Deck 2: Corporations: Introduction and Operating Rules

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/94

العب

ملء الشاشة (f)

Deck 2: Corporations: Introduction and Operating Rules

1

Employment taxes apply to all entity forms of operating a business. As a result, employment taxes are a neutral factor in selecting the most tax effective form of operating a business.

False

2

Rajib is the sole shareholder of Robin Corporation, a calendar year S corporation. Robin earned net profit of $350,000 ($520,000 gross income - $170,000 operating expenses) and distributed $80,000 to Rajib. Rajib must report Robin Corporation profit of $350,000 on his Federal income tax return.

True

3

Quail Corporation is a C corporation with net income of $125,000 during the current year. If Quail paid dividends of $25,000 to its shareholders, the corporation must pay tax on $100,000 of net income. Shareholders must report the $25,000 of dividends as income.

False

4

On December 31, 2015, Lavender, Inc., an accrual basis C corporation, accrues a $50,000 bonus to Barry, its vice president and a 40% shareholder. Lavender pays the bonus to Barry, who is a cash basis taxpayer, on March 14, 2016. Lavender can deduct the bonus in 2016, the year in which it is included in Barry's gross income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

5

If a C corporation uses straight-line depreciation on real estate (§ 1250 property), no portion of a gain on the sale of the property will be recaptured as ordinary income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

6

Jake, the sole shareholder of Peach Corporation, a C corporation, has the corporation pay him $100,000. For tax purposes, Jake would prefer to have the payment treated as dividend instead of salary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

7

A personal service corporation must use a calendar year, and is not permitted to use a fiscal year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

8

Thrush Corporation files Form 1120, which reports taxable income of $200,000. The corporation's tax is $56,250.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

9

The passive loss rules apply to closely held C corporations and to personal service corporations but not to S corporations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

10

Albatross, a C corporation, had $140,000 net income from operations and a $25,000 short-term capital loss in the current year. Albatross Corporation's taxable income is $140,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

11

Azure Corporation, a C corporation, had a long-term capital gain of $50,000 in the current year. The maximum amount of tax applicable to the capital gain is $7,500 ($50,000 × 15%).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

12

Tomas owns a sole proprietorship, and Lucy is the sole shareholder of a C corporation. In the current year both businesses make a net profit of $60,000. Neither business distributes any funds to the owners in the year. For the current year, Tomas must report $60,000 of income on his individual tax return, but Lucy is not required to report any income from the corporation on her individual tax return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

13

Carol and Candace are equal partners in Peach Partnership. In the current year, Peach had a net profit of $75,000 ($250,000 gross income - $175,000 operating expenses) and distributed $25,000 to each partner. Peach must pay tax on $75,000 of income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

14

Eagle Company, a partnership, had a short-term capital loss of $10,000 during the year. Aaron, who owns 25% of Eagle, will report $2,500 of Eagle's short-term capital loss on his individual tax return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

15

Donald owns a 45% interest in a partnership that earned $130,000 in the current year. He also owns 45% of the stock in a C corporation that earned $130,000 during the year. Donald received $20,000 in distributions from each of the two entities during the year. With respect to this information, Donald must report $78,500 of income on his individual income tax return for the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

16

Under the "check-the-box" Regulations, a two-owner LLC that fails to elect to be to treated as a corporation will be taxed as a sole proprietorship.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

17

As a general rule, C corporations must use the cash method of accounting. However, under several exceptions to this rule (e.g., average annual gross receipts of $5 million or less for the most recent 3-year period), a C corporation can use the accrual method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

18

Double taxation of corporate income results because dividend distributions are included in a shareholder's gross income but are not deductible by the corporation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

19

The corporate marginal income tax rates range from 15% to 39%, while the individual marginal income tax rates range from 10% to 39.6%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

20

Don, the sole shareholder of Pastel Corporation (a C corporation), has the corporation pay him a salary of $600,000 in the current year. The Tax Court has held that $200,000 represents unreasonable compensation. Don must report a salary of $400,000 and a dividend of $200,000 on his individual tax return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

21

Heron Corporation, a calendar year C corporation, had an excess charitable contribution for 2014 of $5,000. In 2015, Heron made a further charitable contribution of $20,000. Heron's 2015 deduction is limited to $15,000 (10% of taxable income). The 2015 contribution must be applied first against the $15,000 limitation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

22

A corporate net operating loss can be carried back 2 years and forward 20 years to offset taxable income for those years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

23

Hornbill Corporation, a cash basis and calendar year C corporation, was formed and began operations on May 1, 2015. Hornbill incurred the following expenses during its first year of operations (May 1 - December 31, 2015): temporary directors meeting expenses of $10,500, state of incorporation fee of $5,000, stock certificate printing expenses of $1,200, and legal fees for drafting corporate charter and bylaws of $7,500. Hornbill Corporation's current year deduction for organizational expenditures is $5,800.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

24

An expense that is deducted in computing net income per books but not deductible in computing taxable income is a subtraction item on Schedule M-1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

25

On December 31, 2015, Flamingo, Inc., a calendar year, accrual method C corporation, accrues a bonus of $50,000 to its president (a cash basis taxpayer), who owns 75% of the corporation's outstanding stock. The $50,000 bonus is paid to the president on February 2, 2016. For Flamingo's 2015 Form 1120, the $50,000 bonus will be a subtraction item on Schedule M-1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

26

A personal service corporation with taxable income of $100,000 will have a tax liability of $22,250.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

27

Peach Corporation had $210,000 of net active income, $45,000 of portfolio income, and a $230,000 passive loss during the current year. If Peach is a closely held C corporation that is not a PSC, it can deduct $210,000 of the passive loss in the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

28

Schedule M-1 is used to reconcile net income as computed for financial accounting purposes with taxable income reported on the corporation's income tax return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

29

Crow Corporation, a C corporation, donated scientific property (basis of $30,000, fair market value of $50,000) to State University, a qualified charitable organization, to be used in research. Crow had held the property for four months as inventory. Crow Corporation may deduct $50,000 for the charitable contribution (ignoring the taxable income limitation).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

30

Azul Corporation, a calendar year C corporation, received a dividend of $30,000 from Naranja Corporation. Azul owns 25% of the Naranja Corporation stock. Assuming it is not subject to the taxable income limitation, Azul's dividends received deduction is $21,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

31

A calendar year C corporation can receive an automatic 9-month extension to file its corporate return (Form 1120) by timely filing a Form 7004 for the tax year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

32

A corporation must file a Federal income tax return even if it has no taxable income for the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

33

Ed, an individual, incorporates two separate businesses that he owns by establishing two new C corporations. Each corporation generates taxable income of $50,000. As a general rule, each corporation will have a tax liability of $11,125.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

34

No dividends received deduction is allowed unless the corporation has held the stock for more than 90 days.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

35

Lilac Corporation incurred $4,700 of legal and accounting fees associated with its incorporation. The $4,700 is deductible as startup expenditures on Lilac's tax return for the year in which it begins business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

36

On December 16, 2015, the directors of Quail Corporation (an accrual basis, calendar year taxpayer) authorized a cash donation of $5,000 to the American Cancer Society, a qualified charity. The payment, which is made on April 11, 2016, may be claimed as a deduction for tax year 2015.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

37

For a corporation, the domestic production activities deduction is equal to 9% of the lesser of (1) qualified production activities income or (2) taxable income. However, the deduction cannot exceed 50% of the W-2 wages related to qualified production activities income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

38

Because of the taxable income limitation, no dividends received deduction is allowed if a corporation has an NOL for the current taxable year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

39

For purposes of the estimated tax payment rules, a "large corporation" is defined as a corporation that had taxable income of $1 million or more in any of the three preceding years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

40

In the current year, Oriole Corporation donated a painting worth $30,000 to the Texas Art Museum, a qualified public charity. The museum included the painting in its permanent collection. Oriole Corporation purchased the painting 5 years ago for $10,000. Oriole's charitable contribution deduction is $30,000 (ignoring the taxable income limitation).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

41

In 2015, Bluebird Corporation had net income from operations of $100,000. Further, Bluebird recognized a long-term capital gain of $30,000, and a short-term capital loss of $45,000. Which of the following statements is correct?

A) Bluebird Corporation will have taxable income in 2015 of $100,000 and will have a net capital loss of $15,000 that can be carried back 3 years and forward 5 years.

B) Bluebird Corporation may use the capital loss to offset the capital gain and must carry the net capital loss of $15,000 forward five years as a short-term capital loss.

C) Bluebird Corporation may deduct $33,000 of the capital loss in 2015 and may carry forward the remainder of the capital loss indefinitely to offset capital gains.

D) Bluebird Corporation will have taxable income in 2015 of $85,000.

E) None of the above.

A) Bluebird Corporation will have taxable income in 2015 of $100,000 and will have a net capital loss of $15,000 that can be carried back 3 years and forward 5 years.

B) Bluebird Corporation may use the capital loss to offset the capital gain and must carry the net capital loss of $15,000 forward five years as a short-term capital loss.

C) Bluebird Corporation may deduct $33,000 of the capital loss in 2015 and may carry forward the remainder of the capital loss indefinitely to offset capital gains.

D) Bluebird Corporation will have taxable income in 2015 of $85,000.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

42

Schedule M-2 is used to reconcile unappropriated retained earnings at the beginning of the year with unappropriated retained earnings at the end of the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

43

Juanita owns 60% of the stock in a C corporation that had a profit of $200,000 in 2014. Carlos owns a 60% interest in a partnership that had a profit of $200,000 during the year. The corporation distributed $45,000 to Juanita, and the partnership distributed $45,000 to Carlos. Which of the following statements relating to 2014 is incorrect?

A) Juanita must report $120,000 of income from the corporation.

B) The corporation must pay corporate tax on $200,000 of income.

C) Carlos must report $120,000 of income from the partnership.

D) The partnership is not subject to a Federal entity-level income tax.

E) None of the above.

A) Juanita must report $120,000 of income from the corporation.

B) The corporation must pay corporate tax on $200,000 of income.

C) Carlos must report $120,000 of income from the partnership.

D) The partnership is not subject to a Federal entity-level income tax.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

44

Pablo, a sole proprietor, sold stock held as an investment for a $40,000 long-term capital gain. Pablo's marginal tax rate is 33%. Loon Corporation, a C corporation, sold stock held as an investment for a $40,000 long-term capital gain. Loon's marginal tax rate is 35%. What tax rates are applicable to these capital gains?

A) 15% rate applies to Pablo and 35% rate applies to Loon.

B) 15% rate applies to Loon and 33% rate applies to Pablo.

C) 35% rate applies to Loon and 33% rate applies to Pablo.

D) 15% rate applies to both Pablo and Loon.

E) None of the above.

A) 15% rate applies to Pablo and 35% rate applies to Loon.

B) 15% rate applies to Loon and 33% rate applies to Pablo.

C) 35% rate applies to Loon and 33% rate applies to Pablo.

D) 15% rate applies to both Pablo and Loon.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

45

Patrick, an attorney, is the sole shareholder of Gander Corporation, a C corporation. Gander is a personal service corporation with a fiscal year ending November 30 (pursuant to a § 444 election). The corporation paid Patrick a salary of $180,000 during its fiscal year ending November 30, 2015. How much salary must Gander pay Patrick during the period December 1 through December 31, 2015, to permit the corporation to continue to use its fiscal year without negative tax effects?

A) $0

B) $30,000

C) $165,000

D) $180,000

E) None of the above

A) $0

B) $30,000

C) $165,000

D) $180,000

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

46

Lucinda is a 60% shareholder in Rhea Corporation, a calendar year S corporation. During the year, Rhea Corporation had gross income of $550,000 and operating expenses of $380,000. In addition, the corporation sold land that had been held for investment purposes for a short-term capital gain of $30,000. During the year, Rhea Corporation distributed $50,000 to Lucinda. With respect to this information, which of the following statements is correct?

A) Rhea Corporation will pay tax on taxable income of $200,000.

B) Lucinda reports ordinary income of $50,000.

C) Lucinda reports ordinary income of $120,000.

D) Lucinda reports ordinary income of $102,000 and a short-term capital gain of $18,000.

E) None of the above.

A) Rhea Corporation will pay tax on taxable income of $200,000.

B) Lucinda reports ordinary income of $50,000.

C) Lucinda reports ordinary income of $120,000.

D) Lucinda reports ordinary income of $102,000 and a short-term capital gain of $18,000.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

47

Rachel is the sole member of an LLC, and Jordan is the sole shareholder of a C corporation. Both businesses were started in the current year, and each business has a long-term capital gain of $10,000 for the year. Neither business made any distributions during the year. With respect to this information, which of the following statements is correct?

A) The C corporation receives a preferential tax rate on the LTCG of $10,000.

B) The LLC must pay corporate tax on taxable income of $10,000.

C) Jordan must report $10,000 of LTCG on his tax return.

D) Rachel must report $10,000 of LTCG on her tax return.

E) None of the above.

A) The C corporation receives a preferential tax rate on the LTCG of $10,000.

B) The LLC must pay corporate tax on taxable income of $10,000.

C) Jordan must report $10,000 of LTCG on his tax return.

D) Rachel must report $10,000 of LTCG on her tax return.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

48

Elk, a C corporation, has $370,000 operating income and $290,000 operating expenses during the year. In addition, Elk has a $10,000 long-term capital gain and a $17,000 short-term capital loss. Elk's taxable income is:

A) $63,000.

B) $73,000.

C) $80,000.

D) $90,000.

E) None of the above.

A) $63,000.

B) $73,000.

C) $80,000.

D) $90,000.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which of the following statements is incorrect about LLCs and the check-the-box Regulations?

A) If a limited liability company with more than one owner does not make an election, the entity is taxed as a corporation.

B) All 50 states have passed laws that allow LLCs.

C) An entity with more than one owner and formed as a corporation cannot elect to be taxed as a partnership.

D) If a limited liability company with one owner does not make an election, the entity is taxed as a sole proprietorship.

E) A limited liability company with one owner can elect to be taxed as a corporation.

A) If a limited liability company with more than one owner does not make an election, the entity is taxed as a corporation.

B) All 50 states have passed laws that allow LLCs.

C) An entity with more than one owner and formed as a corporation cannot elect to be taxed as a partnership.

D) If a limited liability company with one owner does not make an election, the entity is taxed as a sole proprietorship.

E) A limited liability company with one owner can elect to be taxed as a corporation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

50

Income that is included in net income per books but not included in taxable income is a subtraction item on Schedule M-1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

51

A corporation with $5 million or more in assets must file Schedule M-3 (instead of Schedule M-1).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

52

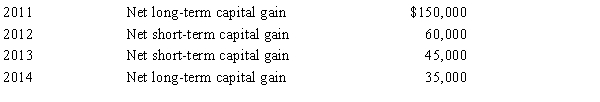

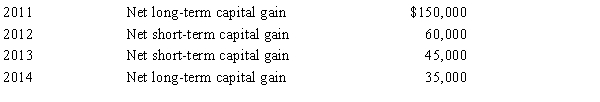

Carrot Corporation, a C corporation, has a net short-term capital gain of $65,000 and a net long-term capital loss of $250,000 during 2015. Carrot Corporation had taxable income from other sources of $720,000. Prior years' transactions included the following:  Compute the amount of Carrot's capital loss carryover to 2016.

Compute the amount of Carrot's capital loss carryover to 2016.

A) $0

B) $32,000

C) $45,000

D) $185,000

E) None of the above

Compute the amount of Carrot's capital loss carryover to 2016.

Compute the amount of Carrot's capital loss carryover to 2016.A) $0

B) $32,000

C) $45,000

D) $185,000

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

53

Copper Corporation, a C corporation, had gross receipts of $5 million in 2012, $6 million in 2013, and $3 million in 2014. Gold Corporation, a personal service corporation (PSC), had gross receipts of $4 million in 2012, $7 million in 2013, and $5 million in 2014. Which of the corporations will be allowed to use the cash method of accounting in 2015?

A) Copper Corporation only.

B) Gold Corporation only.

C) Both Copper Corporation and Gold Corporation.

D) Neither Copper Corporation nor Gold Corporation.

E) None of the above.

A) Copper Corporation only.

B) Gold Corporation only.

C) Both Copper Corporation and Gold Corporation.

D) Neither Copper Corporation nor Gold Corporation.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

54

Flycatcher Corporation, a C corporation, has two equal individual shareholders, Nancy and Pasqual. In the current year, Flycatcher earned $100,000 net profit and paid a dividend of $10,000 to each shareholder. Regardless of any tax consequences resulting from their interests in Flycatcher, Nancy is in the 33% marginal tax bracket and Pasqual is in the 15% marginal tax bracket. With respect to the current year, which of the following statements is incorrect?

A) Flycatcher cannot avoid the corporate tax altogether by distributing all $100,000 of net profit as dividends to the shareholders.

B) Nancy incurs income tax of $1,500 on her dividend income.

C) Pasqual incurs income tax of $1,500 on his dividend income.

D) Flycatcher pays corporate tax of $22,250.

E) None of the above.

A) Flycatcher cannot avoid the corporate tax altogether by distributing all $100,000 of net profit as dividends to the shareholders.

B) Nancy incurs income tax of $1,500 on her dividend income.

C) Pasqual incurs income tax of $1,500 on his dividend income.

D) Flycatcher pays corporate tax of $22,250.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

55

On December 31, 2015, Peregrine Corporation, an accrual method, calendar year taxpayer, accrued a performance bonus of $100,000 to Charles, a cash basis, calendar year taxpayer. Charles is president and sole shareholder of the corporation. When can Peregrine deduct the bonus?

A) In 2015, if the bonus was authorized by the Board of Directors and payment was made on or before March 15, 2016.

B) In 2016, if payment was made at any time during that year.

C) In 2015, if payment was made on or before March 15, 2016.

D) In 2016, but only if payment was made on or before March 15, 2016.

E) None of the above.

A) In 2015, if the bonus was authorized by the Board of Directors and payment was made on or before March 15, 2016.

B) In 2016, if payment was made at any time during that year.

C) In 2015, if payment was made on or before March 15, 2016.

D) In 2016, but only if payment was made on or before March 15, 2016.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

56

Saleh, an accountant, is the sole shareholder of Turquoise Corporation, a C corporation. Turquoise is a personal service corporation with a fiscal year ending September 30 (pursuant to a § 444 election). The corporation paid Saleh a salary of $330,000 during its fiscal year ending September 30, 2015. How much salary must Turquoise pay Saleh during the period October 1 through December 31, 2015, if the corporation is to continue to use its fiscal year without negative tax effects?

A) $0

B) $27,500

C) $82,500

D) $247,500

E) None of the above

A) $0

B) $27,500

C) $82,500

D) $247,500

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

57

Schedule M-3 is similar to Schedule M-1 in that the form is designed to reconcile net income per books with taxable income. However, an objective of Schedule M-3 is more transparency between financial statements and tax returns than that provided by Schedule M-1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

58

Ivory Corporation, a calendar year, accrual method C corporation, has two cash method, calendar year shareholders who are unrelated to each other. Craig owns 35% of the stock, and Oscar owns the remaining 65%. During 2015, Ivory paid a salary of $100,000 to each shareholder. On December 31, 2015, Ivory accrued a bonus of $25,000 to each shareholder. Assuming that the bonuses are paid to the shareholders on February 3, 2016, compute Ivory Corporation's 2015 deduction for the above amounts.

A) $250,000

B) $225,000

C) $200,000

D) $125,000

E) None of above

A) $250,000

B) $225,000

C) $200,000

D) $125,000

E) None of above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

59

Norma formed Hyacinth Enterprises, a proprietorship, in 2015. In its first year, Hyacinth had operating income of $400,000 and operating expenses of $240,000. In addition, Hyacinth had a long-term capital loss of $10,000. Norma, the proprietor of Hyacinth Enterprises, withdrew $75,000 from Hyacinth during the year. Assuming Norma has no other capital gains or losses, how does this information affect her adjusted gross income for 2015?

A) Increases Norma's adjusted gross income by $157,000 ($160,000 ordinary business income - $3,000 long-term capital loss).

B) Increases Norma's adjusted gross income by $150,000 ($160,000 ordinary business income - $10,000 long-term capital loss).

C) Increases Norma's adjusted gross income by $75,000.

D) Increases Norma's adjusted gross income by $160,000.

E) None of the above.

A) Increases Norma's adjusted gross income by $157,000 ($160,000 ordinary business income - $3,000 long-term capital loss).

B) Increases Norma's adjusted gross income by $150,000 ($160,000 ordinary business income - $10,000 long-term capital loss).

C) Increases Norma's adjusted gross income by $75,000.

D) Increases Norma's adjusted gross income by $160,000.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

60

Bjorn owns a 60% interest in an S corporation that earned $150,000 in 2014. He also owns 60% of the stock in a C corporation that earned $150,000 during the year. The S corporation distributed $30,000 to Bjorn and the C corporation paid dividends of $30,000 to Bjorn. How much income must Bjorn report from these businesses?

A) $0 income from the S corporation and $30,000 income from the C corporation.

B) $30,000 income from the S corporation and $30,000 of dividend income from the C corporation.

C) $90,000 income from the S corporation and $0 income from the C corporation.

D) $90,000 income from the S corporation and $30,000 income from the C corporation.

E) None of the above.

A) $0 income from the S corporation and $30,000 income from the C corporation.

B) $30,000 income from the S corporation and $30,000 of dividend income from the C corporation.

C) $90,000 income from the S corporation and $0 income from the C corporation.

D) $90,000 income from the S corporation and $30,000 income from the C corporation.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

61

In the current year, Plum Corporation, a computer manufacturer, donated 100 laptop computers to a local university (a qualified educational organization). The computers were constructed by Plum earlier this year, and the university will use the computers for research and research training. Plum's basis in the computers is $35,000, and their fair market value is $120,000. What is Plum's deduction for the contribution of the computers (ignoring the taxable income limitation)?

A) $35,000

B) $70,000

C) $77,500

D) $85,000

E) $120,000

A) $35,000

B) $70,000

C) $77,500

D) $85,000

E) $120,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

62

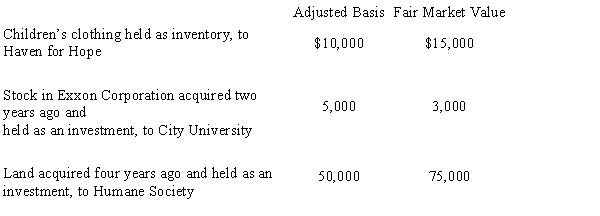

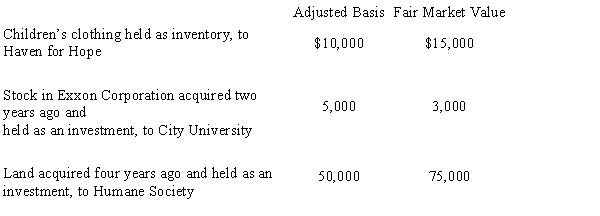

During the current year, Owl Corporation (a C corporation), a retailer of children's apparel, made the following donations to qualified charitable organizations.  How much qualifies for the charitable contribution deduction (ignoring the taxable income limitation)?

How much qualifies for the charitable contribution deduction (ignoring the taxable income limitation)?

A) $63,000

B) $65,000

C) $90,500

D) $92,500

E) None of the above

How much qualifies for the charitable contribution deduction (ignoring the taxable income limitation)?

How much qualifies for the charitable contribution deduction (ignoring the taxable income limitation)?A) $63,000

B) $65,000

C) $90,500

D) $92,500

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

63

In the current year, Sunset Corporation (a C corporation) had operating income of $200,000 and operating expenses of $175,000. In addition, Sunset had a $30,000 long-term capital gain, a $52,000 short-term capital loss, and $5,000 tax-exempt interest income. What is Sunset Corporation's taxable income for the year?

A) $0

B) $3,000

C) $22,000

D) $30,000

E) None of the above

A) $0

B) $3,000

C) $22,000

D) $30,000

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

64

Grebe Corporation, a closely held corporation that is not a PSC, had $75,000 of net active income, $60,000 of portfolio income, and a $105,000 passive activity loss during the year. How much of the passive activity loss can Grebe deduct in the current year?

A) $0

B) $60,000

C) $105,000

D) $135,000

E) None of the above

A) $0

B) $60,000

C) $105,000

D) $135,000

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

65

During the current year, Woodchuck, Inc., a closely held personal service corporation, has $115,000 of net active income, $40,000 of portfolio income, and $135,000 of passive activity loss. What is Woodchuck's taxable income for the current year?

A) $0

B) $20,000

C) $40,000

D) $155,000

E) None of the above

A) $0

B) $20,000

C) $40,000

D) $155,000

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

66

Nancy Smith is the sole shareholder and employee of White Corporation, a C corporation that is engaged exclusively in accounting services. During the current year, White has operating income of $320,000 and operating expenses (excluding salary) of $150,000. Further, White Corporation pays Nancy a salary of $100,000. The salary is reasonable in amount and Nancy is in the 33% marginal tax bracket irrespective of any income from White. Assuming that White Corporation distributes all after-tax income as dividends, how much total combined income tax do White and Nancy pay in the current year? (Ignore any employment tax considerations.)

A) $56,125

B) $64,325

C) $67,625

D) $84,000

E) None of the above

A) $56,125

B) $64,325

C) $67,625

D) $84,000

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

67

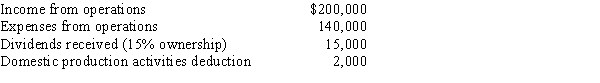

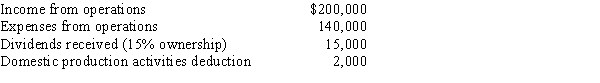

During the current year, Kingbird Corporation (a calendar year C corporation) had the following income and expenses:  On October 1, Kingbird Corporation made a contribution to a qualified charitable organization of $9,000 in cash (not included in any of the above items). Determine Kingbird's charitable contribution deduction for the current year.

On October 1, Kingbird Corporation made a contribution to a qualified charitable organization of $9,000 in cash (not included in any of the above items). Determine Kingbird's charitable contribution deduction for the current year.

A) $9,000

B) $7,500

C) $6,650

D) $6,450

E) None of the above

On October 1, Kingbird Corporation made a contribution to a qualified charitable organization of $9,000 in cash (not included in any of the above items). Determine Kingbird's charitable contribution deduction for the current year.

On October 1, Kingbird Corporation made a contribution to a qualified charitable organization of $9,000 in cash (not included in any of the above items). Determine Kingbird's charitable contribution deduction for the current year.A) $9,000

B) $7,500

C) $6,650

D) $6,450

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

68

Beige Corporation, a C corporation, purchases a warehouse on August 1, 1999, for $1 million. Straight-line depreciation is taken in the amount of $411,750 before the property is sold on June 11, 2015, for $1.2 million. What is the amount and character of the gain recognized by Beige on the sale of the realty?

A) Ordinary income of $0 and § 1231 gain of $611,750.

B) Ordinary income of $411,750 and § 1231 gain of $200,000.

C) Ordinary income of $82,350 and § 1231 gain of $529,400.

D) Ordinary income of $117,650 and § 1231 gain of $494,100.

E) None of the above.

A) Ordinary income of $0 and § 1231 gain of $611,750.

B) Ordinary income of $411,750 and § 1231 gain of $200,000.

C) Ordinary income of $82,350 and § 1231 gain of $529,400.

D) Ordinary income of $117,650 and § 1231 gain of $494,100.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

69

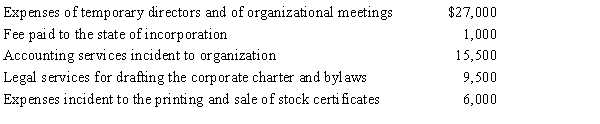

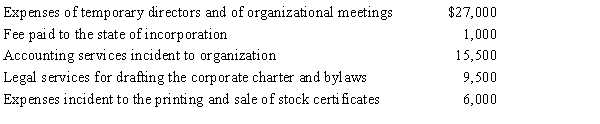

Emerald Corporation, a calendar year C corporation, was formed and began operations on April 1, 2015. The following expenses were incurred during the first tax year (April 1 through December 31, 2015) of operations.  Assuming a § 248 election, what is the Emerald's deduction for organizational expenditures for 2015?

Assuming a § 248 election, what is the Emerald's deduction for organizational expenditures for 2015?

A) $0

B) $4,550

C) $5,000

D) $7,400

E) None of the above

Assuming a § 248 election, what is the Emerald's deduction for organizational expenditures for 2015?

Assuming a § 248 election, what is the Emerald's deduction for organizational expenditures for 2015?A) $0

B) $4,550

C) $5,000

D) $7,400

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

70

Which of the following statements is incorrect regarding the dividends received deduction?

A) A corporation must hold stock for more than 90 days in order to qualify for a deduction with respect to dividends on such stock.

B) The taxable income limitation does not apply with respect to the 100% deduction available to members of an affiliated group.

C) If a stock purchase is financed 75% by debt, the deduction for dividends on such stock is reduced by 75%.

D) The taxable income limitation does not apply if the normal deduction (i.e., 70% or 80% of dividends) results in a net operating loss for the corporation.

E) None of the above.

A) A corporation must hold stock for more than 90 days in order to qualify for a deduction with respect to dividends on such stock.

B) The taxable income limitation does not apply with respect to the 100% deduction available to members of an affiliated group.

C) If a stock purchase is financed 75% by debt, the deduction for dividends on such stock is reduced by 75%.

D) The taxable income limitation does not apply if the normal deduction (i.e., 70% or 80% of dividends) results in a net operating loss for the corporation.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

71

Orange Corporation owns stock in White Corporation and has net operating income of $400,000 for the year. White Corporation pays Orange a dividend of $60,000. What amount of dividends received deduction may Orange claim if it owns 45% of White stock (assuming Orange's dividends received deduction is not limited by its taxable income)?

A) $27,000

B) $42,000

C) $48,000

D) $60,000

E) None of the above

A) $27,000

B) $42,000

C) $48,000

D) $60,000

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

72

Which of the following statements is incorrect regarding the taxation of C corporations?

A) Similar to those applicable to individuals, the marginal tax rate brackets for corporations are adjusted for inflation.

B) Taxable income of a personal service corporation is taxed at a flat rate of 35%.

C) A tax return must be filed whether or not the corporation has taxable income.

D) The highest corporate marginal tax rate is 39%.

E) None of the above.

A) Similar to those applicable to individuals, the marginal tax rate brackets for corporations are adjusted for inflation.

B) Taxable income of a personal service corporation is taxed at a flat rate of 35%.

C) A tax return must be filed whether or not the corporation has taxable income.

D) The highest corporate marginal tax rate is 39%.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

73

Copper Corporation owns stock in Bronze Corporation and has net operating income of $900,000 for the year. Bronze Corporation pays Copper a dividend of $150,000. What amount of dividends received deduction may Copper claim if it owns 85% of Bronze stock (assuming Copper's dividends received deduction is not limited by its taxable income)?

A) $97,500

B) $105,000

C) $120,000

D) $150,000

E) None of the above

A) $97,500

B) $105,000

C) $120,000

D) $150,000

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

74

During the current year, Sparrow Corporation, a calendar year C corporation, had operating income of $425,000, operating expenses of $280,000, a short-term capital loss of $10,000, and a long-term capital gain of $25,000. How much is Sparrow's tax liability for the year?

A) $42,650

B) $42,800

C) $45,650

D) $62,400

E) None of the above

A) $42,650

B) $42,800

C) $45,650

D) $62,400

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

75

Grackle Corporation, a personal service corporation, had $230,000 of net active income, $40,000 of portfolio income, and a $250,000 passive activity loss during the year. How much is Grackle's taxable income?

A) $20,000

B) $40,000

C) $270,000

D) $520,000

E) None of the above

A) $20,000

B) $40,000

C) $270,000

D) $520,000

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

76

During the current year, Violet, Inc., a closely held corporation (not a PSC), has $55,000 of passive activity loss, $80,000 of net active income, and $20,000 of portfolio income. How much is Violet's taxable income for the current year?

A) $20,000

B) $45,000

C) $80,000

D) $100,000

E) None of the above

A) $20,000

B) $45,000

C) $80,000

D) $100,000

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

77

In the current year, Crimson, Inc., a calendar C corporation, has income from operations of $180,000 and operating deductions of $225,000. Crimson also had $30,000 of dividends from a 15% stock ownership in a domestic corporation. Which of the following statements is correct with respect to Crimson for the current year?

A) Crimson's NOL is $15,000.

B) A dividends received deduction is not allowed in computing Crimson's NOL.

C) The NOL is carried back 3 years and forward 10 years by Crimson.

D) Crimson's dividends received deduction is $21,000.

E) None of the above.

A) Crimson's NOL is $15,000.

B) A dividends received deduction is not allowed in computing Crimson's NOL.

C) The NOL is carried back 3 years and forward 10 years by Crimson.

D) Crimson's dividends received deduction is $21,000.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

78

Red Corporation, which owns stock in Blue Corporation, had net operating income of $200,000 for the year. Blue pays Red a dividend of $40,000. Red takes a dividends received deduction of $28,000. Which of the following statements is correct?

A) Red owns 80% of Blue Corporation.

B) Red owns 20% or more, but less than 80% of Blue Corporation.

C) Red owns 80% or more of Blue Corporation.

D) Red owns less than 20% of Blue Corporation.

E) None of the above.

A) Red owns 80% of Blue Corporation.

B) Red owns 20% or more, but less than 80% of Blue Corporation.

C) Red owns 80% or more of Blue Corporation.

D) Red owns less than 20% of Blue Corporation.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

79

Pink, Inc., a calendar year C corporation, manufactures golf gloves. For the current year, Pink had taxable income (before DPAD) of $900,000, qualified domestic production activities income of $750,000, and W-2 wages related to qualified production activities income of $140,000. Pink's domestic production activities deduction for the current year is:

A) $0.

B) $12,600.

C) $67,500.

D) $70,000.

E) None of the above.

A) $0.

B) $12,600.

C) $67,500.

D) $70,000.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

80

Which of the following statements is incorrect with respect to the treatment of net operating losses by corporations?

A) A corporation may elect to forgo the carryback period and just carryforward an NOL.

B) A corporation may claim a dividends received deduction in computing an NOL.

C) An NOL is generally carried back 2 years and forward 20 years.

D) Unlike individuals, corporations do not adjust their NOLs for net capital losses or nonbusiness deductions.

E) None of the above.

A) A corporation may elect to forgo the carryback period and just carryforward an NOL.

B) A corporation may claim a dividends received deduction in computing an NOL.

C) An NOL is generally carried back 2 years and forward 20 years.

D) Unlike individuals, corporations do not adjust their NOLs for net capital losses or nonbusiness deductions.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck