Deck 12: Performance Evaluation in Decentralized Organizations

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

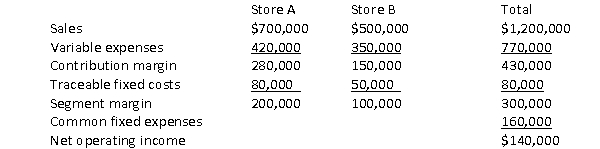

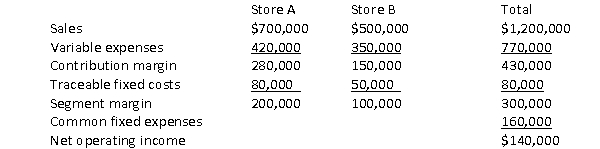

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/66

العب

ملء الشاشة (f)

Deck 12: Performance Evaluation in Decentralized Organizations

1

Cost center managers serve two roles in organizations - achieving cost targets for a given level of output in the short term, and making continuous improvements to increase revenue in the long term.

False

2

Residual income represents the additional profit or value generated by an investment after meeting the required rate of return.

True

3

Ensuring smooth succession is important for the survival of any company.

True

4

Net book value is the original acquisition cost of plant and equipment less accumulated depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

5

Organizations typically use budget variances to measure cost center performance in the long-run.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

6

Decentralizing authority empowers employees at the higher levels.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

7

Firms often use profit before taxes to evaluate profits centers, computed as contribution margin less traceable fixed costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

8

Normally, we exclude interest and taxes from the calculation of an investment center's profit results from its operations because profit center managers usually do not influence financial or tax-related decisions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

9

The major criticism against ROI is that it is not an effective summary measure of business profitability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

10

Suma is a philosophy of continuous improvement that encourages and rewards employees who constantly seek and suggest improvements to activities and business processes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

11

A characteristic of an effective performance measure is that it is easy to understand and communicate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

12

Managers of investment centers enjoy little autonomy in decentralized organizations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

13

Cost center managers are charged with minimizing the cost of producing a specified level of output or the cost of delivering a specified level of service.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

14

A characteristic of an effective performance measure is that it yields maximum information about the decisions or actions of the individual or organizational unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

15

Production managers have little control over the volume of production.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

16

Most controllable measures are informative, however an informative measure is not necessarily controllable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

17

Organizations use monitoring, performance evaluation, and incentive schemes to manage the cost of delegating decisions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

18

Decentralization worsens the problem of divergence between individual and organizational goals by preventing lower-level managers from preparing to move to upper-level positions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

19

The controllability principle is always the right approach for choosing performance measures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

20

Cost centers for which there is a clear relation between inputs and outputs are termed discretionary cost centers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

21

Divisional managers have a keen interest in the transfer price because their individual compensation often depends on the profit reported by their division.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

22

To make effective trade-offs among the attributes of performance measures, organizations often use: a. A combination of performance measures.

B) Only financial performance measures.

C) Avoid using more than one measure.

D) Select a single performance measure that possesses of the characteristics of an effective performance measure.

E) None of the above.

B) Only financial performance measures.

C) Avoid using more than one measure.

D) Select a single performance measure that possesses of the characteristics of an effective performance measure.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following is not a responsibility center?

A) Investment center.

B) Cost center.

C) Administrative center.

D) Profit center.

E) All of the above are responsibility centers.

A) Investment center.

B) Cost center.

C) Administrative center.

D) Profit center.

E) All of the above are responsibility centers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

24

Ideally, the best performance measures: a. Reflect the decision rights assigned to the individual/organizational unit.

B) Yield the maximum information about the decisions or actions of the individual/organizational unit.

C) Have low measurement error.

D) Are easy to understand and communicate.

E) All of the above.

B) Yield the maximum information about the decisions or actions of the individual/organizational unit.

C) Have low measurement error.

D) Are easy to understand and communicate.

E) All of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which of the following is not a cost of decentralization?

A) Might lead to an emphasis on local versus global goals.

B) Requires costly coordination of decisions.

C) Leads to improper decisions due to divergence between individual and organizational goals.

D) Fails to train future managers.

E) All of the above are costs of decentralization.

A) Might lead to an emphasis on local versus global goals.

B) Requires costly coordination of decisions.

C) Leads to improper decisions due to divergence between individual and organizational goals.

D) Fails to train future managers.

E) All of the above are costs of decentralization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

26

A common approach to setting transfer prices is using cost-based transfer prices (including variable and full cost).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

27

The benefits of decentralization include all of the following except:

A) It forces top levels of management to focus on individual units.

B) It empowers more employees at lower levels of management.

C) It allows for better and more timely decision making.

D) It trains future managers.

A) It forces top levels of management to focus on individual units.

B) It empowers more employees at lower levels of management.

C) It allows for better and more timely decision making.

D) It trains future managers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which of the following is a type of decision a regional manager would make?

A) Pricing.

B) Promotion.

C) Office management.

D) A and B only.

E) A, B and C are decisions a regional manager would make.

A) Pricing.

B) Promotion.

C) Office management.

D) A and B only.

E) A, B and C are decisions a regional manager would make.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which of the following is not an example of a cost center?

A) Plant maintenance.

B) Sears store.

C) Human resources.

D) Data processing.

E) General administration.

A) Plant maintenance.

B) Sears store.

C) Human resources.

D) Data processing.

E) General administration.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which of the following is not a benefit of decentralization?

A) Trains future managers.

B) Simple to coordinate decisions.

C) Empowers employees and increases job satisfaction.

D) Permits timely decisions.

E) All of the above are benefits of decentralization.

A) Trains future managers.

B) Simple to coordinate decisions.

C) Empowers employees and increases job satisfaction.

D) Permits timely decisions.

E) All of the above are benefits of decentralization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

31

In an inter-company transfer, as long as the maximum price the buying division is willing to pay is higher than the minimum price the selling division is willing to accept, both divisions will agree to the internal transfer at any price between these two amounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

32

When intra-company transfers occur, a legally recognized sales takes place even though the divisions are part of the same company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following is not a characteristic of effective performance measures?

A) Is easy to understand and communicate.

B) Is easy to measure.

C) Separates employee and organizational goals.

D) Yields maximum information about the decisions or actions of the individual or organizational unit.

E) All of the above are characteristics of effective performance measures.

A) Is easy to understand and communicate.

B) Is easy to measure.

C) Separates employee and organizational goals.

D) Yields maximum information about the decisions or actions of the individual or organizational unit.

E) All of the above are characteristics of effective performance measures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

34

Setting effective transfer prices is relatively simply because division managers' strategic and economic considerations for the company as a whole are the same.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

35

The profit for a selling department in an inter-company transfer is the transfer price without considering costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which of the following is not an example of a profit center?

A) Production department of a manufacturing plant.

B) An individual product line at Proctor and Gamble.

C) A retail store.

D) All of the above are examples of profit centers.

E) None of the above is an example of a profit center.

A) Production department of a manufacturing plant.

B) An individual product line at Proctor and Gamble.

C) A retail store.

D) All of the above are examples of profit centers.

E) None of the above is an example of a profit center.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

37

The minimum price that the selling division wants from an inter-company transfer is the cost of the transfer plus the opportunity cost of the transfer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

38

The maximum amount the buying division in an inter-company transfer is willing to pay is opportunity cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

39

From the perspective of determining corporate pre-tax income, a transfer price does not serve any useful purpose.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

40

In an inter-company transfer, if the maximum price the buying division is willing to pay is less than the minimum price the selling division is willing to accept, both divisions will never agree to the internal transfer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

41

When measuring average operating assets, depreciable fixed assets may be included at any value except: a. Gross book value.

B) Net book value.

C) Current replacement value.

D) Original cost less estimated salvage.

B) Net book value.

C) Current replacement value.

D) Original cost less estimated salvage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

42

Supercircuits is a decentralized company and has a required opportunity cost of capital of 15%. The home computer division, whose current ROI is 10%, is considering an investment which will earn a 13% return. The gaming division, whose current ROI is 20%, is considering an investment which will earn a 17% return. If the objective is to maximize residual income, each division will make the following choice:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which of the following describes ROI? a. It fosters underinvestment.

B) It ignores future period considerations.

C) It is less suitable for evaluating long-term performance.

D) None of the above.

E) All of the above.

B) It ignores future period considerations.

C) It is less suitable for evaluating long-term performance.

D) None of the above.

E) All of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following is not a popular measure of investment center performance? a. Employee turnover.

B) Return on investment.

C) Residual income.

D) Economic value added.

E) None of the above.

B) Return on investment.

C) Residual income.

D) Economic value added.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

45

Which of the following is not a role of a cost center manager in an organization? a. To achieve cost targets for a given level of output In the short term.

B) Making continuous efficiency improvements to cut costs in the long term.

C) To achieve sales targets for a given level of output.

D) Neither A nor B are roles of a cost center manager.

B) Making continuous efficiency improvements to cut costs in the long term.

C) To achieve sales targets for a given level of output.

D) Neither A nor B are roles of a cost center manager.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

46

The Gallagher Company is decentralized and has a required opportunity cost of capital of 20%. The West division, whose current return on investment (ROI) is 15%, is considering an investment which will earn a return of 18%. The East Division, whose current ROI is 25%, is considering an investment which will earn a return of 22%. If the objective is to maximize ROI, each division will make the following choice:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

47

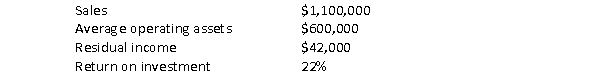

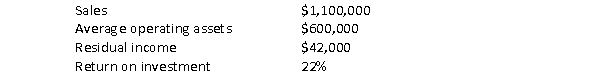

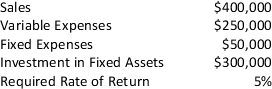

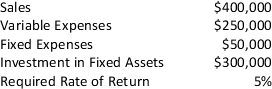

In 2009 the Porter Company reported the following information:  The company's required rate of return was: a. 11.3%

The company's required rate of return was: a. 11.3%

B) 33.3%

C) 15%

D) 29%

The company's required rate of return was: a. 11.3%

The company's required rate of return was: a. 11.3%B) 33.3%

C) 15%

D) 29%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

48

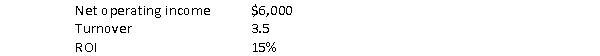

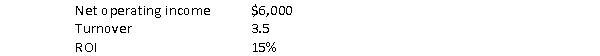

The Versa Company had the following results for 2009:  Versa Company's average operating assets were: a. $140,000

Versa Company's average operating assets were: a. $140,000

B) $40,000

C) $490,000

D) $21,000

Versa Company's average operating assets were: a. $140,000

Versa Company's average operating assets were: a. $140,000B) $40,000

C) $490,000

D) $21,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

49

In 2009 the Yankee Company had average operating assets of $200,000. If the company reported a return on investment of 50% then net operating income for 2009 must have been: a. $100,000

B) $50,000

C) $400,000

D) $200,000

B) $50,000

C) $400,000

D) $200,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

50

The Brett Company has provided the following information for its two stores:  If Store B increases its sales by $50,000 with no change in fixed expenses the overall company net income will: a. Increase by $12,500.

If Store B increases its sales by $50,000 with no change in fixed expenses the overall company net income will: a. Increase by $12,500.

B) Increase by $35,000.

C) Increase by $50,000.

D) Increase by $15,000.

If Store B increases its sales by $50,000 with no change in fixed expenses the overall company net income will: a. Increase by $12,500.

If Store B increases its sales by $50,000 with no change in fixed expenses the overall company net income will: a. Increase by $12,500.B) Increase by $35,000.

C) Increase by $50,000.

D) Increase by $15,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

51

Which of the following is not a performance measure used to evaluate a profit center's manager? a. Customer satisfaction.

B) How well the manager utilizes funds made available to his/her division.

C) Employee turnover.

D) Market share.

E) All of the above are performance measures used to evaluate a profit center's manager.

B) How well the manager utilizes funds made available to his/her division.

C) Employee turnover.

D) Market share.

E) All of the above are performance measures used to evaluate a profit center's manager.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

52

The Greenberg Company reported average operating assets of $400,000 and sales of $1,200,000 in 2009. If the company's margin is 12%, their ROI must have been: a. 24%

B) 36%

C) 33.3%

D) 40%

B) 36%

C) 33.3%

D) 40%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which of the following is the formula for ROI? a. Profit ÷ Investment.

B) (Profit ÷ Sales) x (Sales ÷ Investment).

C) Profit margin x Asset Turnover.

D) None of the above.

E) All of the above.

B) (Profit ÷ Sales) x (Sales ÷ Investment).

C) Profit margin x Asset Turnover.

D) None of the above.

E) All of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

54

A cost center for which there is a clear relation between inputs and outputs is referred to as a: a. Discretionary cost center.

B) Budget center.

C) Engineered cost center.

D) Kaizen center.

E) None of the above.

B) Budget center.

C) Engineered cost center.

D) Kaizen center.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

55

The Hoboken Company has two divisions, North and South. In July, contribution margin for North was $126,000 and sales in the South division were $375,000 with a contribution margin ratio of 40%. Traceable fixed costs for the divisions totaled $101,000. If net operating income was $69,000, then total fixed costs must have been: a. $106,000

B) $207,000

C) $282,000

D) $170,000

B) $207,000

C) $282,000

D) $170,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

56

Firms often view investment centers as: a. Support activities.

B) Discretionary cost centers.

C) Stand-alone businesses.

D) Revenue centers.

E) None of the above.

B) Discretionary cost centers.

C) Stand-alone businesses.

D) Revenue centers.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which of the following does not describe Kaizen? a. Encourages and rewards employees who constantly seek and suggest improvements to activities and business processes.

B) Is a philosophy of continuous improvement.

C) Involves comparing the effectiveness and efficiency of various activities and business processes in a firm against the best practices in the industry.

D) None of the above statements describe Kaizen.

E) All of the above describe Kaizen.

B) Is a philosophy of continuous improvement.

C) Involves comparing the effectiveness and efficiency of various activities and business processes in a firm against the best practices in the industry.

D) None of the above statements describe Kaizen.

E) All of the above describe Kaizen.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

58

Which of the following is not an option in deciding how to incorporate depreciable fixed assets in measuring divisional investment? a. Net book value.

B) Gross book value.

C) Transfer price.

D) Replacement cost of the asset.

E) Current value of the asset.

B) Gross book value.

C) Transfer price.

D) Replacement cost of the asset.

E) Current value of the asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

59

The Allentown Company reported operating income of $25,000 for 2009. If average operating assets for the year were $80,000 and the company had a required return of 12% the company's residual income was: a. $28,000

B) $22,000

C) $15,400

D) $6,600

B) $22,000

C) $15,400

D) $6,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

60

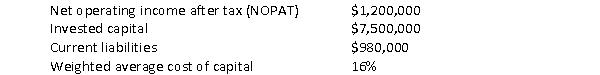

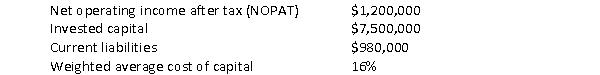

The Grisham Company has reported the following information for 2009:  The company's economic value added is: a. $156,800

The company's economic value added is: a. $156,800

B) $220,000

C) $1,008,000

D) $851,200

The company's economic value added is: a. $156,800

The company's economic value added is: a. $156,800B) $220,000

C) $1,008,000

D) $851,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

61

Which of the following transfer prices, in theory, is the most sound because it provides the best measure of the opportunity cost of inter-divisional transfers? a. Variable cost-based transfer prices.

B) Full cost-based transfer prices.

C) Market-based transfer prices.

D) Negotiated transfer prices.

E) None of the above.

B) Full cost-based transfer prices.

C) Market-based transfer prices.

D) Negotiated transfer prices.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

62

Gant Manufacturing Company has provided the following financial information:  What is Gant's residual income?

What is Gant's residual income?

A) $80,000.

B) $95,000.

C) $100,000.

D) $85,000.

E) None of the above.

What is Gant's residual income?

What is Gant's residual income?A) $80,000.

B) $95,000.

C) $100,000.

D) $85,000.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

63

Which of the following transfer prices gives divisions considerable autonomy? a. Variable cost-based transfer prices.

B) Full cost-based transfer prices.

C) Market-based transfer prices.

D) Negotiated transfer prices.

E) None of the above.

B) Full cost-based transfer prices.

C) Market-based transfer prices.

D) Negotiated transfer prices.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

64

Which of the following transfer prices always results in both divisions voluntarily making the right decisions from the perspective of the company as a whole? a. Variable cost-based transfer prices.

B) Full cost-based transfer prices.

C) Market-based transfer prices.

D) Negotiated transfer prices.

E) None of the above.

B) Full cost-based transfer prices.

C) Market-based transfer prices.

D) Negotiated transfer prices.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

65

Which of the following is not a common approach to transfer pricing? a. Variable cost-based transfer prices.

B) Full cost -based transfer prices.

C) Market-based transfer prices.

D) Negotiated transfer prices.

E) All of the above are common approaches to transfer pricing.

L

B) Full cost -based transfer prices.

C) Market-based transfer prices.

D) Negotiated transfer prices.

E) All of the above are common approaches to transfer pricing.

L

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

66

Which of the following transfer price approaches is most appropriate for a short-term problem in which the selling division has excess capacity? a. Variable cost-based transfer prices.

B) Full cost-based transfer prices.

C) Market-based transfer prices.

D) Negotiated transfer prices.

E) None of the above.

B) Full cost-based transfer prices.

C) Market-based transfer prices.

D) Negotiated transfer prices.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck