was entered in cell D5 and copied to cells D6:D8. What formula should go in cell E5 and get copied to cells E6:E8 to place a "<==" to indicate the choice according to the maximin decision rule?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

65

Exhibit 14.8

The following questions use the information below.

A company needs to buy a new insurance policy. They have three policies to choose from, A, B and C. The policies differ with respect to price, coverage and ease of billing. The company has developed the following AHP tables for price and summary. The other tables are not shown due to space limitations.

Refer to Exhibit 14.8. What formula should go in cell G15 of the Price worksheet to compute the Consistency Ratio?

A) =AVERAGE(G11:G13)-3)/(2*0.58)

B) =AVERAGE(G11:G13)-3)

C) =AVERAGE(G11:G13))/(2*0.58)

D) =AVERAGE(G11:G13)-3)/0.58

The following questions use the information below.

A company needs to buy a new insurance policy. They have three policies to choose from, A, B and C. The policies differ with respect to price, coverage and ease of billing. The company has developed the following AHP tables for price and summary. The other tables are not shown due to space limitations.

Refer to Exhibit 14.8. What formula should go in cell G15 of the Price worksheet to compute the Consistency Ratio?

A) =AVERAGE(G11:G13)-3)/(2*0.58)

B) =AVERAGE(G11:G13)-3)

C) =AVERAGE(G11:G13))/(2*0.58)

D) =AVERAGE(G11:G13)-3)/0.58

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

66

Exhibit 14.9

The following questions are based on the information below.

An investor is considering 4 investments, W, X, Y, and Z. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following payoff matrix has been developed for the investment decision problem.

Refer to Exhibit 14.9. What decision should be made according to the maximax decision rule?

The following questions are based on the information below.

An investor is considering 4 investments, W, X, Y, and Z. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following payoff matrix has been developed for the investment decision problem.

Refer to Exhibit 14.9. What decision should be made according to the maximax decision rule?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

67

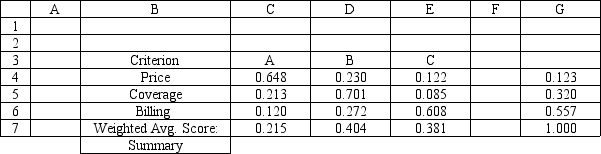

Exhibit 14.8

The following questions use the information below.

A company needs to buy a new insurance policy. They have three policies to choose from, A, B and C. The policies differ with respect to price, coverage and ease of billing. The company has developed the following AHP tables for price and summary. The other tables are not shown due to space limitations.

Refer to Exhibit 14.8. Which policy should the company choose based on the Summary worksheet?

A) A

B) B

C) C

D) None of these

The following questions use the information below.

A company needs to buy a new insurance policy. They have three policies to choose from, A, B and C. The policies differ with respect to price, coverage and ease of billing. The company has developed the following AHP tables for price and summary. The other tables are not shown due to space limitations.

Refer to Exhibit 14.8. Which policy should the company choose based on the Summary worksheet?

A) A

B) B

C) C

D) None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

68

Exhibit 14.8

The following questions use the information below.

A company needs to buy a new insurance policy. They have three policies to choose from, A, B and C. The policies differ with respect to price, coverage and ease of billing. The company has developed the following AHP tables for price and summary. The other tables are not shown due to space limitations.

Refer to Exhibit 14.8. What formula should go in cell C7 and get copied to D7:E7 of the Summary worksheet to compute the Weighted Average Score?

A) =SUMPRODUCT(C4:E4,$G$4:$G$6)

B) =SUMPRODUCT(C4:C6,$C$5:$C$7)

C) =SUMPRODUCT($G$4,$G$6)

D) =SUMPRODUCT(C4:C6,$G$4:$G$6)

The following questions use the information below.

A company needs to buy a new insurance policy. They have three policies to choose from, A, B and C. The policies differ with respect to price, coverage and ease of billing. The company has developed the following AHP tables for price and summary. The other tables are not shown due to space limitations.

Refer to Exhibit 14.8. What formula should go in cell C7 and get copied to D7:E7 of the Summary worksheet to compute the Weighted Average Score?

A) =SUMPRODUCT(C4:E4,$G$4:$G$6)

B) =SUMPRODUCT(C4:C6,$C$5:$C$7)

C) =SUMPRODUCT($G$4,$G$6)

D) =SUMPRODUCT(C4:C6,$G$4:$G$6)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

69

Exhibit 14.9

The following questions are based on the information below.

An investor is considering 4 investments, W, X, Y, and Z. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following payoff matrix has been developed for the investment decision problem.

Refer to Exhibit 14.9. Assume the formula =MAX(B5:C5) was entered in cell D5 and copied to cells D6:D8. What formula should go in cell E5 and get copied to cells E6:E8 to place a "<==" to indicate the choice according to the maximax decision rule?

The following questions are based on the information below.

An investor is considering 4 investments, W, X, Y, and Z. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following payoff matrix has been developed for the investment decision problem.

Refer to Exhibit 14.9. Assume the formula =MAX(B5:C5) was entered in cell D5 and copied to cells D6:D8. What formula should go in cell E5 and get copied to cells E6:E8 to place a "<==" to indicate the choice according to the maximax decision rule?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

70

Exhibit 14.10

The following questions are based on the information below.

An investor is considering 4 investments, W, X, Y, and Z. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following payoff matrix has been developed for the decision problem. The investor has estimated the probability of a declining economy at 80% and an expanding economy at 20%.

Refer to Exhibit 14.10. Complete the Regret Table according to the expected regret decision rule.

The following questions are based on the information below.

An investor is considering 4 investments, W, X, Y, and Z. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following payoff matrix has been developed for the decision problem. The investor has estimated the probability of a declining economy at 80% and an expanding economy at 20%.

Refer to Exhibit 14.10. Complete the Regret Table according to the expected regret decision rule.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

71

Exhibit 14.9

The following questions are based on the information below.

An investor is considering 4 investments, W, X, Y, and Z. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following payoff matrix has been developed for the investment decision problem.

Refer to Exhibit 14.9. What formula should go in cell D5 of the following Regret Table to implement the minimax regret decision rule? Assume that cells B5:C8 contain the regret values for the problem.

The following questions are based on the information below.

An investor is considering 4 investments, W, X, Y, and Z. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following payoff matrix has been developed for the investment decision problem.

Refer to Exhibit 14.9. What formula should go in cell D5 of the following Regret Table to implement the minimax regret decision rule? Assume that cells B5:C8 contain the regret values for the problem.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

72

Exhibit 14.8

The following questions use the information below.

A company needs to buy a new insurance policy. They have three policies to choose from, A, B and C. The policies differ with respect to price, coverage and ease of billing. The company has developed the following AHP tables for price and summary. The other tables are not shown due to space limitations.

Refer to Exhibit 14.8. The Consistency Ratio indicates consistency in the pairwise comparison matrix if the ratio is

A) 0.05

B) 0.10

C) 0.20

D) 0.30

The following questions use the information below.

A company needs to buy a new insurance policy. They have three policies to choose from, A, B and C. The policies differ with respect to price, coverage and ease of billing. The company has developed the following AHP tables for price and summary. The other tables are not shown due to space limitations.

Refer to Exhibit 14.8. The Consistency Ratio indicates consistency in the pairwise comparison matrix if the ratio is

A) 0.05

B) 0.10

C) 0.20

D) 0.30

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

73

Exhibit 14.9

The following questions are based on the information below.

An investor is considering 4 investments, W, X, Y, and Z. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following payoff matrix has been developed for the investment decision problem.

Refer to Exhibit 14.9. The original payoff data is in the worksheet called "Payoffs". What formula should go in cell B5 of this Regret Matrix to compute the regret value?

The following questions are based on the information below.

An investor is considering 4 investments, W, X, Y, and Z. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following payoff matrix has been developed for the investment decision problem.

Refer to Exhibit 14.9. The original payoff data is in the worksheet called "Payoffs". What formula should go in cell B5 of this Regret Matrix to compute the regret value?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

74

Exhibit 14.8

The following questions use the information below.

A company needs to buy a new insurance policy. They have three policies to choose from, A, B and C. The policies differ with respect to price, coverage and ease of billing. The company has developed the following AHP tables for price and summary. The other tables are not shown due to space limitations.

Refer to Exhibit 14.8. What formula should go in cell G11 and get copied to G12:G13 of the Price worksheet to compute the Consistency Measure?

A) =MMULT(C4:E4,$F$11:$F$13)

B) =SUMPRODUCT(C4:E4,$F$11:$F$13)/F11

C) =MMULT(C4:E4,$F$11:$F$13)/F11

D) =MMULT(C7:E7,$F$11:$F$13)/F11

The following questions use the information below.

A company needs to buy a new insurance policy. They have three policies to choose from, A, B and C. The policies differ with respect to price, coverage and ease of billing. The company has developed the following AHP tables for price and summary. The other tables are not shown due to space limitations.

Refer to Exhibit 14.8. What formula should go in cell G11 and get copied to G12:G13 of the Price worksheet to compute the Consistency Measure?

A) =MMULT(C4:E4,$F$11:$F$13)

B) =SUMPRODUCT(C4:E4,$F$11:$F$13)/F11

C) =MMULT(C4:E4,$F$11:$F$13)/F11

D) =MMULT(C7:E7,$F$11:$F$13)/F11

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

75

Exhibit 14.9

The following questions are based on the information below.

An investor is considering 4 investments, W, X, Y, and Z. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following payoff matrix has been developed for the investment decision problem.

Refer to Exhibit 14.9. What decision should be made according to the minimax regret decision rule?

The following questions are based on the information below.

An investor is considering 4 investments, W, X, Y, and Z. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following payoff matrix has been developed for the investment decision problem.

Refer to Exhibit 14.9. What decision should be made according to the minimax regret decision rule?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

76

Exhibit 14.10

The following questions are based on the information below.

An investor is considering 4 investments, W, X, Y, and Z. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following payoff matrix has been developed for the decision problem. The investor has estimated the probability of a declining economy at 80% and an expanding economy at 20%.

Refer to Exhibit 14.10. Complete the following table to determine the expected value of perfect information for the investor.

The following questions are based on the information below.

An investor is considering 4 investments, W, X, Y, and Z. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following payoff matrix has been developed for the decision problem. The investor has estimated the probability of a declining economy at 80% and an expanding economy at 20%.

Refer to Exhibit 14.10. Complete the following table to determine the expected value of perfect information for the investor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

77

Exhibit 14.9

The following questions are based on the information below.

An investor is considering 4 investments, W, X, Y, and Z. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following payoff matrix has been developed for the investment decision problem.

Refer to Exhibit 14.9. What decision should be made according to the maximin decision rule?

The following questions are based on the information below.

An investor is considering 4 investments, W, X, Y, and Z. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following payoff matrix has been developed for the investment decision problem.

Refer to Exhibit 14.9. What decision should be made according to the maximin decision rule?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

78

Exhibit 14.10

The following questions are based on the information below.

An investor is considering 4 investments, W, X, Y, and Z. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following payoff matrix has been developed for the decision problem. The investor has estimated the probability of a declining economy at 80% and an expanding economy at 20%.

Refer to Exhibit 14.10. What formulas should go in cell D5:D14 and B12:C12 of the spreadsheet to compute the EVPI?

The following questions are based on the information below.

An investor is considering 4 investments, W, X, Y, and Z. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following payoff matrix has been developed for the decision problem. The investor has estimated the probability of a declining economy at 80% and an expanding economy at 20%.

Refer to Exhibit 14.10. What formulas should go in cell D5:D14 and B12:C12 of the spreadsheet to compute the EVPI?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

79

Exhibit 14.9

The following questions are based on the information below.

An investor is considering 4 investments, W, X, Y, and Z. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following payoff matrix has been developed for the investment decision problem.

Refer to Exhibit 14.9. What formula should go in cell D5 and get copied to D6:D8 to implement the maximax decision rule?

The following questions are based on the information below.

An investor is considering 4 investments, W, X, Y, and Z. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following payoff matrix has been developed for the investment decision problem.

Refer to Exhibit 14.9. What formula should go in cell D5 and get copied to D6:D8 to implement the maximax decision rule?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

80

An investor is considering 4 investments, A, B, C, D. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following decision tree has been developed for the problem. The investor has estimated the probability of a declining economy at 25% and an expanding economy at 75%. What is the correct decision for this investor based on an expected monetary value criteria? Draw the decision tree for this problem.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck