Deck 14: Applying Financial Modeling

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/118

العب

ملء الشاشة (f)

Deck 14: Applying Financial Modeling

1

5 Why is it important to clearly state assumptions underlying a valuation?

The credibility of any valuation ultimately depends on the validity of its underlying assumptions. Valuation-related assumptions tend to fall into five major categories: (1) market, (2) income statement, (3) balance sheet, (4) synergy, and (5) valuation. Note that implicit assumptions about cash flow are already included in assumptions made about the income statement and changes in the balance sheet, which together drive changes in cash flow. Market assumptions are generally those that relate to the growth rate of unit volume and product price per unit. Income statement assumptions include the projected growth in revenue, the implied market share, and the growth in the major components of cost in relation to sales. Balance sheet assumptions may include the growth in the primary components of working capital and fixed assets in relation to the projected growth in sales. Synergy assumptions relate to the amount and timing associated with each type of anticipated synergy, including cost savings from workforce reductions, productivity improvements due to the introduction of new technologies or processes, and revenue growth because of increased market penetration. Finally, examples of important valuation assumptions include the acquiring firm's target debt to equity ratio used in calculating the cost of capital, the discount rates used during the forecast and stable growth periods, and the growth assumptions used in determining the terminal value.

2

1 Why should a target company be valued as a standalone business? Give examples of the types of adjustments that might have to be made if the target company is part of a larger company?

The valuation of the target firm on a standalone basis provides an estimate of the minimum price that might have to be paid to acquire the firm, assuming the market for such firms is efficient. Note that the notion of a minimum price does not preclude the buyer from buying the target firm at a discount from its true value. For example, the buyer may be able to acquire the target at a discount from its economic value if the seller is in a hurry to sell, the market for such businesses is highly illiquid, or the cost and risk associated with performing due diligence is high encouraging the prudent buyer to offer less than the target's intrinsic value. If the acquirer or target is part of a larger firm, the projected cash flows must be adjusted to reflect all costs and revenue associated with the acquirer's or target's operation. The failure to make the proper adjustments can result in an over-or-understatement of value. Such costs include all administrative expenses such as legal, tax, audit, benefits, and treasury functions that may be heavily subsidized by the parent. Moreover, intercompany revenues must be restated to reflect what they would have been if they had been valued at current market prices.

3

Newco equity value: $57,412.8

b. After change in incremental sales:

b. After change in incremental sales:

b. After change in incremental sales:

4

2 Why should "in the money" options, warrants, and convertible preferred stock and debt be included in the calculation of the purchase price to be paid for Target?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

5

3 What are value drivers? How can they be misused in M&A models?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

6

Thermo Fisher paid $76 per share for each outstanding share of Life Tech. What is the maximum offer price Thermo Fisher could have made without ceding all of the synergy value to Life Tech shareholders? (Hint: Using the Transaction Summary Worksheet, increase the offer price until the NPV in the section entitled Valuation turns negative.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

7

14 What is the fully diluted offer price (equity value) for a tender offer made to acquire a target whose pre-

tender shares are trading for $1.50 per share? The tender offer includes a 30% premium to the target's pre-tender share price. The target has basic shares outstanding of 70 million and 5 million options which may be converted into common shares at $1.60 per share.

tender shares are trading for $1.50 per share? The tender offer includes a 30% premium to the target's pre-tender share price. The target has basic shares outstanding of 70 million and 5 million options which may be converted into common shares at $1.60 per share.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

8

7 Dow Chemical, a leading manufacturer of chemicals, announced that they had an agreement to acquire competitor Rhom and Haas Company. Dow expects to broaden its current product offering by offering the higher margin Rohm and Haas products. What would you identify as possible synergies between these two businesses? In what ways could the combination of these two firms erode combined cash flows?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

9

17 Using the M&A Valuation & Deal Structuring Model accompanying this text:

a. On the Valuation Worksheet, note the enterprise and equity values for Newco.

b. On the Summary Worksheet under Incremental Sales Synergy, change incremental

revenue by $200 million in the first year and $250 million in the second year and

$350 in the third year.

What is the impact on Newco's enterprise and equity values? (Hint: See Valuation Worksheet)

Close model but do not save results.

a. On the Valuation Worksheet, note the enterprise and equity values for Newco.

b. On the Summary Worksheet under Incremental Sales Synergy, change incremental

revenue by $200 million in the first year and $250 million in the second year and

$350 in the third year.

What is the impact on Newco's enterprise and equity values? (Hint: See Valuation Worksheet)

Close model but do not save results.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

10

6 Assume two firms have little geographic overlap in terms of sales and facilities. If they were to merge, how

might this affect the potential for synergy?

might this affect the potential for synergy?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

11

12 Acquiring Company is considering buying Target Company. Target Company is a small biotechnology

firm, which develops products that are licensed to the major pharmaceutical firms? Development costs are expected to generate negative cash flows during the first two years of the forecast period of $(10) and $(5) million, respectively. Licensing fees are expected to generate positive cash flows during years three through five of the forecast period of $5, $10, and $15 million, respectively. Due to the emergence of competitive products, cash flow is expected to grow at a modest 5 percent annually after the fifth year. The discount rate for the first five years is estimated to be 20 percent and then to drop to 10 percent beyond the fifth year. In addition, the present value of the estimated synergy by combining Acquiring and Target companies is $30 million. Calculate the minimum and maximum purchase prices for Target Company. Show your work.

firm, which develops products that are licensed to the major pharmaceutical firms? Development costs are expected to generate negative cash flows during the first two years of the forecast period of $(10) and $(5) million, respectively. Licensing fees are expected to generate positive cash flows during years three through five of the forecast period of $5, $10, and $15 million, respectively. Due to the emergence of competitive products, cash flow is expected to grow at a modest 5 percent annually after the fifth year. The discount rate for the first five years is estimated to be 20 percent and then to drop to 10 percent beyond the fifth year. In addition, the present value of the estimated synergy by combining Acquiring and Target companies is $30 million. Calculate the minimum and maximum purchase prices for Target Company. Show your work.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

12

10 How does the presence of management options and convertible securities affect the calculation of the offer price for the target firm?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

13

9 For most transactions, the full impact of net synergy will not be realized for many months. Why? What factors could account for the delay?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

14

what way did the acquisition of Wrigley's represent a strategic blow to Cadbury?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

15

4 Can the initial offer price ever exceed the maximum purchase price? If yes, why? If no, why not?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

16

was the initial offer price determined according to this case study? Do you find the logic underlying the initial offer price compelling? Explain your answer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

17

16 Using the M&A Valuation & Deal Structuring Model accompanying this text and the data contained in the

cells as a starting point, complete the following:

a. On the Valuation worksheet, what is the enterprise and equity value of Target on the Valuation

Worksheet?

b. On the worksheet named Target Assumptions, decrease COGS (cost of goods sold) as a percent of sales

by one percentage point on the Target Assumptions Worksheet.

What is the impact on the Target's enterprise and equity values? (Hint: See Valuation Worksheet)

Close Model but do not save results.

cells as a starting point, complete the following:

a. On the Valuation worksheet, what is the enterprise and equity value of Target on the Valuation

Worksheet?

b. On the worksheet named Target Assumptions, decrease COGS (cost of goods sold) as a percent of sales

by one percentage point on the Target Assumptions Worksheet.

What is the impact on the Target's enterprise and equity values? (Hint: See Valuation Worksheet)

Close Model but do not save results.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

18

18 Using the M&A Valuation & Deal Structuring Model accompanying this text:

a. Under the heading Form of Payment, change the composition of the purchase price to 100% cash.

Assume the purchase price is partially financed by reducing Acquirer excess cash by $1 billion and by

raising $4 billion by issuing new Acquirer equity. Under the Sources and Uses heading, how is the

remainder of the purchase price financed?

b. Change the composition of the purchase price to 100% equity, what is the impact on how the purchase

price is financed?

Close model but do not save the results.

a. Under the heading Form of Payment, change the composition of the purchase price to 100% cash.

Assume the purchase price is partially financed by reducing Acquirer excess cash by $1 billion and by

raising $4 billion by issuing new Acquirer equity. Under the Sources and Uses heading, how is the

remainder of the purchase price financed?

b. Change the composition of the purchase price to 100% equity, what is the impact on how the purchase

price is financed?

Close model but do not save the results.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

19

15 Using the M&A Valuation & Deal Structuring Model on the website accompanying this text and the data

contained in the cells as a starting point, complete the following:

a. What is the enterprise and equity value of Target on the Valuation Worksheet?

b. Increase the sales growth rate by one percentage point (i.e., to 6.5%) on the Target Assumptions

Worksheet.

What is the impact on the Target's enterprise and equity values? (Hint: See Valuation Worksheet)

Close model but do not save results.

contained in the cells as a starting point, complete the following:

a. What is the enterprise and equity value of Target on the Valuation Worksheet?

b. Increase the sales growth rate by one percentage point (i.e., to 6.5%) on the Target Assumptions

Worksheet.

What is the impact on the Target's enterprise and equity values? (Hint: See Valuation Worksheet)

Close model but do not save results.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

20

8 Dow Chemical's acquisition of Rhom and Haas included a 74 percent premium over the firm's pre-announcement share price. What is the probable process Dow employed in determining the stunning magnitude of this premium?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

21

present value of net synergy is the difference between the present value of projected cash flows from sources and destroyers of value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

22

synergy may be estimated as the difference between the sum of the present values of the target and acquiring firms, including the effects of synergy, and the value of the target firm including the effects of synergy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

23

the acquisition of the target is believed to be very important to implement the acquirer's strategy, the acquirer should be willing to pay up to the maximum purchase price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

24

savings are likely to be greatest when firms with dissimilar operations are consolidated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

25

The current stock price of the acquiring firm may decline in a share for share exchange due to the potential

dilution in earnings per share.

dilution in earnings per share.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

26

The share exchange ratio indicates the number of acquirer shares to be exchanged for each share of target stock based on the target firm's current share price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

27

Thermo Fisher designed a capital structure for financing the deal that would retain its investment grade credit rating. To do so, it targeted a debt to total capital and interest coverage ratio consistent with the industry average for these credit ratios. What is the potential impact on Thermo Fisher's ability to retain an investment grade credit rating if it had financed the takeover using 100% senior debt? (Hint: In the Sources and Uses section of the Transaction Summary Worksheet, set excess cash, new common shares issued, and convertible preferred shares to zero. Senior debt will automatically increase to 100% of the equity consideration plus transaction expenses.) Explain your answer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

28

Non-compliance with environmental laws, product liabilities, pending lawsuits, poor product quality, patents, poorly written or missing customer contracts, and high employee turnover are all considered destroyers of value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

29

maximum purchase price is the minimum price plus the present value of sources of value. True or False

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

30

target firm's underutilized borrowing capacity is often considered a source of value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

31

Minimum purchase price or initial offer price for a target is the target's standalone value or market value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

32

The share exchange ratio is defined as offer price divided by the target firm's current share price. True or False

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

33

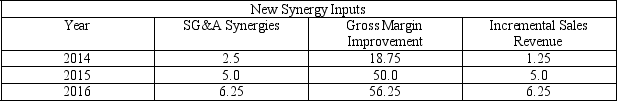

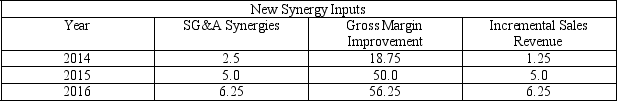

Fisher, CEO of Thermo Fisher, asked rhetorically what if synergy were not realized as quickly and in the amount expected. How patient would shareholders be if the projected impact on earnings per share was not realized? Assume that the integration effort is far more challenging than anticipated and that only one-fourth of the expected SG&A savings, margin improvement, and revenue synergy are realized. Furthermore, assume that actual integration expenses (shown on Newco's Assumptions Worksheet) due to the unanticipated need to upgrade and co-locate research and development facilities and to transfer hundreds of staff are $150 million in 2014, $150 million in 2015, $100 million in 2016, and $50 million in 2017. The model output resulting from these assumption changes is called the Impaired Integration Case.

What is the impact on Thermo Fisher's earning per share (including Life Tech) and the net present value of the combined firms? Compare the difference between the model "Base Case" and the model output from the "Impaired Integration Case" resulting from making the changes indicated in this question. (Hints: In the Synergy Section of the Acquirer (Thermo Fisher) Worksheet, reduce the synergy inputs for each year between 2014 and 2016 by seventy-five percent and allow them to remain at those levels through 2018.

On the Newco Assumptions Worksheet, change the integration expense figures to reflect the new numbers for 2014, 2015, 2016, and 2017.).

On the Newco Assumptions Worksheet, change the integration expense figures to reflect the new numbers for 2014, 2015, 2016, and 2017.).

What is the impact on Thermo Fisher's earning per share (including Life Tech) and the net present value of the combined firms? Compare the difference between the model "Base Case" and the model output from the "Impaired Integration Case" resulting from making the changes indicated in this question. (Hints: In the Synergy Section of the Acquirer (Thermo Fisher) Worksheet, reduce the synergy inputs for each year between 2014 and 2016 by seventy-five percent and allow them to remain at those levels through 2018.

On the Newco Assumptions Worksheet, change the integration expense figures to reflect the new numbers for 2014, 2015, 2016, and 2017.).

On the Newco Assumptions Worksheet, change the integration expense figures to reflect the new numbers for 2014, 2015, 2016, and 2017.).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

34

Assuming Thermo Fisher would have been able to purchase the firm in a share for share exchange, what would have happened to the EPS in the first year? (Hint: In the form of payment section of the Acquirer Transaction Summary Worksheet, set the percentage of the payment denoted by "% Stock" to 100%. In the Sources and Uses Section, set excess cash, new common shares issued, and convertible preferred shares to zero.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

35

Net synergy is the difference between the present value of the estimated sources of value and destroyers of

value. True of False

value. True of False

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

36

The effects of synergy resulting from combining the acquirer and target firms do not affect the acquirer's ability to finance the transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

37

In determining the initial offer price, the acquirer must decide how much of the anticipated synergy to share with the target firm's shareholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

38

Pro forma financial statements are frequently used to show what the acquirer and target's combined

financial statements would look like if they were merged.

financial statements would look like if they were merged.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

39

The acquiring firm's existing loan covenants need not be considered in determining the feasibility of acquiring the target firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

40

target firm's high employee turnover is often considered a destroyer of value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

41

Revenue-related synergy may result from the acquirer being able to sell their products to the target firm's customers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

42

The valuation of the combined businesses should reflect only the sum of their standalone values but

not the incremental value of synergy.

not the incremental value of synergy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

43

When one company acquires another, year over year historical earnings comparisons for the acquiring firm are unaffected.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

44

In calculating the value of net synergy, the costs required to realize the anticipated synergy should be ignored because they are difficult to forecast.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

45

A clear statement of all assumptions underlying the model's projections forces the analyst to display their biases and to be prepared to defend their assumptions to others.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

46

The offer price for a target firm is considered appropriate if the NPV of the difference between the present value of target plus anticipated synergy and the offer price including any transaction-related expenses is less than zero.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

47

It is unimportant whether the acquirer uses the target's or its own weighted average cost of capital when valuing the target firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

48

M&A valuation and deal structuring models commonly require the estimation of the standalone value of

target firm but never the acquirer.

target firm but never the acquirer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

49

A standalone business is one whose financial statements reflect all the costs of running the business and all of the revenues generated by the business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

50

The appropriate discount rate for the combined firms is generally the target's cost of capital unless the two firms have similar risk profiles and are based in the same country.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

51

Financial modeling refers to the application of spreadsheet software to define simple arithmetic relationships among variables within the firm's income, balance sheet, and cash-flow statements and to define the interrelationships among the various financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

52

Financial models are of little value in determining whether the proposed purchase price can be financed by the acquirer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

53

Assume Firm A's acquisition of Firm B results in a reduction in the combined firms' debt-to-total capital ratio to .25. If the same ratio for the industry is .5, the combined firm may be able to increase its borrowing to the industry average, assuming no extenuating circumstances. However, this should not be viewed as a source of value to the acquiring firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

54

Financial models can be used to answer the following questions: How much is the target company worth without the effects of synergy? What is the value of expected synergy? What is the maximum price that the acquiring company should pay for the target?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

55

The acquirer's standalone value represents a reference point against which the value of the combined

businesses (Newco) must be compared to determine if a deal makes sense.

businesses (Newco) must be compared to determine if a deal makes sense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

56

Value drivers are variables which exert the greatest impact on firm value, often including the revenue

growth rate, cost of sales as a percent of sales, S,G,&A as a percent of sales, WACC assumed during

annual cash flow growth and terminal periods, and the cash flow growth rate assumed during terminal

period.

growth rate, cost of sales as a percent of sales, S,G,&A as a percent of sales, WACC assumed during

annual cash flow growth and terminal periods, and the cash flow growth rate assumed during terminal

period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

57

Complex models because of their greater sophistication are necessarily more accurate than simple models.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

58

Potential sources of value rarely include factors not recorded on a firm's balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

59

In determining the initial offer price, the acquiring company must decide how much of anticipated synergy it is willing to share with the target firm's shareholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

60

The appropriate financial structure can be determined from a range of different scenarios created by making small changes in selected value drivers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

61

M&A modeling facilitates deal valuation and structuring but not financing decisions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

62

In calculating synergy, it is important to include the costs associated with recruiting and training

employees, achieving productivity improvements, layoffs, and exploiting revenue opportunities. True or

False

employees, achieving productivity improvements, layoffs, and exploiting revenue opportunities. True or

False

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

63

Fully diluted shares outstanding, that is, the number of Target's "basic" shares outstanding (i.e., pre-

transaction shares outstanding) plus the number of shares represented by the firm's "in the money" options,

warrants, and convertible debt and preferred securities should be used in the calculation of the total cost of

a takeover.

transaction shares outstanding) plus the number of shares represented by the firm's "in the money" options,

warrants, and convertible debt and preferred securities should be used in the calculation of the total cost of

a takeover.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

64

Target is a wholly owned subsidiary of MegaCorp Inc. MegaCorp supplies a number of services to target. Target sells some of its products to other MegaCorp subsidiaries. Target also buys products from other MegaCorp subsidiaries that are used as inputs in producing Target's products. Which of the following adjustments should the acquirer make to Target's financial statements before valuing the firm?

A) Deduct the actual cost of services required by Target that are being supplied by the parent without charge from target's cost of sales.

B) Deduct the difference between the cost of products purchased from other MegaCorp subsidiaries at below market prices and the actual market prices for such products from Target's cost of sales.

C) Deduct the difference between the cost of products purchased from other MegaCorp subsidiaries at above market prices and the actual cost of such products if purchased from other sources from Target's cost of sales

D) A and B only.

E) None of the above.

A) Deduct the actual cost of services required by Target that are being supplied by the parent without charge from target's cost of sales.

B) Deduct the difference between the cost of products purchased from other MegaCorp subsidiaries at below market prices and the actual market prices for such products from Target's cost of sales.

C) Deduct the difference between the cost of products purchased from other MegaCorp subsidiaries at above market prices and the actual cost of such products if purchased from other sources from Target's cost of sales

D) A and B only.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

65

initial offer price for the target firm is defined as

A) The minimum price

B) The present value of the minimum price plus some fraction of the present value of net synergy

C) The present value of net synergy plus the current market value of the target firm

D) The maximum price less the minimum price

E) The maximum price less the present value of net synergy

A) The minimum price

B) The present value of the minimum price plus some fraction of the present value of net synergy

C) The present value of net synergy plus the current market value of the target firm

D) The maximum price less the minimum price

E) The maximum price less the present value of net synergy

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

66

To determine if certain cash flows result from synergy ask if they can be generated only if the businesses

are combined. If the answer is yes, then the cash flow in question is due to synergy.

are combined. If the answer is yes, then the cash flow in question is due to synergy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

67

The initial offer price for the target firm should lie between the minimum and maximum offer prices. True

or False

or False

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

68

Which of the following is generally not considered a source of value to the acquiring firm?

A) Duplicate facilities

B) Patents

C) Land on the balance sheet at below market value

D) Warranty claims

E) Copyrights

A) Duplicate facilities

B) Patents

C) Land on the balance sheet at below market value

D) Warranty claims

E) Copyrights

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

69

The maximum offer price is equal to the sum of the standalone value (or minimum price) plus some

fraction of present value net synergy.

fraction of present value net synergy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

70

Underutilized borrowing capacity or significant excess cash balances also can make an acquisition target

less attractive.

less attractive.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

71

The value of the firm created by combining an acquiring and target firms is impacted only by changes in the value drivers of the target firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

72

To evaluate the credibility of a financial model's results it is important to examine the credibility of the

assumptions used to project the value drivers.

assumptions used to project the value drivers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

73

Assume a firm's debt to equity ratio is currently below its industry average. Increasing it to the industry

average can represent a source of value.

average can represent a source of value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

74

Which of the following is not true about generally accepted accounting principles (GAAP)?

A) GAAP provide specific guidelines as to how to account for specific events impacting the financial performance of the firm.

B) The scrupulous application GAAP accounting rules does ensure consistency in comparing one firm's financial performance to another.

C) It is customary for definitive agreements of purchase and sale to require that a target company represent that its financial books are kept in accordance with GAAP.

D) GAAP guarantees that a firm's financial books are accurate.

E) Differences between how a firm records actual financial transactions and how they should be recorded based on GAAP may indicate fraud or mismanagement.

A) GAAP provide specific guidelines as to how to account for specific events impacting the financial performance of the firm.

B) The scrupulous application GAAP accounting rules does ensure consistency in comparing one firm's financial performance to another.

C) It is customary for definitive agreements of purchase and sale to require that a target company represent that its financial books are kept in accordance with GAAP.

D) GAAP guarantees that a firm's financial books are accurate.

E) Differences between how a firm records actual financial transactions and how they should be recorded based on GAAP may indicate fraud or mismanagement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

75

share exchange ratio is defined as

A) Offer price for the target divided by the acquirer's share price

B) Offer price for the target divided by the target's share price

C) Acquirer's share price divided by the target's share price

D) Target's share price divided by the offer price

E) Acquirer's share price divided by the offer price

A) Offer price for the target divided by the acquirer's share price

B) Offer price for the target divided by the target's share price

C) Acquirer's share price divided by the target's share price

D) Target's share price divided by the offer price

E) Acquirer's share price divided by the offer price

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

76

The number of new acquirer shares that must be issued to complete a deal is unaffected by such

derivative securities as options issued to Target's employees and warrants, as well as convertible securities.

derivative securities as options issued to Target's employees and warrants, as well as convertible securities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

77

Although public firms are required to file their financial statements with the Securities and Exchange

Commission in accordance with GAAP, so-called pro forma financial statements are used as hypothetical

representations of the potential performance of the acquirer and target firms if they were merged. True or

False

Commission in accordance with GAAP, so-called pro forma financial statements are used as hypothetical

representations of the potential performance of the acquirer and target firms if they were merged. True or

False

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

78

If the acquirer were to pay the target firm shareholders the maximum estimated offer price it would be

ceding all of the net synergy created by combining the two firms to the target's shareholders.

ceding all of the net synergy created by combining the two firms to the target's shareholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

79

Which of the following is not true about common size financial statements?

A) Such statements are used to uncover data irregularities.

B) Such statements are constructed by calculating the percentage each line item of the income statement, balance sheet, and cash flow statement is of annual sales.

C) Such statements are useful for comparing businesses of different sizes in the same industry at different moments in time.

D) Common size statements applied over a number of consecutive periods may be used to determine if the target firm is deferring necessary spending.

E) Common size statements may be calculated for both quarterly and annual financial data.

A) Such statements are used to uncover data irregularities.

B) Such statements are constructed by calculating the percentage each line item of the income statement, balance sheet, and cash flow statement is of annual sales.

C) Such statements are useful for comparing businesses of different sizes in the same industry at different moments in time.

D) Common size statements applied over a number of consecutive periods may be used to determine if the target firm is deferring necessary spending.

E) Common size statements may be calculated for both quarterly and annual financial data.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

80

Ultimately, what fraction of synergy is negotiated successfully by the target depends on its leverage or

influence relative to the acquirer.

influence relative to the acquirer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck