Deck 6: Process Costing

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/176

العب

ملء الشاشة (f)

Deck 6: Process Costing

1

Many service organizations and just-in-time (JIT) manufacturing firms operate in an environment without work-in-process inventories.

True

2

FIFO follows the job-order costing principle.

False

3

In firms with ending work-in-process inventories, output is measured using equivalent units.

True

4

The major benefit of the weighted average method is simplicity. The major disadvantage is that accuracy and performance measurements are impaired.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

5

The cost flows for a process-costing system are totally different from those of a job order costing system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

6

Process systems are characterized by a larger number of homogeneous products passing through a series of processes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

7

Equivalent units are the incomplete units that could have been produced given the total amount of effort expended.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

8

For the receiving department of a process-costing manufacturer, transferred-in goods are materials that are added at the end of the process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

9

A process is a series of activities or operations, which are linked to perform a specific objective.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

10

In a process-costing system, the costing of goods transferred out in BWIP inventory is difficult because there are multiple categories of completed units.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

11

In calculating equivalent units of production using the weighted average method, the transferred-in goods are treated as materials added at the beginning of the process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

12

The FIFO costing method recognizes that the work and costs carried over from the prior period legitimately belong to that period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

13

In JIT manufacturing, work cells are created that produce a product from start to finish.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

14

When manufacturing companies exhibit characteristics of both job and process environments, they use batch production processes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

15

Transferred-in goods, must be converted to the units of measure used by the current department.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

16

The production report is the document that summarizes the manufacturing activity that takes place in a work-in-process department.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

17

The FIFO method unit costs are used to value output that is related to future periods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

18

In a process-costing system, work-in-process inventory, materials are added uniformly so that multiple calculations of equivalent units are needed for each type of input.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

19

Services that are basically homogeneous and repetitive cannot take advantage of a process-costing approach.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

20

The weighted average method treats the equivalent output and costs in beginning work-in-process inventories as if they belong to the current period when calculating unit cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

21

The weighted average costing method picks up __________ inventory costs and outputs and treats them as if they belong in the current period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

22

Spoilage in a process costing process means that more units enter the process than leave it.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

23

A key input to the cost of production report is __________ costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

24

In a __________ costing system, production costs are accumulated by process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

25

Abnormal spoilage costs are treated the same as normal spoilage for process costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

26

Operation costing uses a blend of job-order and process-costing procedures whenever batches of dissimilar products are produced.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

27

Companies using JIT manufacturing do not use __________ inventories for their process costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

28

The unit-costing method that excludes prior-period work and costs in computing current-period unit work and costs is called the __________ costing method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

29

For beginning work-in-process category using FIFO, the manufacturing cost is the sum of the current-period __________ and the current __________ to complete the BWIP.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

30

FIFO follows the __________ principle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

31

The basic characteristics of process costing include: cost flows, journal entries, and

the __________ report.

the __________ report.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

32

The accounting system which accumulates production costs by process and uses a work-in-process account for each process is called __________ .

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

33

The __________ method is a unit-costing method that merges prior-period work and costs with current period work and costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

34

When materials are not added uniformly using a work-in-process system, __________ of equivalent units are needed, one for each type of input.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

35

The process that determines the equality of the costs in beginning work in process and the costs incurred during the period is called __________ .

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

36

In process costing, __________ costing can be used to assign shared overhead to processes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

37

Using the weighted average costing method, the costing of goods transferred out is __________ since there is only one category of completed units.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

38

In operation costing, job-order procedures are used to assign direct materials costs and process procedures are used to assign conversion costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

39

When spoilage is assumed to be normal, it is not tracked separately, it is simply included in the total cost of good units.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

40

The units that could have been produced in a period given the amount of manufacturing inputs used are called __________ .

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

41

Which of the following is true of a production report prepared under a process-costing system?

A)It provides information about the physical units processed in a department.

B)It has a unit information section, a cost information section, and a revenue information section.

C)It summarizes the manufacturing activity of a company only at the end of a reporting period.

D)It is prepared at the final stage of a manufacturing activity.

A)It provides information about the physical units processed in a department.

B)It has a unit information section, a cost information section, and a revenue information section.

C)It summarizes the manufacturing activity of a company only at the end of a reporting period.

D)It is prepared at the final stage of a manufacturing activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

42

__________ is a costing system that blends job-order and process-costing procedures applied to batches of homogeneous products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

43

The appropriate cost accounting system to use when inventory items are produced on an assembly line is

A)weighted average.

B)job-order costing.

C)process costing.

D)perpetual method.

A)weighted average.

B)job-order costing.

C)process costing.

D)perpetual method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

44

In process costing, costs are accounted for by

A)job.

B)batch.

C)process.

D)year.

A)job.

B)batch.

C)process.

D)year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

45

For the receiving department, transferred in goods are added at the __________ of the process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

46

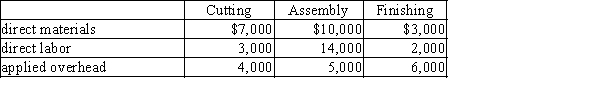

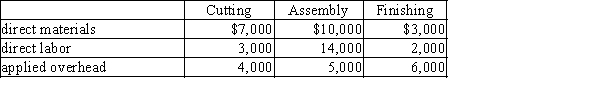

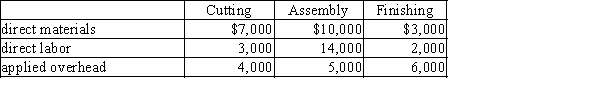

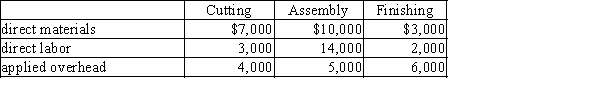

Leandro Corp. manufactures wooden desks. Production consists of three processes: cutting, assembly, and finishing. The following costs are given for April: There were no work in process inventories and 1,000 podiums were produced.

What is the cost transferred out of the assembly department.

A)$43,000

B)$54,000

C)$29,000

D)$14,000

E)none of the above

What is the cost transferred out of the assembly department.

A)$43,000

B)$54,000

C)$29,000

D)$14,000

E)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

47

The documents used to collect production costs for each batch in operation costing are called __________ .

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

48

When spoilage is due to the exacting nature of a particular job it is called __________ spoilage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

49

The Allen Company has the following information for the Assembly Department for the month of October: Overhead rate is 200 percent of direct labor costs. Allen Company uses a process costing system for the Assembly Department.

What is the total amount of debits to Work in Process-Assembly Department for October?

A)$125,000

B)$131,000

C)$139,000

D)$109,000

What is the total amount of debits to Work in Process-Assembly Department for October?

A)$125,000

B)$131,000

C)$139,000

D)$109,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

50

What system would a manufacturer of unique special orders or batch processes most likely use to accumulate costs?

A)contract costing

B)variable costing

C)process costing

D)job-order costing

A)contract costing

B)variable costing

C)process costing

D)job-order costing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

51

The cost assigned to goods from a prior process is called the __________ cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

52

The Allen Company has the following information for the Assembly Department for the month of October: Overhead rate is 200 percent of direct labor costs. Allen Company uses a process costing system for the Assembly Department.

The journal entry to record goods completed and transferred out of the Assembly Department would include a

A)debit to Finished Goods Inventory for $125,000.

B)credit to Materials Inventory for $125,000.

C)debit to Work in Process-Assembly Department for $125,000.

D)debit to Work in Process-Finishing Department for $125,000.

The journal entry to record goods completed and transferred out of the Assembly Department would include a

A)debit to Finished Goods Inventory for $125,000.

B)credit to Materials Inventory for $125,000.

C)debit to Work in Process-Assembly Department for $125,000.

D)debit to Work in Process-Finishing Department for $125,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which of the following is a difference between a job-order costing system and a process-costing system?

A)A job-order costing system accumulates costs by department, while a process costing-system accumulates costs by job.

B)A job-order costing system is used only by manufacturing firms, while a process-costing system is used by both manufacturing firms and service firms.

C)A job-order costing system uses a single work-in-process account, while a process-costing system has a work-in-process account for every process.

D)A job-order costing system uses cost-sheets for assigning labor costs, while a process-costing system uses time tickets for assigning labor costs to processes.

A)A job-order costing system accumulates costs by department, while a process costing-system accumulates costs by job.

B)A job-order costing system is used only by manufacturing firms, while a process-costing system is used by both manufacturing firms and service firms.

C)A job-order costing system uses a single work-in-process account, while a process-costing system has a work-in-process account for every process.

D)A job-order costing system uses cost-sheets for assigning labor costs, while a process-costing system uses time tickets for assigning labor costs to processes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

54

In operation costing, the process which produces batches of different products which are identical in many ways but differ in others is called __________ process

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

55

The costing system that uses job-order procedures to assign direct material costs to batches and process procedures to assign conversion costs is called __________ costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

56

When spoilage is assumed to be __________ it is embedded in the total cost of good units.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

57

When products and their costs are moved from one process to the next process, these costs are referred to as

A)unit costs.

B)transferred-in costs.

C)WIP inventory costs.

D)equivalent unit costs.

A)unit costs.

B)transferred-in costs.

C)WIP inventory costs.

D)equivalent unit costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

58

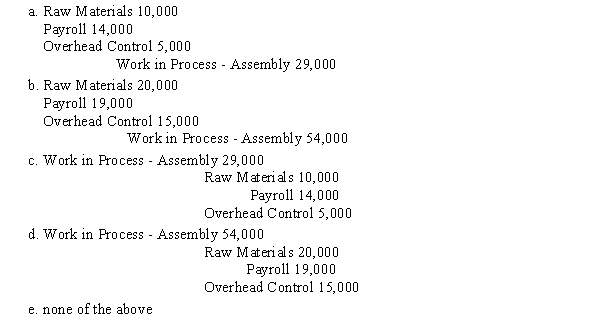

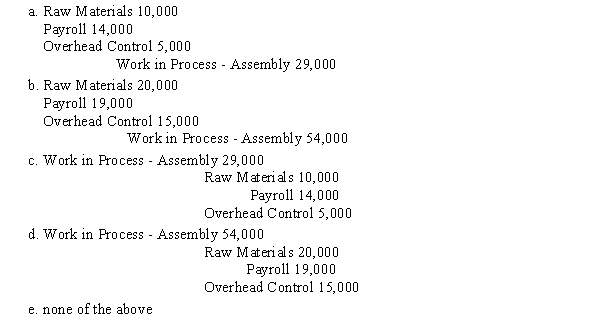

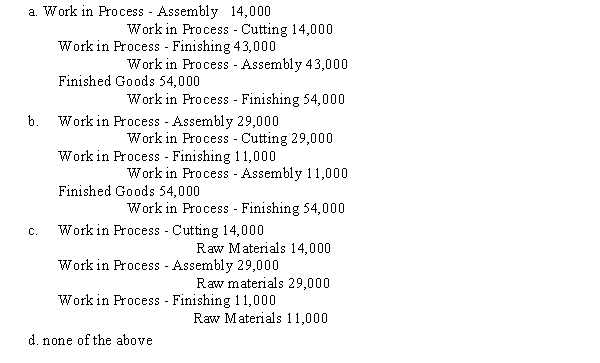

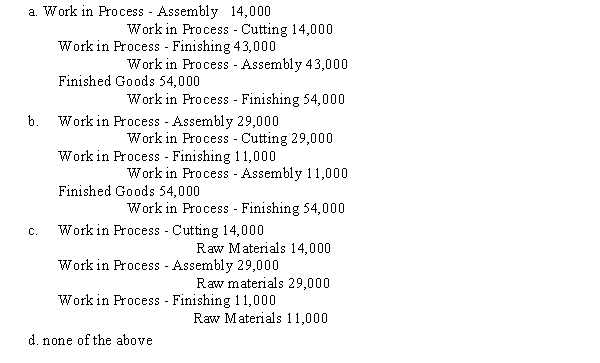

Leandro Corp. manufactures wooden desks. Production consists of three processes: cutting, assembly, and finishing. The following costs are given for April:  There were no work in process inventories and 1,000 podiums were produced.

There were no work in process inventories and 1,000 podiums were produced.

The journal entry to assign costs to the Assembly process would be

There were no work in process inventories and 1,000 podiums were produced.

There were no work in process inventories and 1,000 podiums were produced.The journal entry to assign costs to the Assembly process would be

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

59

The usual approach in process manufacturing is to treat transferred-in goods as a separate material category when calculating __________ .

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

60

Manufacturing firms that have characteristics of both job and process environments often use __________ processes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

61

The following information is available from the records of Diamond Cut, Inc.: What are the conversion costs in the Finishing Department?

A)$35,000

B)$37,500

C)$40,000

D)$57,500

A)$35,000

B)$37,500

C)$40,000

D)$57,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

62

Maynard Inc. manufactures desks. The following data was given for production in February: What were the total number of units to account for?

A)50

B)150

C)200

D)400

E)none of the above

A)50

B)150

C)200

D)400

E)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

63

The following information is available from the records of Diamond Cut, Inc.: What are the "total costs to account for" in the Assembly Department?

A)$32,000

B)$44,500

C)$21,000

D)$10,000

A)$32,000

B)$44,500

C)$21,000

D)$10,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

64

When conversion costs are uniform,

A)materials, labor, and overhead are applied at different rates throughout the process.

B)materials, labor, and overhead are added throughout the process at the same rate.

C)labor and overhead are added at the same rate but different materials are added at a different point.

D)materials and labor are added at the same rate but overhead is applied uniformly.

A)materials, labor, and overhead are applied at different rates throughout the process.

B)materials, labor, and overhead are added throughout the process at the same rate.

C)labor and overhead are added at the same rate but different materials are added at a different point.

D)materials and labor are added at the same rate but overhead is applied uniformly.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

65

As production occurs, materials, direct labor, and applied manufacturing overhead are recorded in

A)cost of goods sold.

B)work in process.

C)materials.

D)finished goods.

A)cost of goods sold.

B)work in process.

C)materials.

D)finished goods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

66

Equivalent units expresses all activity of the period in terms of

A)direct labor hours.

B)partially completed units.

C)fully completed units.

D)units of input.

A)direct labor hours.

B)partially completed units.

C)fully completed units.

D)units of input.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

67

Moccasin Company produces 15,000 bars of chocolates and has the following cost data for the month of January:

Calculate the costs transferred out of the Molding Department for the month of January. Assume no work-in-process inventories.

A)$24,500

B)$36,000

C)$11,500

D)$30,000

Calculate the costs transferred out of the Molding Department for the month of January. Assume no work-in-process inventories.

A)$24,500

B)$36,000

C)$11,500

D)$30,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

68

The term given to units that represents the number of completed units that is equal, in terms of production inputs, to a given number of partially completed units is:

A)Units completed

B)Equivalent units

C)Units started and completed

D)Total units in production

A)Units completed

B)Equivalent units

C)Units started and completed

D)Total units in production

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

69

In order to determine product costs, JIT firms are usually structured so they can use:

A)job-order costing

B)process costing

C)joint costing

D)variable costing

A)job-order costing

B)process costing

C)joint costing

D)variable costing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

70

Which is TRUE about services?

A)Some services may require that a sequence of uniform processes be performed.

B)Services can never be homogeneous and repetitively produced.

C)Services cannot have work-in-process inventories.

D)All services require job-order costing.

A)Some services may require that a sequence of uniform processes be performed.

B)Services can never be homogeneous and repetitively produced.

C)Services cannot have work-in-process inventories.

D)All services require job-order costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

71

Maynard Inc. manufactures desks. The following data was given for production in February: How many units were completed?

A)400

B)200

C)150

D)50

E)none of the above

A)400

B)200

C)150

D)50

E)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

72

In a process costing system, which of the following would be TRUE?

A)There is no need to use time tickets to assign costs to processes.

B)There is no need to track materials to processes.

C)A process costing system is more expensive to maintain because it has more work-in-process accounts.

D)all of the above are true.

A)There is no need to use time tickets to assign costs to processes.

B)There is no need to track materials to processes.

C)A process costing system is more expensive to maintain because it has more work-in-process accounts.

D)all of the above are true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

73

That which determine(s) whether the costs assigned to units transferred out and to units in ending work in process are equal to the costs in beginning work in process, plus the manufacturing costs incurred in the current period is(are) called:

A)Equivalent unit of output

B)Cost reconciliation

C)Batch production process

D)Transferred-in costs

A)Equivalent unit of output

B)Cost reconciliation

C)Batch production process

D)Transferred-in costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

74

The complete units that could have been produced given the total amount of productive effort expended for the period under consideration are the:

A)units in ending work in process.

B)units in beginning work in process.

C)total units of output.

D)equivalent units of output.

A)units in ending work in process.

B)units in beginning work in process.

C)total units of output.

D)equivalent units of output.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

75

Maynard Inc. manufactures desks. The following data was given for production in February: What are the equivalent units?

A)200

B)170

C)180

D)150

E)none of the above

A)200

B)170

C)180

D)150

E)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

76

The role of activity-based costing for both cellular and independent process manufacturing is to:

A)determine the profitability of a department.

B)compute the unit fixed costs incurred by a firm.

C)assign overhead shared by processes to individual processes.

D)separate fixed and variable costs incurred by multiple processes.

A)determine the profitability of a department.

B)compute the unit fixed costs incurred by a firm.

C)assign overhead shared by processes to individual processes.

D)separate fixed and variable costs incurred by multiple processes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

77

Jamie Hopen, CPA, prepares tax returns. The production costs and the number of tax returns prepared for the month of September are as follows: Number of tax returns 300

What is the cost of services sold?

A)$1,800

B)$4,000

C)$200

D)$6,000

What is the cost of services sold?

A)$1,800

B)$4,000

C)$200

D)$6,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

78

Jamie Hopen, CPA, prepares tax returns. The production costs and the number of tax returns prepared for the month of September are as follows: Number of tax returns 300

What is the unit cost per tax return?

A)$0.67

B)$15.00

C)$20.00

D)$3.33

What is the unit cost per tax return?

A)$0.67

B)$15.00

C)$20.00

D)$3.33

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

79

JIT manufacturing emphasizes

A)continuous improvement.

B)elimination of waste.

C)reduction of work-in-process inventories.

D)all of the above.

A)continuous improvement.

B)elimination of waste.

C)reduction of work-in-process inventories.

D)all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck

80

Leandro Corp. manufactures wooden desks. Production consists of three processes: cutting, assembly, and finishing. The following costs are given for April:  There were no work in process inventories and 1,000 podiums were produced.

There were no work in process inventories and 1,000 podiums were produced.

Record the journal entries to record the transfer of goods from process to process.

There were no work in process inventories and 1,000 podiums were produced.

There were no work in process inventories and 1,000 podiums were produced.Record the journal entries to record the transfer of goods from process to process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 176 في هذه المجموعة.

فتح الحزمة

k this deck