Deck 16: Specimen Financial Statements: the Coca-Cola Company

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

Match between columns

الفرضيات:

Supervisor approves hours worked.

Supervisor approves hours worked.

Supervisor approves hours worked.

Supervisor approves hours worked.

Posting job openings.

Posting job openings.

Posting job openings.

Posting job openings.

Distribution of checks by the treasurer.

Distribution of checks by the treasurer.

Distribution of checks by the treasurer.

Distribution of checks by the treasurer.

Maintenance of payroll records.

Maintenance of payroll records.

Maintenance of payroll records.

Maintenance of payroll records.

الردود:

PAY= Paying the Payroll

T= Timekeeping

H= Hiring Employees

PRE =Preparing the Payroll

PAY= Paying the Payroll

T= Timekeeping

H= Hiring Employees

PRE =Preparing the Payroll

PAY= Paying the Payroll

T= Timekeeping

H= Hiring Employees

PRE =Preparing the Payroll

PAY= Paying the Payroll

T= Timekeeping

H= Hiring Employees

PRE =Preparing the Payroll

PAY= Paying the Payroll

T= Timekeeping

H= Hiring Employees

PRE =Preparing the Payroll

PAY= Paying the Payroll

T= Timekeeping

H= Hiring Employees

PRE =Preparing the Payroll

PAY= Paying the Payroll

T= Timekeeping

H= Hiring Employees

PRE =Preparing the Payroll

PAY= Paying the Payroll

T= Timekeeping

H= Hiring Employees

PRE =Preparing the Payroll

PAY= Paying the Payroll

T= Timekeeping

H= Hiring Employees

PRE =Preparing the Payroll

PAY= Paying the Payroll

T= Timekeeping

H= Hiring Employees

PRE =Preparing the Payroll

PAY= Paying the Payroll

T= Timekeeping

H= Hiring Employees

PRE =Preparing the Payroll

PAY= Paying the Payroll

T= Timekeeping

H= Hiring Employees

PRE =Preparing the Payroll

سؤال

Match between columns

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/39

العب

ملء الشاشة (f)

Deck 16: Specimen Financial Statements: the Coca-Cola Company

1

Which one of the following payroll taxes is not withheld from the employee's wages because it is not levied on the employee?

A) Federal income tax

B) Federal unemployment tax

C) State income tax

D) FICA tax

A) Federal income tax

B) Federal unemployment tax

C) State income tax

D) FICA tax

B

2

The form showing gross earnings, FICA taxes withheld, and income taxes withheld for the year is

A) Form W-4.

B) Form W-2.

C) Form 1040.

D) Schedule A.

A) Form W-4.

B) Form W-2.

C) Form 1040.

D) Schedule A.

B

3

An employee's time card is used to record the number of exemptions claimed by the employee for income tax withholding purposes.

F

4

The state unemployment tax rate is usually 5.4% on the first $7,000 of wages paid to an employee during the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

5

FICA taxes withheld and federal income taxes withheld are mandatory payroll deductions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which one of the following payroll taxes does not result in a payroll tax expense for the employer?

A) FICA tax

B) Federal income tax

C) Federal unemployment tax

D) State unemployment tax

A) FICA tax

B) Federal income tax

C) Federal unemployment tax

D) State unemployment tax

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

7

Internal control over payroll is not necessary because employees will complain if they do not receive the correct amount on their payroll checks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

8

Assuming a FICA tax rate of 7.65% on the first $117,000 in wages and 1.45% in excess of $117,000 and a federal income tax rate of 20% on all wages, what would be an employee's net pay for the year if he earned $180,000? Round all calculations to the nearest dollar.

A) $134,867

B) $133,953

C) $144,000

D) $134,136

A) $134,867

B) $133,953

C) $144,000

D) $134,136

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

9

Jerri Rice has worked 44 hours this week. She worked at least 8 hours each day. Her regular hourly wage is $12 per hour with one and one-half times her regular rate for any hours which exceed 40 hours per week. What are Jerri's gross wages for the week?

A) $528

B) $552

C) $792

D) $576

A) $528

B) $552

C) $792

D) $576

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

10

A Wage and Tax Statement shows gross earnings, FICA taxes withheld, and income taxes withheld for the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

11

A good internal control feature is to have a written hiring authorization form completed before a new employee is added to the payroll.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

12

The employer incurs a payroll tax expense equal to the amount withheld from the employees' wages for federal income taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

13

FICA taxes do not provide workers with

A) life insurance.

B) supplemental retirement.

C) employment disability.

D) medical benefits.

A) life insurance.

B) supplemental retirement.

C) employment disability.

D) medical benefits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

14

Lucie Ball's regular rate of pay is $15 per hour with one and one-half times her regular rate for any hours which exceed 40 hours per week. She worked 48 hours last week. Therefore, her gross wages were

A) $720.

B) $600.

C) $780.

D) $1,080.

A) $720.

B) $600.

C) $780.

D) $1,080.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

15

FICA taxes and federal income taxes are levied on employees' earnings without limit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

16

Most companies are required to compute overtime at

A) the worker's regular hourly wage.

B) 1.25 times the worker's regular hourly wage.

C) 1.5 times the worker's regular hourly wage.

D) 2.5 times the worker's regular hourly wage.

A) the worker's regular hourly wage.

B) 1.25 times the worker's regular hourly wage.

C) 1.5 times the worker's regular hourly wage.

D) 2.5 times the worker's regular hourly wage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

17

A good internal control feature is to have several employees choose one person to punch all of their time cards.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

18

By January 31 following the end of a calendar year, an employer is required to provide each employee with a(n)

A) state unemployment tax form.

B) federal unemployment tax form 940.

C) wage and tax statement form W-2.

D) employee's withholding allowance certificate form W-4.

A) state unemployment tax form.

B) federal unemployment tax form 940.

C) wage and tax statement form W-2.

D) employee's withholding allowance certificate form W-4.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

19

An employee earnings record is a cumulative record of each employee's gross earnings, deductions, and net pay during the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

20

The journal entry to record the payroll for a period will include a credit to Salaries and Wages Payable for the gross

A) amount less all payroll deductions.

B) amount of all paychecks issued.

C) pay less taxes payable.

D) pay less voluntary deductions.

A) amount less all payroll deductions.

B) amount of all paychecks issued.

C) pay less taxes payable.

D) pay less voluntary deductions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

21

Changes in pay rates during employment should be authorized by the

A) human resources department.

B) payroll department.

C) treasurer's department.

D) timekeeping department.

A) human resources department.

B) payroll department.

C) treasurer's department.

D) timekeeping department.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which of the following is not performed by the payroll department?

A) Preparation of payroll checks

B) Maintaining payroll records

C) Signing of payroll checks

D) Preparation of payroll tax returns

A) Preparation of payroll checks

B) Maintaining payroll records

C) Signing of payroll checks

D) Preparation of payroll tax returns

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

23

Control over timekeeping does not include

A) having one employee punch the time cards for several employees in the same work area.

B) time clock procedure monitoring by a supervisor.

C) pay period time reports kept by a supervisor for salaried personnel.

D) overtime approval by a supervisor.

A) having one employee punch the time cards for several employees in the same work area.

B) time clock procedure monitoring by a supervisor.

C) pay period time reports kept by a supervisor for salaried personnel.

D) overtime approval by a supervisor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

24

A payroll tax expense which is borne entirely by the employer is the federal _______________ tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

25

An employee's payroll check is distributed by the

A) personnel department.

B) payroll department.

C) cashier.

D) treasurer's department.

A) personnel department.

B) payroll department.

C) cashier.

D) treasurer's department.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

26

Two federal taxes which are levied against employees' wages that must be deducted in arriving at net pay are (1) ________________ taxes and (2) _______________ taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

27

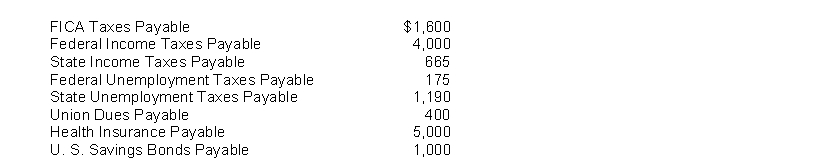

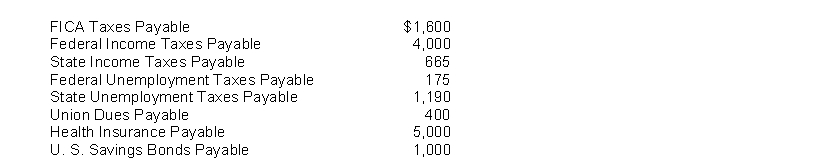

The following payroll liability accounts are included in the ledger of Clementine Company on January 1, 2018:  In January, the following transactions occurred:

In January, the following transactions occurred:

Jan. 9 Sent a check for $5,000 to Blue Cross and Blue Shield.

11 Deposited a check for $5,600 in Federal Reserve Bank for FICA taxes and federal income taxes withheld.

14 Sent a check for $400 to the union treasurer for union dues.

18 Paid state income taxes withheld from employees.

21 Paid state and federal unemployment taxes.

22 Purchased U. S. Savings Bonds for employees by writing a check for $1,000.

Instructions

Journalize the January transactions

In January, the following transactions occurred:

In January, the following transactions occurred:Jan. 9 Sent a check for $5,000 to Blue Cross and Blue Shield.

11 Deposited a check for $5,600 in Federal Reserve Bank for FICA taxes and federal income taxes withheld.

14 Sent a check for $400 to the union treasurer for union dues.

18 Paid state income taxes withheld from employees.

21 Paid state and federal unemployment taxes.

22 Purchased U. S. Savings Bonds for employees by writing a check for $1,000.

Instructions

Journalize the January transactions

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

28

Ann Hech's regular hourly wage is $18 an hour. She receives overtime pay at the rate of time and a half. The FICA tax rate is 7.65%. Ann is paid every two weeks. For the first pay period in January, Ann worked 86 hours of which 6 were overtime hours. Ann's federal income tax withholding is $400 and her state income tax withholding is $170. Ann has authorized that $50 be withheld from her check each pay period for savings bonds.

Instructions

Compute Ann Hech's gross earnings and net pay for the pay period showing each payroll deduction in arriving at net pay.

Instructions

Compute Ann Hech's gross earnings and net pay for the pay period showing each payroll deduction in arriving at net pay.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

29

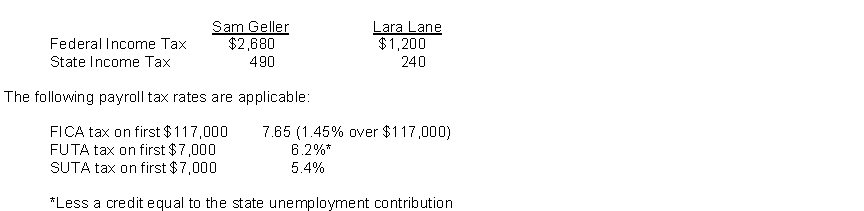

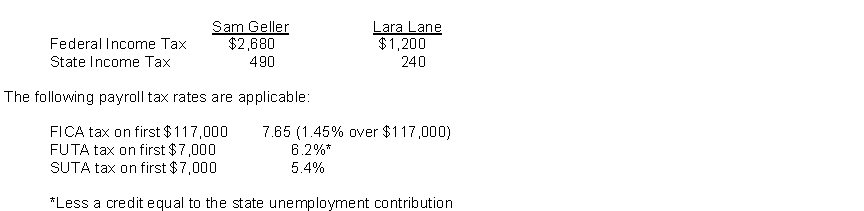

Sam Geller had earned (accumulated) salary of $110,000 through November 30. His December salary amounted to $9,800. Lara Lane began employment on December 1 and will be paid her first month's salary of $7,000 on December 31. Income tax withholding for December for each employee is as follows:  Instructions

Instructions

Record the payroll for the two employees at December 31 and record the employer's share of payroll tax expense for the December 31 payroll. Round all calculations to the nearest dollar.

Instructions

InstructionsRecord the payroll for the two employees at December 31 and record the employer's share of payroll tax expense for the December 31 payroll. Round all calculations to the nearest dollar.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

30

The employer incurs a payroll tax expense equal to the amount contributed by each employee for ______________ taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

31

The tax that is paid equally by the employer and employee is the

A) federal income tax.

B) federal unemployment tax.

C) state unemployment tax.

D) FICA tax.

A) federal income tax.

B) federal unemployment tax.

C) state unemployment tax.

D) FICA tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which of the following employees would likely receive a salary instead of wages?

A) Store clerk

B) Factory employee

C) Sales manager

D) Manual laborer

A) Store clerk

B) Factory employee

C) Sales manager

D) Manual laborer

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

33

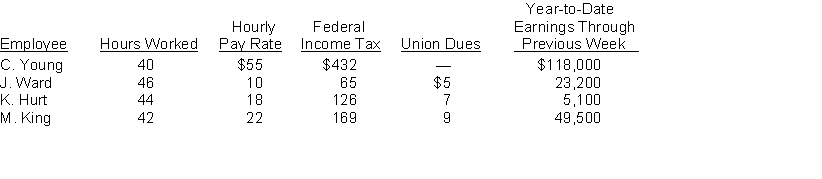

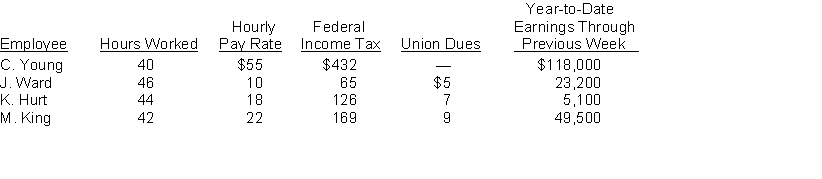

Assume that the payroll records of Erroll Oil Company provided the following information for the weekly payroll ended November 30, 2018.  Additional information: All employees are paid overtime at time and a half for hours worked in excess of 40 per week. The FICA tax rate is 7.65% for the first $117,000 of each employee's annual earnings and 1.45% in excess of $117,000. The employer pays unemployment taxes of 6.2% (5.4% for state and .8% for federal) on the first $7,000 of each employee's annual earnings.

Additional information: All employees are paid overtime at time and a half for hours worked in excess of 40 per week. The FICA tax rate is 7.65% for the first $117,000 of each employee's annual earnings and 1.45% in excess of $117,000. The employer pays unemployment taxes of 6.2% (5.4% for state and .8% for federal) on the first $7,000 of each employee's annual earnings.

Instructions

(a) Prepare the payroll register for the pay period.

(b) Prepare general journal entries to record the payroll and payroll taxes.

Additional information: All employees are paid overtime at time and a half for hours worked in excess of 40 per week. The FICA tax rate is 7.65% for the first $117,000 of each employee's annual earnings and 1.45% in excess of $117,000. The employer pays unemployment taxes of 6.2% (5.4% for state and .8% for federal) on the first $7,000 of each employee's annual earnings.

Additional information: All employees are paid overtime at time and a half for hours worked in excess of 40 per week. The FICA tax rate is 7.65% for the first $117,000 of each employee's annual earnings and 1.45% in excess of $117,000. The employer pays unemployment taxes of 6.2% (5.4% for state and .8% for federal) on the first $7,000 of each employee's annual earnings.Instructions

(a) Prepare the payroll register for the pay period.

(b) Prepare general journal entries to record the payroll and payroll taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

34

Instructions

Compute Banner's payroll tax expense for the year. Make a summary journal entry to record the payroll tax expense.

Compute Banner's payroll tax expense for the year. Make a summary journal entry to record the payroll tax expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

35

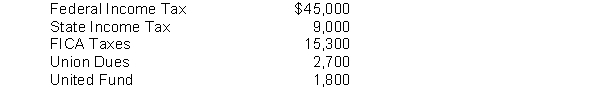

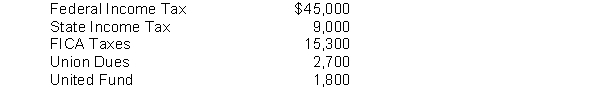

Warren Company's payroll for the week ending January 15 amounted to $200,000 for salaries and wages. None of the employees has reached the earnings limits specified for federal or state employer payroll taxes. The following deductions were withheld from employees' salaries and wages:  Federal unemployment tax (FUTA) rate is 6.2% less a credit equal to the rate paid for state unemployment taxes. The state unemployment tax (SUTA) rate is 5.4%.

Federal unemployment tax (FUTA) rate is 6.2% less a credit equal to the rate paid for state unemployment taxes. The state unemployment tax (SUTA) rate is 5.4%.

Instructions

Prepare the journal entries to record the weekly payroll ending January 15 and also the employer's payroll tax expense on the payroll.

Federal unemployment tax (FUTA) rate is 6.2% less a credit equal to the rate paid for state unemployment taxes. The state unemployment tax (SUTA) rate is 5.4%.

Federal unemployment tax (FUTA) rate is 6.2% less a credit equal to the rate paid for state unemployment taxes. The state unemployment tax (SUTA) rate is 5.4%.Instructions

Prepare the journal entries to record the weekly payroll ending January 15 and also the employer's payroll tax expense on the payroll.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

36

The effective federal unemployment tax rate is usually

A) 6.2%.

B) 0.8%.

C) 5.4%.

D) 8.0%.

A) 6.2%.

B) 0.8%.

C) 5.4%.

D) 8.0%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

37

Diane Lane earns a salary of $9,900 per month during the year. FICA taxes are 7.65% on the first $117,000 of gross earnings and 1.45% in excess of $117,000. Federal unemployment insurance taxes are 6.2% of the first $7,000; however, a credit is allowed equal to the state unemployment insurance taxes of 5.4% on the $7,000. During the year, $32,300 was withheld for federal income taxes and $6,700 was withheld for state income taxes.

Instructions

(a) Prepare a journal entry summarizing the payment of Lane's total salary during the year.

(b) Prepare a journal entry summarizing the employer payroll tax expense on Lane's salary for the year.

(c) Determine the cost of employing Lane for the year.

Instructions

(a) Prepare a journal entry summarizing the payment of Lane's total salary during the year.

(b) Prepare a journal entry summarizing the employer payroll tax expense on Lane's salary for the year.

(c) Determine the cost of employing Lane for the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

38

Match between columns

الفرضيات:

Supervisor approves hours worked.

Supervisor approves hours worked.

Supervisor approves hours worked.

Supervisor approves hours worked.

Posting job openings.

Posting job openings.

Posting job openings.

Posting job openings.

Distribution of checks by the treasurer.

Distribution of checks by the treasurer.

Distribution of checks by the treasurer.

Distribution of checks by the treasurer.

Maintenance of payroll records.

Maintenance of payroll records.

Maintenance of payroll records.

Maintenance of payroll records.

الردود:

PAY= Paying the Payroll

T= Timekeeping

H= Hiring Employees

PRE =Preparing the Payroll

PAY= Paying the Payroll

T= Timekeeping

H= Hiring Employees

PRE =Preparing the Payroll

PAY= Paying the Payroll

T= Timekeeping

H= Hiring Employees

PRE =Preparing the Payroll

PAY= Paying the Payroll

T= Timekeeping

H= Hiring Employees

PRE =Preparing the Payroll

PAY= Paying the Payroll

T= Timekeeping

H= Hiring Employees

PRE =Preparing the Payroll

PAY= Paying the Payroll

T= Timekeeping

H= Hiring Employees

PRE =Preparing the Payroll

PAY= Paying the Payroll

T= Timekeeping

H= Hiring Employees

PRE =Preparing the Payroll

PAY= Paying the Payroll

T= Timekeeping

H= Hiring Employees

PRE =Preparing the Payroll

PAY= Paying the Payroll

T= Timekeeping

H= Hiring Employees

PRE =Preparing the Payroll

PAY= Paying the Payroll

T= Timekeeping

H= Hiring Employees

PRE =Preparing the Payroll

PAY= Paying the Payroll

T= Timekeeping

H= Hiring Employees

PRE =Preparing the Payroll

PAY= Paying the Payroll

T= Timekeeping

H= Hiring Employees

PRE =Preparing the Payroll

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck

39

Match between columns

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 39 في هذه المجموعة.

فتح الحزمة

k this deck