Deck 13: The Translation of Financial Statements of Foreign Affiliates

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/38

العب

ملء الشاشة (f)

Deck 13: The Translation of Financial Statements of Foreign Affiliates

1

In preparing consolidated financial statements of a U.S.parent company and a foreign subsidiary, the foreign subsidiary's functional currency is the currency:

A)of the country the parent is located.

B)of the country the subsidiary is located.

C)in which the subsidiary primarily generates and spends cash.

D)in which the subsidiary maintains its accounting records.

A)of the country the parent is located.

B)of the country the subsidiary is located.

C)in which the subsidiary primarily generates and spends cash.

D)in which the subsidiary maintains its accounting records.

C

2

If the functional currency is determined to be the U.S.dollar and its financial statements are prepared in the local currency, SFAS 52, requires which of the following procedures to be followed?

A)Translate the financial statements into U.S.dollars using the current rate method.

B)Remeasure the financial statements into U.S.dollars using the temporal method.

C)Translate the financial statements into U.S.dollars using the temporal method.

D)Remeasure the financial statements into U.S.dollars using the current rate method.

A)Translate the financial statements into U.S.dollars using the current rate method.

B)Remeasure the financial statements into U.S.dollars using the temporal method.

C)Translate the financial statements into U.S.dollars using the temporal method.

D)Remeasure the financial statements into U.S.dollars using the current rate method.

B

3

Assuming no significant inflation, gains resulting from the process of translating a foreign entity's financial statements from the functional currency to U.S.dollars should be included as a(n):

A)other comprehensive income item.

B)extraordinary item (net of tax).

C)part of continuing operations.

D)deferred credit.

A)other comprehensive income item.

B)extraordinary item (net of tax).

C)part of continuing operations.

D)deferred credit.

A

4

P Company acquired 90% of the outstanding common stock of S Company which is a foreign company.The acquisition was accounted for using the purchase method.In preparing consolidated statements, the paid-in capital of S Company should be converted at the:

A)exchange rate effective when S Company was organized.

B)exchange rate effective on the date of purchase of the stock of S Company by P Company.

C)average exchange rate for the period S Company stock has been upheld by P Company.

D)current exchange rate.

A)exchange rate effective when S Company was organized.

B)exchange rate effective on the date of purchase of the stock of S Company by P Company.

C)average exchange rate for the period S Company stock has been upheld by P Company.

D)current exchange rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

5

Average exchange rates are used to translate certain items from foreign financial statements into U.S.dollars.Such averages are used in order to:

A)smooth out large translation gains and losses.

B)eliminate temporary fluctuation in exchange rates that may be reversed in the next fiscal period.

C)avoid using different exchange rates for some revenue and expense accounts.

D)approximate the exchange rate in effect when the items were recognized.

A)smooth out large translation gains and losses.

B)eliminate temporary fluctuation in exchange rates that may be reversed in the next fiscal period.

C)avoid using different exchange rates for some revenue and expense accounts.

D)approximate the exchange rate in effect when the items were recognized.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

6

A foreign subsidiary's functional currency is its local currency and inflation of over 100 percent has been experienced over a three-year period.For consolidation purposes, SFAS No.52 requires the use of:

A)the current rate method only.

B)the temporal method only

C)both the current rate and temporal methods.

D)neither the current rate or the temporal method.

A)the current rate method only.

B)the temporal method only

C)both the current rate and temporal methods.

D)neither the current rate or the temporal method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

7

The process of translating the accounts of a foreign entity into its functional currency when they are stated in another currency is called:

A)verification.

B)translation.

C)remeasurement.

D)None of these.

A)verification.

B)translation.

C)remeasurement.

D)None of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

8

The translation adjustment that results from translating the financial statements of a foreign subsidiary using the current rate method should be:

A)included as a separate item in the stockholders' equity section of the balance sheet.

B)included in the determination of net income for the period it occurs.

C)deferred and amortized over a period not to exceed forty years.

D)deferred until a subsequent year when a loss occurs and offset against that loss.

A)included as a separate item in the stockholders' equity section of the balance sheet.

B)included in the determination of net income for the period it occurs.

C)deferred and amortized over a period not to exceed forty years.

D)deferred until a subsequent year when a loss occurs and offset against that loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

9

Gains from remeasuring a foreign subsidiary's financial statements from the local currency, which is not the functional currency, into the parent company's currency should be reported as a(n):

A)other comprehensive income item.

B)extraordinary item (net of tax).

C)part of continuing operations.

D)deferred credit.

A)other comprehensive income item.

B)extraordinary item (net of tax).

C)part of continuing operations.

D)deferred credit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

10

The objective of remeasurement is to:

A)produce the same results as if the books were maintained in the currency of the foreign entity's largest customer.

B)produce the same results as if the books were maintained solely in the local currency.

C)produce the same results as if the books were maintained solely in the functional currency.

D)None of the above.

A)produce the same results as if the books were maintained in the currency of the foreign entity's largest customer.

B)produce the same results as if the books were maintained solely in the local currency.

C)produce the same results as if the books were maintained solely in the functional currency.

D)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

11

Under the temporal method, monetary assets and liabilities are translated by using the exchange rate existing at the:

A)beginning of the current year.

B)date the transaction occurred.

C)balance sheet date.

D)None of these.

A)beginning of the current year.

B)date the transaction occurred.

C)balance sheet date.

D)None of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

12

When the functional currency is identified as the U.S.dollar, land purchased by a foreign subsidiary after the controlling interest was acquired by the parent company should be translated using the:

A)historical rate in effect when the land was purchased.

B)current rate in effect at the balance sheet date.

C)forward rate.

D)average exchange rate for the current period.

A)historical rate in effect when the land was purchased.

B)current rate in effect at the balance sheet date.

C)forward rate.

D)average exchange rate for the current period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

13

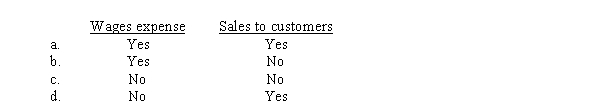

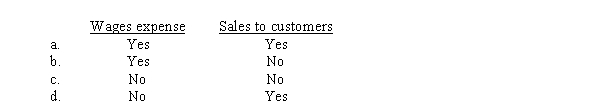

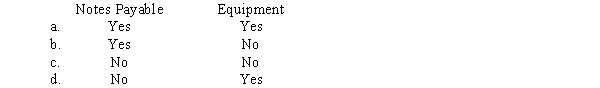

A foreign subsidiary's functional currency is its local currency which has not experienced significant inflation.The weighted average exchange rate for the current year would be the appropriate exchange rate for translating

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

14

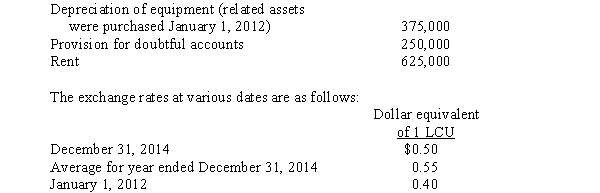

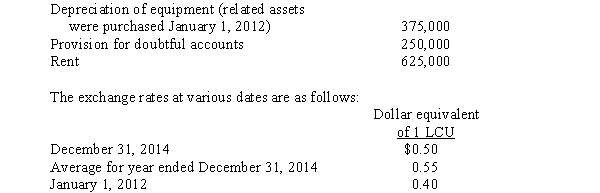

A wholly owned subsidiary of a U.S.parent company has certain expense accounts for the year ended December 31, 2014, stated in local currency units (LCU) as follows:

LCU

Assume that the LCU is the subsidiary's functional currency and that the charges to the expense accounts occurred approximately evenly during the year.What total dollar amount should be included in the translated income statement to reflect these expenses?

A)$687,500

B)$625,000

C)$550,000

D)$500,000

LCU

Assume that the LCU is the subsidiary's functional currency and that the charges to the expense accounts occurred approximately evenly during the year.What total dollar amount should be included in the translated income statement to reflect these expenses?

A)$687,500

B)$625,000

C)$550,000

D)$500,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

15

The appropriate exchange rate for translating a plant asset in the balance sheet of a foreign subsidiary in which the functional currency is the U.S.dollar is the:

A)current exchange rate.

B)average exchange rate for the current year.

C)historical exchange rate in effect when the plant asset was acquired or the date of acquisition, whichever is later.

D)forward rate.

A)current exchange rate.

B)average exchange rate for the current year.

C)historical exchange rate in effect when the plant asset was acquired or the date of acquisition, whichever is later.

D)forward rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

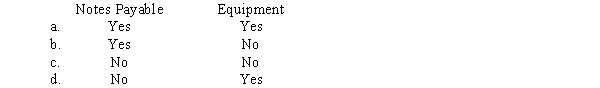

16

When translating foreign currency financial statements for a company whose functional currency is the U.S.dollar, which of the following accounts is translated using historical exchange rates?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of the following would be restated using the current exchange rate under the temporal method?

A)Marketable securities carried at cost.

B)Inventory carried at market.

C)Common stock.

D)None of these.

A)Marketable securities carried at cost.

B)Inventory carried at market.

C)Common stock.

D)None of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

18

Paid-in capital accounts are translated using the historical exchange rate under:

A)the current rate method only.

B)the temporal method only.

C)both the current rate and temporal methods.

D)neither the current rate nor temporal methods.

A)the current rate method only.

B)the temporal method only.

C)both the current rate and temporal methods.

D)neither the current rate nor temporal methods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

19

Which of the following would be restated using the average exchange rate under the temporal method?

A)cost of goods sold

B)depreciation expense

C)amortization expense

D)None of these

A)cost of goods sold

B)depreciation expense

C)amortization expense

D)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

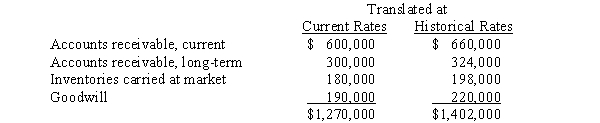

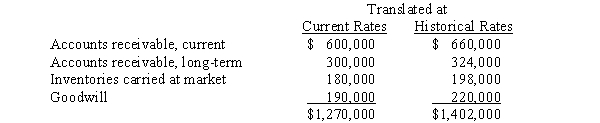

20

The following balance sheet accounts of a foreign subsidiary at December 31, 2014, have been translated into U.S.dollars as follows:  What total should be included in the translated balance sheet at December 31, 2014, for the above items? Assume the U.S.dollar is the functional currency.

What total should be included in the translated balance sheet at December 31, 2014, for the above items? Assume the U.S.dollar is the functional currency.

A)$1,270,000

B)$1,288,000

C)$1,300,000

D)$1,354,000

What total should be included in the translated balance sheet at December 31, 2014, for the above items? Assume the U.S.dollar is the functional currency.

What total should be included in the translated balance sheet at December 31, 2014, for the above items? Assume the U.S.dollar is the functional currency.A)$1,270,000

B)$1,288,000

C)$1,300,000

D)$1,354,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

21

The __________is the functional currency of a foreign subsidiary with operations that are relatively self-contained and integrated within the country in which it is located.In such cases, the__________ method of translation would be used to translate the accounts into dollars.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

22

This type of executive stock option is often referred to as "spring-loading." Do you think this practice should be allowed? Does it provide in-formation about the integrity of the firm or is this just good business practice?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

23

What is the objective of the temporal method of translation?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

24

Under the current rate method, how are assets and liabilities that are stated in a foreign currency translated?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

25

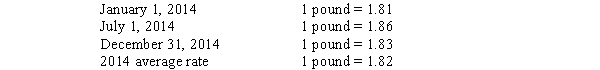

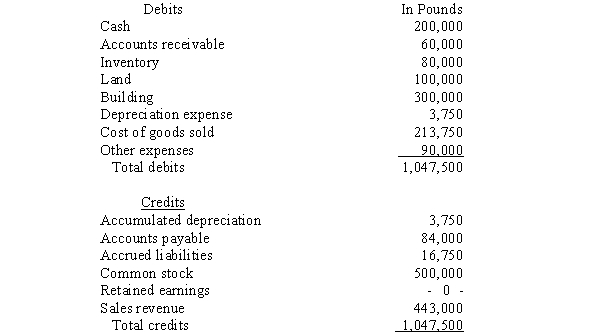

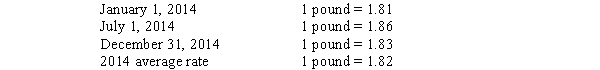

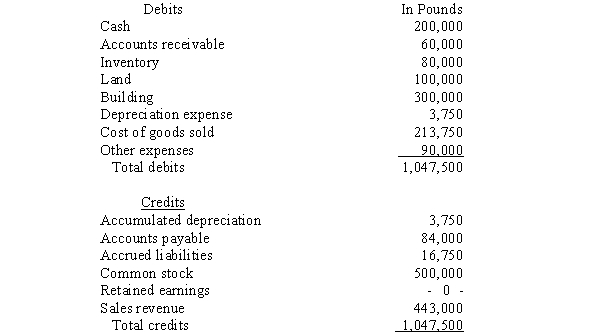

Pike Corporation, a U.S.Company, formed a subsidiary with a new company in London on January 1, 2014, by investing 500,000 British pounds in exchange for all of the subsidiary's common stock.The subsidiary purchased land for 100,000 pounds and a building for 300,000 pounds on July 1, 2014.The building is being depreciated over a 40-year life by the straight-line method.The inventory is valued on an average cost basis.The British pound is the subsidiary's functional currency and its reporting currency and has not experienced any abnormal inflation.Exchange rates for the pound on various dates were:

The subsidiary's adjusted trial balance is presented below for the year ended December 31, 2014.

Required: Prepare the subsidiary's:

A.Translated workpapers (round to the nearest dollar)

B.Translated income statement

C.Translated balance sheet

The subsidiary's adjusted trial balance is presented below for the year ended December 31, 2014.

Required: Prepare the subsidiary's:

A.Translated workpapers (round to the nearest dollar)

B.Translated income statement

C.Translated balance sheet

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

26

A translation adjustment results from the process of translating financial statements of a foreign subsidiary from its functional currency into dollars.Where is the translation adjustment reported in the financial statements if the current rate method is used to translate the accounts?

Business Ethics Question from the Textbook

The Shady Tree Company is preparing to announce their quarterly earnings numbers.The company expects to beat the analysts' forecast of earnings by at least5cents a share.In anticipation of the increase in stock value and before the release of the earnings numbers, the company issued stock options to the top executives in the firm, with the option price equal to today's market price.

Business Ethics Question from the Textbook

The Shady Tree Company is preparing to announce their quarterly earnings numbers.The company expects to beat the analysts' forecast of earnings by at least5cents a share.In anticipation of the increase in stock value and before the release of the earnings numbers, the company issued stock options to the top executives in the firm, with the option price equal to today's market price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

27

The __________is the functional currency of a foreign subsidiary that is a direct and integral component or extension of a U.S.parent company.In such cases, the __________method of translation is used to translate (remeasure) the accounts into dollars.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

28

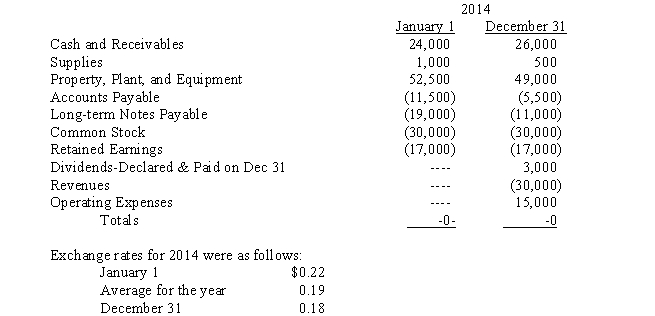

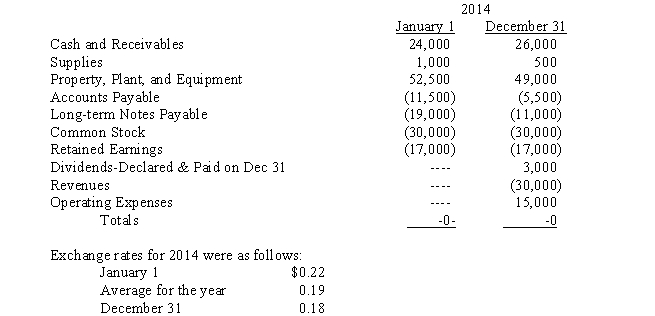

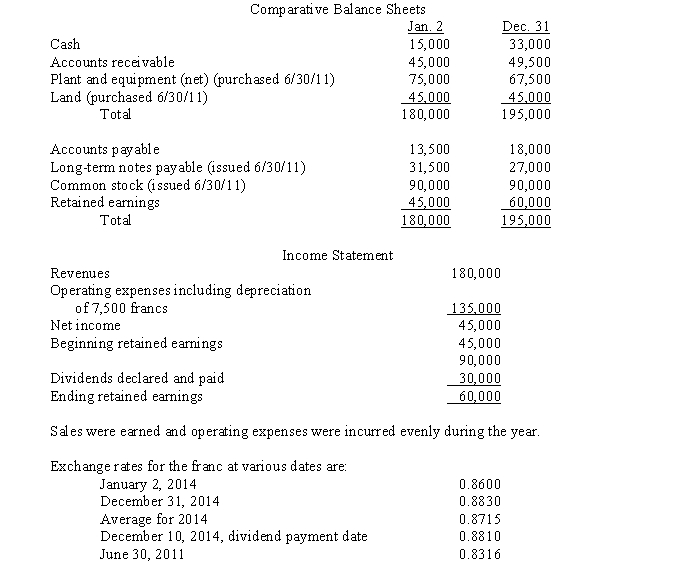

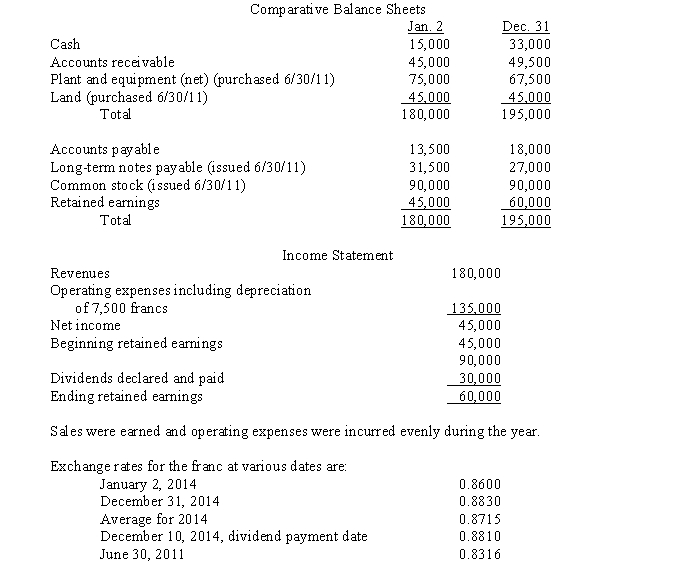

Dakota, Inc.owns a company that operates in France.Account balances in francs for the subsidiary are shown below:

Revenues were earned and operating expenses, except for depreciation and supplies used, were incurred evenly throughout the year.No purchases of supplies or plant assets were made during the year.

Required:

A.Prepare a schedule to compute the translation adjustment for the year, assuming the subsidiary's functional currency is the franc.

B.Prepare a schedule to compute the translation gain or loss, assuming the subsidiary's functional currency is the U.S.dollar.

Revenues were earned and operating expenses, except for depreciation and supplies used, were incurred evenly throughout the year.No purchases of supplies or plant assets were made during the year.

Required:

A.Prepare a schedule to compute the translation adjustment for the year, assuming the subsidiary's functional currency is the franc.

B.Prepare a schedule to compute the translation gain or loss, assuming the subsidiary's functional currency is the U.S.dollar.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

29

Under the current rate method, describe how the various balance sheet accounts are translated (including the equity accounts) and how this translation affects the computation of various ratios (such as debt to equity or the current ratio).In particular, discuss whether or not the ratios will change when computed in local currencies and compared to their calculations (after translation) using the parent's currency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

30

The translation process can be done using either the current rate method or the temporal method.Explain under what circumstances each of the methods is appropriate.

Questions from the Textbook

Questions from the Textbook

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which method of translation is used to convert the financial statements when a foreign subsidiary operates in a highly inflationary economy?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

32

Assuming that the temporal method is used, how are revenue and expense items in foreign currency financial statements converted?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

33

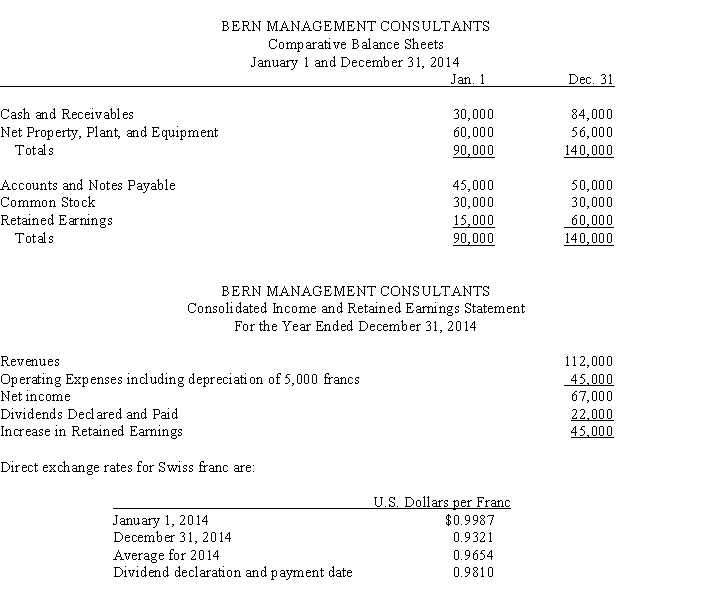

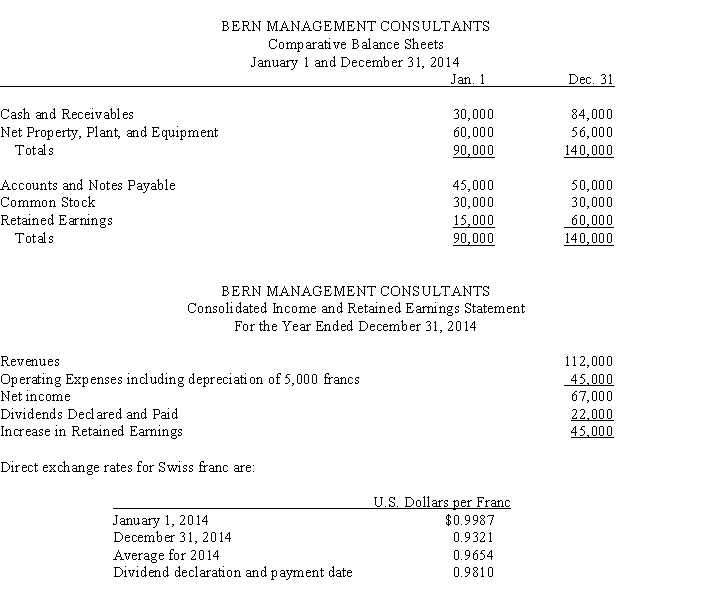

January 1, 2014, Roswell Systems, a U.S.-based company, purchased a controlling interest in Bern Management Consultants located in Bern, Switzerland.The acquisition was treated as a purchase transaction.The 2014 financial statements stated in Swiss francs are given below.

Required:

A.Translate the year-end balance sheet and income statement of the foreign subsidiary using the current rate method of translation.

B.Prepare a schedule to verify the translation adjustment.

Required:

A.Translate the year-end balance sheet and income statement of the foreign subsidiary using the current rate method of translation.

B.Prepare a schedule to verify the translation adjustment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

34

Using the information provided in Problem use the temporal method instead of the current rate method.

Required: Prepare the subsidiary's:

A.Translated workpapers (round to the nearest dollar)

B.Translated income statement

C.Translated balance sheet

Required: Prepare the subsidiary's:

A.Translated workpapers (round to the nearest dollar)

B.Translated income statement

C.Translated balance sheet

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

35

Define remeasurement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

36

Use the information below to (a) translate the year-end financial statements of Perfect Company, the foreign subsidiary, using the temporal method, and (b) prepare a schedule to compute the translation gain or loss for Perfect Company.Round numbers to the nearest dollar.

On January 2, 2014, Design Inc., a U.S.parent company, purchased a 100% interest in Perfect Company, a subdivision located in Switzerland.The purchase method of accounting was used to account for the acquisition.The 2014 financial statements for Perfect Company, the subsidiary, in Swiss francs were as follows:

On January 2, 2014, Design Inc., a U.S.parent company, purchased a 100% interest in Perfect Company, a subdivision located in Switzerland.The purchase method of accounting was used to account for the acquisition.The 2014 financial statements for Perfect Company, the subsidiary, in Swiss francs were as follows:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

37

What requirements must be satisfied if a foreign subsidiary is to be consolidated?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

38

To accomplish the objectives of translation, two translation methods are used depending on the functional currency of the foreign entity.Describe the two translation methods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck