Deck 13: Mechanisms of International Adjustment

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/116

العب

ملء الشاشة (f)

Deck 13: Mechanisms of International Adjustment

1

An appreciation of the U.S.dollar tends to

A) discourage foreigners from making investments in the United States.

B) discourage Americans from purchasing foreign goods and services.

C) increase the number of dollars that could be bought with foreign currencies.

D) discourage Americans from traveling overseas.

A) discourage foreigners from making investments in the United States.

B) discourage Americans from purchasing foreign goods and services.

C) increase the number of dollars that could be bought with foreign currencies.

D) discourage Americans from traveling overseas.

discourage foreigners from making investments in the United States.

2

Assume the Canadian demand elasticity for imports equals 0.2, while the foreign demand elasticity for Canadian exports equals 0.3.Responding to a trade deficit, suppose the Canadian dollar depreciates by 20 percent.Other things equal, for Canada, the depreciation would lead to

A) a worsening trade balance-a larger deficit.

B) an improving trade balance-a smaller deficit.

C) an unchanged trade balance.

D) None of these are correct.

A) a worsening trade balance-a larger deficit.

B) an improving trade balance-a smaller deficit.

C) an unchanged trade balance.

D) None of these are correct.

a worsening trade balance-a larger deficit.

3

Which approach predicts that if an economy operates at full employment and faces a trade deficit, currency devaluation (depreciation) will improve the trade balance only if domestic spending is cut, thus freeing resources to produce exports?

A) the absorption approach

B) the Marshall-Lerner condition

C) the monetary approach

D) the elasticity approach

A) the absorption approach

B) the Marshall-Lerner condition

C) the monetary approach

D) the elasticity approach

the absorption approach

4

Assume that Brazil has a constant money supply and that it devalues its currency.The monetary approach to devaluation reasons that one of the following tends to occur for Brazil.

A) Domestic prices rise, the purchasing power of money falls, and consumption falls.

B) Domestic prices rise, the purchasing power of money rises, and consumption rises.

C) Domestic prices fall, the purchasing power of money rises, and consumption falls.

D) Domestic prices fall, the purchasing power of money rises, and consumption rises.

A) Domestic prices rise, the purchasing power of money falls, and consumption falls.

B) Domestic prices rise, the purchasing power of money rises, and consumption rises.

C) Domestic prices fall, the purchasing power of money rises, and consumption falls.

D) Domestic prices fall, the purchasing power of money rises, and consumption rises.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

5

Assume the Canadian demand elasticity for imports equals 1.2, while the foreign demand elasticity for Canadian exports equals 1.8.Responding to a trade deficit, suppose the Canadian dollar depreciates by 10 percent.Other things equal, for Canada, the depreciation would lead to

A) a worsening trade balance-a larger deficit.

B) an improving trade balance-a smaller deficit.

C) an unchanged trade balance.

D) None of these are correct.

A) a worsening trade balance-a larger deficit.

B) an improving trade balance-a smaller deficit.

C) an unchanged trade balance.

D) None of these are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

6

Complete currency pass-through arises when a 10 percent depreciation in the value of the dollar causes U.S.________prices to __________.

A) import, fall by 10 percent

B) import, rise by 10 percent

C) export, rise by 10 percent

D) export, rise by 20 percent

A) import, fall by 10 percent

B) import, rise by 10 percent

C) export, rise by 10 percent

D) export, rise by 20 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

7

From 1985 to 1988 the U.S.dollar depreciated over 50 percent against the yen, yet Japanese export prices to Americans did not come down the full extent of the dollar depreciation.This is best explained by

A) partial currency pass-through.

B) complete currency pass-through.

C) a partial J-curve effect.

D) a complete J-curve effect.

A) partial currency pass-through.

B) complete currency pass-through.

C) a partial J-curve effect.

D) a complete J-curve effect.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

8

Assume an economy operates at full employment and faces a trade deficit.According to the absorption approach, currency devaluation will improve the trade balance if domestic

A) interest rates rise, thus encouraging investment spending.

B) income rises, thus stimulating consumption.

C) output falls to a lower level.

D) spending is cut, thus freeing resources to produce exports.

A) interest rates rise, thus encouraging investment spending.

B) income rises, thus stimulating consumption.

C) output falls to a lower level.

D) spending is cut, thus freeing resources to produce exports.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

9

The extent to which a change in the exchange rate leads to changes in import and export prices is known as

A) the J-curve effect.

B) the Marshall-Lerner condition.

C) the absorption approach.

D) the pass-through effect.

A) the J-curve effect.

B) the Marshall-Lerner condition.

C) the absorption approach.

D) the pass-through effect.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

10

The shift in focus toward imperfectly competitive markets in domestic and international trade questions the concept of

A) official exchange rates.

B) complete currency pass-through.

C) exchange arbitrage.

D) trade-adjustment assistance.

A) official exchange rates.

B) complete currency pass-through.

C) exchange arbitrage.

D) trade-adjustment assistance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which of the following is true for the J-curve effect?

A) It applies to the interest rate effects of currency depreciation.

B) It applies to the income effects of currency depreciation.

C) It suggests that demand tends to be most elastic over the long run.

D) It suggests that demand tends to be least elastic over the long run.

A) It applies to the interest rate effects of currency depreciation.

B) It applies to the income effects of currency depreciation.

C) It suggests that demand tends to be most elastic over the long run.

D) It suggests that demand tends to be least elastic over the long run.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

12

Because of the J-curve effect and partial currency pass-through, a depreciation of the domestic currency tends to increase the size of a

A) trade surplus in the short run.

B) trade surplus in the long run.

C) trade deficit in the short run.

D) trade deficit in the long run.

A) trade surplus in the short run.

B) trade surplus in the long run.

C) trade deficit in the short run.

D) trade deficit in the long run.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

13

According to the Marshall-Lerner condition, a currency depreciation is least likely to lead to an improvement in the home country's trade balance when

A) home demand for imports is inelastic and foreign export demand is inelastic.

B) home demand for imports is elastic and foreign export demand is inelastic.

C) home demand for imports is inelastic and foreign export demand is elastic.

D) home demand for imports is elastic and foreign export demand is elastic.

A) home demand for imports is inelastic and foreign export demand is inelastic.

B) home demand for imports is elastic and foreign export demand is inelastic.

C) home demand for imports is inelastic and foreign export demand is elastic.

D) home demand for imports is elastic and foreign export demand is elastic.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

14

The Marshall-Lerner condition deals with the impact of currency depreciation on

A) domestic income.

B) domestic absorption.

C) purchasing power of money balances.

D) relative prices.

A) domestic income.

B) domestic absorption.

C) purchasing power of money balances.

D) relative prices.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

15

If foreign manufacturers cut manufacturing costs and profit margins in response to a depreciation in the U.S.dollar, the effect of these actions is to

A) shorten the amount of time in which the depreciation leads to a smaller trade deficit.

B) shorten the amount of time in which the depreciation leads to a smaller trade surplus.

C) lengthen the amount of time in which the depreciation leads to a smaller trade deficit.

D) lengthen the amount of time in which the depreciation leads to a smaller trade surplus.

A) shorten the amount of time in which the depreciation leads to a smaller trade deficit.

B) shorten the amount of time in which the depreciation leads to a smaller trade surplus.

C) lengthen the amount of time in which the depreciation leads to a smaller trade deficit.

D) lengthen the amount of time in which the depreciation leads to a smaller trade surplus.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

16

American citizens planning a vacation abroad would welcome

A) an appreciation of the dollar.

B) a depreciation of the dollar.

C) higher wages extended to foreign workers.

D) lower wages extended to foreign workers.

A) an appreciation of the dollar.

B) a depreciation of the dollar.

C) higher wages extended to foreign workers.

D) lower wages extended to foreign workers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

17

According to the J-curve concept, there are multiple potential outcomes on the balance of payments from a currency depreciation.Which of the following is NOT one of those outcomes?

A) The effects of a currency depreciation are transmitted primarily via the income adjusted mechanism.

B) The effects of a currency depreciation are likely to be adverse or negative in the short run.

C) In the long run, the effects of a currency depreciation are likely to be positive given favorable elasticity conditions.

D) The effects of a currency depreciation may be influenced by offsetting devaluations made by other countries.

A) The effects of a currency depreciation are transmitted primarily via the income adjusted mechanism.

B) The effects of a currency depreciation are likely to be adverse or negative in the short run.

C) In the long run, the effects of a currency depreciation are likely to be positive given favorable elasticity conditions.

D) The effects of a currency depreciation may be influenced by offsetting devaluations made by other countries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

18

According to the J-curve effect, when the exchange value of a country's currency appreciates, the country's trade balance

A) first moves toward deficit, then later toward surplus.

B) first moves toward surplus, then later toward deficit.

C) moves into deficit and stays there.

D) moves into surplus and stays there.

A) first moves toward deficit, then later toward surplus.

B) first moves toward surplus, then later toward deficit.

C) moves into deficit and stays there.

D) moves into surplus and stays there.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

19

According to the Marshall-Lerner condition, a currency depreciation will best lead to an improvement on the home country's trade balance when the

A) home demand for imports is inelastic and foreign export demand is inelastic.

B) home demand for imports is inelastic and foreign export demand is elastic.

C) home demand for imports is elastic and foreign export demand is inelastic.

D) home demand for imports is elastic and foreign export demand is elastic.

A) home demand for imports is inelastic and foreign export demand is inelastic.

B) home demand for imports is inelastic and foreign export demand is elastic.

C) home demand for imports is elastic and foreign export demand is inelastic.

D) home demand for imports is elastic and foreign export demand is elastic.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

20

According to the absorption approach, the economic circumstances that best warrant a currency devaluation is where the domestic economy faces

A) unemployment coupled with a trade deficit.

B) unemployment coupled with a trade surplus.

C) full employment coupled with a trade deficit.

D) full employment coupled with a trade surplus.

A) unemployment coupled with a trade deficit.

B) unemployment coupled with a trade surplus.

C) full employment coupled with a trade deficit.

D) full employment coupled with a trade surplus.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

21

According to the Marshall-Lerner condition, a currency devaluation will be successful in improving a country's trade balance if the

A) sum of the elasticities of supply is more than 1.

B) sum of the elasticities of supply is less than 1.

C) sum of the elasticities of demand is more than 1.

D) sum of the elasticities of demand is less than 1.

A) sum of the elasticities of supply is more than 1.

B) sum of the elasticities of supply is less than 1.

C) sum of the elasticities of demand is more than 1.

D) sum of the elasticities of demand is less than 1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

22

The ______ is a theory of exchange rate adjustment and the balance of payments that considers how domestic spending on domestic goods and the trade balance changes relative to domestic output.

A) monetary approach

B) elasticity approach

C) portfolio approach

D) absorption approach

A) monetary approach

B) elasticity approach

C) portfolio approach

D) absorption approach

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which approach analyzes a nation's balance of payments in terms of money demand and money supply?

A) the expenditure approach

B) the absorption approach

C) the elasticity approach

D) the monetary approach

A) the expenditure approach

B) the absorption approach

C) the elasticity approach

D) the monetary approach

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

24

The J-curve effect implies that following a currency appreciation, a country's trade balance

A) worsens before it improves.

B) continually worsens.

C) improves before it worsens.

D) continually improves.

A) worsens before it improves.

B) continually worsens.

C) improves before it worsens.

D) continually improves.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

25

Empirical evidence regarding the effects of currency devaluation on the balance of trade indicates that

A) complete exchange-rate pass-through generally occurs.

B) partial exchange-rate pass-through generally occurs.

C) currency devaluations always improve the trade balance in the short run.

D) currency devaluations always worsen the trade balance in the long run.

A) complete exchange-rate pass-through generally occurs.

B) partial exchange-rate pass-through generally occurs.

C) currency devaluations always improve the trade balance in the short run.

D) currency devaluations always worsen the trade balance in the long run.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

26

Concerning a currency depreciation, the elasticity approach and the absorption approach are theories that deal with the impact of the depreciation on

A) exports and imports of goods and services.

B) the domestic supply and demand of money.

C) capital inflows and capital outflows.

D) rates of inflation and rates of deflation.

A) exports and imports of goods and services.

B) the domestic supply and demand of money.

C) capital inflows and capital outflows.

D) rates of inflation and rates of deflation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which approach considers the extent by which foreign and domestic prices adjust to a change in the exchange rate in the short run?

A) the monetary approach

B) the absorption approach

C) the expenditure approach

D) the pass-through approach

A) the monetary approach

B) the absorption approach

C) the expenditure approach

D) the pass-through approach

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

28

The longer the currency pass-through period, the _______ required for currency depreciation to have the intended effect on the trade balance.

A) shorter the time period

B) longer the time period

C) larger the spending cut

D) smaller the spending cut

A) shorter the time period

B) longer the time period

C) larger the spending cut

D) smaller the spending cut

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

29

The ______ refers to the extent to which changing currency values result in changes in import and export prices.

A) time path of devaluation

B) Marshall-Lerner condition

C) J-curve effect

D) pass-through effect

A) time path of devaluation

B) Marshall-Lerner condition

C) J-curve effect

D) pass-through effect

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

30

Suppose a country devalues its currency.If the country's demand for imports is ______, the price increase resulting from the devaluation results in a relatively small decrease in the volume of imports, causing total import expenditures to increase.

A) perfectly elastic

B) relatively elastic

C) unit elastic

D) relatively inelastic

A) perfectly elastic

B) relatively elastic

C) unit elastic

D) relatively inelastic

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

31

Assume that Ford Motor Company obtains all of its inputs in the United States and all of its costs are denominated in dollars.An appreciation of the dollar's exchange value

A) enhances its international competitiveness.

B) worsens its international competitiveness.

C) does not affect its international competitiveness.

D) None of these are correct.

A) enhances its international competitiveness.

B) worsens its international competitiveness.

C) does not affect its international competitiveness.

D) None of these are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

32

Assume that a country operates at less than full employment and has excess productive capacity.According to the absorption approach, a currency depreciation tends to

A) expand domestic output and improve the balance of trade.

B) expand domestic output and worsen the balance of trade.

C) contract domestic output and improve the balance of trade.

D) contract domestic output and worsen the balance of trade.

A) expand domestic output and improve the balance of trade.

B) expand domestic output and worsen the balance of trade.

C) contract domestic output and improve the balance of trade.

D) contract domestic output and worsen the balance of trade.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

33

The shorter the currency pass-through period, the _______ required for currency depreciation to have the intended effect on the trade balance.

A) shorter the time period

B) longer the time period

C) larger the spending cut

D) smaller the spending cut

A) shorter the time period

B) longer the time period

C) larger the spending cut

D) smaller the spending cut

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

34

According to the Absorption approach, a currency depreciation leads to an improvement in the balance of trade when a country

A) operates at full employment with no excess production capacity.

B) operates at unemployment with excess production capacity.

C) realizes high rates of inflation.

D) realizes high rates of deflation.

A) operates at full employment with no excess production capacity.

B) operates at unemployment with excess production capacity.

C) realizes high rates of inflation.

D) realizes high rates of deflation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

35

Assume that Ford Motor Company obtains all of its inputs in the United States and all of its costs are denominated in dollars.A depreciation of the dollar's exchange value

A) enhances its international competitiveness.

B) worsens its international competitiveness.

C) does not affect its international competitiveness.

D) None of these are correct.

A) enhances its international competitiveness.

B) worsens its international competitiveness.

C) does not affect its international competitiveness.

D) None of these are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

36

Assume that Ford Motor Company obtains some of its inputs in Mexico (foreign sourcing).As the peso becomes a larger portion of Ford's total costs, a dollar depreciation leads to a/an ________ in the peso cost of a Ford vehicle and a /an __________ in the dollar cost of a Ford compared to the cost changes that occur when all input costs are dollar denominated.

A) decrease, increase

B) increase, decrease

C) decrease, decrease

D) increase, increase

A) decrease, increase

B) increase, decrease

C) decrease, decrease

D) increase, increase

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

37

According to the ______, following a currency devaluation, the balance of trade worsens for a while before improving.

A) A-curve effect

B) J-curve effect

C) L-curve effect

D) T-curve effect

A) A-curve effect

B) J-curve effect

C) L-curve effect

D) T-curve effect

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

38

Assume that a country is operating at full employment.According to the absorption approach, the only way that currency depreciation can improve the balance of trade is for the country to implement

A) expansionary fiscal policy to increase domestic spending.

B) expansionary monetary policy to increase domestic spending.

C) contractionary fiscal policy or monetary policy to cut domestic spending.

D) import tariffs and quotas that increase spending on domestically produced goods.

A) expansionary fiscal policy to increase domestic spending.

B) expansionary monetary policy to increase domestic spending.

C) contractionary fiscal policy or monetary policy to cut domestic spending.

D) import tariffs and quotas that increase spending on domestically produced goods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

39

Assume that Ford Motor Company obtains some of its inputs in Mexico (foreign sourcing).As the peso becomes a larger portion of Ford's total costs, a dollar appreciation leads to a _______ in the peso cost of a Ford vehicle and a _______ in the dollar cost of a Ford compared to the cost changes that occur when all input costs are dollar denominated.

A) smaller increase, larger decrease

B) smaller increase, smaller decrease

C) larger increase, smaller decrease

D) larger increase, larger decrease

A) smaller increase, larger decrease

B) smaller increase, smaller decrease

C) larger increase, smaller decrease

D) larger increase, larger decrease

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

40

The ____ effect suggests that following a currency depreciation, a country's trade balance worsens for a period before it improves.

A) Marshall-Lerner

B) J-curve

C) absorption

D) pass-through

A) Marshall-Lerner

B) J-curve

C) absorption

D) pass-through

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

41

According to the Marshall-Lerner condition, currency depreciation would have a positive effect on a country's trade balance if the elasticity of demand for its exports plus the elasticity of demand for its imports equals

A) 0.2.

B) 0.5.

C) 1.0.

D) 2.0.

A) 0.2.

B) 0.5.

C) 1.0.

D) 2.0.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

42

According to the Absorption approach, after a currency depreciation, which of the following causes a trade deficit to decrease?

A) a decline in domestic interest rates

B) a rise in domestic imports

C) a rise in government spending

D) a decline in domestic absorption

A) a decline in domestic interest rates

B) a rise in domestic imports

C) a rise in government spending

D) a decline in domestic absorption

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

43

The Marshall-Lerner condition illustrates

A) the price effects of a nation's currency depreciation on its trade deficit.

B) the income effects of a nation's currency appreciation on its trade deficit.

C) the effect of fixed exchange rate systems on the trade balance.

D) the change in money demand and money supply and its effect on a trade deficit.

A) the price effects of a nation's currency depreciation on its trade deficit.

B) the income effects of a nation's currency appreciation on its trade deficit.

C) the effect of fixed exchange rate systems on the trade balance.

D) the change in money demand and money supply and its effect on a trade deficit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

44

The Marshall-Lerner condition suggests that depreciation of the Swiss franc leads to a worsening of Switzerland's trade balance if the

A) elasticity of demand for Swiss exports is 0.4 while the Swiss elasticity of demand for imports is 0.2.

B) elasticity of demand for Swiss exports is 0.6 while the Swiss elasticity of demand for imports is 0.4.

C) elasticity of demand for Swiss exports is 0.5 while the Swiss elasticity of demand for imports is 0.7.

D) elasticity of demand for Swiss exports is 0.6 while the Swiss elasticity of demand for imports is 0.7.

A) elasticity of demand for Swiss exports is 0.4 while the Swiss elasticity of demand for imports is 0.2.

B) elasticity of demand for Swiss exports is 0.6 while the Swiss elasticity of demand for imports is 0.4.

C) elasticity of demand for Swiss exports is 0.5 while the Swiss elasticity of demand for imports is 0.7.

D) elasticity of demand for Swiss exports is 0.6 while the Swiss elasticity of demand for imports is 0.7.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

45

According to the J-curve effect, an appreciation of the yen's exchange value has

A) no impact on the Japanese trade balance in the short run.

B) no impact on the Japanese trade balance in the long run.

C) an immediate negative effect on the Japanese trade balance.

D) an immediate positive effect on the Japanese trade balance.

A) no impact on the Japanese trade balance in the short run.

B) no impact on the Japanese trade balance in the long run.

C) an immediate negative effect on the Japanese trade balance.

D) an immediate positive effect on the Japanese trade balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

46

The effect of currency depreciation on the purchasing power of money balances and the resulting impact on domestic expenditures is emphasized by the

A) absorption approach.

B) monetary approach.

C) fiscal approach.

D) elasticity approach.

A) absorption approach.

B) monetary approach.

C) fiscal approach.

D) elasticity approach.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

47

The time period that it takes for companies to increase output of commodities for which demand has increased due to currency depreciation is known as the

A) recognition lag.

B) decision lag.

C) replacement lag.

D) production lag.

A) recognition lag.

B) decision lag.

C) replacement lag.

D) production lag.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

48

The analysis of the effects of a currency depreciation on a country's trade balance include all of the following except

A) the absorption approach.

B) the elasticity approach.

C) the fiscal approach.

D) the monetary approach.

A) the absorption approach.

B) the elasticity approach.

C) the fiscal approach.

D) the monetary approach.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

49

According to the J-curve effect, currency appreciation

A) decreases a trade surplus.

B) increases a trade surplus.

C) decreases a trade surplus before increasing a trade surplus.

D) increases a trade surplus before decreasing a trade surplus.

A) decreases a trade surplus.

B) increases a trade surplus.

C) decreases a trade surplus before increasing a trade surplus.

D) increases a trade surplus before decreasing a trade surplus.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

50

Given favorable elasticity conditions, other things equal a depreciation of the euro tends to result in

A) lower prices of imported products for Italy.

B) higher prices of imported products for Italy.

C) a larger trade deficit for Italy.

D) a smaller trade surplus for Italy.

A) lower prices of imported products for Italy.

B) higher prices of imported products for Italy.

C) a larger trade deficit for Italy.

D) a smaller trade surplus for Italy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

51

One of the lags that occurs between changes in relative prices and the quantities of goods traded is the

A) recognition lag.

B) recovery lag.

C) implementation lag.

D) legislative lag.

A) recognition lag.

B) recovery lag.

C) implementation lag.

D) legislative lag.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

52

According to the Marshall-Lerner condition, currency depreciation would have a negative effect on a country's trade balance if the elasticity of demand for its exports plus the elasticity of demand for its imports equals

A) 0.5.

B) 1.0.

C) 1.5.

D) 2.0.

A) 0.5.

B) 1.0.

C) 1.5.

D) 2.0.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

53

According to the J-curve effect, currency depreciation

A) decreases a trade deficit.

B) increases a trade deficit.

C) decreases a trade deficit before increasing a trade deficit.

D) increases a trade deficit before decreasing a trade deficit.

A) decreases a trade deficit.

B) increases a trade deficit.

C) decreases a trade deficit before increasing a trade deficit.

D) increases a trade deficit before decreasing a trade deficit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

54

The time period that it takes for companies to form new business connections and place new orders in response to currency depreciation is known as the

A) recognition lag.

B) replacement lag.

C) decision lag.

D) production lag.

A) recognition lag.

B) replacement lag.

C) decision lag.

D) production lag.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

55

According to the Marshall-Lerner condition, currency depreciation has no effect on a country's trade balance if the elasticity of demand for its exports plus the elasticity of demand for its imports equals

A) 0.1.

B) 0.5.

C) 1.0.

D) 2.0.

A) 0.1.

B) 0.5.

C) 1.0.

D) 2.0.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

56

According to the absorption approach equation B = Y - A, currency devaluation improves a nation's trade balance if

A) Y increases and A increases.

B) Y decreases and A decreases.

C) Y increases and/or A decreases.

D) Y decreases and/or A increases.

A) Y increases and A increases.

B) Y decreases and A decreases.

C) Y increases and/or A decreases.

D) Y decreases and/or A increases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

57

Given favorable elasticity conditions, other things equal an appreciation of the yen results in

A) a smaller Japanese trade deficit.

B) a larger Japanese trade surplus.

C) decreased prices for imported products for Japan.

D) increased prices for imported products for Japan.

A) a smaller Japanese trade deficit.

B) a larger Japanese trade surplus.

C) decreased prices for imported products for Japan.

D) increased prices for imported products for Japan.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

58

The absorption approach to currency depreciation is represented by which of the following equations?

A) B = Y - A

B) Y = C + I + G + (X-M)

C) I + X = S + M

D) S - I = X - M

A) B = Y - A

B) Y = C + I + G + (X-M)

C) I + X = S + M

D) S - I = X - M

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

59

Suppose a country devalues its currency.If the country's demand for imports is ______, the price increase resulting from the devaluation results in a relatively large decrease in the volume of imports, causing total import expenditures to decrease.

A) perfectly inelastic

B) relatively inelastic

C) unit elastic

D) relatively elastic

A) perfectly inelastic

B) relatively inelastic

C) unit elastic

D) relatively elastic

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

60

According to the J-curve effect, a depreciation of the pound's exchange value has

A) no impact on a U.K. balance-of-trade deficit in the short run.

B) no impact on a U.K. balance-of-trade deficit in the long run.

C) an immediate negative effect on the U.K. balance of trade.

D) an immediate positive effect on the U.K. balance of trade.

A) no impact on a U.K. balance-of-trade deficit in the short run.

B) no impact on a U.K. balance-of-trade deficit in the long run.

C) an immediate negative effect on the U.K. balance of trade.

D) an immediate positive effect on the U.K. balance of trade.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

61

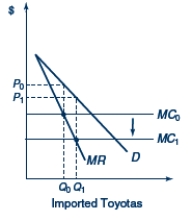

Figure 13.1. U.S. market for Imported Toyotas

In Figure 13.1, D represents the U.S.demand curve for Toyotas and MC0 represents the marginal cost of producing Toyotas.Assume that Toyota behaves like a monopolist in the U.S.market.A shift in the marginal cost curve from MC0 to MC1 leads to

A) a complete pass-through of the depreciation of the dollar.

B) a complete pass-through of the appreciation of the dollar.

C) a partial pass-through of the depreciation of the dollar.

D) a partial pass-through of the appreciation of the dollar.

In Figure 13.1, D represents the U.S.demand curve for Toyotas and MC0 represents the marginal cost of producing Toyotas.Assume that Toyota behaves like a monopolist in the U.S.market.A shift in the marginal cost curve from MC0 to MC1 leads to

A) a complete pass-through of the depreciation of the dollar.

B) a complete pass-through of the appreciation of the dollar.

C) a partial pass-through of the depreciation of the dollar.

D) a partial pass-through of the appreciation of the dollar.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

62

Figure 13.1. U.S. market for Imported Toyotas

In Figure 13.1, D represents the U.S.demand curve for Toyotas and MC0 represents the marginal cost of producing Toyotas.A shift in the marginal cost curve from MC0 to MC1 represents

A) an appreciation of the dollar relative to the yen.

B) an appreciation of the yen relative to the dollar.

C) a depreciation of the dollar relative to the yen.

D) neither an appreciation nor a depreciation of the dollar relative to the yen.

In Figure 13.1, D represents the U.S.demand curve for Toyotas and MC0 represents the marginal cost of producing Toyotas.A shift in the marginal cost curve from MC0 to MC1 represents

A) an appreciation of the dollar relative to the yen.

B) an appreciation of the yen relative to the dollar.

C) a depreciation of the dollar relative to the yen.

D) neither an appreciation nor a depreciation of the dollar relative to the yen.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

63

When manufacturing computer software, suppose that Microsoft Inc.uses labor and materials whose costs are denominated in dollars and Swiss francs respectively.If the dollar's exchange value depreciates 10 percent against the Swiss franc, the Swiss franc-denominated cost of the firm's software falls by 10 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

64

By decreasing the relative production costs of U.S.companies, a dollar appreciation tends to lower U.S.export prices in foreign-currency terms, which induces an increase in the amount of U.S.goods exported abroad.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

65

The absorption approach to currency depreciation focuses on

A) the purchasing power of money.

B) relative price effects.

C) income effects.

D) price elasticity of demand.

A) the purchasing power of money.

B) relative price effects.

C) income effects.

D) price elasticity of demand.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

66

According to the absorption approach, currency devaluation best improves a country's trade balance when its economy is at maximum capacity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

67

When producing jetliners, suppose that Boeing employs labor and materials whose costs are denominated in dollars and Chinese yuan respectively.If the dollar's exchange value depreciates 20 percent against the yuan, the yuan-denominated cost of a Boeing jetliner falls by an amount less than 20 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

68

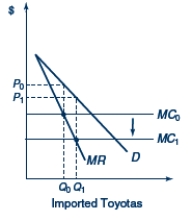

Figure 13.2. The U.S. Market for Imported Toyotas

In Figure 13.2, D represents the U.S.demand curve for Toyotas and MC0 represents the marginal cost of producing Toyotas.A shift in the marginal cost curve from MC0 to MC2 represents

A) an appreciation of the dollar relative to the yen.

B) a depreciation of the yen relative to the dollar.

C) a depreciation of the dollar relative to the yen.

D) neither an appreciation nor a depreciation of the dollar relative to the yen.

In Figure 13.2, D represents the U.S.demand curve for Toyotas and MC0 represents the marginal cost of producing Toyotas.A shift in the marginal cost curve from MC0 to MC2 represents

A) an appreciation of the dollar relative to the yen.

B) a depreciation of the yen relative to the dollar.

C) a depreciation of the dollar relative to the yen.

D) neither an appreciation nor a depreciation of the dollar relative to the yen.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

69

As yen-denominated costs become a larger portion of Ford's total costs, a dollar appreciation results in a smaller increase in the yen-denominated cost of a Ford auto than occurs when all input costs are dollar denominated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

70

When manufacturing automobiles, suppose that General Motors uses labor and materials whose costs are denominated in dollars and pounds respectively.If the dollar's exchange value appreciates by 15 percent against the pound, the pound-denominated cost of a GM vehicle rises by 15 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

71

If a currency's exchange rate is overvalued, a government would likely initiate actions to revalue the currency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

72

A depreciation of the dollar results in Whirlpool dishwashers becoming less competitive in Europe.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

73

The purpose of currency devaluation is to cause a depreciation in a currency's exchange value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

74

Currency devaluation is initiated by governmental policy rather than the free-market forces of supply and demand.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

75

If a currency's exchange rate is undervalued, a government would likely initiate actions to devalue the currency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

76

Figure 13.2. The U.S. Market for Imported Toyotas

In Figure 13.2, D represents the U.S.demand curve for Toyotas and MC0 represents the marginal cost of producing Toyotas.Assume that Toyota behaves like a monopolist in the U.S.market.A shift in the marginal cost curve from MC0 to MC2 leads to

A) a complete pass-through of the depreciation of the dollar.

B) a complete pass-through of the appreciation of the dollar.

C) a partial pass-through of the depreciation of the dollar.

D) a partial pass-through of the appreciation of the dollar.d

In Figure 13.2, D represents the U.S.demand curve for Toyotas and MC0 represents the marginal cost of producing Toyotas.Assume that Toyota behaves like a monopolist in the U.S.market.A shift in the marginal cost curve from MC0 to MC2 leads to

A) a complete pass-through of the depreciation of the dollar.

B) a complete pass-through of the appreciation of the dollar.

C) a partial pass-through of the depreciation of the dollar.

D) a partial pass-through of the appreciation of the dollar.d

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

77

Assume that General Motors employs labor and materials, whose costs are denominated in dollars, in the production of automobiles.If the dollar's exchange value depreciates by 10 percent against the yen, the yen-denominated cost of a GM vehicle rises by 10 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

78

Appreciation of the dollar's exchange value worsens the international competitiveness of Boeing Inc., whereas a dollar depreciation improves its international competitiveness.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

79

The purpose of currency revaluation is to cause an appreciation in a currency's exchange value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

80

Assume that General Motors employs labor and materials, whose costs are denominated in dollars, in the production of automobiles.If the dollar's exchange value appreciates by 10 percent against the yen, the yen-denominated cost of a GM vehicle falls by 10 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck