Deck 14: Advanced Pricing Techniques

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

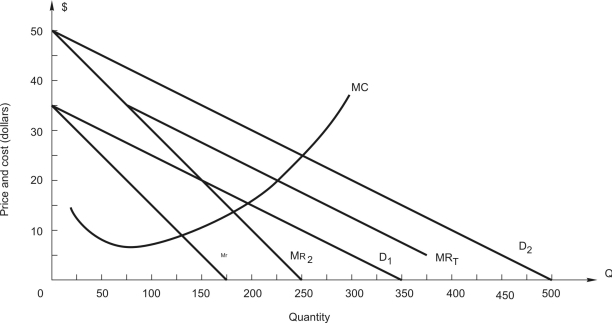

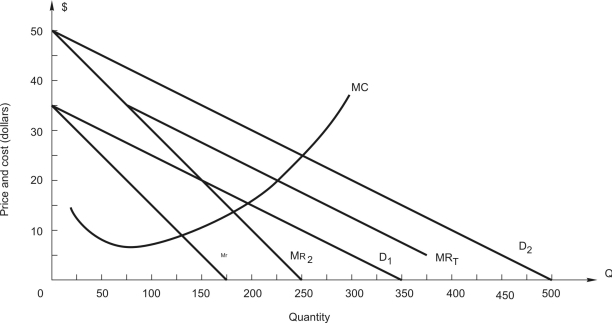

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

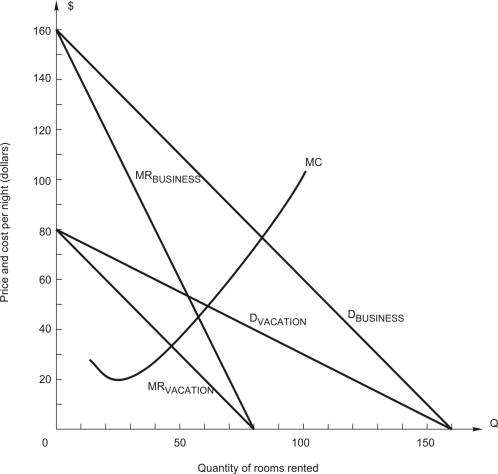

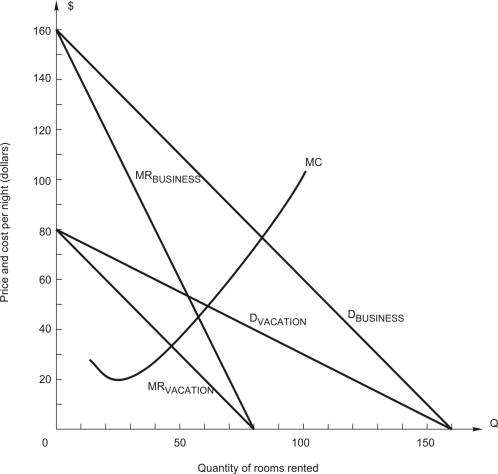

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/57

العب

ملء الشاشة (f)

Deck 14: Advanced Pricing Techniques

1

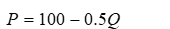

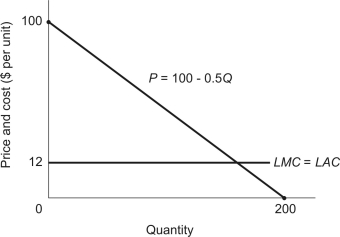

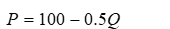

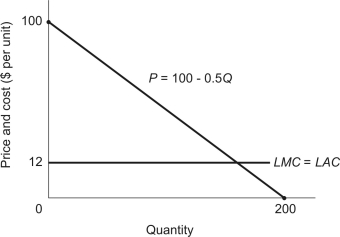

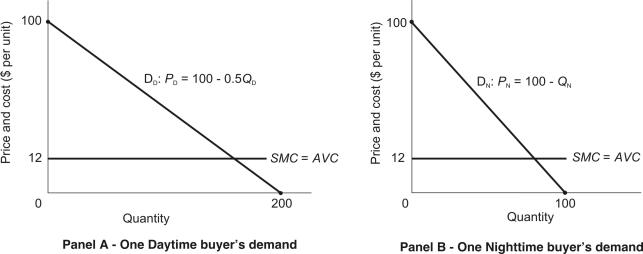

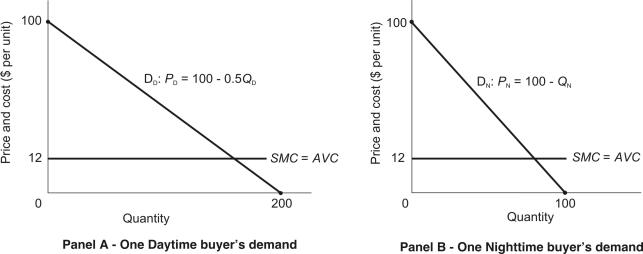

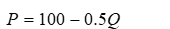

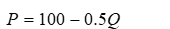

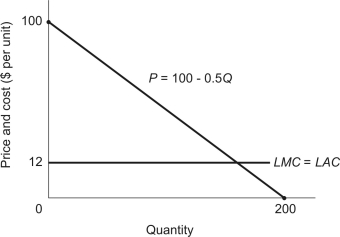

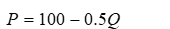

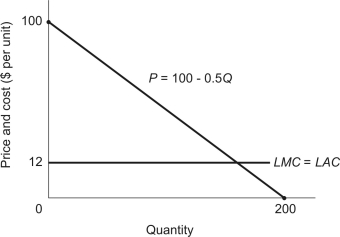

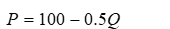

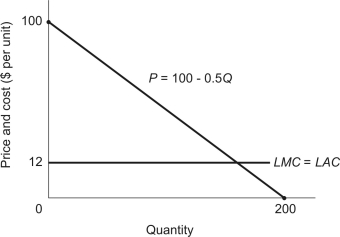

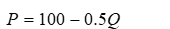

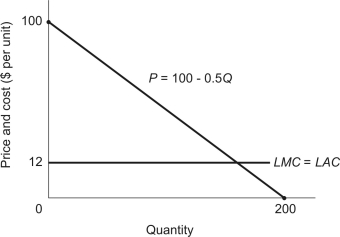

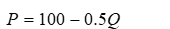

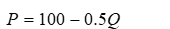

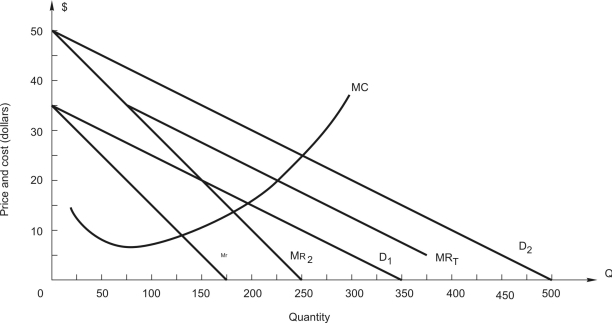

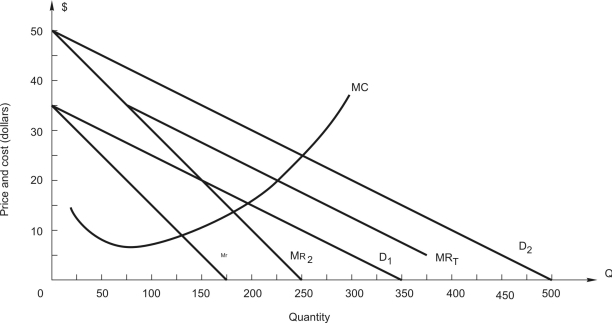

A firm faces the demand for its product, , as shown in the figure below. It produces under conditions of constant costs in the long run, and LMC = LAC = $12 per unit. Answer Questions .

, as shown in the figure below. It produces under conditions of constant costs in the long run, and LMC = LAC = $12 per unit. Answer Questions .

-At the profit-maximizing uniform price, the firm earns economic profit of __________ when it engages in uniform pricing.

A) $3,872

B) $4,728

C) $4,874

D) $5,428

E) none of the above

, as shown in the figure below. It produces under conditions of constant costs in the long run, and LMC = LAC = $12 per unit. Answer Questions .

, as shown in the figure below. It produces under conditions of constant costs in the long run, and LMC = LAC = $12 per unit. Answer Questions .

-At the profit-maximizing uniform price, the firm earns economic profit of __________ when it engages in uniform pricing.

A) $3,872

B) $4,728

C) $4,874

D) $5,428

E) none of the above

$3,872

2

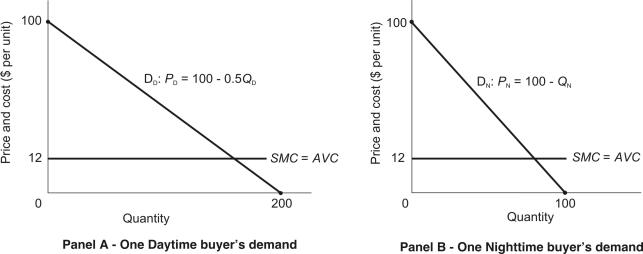

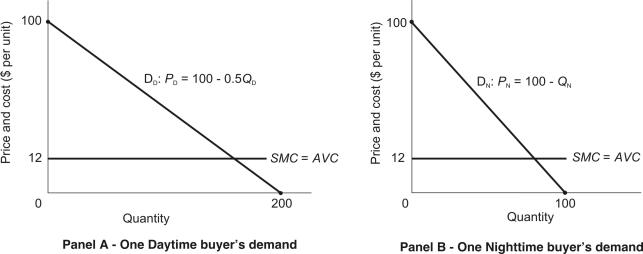

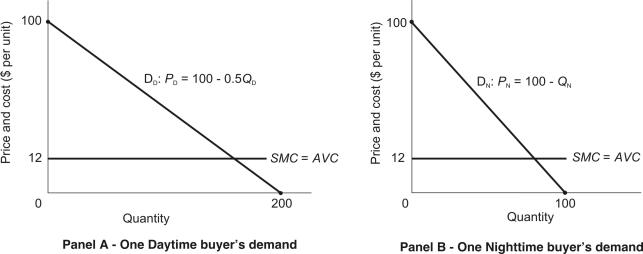

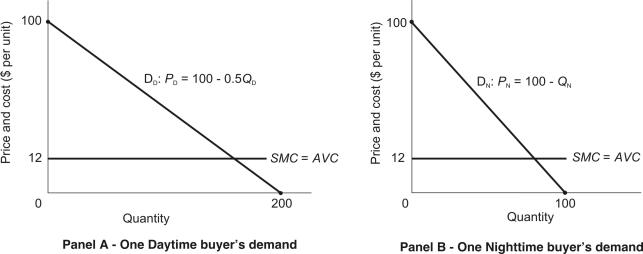

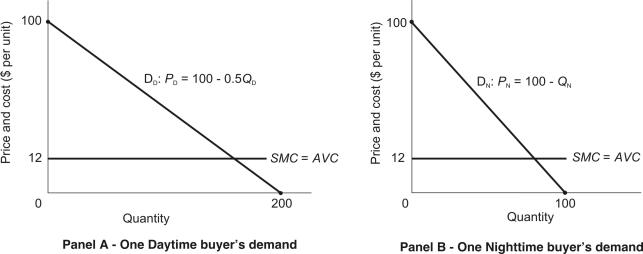

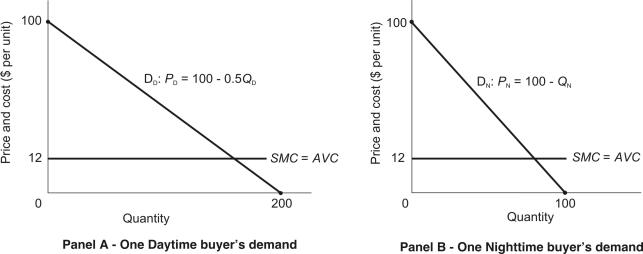

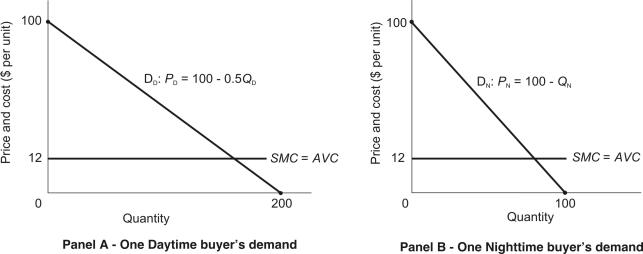

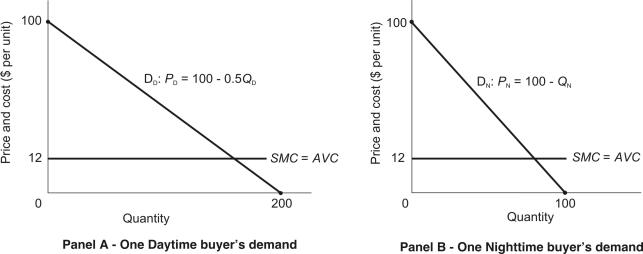

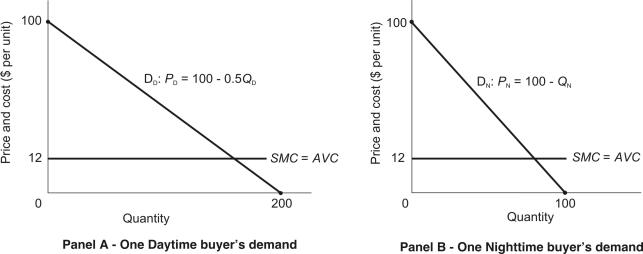

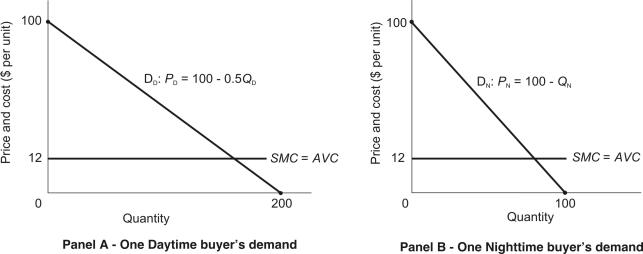

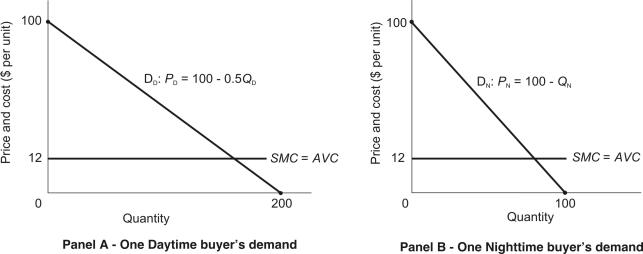

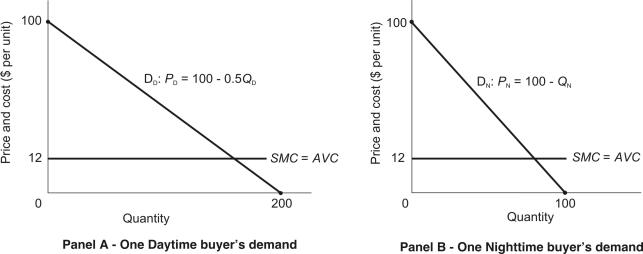

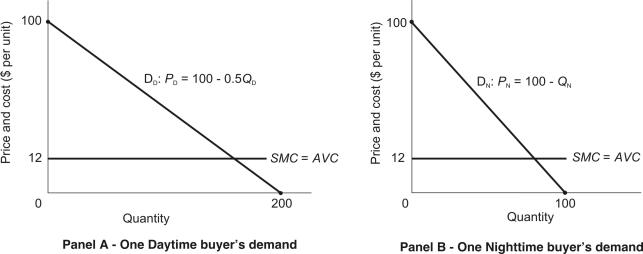

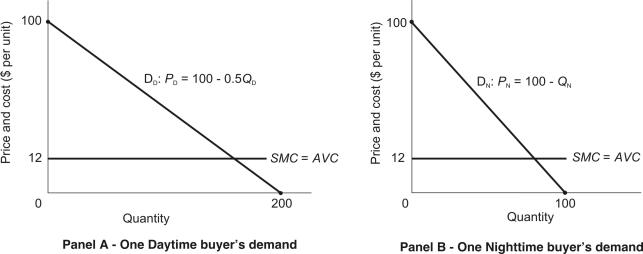

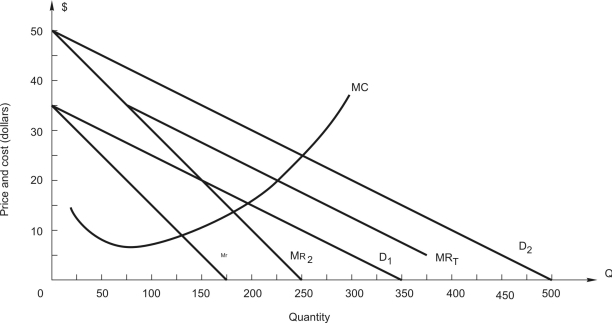

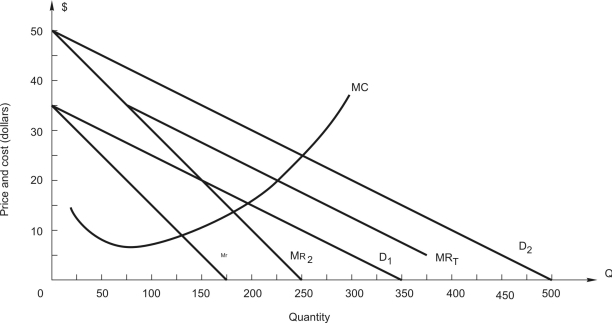

In Questions a firm sells its product to two groups of buyers: daytime buyers and nighttime buyers. There are 50 daytime buyers, all of whom have identical demands given by DD in the figure below. There are 50 nighttime buyers, all of whom have identical demands given by DN in the figure below. The firm's variable costs are constant (SMC = AVC = $12) and its total fixed cost is $250,000. The marketing director must devise a two-part pricing plan that will maximize the firm's profit.

-Assuming both daytime and nighttime markets are served, the optimal fixed access charge (A*) is

A) A* = $1,472

B) A* = $2,178

C) A* = $3,872

D) A* = $4,356

E) A* = $7,744

-Assuming both daytime and nighttime markets are served, the optimal fixed access charge (A*) is

A) A* = $1,472

B) A* = $2,178

C) A* = $3,872

D) A* = $4,356

E) A* = $7,744

A* = $2,178

3

In Questions a firm sells its product to two groups of buyers: daytime buyers and nighttime buyers. There are 50 daytime buyers, all of whom have identical demands given by DD in the figure below. There are 50 nighttime buyers, all of whom have identical demands given by DN in the figure below. The firm's variable costs are constant (SMC = AVC = $12) and its total fixed cost is $250,000. The marketing director must devise a two-part pricing plan that will maximize the firm's profit.

-Assuming both daytime and nighttime markets are served, the optimal per unit usage fee (f*) is

A) f * = $24

B) f * = $34

C) f * = $44

D) f * = $54

E) f * = $64

-Assuming both daytime and nighttime markets are served, the optimal per unit usage fee (f*) is

A) f * = $24

B) f * = $34

C) f * = $44

D) f * = $54

E) f * = $64

f * = $34

4

In Questions a firm sells its product to two groups of buyers: daytime buyers and nighttime buyers. There are 50 daytime buyers, all of whom have identical demands given by DD in the figure below. There are 50 nighttime buyers, all of whom have identical demands given by DN in the figure below. The firm's variable costs are constant (SMC = AVC = $12) and its total fixed cost is $250,000. The marketing director must devise a two-part pricing plan that will maximize the firm's profit.

-Should the firm bother to sell output to the nighttime market?

A) Yes, because only $77,200 of profit is earned by serving only the daytime buyers.

B) Yes, because only $137,200 of profit is earned by serving only the daytime buyers.

C) No, because $240,000 of profit is earned by serving only the daytime buyers.

D) No, because $300,000 of profit is earned by serving only the daytime buyers.

-Should the firm bother to sell output to the nighttime market?

A) Yes, because only $77,200 of profit is earned by serving only the daytime buyers.

B) Yes, because only $137,200 of profit is earned by serving only the daytime buyers.

C) No, because $240,000 of profit is earned by serving only the daytime buyers.

D) No, because $300,000 of profit is earned by serving only the daytime buyers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

5

Refer to the following:

A news magazine offers students a discount on the regular subscription rate. The total number of subscriptions is optimal, and, at the current prices, the marginal revenue from the last subscription sold to a student is $6, while the marginal revenue from the last subscription sold to a regular customer is $10.

-In order to maximize profit, the magazine should

A) stop offering students a discount on the regular subscription rate.

B) offer students a higher discount (lower the price to students).

C) offer students a lower discount (raise the price to students).

D) offer all customers the same discount received by the students.

A news magazine offers students a discount on the regular subscription rate. The total number of subscriptions is optimal, and, at the current prices, the marginal revenue from the last subscription sold to a student is $6, while the marginal revenue from the last subscription sold to a regular customer is $10.

-In order to maximize profit, the magazine should

A) stop offering students a discount on the regular subscription rate.

B) offer students a higher discount (lower the price to students).

C) offer students a lower discount (raise the price to students).

D) offer all customers the same discount received by the students.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

6

In Questions a firm sells its product to two groups of buyers: daytime buyers and nighttime buyers. There are 50 daytime buyers, all of whom have identical demands given by DD in the figure below. There are 50 nighttime buyers, all of whom have identical demands given by DN in the figure below. The firm's variable costs are constant (SMC = AVC = $12) and its total fixed cost is $250,000. The marketing director must devise a two-part pricing plan that will maximize the firm's profit.

-Suppose the marketing director ignores the nighttime market and wishes to extract all consumer surplus from the daytime buyers. By setting the optimal access charge and user fee, the firm will earn $_________ of profit on each one of the 50 daytime buyers.

A) $1,872.

B) $1,936.

C) $7,744.

D) $9,856.

-Suppose the marketing director ignores the nighttime market and wishes to extract all consumer surplus from the daytime buyers. By setting the optimal access charge and user fee, the firm will earn $_________ of profit on each one of the 50 daytime buyers.

A) $1,872.

B) $1,936.

C) $7,744.

D) $9,856.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

7

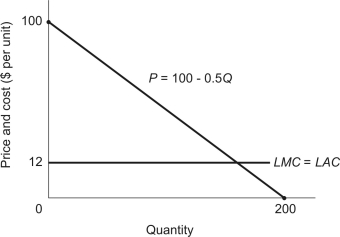

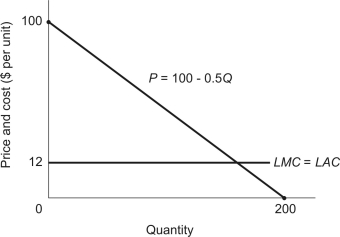

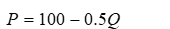

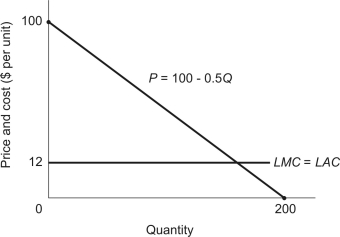

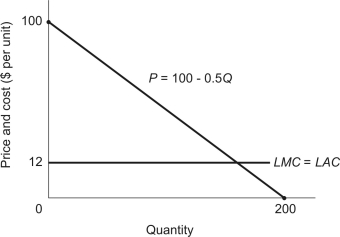

A firm faces the demand for its product, , as shown in the figure below. It produces under conditions of constant costs in the long run, and LMC = LAC = $12 per unit. Answer Questions .

, as shown in the figure below. It produces under conditions of constant costs in the long run, and LMC = LAC = $12 per unit. Answer Questions .

-Under uniform pricing, consumers enjoy $______ of consumer surplus.

A) $1,872

B) $1,936

C) $2,474

D) $2,500

, as shown in the figure below. It produces under conditions of constant costs in the long run, and LMC = LAC = $12 per unit. Answer Questions .

, as shown in the figure below. It produces under conditions of constant costs in the long run, and LMC = LAC = $12 per unit. Answer Questions .

-Under uniform pricing, consumers enjoy $______ of consumer surplus.

A) $1,872

B) $1,936

C) $2,474

D) $2,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

8

In Questions a firm sells its product to two groups of buyers: daytime buyers and nighttime buyers. There are 50 daytime buyers, all of whom have identical demands given by DD in the figure below. There are 50 nighttime buyers, all of whom have identical demands given by DN in the figure below. The firm's variable costs are constant (SMC = AVC = $12) and its total fixed cost is $250,000. The marketing director must devise a two-part pricing plan that will maximize the firm's profit.

-Now suppose the marketing director wishes to serve both daytime and nighttime buyers, what is the MRf function?

A) MRf = 5,000 - 200f

B) MRf = 7,500 - 250f

C) MRf = 8,000 - 250f

D) MRf = 7,500 - 200f

-Now suppose the marketing director wishes to serve both daytime and nighttime buyers, what is the MRf function?

A) MRf = 5,000 - 200f

B) MRf = 7,500 - 250f

C) MRf = 8,000 - 250f

D) MRf = 7,500 - 200f

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

9

In Questions a firm sells its product to two groups of buyers: daytime buyers and nighttime buyers. There are 50 daytime buyers, all of whom have identical demands given by DD in the figure below. There are 50 nighttime buyers, all of whom have identical demands given by DN in the figure below. The firm's variable costs are constant (SMC = AVC = $12) and its total fixed cost is $250,000. The marketing director must devise a two-part pricing plan that will maximize the firm's profit.

-Assuming the firm will serve both daytime and nighttime buyers, what is the MCf function?

A) MCf = -1,800

B) MCf = -2,000

C) MCf = 8,000 - 250f

D) MCf = 7,500 + 200f

E) none of the above

-Assuming the firm will serve both daytime and nighttime buyers, what is the MCf function?

A) MCf = -1,800

B) MCf = -2,000

C) MCf = 8,000 - 250f

D) MCf = 7,500 + 200f

E) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

10

In Questions a firm sells its product to two groups of buyers: daytime buyers and nighttime buyers. There are 50 daytime buyers, all of whom have identical demands given by DD in the figure below. There are 50 nighttime buyers, all of whom have identical demands given by DN in the figure below. The firm's variable costs are constant (SMC = AVC = $12) and its total fixed cost is $250,000. The marketing director must devise a two-part pricing plan that will maximize the firm's profit.

-Suppose the marketing director ignores the nighttime market and wishes to extract all consumer surplus from the daytime buyers. The optimal access charge is $_________ and the optimal usage fee is $______ per unit.

A) A* = $1,000 and f * = $12

B) A* = $2,400 and f * = $12

C) A* = $7,744 and f * = $12

D) A* = $9,856 and f * = $12

-Suppose the marketing director ignores the nighttime market and wishes to extract all consumer surplus from the daytime buyers. The optimal access charge is $_________ and the optimal usage fee is $______ per unit.

A) A* = $1,000 and f * = $12

B) A* = $2,400 and f * = $12

C) A* = $7,744 and f * = $12

D) A* = $9,856 and f * = $12

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

11

In order to maximize profit, a firm that sells its output in two markets will allocate total output between the two markets so that:

A) marginal revenue is equal in the two markets

B) marginal revenue for the firm is equal to the sum of the marginal revenues

C) marginal revenue for the firm is equal to the sum of the marginal costs

D) both a and b

E) none of the above

A) marginal revenue is equal in the two markets

B) marginal revenue for the firm is equal to the sum of the marginal revenues

C) marginal revenue for the firm is equal to the sum of the marginal costs

D) both a and b

E) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

12

A firm selling in two markets is practicing price discrimination

A) anytime it charges different consumers different prices.

B) when it is charging different consumers different prices and the price difference is not based upon cost differences.

C) when it refuses to sell the good to some group of consumers.

D) all of the above

E) none of the above

A) anytime it charges different consumers different prices.

B) when it is charging different consumers different prices and the price difference is not based upon cost differences.

C) when it refuses to sell the good to some group of consumers.

D) all of the above

E) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

13

To maximize profit a price discriminating firm should

A) produce the output at which total marginal revenue equals marginal cost.

B) allocate the optimal output so the elasticity is the same in each market.

C) allocate the output so that marginal revenue is the same in each market.

D) both a and c

E) all of the above

A) produce the output at which total marginal revenue equals marginal cost.

B) allocate the optimal output so the elasticity is the same in each market.

C) allocate the output so that marginal revenue is the same in each market.

D) both a and c

E) all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

14

In Questions a firm sells its product to two groups of buyers: daytime buyers and nighttime buyers. There are 50 daytime buyers, all of whom have identical demands given by DD in the figure below. There are 50 nighttime buyers, all of whom have identical demands given by DN in the figure below. The firm's variable costs are constant (SMC = AVC = $12) and its total fixed cost is $250,000. The marketing director must devise a two-part pricing plan that will maximize the firm's profit.

-How much profit will the firm earn by charging the optimal access charge and optimal access fee (remember that there are 50 daytime and 50 nighttime buyers)?

A) $80,600

B) $90,600

C) $124,600

D) $185,600

E) $215,600

-How much profit will the firm earn by charging the optimal access charge and optimal access fee (remember that there are 50 daytime and 50 nighttime buyers)?

A) $80,600

B) $90,600

C) $124,600

D) $185,600

E) $215,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

15

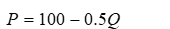

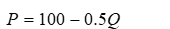

A firm faces the demand for its product, , as shown in the figure below. It produces under conditions of constant costs in the long run, and LMC = LAC = $12 per unit. Answer Questions .

, as shown in the figure below. It produces under conditions of constant costs in the long run, and LMC = LAC = $12 per unit. Answer Questions .

-A firm faces the demand and cost conditions for its product given in the figure. If the firm must set a uniform price for the good, what price will it set to maximize its profit in the long run?

A) $12

B) $24

C) $25

D) $30

E) none of the above

, as shown in the figure below. It produces under conditions of constant costs in the long run, and LMC = LAC = $12 per unit. Answer Questions .

, as shown in the figure below. It produces under conditions of constant costs in the long run, and LMC = LAC = $12 per unit. Answer Questions .

-A firm faces the demand and cost conditions for its product given in the figure. If the firm must set a uniform price for the good, what price will it set to maximize its profit in the long run?

A) $12

B) $24

C) $25

D) $30

E) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

16

To successfully practice price discrimination

A) the firm must be a pure monopoly

B) the firm must possess market power

C) it must be difficult for consumers in one market to sell to consumers in the other market

D) both a and c

E) both b and c

A) the firm must be a pure monopoly

B) the firm must possess market power

C) it must be difficult for consumers in one market to sell to consumers in the other market

D) both a and c

E) both b and c

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

17

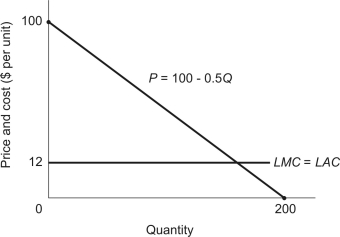

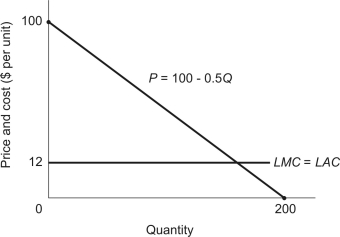

A firm faces the demand for its product, , as shown in the figure below. It produces under conditions of constant costs in the long run, and LMC = LAC = $12 per unit. Answer Questions .

, as shown in the figure below. It produces under conditions of constant costs in the long run, and LMC = LAC = $12 per unit. Answer Questions .

-Under uniform pricing, the firm loses sales on _______ units that could be profitably sold if buyers paid their demand prices instead of facing the uniform price.

A) 44

B) 50

C) 88

D) 176

, as shown in the figure below. It produces under conditions of constant costs in the long run, and LMC = LAC = $12 per unit. Answer Questions .

, as shown in the figure below. It produces under conditions of constant costs in the long run, and LMC = LAC = $12 per unit. Answer Questions .

-Under uniform pricing, the firm loses sales on _______ units that could be profitably sold if buyers paid their demand prices instead of facing the uniform price.

A) 44

B) 50

C) 88

D) 176

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

18

A firm faces the demand for its product, , as shown in the figure below. It produces under conditions of constant costs in the long run, and LMC = LAC = $12 per unit. Answer Questions .

, as shown in the figure below. It produces under conditions of constant costs in the long run, and LMC = LAC = $12 per unit. Answer Questions .

-If the firm can practice first-degree price discrimination, it can make a maximum profit of

A) $1,872.

B) $1,936.

C) $7,744.

D) $9,856.

, as shown in the figure below. It produces under conditions of constant costs in the long run, and LMC = LAC = $12 per unit. Answer Questions .

, as shown in the figure below. It produces under conditions of constant costs in the long run, and LMC = LAC = $12 per unit. Answer Questions .

-If the firm can practice first-degree price discrimination, it can make a maximum profit of

A) $1,872.

B) $1,936.

C) $7,744.

D) $9,856.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

19

If a firm is selling a product in two markets, A and B, and the marginal revenue in A is $25 and the marginal revenue in B is $20, the firm should

A) charge a higher price in A where MR is higher

B) charge a lower price in B where MR is lower

C) sell more in B and less in A

D) sell more in A and less in B

E) both a and c

A) charge a higher price in A where MR is higher

B) charge a lower price in B where MR is lower

C) sell more in B and less in A

D) sell more in A and less in B

E) both a and c

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

20

A firm faces the demand for its product, , as shown in the figure below. It produces under conditions of constant costs in the long run, and LMC = LAC = $12 per unit. Answer Questions .

, as shown in the figure below. It produces under conditions of constant costs in the long run, and LMC = LAC = $12 per unit. Answer Questions .

-the firm can practice first-degree price discrimination, it will be able to collect $________ in total revenue under perfect price discrimination.

A) $1,872

B) $1,936

C) $7,744

D) $9,856

E) none of the above

, as shown in the figure below. It produces under conditions of constant costs in the long run, and LMC = LAC = $12 per unit. Answer Questions .

, as shown in the figure below. It produces under conditions of constant costs in the long run, and LMC = LAC = $12 per unit. Answer Questions .

-the firm can practice first-degree price discrimination, it will be able to collect $________ in total revenue under perfect price discrimination.

A) $1,872

B) $1,936

C) $7,744

D) $9,856

E) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

21

In order to maximize profit, a firm producing two goods that are related in consumption should choose the levels of output at which

A) total marginal revenue equals total marginal cost.

B) total marginal revenue equals the marginal cost of each good.

C) the marginal revenue of each good equals total marginal cost.

D) marginal revenue equals marginal cost for each good simultaneously.

A) total marginal revenue equals total marginal cost.

B) total marginal revenue equals the marginal cost of each good.

C) the marginal revenue of each good equals total marginal cost.

D) marginal revenue equals marginal cost for each good simultaneously.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

22

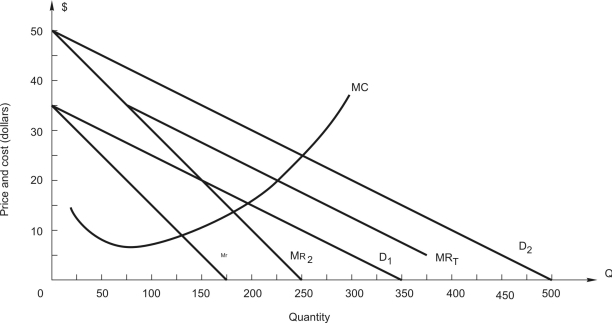

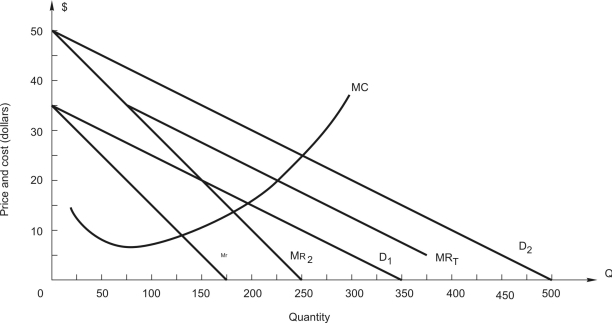

Refer to the following figure:

The graph shows the demands and marginal revenue in two markets, 1 and 2, for a price discriminating firm along with total marginal revenue, MRT, and marginal cost.

-What price should the firm charge in each market?

A) P1 = $20, P2 = $32.50

B) P1 = $35, P2 = $22.50

C) P1 = $20, P2 = $20

D) P1 = $27.50, P2 = $35

E) Impossible to say because market demand is not given

The graph shows the demands and marginal revenue in two markets, 1 and 2, for a price discriminating firm along with total marginal revenue, MRT, and marginal cost.

-What price should the firm charge in each market?

A) P1 = $20, P2 = $32.50

B) P1 = $35, P2 = $22.50

C) P1 = $20, P2 = $20

D) P1 = $27.50, P2 = $35

E) Impossible to say because market demand is not given

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

23

Refer to the following:

A firm sells two goods (X and Y) that are related in consumption. The estimated inverse demand and cost functions are:

-What are the profit-maximizing levels of output for the two goods?

A) = 6, = 3

B) = 40, = 40

C) = 58, = 30

D) = 240, = 270

E) none of the above

A firm sells two goods (X and Y) that are related in consumption. The estimated inverse demand and cost functions are:

-What are the profit-maximizing levels of output for the two goods?

A) = 6, = 3

B) = 40, = 40

C) = 58, = 30

D) = 240, = 270

E) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

24

Refer to the following:

A firm sells two goods (X and Y) that are related in consumption. The estimated demand and cost conditions are:

-What are the profit-maximizing levels of output for the two goods?

A) = 20, = 10

B) = 41, = 24

C) = 56, = 24

D) = 51, = 74

E) none of the above

A firm sells two goods (X and Y) that are related in consumption. The estimated demand and cost conditions are:

-What are the profit-maximizing levels of output for the two goods?

A) = 20, = 10

B) = 41, = 24

C) = 56, = 24

D) = 51, = 74

E) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

25

Refer to the following:

-What are the profit-maximizing prices for the two goods?

A) = $375, = $284

B) = $423, = $712

C) = $166, = $324

D) = $481, = $588

-What are the profit-maximizing prices for the two goods?

A) = $375, = $284

B) = $423, = $712

C) = $166, = $324

D) = $481, = $588

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

26

Relate to the following:

A firm is producing two goods (X and Y) that are related in consumption. The demand function for X is:

-In order to maximize profit, the firm

A) should determine jointly the levels of output for the two goods.

B) should treat the price of Y as given when determining the optimal production of good X.

C) should choose the levels of output for goods X and Y at which total marginal revenue equals total marginal cost.

D) both a and b

E) both a and c

A firm is producing two goods (X and Y) that are related in consumption. The demand function for X is:

-In order to maximize profit, the firm

A) should determine jointly the levels of output for the two goods.

B) should treat the price of Y as given when determining the optimal production of good X.

C) should choose the levels of output for goods X and Y at which total marginal revenue equals total marginal cost.

D) both a and b

E) both a and c

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

27

In order to maximize profit, a firm that produces two goods that are related in consumption should chose the levels of output at which:

A) total marginal revenue equals total marginal cost

B) total marginal revenue equals the marginal cost of each good

C) the marginal revenue of each good equals total marginal cost

D) marginal revenue equals marginal cost for each good

E) none of the above

A) total marginal revenue equals total marginal cost

B) total marginal revenue equals the marginal cost of each good

C) the marginal revenue of each good equals total marginal cost

D) marginal revenue equals marginal cost for each good

E) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

28

Refer to the following:

A firm sells two goods (X and Y) that are related in consumption. The estimated inverse demand and cost functions are:

-Good X and Y are:

A) complements

B) substitutes

C) independent

D) normal

E) inferior

A firm sells two goods (X and Y) that are related in consumption. The estimated inverse demand and cost functions are:

-Good X and Y are:

A) complements

B) substitutes

C) independent

D) normal

E) inferior

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

29

Gus has 20 acres of land in cultivation and is currently planting both soybeans and peanuts. The last acre planted in soybeans yielded 20 bushels, and the last bushel of soybeans added $0.50 to Gus's total revenue. The last acre planted in peanuts yielded 10 bushels and the last bushel of peanuts added $1 to Gus's total revenue. Gus:

A) is maximizing profit.

B) should devote more acres to soybeans and fewer to peanuts.

C) should devote more acres to peanuts and fewer to soybeans.

D) should devote 10 acres to each crop.

A) is maximizing profit.

B) should devote more acres to soybeans and fewer to peanuts.

C) should devote more acres to peanuts and fewer to soybeans.

D) should devote 10 acres to each crop.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

30

Refer to the following:

-What are the profit-maximizing levels of output for the two goods?

A) = 30, = 34

B) = 63, = 66

C) = 142, = 110

D) = 191, = 163

-What are the profit-maximizing levels of output for the two goods?

A) = 30, = 34

B) = 63, = 66

C) = 142, = 110

D) = 191, = 163

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

31

Refer to the following:

-Goods X and Y are:

A) normal

B) inferior

C) independent

D) substitutes

E) complements

-Goods X and Y are:

A) normal

B) inferior

C) independent

D) substitutes

E) complements

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

32

Relate to the following:

A firm is producing two goods (X and Y) that are related in consumption. The demand function for X is:

-Which of the following pairs of goods might the firm be producing?

A) cameras and film

B) cola and caffeine-free coke

C) newspapers and tennis balls

D) bran cereal and sugar-frosted corn flakes

E) both b and d

A firm is producing two goods (X and Y) that are related in consumption. The demand function for X is:

-Which of the following pairs of goods might the firm be producing?

A) cameras and film

B) cola and caffeine-free coke

C) newspapers and tennis balls

D) bran cereal and sugar-frosted corn flakes

E) both b and d

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

33

Refer to the following figure:

The graph shows the demands and marginal revenue in two markets, 1 and 2, for a price discriminating firm along with total marginal revenue, MRT, and marginal cost.

-How should the firm allocate sales between the two markets?

A) 150 in each market

B) 100 in market 1, 175 in 2

C) 150 in market 1, 300 in 2

D) 112.5 in each market

E) 75 in market 1, 150 in 2

The graph shows the demands and marginal revenue in two markets, 1 and 2, for a price discriminating firm along with total marginal revenue, MRT, and marginal cost.

-How should the firm allocate sales between the two markets?

A) 150 in each market

B) 100 in market 1, 175 in 2

C) 150 in market 1, 300 in 2

D) 112.5 in each market

E) 75 in market 1, 150 in 2

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

34

Refer to the following figure:

The graph shows the demands and marginal revenue in two markets, 1 and 2, for a price discriminating firm along with total marginal revenue, MRT, and marginal cost.

-At the optimal price and quantity, what is demand elasticity in each market?

A) E1 =-3.67, E2 = -2.33

B) E1 =-03, E2 = -4

C) E1 = -2.5, E2 = -3.5

D) E1 = -3, E2 = -3

E) E1 = -1.67, E2 = -2.33

The graph shows the demands and marginal revenue in two markets, 1 and 2, for a price discriminating firm along with total marginal revenue, MRT, and marginal cost.

-At the optimal price and quantity, what is demand elasticity in each market?

A) E1 =-3.67, E2 = -2.33

B) E1 =-03, E2 = -4

C) E1 = -2.5, E2 = -3.5

D) E1 = -3, E2 = -3

E) E1 = -1.67, E2 = -2.33

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

35

Refer to the following:

A firm sells two goods (X and Y) that are related in consumption. The estimated inverse demand and cost functions are:

-What are the profit-maximizing prices for the two goods?

A) = $40, = $32.50

B) = $53.50, = $61

C) = $80, = $55

D) = $112.50, = $87.75

E) none of the above

A firm sells two goods (X and Y) that are related in consumption. The estimated inverse demand and cost functions are:

-What are the profit-maximizing prices for the two goods?

A) = $40, = $32.50

B) = $53.50, = $61

C) = $80, = $55

D) = $112.50, = $87.75

E) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

36

Refer to the following:

A firm sells two goods (X and Y) that are related in consumption. The estimated demand and cost conditions are:

-What are the profit-maximizing prices for the two goods?

A) = $25.60, = $20.50

B) = $30, = $35

C) = $50, = $45

D) = $11.20, = $42.70

A firm sells two goods (X and Y) that are related in consumption. The estimated demand and cost conditions are:

-What are the profit-maximizing prices for the two goods?

A) = $25.60, = $20.50

B) = $30, = $35

C) = $50, = $45

D) = $11.20, = $42.70

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

37

Refer to the following:

A news magazine offers students a discount on the regular subscription rate. The total number of subscriptions is optimal, and, at the current prices, the marginal revenue from the last subscription sold to a student is $6, while the marginal revenue from the last subscription sold to a regular customer is $10.

-If the magazine sells one more subscription to a regular customer and one less subscription to a student:

A) profit will increase $4

B) profit will increase $16

C) profit will decrease $6

D) profit will decrease $10

E) none of the above

A news magazine offers students a discount on the regular subscription rate. The total number of subscriptions is optimal, and, at the current prices, the marginal revenue from the last subscription sold to a student is $6, while the marginal revenue from the last subscription sold to a regular customer is $10.

-If the magazine sells one more subscription to a regular customer and one less subscription to a student:

A) profit will increase $4

B) profit will increase $16

C) profit will decrease $6

D) profit will decrease $10

E) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

38

Refer to the following figure:

The graph shows the demands and marginal revenue in two markets, 1 and 2, for a price discriminating firm along with total marginal revenue, MRT, and marginal cost.

-What total output should the firm produce?

A) 275 units

B) 225 units

C) 175 units

D) 350 units

E) 100 units

The graph shows the demands and marginal revenue in two markets, 1 and 2, for a price discriminating firm along with total marginal revenue, MRT, and marginal cost.

-What total output should the firm produce?

A) 275 units

B) 225 units

C) 175 units

D) 350 units

E) 100 units

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

39

Refer to the following:

A firm sells two goods (X and Y) that are related in consumption. The estimated demand and cost conditions are:

-Goods X and Y are

A) complement

B) substitutes

C) independent

D) normal

E) inferior

A firm sells two goods (X and Y) that are related in consumption. The estimated demand and cost conditions are:

-Goods X and Y are

A) complement

B) substitutes

C) independent

D) normal

E) inferior

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

40

Refer to the following figure:

The graph shows the demands and marginal revenue in two markets, 1 and 2, for a price discriminating firm along with total marginal revenue, MRT, and marginal cost.

-What rule do your answers to the previous two questions demonstrate for price determination for a firm that practices price discrimination?

A) elasticity and price are not related

B) price is lower in the higher elasticity market

C) price is higher in the higher elasticity market

D) profit is maximized when both prices and elasticities are equal

E) none of the above

The graph shows the demands and marginal revenue in two markets, 1 and 2, for a price discriminating firm along with total marginal revenue, MRT, and marginal cost.

-What rule do your answers to the previous two questions demonstrate for price determination for a firm that practices price discrimination?

A) elasticity and price are not related

B) price is lower in the higher elasticity market

C) price is higher in the higher elasticity market

D) profit is maximized when both prices and elasticities are equal

E) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

41

Using the following information:

Drill Quest, Inc. manufactures drill bits for the oil industry. Drill Quest uses cost-plus pricing to set the price of its bits. Currently Drill Quest applies a 50 percent markup on average total cost. Average variable cost of producing bits is constant and equal to $6,000 per bit. Total fixed cost at Drill Quest is $550,000. DrillQuest currently produces 690 bits. Statistical estimation of demand for Drill Quest brand bits produces the following linear demand equation (where Q is the number of bits demanded and P is the price of bits):

-Use the MR = SMC approach to finding the profit-maximizing point on the demand for Drill Quest's bits. The profit-maximizing number of bits to sell is

A) 250

B) 300

C) 350

D) 400

E) 450

Drill Quest, Inc. manufactures drill bits for the oil industry. Drill Quest uses cost-plus pricing to set the price of its bits. Currently Drill Quest applies a 50 percent markup on average total cost. Average variable cost of producing bits is constant and equal to $6,000 per bit. Total fixed cost at Drill Quest is $550,000. DrillQuest currently produces 690 bits. Statistical estimation of demand for Drill Quest brand bits produces the following linear demand equation (where Q is the number of bits demanded and P is the price of bits):

-Use the MR = SMC approach to finding the profit-maximizing point on the demand for Drill Quest's bits. The profit-maximizing number of bits to sell is

A) 250

B) 300

C) 350

D) 400

E) 450

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

42

Answer Questions based on the following situation:

Black Diamond Tennis & Golf Club offers golf and tennis memberships to the residents of Black Diamond, Ohio, in which there are two types of families: golf-oriented families and tennis-oriented families. There are 100 golf-oriented families and 100 tennis-oriented families in Black Diamond. Forecasted demand prices for golf and tennis memberships by family type are given below. There is no way to identify family types for pricing purposes, and all costs are fixed so that maximizing total revenue is equivalent to maximizing profit.

Demand Prices for Golf and Tennis Memberships

-If Black Diamond Tennis & Golf Club plans to offer golf and tennis memberships separately, what prices should be charged for each kind of membership if Berkely wishes to maximize profit?

A) Charge $75 for tennis memberships and $50 for golf memberships.

B) Charge $75 for tennis memberships and $200 for golf memberships.

C) Charge $150 for tennis memberships and $200 for golf memberships.

D) Charge $150 for tennis memberships and $50 for golf memberships.

E) either b or c

Black Diamond Tennis & Golf Club offers golf and tennis memberships to the residents of Black Diamond, Ohio, in which there are two types of families: golf-oriented families and tennis-oriented families. There are 100 golf-oriented families and 100 tennis-oriented families in Black Diamond. Forecasted demand prices for golf and tennis memberships by family type are given below. There is no way to identify family types for pricing purposes, and all costs are fixed so that maximizing total revenue is equivalent to maximizing profit.

Demand Prices for Golf and Tennis Memberships

-If Black Diamond Tennis & Golf Club plans to offer golf and tennis memberships separately, what prices should be charged for each kind of membership if Berkely wishes to maximize profit?

A) Charge $75 for tennis memberships and $50 for golf memberships.

B) Charge $75 for tennis memberships and $200 for golf memberships.

C) Charge $150 for tennis memberships and $200 for golf memberships.

D) Charge $150 for tennis memberships and $50 for golf memberships.

E) either b or c

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

43

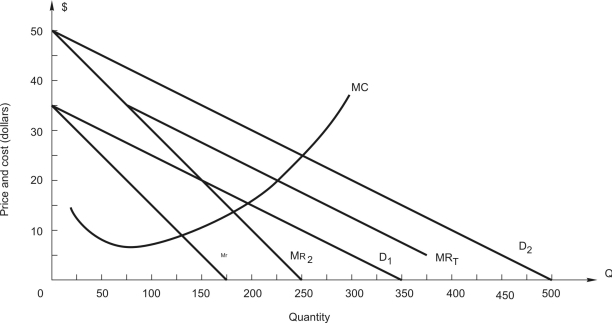

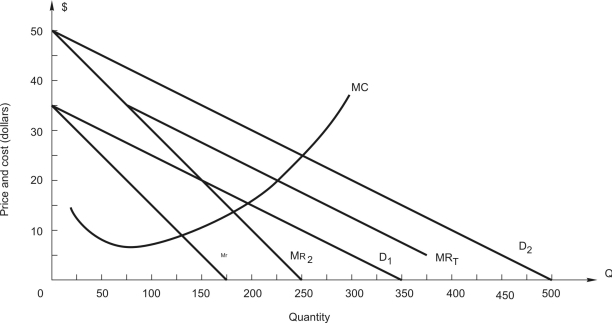

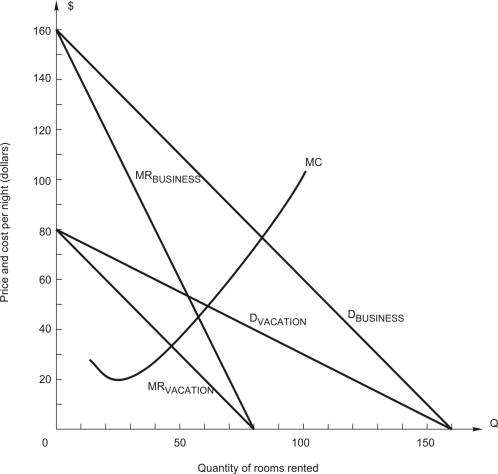

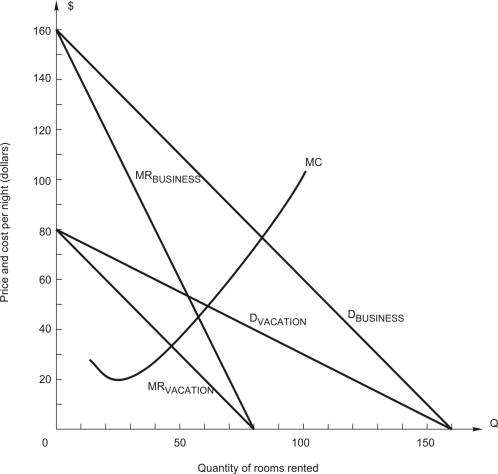

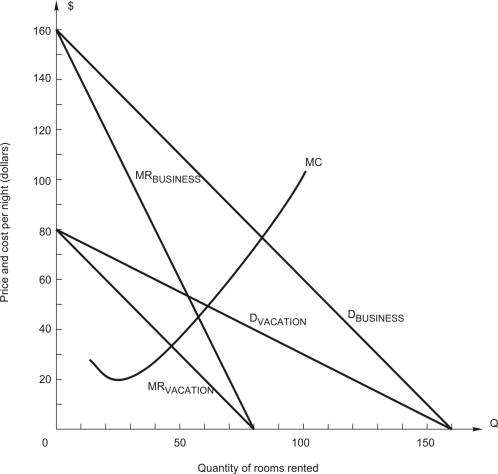

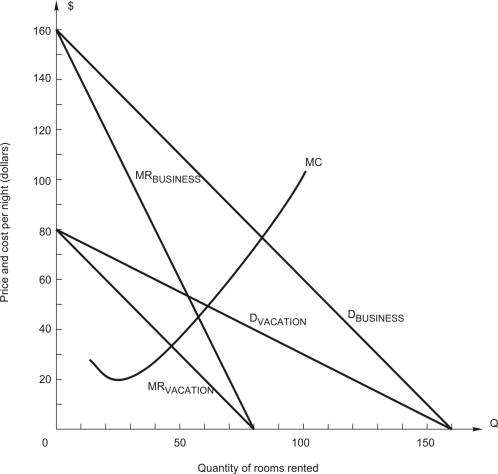

Refer to the following figure:

The Hilton Hotel chain serves both business and vacation travelers.

and

represent the demand and marginal revenue for business travelers, while

and

are the demand and marginal revenue for vacation travelers.

-If marginal cost decreases to the point that total marginal revenue (MRT is not shown in the figure) for Hilton at the profit-maximizing level of total output is $40, what price should the Hilton charge BUSINESS travelers?

A) $60

B) $80

C) $100

D) $120

E) $140

The Hilton Hotel chain serves both business and vacation travelers.

and

represent the demand and marginal revenue for business travelers, while

and

are the demand and marginal revenue for vacation travelers.

-If marginal cost decreases to the point that total marginal revenue (MRT is not shown in the figure) for Hilton at the profit-maximizing level of total output is $40, what price should the Hilton charge BUSINESS travelers?

A) $60

B) $80

C) $100

D) $120

E) $140

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

44

Refer to the following figure:

The Hilton Hotel chain serves both business and vacation travelers.

and

represent the demand and marginal revenue for business travelers, while

and

are the demand and marginal revenue for vacation travelers.

-What price should the Hilton charge VACATION travelers?

A) $20

B) $30

C) $50

D) $60

E) $70

The Hilton Hotel chain serves both business and vacation travelers.

and

represent the demand and marginal revenue for business travelers, while

and

are the demand and marginal revenue for vacation travelers.

-What price should the Hilton charge VACATION travelers?

A) $20

B) $30

C) $50

D) $60

E) $70

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

45

Refer to the following:

The WildTimes Bar offers female patrons a lower price for a drink than male patrons. The bar will maximize profit by selling a total of 200 drinks per night. At the current prices, male customers buy 150 drinks, while female customers buy 50 drinks. The marginal revenue from the last drink sold to a male customer is $1.50, while the marginal revenue from the last drink sold to a female customer is $0.50.

-The bar

A) should lower the price for male customers and raise the price for female customers.

B) should lower the price for female customers and raise the price for male customers.

C) should charge the same price regardless of gender.

D) is maximizing profit; should keep selling 150 drinks to male customer and 50 drinks to female customers.

The WildTimes Bar offers female patrons a lower price for a drink than male patrons. The bar will maximize profit by selling a total of 200 drinks per night. At the current prices, male customers buy 150 drinks, while female customers buy 50 drinks. The marginal revenue from the last drink sold to a male customer is $1.50, while the marginal revenue from the last drink sold to a female customer is $0.50.

-The bar

A) should lower the price for male customers and raise the price for female customers.

B) should lower the price for female customers and raise the price for male customers.

C) should charge the same price regardless of gender.

D) is maximizing profit; should keep selling 150 drinks to male customer and 50 drinks to female customers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

46

Using the following information:

Drill Quest, Inc. manufactures drill bits for the oil industry. Drill Quest uses cost-plus pricing to set the price of its bits. Currently Drill Quest applies a 50 percent markup on average total cost. Average variable cost of producing bits is constant and equal to $6,000 per bit. Total fixed cost at Drill Quest is $550,000. DrillQuest currently produces 690 bits. Statistical estimation of demand for Drill Quest brand bits produces the following linear demand equation (where Q is the number of bits demanded and P is the price of bits):

-Use the MR = SMC approach to finding the profit-maximizing point on the demand for Drill Quest's bits. The maximum possible profit is $___________.

A) $2,895,000

B) $2,345,000

C) $3,500,000

D) $3,895,000

E) $4,895,000

Drill Quest, Inc. manufactures drill bits for the oil industry. Drill Quest uses cost-plus pricing to set the price of its bits. Currently Drill Quest applies a 50 percent markup on average total cost. Average variable cost of producing bits is constant and equal to $6,000 per bit. Total fixed cost at Drill Quest is $550,000. DrillQuest currently produces 690 bits. Statistical estimation of demand for Drill Quest brand bits produces the following linear demand equation (where Q is the number of bits demanded and P is the price of bits):

-Use the MR = SMC approach to finding the profit-maximizing point on the demand for Drill Quest's bits. The maximum possible profit is $___________.

A) $2,895,000

B) $2,345,000

C) $3,500,000

D) $3,895,000

E) $4,895,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

47

Using the following information:

Drill Quest, Inc. manufactures drill bits for the oil industry. Drill Quest uses cost-plus pricing to set the price of its bits. Currently Drill Quest applies a 50 percent markup on average total cost. Average variable cost of producing bits is constant and equal to $6,000 per bit. Total fixed cost at Drill Quest is $550,000. DrillQuest currently produces 690 bits. Statistical estimation of demand for Drill Quest brand bits produces the following linear demand equation (where Q is the number of bits demanded and P is the price of bits):

-Using cost-plus pricing, Drill Quest prices its bits at $______________ per bit.

A) $10,195

B) $12,175

C) $797

D) $6,000

E) $6,797

Drill Quest, Inc. manufactures drill bits for the oil industry. Drill Quest uses cost-plus pricing to set the price of its bits. Currently Drill Quest applies a 50 percent markup on average total cost. Average variable cost of producing bits is constant and equal to $6,000 per bit. Total fixed cost at Drill Quest is $550,000. DrillQuest currently produces 690 bits. Statistical estimation of demand for Drill Quest brand bits produces the following linear demand equation (where Q is the number of bits demanded and P is the price of bits):

-Using cost-plus pricing, Drill Quest prices its bits at $______________ per bit.

A) $10,195

B) $12,175

C) $797

D) $6,000

E) $6,797

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

48

Refer to the following figure:

The Hilton Hotel chain serves both business and vacation travelers.

and

represent the demand and marginal revenue for business travelers, while

and

are the demand and marginal revenue for vacation travelers.

-What is the profit-maximizing number of BUSINESS travelers to serve?

A) 50

B) 100

C) 150

D) 200

E) 300

The Hilton Hotel chain serves both business and vacation travelers.

and

represent the demand and marginal revenue for business travelers, while

and

are the demand and marginal revenue for vacation travelers.

-What is the profit-maximizing number of BUSINESS travelers to serve?

A) 50

B) 100

C) 150

D) 200

E) 300

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

49

Refer to the following:

The WildTimes Bar offers female patrons a lower price for a drink than male patrons. The bar will maximize profit by selling a total of 200 drinks per night. At the current prices, male customers buy 150 drinks, while female customers buy 50 drinks. The marginal revenue from the last drink sold to a male customer is $1.50, while the marginal revenue from the last drink sold to a female customer is $0.50.

-If the bar sells 151 drinks to male customers and 49 drinks to female customers instead, then

A) total revenue will decrease $0.50.

B) profit will decrease $0.50.

C) total revenue will increase $1.

D) total revenue will increase $1.50.

E) both a and b

The WildTimes Bar offers female patrons a lower price for a drink than male patrons. The bar will maximize profit by selling a total of 200 drinks per night. At the current prices, male customers buy 150 drinks, while female customers buy 50 drinks. The marginal revenue from the last drink sold to a male customer is $1.50, while the marginal revenue from the last drink sold to a female customer is $0.50.

-If the bar sells 151 drinks to male customers and 49 drinks to female customers instead, then

A) total revenue will decrease $0.50.

B) profit will decrease $0.50.

C) total revenue will increase $1.

D) total revenue will increase $1.50.

E) both a and b

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

50

Using the following information:

Drill Quest, Inc. manufactures drill bits for the oil industry. Drill Quest uses cost-plus pricing to set the price of its bits. Currently Drill Quest applies a 50 percent markup on average total cost. Average variable cost of producing bits is constant and equal to $6,000 per bit. Total fixed cost at Drill Quest is $550,000. DrillQuest currently produces 690 bits. Statistical estimation of demand for Drill Quest brand bits produces the following linear demand equation (where Q is the number of bits demanded and P is the price of bits):

-Using the cost-plus price in question 2, Drill Quest earns profit of (approximately) $___________ by selling 690 bits.

A) $2,895,000

B) $2,345,000

C) $3,500,000

D) $3,895,000

E) $4,895,000

Drill Quest, Inc. manufactures drill bits for the oil industry. Drill Quest uses cost-plus pricing to set the price of its bits. Currently Drill Quest applies a 50 percent markup on average total cost. Average variable cost of producing bits is constant and equal to $6,000 per bit. Total fixed cost at Drill Quest is $550,000. DrillQuest currently produces 690 bits. Statistical estimation of demand for Drill Quest brand bits produces the following linear demand equation (where Q is the number of bits demanded and P is the price of bits):

-Using the cost-plus price in question 2, Drill Quest earns profit of (approximately) $___________ by selling 690 bits.

A) $2,895,000

B) $2,345,000

C) $3,500,000

D) $3,895,000

E) $4,895,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

51

Answer Questions based on the following situation:

Black Diamond Tennis & Golf Club offers golf and tennis memberships to the residents of Black Diamond, Ohio, in which there are two types of families: golf-oriented families and tennis-oriented families. There are 100 golf-oriented families and 100 tennis-oriented families in Black Diamond. Forecasted demand prices for golf and tennis memberships by family type are given below. There is no way to identify family types for pricing purposes, and all costs are fixed so that maximizing total revenue is equivalent to maximizing profit.

Demand Prices for Golf and Tennis Memberships

-What is the optimal price to charge for a bundled tennis and golf and tennis membership?

A) $150

B) $200

C) $225

D) $250

E) $275

Black Diamond Tennis & Golf Club offers golf and tennis memberships to the residents of Black Diamond, Ohio, in which there are two types of families: golf-oriented families and tennis-oriented families. There are 100 golf-oriented families and 100 tennis-oriented families in Black Diamond. Forecasted demand prices for golf and tennis memberships by family type are given below. There is no way to identify family types for pricing purposes, and all costs are fixed so that maximizing total revenue is equivalent to maximizing profit.

Demand Prices for Golf and Tennis Memberships

-What is the optimal price to charge for a bundled tennis and golf and tennis membership?

A) $150

B) $200

C) $225

D) $250

E) $275

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

52

Answer Questions based on the following situation:

Black Diamond Tennis & Golf Club offers golf and tennis memberships to the residents of Black Diamond, Ohio, in which there are two types of families: golf-oriented families and tennis-oriented families. There are 100 golf-oriented families and 100 tennis-oriented families in Black Diamond. Forecasted demand prices for golf and tennis memberships by family type are given below. There is no way to identify family types for pricing purposes, and all costs are fixed so that maximizing total revenue is equivalent to maximizing profit.

Demand Prices for Golf and Tennis Memberships

-The conditions are right for bundle pricing to increase profit at Black Diamond Tennis & Golf Club because

A) demand prices for golf are greater than demand prices for tennis.

B) Demand prices differ across family types for tennis and golf memberships.

C) Demand prices are negatively correlated.

D) Demand prices are positively correlated.

E) Both b and c

Black Diamond Tennis & Golf Club offers golf and tennis memberships to the residents of Black Diamond, Ohio, in which there are two types of families: golf-oriented families and tennis-oriented families. There are 100 golf-oriented families and 100 tennis-oriented families in Black Diamond. Forecasted demand prices for golf and tennis memberships by family type are given below. There is no way to identify family types for pricing purposes, and all costs are fixed so that maximizing total revenue is equivalent to maximizing profit.

Demand Prices for Golf and Tennis Memberships

-The conditions are right for bundle pricing to increase profit at Black Diamond Tennis & Golf Club because

A) demand prices for golf are greater than demand prices for tennis.

B) Demand prices differ across family types for tennis and golf memberships.

C) Demand prices are negatively correlated.

D) Demand prices are positively correlated.

E) Both b and c

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

53

Answer Questions based on the following situation:

Black Diamond Tennis & Golf Club offers golf and tennis memberships to the residents of Black Diamond, Ohio, in which there are two types of families: golf-oriented families and tennis-oriented families. There are 100 golf-oriented families and 100 tennis-oriented families in Black Diamond. Forecasted demand prices for golf and tennis memberships by family type are given below. There is no way to identify family types for pricing purposes, and all costs are fixed so that maximizing total revenue is equivalent to maximizing profit.

Demand Prices for Golf and Tennis Memberships

-How much total revenue can be generated each month under the pricing plan in the previous question?

A) $20,000

B) $25,000

C) $35,000

D) $70,000

E) $95,000

Black Diamond Tennis & Golf Club offers golf and tennis memberships to the residents of Black Diamond, Ohio, in which there are two types of families: golf-oriented families and tennis-oriented families. There are 100 golf-oriented families and 100 tennis-oriented families in Black Diamond. Forecasted demand prices for golf and tennis memberships by family type are given below. There is no way to identify family types for pricing purposes, and all costs are fixed so that maximizing total revenue is equivalent to maximizing profit.

Demand Prices for Golf and Tennis Memberships

-How much total revenue can be generated each month under the pricing plan in the previous question?

A) $20,000

B) $25,000

C) $35,000

D) $70,000

E) $95,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

54

A drugstore offers a discount on prescriptions to senior citizens. This suggests that the absolute value of elasticity of demand for senior citizens is

A) greater than one.

B) less than one.

C) greater than the elasticity of demand for other customers.

D) less than the elasticity of demand for other customers.

A) greater than one.

B) less than one.

C) greater than the elasticity of demand for other customers.

D) less than the elasticity of demand for other customers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

55

Answer Questions based on the following situation:

Black Diamond Tennis & Golf Club offers golf and tennis memberships to the residents of Black Diamond, Ohio, in which there are two types of families: golf-oriented families and tennis-oriented families. There are 100 golf-oriented families and 100 tennis-oriented families in Black Diamond. Forecasted demand prices for golf and tennis memberships by family type are given below. There is no way to identify family types for pricing purposes, and all costs are fixed so that maximizing total revenue is equivalent to maximizing profit.

Demand Prices for Golf and Tennis Memberships

-How much revenue will bundle price in the previous question produce for Black Diamond Tennis & Golf Club?

A) $25,000

B) $27,500

C) $35,000

D) $40,000

Black Diamond Tennis & Golf Club offers golf and tennis memberships to the residents of Black Diamond, Ohio, in which there are two types of families: golf-oriented families and tennis-oriented families. There are 100 golf-oriented families and 100 tennis-oriented families in Black Diamond. Forecasted demand prices for golf and tennis memberships by family type are given below. There is no way to identify family types for pricing purposes, and all costs are fixed so that maximizing total revenue is equivalent to maximizing profit.

Demand Prices for Golf and Tennis Memberships

-How much revenue will bundle price in the previous question produce for Black Diamond Tennis & Golf Club?

A) $25,000

B) $27,500

C) $35,000

D) $40,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

56

Using the following information:

Drill Quest, Inc. manufactures drill bits for the oil industry. Drill Quest uses cost-plus pricing to set the price of its bits. Currently Drill Quest applies a 50 percent markup on average total cost. Average variable cost of producing bits is constant and equal to $6,000 per bit. Total fixed cost at Drill Quest is $550,000. DrillQuest currently produces 690 bits. Statistical estimation of demand for Drill Quest brand bits produces the following linear demand equation (where Q is the number of bits demanded and P is the price of bits):

-Use the MR = SMC approach to finding the profit-maximizing point on the demand for Drill Quest's bits. The profit-maximizing price to charge is $___________ per bit.

A) $15,000

B) $12,500

C) $10,378

D) $10,245

E) $10,000

Drill Quest, Inc. manufactures drill bits for the oil industry. Drill Quest uses cost-plus pricing to set the price of its bits. Currently Drill Quest applies a 50 percent markup on average total cost. Average variable cost of producing bits is constant and equal to $6,000 per bit. Total fixed cost at Drill Quest is $550,000. DrillQuest currently produces 690 bits. Statistical estimation of demand for Drill Quest brand bits produces the following linear demand equation (where Q is the number of bits demanded and P is the price of bits):

-Use the MR = SMC approach to finding the profit-maximizing point on the demand for Drill Quest's bits. The profit-maximizing price to charge is $___________ per bit.

A) $15,000

B) $12,500

C) $10,378

D) $10,245

E) $10,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

57

Using the following information:

Drill Quest, Inc. manufactures drill bits for the oil industry. Drill Quest uses cost-plus pricing to set the price of its bits. Currently Drill Quest applies a 50 percent markup on average total cost. Average variable cost of producing bits is constant and equal to $6,000 per bit. Total fixed cost at Drill Quest is $550,000. DrillQuest currently produces 690 bits. Statistical estimation of demand for Drill Quest brand bits produces the following linear demand equation (where Q is the number of bits demanded and P is the price of bits):

-If Drill Quest wishes to use cost-plus pricing, it can maximize profit by applying a markup of _____ percent on __________.

A) 150 percent; AVC

B) 150 percent; ATC

C) 50 percent; AVC

D) 50 percent; ATC

E) 250 percent; AVC

Drill Quest, Inc. manufactures drill bits for the oil industry. Drill Quest uses cost-plus pricing to set the price of its bits. Currently Drill Quest applies a 50 percent markup on average total cost. Average variable cost of producing bits is constant and equal to $6,000 per bit. Total fixed cost at Drill Quest is $550,000. DrillQuest currently produces 690 bits. Statistical estimation of demand for Drill Quest brand bits produces the following linear demand equation (where Q is the number of bits demanded and P is the price of bits):

-If Drill Quest wishes to use cost-plus pricing, it can maximize profit by applying a markup of _____ percent on __________.

A) 150 percent; AVC

B) 150 percent; ATC

C) 50 percent; AVC

D) 50 percent; ATC

E) 250 percent; AVC

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck