Deck 7: Operating Budgets: Bridging Planning and Control

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/54

العب

ملء الشاشة (f)

Deck 7: Operating Budgets: Bridging Planning and Control

1

Many firms use cross-functional teams that include employees from several departments to prepare the budget.

True

2

An example of a cost center is a production plant.

True

3

Little time is spent in preparing the revenue budget, as its accuracy is not as crucial as budgets involving costs.

False

4

A drawback of participative budgeting arises because employees have better information about operating conditions than their managers do.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

5

In a centralized decision-making environment, the manager delegates decision making to individuals with relevant experience and knowledge.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

6

In preparing a cash budget, from an accounting record-keeping perspective there is no need to adjust the balance of accounts receivable and reported income to reflect the uncollectible debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

7

The production budget combines the demand information provided by the revenue budget and the company's inventory policy regarding finished goods to determine production levels in the coming period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

8

The variable cost of goods manufactured is the sum of several cost items: material, labor, variable overhead, and variable selling and administrative expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

9

In preparing a manufacturing overhead budget, depreciation is included when estimating the cash outflows associated with manufacturing overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

10

The purchasing and production managers coordinate closely to prepare the materials usage budget because it requires both price and quantity estimates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

11

Under responsibility accounting, managers are held accountable for the revenue and cost items they control.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

12

A top-down approach to budgeting reflects a participative style of management.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

13

Strategic budgets bridge short-term decisions and long-term plans.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

14

A profit center is an organizational unit that has control over revenues, costs, and long-term investment decisions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

15

Financial budgets quantify the outcomes of operating budgets in summary financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

16

The first step in preparing a master budget is to prepare the revenue budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

17

Multi-year budgets are strategic plans that specify the direction in which a company desires to head.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

18

In preparing a cash budget, making a scheduled payment on a loan would not be included in cash flows from operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

19

In preparing a direct labor budget, the cash outflow for labor depends on production volume and not on sales volume.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

20

Effective working capital management can save companies money in terms of interest payments on costly short-term loans.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

21

The sales budget of the Owens Company for each of the next three months is shown: January 40,000 units

February 50,000 units

March 30,000 units

The company's policy requires that 20% of the following month's budgeted sales units are on hand at the beginning of each period. How many units must be produced in February?

A) 40,000 units

B) 46,000 units

C) 56,000 units

D) 54,000 units

February 50,000 units

March 30,000 units

The company's policy requires that 20% of the following month's budgeted sales units are on hand at the beginning of each period. How many units must be produced in February?

A) 40,000 units

B) 46,000 units

C) 56,000 units

D) 54,000 units

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which of the following is the sequence involved in which operating budgets link long- and short-term plans?

A) Short-term plans; Operational plans; Evaluate; Long-term plans.

B) Short-term plans; Operations plans; Evaluate; Revise.

C) Long-term plans; Short-term plans; Operational plans; Revise.

D) Long-term plans; Operational plans; Evaluate; Revise.

E) None of the above.

A) Short-term plans; Operational plans; Evaluate; Long-term plans.

B) Short-term plans; Operations plans; Evaluate; Revise.

C) Long-term plans; Short-term plans; Operational plans; Revise.

D) Long-term plans; Operational plans; Evaluate; Revise.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following is not a benefit of budgeting?

A) It allows for coordination between various business units.

B) It sets goals for the organization.

C) It formalizes the plans of management.

D) It reduces the need for analysis with regard to company expenses

A) It allows for coordination between various business units.

B) It sets goals for the organization.

C) It formalizes the plans of management.

D) It reduces the need for analysis with regard to company expenses

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

24

Cody Manufacturing started doing business on January 1st of the current year. Cody estimates that its sales will be 9,000 units in the first quarter, 7,000 units in the second quarter, 14,000 units in the third quarter, and 12,000 units in the fourth quarter. Cody's selling price is set at $20 per unit and is not expected to change during the year. Cody intends to have 10% of the next quarter's sales in its ending inventory each quarter. How many units should Cody budget for second quarter's production?

A) 6,300 units.

B) 9,700 units.

C) 7,700 units.

D) 7,000 units.

E) None of the above.

A) 6,300 units.

B) 9,700 units.

C) 7,700 units.

D) 7,000 units.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

25

In the cash budget, which of the following is not an item of cash outflow for operations? a. Payments for marketing and administrative costs.

B) Payments to direct labor.

C) Payments to purchase a machine that will last for several years.

D) Expenditures on manufacturing overhead.

E) All of the above are items of cash outflow for operations.

B) Payments to direct labor.

C) Payments to purchase a machine that will last for several years.

D) Expenditures on manufacturing overhead.

E) All of the above are items of cash outflow for operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

26

The Gretzky Company has budgeted the following sales for the 1st quarter of 2008: January $120,000

February $150,000

March $160,000

Only 20% of the company's sales are made in cash. The company expects to collect 30% of sales on account in the month of the sale, 60% in the month following the sale, and the final 10% will be collected two months following the sale. Bad debts are immaterial to the budget. Total budgeted cash collections in March will be:

A) $128,000

B) $182,000

C) $152,000

D) $120,000

February $150,000

March $160,000

Only 20% of the company's sales are made in cash. The company expects to collect 30% of sales on account in the month of the sale, 60% in the month following the sale, and the final 10% will be collected two months following the sale. Bad debts are immaterial to the budget. Total budgeted cash collections in March will be:

A) $128,000

B) $182,000

C) $152,000

D) $120,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

27

Jackson Company's payment policy is to pay 40 percent of its accounts payable in the quarter purchases are made and 60 percent in the following quarter. Assume Jackson's credit purchases totaled $400,000 in quarter 1, $420,000 in quarter 2, $530,000 in quarter 3 and $580,000 in quarter 4. What will Jackson's cash payments be for quarter 3? a. $482,500

B) $560,000

C) $530,000

D) $464,000

E) None of the above.

B) $560,000

C) $530,000

D) $464,000

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which of the following is not a financial budget?

A) Production budget.

B) Budgeted Income Statement.

C) Cash budget.

D) Budgeted Balance Sheet.

E) All of the above are financial budgets.

A) Production budget.

B) Budgeted Income Statement.

C) Cash budget.

D) Budgeted Balance Sheet.

E) All of the above are financial budgets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which of the following is not an example of conflicts created in the budgeting process?

A) Because firms want to use the most up-to-date information about local operating conditions, they ask lower-level employees for this information, but these employees may not be forthright in sharing their information.

B) Because a production manager may be overly pessimistic about expected costs, the quality of information used to plan costs may be reduced.

C) Downplaying expected sales may lead to more achievable targets for the managers, but reduce the quality of information used to plan sales.

D) The planned targets in budgets become the benchmark for actual results, thereby facilitating control.

E) All of the above are examples of conflicts in the budgeting process.

A) Because firms want to use the most up-to-date information about local operating conditions, they ask lower-level employees for this information, but these employees may not be forthright in sharing their information.

B) Because a production manager may be overly pessimistic about expected costs, the quality of information used to plan costs may be reduced.

C) Downplaying expected sales may lead to more achievable targets for the managers, but reduce the quality of information used to plan sales.

D) The planned targets in budgets become the benchmark for actual results, thereby facilitating control.

E) All of the above are examples of conflicts in the budgeting process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

30

Jackson Company's credit history indicates that 60 percent of revenue is collected in the quarter the sales occur, 35 percent in the quarter following the month of sales, and 5 percent in the quarter thereafter. Assume Jackson's cash sales remain steady at $25,000 each quarter, credit sales are $600,000 in quarter 1, $520,000 in quarter 2, $480,000 in quarter 3, and $650,000 in quarter 4. What will Jackson's cash collections from sales be for the quarter 3? a. $500

B) $525,000

C) $505,000

D) $540,500

E) None of the above.

B) $525,000

C) $505,000

D) $540,500

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

31

The budgeted amount of raw materials necessary for a period is computed by: a. Subtracting the beginning inventory of raw materials from the materials necessary to meet the production budget

B) Subtracting the desired ending inventory of raw materials to the raw materials necessary to meet the production budget and adding that result to the desired ending inventory of raw materials

C) Adding the desired ending inventory of raw materials to the raw materials necessary to meet the production budget

D) Adding the desired ending inventory of raw materials to the raw materials necessary to meet the production budget and subtracting the desired ending inventory of raw materials

B) Subtracting the desired ending inventory of raw materials to the raw materials necessary to meet the production budget and adding that result to the desired ending inventory of raw materials

C) Adding the desired ending inventory of raw materials to the raw materials necessary to meet the production budget

D) Adding the desired ending inventory of raw materials to the raw materials necessary to meet the production budget and subtracting the desired ending inventory of raw materials

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which of the following is not a method for companies to manage cash shortfalls? a. Accelerate revenues.

B) Defer payments.

C) Alter timing of special cash inflows.

D) Borrow.

E) All of the above are methods to manage cash shortfalls.

B) Defer payments.

C) Alter timing of special cash inflows.

D) Borrow.

E) All of the above are methods to manage cash shortfalls.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following is not a reason why firms use budgets?

A) Performance evaluation.

B) Coordination.

C) Planning.

D) Operating leverage.

E) All of the above are reasons why firms use budgets.

A) Performance evaluation.

B) Coordination.

C) Planning.

D) Operating leverage.

E) All of the above are reasons why firms use budgets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

34

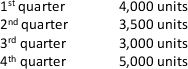

Donaldson Manufacturing Company's production budget requires the following units for the upcoming year:  Each unit requires two pounds of material. The material cost is $1.50 per pound. Donaldson intends to have beginning inventory equal to 10% of the current quarter's material needs. Budgeted direct material usage costs for the second quarter would be:

Each unit requires two pounds of material. The material cost is $1.50 per pound. Donaldson intends to have beginning inventory equal to 10% of the current quarter's material needs. Budgeted direct material usage costs for the second quarter would be:

A) $4,650

B) $5,100

C) $10,650

D) $10,350

E) $3,550

Each unit requires two pounds of material. The material cost is $1.50 per pound. Donaldson intends to have beginning inventory equal to 10% of the current quarter's material needs. Budgeted direct material usage costs for the second quarter would be:

Each unit requires two pounds of material. The material cost is $1.50 per pound. Donaldson intends to have beginning inventory equal to 10% of the current quarter's material needs. Budgeted direct material usage costs for the second quarter would be:A) $4,650

B) $5,100

C) $10,650

D) $10,350

E) $3,550

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following are questions marketing and production managers address when preparing the production budget?

A) Is there enough production capacity to meet projected sales?

B) Should the company add more temporary or permanent capacity?

C) What inventory level is needed for each product?

D) What is the estimated cost of direct material to be used in production?

E) All of the above are questions to address when preparing the production budget.

A) Is there enough production capacity to meet projected sales?

B) Should the company add more temporary or permanent capacity?

C) What inventory level is needed for each product?

D) What is the estimated cost of direct material to be used in production?

E) All of the above are questions to address when preparing the production budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which of the following is not a major component of the cash budget? a. Cash inflow from operations.

B) Cash outflow for operations.

C) Non-cash flow from operations.

D) Cash flows for special items.

E) All of the above are major components of the cash budget.

B) Cash outflow for operations.

C) Non-cash flow from operations.

D) Cash flows for special items.

E) All of the above are major components of the cash budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

37

All of the following would be found on a cash budget except: a. Budgeted cash collections

B) Budgeted borrowings

C) Budgeted depreciation expense

D) Budgeted direct labor costs

B) Budgeted borrowings

C) Budgeted depreciation expense

D) Budgeted direct labor costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

38

Wallace Company makes and sells a single product. Each unit requires two hours of labor at $8 per hour. The company has budgeted to sell 8,000 units and produce 10,000 units during the current month. Each product requires three pounds of material for each unit produced. Budgeted direct labor costs for the current month would be: a. $160,000

B) $128,000

C) $80,000

D) $192,000

E) $64,000

B) $128,000

C) $80,000

D) $192,000

E) $64,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which is the correct order of budget preparation for a merchandising company? a. Selling and administrative expense budget, cash budget, budgeted income statement, budgeted balance sheet.

B) Sales budget, cash budget, selling and administrative expense budget, budgeted income statement.

C) Sales budget, cash budget, budgeted balance sheet, budgeted income statement

D) Cash budget, selling and administrative expense budget, budgeted income statement, budgeted balance sheet.

B) Sales budget, cash budget, selling and administrative expense budget, budgeted income statement.

C) Sales budget, cash budget, budgeted balance sheet, budgeted income statement

D) Cash budget, selling and administrative expense budget, budgeted income statement, budgeted balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

40

Budgets are used to:

A) Enable various departments to coordinate their activities in a way that benefits the company as a whole.

B) Highlight linkages among departments and force each department to consider how its actions influence the actions of other departments.

C) Communicate the plan targets to everyone in the organization.

D) A and C only.

E) All of the above are reasons budgets are used.

A) Enable various departments to coordinate their activities in a way that benefits the company as a whole.

B) Highlight linkages among departments and force each department to consider how its actions influence the actions of other departments.

C) Communicate the plan targets to everyone in the organization.

D) A and C only.

E) All of the above are reasons budgets are used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

41

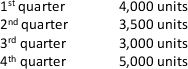

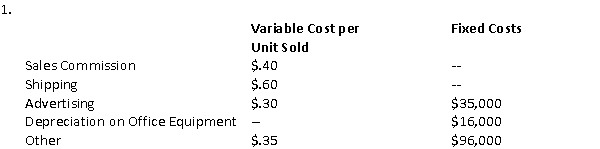

The Ferguson Company makes and sells a single product. The company has estimated the following costs in order to prepared their selling and administrative expenses budget for 2009:  If the sales budget indicates that 120,000 units will be sold in 2009, the total budgeted selling and administrative expenses will be:

If the sales budget indicates that 120,000 units will be sold in 2009, the total budgeted selling and administrative expenses will be:

A) $329,000

B) $345,000

C) $198,000

D) $147,000

If the sales budget indicates that 120,000 units will be sold in 2009, the total budgeted selling and administrative expenses will be:

If the sales budget indicates that 120,000 units will be sold in 2009, the total budgeted selling and administrative expenses will be:A) $329,000

B) $345,000

C) $198,000

D) $147,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

42

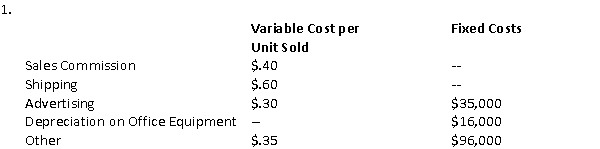

The sales budget for the Johnson Company indicates the following units to be sold:  The company requires that ending inventory be equivalent to 20% of the following month's sales. If each unit is budgeted to have a cost of $4.50, the budgeted balance in the company's ending inventory account at March 31st will be:

The company requires that ending inventory be equivalent to 20% of the following month's sales. If each unit is budgeted to have a cost of $4.50, the budgeted balance in the company's ending inventory account at March 31st will be:

A) $4,000

B) $14,400

C) $12,000

D) $18,000

The company requires that ending inventory be equivalent to 20% of the following month's sales. If each unit is budgeted to have a cost of $4.50, the budgeted balance in the company's ending inventory account at March 31st will be:

The company requires that ending inventory be equivalent to 20% of the following month's sales. If each unit is budgeted to have a cost of $4.50, the budgeted balance in the company's ending inventory account at March 31st will be:A) $4,000

B) $14,400

C) $12,000

D) $18,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which of the following is not a common form of a responsibility center? a. Cost Center.

B) Investment Center

C) Revenue Center.

D) Profit Center.

E) All of the above are common forms of responsibility centers.

B) Investment Center

C) Revenue Center.

D) Profit Center.

E) All of the above are common forms of responsibility centers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

44

The Brady Company has budgeted the following activity for April: Sales of $1,000,000 all in cash

The cost of goods sold is 75% of the selling price

Inventory purchases of $800,000 were paid for in cash

Selling and Administrative expenses are budgeted at $80,000 and are paid in cash in the period incurred.

Depreciation expense for April is budgeted at $14,000

The cash balance at March 31st is $45,000

The budgeted cash balance at the end of April will be:

A) $165,000

B) $120,000

C) $151,000

D) $(85,000)

The cost of goods sold is 75% of the selling price

Inventory purchases of $800,000 were paid for in cash

Selling and Administrative expenses are budgeted at $80,000 and are paid in cash in the period incurred.

Depreciation expense for April is budgeted at $14,000

The cash balance at March 31st is $45,000

The budgeted cash balance at the end of April will be:

A) $165,000

B) $120,000

C) $151,000

D) $(85,000)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

45

The Murcer Company has budgeted the following activity for October: Sales of $300,000 all in cash

Inventory of finished goods at September 30th is $120,000

The cost of goods sold is 60% of the selling price

Planned merchandise inventory at October 31st is $100,000

All purchases were paid for in cash

Budgeted inventory purchases for October are:

A) $300,000

B) $280,000

C) $160,000

D) $152,000

Inventory of finished goods at September 30th is $120,000

The cost of goods sold is 60% of the selling price

Planned merchandise inventory at October 31st is $100,000

All purchases were paid for in cash

Budgeted inventory purchases for October are:

A) $300,000

B) $280,000

C) $160,000

D) $152,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

46

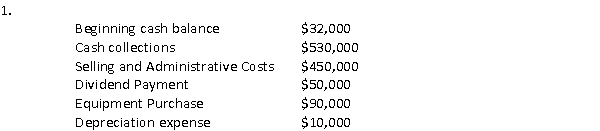

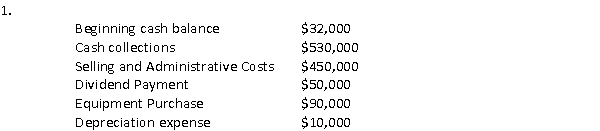

The Crescent Company, a merchandising company, maintains a minimum cash balance of $25,000. Budgeted items for the 1st quarter of 2009 includes the following:  In order to maintain the minimum cash balance, the company will need to borrow:

In order to maintain the minimum cash balance, the company will need to borrow:

A) $25,000

B) $28,000

C) $85,000

D) $53,000

In order to maintain the minimum cash balance, the company will need to borrow:

In order to maintain the minimum cash balance, the company will need to borrow:A) $25,000

B) $28,000

C) $85,000

D) $53,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

47

In relation to budgeting, which of the following does not depend on management style? a. The quality of information obtained.

B) The delegation of decision rights.

C) The cost of budgeting.

D) The commitment to budgets.

E) All of the above depend on management style.

B) The delegation of decision rights.

C) The cost of budgeting.

D) The commitment to budgets.

E) All of the above depend on management style.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

48

The Ramirez Company budgets variable manufacturing overhead at 60% of direct labor costs. If the company estimates that 10,000 direct labor hours will be used at an average rate of $8.50 per hour. Fixed manufacturing overhead costs are budgeted at $45,000 with $10,000 of that amount being depreciation on plant machinery. Total budgeted manufacturing overhead will be: a. $130,000

B) $96,000

C) $120,000

D) $86,000

B) $96,000

C) $120,000

D) $86,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

49

The Tafoya Company has budgeted the following sales for the 1st quarter of 2008: January $80,000

February $70,000

March $90,000

All sales are made on account. The company expects to collect 40% of sales on account in the month of the sale, 50% in the month following the sale, and the final 10% two months following the sale. Bad debts are immaterial to the budget. The balance in accounts receivable at the end of March will be:

A, $61,000

B) $54,000

C) $71,000

D) $64,000

February $70,000

March $90,000

All sales are made on account. The company expects to collect 40% of sales on account in the month of the sale, 50% in the month following the sale, and the final 10% two months following the sale. Bad debts are immaterial to the budget. The balance in accounts receivable at the end of March will be:

A, $61,000

B) $54,000

C) $71,000

D) $64,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which of the following is a concern of using prior performance as the starting point for developing budgets? a. This approach can foster a business-as-usual mentality.

B) This approach may blind decision makers to the need for drastic changes in business by making them focus narrowly on small changes from the status quo.

C) This approach can lead to ratcheting up performance expectations, but are less likely to ratchet down.

D) Both A and B are concerns.

E) A, B and C are concerns.

B) This approach may blind decision makers to the need for drastic changes in business by making them focus narrowly on small changes from the status quo.

C) This approach can lead to ratcheting up performance expectations, but are less likely to ratchet down.

D) Both A and B are concerns.

E) A, B and C are concerns.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

51

A top-down budget: a. Often generates expectations which are often too hard to achieve.

B) Should never be prepared since it lacks input of plant supervisors.

C) Is a time consuming approach to budgeting.

D) Should always be prepared since ultimately management is held responsible for meeting the goals set in the budget.

B) Should never be prepared since it lacks input of plant supervisors.

C) Is a time consuming approach to budgeting.

D) Should always be prepared since ultimately management is held responsible for meeting the goals set in the budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

52

Which of the following is a factor in determining the quality of the information obtained for budgeting, as well as the way in which budgets are developed and used in organizations? a. Organizational structure.

B) Management style.

C) Competition.

D) Both A and

B) e. A, B and

C)

B) Management style.

C) Competition.

D) Both A and

B) e. A, B and

C)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which of the following is not a characteristic of bottom-up budgeting? a. Encourages organization-wide input into the process.

B) Takes advantage of employees' intimate knowledge of operations when formulating plans.

C) Is not as time consuming as top-down budgeting.

D) Increases employees' commitment to achieving budget goals.

E) All of the above are characteristics of bottom-up budgeting.

B) Takes advantage of employees' intimate knowledge of operations when formulating plans.

C) Is not as time consuming as top-down budgeting.

D) Increases employees' commitment to achieving budget goals.

E) All of the above are characteristics of bottom-up budgeting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

54

The Yow Company makes and sells a single product, the Zingo. Each Zingo requires 1.5 direct labor hours at an average rate of $7.60 per hour. If the budgeted direct labor cost for June is $151,050, the company's budgeted production must be: a. 16,600 units

B) 11,400 units

C) 19,875 units

D) 13,250 units

B) 11,400 units

C) 19,875 units

D) 13,250 units

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck