Deck 9: Sales and Cash Receipts

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

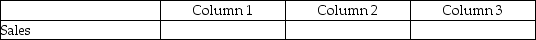

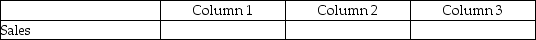

سؤال

سؤال

سؤال

سؤال

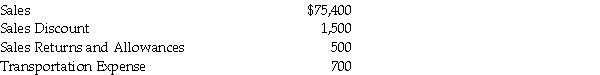

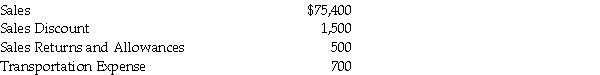

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/125

العب

ملء الشاشة (f)

Deck 9: Sales and Cash Receipts

1

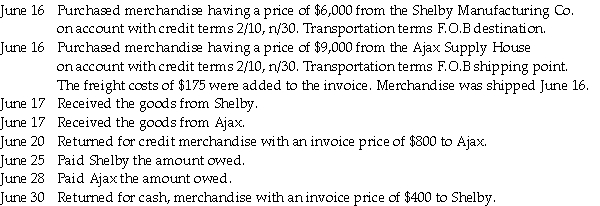

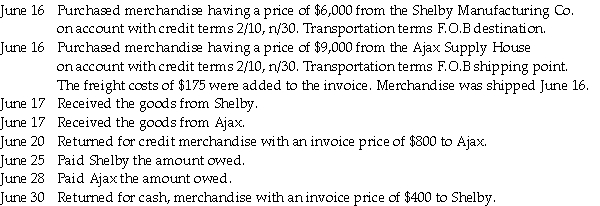

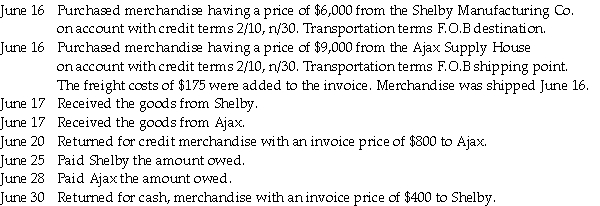

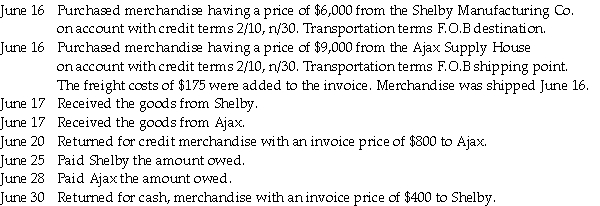

The Bixby Co.had the following transactions involving the purchase of merchandise.Prepare the necessary general journal entries.Any applicable freight costs are prepaid by the seller.The perpetual inventory method is in use.

Merchants who buy goods from wholesalers for resale to customers are:

A)merchandisers.

B)retailers.

C)service companies.

D)None of the above is correct.

Merchants who buy goods from wholesalers for resale to customers are:

A)merchandisers.

B)retailers.

C)service companies.

D)None of the above is correct.

B

2

Santa Materials sold goods for $2,000 plus 2% sales tax to a charge customer,terms n/30.Which entry is required to record this transaction?

A)Debit Accounts Receivable $2,040;credit Sales Tax Payable $140;credit Sales $2,000

B)Debit Cash $2,000;credit Sales $2,000

C)Debit Accounts Receivable $2,000;credit Sales $2,000

D)Debit Accounts Receivable $2,040;credit Sales $2,040

A)Debit Accounts Receivable $2,040;credit Sales Tax Payable $140;credit Sales $2,000

B)Debit Cash $2,000;credit Sales $2,000

C)Debit Accounts Receivable $2,000;credit Sales $2,000

D)Debit Accounts Receivable $2,040;credit Sales $2,040

A

3

A contra-revenue account with a debit balance for returned goods is called:

A)Sales Returns and Allowances.

B)Sales Discount.

C)the credit period.

D)the discount period.

A)Sales Returns and Allowances.

B)Sales Discount.

C)the credit period.

D)the discount period.

A

4

The side that increases the balance of the Sales Discount account is:

A)a credit.

B)a debit.

C)zero.

D)It does not have a normal balance.

A)a credit.

B)a debit.

C)zero.

D)It does not have a normal balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

5

The normal balance of the Sales Returns and Allowances account is:

A)a credit.

B)a debit.

C)zero.

D)It does not have a normal balance.

A)a credit.

B)a debit.

C)zero.

D)It does not have a normal balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

6

Betsy's pottery sold 200 tiles at $25.00 each to a charge customer,terms 1/10,n/30.Which entry is required to record this transaction?

A)Debit Cash $5,000;credit Tile Sales $5,000

B)Debit Accounts Payable $4,050;credit Tile Sales $4,050

C)Debit Accounts Receivable $4,050;debit Sales Discount $50.00;credit Tile Sales $5,000

D)Debit Accounts Receivable $5,000;credit Tile Sales $5,000

A)Debit Cash $5,000;credit Tile Sales $5,000

B)Debit Accounts Payable $4,050;credit Tile Sales $4,050

C)Debit Accounts Receivable $4,050;debit Sales Discount $50.00;credit Tile Sales $5,000

D)Debit Accounts Receivable $5,000;credit Tile Sales $5,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

7

The length of time the customer is allowed to repay the bill is the:

A)discount period.

B)short period.

C)credit period.

D)due date.

A)discount period.

B)short period.

C)credit period.

D)due date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

8

Maria's Blankets and Bedding had a sale of $450 to a charge customer,terms 1/15,n/30.Maria should record this transaction as follows:

A)debit Accounts Receivable $450;credit Sales $450.

B)debit Cash $450;credit Sales $450.

C)debit Accounts Receivable $346.50;debit Sales Discounts $4.50;credit Sales $450.

D)debit Sales $450;credit Accounts Receivable $450.

A)debit Accounts Receivable $450;credit Sales $450.

B)debit Cash $450;credit Sales $450.

C)debit Accounts Receivable $346.50;debit Sales Discounts $4.50;credit Sales $450.

D)debit Sales $450;credit Accounts Receivable $450.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

9

Home Restoration reports net sales of $60,000.If sales returns and allowances are $10,000 and sales discounts are $1,500,what are gross sales?

A)$60,000

B)$71,500

C)$68,500

D)$38,500

A)$60,000

B)$71,500

C)$68,500

D)$38,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

10

B&B Lumber reports gross sales of $80,000.If sales returns and allowances are $20,000 and sales discounts are $3,000,what are the net sales?

A)$83,000

B)$63,000

C)$57,000

D)$70,000

A)$83,000

B)$63,000

C)$57,000

D)$70,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

11

A characteristic of the account,Sales Discount,includes the following except for:

A)debit balance.

B)contra-revenue account.

C)records the cash discounts granted to customers.

D)contra-asset.

A)debit balance.

B)contra-revenue account.

C)records the cash discounts granted to customers.

D)contra-asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

12

The liability account used to record sales tax owed is:

A)Sales Tax Expense.

B)Prepaid Taxes.

C)Sales Tax Payable.

D)Sales.

A)Sales Tax Expense.

B)Prepaid Taxes.

C)Sales Tax Payable.

D)Sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

13

Gross sales equals:

A)net sales minus sales discount.

B)sales discount less net income.

C)the total of cash sales and credit sales.

D)supplies minus inventory.

A)net sales minus sales discount.

B)sales discount less net income.

C)the total of cash sales and credit sales.

D)supplies minus inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

14

The time frame when customers are allowed to pay their bills and still be eligible for a discount is the:

A)credit period.

B)discount period.

C)short period.

D)due date.

A)credit period.

B)discount period.

C)short period.

D)due date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

15

Sales Tax Payable is a:

A)liability account with a debit balance.

B)liability account with a credit balance.

C)contra-asset account with a debit balance.

D)contra-asset account with a credit balance.

A)liability account with a debit balance.

B)liability account with a credit balance.

C)contra-asset account with a debit balance.

D)contra-asset account with a credit balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

16

A characteristic of Sales Returns and Allowances is that:

A)it has a debit balance.

B)it tracks returns from customers.

C)it is a contra-revenue account.

D)All of these answers are correct.

A)it has a debit balance.

B)it tracks returns from customers.

C)it is a contra-revenue account.

D)All of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

17

Credit terms of 2/10,n/30 mean that:

A)a 2% discount is allowed if the bill is paid within between 10 and 30 days.

B)a 2% discount is allowed if the bill is paid within 30 days.

C)a 2% discount is allowed if the bill is paid after 10 days.

D)a 2% discount is allowed if the customer pays the bill within 10 days,or the entry amount is due within 30 days.

A)a 2% discount is allowed if the bill is paid within between 10 and 30 days.

B)a 2% discount is allowed if the bill is paid within 30 days.

C)a 2% discount is allowed if the bill is paid after 10 days.

D)a 2% discount is allowed if the customer pays the bill within 10 days,or the entry amount is due within 30 days.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

18

Net sales equal:

A)gross sales.

B)gross sales - sales returns and allowances.

C)gross sales - sales returns and allowances - sales discounts.

D)gross sales - gross profit.

A)gross sales.

B)gross sales - sales returns and allowances.

C)gross sales - sales returns and allowances - sales discounts.

D)gross sales - gross profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

19

The Bixby Co.had the following transactions involving the purchase of merchandise.Prepare the necessary general journal entries.Any applicable freight costs are prepaid by the seller.The perpetual inventory method is in use.

Merchandise is:

A)the same as inventory.

B)an asset.

C)the same as supplies.

D)Both A and B are correct.

Merchandise is:

A)the same as inventory.

B)an asset.

C)the same as supplies.

D)Both A and B are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

20

Reduction given to company customers for early payment is a:

A)sales returns and allowance.

B)purchase discount.

C)sales discount.

D)customer discount.

A)sales returns and allowance.

B)purchase discount.

C)sales discount.

D)customer discount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

21

The arrangements between buyer and seller as to when payments for merchandise are to be made are called:

A)credit terms.

B)net cash.

C)cash on demand.

D)discount period.

A)credit terms.

B)net cash.

C)cash on demand.

D)discount period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

22

Mike returned $200 of merchandise to Secret Trails.His original purchase was Mike 400,with terms 1/10,n/30.If Justin pays the balance of his account after the discount period,how much should he pay?

A)$204.00

B)$196.00

C)$200.00

D)$400.00

A)$204.00

B)$196.00

C)$200.00

D)$400.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

23

If management wanted to determine if customers were returning goods at a higher rate than usual,it could use the Sales Returns and Allowances account to analyze the information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

24

Net Sales equals Gross Sales - Sales Returns and Allowances - Accounts Receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

25

Customer returned merchandise for credit.This will be recorded with:

A)a debit to an asset account.

B)a debit to a revenue account.

C)a credit to an asset account.

D)None of these is correct.

A)a debit to an asset account.

B)a debit to a revenue account.

C)a credit to an asset account.

D)None of these is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

26

A wholesale customer returned merchandise having already paid for it within the cash discount period.The return will be recorded with:

A)a credit to an asset account.

B)a credit to a liability account.

C)a credit to Capital.

D)None of these is correct.

A)a credit to an asset account.

B)a credit to a liability account.

C)a credit to Capital.

D)None of these is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

27

The contra-revenue accounts include:

A)Sales Tax Payable.

B)Sales Returns and Allowances.

C)Sales Discount.

D)Both B and C are correct.

A)Sales Tax Payable.

B)Sales Returns and Allowances.

C)Sales Discount.

D)Both B and C are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

28

Max's Art studio was moving and sold furniture that was no longer needed for cash.The entry would include:

A)a credit to Sales.

B)a debit to Sales.

C)a credit to Furniture.

D)a credit to Cash.

A)a credit to Sales.

B)a debit to Sales.

C)a credit to Furniture.

D)a credit to Cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

29

Sue's Jewelry sold 20 necklaces for $25 each to a credit customer.The invoice included a 6% sales tax and payment terms of 2/10,n/30.In addition,5 necklaces were returned prior to payment.The entry to record the original sale would include:

A)a debit to Accounts Receivable for $530.

B)a debit to Accounts Receivable for $500.

C)a debit to Sales for $530.

D)a debit to Sales for $500.

A)a debit to Accounts Receivable for $530.

B)a debit to Accounts Receivable for $500.

C)a debit to Sales for $530.

D)a debit to Sales for $500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

30

The document indicating to the customer that the seller is reducing the amount owed by the customer is:

A)credit memorandum.

B)sales discount.

C)sales returns and allowances.

D)debit memorandum.

A)credit memorandum.

B)sales discount.

C)sales returns and allowances.

D)debit memorandum.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

31

Sales discounts are NOT taken on which of the following?

A)Sales Tax

B)Freight

C)Merchandise returned

D)Sales Discounts are not taken on any of the above.

A)Sales Tax

B)Freight

C)Merchandise returned

D)Sales Discounts are not taken on any of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

32

Sold merchandise on account would be recorded with:

A)a debit to an asset account.

B)a debit to a liability account.

C)a debit to Capital.

D)None of these is correct.

A)a debit to an asset account.

B)a debit to a liability account.

C)a debit to Capital.

D)None of these is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

33

Monica's Closet received payment in full within the discount period for goods sold on a $600 sales invoice,terms 2/10,n/30.Which entry records this payment?

A)Debit Accounts Receivable $600;credit Sales $600

B)Debit Cash $600;credit Accounts Receivable $600

C)Debit Cash $588,debit Sales Discount $12;credit Sales $600

D)Debit Cash $588,debit Sales Discount $12;credit Accounts Receivable $600

A)Debit Accounts Receivable $600;credit Sales $600

B)Debit Cash $600;credit Accounts Receivable $600

C)Debit Cash $588,debit Sales Discount $12;credit Sales $600

D)Debit Cash $588,debit Sales Discount $12;credit Accounts Receivable $600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

34

The total of all cash sales and credit sales equals:

A)net sales.

B)gross sales.

C)accounts receivable.

D)sales returns and allowances.

A)net sales.

B)gross sales.

C)accounts receivable.

D)sales returns and allowances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

35

Urban Camping sold goods for $200 to a charge customer.The customer returned for credit $80 worth of goods.Which entry is required to record the return transaction?

A)Debit Sales Returns and Allowances $80;credit Accounts Receivable $80

B)Debit Sales Returns and Allowances $80;credit Sales $80

C)Debit Sales $80;credit Sales Returns and Allowances $80

D)Debit Accounts Receivable $80;credit Sales Returns and Allowances $80

A)Debit Sales Returns and Allowances $80;credit Accounts Receivable $80

B)Debit Sales Returns and Allowances $80;credit Sales $80

C)Debit Sales $80;credit Sales Returns and Allowances $80

D)Debit Accounts Receivable $80;credit Sales Returns and Allowances $80

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

36

A sales discount correctly taken by the charge customer was debited to Sales at the time the entry was recorded.This error will cause:

A)the net income for the period to be overstated.

B)the net income for the period to be understated.

C)the sales discount account to be understated.

D)the sales account to be overstated.

A)the net income for the period to be overstated.

B)the net income for the period to be understated.

C)the sales discount account to be understated.

D)the sales account to be overstated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

37

Merchandise sold on credit was returned for credit and recorded with a debit to Sales Returns and Allowances and a credit to Accounts Payable.This error will cause:

A)the net income for the period to be overstated.

B)the net income for the period to be understated.

C)the assets to be overstated.

D)the accounts payable to be understated.

A)the net income for the period to be overstated.

B)the net income for the period to be understated.

C)the assets to be overstated.

D)the accounts payable to be understated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

38

Secret Trails received payment in full within the credit period for horse boarding for $900 plus 6% sales tax.Terms of the sale were 2/10,n/30.Which entry is required to record this?

A)Debit Cash,$900;credit Sales,$900

B)Debit Cash,$936;debit Sales Discount $18;credit Accounts Receivable,$954

C)Debit Cash,$954;credit Sales,$954

D)Debit Cash,$936;credit Sales,$936

A)Debit Cash,$900;credit Sales,$900

B)Debit Cash,$936;debit Sales Discount $18;credit Accounts Receivable,$954

C)Debit Cash,$954;credit Sales,$954

D)Debit Cash,$936;credit Sales,$936

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

39

John sold goods for $100 to a charge customer.The customer returned for credit $25 worth of goods.Terms of the sale were 1/10,n/30.If the customer pays the amount owed within the discount period,what is the amount the customer should pay?

A)$74.25

B)$75.00

C)$100.00

D)$90.00

A)$74.25

B)$75.00

C)$100.00

D)$90.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

40

The normal balance of Sales Tax Payable is a credit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

41

For each of the following, identify in column 1 the category to which the account belongs, in column 2 the normal balance for the account, and in column 3 the financial statement on which the account balance is reported.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

42

Explain why the account Sales Tax Payable is credited when a sale is made subject to a sales tax?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

43

For each of the following, identify in column 1 the category to which the account belongs, in column 2 the normal balance for the account, and in column 3 the financial statement on which the account balance is reported.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

44

When a customer returns defective office supplies the Sales Returns and Allowances account will be debited.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

45

Use the following information to answer the questions below:

The Net Sales are ________.

The Net Sales are ________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

46

Sales Tax Payable represents an asset on the books of the seller.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

47

Determine the amount of net sales given:

gross sales = $200,000

sales discounts = $25,000

sales returns and allowances = $35,000

$ ________

gross sales = $200,000

sales discounts = $25,000

sales returns and allowances = $35,000

$ ________

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

48

Sales Returns and Allowances is a contra-sales account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

49

The Sales Returns and Allowances account is contra-revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

50

Sales Discounts is an asset account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

51

If cash flow is so important to merchandisers,why do they extend credit to their customers?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

52

If a customer returns merchandise,the income for that period will be increased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

53

Sales tax collected by the seller is not included in the seller's total revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

54

Sales Discounts and Sales Returns and Allowances are contra-asset accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

55

The time a customer is granted to pay the bill is the discount period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

56

Compare and discuss a discount period versus a credit period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

57

Terms of 3/10,n/30 means that a customer is allowed a 3% discount if he or she pays within 10 days of the invoice date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

58

Sales is a revenue account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

59

For each of the following, identify in column 1 the category to which the account belongs, in column 2 the normal balance for the account, and in column 3 the financial statement on which the account balance is reported.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

60

Calculate gross sales:

net sales = $100,000

sales returns and allowances = $25,000

sales discounts = $30,000

accounts receivable = $12,000

net sales = $100,000

sales returns and allowances = $25,000

sales discounts = $30,000

accounts receivable = $12,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

61

A record showing the activity and the balances owed by each customer is called the:

A)accounts payable journal.

B)sales journal.

C)cash receipts journal.

D)accounts receivable subsidiary ledger.

A)accounts payable journal.

B)sales journal.

C)cash receipts journal.

D)accounts receivable subsidiary ledger.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

62

A checkmark in the PR column in the general journal means:

A)the entry was recorded correctly.

B)the amount was posted to the controlling account.

C)the amount was recorded in the subsidiary ledger.

D)the customer paid in the discount period.

A)the entry was recorded correctly.

B)the amount was posted to the controlling account.

C)the amount was recorded in the subsidiary ledger.

D)the customer paid in the discount period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

63

Every controlling account must have its own:

A)junior ledger.

B)general ledger.

C)subsidiary ledger.

D)general journal.

A)junior ledger.

B)general ledger.

C)subsidiary ledger.

D)general journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

64

Which of the following statements about subsidiary ledgers is most accurate?

A)The subsidiary ledger accounts will never equal the control account in the general ledger.

B)The accounts receivable subsidiary ledger is a book of accounts that provides supporting detail for Accounts Receivable.

C)The subsidiary ledger accounts will equal the amount of cash sales.

D)All of these answers are correct.

A)The subsidiary ledger accounts will never equal the control account in the general ledger.

B)The accounts receivable subsidiary ledger is a book of accounts that provides supporting detail for Accounts Receivable.

C)The subsidiary ledger accounts will equal the amount of cash sales.

D)All of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

65

If a credit memorandum is issued,what account will be decreased on the seller's books?

A)Accounts Receivable

B)Accounts Payable

C)Sales

D)Sales Returns and Allowances

A)Accounts Receivable

B)Accounts Payable

C)Sales

D)Sales Returns and Allowances

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

66

The principal ledger containing all the balance sheet and income statement accounts is the:

A)general ledger.

B)creditors' ledger.

C)customers' ledger.

D)subsidiary ledger.

A)general ledger.

B)creditors' ledger.

C)customers' ledger.

D)subsidiary ledger.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

67

The normal balance of the accounts receivable subsidiary ledger is:

A)credit.

B)debit.

C)It does not have a normal balance.

D)Not enough information provided.

A)credit.

B)debit.

C)It does not have a normal balance.

D)Not enough information provided.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

68

For each of the following, identify in column 1 the category to which the account belongs, in column 2 the normal balance for the account, and in column 3 the financial statement on which the account balance is reported.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

69

Accounts of a single type are kept in the:

A)supplemental ledger.

B)junior ledger.

C)subsidiary ledger.

D)None of these answers is correct.

A)supplemental ledger.

B)junior ledger.

C)subsidiary ledger.

D)None of these answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

70

For each of the following, identify in column 1 the category to which the account belongs, in column 2 the normal balance for the account, and in column 3 the financial statement on which the account balance is reported.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

71

For each of the following, identify in column 1 the category to which the account belongs, in column 2 the normal balance for the account, and in column 3 the financial statement on which the account balance is reported.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

72

When using a subsidiary ledger,the Accounts Receivable account in the general ledger is called the:

A)master account.

B)subsidiary account.

C)receivable account.

D)controlling account.

A)master account.

B)subsidiary account.

C)receivable account.

D)controlling account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

73

Recording to the accounts receivable subsidiary ledger is done:

A)daily.

B)monthly.

C)weekly.

D)annually.

A)daily.

B)monthly.

C)weekly.

D)annually.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

74

For each of the following, identify in column 1 the category to which the account belongs, in column 2 the normal balance for the account, and in column 3 the financial statement on which the account balance is reported.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

75

For each of the following, identify in column 1 the category to which the account belongs, in column 2 the normal balance for the account, and in column 3 the financial statement on which the account balance is reported.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

76

If a credit memorandum is issued,what account will be increased on the seller's books?

A)Accounts Receivable

B)Accounts Payable

C)Sales Discount

D)Sales Returns and Allowances

A)Accounts Receivable

B)Accounts Payable

C)Sales Discount

D)Sales Returns and Allowances

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

77

For each of the following, identify in column 1 the category to which the account belongs, in column 2 the normal balance for the account, and in column 3 the financial statement on which the account balance is reported.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

78

The accounts receivable subsidiary ledger:

A)is organized in alphabetical order.

B)is not kept in the same book as Accounts Receivable.

C)should equal the controlling account in the general ledger.

D)All of the above are correct.

A)is organized in alphabetical order.

B)is not kept in the same book as Accounts Receivable.

C)should equal the controlling account in the general ledger.

D)All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

79

Entries to customers' accounts for sales are posted in the:

A)accounts receivable subsidiary ledger.

B)accounts payable subsidiary ledger.

C)fixed asset subsidiary ledger.

D)sales subsidiary ledger.

A)accounts receivable subsidiary ledger.

B)accounts payable subsidiary ledger.

C)fixed asset subsidiary ledger.

D)sales subsidiary ledger.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

80

The return of merchandise by a credit customer was recorded with a debit to Accounts Payable and a credit to Accounts Receivable and the subsidiary ledger.This error will cause:

A)the net income for the period to be overstated.

B)the net income for the period to be understated.

C)the control account to not agree with the subsidiary ledger.

D)the assets to be overstated.

A)the net income for the period to be overstated.

B)the net income for the period to be understated.

C)the control account to not agree with the subsidiary ledger.

D)the assets to be overstated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck