Deck 27: Manufacturing Accounting: The Work Sheet and Financial Statements

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/66

العب

ملء الشاشة (f)

Deck 27: Manufacturing Accounting: The Work Sheet and Financial Statements

1

To close operating expenses at the end of the year, Income Summary is credited.

False

2

The estimated amount of uncollectible accounts is adjusted on the work sheet by debiting Allowance for Bad Debts and crediting Bad Debt Expense.

False

3

Factory Overhead has a zero balance after all adjustments, so it is not necessary to close the account at the end of the accounting period.

False

4

With a perpetual inventory system, the movement of goods from materials to work in process to finished goods to cost of goods sold is recorded as the movement occurs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

5

The entry to apply factory overhead to work in process ending inventory includes a debit to Work in Process Inventory and a credit to Factory Overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

6

To record an adjustment for income tax for the period, Corporate Income Tax is debited and Income Tax Expense is credited.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

7

Factory building insurance expense is part of factory overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

8

Underapplied overhead is adjusted on the work sheet by debiting Overapplied Overhead and crediting Work in Process Inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

9

Manufacturing company and merchandising company work sheets are prepared using the same five steps.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

10

The income statement of a manufacturer is commonly supported by a schedule of cost of goods manufactured.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

11

In a corporation, the stockholders' equity section contains information regarding capital stock, paid-in capital in excess of par, and retained earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

12

All of the data for the statement of retained earnings is taken from the Balance Sheet columns of the work sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

13

Overapplied overhead is adjusted on the work sheet by debiting Overapplied Overhead and crediting Work in Process Inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

14

Factory overhead must be applied to work in process at the end of the year, even though those jobs are not yet finished.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

15

Debits in the factory overhead account represent the overhead applied to production.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

16

A manufacturing company's work sheet includes three inventory accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

17

The amount of expired factory equipment insurance is adjusted on the work sheet by debiting Equipment Insurance Expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

18

Manufacturing companies will include three inventory accounts in the liability section of the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

19

The amount of interest due on notes and bonds payable owed by the company is adjusted on the work sheet by debiting Interest Expense and crediting Accrued Interest Payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

20

Both the debit and the credit balances in Factory Overhead are closed to Income Summary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

21

If factory overhead applied is less than the adjusted debit balance of Factory Overhead, the difference is known as underapplied overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

22

The amount of interest due on notes and bonds payable owed by the company is adjusted by

A) debiting Interest Payable and crediting Cost of Goods Sold.

B) debiting Interest Payable and crediting Interest Expense.

C) debiting Interest Expense and crediting Interest Payable.

D) debiting Interest Expense and crediting Cost of Goods Sold.

A) debiting Interest Payable and crediting Cost of Goods Sold.

B) debiting Interest Payable and crediting Interest Expense.

C) debiting Interest Expense and crediting Interest Payable.

D) debiting Interest Expense and crediting Cost of Goods Sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following statements is NOT true of manufacturing company accounting?

A) Materials inventory represents the raw materials purchased by the company to use in the production of its product(s).

B) Inventories are divided into three separate accounts.

C) Factory overhead debits represent the overhead that has been applied to production.

D) Factory overhead shows both a debit and a credit balance on the work sheet.

A) Materials inventory represents the raw materials purchased by the company to use in the production of its product(s).

B) Inventories are divided into three separate accounts.

C) Factory overhead debits represent the overhead that has been applied to production.

D) Factory overhead shows both a debit and a credit balance on the work sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

24

In a periodic inventory system, costs of goods sold are computed through an adjustment process at the end of the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

25

The adjusting entry to apply factory overhead to the work in process ending inventory includes

A) debiting Finished Goods Inventory and crediting Factory Overhead.

B) debiting Work in Process Inventory and crediting Factory Overhead.

C) debiting Factory Overhead and crediting Work in Process Inventory.

D) debiting Factory Overhead and crediting Finished Goods Inventory.

A) debiting Finished Goods Inventory and crediting Factory Overhead.

B) debiting Work in Process Inventory and crediting Factory Overhead.

C) debiting Factory Overhead and crediting Work in Process Inventory.

D) debiting Factory Overhead and crediting Finished Goods Inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

26

The difference between the debits and credits for each pair of columns in the Income Statement and Balance Sheet sections of the work sheet represents net income or net loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

27

To close Income Summary at the end of the year, Retained Earnings is credited for the amount of net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

28

Both debit and credit balances of Factory Overhead are shown in the Adjusted Trial Balance columns of the work sheet; however, neither of these amounts is extended to the Income Statement or to the Balance Sheet columns.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

29

The adjustment for corporate income tax should be reversed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

30

All of the data for the income statement is obtained from the Income Statement columns of the work sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which of the following accounts on the manufacturing company work sheet is NOT an asset account?

A) work in process inventory

B) factory overhead

C) prepaid insurance

D) finished goods inventory

A) work in process inventory

B) factory overhead

C) prepaid insurance

D) finished goods inventory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

32

Debits in the factory overhead account represent the actual overhead costs incurred.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

33

The supplementary schedule of cost of goods sold is unique to a manufacturing company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

34

If factory overhead applied is more than the adjusted debit balance of Factory Overhead, the difference is known as underapplied overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

35

The entry to close Cost of Goods Sold at the end of the year includes a debit to Income Summary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

36

Factory overhead is applied at a predetermined rate when a job is completed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

37

In a perpetual inventory system, costs of goods sold are accumulated in the cost of goods sold account as sales occur during the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

38

In a perpetual inventory system, the inventory accounts reflects ending balances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

39

On a work sheet for a manufacturing company, Factory Overhead shows both a debit and a credit balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

40

Overhead must be applied to work in process at year end.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

41

In the factory overhead account, the debit represents the

A) actual overhead cost incurred.

B) estimated overhead cost incurred.

C) actual overhead to be applied to production.

D) estimated overhead to be applied to production.

A) actual overhead cost incurred.

B) estimated overhead cost incurred.

C) actual overhead to be applied to production.

D) estimated overhead to be applied to production.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

42

The balance of retained earnings at the beginning of the year was $475,000, and the balance at the end of the year was $550,000. Cash dividends declared during the year were $35,000. The amount of net income for the year was

A) $75,000.

B) $515,000.

C) $110,000.

D) $80,000.

A) $75,000.

B) $515,000.

C) $110,000.

D) $80,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

43

Source data for direct labor comes from the

A) materials inventory in the general ledger,

B) work in process inventory in the general ledger.

C) Adjusted Trial Balance columns of the work sheet.

D) Income Statement columns of the work sheet.

A) materials inventory in the general ledger,

B) work in process inventory in the general ledger.

C) Adjusted Trial Balance columns of the work sheet.

D) Income Statement columns of the work sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

44

The entry to close Cost of Goods Sold includes

A) debiting Income summary and crediting Cost of Goods Sold.

B) debiting Cost of Goods Sold and crediting Income Summary.

C) debiting Retained Earnings and crediting Cost of Goods Sold.

D) debiting Cost of Goods Sold and crediting Retained Earnings.

A) debiting Income summary and crediting Cost of Goods Sold.

B) debiting Cost of Goods Sold and crediting Income Summary.

C) debiting Retained Earnings and crediting Cost of Goods Sold.

D) debiting Cost of Goods Sold and crediting Retained Earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

45

The amount of uncollectible accounts is adjusted by

A) debiting Factory Overhead and crediting Accounts Receivable.

B) debiting Bad Debt Expense and crediting Factory Overhead Applied.

C) debiting Factory Overhead and crediting Allowance for Bad Debts.

D) debiting Bad Debt Expense and crediting Allowance for Bad Debts.

A) debiting Factory Overhead and crediting Accounts Receivable.

B) debiting Bad Debt Expense and crediting Factory Overhead Applied.

C) debiting Factory Overhead and crediting Allowance for Bad Debts.

D) debiting Bad Debt Expense and crediting Allowance for Bad Debts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

46

The adjustment to increase Income Tax Expense includes

A) debiting Factory Overhead and crediting Income Tax Payable.

B) debiting Income Tax Payable and crediting Income Tax Payable.

C) debiting Income Tax Expense and crediting Factory Overhead.

D) debiting Income Tax Expense and crediting Income Tax Payable.

A) debiting Factory Overhead and crediting Income Tax Payable.

B) debiting Income Tax Payable and crediting Income Tax Payable.

C) debiting Income Tax Expense and crediting Factory Overhead.

D) debiting Income Tax Expense and crediting Income Tax Payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

47

Which of the following steps are involved in closing the temporary accounts of a manufacturing business?

A) The balance of Factory Overhead is credited to Income Summary.

B) The balances of operating expense accounts are credited to Income Summary.

C) The balance of Cost of Goods Sold is credited to Income Summary.

D) The balance of Retained Earnings is credited to Income Summary.

A) The balance of Factory Overhead is credited to Income Summary.

B) The balances of operating expense accounts are credited to Income Summary.

C) The balance of Cost of Goods Sold is credited to Income Summary.

D) The balance of Retained Earnings is credited to Income Summary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

48

The amount of expired factory equipment insurance is adjusted by

A) debiting Factory Overhead and crediting Prepaid Insurance.

B) debiting Equipment Insurance Expense and crediting Factory Overhead.

C) debiting Prepaid Insurance and crediting Equipment Insurance Expense.

D) debiting Prepaid Insurance and crediting Accounts Payable.

A) debiting Factory Overhead and crediting Prepaid Insurance.

B) debiting Equipment Insurance Expense and crediting Factory Overhead.

C) debiting Prepaid Insurance and crediting Equipment Insurance Expense.

D) debiting Prepaid Insurance and crediting Accounts Payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

49

If factory overhead applied is less than the adjusted debit balance of Factory Overhead, the difference is known as

A) underapplied overhead.

B) cost of goods sold.

C) overabsorbed overhead.

D) overapplied overhead.

A) underapplied overhead.

B) cost of goods sold.

C) overabsorbed overhead.

D) overapplied overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

50

Source data for work in process at the beginning of the accounting period comes from the

A) materials inventory in the general ledger.

B) work in process inventory in the general ledger.

C) Adjusted Trial Balance columns of the work sheet.

D) Income Statement columns of the work sheet.

A) materials inventory in the general ledger.

B) work in process inventory in the general ledger.

C) Adjusted Trial Balance columns of the work sheet.

D) Income Statement columns of the work sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

51

Source data for the work in process inventory as of the end of the accounting period comes from the

A) materials inventory in the general ledger.

B) work in process inventory in the general ledger.

C) Balance Sheet columns of the work sheet.

D) Income Statement columns of the work sheet.

A) materials inventory in the general ledger.

B) work in process inventory in the general ledger.

C) Balance Sheet columns of the work sheet.

D) Income Statement columns of the work sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

52

The depreciation of factory equipment is adjusted by

A) debiting Depreciation Expense and crediting Factory Equipment.

B) debiting Factory Overhead and crediting Accumulated Depreciation-Factory Equipment.

C) debiting Accumulated Depreciation-Factory Equipment and crediting Factory Overhead.

D) debiting Accumulated Depreciation-Factory Equipment and crediting Depreciation Expense.

A) debiting Depreciation Expense and crediting Factory Equipment.

B) debiting Factory Overhead and crediting Accumulated Depreciation-Factory Equipment.

C) debiting Accumulated Depreciation-Factory Equipment and crediting Factory Overhead.

D) debiting Accumulated Depreciation-Factory Equipment and crediting Depreciation Expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

53

If factory overhead applied is more than the adjusted debit balance of Factory Overhead, the difference is known as

A) underapplied overhead.

B) overapplied overhead.

C) organization costs.

D) adjusted work in process.

A) underapplied overhead.

B) overapplied overhead.

C) organization costs.

D) adjusted work in process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

54

Which of the following adjustments is NOT made to Factory Overhead on the work sheet?

A) factory equipment insurance

B) factory building insurance

C) office supplies

D) factory supplies

A) factory equipment insurance

B) factory building insurance

C) office supplies

D) factory supplies

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

55

If the estimated amount of uncollectible accounts at the end of the year (based on the aging method) was $3,675.32 and Allowance for Bad Debts had a credit balance of $860, the necessary adjustment would include

A) debiting Allowance for Bad Debts, $3,675.32.

B) crediting Allowance for Bad Debts, $3,675.32.

C) debiting Bad Debt Expense, $2,815.32.

D) crediting Bad Debt Expense, $2,815.32.

A) debiting Allowance for Bad Debts, $3,675.32.

B) crediting Allowance for Bad Debts, $3,675.32.

C) debiting Bad Debt Expense, $2,815.32.

D) crediting Bad Debt Expense, $2,815.32.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

56

The entry to close operating expenses includes

A) debiting Operating Expenses.

B) debiting Income Summary.

C) debiting Retained Earnings.

D) debiting Cost of Goods Sold.

A) debiting Operating Expenses.

B) debiting Income Summary.

C) debiting Retained Earnings.

D) debiting Cost of Goods Sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

57

Factory supplies used during the year is adjusted by

A) debiting Factory Supplies and crediting Factory Supplies Expense.

B) debiting Factory Supplies Expense and crediting Factory Supplies.

C) debiting Office Supplies Expense and crediting Factory Supplies Payable.

D) debiting Factory Overhead and crediting Factory Supplies.

A) debiting Factory Supplies and crediting Factory Supplies Expense.

B) debiting Factory Supplies Expense and crediting Factory Supplies.

C) debiting Office Supplies Expense and crediting Factory Supplies Payable.

D) debiting Factory Overhead and crediting Factory Supplies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

58

Which of the following accounts is not closed at the end of the accounting period?

A) Factory Overhead

B) Allowance for Bad Debts

C) Cost of Goods Sold

D) Income Summary

A) Factory Overhead

B) Allowance for Bad Debts

C) Cost of Goods Sold

D) Income Summary

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

59

The entry to close Income Summary for a loss would include

A) a credit to Income Summary.

B) a credit to Retained Earnings.

C) a debit to Capital Stock.

D) a debit to Income Summary.

A) a credit to Income Summary.

B) a credit to Retained Earnings.

C) a debit to Capital Stock.

D) a debit to Income Summary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

60

Source data for the beginning materials inventory comes from the

A) materials inventory in the general ledger.

B) work in process inventory in the general ledger.

C) Adjusted Trial Balance columns of the work sheet.

D) Income Statement columns of the work sheet.

A) materials inventory in the general ledger.

B) work in process inventory in the general ledger.

C) Adjusted Trial Balance columns of the work sheet.

D) Income Statement columns of the work sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

61

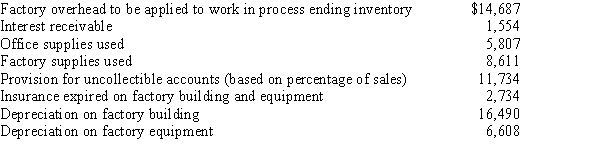

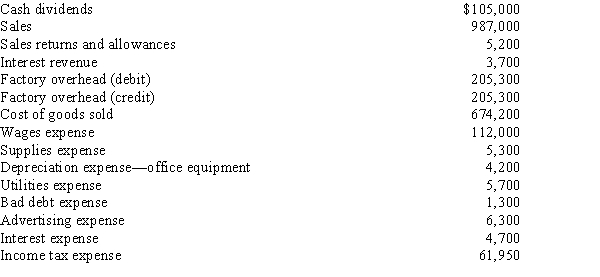

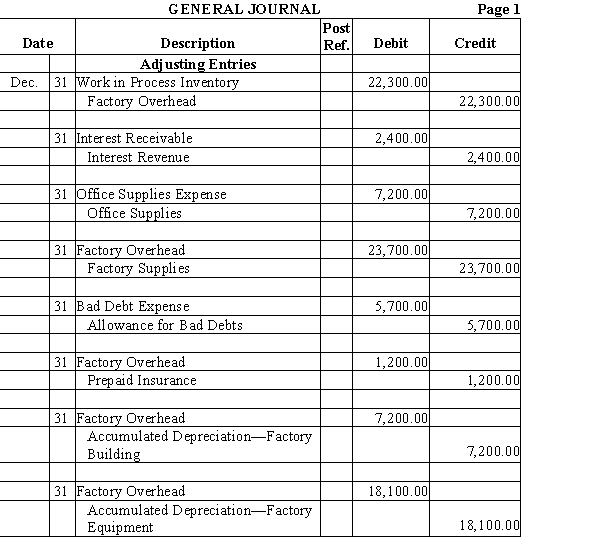

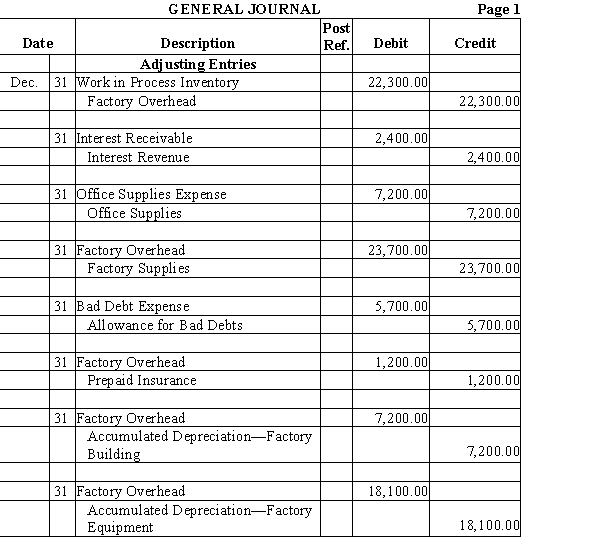

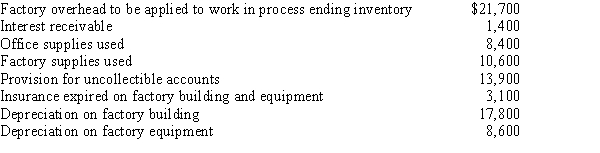

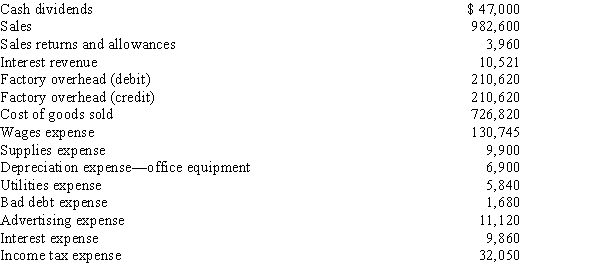

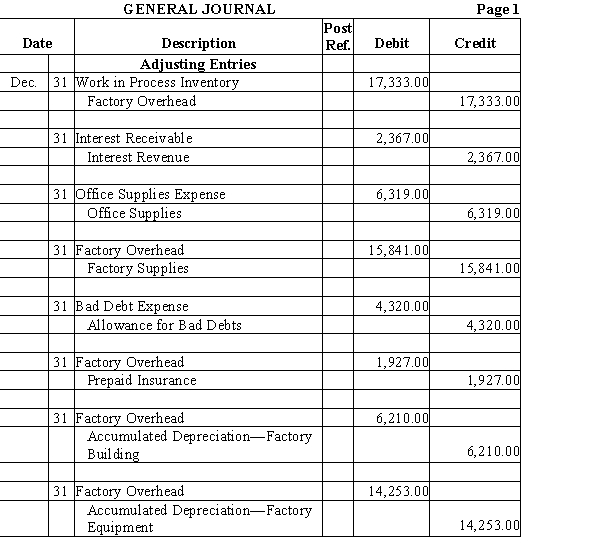

Santiago Company has provided data for the year-end adjustments as follows:

Required:

Prepare the year-end adjusting entries in general journal form.

Required:

Prepare the year-end adjusting entries in general journal form.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

62

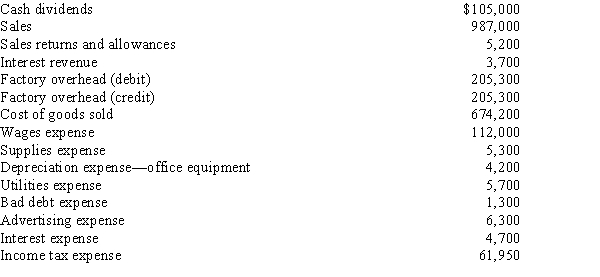

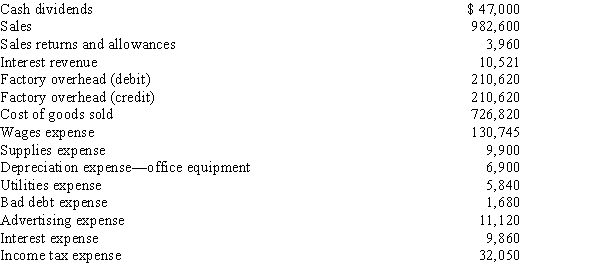

From the data below for the Sorta Company, prepare the closing entries for the year ended December 31, 20--.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

63

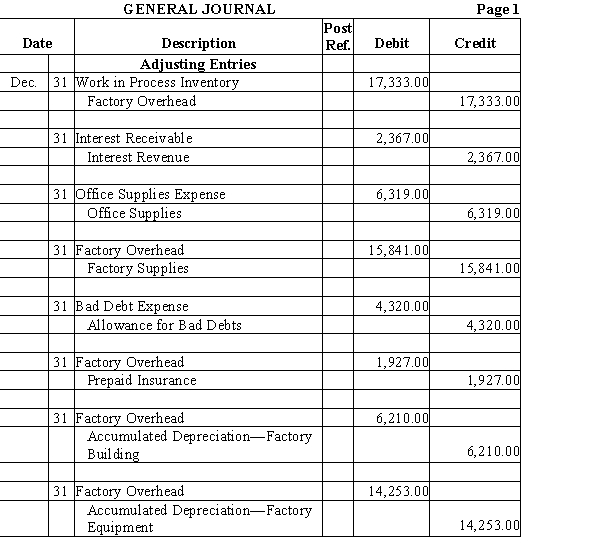

From the adjusting entries below, prepare the reversing entry(ies) that would be needed on January 1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

64

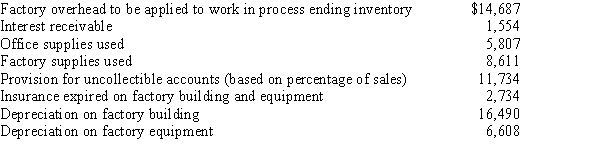

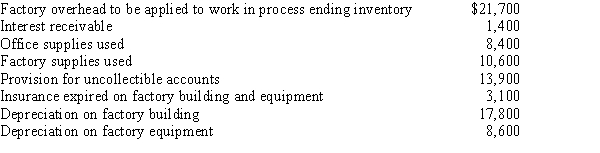

Prepare the year-end adjusting entries in general journal form for Dombrowski Corporation. Information for the year-end adjustments is as follows:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

65

From the data below for Wong Company, prepare the closing entries for the year ended December 31.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

66

From the adjusting entries below, prepare the reversing entry(ies) that would be needed for January 1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck