Deck 8: Changes in Ownership Interest

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/27

العب

ملء الشاشة (f)

Deck 8: Changes in Ownership Interest

1

Use the following information for Questions 19-21.

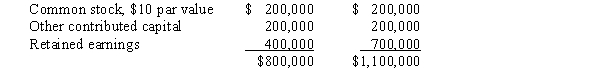

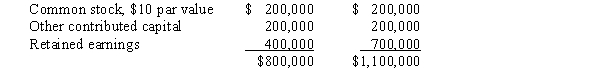

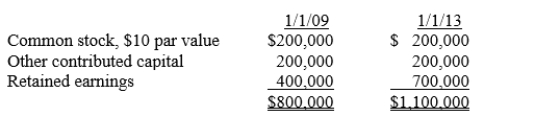

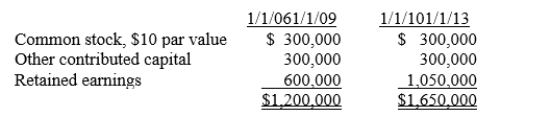

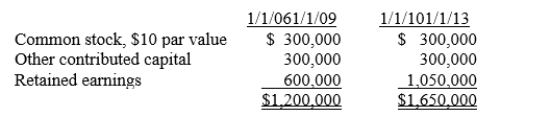

On January 1, 2009, Pharma Company purchased 16,000 of the 20,000 outstanding common shares of Sludge Company for $760,000.On January 1, 2013, Pharma Company sold 2,000 of its shares of Sludge Company on the open market for $90 per share.Sludge Company's stockholders' equity on January 1, 2009, and January 1, 2013, was as follows:

1/1/09 1/1/13 The difference between implied and book value is assigned to Sludge Company's land.

The difference between implied and book value is assigned to Sludge Company's land.

The amount of the gain on sale of the 2,000 shares that should be recorded on the books of Pharma Company is

A)$34,000.

B)$85,000.

C)$48,000.

D)$100,000.

E)None of these.

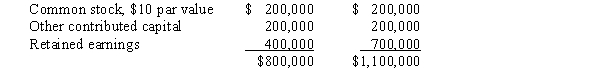

On January 1, 2009, Pharma Company purchased 16,000 of the 20,000 outstanding common shares of Sludge Company for $760,000.On January 1, 2013, Pharma Company sold 2,000 of its shares of Sludge Company on the open market for $90 per share.Sludge Company's stockholders' equity on January 1, 2009, and January 1, 2013, was as follows:

1/1/09 1/1/13

The difference between implied and book value is assigned to Sludge Company's land.

The difference between implied and book value is assigned to Sludge Company's land.The amount of the gain on sale of the 2,000 shares that should be recorded on the books of Pharma Company is

A)$34,000.

B)$85,000.

C)$48,000.

D)$100,000.

E)None of these.

B

2

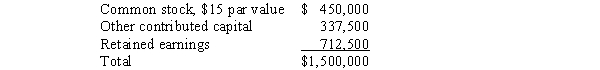

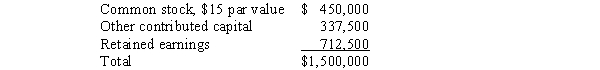

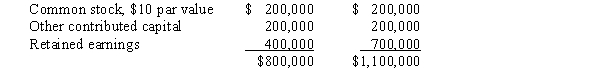

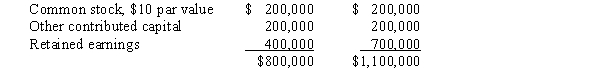

Parr Company owned 24,000 of the 30,000 outstanding common shares of Solomon Company on January 1, 2013.Parr's shares were purchased at book value when the fair values of Solomon's assets and liabilities were equal to their book values.The stockholders' equity of Solomon Company on January 1, 2013, consisted of the following:  Solomon Company sold 7,500 additional shares of common stock for $90 per share on January 2, 2013.If Parr Company purchased all 7,500 shares, the book entry to record the purchase should increase the Investment in Solomon Company account by

Solomon Company sold 7,500 additional shares of common stock for $90 per share on January 2, 2013.If Parr Company purchased all 7,500 shares, the book entry to record the purchase should increase the Investment in Solomon Company account by

A)$562,500.

B)$590,625.

C)$675,000.

D)$150,000.

E)Some other account.why now have 5 choices? most professors would prefer the consistency of 4 only - be consistent

Solomon Company sold 7,500 additional shares of common stock for $90 per share on January 2, 2013.If Parr Company purchased all 7,500 shares, the book entry to record the purchase should increase the Investment in Solomon Company account by

Solomon Company sold 7,500 additional shares of common stock for $90 per share on January 2, 2013.If Parr Company purchased all 7,500 shares, the book entry to record the purchase should increase the Investment in Solomon Company account byA)$562,500.

B)$590,625.

C)$675,000.

D)$150,000.

E)Some other account.why now have 5 choices? most professors would prefer the consistency of 4 only - be consistent

C

3

The purchase by a subsidiary of some of its shares from noncontrolling stockholders results in the parent company's share of the subsidiary's net assets

A)increasing.

B)decreasing.

C)remaining unchanged.

D)increasing, decreasing, or remaining unchanged.

A)increasing.

B)decreasing.

C)remaining unchanged.

D)increasing, decreasing, or remaining unchanged.

D

4

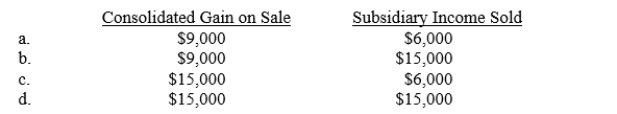

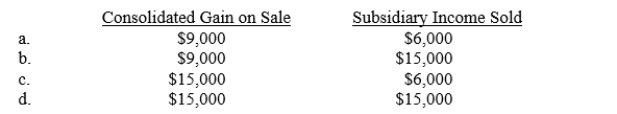

P Corporation purchased an 80% interest in S Corporation on January 1, 2013, at book value for $300,000.S's net income for 2013 was $90,000 and no dividends were declared.On May 1, 2013, P reduced its interest in S by selling a 20% interest, or one-fourth of its investment for $90,000.What will be the Consolidated Gain on Sale and Subsidiary Income Sold for 2013?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

5

Parr Company owned 24,000 of the 30,000 outstanding common shares of Solomon Company on January 1, 2013.Parr's shares were purchased at book value when the fair values of Solomon's assets and liabilities were equal to their book values.The stockholders' equity of Solomon Company on January 1, 2013, consisted of the following: Solomon Company sold 7,500 additional shares of common stock for $90 per share on January 2, 2013.If all 7,500 shares were sold to noncontrolling stockholders, the workpaper adjustment needed each time a workpaper is prepared should increase (decrease) the Investment in Solomon Company by

A)($140,625).

B)$140,625.

C)($112,500).

D)$192,000.

E)None of these.

A)($140,625).

B)$140,625.

C)($112,500).

D)$192,000.

E)None of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which one of the following statements regarding IFRS and accounting for step acquisitions is most correct?

A)Under IFRS goodwill is identified and net assets remeasured to fair value for all subsequent transactions, both increasing and decreasing the ownership percentage, after control is achieved.

B)IFRS requires the recording of additional goodwill on subsequent increases in the parent's ownership percentage.

C)Under IFRS acquisition accounting is applied only at the date that control is achieved.

D)IFRS requires the non-controlling interest to be measured at fair value.

A)Under IFRS goodwill is identified and net assets remeasured to fair value for all subsequent transactions, both increasing and decreasing the ownership percentage, after control is achieved.

B)IFRS requires the recording of additional goodwill on subsequent increases in the parent's ownership percentage.

C)Under IFRS acquisition accounting is applied only at the date that control is achieved.

D)IFRS requires the non-controlling interest to be measured at fair value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

7

Use the following information for Questions 19-21.

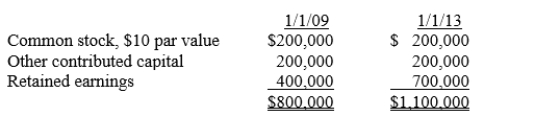

On January 1, 2009, Pharma Company purchased 16,000 of the 20,000 outstanding common shares of Sludge Company for $760,000.On January 1, 2013, Pharma Company sold 2,000 of its shares of Sludge Company on the open market for $90 per share.Sludge Company's stockholders' equity on January 1, 2009, and January 1, 2013, was as follows:

1/1/09 1/1/13 The difference between implied and book value is assigned to Sludge Company's land.

The difference between implied and book value is assigned to Sludge Company's land.

Assuming no other equity transactions, the amount of the difference between implied and book value that would be added to land on a work paper for the preparation of consolidated statements on December 31, 2013 would be

A)$120,000.

B)$115,000.

C)$105,000.

D)$84,000.

On January 1, 2009, Pharma Company purchased 16,000 of the 20,000 outstanding common shares of Sludge Company for $760,000.On January 1, 2013, Pharma Company sold 2,000 of its shares of Sludge Company on the open market for $90 per share.Sludge Company's stockholders' equity on January 1, 2009, and January 1, 2013, was as follows:

1/1/09 1/1/13

The difference between implied and book value is assigned to Sludge Company's land.

The difference between implied and book value is assigned to Sludge Company's land.Assuming no other equity transactions, the amount of the difference between implied and book value that would be added to land on a work paper for the preparation of consolidated statements on December 31, 2013 would be

A)$120,000.

B)$115,000.

C)$105,000.

D)$84,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

8

On January 1, 2009, Panda Company purchased 16,000 of the 20,000 outstanding common shares of Simian Company for $760,000.On January 1, 2013, Panda Company sold 2,000 of its shares of Simian Company on the open market for $90 per share.Simian Company's stockholders' equity on January 1, 2009, and January 1, 2013, was as follows:  The difference between implied and book value is assigned to Simian Company's land.Assuming no other equity transactions, the amount of the difference between implied and book value that would be added to land on a workpaper for the preparation of consolidated statements on December 31, 2013, would be

The difference between implied and book value is assigned to Simian Company's land.Assuming no other equity transactions, the amount of the difference between implied and book value that would be added to land on a workpaper for the preparation of consolidated statements on December 31, 2013, would be

A)$120,000.

B)$115,000.

C)$105,000.

D)$84,000.

E)None of these.

The difference between implied and book value is assigned to Simian Company's land.Assuming no other equity transactions, the amount of the difference between implied and book value that would be added to land on a workpaper for the preparation of consolidated statements on December 31, 2013, would be

The difference between implied and book value is assigned to Simian Company's land.Assuming no other equity transactions, the amount of the difference between implied and book value that would be added to land on a workpaper for the preparation of consolidated statements on December 31, 2013, would beA)$120,000.

B)$115,000.

C)$105,000.

D)$84,000.

E)None of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

9

If a subsidiary issues new shares of its stock to noncontrolling stockholders, the book value of the parent's interest in the subsidiary may

A)increase.

B)decrease.

C)remain the same.

D)increase, decrease, or remain the same.

A)increase.

B)decrease.

C)remain the same.

D)increase, decrease, or remain the same.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

10

On January 1, 2013, P Corporation purchased 75% of S Corporation for $500,000.S's stockholders' equity on that date was equal to $600,000 and S had 40,000 shares issued and outstanding on that date.S Corporation sold an additional 8,000 shares of previously unissued stock on December 31, 2013.

Assume that P Corporation purchased the additional shares what would be their current percentage ownership on December 31, 2013?

A)62 1/2%.

B)75%

C)79 1/6%

D)100%

Assume that P Corporation purchased the additional shares what would be their current percentage ownership on December 31, 2013?

A)62 1/2%.

B)75%

C)79 1/6%

D)100%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

11

Use the following information for Questions 19-21.

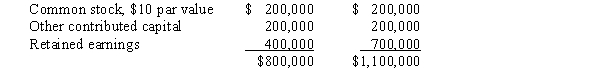

On January 1, 2009, Pharma Company purchased 16,000 of the 20,000 outstanding common shares of Sludge Company for $760,000.On January 1, 2013, Pharma Company sold 2,000 of its shares of Sludge Company on the open market for $90 per share.Sludge Company's stockholders' equity on January 1, 2009, and January 1, 2013, was as follows:

1/1/09 1/1/13 The difference between implied and book value is assigned to Sludge Company's land.

The difference between implied and book value is assigned to Sludge Company's land.

As a result of the sale, Pharma Company's Investment in Sludge account should be credited for

A)$110,000.

B)$137,500.

C)$80,000.

D)$95,000.

E)None of these.

On January 1, 2009, Pharma Company purchased 16,000 of the 20,000 outstanding common shares of Sludge Company for $760,000.On January 1, 2013, Pharma Company sold 2,000 of its shares of Sludge Company on the open market for $90 per share.Sludge Company's stockholders' equity on January 1, 2009, and January 1, 2013, was as follows:

1/1/09 1/1/13

The difference between implied and book value is assigned to Sludge Company's land.

The difference between implied and book value is assigned to Sludge Company's land.As a result of the sale, Pharma Company's Investment in Sludge account should be credited for

A)$110,000.

B)$137,500.

C)$80,000.

D)$95,000.

E)None of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

12

The purchase by a subsidiary of some of its shares from the noncontrolling stockholders results in an increase in the parent's percentage interest in the subsidiary.The parent company's share of the subsidiary's net assets will increase if the shares are purchased:

A)at a price equal to book value.

B)at a price below book value.

C)at a price above book value.

D)will not show an increase.

A)at a price equal to book value.

B)at a price below book value.

C)at a price above book value.

D)will not show an increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

13

P Corporation purchased an 80% interest in S Corporation on January 1, 2013, at book value for $300,000.S's net income for 2013 was $90,000 and no dividends were declared.On May 1, 2013, P reduced its interest in S by selling a 20% interest, or one-fourth of its investment for $90,000.What would be the balance in the Investment of S Corporation account on December 31, 2013?

A)$300,000.

B)$225,000.

C)$279,000.

D)$261,000.

A)$300,000.

B)$225,000.

C)$279,000.

D)$261,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

14

On January 1 2013, Paulus Company purchased 75% of Sweet Corporation for $500,000.Sweet' stockholders' equity on that date was equal to $600,000 and Sweet had 60,000 shares issued and outstanding on that date.Sweet Corporation sold an additional 15,000 shares of previously unissued stock on December 31, 2013.

AssumeAssuming that Paulus Company purchased the additional shares, what would be their current percentage ownership on December 31, 2013?

A)92%

B)87%

C)80%

D)100%

AssumeAssuming that Paulus Company purchased the additional shares, what would be their current percentage ownership on December 31, 2013?

A)92%

B)87%

C)80%

D)100%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

15

On January 1, 2013, P Corporation purchased 75% of S Corporation for $500,000.S's stockholders' equity on that date was equal to $600,000 and S had 40,000 shares issued and outstanding on that date.S Corporation sold an additional 8,000 shares of previously unissued stock on December 31, 2013.

Assume S sold the 8,000 shares to outside interests, P's percent ownership would be:

A)56 1/4%

B)62 1/2%

C)75%

D)79 1/6%

Assume S sold the 8,000 shares to outside interests, P's percent ownership would be:

A)56 1/4%

B)62 1/2%

C)75%

D)79 1/6%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

16

The computation of noncontrolling interest in net assets is made by multiplying the noncontrolling interest percentage at the

A)beginning of the year times subsidiary stockholders' equity amounts.

B)beginning of the year times consolidated stockholders' equity amounts.

C)end of the year times subsidiary stockholders' equity amounts.

D)end of the year times consolidated stockholders' equity amounts.

A)beginning of the year times subsidiary stockholders' equity amounts.

B)beginning of the year times consolidated stockholders' equity amounts.

C)end of the year times subsidiary stockholders' equity amounts.

D)end of the year times consolidated stockholders' equity amounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

17

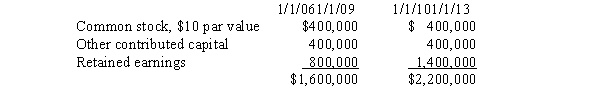

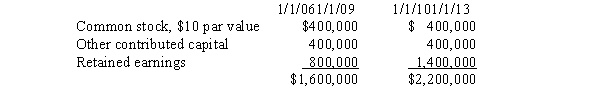

On January 1, 2009, Pine Corporation purchased 24,000 of the 30,000 outstanding common shares of Summit Company for $1,140,000.On January 1, 2013, Pine Corporation sold 3,000 of its shares of Summit Company on the open market for $90 per share.Summit Company's stockholders' equity on January 1, 2009, and January 1, 2013, was as follows:  The difference between implied and book value is assigned to Summit Company's land.As a result of the sale, Pine Corporation's Investment in Summit account should be credited for

The difference between implied and book value is assigned to Summit Company's land.As a result of the sale, Pine Corporation's Investment in Summit account should be credited for

A)$165,000.

B)$206,250.

C)$120,000.

D)$142,500.

E)None of these.

The difference between implied and book value is assigned to Summit Company's land.As a result of the sale, Pine Corporation's Investment in Summit account should be credited for

The difference between implied and book value is assigned to Summit Company's land.As a result of the sale, Pine Corporation's Investment in Summit account should be credited forA)$165,000.

B)$206,250.

C)$120,000.

D)$142,500.

E)None of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

18

On January 1 2013, Pounder Company purchased 75% of SludgeSmile Company for $500,000.SludgeSmile Company's stockholders' equity on that date was equal to $600,000 and SludgeSmile Company had 60,000 shares issued and outstanding on that date.SludgeSmile Company Corporation sold an additional 15,000 shares of previously unissued stock on December 31, 2013.

Assume SludgeSmile Company sold the 15,000 shares to outside interests, Pounder Company's percent ownership would be:

A)33 1/3%

B)60%

C)75%

D)80%

Assume SludgeSmile Company sold the 15,000 shares to outside interests, Pounder Company's percent ownership would be:

A)33 1/3%

B)60%

C)75%

D)80%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

19

On January 1, 2009, Parent Company purchased 32,000 of the 40,000 outstanding common shares of Sub Company for $1,520,000.On January 1, 2013, Parent Company sold 4,000 of its shares of Sub Company on the open market for $90 per share.Sub Company's stockholders' equity on January 1, 2009, and January 1, 2013, was as follows:  The difference between implied and book value is assigned to Sub Company's land.The amount of the gain on sale of the 4,000 shares that should be recorded on the books of Parent Company is

The difference between implied and book value is assigned to Sub Company's land.The amount of the gain on sale of the 4,000 shares that should be recorded on the books of Parent Company is

A)$68,000.

B)$170,000.

C)$96,000.

D)$200,000.

E)None of these.

The difference between implied and book value is assigned to Sub Company's land.The amount of the gain on sale of the 4,000 shares that should be recorded on the books of Parent Company is

The difference between implied and book value is assigned to Sub Company's land.The amount of the gain on sale of the 4,000 shares that should be recorded on the books of Parent Company isA)$68,000.

B)$170,000.

C)$96,000.

D)$200,000.

E)None of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

20

When the parent company sells a portion of its investment in a subsidiary, the workpaper entry to adjust for the current year's income sold to noncontrolling stockholders includes a

A)debit to Subsidiary Income Sold.

B)debit to Equity in Subsidiary Income.

C)credit to Equity in Subsidiary Income.

D)credit to Subsidiary Income Sold.

A)debit to Subsidiary Income Sold.

B)debit to Equity in Subsidiary Income.

C)credit to Equity in Subsidiary Income.

D)credit to Subsidiary Income Sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

21

Pamela Company acquired 80% of the outstanding common stock of Silt Company on January 1, 2011, for $396,000.At the date of purchase, Silt Company had a balance in its $2 par value common stock account of $360,000 and retained earnings of $90,000.On January 1, 2013, Silt Company issued 45,000 shares of its previously unissued stock to noncontrolling stockholders for $3 per share.On this date, Silt Company had a retained earnings balance of $152,000.The difference between cost and book value relates to subsidiary land.No dividends were paid in 2013.Silt Company reported income of $30,000 in 2013.

Required:

A.Prepare the journal entry on Pamela's books to record the effect of the issuance assuming the equity method.

B.Prepare the eliminating entries needed for the preparation of a consolidated statements workpaper on December 31, 2013, assuming the equity method.

Required:

A.Prepare the journal entry on Pamela's books to record the effect of the issuance assuming the equity method.

B.Prepare the eliminating entries needed for the preparation of a consolidated statements workpaper on December 31, 2013, assuming the equity method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

22

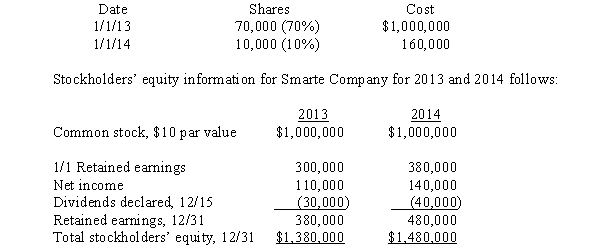

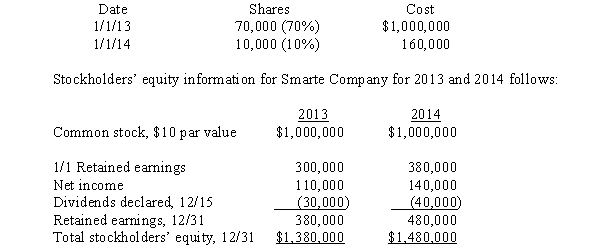

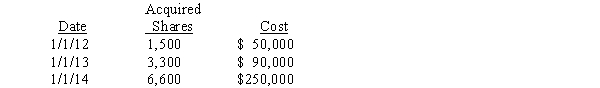

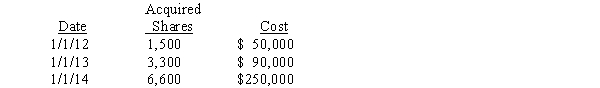

Poole made the following purchases of Smarte Company common stock:

On July 1, 2014, Poole sold 14,000 shares of Smarte Company common stock on the open market for $22 per share.The shares sold were purchased on January 1, 2013.Smarte notified Poole that its net income for the first six months was $70,000.Any difference between cost and book value relates to subsidiary land.Poole uses the cost method to account for its investment in Smarte Company.

Required:

A.Prepare the journal entry made by Poole to record the sale of the 14,000 shares on July 1, 2014.

B.Prepare the workpaper eliminating entries needed for a consolidated statements workpaper on December 31, 2014.

C.Compute the amount of noncontrolling interest that would be reported on the consolidated balance sheet on December 31, 2014.

On July 1, 2014, Poole sold 14,000 shares of Smarte Company common stock on the open market for $22 per share.The shares sold were purchased on January 1, 2013.Smarte notified Poole that its net income for the first six months was $70,000.Any difference between cost and book value relates to subsidiary land.Poole uses the cost method to account for its investment in Smarte Company.

Required:

A.Prepare the journal entry made by Poole to record the sale of the 14,000 shares on July 1, 2014.

B.Prepare the workpaper eliminating entries needed for a consolidated statements workpaper on December 31, 2014.

C.Compute the amount of noncontrolling interest that would be reported on the consolidated balance sheet on December 31, 2014.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

23

On January 1, 2011, Panel Company acquired 90% of the common stock of Singapore Company for $650,000.At that time, Singapore had common stock ($5 par) of $500,000 and retained earnings of $200,000.

On January 1, 2013, Singapore issued 20,000 shares of its unissued common stock, with a market value of $7 per share, to noncontrolling stockholders.Singapore's retained earnings balance on this date was $300,000.Any difference between cost and book value relates to Singapore's land.No dividends were declared in 2013.

Required:

A.Prepare the entry on Panel's books to record the effect of the issuance assuming the cost method.

B.Prepare the elimination entries for the preparation of a consolidated statements workpaper on December 31, 2013 assuming the cost method.

On January 1, 2013, Singapore issued 20,000 shares of its unissued common stock, with a market value of $7 per share, to noncontrolling stockholders.Singapore's retained earnings balance on this date was $300,000.Any difference between cost and book value relates to Singapore's land.No dividends were declared in 2013.

Required:

A.Prepare the entry on Panel's books to record the effect of the issuance assuming the cost method.

B.Prepare the elimination entries for the preparation of a consolidated statements workpaper on December 31, 2013 assuming the cost method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

24

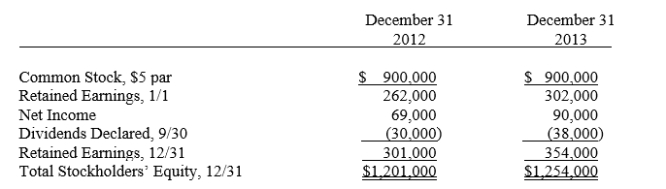

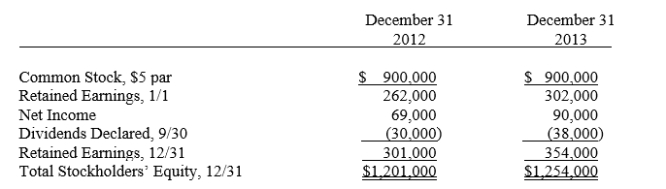

Partner Company acquired 85% of the common stock of Simplex Company in two separate cash transactions.The first purchase of 108,000 shares (60%) on January 1, 2012, cost $735,000.The second purchase, one year later, of 45,000 shares (25%) cost $330,000.Simplex Company's stockholders' equity was as follows:

On April 1, 2013, after a significant rise in the market price of Simplex Company's stock, Partner Company sold 32,400 of its Simplex Company shares for $390,000.Simplex Company notified Partner Company that its net income for the first three months was $22,000.The shares sold were identified as those obtained in the first purchase.Any difference between cost and book value relates to goodwill.Partner uses the partial equity method to account for its investment in Simplex Company.

Required:

A.Prepare the journal entries Partner Company will make on its books during 2012 and 2013 to account for its investment in Simplex Company.

B.Prepare the workpaper eliminating entries needed for a consolidated statements workpaper on December 31, 2013.

On April 1, 2013, after a significant rise in the market price of Simplex Company's stock, Partner Company sold 32,400 of its Simplex Company shares for $390,000.Simplex Company notified Partner Company that its net income for the first three months was $22,000.The shares sold were identified as those obtained in the first purchase.Any difference between cost and book value relates to goodwill.Partner uses the partial equity method to account for its investment in Simplex Company.

Required:

A.Prepare the journal entries Partner Company will make on its books during 2012 and 2013 to account for its investment in Simplex Company.

B.Prepare the workpaper eliminating entries needed for a consolidated statements workpaper on December 31, 2013.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

25

Pizza Company purchased Salt Company common stock through open-market purchases as follows:

Salt Company had 12,000 shares of $20 par value common stock outstanding during the entire period.Salt had the following retained earnings balances on the relevant dates:

Salt Company declared no dividends in 2012 or 2013 but did declare $60,000 of dividends in 2014.Any difference between cost and book value is assigned to subsidiary land.Pizza uses the equity method to account for its investment in Salt.

Required:

A.Prepare the journal entries Pizza Company will make during 2013 and 2014 to account for its investment in Salt Company.

B.Prepare workpaper eliminating entries necessary to prepare a consolidated statements workpaper on December 31, 2014.

Salt Company had 12,000 shares of $20 par value common stock outstanding during the entire period.Salt had the following retained earnings balances on the relevant dates:

Salt Company declared no dividends in 2012 or 2013 but did declare $60,000 of dividends in 2014.Any difference between cost and book value is assigned to subsidiary land.Pizza uses the equity method to account for its investment in Salt.

Required:

A.Prepare the journal entries Pizza Company will make during 2013 and 2014 to account for its investment in Salt Company.

B.Prepare workpaper eliminating entries necessary to prepare a consolidated statements workpaper on December 31, 2014.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

26

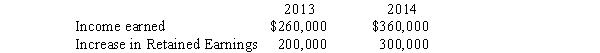

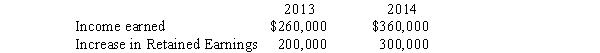

Pratt Company purchased 40,000 shares of Silas Company's common stock for $860,000 on January 1, 2013.At that time Silas Company had $500,000 of $10 par value common stock and $300,000 of retained earnings.Silas Company's income earned and increase in retained earnings during 2013 and 2014 were:

Silas Company income is earned evenly throughout the year.

On September 1, 2014, Pratt Company sold on the open market, 12,000 shares of its Silas Company stock for $460,000.Any difference between cost and book value relates to Silas Company land.Pratt Company uses the cost method to account for its investment in Silas Company.

Required:

A.Compute Pratt Company's reported gain (loss) on the sale.

B.Prepare all consolidated statements workpaper eliminating entries for a workpaper on December 31, 2014.

Silas Company income is earned evenly throughout the year.

On September 1, 2014, Pratt Company sold on the open market, 12,000 shares of its Silas Company stock for $460,000.Any difference between cost and book value relates to Silas Company land.Pratt Company uses the cost method to account for its investment in Silas Company.

Required:

A.Compute Pratt Company's reported gain (loss) on the sale.

B.Prepare all consolidated statements workpaper eliminating entries for a workpaper on December 31, 2014.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

27

P Company purchased 96,000 shares of the common stock of S Company for $1,200,000 on January 1, 2010, when S's stockholders' equity consisted of $5 par value, Common Stock at $600,000 and Retained Earnings of $800,000.The difference between cost and book value relates to goodwill.

On January 2, 2013, S Company purchased 20,000 of its own shares from noncontrolling interests for cash of $300,000 to be held as treasury stock.S Company's retained earnings had increased to $1,000,000 by January 2, 2013.S Company uses the cost method in regards to its treasury stock and P Company uses the equity method to account for its investment in S Company.

Required:

Prepare all determinable workpaper entries for the preparation of consolidated statements on December 31, 2013.

On January 2, 2013, S Company purchased 20,000 of its own shares from noncontrolling interests for cash of $300,000 to be held as treasury stock.S Company's retained earnings had increased to $1,000,000 by January 2, 2013.S Company uses the cost method in regards to its treasury stock and P Company uses the equity method to account for its investment in S Company.

Required:

Prepare all determinable workpaper entries for the preparation of consolidated statements on December 31, 2013.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck