Deck 22: Analyzing Financial Statements

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/121

العب

ملء الشاشة (f)

Deck 22: Analyzing Financial Statements

1

A common-size comparative statement shows:

A)percents.

B)dollar increases/decreases.

C)whole dollar amounts.

D)None of the above

A)percents.

B)dollar increases/decreases.

C)whole dollar amounts.

D)None of the above

A

2

The revenue of Carol's Environmental Services for Years 1,2,and 3 are $40,000,$60,000 and $80,000,respectively.Year 1 is the base year.The trend percentage for Year 3 is:

A)50%.

B)150%.

C)200%.

D)133%.

A)50%.

B)150%.

C)200%.

D)133%.

C

3

A statement presenting data from two or more consecutive periods is called a:

A)comparative statement.

B)compromising statement.

C)common-size statement.

D)Both A and C

A)comparative statement.

B)compromising statement.

C)common-size statement.

D)Both A and C

A

4

For vertical analysis purposes,a base item on a balance sheet is:

A)total assets.

B)total equity.

C)total liabilities.

D)net equity.

A)total assets.

B)total equity.

C)total liabilities.

D)net equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

5

If total assets are $10,000,what is the vertical analysis for Cash when it has a balance of $6,000?

A)40%

B)60%

C)250%

D)25%

A)40%

B)60%

C)250%

D)25%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

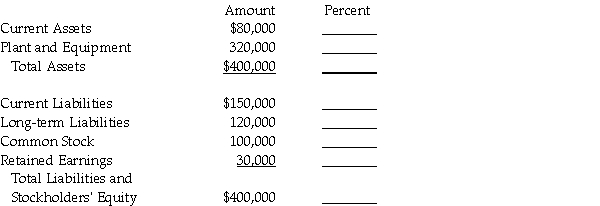

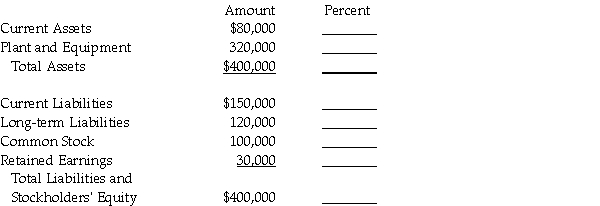

6

From the following balance sheet for Bricks Corporation,compute the common-size balance sheet amounts.(Round all percentages to nearest tenth of a percent. )

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

7

If current assets were $88,000 in 20X7 and $100,000 in 20X8,what was the amount of increase or decrease? (Round to nearest percent. )

A)The percentage increase is 14%.

B)The percentage decrease is 12%.

C)The percentage decrease is 14%.

D)The percentage increase is 12%.

A)The percentage increase is 14%.

B)The percentage decrease is 12%.

C)The percentage decrease is 14%.

D)The percentage increase is 12%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

8

In a common-size income statement,advertising expenses are 10%.This means that they are 10% of:

A)net income.

B)net sales.

C)gross profit.

D)net profit.

A)net income.

B)net sales.

C)gross profit.

D)net profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

9

To find the percent of increase or decrease of an item in a comparative balance sheet you use the formula: % change = amount of change/base (new year).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

10

What was the percentage of decrease in the Accounts Receivable account if the receivables were $80,000 in Year 1,and $60,000 in Year 2?

A)(25%)

B)33.33%

C)(33.33%)

D)25%

A)(25%)

B)33.33%

C)(33.33%)

D)25%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

11

For vertical analysis purposes,the base item on an income statement is:

A)net income.

B)net sales.

C)total expenses.

D)total sales.

A)net income.

B)net sales.

C)total expenses.

D)total sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

12

The sales of Mary's Services for Years 1,2,and 3 are $25,000,$45,000,$60,000,respectively.The trend percentage for Year 3 is:

A)42%.

B)240%.

C)180%.

D)58%.

A)42%.

B)240%.

C)180%.

D)58%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

13

Statements that are often used to compare similar businesses are called:

A)comparative analysis.

B)vertical analysis.

C)horizontal analysis.

D)common-size statements.

A)comparative analysis.

B)vertical analysis.

C)horizontal analysis.

D)common-size statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which analysis deals with comparing items in a financial report by expressing each item as a percentage of a certain base total?

A)Vertical analysis

B)Ratio analysis

C)Trend analysis

D)Common-size statement

A)Vertical analysis

B)Ratio analysis

C)Trend analysis

D)Common-size statement

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

15

Comparative reports in which each item is expressed as a percentage of a base amount without dollar amounts are called:

A)comparative financial statements.

B)common-size statements.

C)cash flow analysis.

D)horizontal analysis.

A)comparative financial statements.

B)common-size statements.

C)cash flow analysis.

D)horizontal analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

16

If Cash is $1,595 in 20X2 and $3,671 in 20X1,what is the percent of increase or (decrease)from 20X1 to 20X2?

A)56.55%

B)(56.55%)

C)36.12%

D)(36.12%)

A)56.55%

B)(56.55%)

C)36.12%

D)(36.12%)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

17

In a comparative balance sheet,the ending Cash for 2015 was $315,000 and is $262,395 for 2016.The net increase or decrease from 2015 to 2016 is:

A)86.0%.

B)14.3%.

C)26.4%.

D)(16.7%).

A)86.0%.

B)14.3%.

C)26.4%.

D)(16.7%).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

18

For trend analysis to work correctly,the accountant should divide the item in one year by the:

A)beginning percentage.

B)base year total.

C)current year total.

D)horizontal analysis.

A)beginning percentage.

B)base year total.

C)current year total.

D)horizontal analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

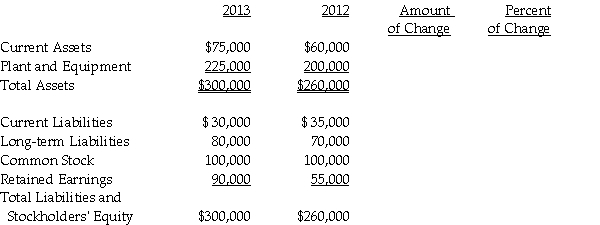

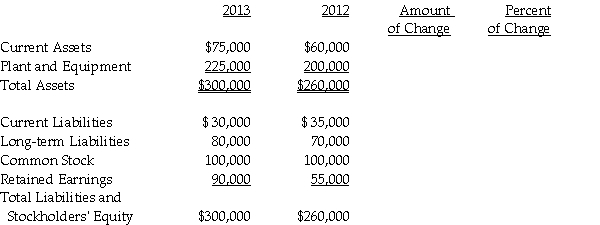

19

Complete the horizontal analysis of Soopy's Used Cars.(Round all percentages to the nearest tenth of a percent. )

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

20

Net income was $60,000 in Year 1 and $45,000 in Year 2.The percentage increase or decrease in net income was:

A)33.33%.

B)133.33%.

C)(25%).

D)(33.33%).

A)33.33%.

B)133.33%.

C)(25%).

D)(33.33%).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

21

The current ratio determines the ability of a company to:

A)pay off all payables.

B)pay off current payables.

C)manage its ability to earn profit.

D)use its equity.

A)pay off all payables.

B)pay off current payables.

C)manage its ability to earn profit.

D)use its equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

22

Smith Company has the following account balances:

Calculate Smith Company's current ratio.

A)8)0

B)7)6

C)2)0

D)16.0

Calculate Smith Company's current ratio.

A)8)0

B)7)6

C)2)0

D)16.0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

23

An acid test (quick)ratio of 0.75 to 1 would indicate:

A)a ratio that would not allow a company to pay off all current liabilities with quick assets.

B)for every $0.75 of short-term debt there is $1.00 of quick assets to meet short-term obligations.

C)for every $1 of current assets there is $0.75 of short-term debt.

D)Both A and B are correct.

A)a ratio that would not allow a company to pay off all current liabilities with quick assets.

B)for every $0.75 of short-term debt there is $1.00 of quick assets to meet short-term obligations.

C)for every $1 of current assets there is $0.75 of short-term debt.

D)Both A and B are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

24

The ratios that measure a company's ability to earn profits are known as.

A)Liquidity Ratios.

B)Debt Management Ratios.

C)Profitability Ratios.

D)None of the above

A)Liquidity Ratios.

B)Debt Management Ratios.

C)Profitability Ratios.

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

25

The ratios that measure a company's ability to pay off short-term debt are known as:

A)Liquidity Ratios.

B)Debt Management Ratios.

C)Profitability Ratios.

D)None of the above

A)Liquidity Ratios.

B)Debt Management Ratios.

C)Profitability Ratios.

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

26

Define two types of comparative income statements and compare the information provided by them.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

27

The current ratio is:

A)quick assets divided by current liabilities.

B)assets divided by liabilities.

C)current assets divided by current liabilities.

D)net sales divided by current liabilities.

A)quick assets divided by current liabilities.

B)assets divided by liabilities.

C)current assets divided by current liabilities.

D)net sales divided by current liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

28

Common-size statements deal with the percentage of change in a certain item over several years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

29

The current ratio for a company with current assets of $120,000,current liabilities of $50,000,total assets of $150,000,and net sales of $80,000,would be:

A)3)0.

B)0)416.

C)2)4.

D)0)333.

A)3)0.

B)0)416.

C)2)4.

D)0)333.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

30

Common-size statements are used to compare companies of the same size.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

31

Using just a base year and one additional year is not sufficient to do a long-term trend analysis of accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

32

A type of analysis that compares each item with the same item in other periods is called horizontal analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

33

The ratios that measures a company's mix of debt and equity financing are known as:

A)Liquidity Ratios.

B)Debt Management Ratios.

C)Profitability Ratios.

D)None of the above

A)Liquidity Ratios.

B)Debt Management Ratios.

C)Profitability Ratios.

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

34

An accountant is completing a trend analysis for a company by comparing sales for years 2003 through 2013.The base year for the calculations is 2003.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which statement below best describes the quick (acid test)ratio?

A)The acid test ratio considers only the most liquid assets: cash,accounts receivable,and temporary investments.

B)The current ratio includes only the assets most easily converted into cash.

C)The acid test adds merchandise inventory and prepaid expenses in the computation of current assets.

D)None of these answers is correct.

A)The acid test ratio considers only the most liquid assets: cash,accounts receivable,and temporary investments.

B)The current ratio includes only the assets most easily converted into cash.

C)The acid test adds merchandise inventory and prepaid expenses in the computation of current assets.

D)None of these answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

36

If Rick's sales increased from $40,000 to $80,000 and its cost of goods sold increased from $25,000 to $60,000,then vertical analysis based on sales would show the following for cost of goods sold for the two periods:

A)75% and 62.5%.

B)62.5% and 75%

C)133.33% and 160%

D)160% and 133.33%.

A)75% and 62.5%.

B)62.5% and 75%

C)133.33% and 160%

D)160% and 133.33%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

37

An expression of the amount of each item in a statement shown as a percentage of some designated total for purposes of comparison is called:

A)horizontal analysis.

B)earnings per share analysis.

C)return on total assets.

D)vertical analysis.

A)horizontal analysis.

B)earnings per share analysis.

C)return on total assets.

D)vertical analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

38

If Cara's Piano sales increased from $40,000 to $60,000 and its cost of goods sold decreased from $24,000 to $12,000,then vertical analysis based on sales would show the following for cost of goods sold (rounded to the nearest percent):

A)60% and 20%.

B)10% and 30%.

C)50% and 67%.

D)67% and 40%.

A)60% and 20%.

B)10% and 30%.

C)50% and 67%.

D)67% and 40%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

39

A form of analysis in which each item on a report is shown as a percent of net sales is called a horizontal analysis of the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

40

If Rick's sales decreased from $90,000 (year 1)to $45,000 (year 2)and its cost of goods sold decreased from $40,000 (year 1)to $15,000 (year 2),then vertical analysis based on sales would show the following for cost of goods sold for the two periods:

A)33.33% and 44.44%.

B)44.44% and 33.33%.

C)300% and 225%.

D)None of the above

A)33.33% and 44.44%.

B)44.44% and 33.33%.

C)300% and 225%.

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

41

If management wishes to measure a business's ability to pay upcoming debts,they could refer to measures for:

A)leverage.

B)liquidity.

C)debt management.

D)profitability.

A)leverage.

B)liquidity.

C)debt management.

D)profitability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

42

With a beginning Accounts Receivable balance of $40,000,an ending balance of $100,000,and net credit sales of $600,000,compute accounts receivable turnover ratio (rounded to the nearest tenth).

A)7)6

B)11.4

C)8)57

D)3)8

A)7)6

B)11.4

C)8)57

D)3)8

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

43

The ratio that indicates how many days it takes to turn accounts receivable into cash is the:

A)accounts receivable turnover ratio.

B)average turnover ratio.

C)average collection period.

D)quick assets turnover ratio.

A)accounts receivable turnover ratio.

B)average turnover ratio.

C)average collection period.

D)quick assets turnover ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

44

With a beginning Accounts Receivable balance of $30,000,an ending balance of $46,000,and net credit sales of $480,000,compute accounts receivable turnover ratio.

A)0)08

B)12.63

C)16.0

D)10.43

A)0)08

B)12.63

C)16.0

D)10.43

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

45

If the average collection period is 35 days,this means:

A)from the date of purchase to the date of payment is 35 days.

B)from the date of sale to the date of receipt of payment is 35 days.

C)from the date of discount to the date of receipt of payment is 35 days.

D)None of these answers is correct.

A)from the date of purchase to the date of payment is 35 days.

B)from the date of sale to the date of receipt of payment is 35 days.

C)from the date of discount to the date of receipt of payment is 35 days.

D)None of these answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

46

If beginning and ending inventories are $20,000 and $30,000,respectively,and cost of goods sold is $450,000,what is the inventory turnover ratio?

A)18

B)16

C)15.5

D)15

A)18

B)16

C)15.5

D)15

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

47

If management wishes to evaluate the ability of a business to use sales to cover the operating expenses,they could use the:

A)rate of return on total assets.

B)rate of return on common stockholders' equity.

C)gross profit rate.

D)times interest earned.

A)rate of return on total assets.

B)rate of return on common stockholders' equity.

C)gross profit rate.

D)times interest earned.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

48

A company has $50,000 in cash,$15,000 in accounts receivable,$25,000 in temporary investments and $125,000 in merchandise inventory.The company has $50,000 in current liabilities.The company's acid test (quick)ratio is:

A)1)30.

B)0)526.

C)4)30.

D)1)80.

A)1)30.

B)0)526.

C)4)30.

D)1)80.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

49

If management wishes to determine the average degree of delinquency of the charge customers,they could use the:

A)rate of return on total assets.

B)rate of return on common stockholders' equity.

C)accounts receivable turnover.

D)quick (acid test)ratio.

A)rate of return on total assets.

B)rate of return on common stockholders' equity.

C)accounts receivable turnover.

D)quick (acid test)ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

50

If management wishes to know how well the inventory is moving for a business,they could use the:

A)accounts receivable turnover.

B)inventory turnover.

C)acid test ratio.

D)current ratio.

A)accounts receivable turnover.

B)inventory turnover.

C)acid test ratio.

D)current ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

51

If management wishes to measure how effectively the assets were used in generating a profit,they could use the:

A)rate of return on total assets.

B)rate of return on common stockholders' equity.

C)return on sales.

D)times interest earned.

A)rate of return on total assets.

B)rate of return on common stockholders' equity.

C)return on sales.

D)times interest earned.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

52

If management wishes to know how long it takes to collect from a charge customer,they could use the:

A)rate of return on total assets.

B)average collection period.

C)acid test ratio.

D)current ratio.

A)rate of return on total assets.

B)average collection period.

C)acid test ratio.

D)current ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

53

The inventory turnover ratio calculates:

A)how many times the inventory turns over in one period.

B)number of times inventory is purchased in one period.

C)the dollar amount of change in inventory in one period.

D)None of these answers is correct.

A)how many times the inventory turns over in one period.

B)number of times inventory is purchased in one period.

C)the dollar amount of change in inventory in one period.

D)None of these answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

54

Chuck Company has a beginning Accounts Receivable balance of $85,000 and an ending balance of $50,000.Net credit sales are $300,000.The company's accounts receivable turnover ratio is:

A)4)444.

B)4)167.

C)4)000.

D)None of the above

A)4)444.

B)4)167.

C)4)000.

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

55

If management wishes to evaluate the amount of assets which were financed by creditors,they could use the:

A)debt to total assets.

B)rate of return on common stockholders' equity.

C)debt to total liabilities.

D)times interest earned.

A)debt to total assets.

B)rate of return on common stockholders' equity.

C)debt to total liabilities.

D)times interest earned.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

56

Carla's Fashions has an average collection period of 30 days.You could infer that Carla's Fashions:

A)bills her customers semi-monthly.

B)bills her customers quarterly.

C)has an accounts receivable turnover of approximately 12.

D)Both A and C can be inferred.

A)bills her customers semi-monthly.

B)bills her customers quarterly.

C)has an accounts receivable turnover of approximately 12.

D)Both A and C can be inferred.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

57

If management wishes to evaluate how effectively the assets of a business are being used,they could use the:

A)asset turnover.

B)rate of return on common stockholders' equity.

C)acid test ratio.

D)debt to total stockholders' equity.

A)asset turnover.

B)rate of return on common stockholders' equity.

C)acid test ratio.

D)debt to total stockholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

58

If management wishes to know the ability to pay off the current debts of a business,they could use the:

A)debt to total assets.

B)current ratio.

C)inventory turnover ratio.

D)times interest earned.

A)debt to total assets.

B)current ratio.

C)inventory turnover ratio.

D)times interest earned.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

59

Scott Company had a current ratio of 2.57:1 in Year 1 and 2.76:1 in Year 2.This change in current ratio indicates:

A)the company's debt paying ability has improved.

B)the company's debt paying ability has weakened.

C)the company's customers are paying their accounts sooner.

D)the company is able to sell its inventory faster.

A)the company's debt paying ability has improved.

B)the company's debt paying ability has weakened.

C)the company's customers are paying their accounts sooner.

D)the company is able to sell its inventory faster.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

60

If beginning and ending inventories are $175,000 and $125,000,respectively,and the cost of goods sold is $450,000,what is the inventory turnover ratio?

A)4)50

B)3)00

C)3)60

D)0)28

A)4)50

B)3)00

C)3)60

D)0)28

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

61

What is Jane's rate of return on total assets if total assets are $125,000,net income is $2,000,interest expense is $1,600,and income tax is $3,000?

A)4)66%

B)5)28%

C)5)65%

D)2)33%

A)4)66%

B)5)28%

C)5)65%

D)2)33%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

62

What is the inventory turnover if the beginning inventory was $75,000,cost of goods sold was $300,000,and ending inventory was $65,000?

A)6)4 times

B)4)3 times

C)3)8 times

D)None of the above

A)6)4 times

B)4)3 times

C)3)8 times

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

63

What is George's gross profit rate if net sales are $100,000,operating expenses are $25,000,and cost of goods sold is $60,000?

A)40.0%

B)25.0%

C)35.0%

D)60.0%

A)40.0%

B)25.0%

C)35.0%

D)60.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

64

The ratio that indicates how much profit is generated from each sales dollar to cover general and selling expenses is:

A)gross profit rate.

B)return on sales.

C)rate of return on total assets.

D)rate of return on common stockholders' equity.

A)gross profit rate.

B)return on sales.

C)rate of return on total assets.

D)rate of return on common stockholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

65

Accounts receivable on January 1 was $30,000 and,at the end of the year it was $50,000.Net credit sales were $160,000.Accounts receivable turnover is:

A)2 times.

B)4 times.

C)5 times.

D)6)67 times.

A)2 times.

B)4 times.

C)5 times.

D)6)67 times.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

66

Which of the following ratios helps evaluate how well a company is earning profit for the common stockholders?

A)Times interest earned ratio

B)Return on sales ratio

C)Return on total assets

D)Rate of return on common stockholders' equity

A)Times interest earned ratio

B)Return on sales ratio

C)Return on total assets

D)Rate of return on common stockholders' equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

67

Saxon Corporation's beginning inventory was $15,000.The cost of goods sold was $350,000 for the year,with an ending inventory of $20,000.Inventory turnover for the year is:

A)20 times.

B)10 times.

C)11.67 times.

D)8)75 times.

A)20 times.

B)10 times.

C)11.67 times.

D)8)75 times.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

68

Asset management ratios measure:

A)a company's ability to earn a profit.

B)a company's ability to meet short-term obligations.

C)how well a company is using debt versus equity.

D)how effectively a company is using its assets.

A)a company's ability to earn a profit.

B)a company's ability to meet short-term obligations.

C)how well a company is using debt versus equity.

D)how effectively a company is using its assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

69

Which of the following ratios measures the earnings of a company on each sales dollar?

A)Return on assets

B)Return on sales

C)Return on inventory

D)Return on stockholders' equity

A)Return on assets

B)Return on sales

C)Return on inventory

D)Return on stockholders' equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

70

The risk of creditors in relation to the risk taken by stockholders is measured by:

A)debt to stockholders' equity ratio.

B)gross profit ratio.

C)rate of return to stockholders.

D)None of these answers is correct.

A)debt to stockholders' equity ratio.

B)gross profit ratio.

C)rate of return to stockholders.

D)None of these answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

71

If current assets are $80,000 and current liabilities are $45,000,the current ratio is:

A)1:1.

B)0)77:1.

C)1)78:1.

D)1)2:1

A)1:1.

B)0)77:1.

C)1)78:1.

D)1)2:1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

72

Interest expense was $10,000,income tax expense $20,000,and net income after taxes is $40,000.The number of times interest was earned is:

A)9 times.

B)8 times.

C)7 times.

D)6 times.

A)9 times.

B)8 times.

C)7 times.

D)6 times.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

73

If current assets were $140,000,merchandise inventory was $50,000,and current liabilities were $15,000,the acid test ratio is:

A)6:1.

B)4:1.

C)2:1.

D)1:2.

A)6:1.

B)4:1.

C)2:1.

D)1:2.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

74

If current assets are $60,000 and current liabilities are $10,000,the current ratio is:

A)5:1.

B)6:1.

C)0)6:1.

D)None of the above.

A)5:1.

B)6:1.

C)0)6:1.

D)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

75

Compute the gross profit rate when net sales are $350,000 and gross profits are $189,000.

A)51:10

B)54%

C)51%

D)54:10

A)51:10

B)54%

C)51%

D)54:10

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

76

The ratio that measures the productivity of total assets used is the:

A)rate of return on total assets.

B)return on sales.

C)inventory turnover.

D)rate of return on common stockholders' equity.

A)rate of return on total assets.

B)return on sales.

C)inventory turnover.

D)rate of return on common stockholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

77

Compute the gross profit rate when sales are $500,000;net sales are $450,000 and gross profits are $100,000.

A)22.22%

B)20.00%

C)0)2222 to 1

D)0)2000 to 1

A)22.22%

B)20.00%

C)0)2222 to 1

D)0)2000 to 1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

78

The ratio that indicates the amount of assets that are financed by creditors is:

A)debt to stockholders' equity.

B)debt to total retained earnings ratio.

C)debts to total assets ratio.

D)None of the above

A)debt to stockholders' equity.

B)debt to total retained earnings ratio.

C)debts to total assets ratio.

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

79

The higher the times interest earned ratio,the more likely:

A)a default in payment will occur.

B)a business needs to borrow money.

C)a business will suffer a loss.

D)interest payments can be made.

A)a default in payment will occur.

B)a business needs to borrow money.

C)a business will suffer a loss.

D)interest payments can be made.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

80

Noble Company's accounts receivable turnover was 24.6 in Year 1 and 18.2 in Year 2.This change in accounts receivable turnover indicates:

A)the company is not selling its inventory as fast.

B)the company is selling its inventory faster.

C)the company's customers are paying faster.

D)the company's customers are paying slower.

A)the company is not selling its inventory as fast.

B)the company is selling its inventory faster.

C)the company's customers are paying faster.

D)the company's customers are paying slower.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck