Deck 2: The Balance Sheet

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/55

العب

ملء الشاشة (f)

Deck 2: The Balance Sheet

1

___________are also referred to as short-term investments.

Marketable securities

2

Many companies list an account titled___________on the balance sheet even though no dollar amount will appear.

commitments and contingencies

3

A___________lease affects both the balance sheet and the income statement.

capital

4

Retained earnings is the unused stash of cash that a firm has accumulated since inception.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

5

The valuation of marketable securities on the balance sheet requires the separation of investment securities into three categories: held to maturity, trading securities, and securities available for sale.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

6

Working capital refers to the investment in property, plant and equipment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

7

A classified balance sheet means that the asset and liability sections are categorized into key areas.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

8

The net realizable value of accounts receivable is the actual amount of the account less an___________

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

9

The three cost flow assumptions most frequently used in the U.S.are ___________, ___________, and ___________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

10

Companies that are paid in advance for services or products record a liability on the receipt of cash in an account titled___________ or___________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

11

Companies that use IFRS may switch the order of presentation of assets and liabilities, listing noncurrent items before current items.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

12

___________are those assets expected to be converted into cash within one year or operating cycle, whichever is longer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

13

Accounts receivable are recorded on the balance sheet at gross realizable value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

14

A------expresses each item on the balance sheet as a percentage of total assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

15

___________arises when one company acquires another company for a price in excess of the fair market value of the net identifiable assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

16

The balance sheet is also called the statement of condition or statement of financial position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

17

The balance sheet is prepared for a period of time, generally a year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

18

A common-size balance sheet is useful to the analyst because it facilitates the structural analysis of the firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

19

Additional information helpful to the analysis of accounts receivable and the allowance account is provided in the schedule of------.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

20

As part of an integrated disclosure system required by the SEC, the information presented in annual reports includes three-year audited balance sheets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which type of firm would most likely carry the most finished goods inventory?

A)A manufacturing firm.

B)A retail firm.

C)A service firm.

D)A wholesale firm.

A)A manufacturing firm.

B)A retail firm.

C)A service firm.

D)A wholesale firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which item below would not be a quality of financial reporting issue related to the balance sheet?

A)Mismatching the type of debt (short or long-term) used to finance assets.

B)Discretionary expenses.

C)Overvaluation of assets.

D)Off-balance sheet financing.

A)Mismatching the type of debt (short or long-term) used to finance assets.

B)Discretionary expenses.

C)Overvaluation of assets.

D)Off-balance sheet financing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following accounts could be categorized as either a current or noncurrent liability depending on date the debt is due?

A)Notes payable and deferred taxes.

B)Accounts payable and current portion of long-term debt.

C)Deferred taxes and mortgages due in 30 years.

D)Long-term warranties and accounts payable.

A)Notes payable and deferred taxes.

B)Accounts payable and current portion of long-term debt.

C)Deferred taxes and mortgages due in 30 years.

D)Long-term warranties and accounts payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

24

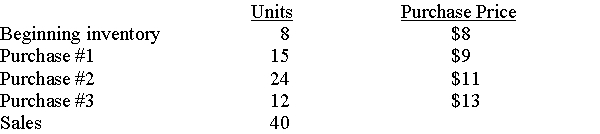

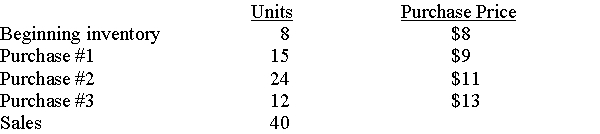

Use the following information to answer questions

ABC Company purchases five products for sale in the order and at the costs shown:

-Assume ABC sells two items and uses the FIFO method of inventory valuation.What amount would appear in ending inventory on the balance sheet?

A)$22

B)$46

C)$45

D)$31

ABC Company purchases five products for sale in the order and at the costs shown:

-Assume ABC sells two items and uses the FIFO method of inventory valuation.What amount would appear in ending inventory on the balance sheet?

A)$22

B)$46

C)$45

D)$31

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

25

When will a firm regard goodwill on its books?

A)When one company acquires another company for a price in excess of the fair market value of the net identifiable assets acquired.

B)When the firm donates property to charities.

C)When it is determined that there has been a loss of value of long-term assets.

D)When fixed assets are impaired.

A)When one company acquires another company for a price in excess of the fair market value of the net identifiable assets acquired.

B)When the firm donates property to charities.

C)When it is determined that there has been a loss of value of long-term assets.

D)When fixed assets are impaired.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

26

Use the following information to answer questions

ABC Company purchases five products for sale in the order and at the costs shown:

-Assume ABC uses the average cost method of inventory valuation.What unit cost would be used to determine the amount in ending inventory or cost of goods sold?

A)$12.67

B)$13.60

C)$15.00

D)$13.00

ABC Company purchases five products for sale in the order and at the costs shown:

-Assume ABC uses the average cost method of inventory valuation.What unit cost would be used to determine the amount in ending inventory or cost of goods sold?

A)$12.67

B)$13.60

C)$15.00

D)$13.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which of the following marketable securities are reported at fair value?

A)Held to maturity and trading securities.

B)Trading securities and securities available for sale.

C)Held to maturity and securities available for sale.

D)Corporate bonds and convertible debt.

A)Held to maturity and trading securities.

B)Trading securities and securities available for sale.

C)Held to maturity and securities available for sale.

D)Corporate bonds and convertible debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which of the following statements is false?

A)Companies are allowed to use more than one inventory valuation method.

B)LIFO is an income tax concept.

C)Using FIFO for high-technology products makes sense if the firm is trying to reduce taxes because the technology industry is generally deflationary.

D)Companies using IFRS may not reverse entries for inventory write-downs if the market recovers.

A)Companies are allowed to use more than one inventory valuation method.

B)LIFO is an income tax concept.

C)Using FIFO for high-technology products makes sense if the firm is trying to reduce taxes because the technology industry is generally deflationary.

D)Companies using IFRS may not reverse entries for inventory write-downs if the market recovers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which of the following statements is true?

A)The straight-line method of depreciation allocates a decreasing amount of depreciation expense each year.

B)Straight-line depreciation is the least used method for financial reporting purposes.

C)Fixed assets are reported at historical cost less accumulated depreciation on the balance sheet.

D)The total amount of depreciation over the asset's life is larger when using an accelerated method of depreciation.

A)The straight-line method of depreciation allocates a decreasing amount of depreciation expense each year.

B)Straight-line depreciation is the least used method for financial reporting purposes.

C)Fixed assets are reported at historical cost less accumulated depreciation on the balance sheet.

D)The total amount of depreciation over the asset's life is larger when using an accelerated method of depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which method of inventory would be least likely to be used by a European firm?

A)FIFO.

B)LIFO.

C)Average cost.

D)LIFO and FIFO.

A)FIFO.

B)LIFO.

C)Average cost.

D)LIFO and FIFO.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

31

Use the following information to answer questions

ABC Company purchases five products for sale in the order and at the costs shown:

-Assume ABC sells two items and uses the LIFO method of inventory valuation.What amount would appear for cost of goods sold on the income statement?

A)$37

B)$41

C)$22

D)$31

ABC Company purchases five products for sale in the order and at the costs shown:

-Assume ABC sells two items and uses the LIFO method of inventory valuation.What amount would appear for cost of goods sold on the income statement?

A)$37

B)$41

C)$22

D)$31

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which items would be classified as long-term debt?

A)Accounts payable, unearned revenue, pension liabilities.

B)Common stock, retained earnings, bonds payable.

C)Mortgages, convertible debentures, bonds payable.

D)Deferred taxes, accrued expenses, treasury stock.

A)Accounts payable, unearned revenue, pension liabilities.

B)Common stock, retained earnings, bonds payable.

C)Mortgages, convertible debentures, bonds payable.

D)Deferred taxes, accrued expenses, treasury stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

33

The balancing equation is expressed as:

A)Assets + Liabilities = Stockholders' Equity.

B)Revenues - Expenses = Net Income.

C)Sales - Costs = Net Profit.

D)Assets = Liabilities + Stockholders' Equity.

A)Assets + Liabilities = Stockholders' Equity.

B)Revenues - Expenses = Net Income.

C)Sales - Costs = Net Profit.

D)Assets = Liabilities + Stockholders' Equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following statements is false?

A)Common-size balance sheets allow for comparison of firms with different levels of total assets by introducing a common denominator.

B)The common-size balance sheet reveals the composition of assets within major categories.

C)Each item on a common-size balance sheet is expressed as a percentage of sales.

D)The common-size balance sheet reveals the capital and the debt structure of the firm.

A)Common-size balance sheets allow for comparison of firms with different levels of total assets by introducing a common denominator.

B)The common-size balance sheet reveals the composition of assets within major categories.

C)Each item on a common-size balance sheet is expressed as a percentage of sales.

D)The common-size balance sheet reveals the capital and the debt structure of the firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following items should alert the analyst to the potential for manipulation when analyzing accounts receivable and the allowance for doubtful accounts?

A)Sales, accounts receivable and the allowance for doubtful accounts are all growing at approximately the same rate.

B)A company lowers its credit standards and also increases the balance in the allowance for doubtful accounts.

C)Accounts receivable is growing at a large rate and the allowance for doubtful accounts is decreasing.

D)An analysis of the "Valuation and Qualifying Accounts" schedule required in the Form 10-K reveals that the amounts recorded for bad debt expense are close in amount to the actual amounts written off each year.

A)Sales, accounts receivable and the allowance for doubtful accounts are all growing at approximately the same rate.

B)A company lowers its credit standards and also increases the balance in the allowance for doubtful accounts.

C)Accounts receivable is growing at a large rate and the allowance for doubtful accounts is decreasing.

D)An analysis of the "Valuation and Qualifying Accounts" schedule required in the Form 10-K reveals that the amounts recorded for bad debt expense are close in amount to the actual amounts written off each year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which of the following accounts would be classified as current assets on the balance sheet?

A)Accounts receivable, inventory, cash equivalents.

B)Marketable securities, accounts payable, property, plant and equipment.

C)Prepaid expenses, goodwill, long-term investments.

D)Property, plant and equipment, inventory, goodwill.

A)Accounts receivable, inventory, cash equivalents.

B)Marketable securities, accounts payable, property, plant and equipment.

C)Prepaid expenses, goodwill, long-term investments.

D)Property, plant and equipment, inventory, goodwill.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

37

How are deferred taxes recorded on the balance sheet?

A)As current or noncurrent liabilities.

B)As stockholders' equity.

C)As noncurrent assets or noncurrent liabilities.

D)As current or noncurrent assets or liabilities.

A)As current or noncurrent liabilities.

B)As stockholders' equity.

C)As noncurrent assets or noncurrent liabilities.

D)As current or noncurrent assets or liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

38

Which method of inventory assumes the last units purchased will remain in ending inventory on the balance sheet?

A)FIFO.

B)LIFO.

C)Average cost.

D)LIFO and FIFO.

A)FIFO.

B)LIFO.

C)Average cost.

D)LIFO and FIFO.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which stockholders' equity account represents the sum of every dollar a company has earned since its inception, less any payments made to shareholders in the form of dividends?

A)Treasury stock.

B)Accumulated other comprehensive income

C)Retained earnings.

D)Preferred stock.

A)Treasury stock.

B)Accumulated other comprehensive income

C)Retained earnings.

D)Preferred stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

40

Which of the following items would not be classified as cash equivalents?

A)U.S.Treasury bills.

B)Trading securities.

C)Commercial paper.

D)Money market funds.

A)U.S.Treasury bills.

B)Trading securities.

C)Commercial paper.

D)Money market funds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

41

Explain the differences between accounts payable, short-term debt, current maturities of long-term debt, accrued liabilities and unearned revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

42

The Breakfast Company purchases equipment for $100,000.Management estimates that the equipment will have a useful life of eight years and no salvage value.

a.Calculate depreciation expense and the book value of the equipment at the end of the first year using the straight-line method of depreciation.

b.Calculate depreciation expense and the book value at the end of the first year using the double-declining balance method of depreciation.

a.Calculate depreciation expense and the book value of the equipment at the end of the first year using the straight-line method of depreciation.

b.Calculate depreciation expense and the book value at the end of the first year using the double-declining balance method of depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

43

Explain the format and key components of a balance sheet prepared in the U.S.or overseas.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

44

Why should the allowance for doubtful accounts and the valuation and qualifying accounts schedule be analyzed?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

45

Using the following information calculate the ending inventory balance and the cost of goods sold expense that would be reported at the end of the year if the following inventory valuation methods are used:

a.Average cost

b.FIFO

c.LIFO

a.Average cost

b.FIFO

c.LIFO

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

46

Redtop Co.purchased a piece of equipment last year for $300,000.Management estimates that the equipment will have a useful life of five years and no salvage value.The depreciation expense recorded for tax purposes will be $72,000 this year (Year 2).The company uses the straight-line method of depreciation for reporting purposes.

a.Calculate the amount of depreciation expense for reporting purposes this year (Year 2).

b.What will be the net book value of the equipment reported on the balance sheet at the end of this year (Year 2)?

c.Will a deferred tax asset or liability be created as a result of the depreciation recorded for tax and financial reporting purposes?

d.What amount will be added to the deferred tax account as a result of the depreciation timing difference?

a.Calculate the amount of depreciation expense for reporting purposes this year (Year 2).

b.What will be the net book value of the equipment reported on the balance sheet at the end of this year (Year 2)?

c.Will a deferred tax asset or liability be created as a result of the depreciation recorded for tax and financial reporting purposes?

d.What amount will be added to the deferred tax account as a result of the depreciation timing difference?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

47

Explain the differences between long-term notes payable, mortgages, debentures, bonds payable, and convertible debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

48

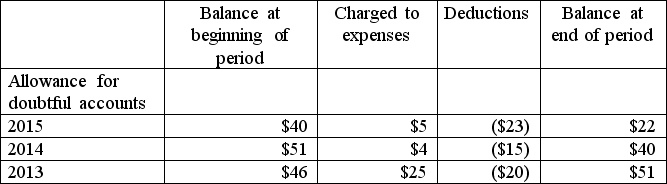

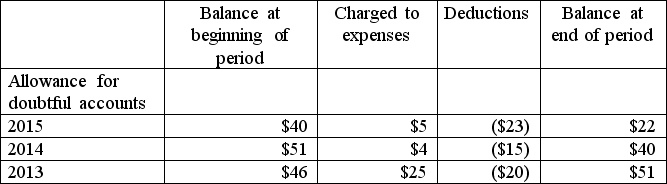

Using the following excerpts from the most recent annual report of WooHoo, a high technology firm, analyze the accounts receivable and allowance for doubtful accounts.Be sure to show all calculations and write a thorough interpretation of those calculations.

WooHoo

WooHoo

Valuation And Qualifying Accounts

For the Years Ended April 30, 2015, 2014 and 2013

WooHoo

WooHooValuation And Qualifying Accounts

For the Years Ended April 30, 2015, 2014 and 2013

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

49

Define current assets and current liabilities and give two examples of each.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

50

Why is the inventory accounting method chosen by a company important to the user of financial statement information?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

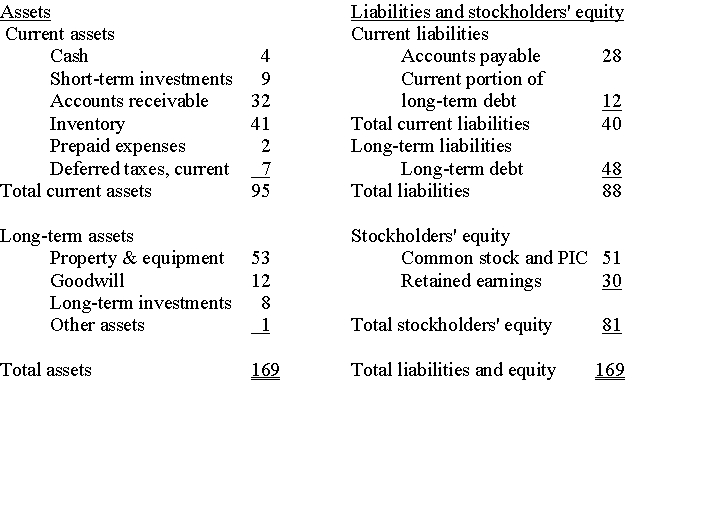

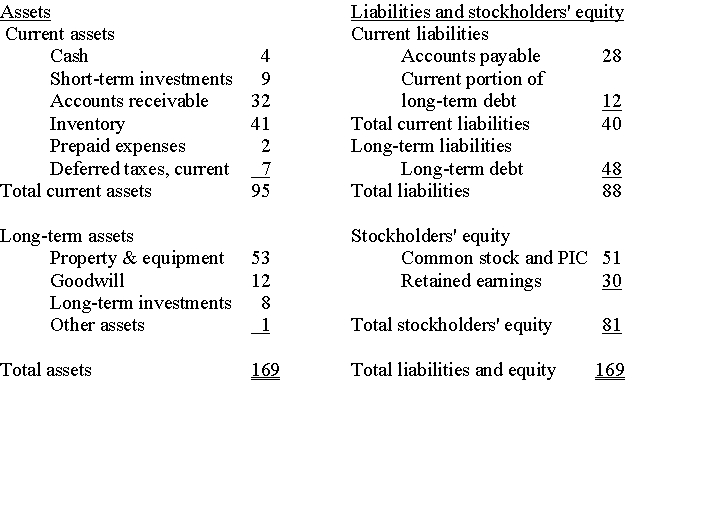

k this deck

51

Using the following balance sheet, prepare a common size balance sheet:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

52

Explain the impact of calculating depreciation using the straight-line method versus an accelerated method on the amounts shown on a balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

53

Write a short explanation of why you agree or disagree with the following statement:

"The LIFO method of inventory valuation cannot be used by grocery stores."

"The LIFO method of inventory valuation cannot be used by grocery stores."

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

54

Using the following information calculate the ending inventory balance and the cost of goods sold expense that would be reported at the end of the year if the following inventory valuation methods are used:

a.Average cost

b.FIFO

c.LIFO

a.Average cost

b.FIFO

c.LIFO

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

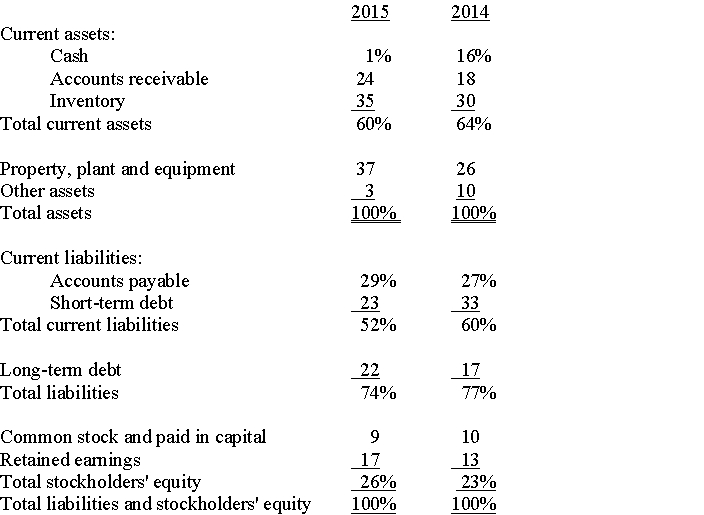

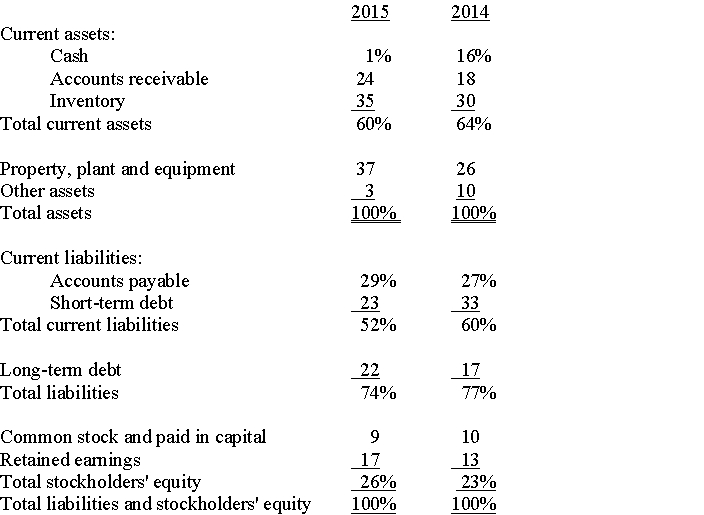

55

Analyze the following common size balance sheet:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck