Deck 9: Payroll Accounting: Employer Taxes and Reports

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

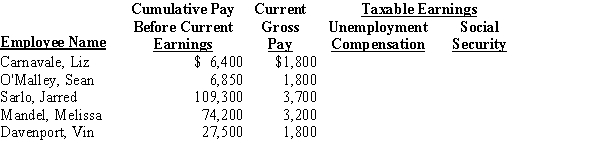

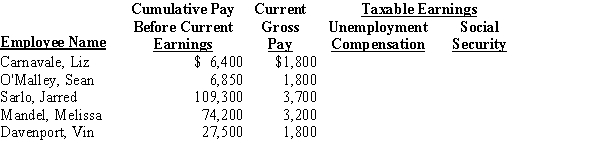

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

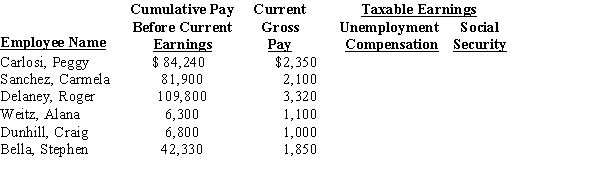

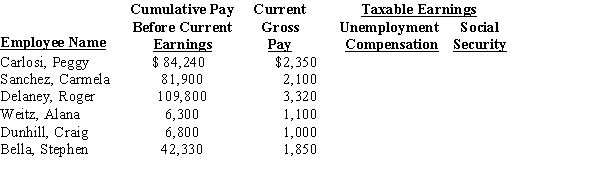

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/79

العب

ملء الشاشة (f)

Deck 9: Payroll Accounting: Employer Taxes and Reports

1

The date by which federal income tax withholding, Social Security, and Medicare taxes must be paid depends on the amount of these taxes.

True

2

The cost of workers' compensation insurance to a construction company with 15 employees would likely be higher than the cost of insurance to a small candy company with 15 employees.

True

3

Match the terms with the definitions.a.direct deposit

b.electronic system

c.employee

d.employee earnings record

e.Fair Labor Standards Act (FLSA)

f.FICA taxes

g.gross pay

h.independent contractor

i.manual system

j.net pay

k.payroll processing center

l.payroll register

m.salary

n.wage-bracket method

o.wages

p.withholding allowance

Most employers have to pay FICA and FUTA taxes.

b.electronic system

c.employee

d.employee earnings record

e.Fair Labor Standards Act (FLSA)

f.FICA taxes

g.gross pay

h.independent contractor

i.manual system

j.net pay

k.payroll processing center

l.payroll register

m.salary

n.wage-bracket method

o.wages

p.withholding allowance

Most employers have to pay FICA and FUTA taxes.

True

4

Match the terms with the definitions.a.direct deposit

b.electronic system

c.employee

d.employee earnings record

e.Fair Labor Standards Act (FLSA)

f.FICA taxes

g.gross pay

h.independent contractor

i.manual system

j.net pay

k.payroll processing center

l.payroll register

m.salary

n.wage-bracket method

o.wages

p.withholding allowance

Self-employed individuals can be viewed as both employer and employee.

b.electronic system

c.employee

d.employee earnings record

e.Fair Labor Standards Act (FLSA)

f.FICA taxes

g.gross pay

h.independent contractor

i.manual system

j.net pay

k.payroll processing center

l.payroll register

m.salary

n.wage-bracket method

o.wages

p.withholding allowance

Self-employed individuals can be viewed as both employer and employee.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

5

In general, the larger the amount of Social Security and Medicare taxes due from an employer, the more frequently payments must be made.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

6

Match the terms with the definitions.a.direct deposit

b.electronic system

c.employee

d.employee earnings record

e.Fair Labor Standards Act (FLSA)

f.FICA taxes

g.gross pay

h.independent contractor

i.manual system

j.net pay

k.payroll processing center

l.payroll register

m.salary

n.wage-bracket method

o.wages

p.withholding allowance

The employer FICA tax is levied on employers at the same rate and on the same earnings bases as the employee FICA tax.

b.electronic system

c.employee

d.employee earnings record

e.Fair Labor Standards Act (FLSA)

f.FICA taxes

g.gross pay

h.independent contractor

i.manual system

j.net pay

k.payroll processing center

l.payroll register

m.salary

n.wage-bracket method

o.wages

p.withholding allowance

The employer FICA tax is levied on employers at the same rate and on the same earnings bases as the employee FICA tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

7

Employers are allowed a credit against the FUTA tax for participation in state unemployment programs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

8

Match the terms with the definitions.a.direct deposit

b.electronic system

c.employee

d.employee earnings record

e.Fair Labor Standards Act (FLSA)

f.FICA taxes

g.gross pay

h.independent contractor

i.manual system

j.net pay

k.payroll processing center

l.payroll register

m.salary

n.wage-bracket method

o.wages

p.withholding allowance

The FUTA tax applies to all employee earnings throughout the year.

b.electronic system

c.employee

d.employee earnings record

e.Fair Labor Standards Act (FLSA)

f.FICA taxes

g.gross pay

h.independent contractor

i.manual system

j.net pay

k.payroll processing center

l.payroll register

m.salary

n.wage-bracket method

o.wages

p.withholding allowance

The FUTA tax applies to all employee earnings throughout the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

9

Match the terms with the definitions.a.direct deposit

b.electronic system

c.employee

d.employee earnings record

e.Fair Labor Standards Act (FLSA)

f.FICA taxes

g.gross pay

h.independent contractor

i.manual system

j.net pay

k.payroll processing center

l.payroll register

m.salary

n.wage-bracket method

o.wages

p.withholding allowance

Persons earning self-employment income of $400 or more must pay a self-employment tax.

b.electronic system

c.employee

d.employee earnings record

e.Fair Labor Standards Act (FLSA)

f.FICA taxes

g.gross pay

h.independent contractor

i.manual system

j.net pay

k.payroll processing center

l.payroll register

m.salary

n.wage-bracket method

o.wages

p.withholding allowance

Persons earning self-employment income of $400 or more must pay a self-employment tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

10

Match the terms with the definitions.a.direct deposit

b.electronic system

c.employee

d.employee earnings record

e.Fair Labor Standards Act (FLSA)

f.FICA taxes

g.gross pay

h.independent contractor

i.manual system

j.net pay

k.payroll processing center

l.payroll register

m.salary

n.wage-bracket method

o.wages

p.withholding allowance

Self-employment income is the gross income of a trade or business run by an individual.

b.electronic system

c.employee

d.employee earnings record

e.Fair Labor Standards Act (FLSA)

f.FICA taxes

g.gross pay

h.independent contractor

i.manual system

j.net pay

k.payroll processing center

l.payroll register

m.salary

n.wage-bracket method

o.wages

p.withholding allowance

Self-employment income is the gross income of a trade or business run by an individual.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

11

Match the terms with the definitions.a.direct deposit

b.electronic system

c.employee

d.employee earnings record

e.Fair Labor Standards Act (FLSA)

f.FICA taxes

g.gross pay

h.independent contractor

i.manual system

j.net pay

k.payroll processing center

l.payroll register

m.salary

n.wage-bracket method

o.wages

p.withholding allowance

Employers' payroll taxes include FICA, FUTA, and SUTA taxes.

b.electronic system

c.employee

d.employee earnings record

e.Fair Labor Standards Act (FLSA)

f.FICA taxes

g.gross pay

h.independent contractor

i.manual system

j.net pay

k.payroll processing center

l.payroll register

m.salary

n.wage-bracket method

o.wages

p.withholding allowance

Employers' payroll taxes include FICA, FUTA, and SUTA taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

12

Match the terms with the definitions.a.direct deposit

b.electronic system

c.employee

d.employee earnings record

e.Fair Labor Standards Act (FLSA)

f.FICA taxes

g.gross pay

h.independent contractor

i.manual system

j.net pay

k.payroll processing center

l.payroll register

m.salary

n.wage-bracket method

o.wages

p.withholding allowance

The employer must pay the amount owed for Social Security and Medicare by the business to the IRS; however, the employees pay for Social Security and Medicare directly to the IRS.

b.electronic system

c.employee

d.employee earnings record

e.Fair Labor Standards Act (FLSA)

f.FICA taxes

g.gross pay

h.independent contractor

i.manual system

j.net pay

k.payroll processing center

l.payroll register

m.salary

n.wage-bracket method

o.wages

p.withholding allowance

The employer must pay the amount owed for Social Security and Medicare by the business to the IRS; however, the employees pay for Social Security and Medicare directly to the IRS.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

13

The due date for payroll taxes is the last day of each fiscal quarter: March 31, June 30, September 30, and December 31.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

14

Match the terms with the definitions.a.direct deposit

b.electronic system

c.employee

d.employee earnings record

e.Fair Labor Standards Act (FLSA)

f.FICA taxes

g.gross pay

h.independent contractor

i.manual system

j.net pay

k.payroll processing center

l.payroll register

m.salary

n.wage-bracket method

o.wages

p.withholding allowance

Self-employment tax is double the Social Security and Medicare rates.

b.electronic system

c.employee

d.employee earnings record

e.Fair Labor Standards Act (FLSA)

f.FICA taxes

g.gross pay

h.independent contractor

i.manual system

j.net pay

k.payroll processing center

l.payroll register

m.salary

n.wage-bracket method

o.wages

p.withholding allowance

Self-employment tax is double the Social Security and Medicare rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

15

Form 940 is called the Employer's Quarterly Federal Tax Return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

16

Match the terms with the definitions.a.direct deposit

b.electronic system

c.employee

d.employee earnings record

e.Fair Labor Standards Act (FLSA)

f.FICA taxes

g.gross pay

h.independent contractor

i.manual system

j.net pay

k.payroll processing center

l.payroll register

m.salary

n.wage-bracket method

o.wages

p.withholding allowance

The amount of employers' Medicare taxes is computed by multiplying total earnings by 1.45%.

b.electronic system

c.employee

d.employee earnings record

e.Fair Labor Standards Act (FLSA)

f.FICA taxes

g.gross pay

h.independent contractor

i.manual system

j.net pay

k.payroll processing center

l.payroll register

m.salary

n.wage-bracket method

o.wages

p.withholding allowance

The amount of employers' Medicare taxes is computed by multiplying total earnings by 1.45%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

17

Match the terms with the definitions.a.direct deposit

b.electronic system

c.employee

d.employee earnings record

e.Fair Labor Standards Act (FLSA)

f.FICA taxes

g.gross pay

h.independent contractor

i.manual system

j.net pay

k.payroll processing center

l.payroll register

m.salary

n.wage-bracket method

o.wages

p.withholding allowance

One-half of the self-employment tax is really a personal expense to the owner of the business.

b.electronic system

c.employee

d.employee earnings record

e.Fair Labor Standards Act (FLSA)

f.FICA taxes

g.gross pay

h.independent contractor

i.manual system

j.net pay

k.payroll processing center

l.payroll register

m.salary

n.wage-bracket method

o.wages

p.withholding allowance

One-half of the self-employment tax is really a personal expense to the owner of the business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

18

If an employer wishes, the FUTA tax may be deducted from employees' earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

19

Match the terms with the definitions.a.direct deposit

b.electronic system

c.employee

d.employee earnings record

e.Fair Labor Standards Act (FLSA)

f.FICA taxes

g.gross pay

h.independent contractor

i.manual system

j.net pay

k.payroll processing center

l.payroll register

m.salary

n.wage-bracket method

o.wages

p.withholding allowance

The payroll register is a key source of information for computing employer payroll taxes.

b.electronic system

c.employee

d.employee earnings record

e.Fair Labor Standards Act (FLSA)

f.FICA taxes

g.gross pay

h.independent contractor

i.manual system

j.net pay

k.payroll processing center

l.payroll register

m.salary

n.wage-bracket method

o.wages

p.withholding allowance

The payroll register is a key source of information for computing employer payroll taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

20

Match the terms with the definitions.a.direct deposit

b.electronic system

c.employee

d.employee earnings record

e.Fair Labor Standards Act (FLSA)

f.FICA taxes

g.gross pay

h.independent contractor

i.manual system

j.net pay

k.payroll processing center

l.payroll register

m.salary

n.wage-bracket method

o.wages

p.withholding allowance

Self-employment tax is a contribution to the unemployment compensation program.

b.electronic system

c.employee

d.employee earnings record

e.Fair Labor Standards Act (FLSA)

f.FICA taxes

g.gross pay

h.independent contractor

i.manual system

j.net pay

k.payroll processing center

l.payroll register

m.salary

n.wage-bracket method

o.wages

p.withholding allowance

Self-employment tax is a contribution to the unemployment compensation program.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

21

Since there is no maximum earnings on the Medicare component of the Social Security tax, the Medicare tax rate of 1.45% is applied to total earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

22

In most states, if an employer has very few former employees who collect unemployment compensation, the employer qualifies for a lower state unemployment tax rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

23

By January 31 each year, employers must furnish each employee with a Wage and Tax Statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

24

The EFTPS is an electronic funds transfer system for making federal tax deposits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

25

Employees usually pay the entire cost of workers' compensation insurance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

26

Each employer must have an Employer Identification Number (EIN) to show on all tax reports.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

27

Workers' compensation provides insurance for employees who suffer a job-related illness or injury.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

28

The Social Security, Medicare, FUTA, and SUTA tax accounts normally have credit balances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

29

Employer payroll taxes clearly are an insignificant cost of doing business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

30

In most states, the state unemployment tax is levied only on employers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

31

Social Security, Medicare, FUTA, and SUTA taxes have separate liability accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

32

The due date for payroll taxes is not the same date for all employers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

33

If an employer qualifies for a lower state unemployment tax rate, this lowers the credit allowed in computing the federal unemployment tax due.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

34

FUTA taxes are deposited and an annual report of federal unemployment tax is filed using Form 8109.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

35

Form 941, Employer's Quarterly Federal Tax Return, must be filed with the IRS at the end of the month following each calendar quarter.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which of the following is a payroll tax normally paid by both the employee and the employer?

A) Medicare tax

B) FUTA tax

C) property tax

D) SUTA tax

A) Medicare tax

B) FUTA tax

C) property tax

D) SUTA tax

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

37

SUTA tax payments vary among states but are usually required on a quarterly basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

38

Journalizing payroll taxes for the employer will require several debit entries but only one credit entry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

39

The Social Security, Medicare, and FUTA tax accounts are debited when the taxes are actually paid to the IRS.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

40

Any Federal Reserve Bank or other authorized commercial bank may issue an Employer Identification Number (EIN).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

41

The total payroll cost to an employer of an employee who has gross earnings of $78,000 is

A) $78,000 plus 30 percent.

B) less than $78,000.

C) exactly $78,000.

D) more than $78,000.

A) $78,000 plus 30 percent.

B) less than $78,000.

C) exactly $78,000.

D) more than $78,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

42

The federal unemployment tax is levied on

A) employers and is not deducted from employees' earnings.

B) employees and is deducted from customer payments.

C) employers and is deducted from employees' earnings.

D) employees and employers.

A) employers and is not deducted from employees' earnings.

B) employees and is deducted from customer payments.

C) employers and is deducted from employees' earnings.

D) employees and employers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

43

The date on which an employer must pay Social Security and Medicare taxes is

A) January 1 of each year.

B) December 31 of each year.

C) June 30 of each year.

D) dependent on the amount of the taxes.

A) January 1 of each year.

B) December 31 of each year.

C) June 30 of each year.

D) dependent on the amount of the taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

44

Form 941 is a(n)

A) Employee Withholding Allowance Certificate.

B) Employer's Quarterly Federal Tax Return.

C) Wage and Tax Statement.

D) Employer's Annual Federal Unemployment Tax Return.

A) Employee Withholding Allowance Certificate.

B) Employer's Quarterly Federal Tax Return.

C) Wage and Tax Statement.

D) Employer's Annual Federal Unemployment Tax Return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

45

To journalize the payment of Medicare taxes to the IRS, the correct entry would be

A) debit Medicare Tax Payable and credit IRS.

B) debit Medicare Tax Payable and credit Social Security Payable.

C) debit Medicare Tax Payable and credit Cash.

D) debit Medicare Tax Payable and credit Payroll Taxes Expense.

A) debit Medicare Tax Payable and credit IRS.

B) debit Medicare Tax Payable and credit Social Security Payable.

C) debit Medicare Tax Payable and credit Cash.

D) debit Medicare Tax Payable and credit Payroll Taxes Expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

46

The employer pays which of the following to the Internal Revenue Service?

A) the employer's Social Security and Medicare taxes

B) sales taxes

C) property taxes

D) no taxes

A) the employer's Social Security and Medicare taxes

B) sales taxes

C) property taxes

D) no taxes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

47

Employers who have less than $2,500 due in federal income tax withholding and Social Security and Medicare taxes at the end of the quarter should journalize the debt and pay at the end of the

A) year.

B) quarter.

C) month following the end of the quarter.

D) next banking day.

A) year.

B) quarter.

C) month following the end of the quarter.

D) next banking day.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

48

Employers who have $100,000 or more due in federal income tax withholding and Social Security and Medicare taxes on any day during the current quarter should journalize the debt and pay at the end of the

A) year.

B) quarter.

C) month following the end of the quarter.

D) next banking day.

A) year.

B) quarter.

C) month following the end of the quarter.

D) next banking day.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

49

A key source of information for computing employer payroll taxes is the

A) statement of owner's equity.

B) end-of-period balance sheet.

C) payroll register.

D) employees' check stubs.

A) statement of owner's equity.

B) end-of-period balance sheet.

C) payroll register.

D) employees' check stubs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

50

A self-employment tax is required of an individual who owns his or her own business and makes

A) $1 or more.

B) $200 or more.

C) $400 or more.

D) $1,000 or more.

A) $1 or more.

B) $200 or more.

C) $400 or more.

D) $1,000 or more.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

51

To journalize the employer's payroll taxes, we need to credit all of the following accounts EXCEPT

A) Payroll Taxes Expense.

B) Social Security Tax Payable.

C) Medicare Tax Payable.

D) FUTA Tax Payable.

A) Payroll Taxes Expense.

B) Social Security Tax Payable.

C) Medicare Tax Payable.

D) FUTA Tax Payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

52

An Employer Identification Number (EIN) is obtained by the employer from the

A) nearest Federal Reserve Bank.

B) CIA.

C) Internal Revenue Service.

D) nearest local federally insured bank.

A) nearest Federal Reserve Bank.

B) CIA.

C) Internal Revenue Service.

D) nearest local federally insured bank.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

53

The rules by which employers must deposit Social Security and Medicare taxes can be found in the

A) Circular E--Employer's Tax Guide.

B) Circle K Tax Guide.

C) Federal Reserve Bank Tax Guide.

D) state tax guide.

A) Circular E--Employer's Tax Guide.

B) Circle K Tax Guide.

C) Federal Reserve Bank Tax Guide.

D) state tax guide.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

54

The employer usually pays the entire cost of

A) FICA.

B) Workers' Compensation Insurance.

C) Medical Insurance.

D) Disability Insurance.

A) FICA.

B) Workers' Compensation Insurance.

C) Medical Insurance.

D) Disability Insurance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

55

A self-employment tax is a contribution to the

A) charities of the individual owner's choice.

B) SUTA programs.

C) FUTA programs.

D) Social Security and Medicare programs.

A) charities of the individual owner's choice.

B) SUTA programs.

C) FUTA programs.

D) Social Security and Medicare programs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

56

Melissa Taylor has gross earnings of $425 and withholdings of $26.35 for Social Security tax, $6.16 for Medicare tax, and $35 for federal income tax. Her employer pays $26.35 for Social Security tax, $6.16 for Medicare tax, $3 for FUTA tax, and $9 for SUTA tax. The total cost of Melissa to her employer is

A) $32.51.

B) $425.00.

C) $469.51.

D) $437.00.

A) $32.51.

B) $425.00.

C) $469.51.

D) $437.00.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

57

When all taxes have been paid, the Social Security Tax Payable account will have

A) a debit balance.

B) a credit balance.

C) a zero balance.

D) equal debit and credit balances.

A) a debit balance.

B) a credit balance.

C) a zero balance.

D) equal debit and credit balances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

58

After estimating its payroll for the year, an employer usually pays workers' compensation insurance

A) at the beginning of the year.

B) monthly.

C) quarterly.

D) at the end of the year.

A) at the beginning of the year.

B) monthly.

C) quarterly.

D) at the end of the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

59

Which of the following tax programs often has a merit-rating system to encourage employers to provide regular employment for workers?

A) FICA

B) FUTA

C) SUTA

D) workers' compensation insurance

A) FICA

B) FUTA

C) SUTA

D) workers' compensation insurance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

60

The self-employment tax rate is double the rate of

A) Social Security and Medicare taxes.

B) FUTA taxes.

C) SUTA taxes.

D) property taxes.

A) Social Security and Medicare taxes.

B) FUTA taxes.

C) SUTA taxes.

D) property taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

61

Anthony Pescador owns Sundance Florist. He does his banking at United Credit Union (UCU) in Myrtle Beach, South Carolina. The amounts in his general ledger for payroll taxes and the employee's withholding of Social Security, Medicare, and federal income tax as of April 15 of the current year show the following: Social Security tax payable (employer and employee), $3,412; Medicare tax payable (employer and employee), $816; FUTA tax payable, $180; SUTA tax payable, $1,256; and Employee income tax payable, $9,828. Journalize the payment of the Form 941 deposit to UCU and the payment of the SUTA tax to the State of South Carolina as of April 15, 20--.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

62

Match the terms with the definitions.a.Electronic Federal Tax Payment System (EFTPS)

b.employer FICA taxes

c.Employer Identification Number (EIN)

d.Form W-2

e.Form W-3

f.Form 940

g.Form 941

h.FUTA (Federal Unemployment Tax Act) tax

i.merit-rating system

j.self-employment income

k.self-employment tax

l.SUTA (state unemployment tax) tax

m.workers' compensation insurance

Transmittal of Wage and Tax Statements

b.employer FICA taxes

c.Employer Identification Number (EIN)

d.Form W-2

e.Form W-3

f.Form 940

g.Form 941

h.FUTA (Federal Unemployment Tax Act) tax

i.merit-rating system

j.self-employment income

k.self-employment tax

l.SUTA (state unemployment tax) tax

m.workers' compensation insurance

Transmittal of Wage and Tax Statements

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

63

Mark Turney owns Creative Corners. He does his banking at United Federal Bank (UFB) in Tucson, Arizona. The amounts in his general ledger for payroll taxes and the employee's withholding of Social Security, Medicare, and federal income tax as of April 15 of the current year show the following: Social Security tax payable (employer and employee), $3,020; Medicare tax payable (employer and employee), $734; FUTA tax payable, $84; SUTA tax payable, $414; and Employees income tax payable, $4,622. Journalize the payment of the Form 941 deposit to UFB and the payment of the SUTA tax to the State of Arizona as of April 15, 20--.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

64

Match the terms with the definitions.a.Electronic Federal Tax Payment System (EFTPS)

b.employer FICA taxes

c.Employer Identification Number (EIN)

d.Form W-2

e.Form W-3

f.Form 940

g.Form 941

h.FUTA (Federal Unemployment Tax Act) tax

i.merit-rating system

j.self-employment income

k.self-employment tax

l.SUTA (state unemployment tax) tax

m.workers' compensation insurance

Taxes levied on employers at the same rates and on the same earnings bases as the employee FICA taxes.

b.employer FICA taxes

c.Employer Identification Number (EIN)

d.Form W-2

e.Form W-3

f.Form 940

g.Form 941

h.FUTA (Federal Unemployment Tax Act) tax

i.merit-rating system

j.self-employment income

k.self-employment tax

l.SUTA (state unemployment tax) tax

m.workers' compensation insurance

Taxes levied on employers at the same rates and on the same earnings bases as the employee FICA taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

65

Match the terms with the definitions.a.Electronic Federal Tax Payment System (EFTPS)

b.employer FICA taxes

c.Employer Identification Number (EIN)

d.Form W-2

e.Form W-3

f.Form 940

g.Form 941

h.FUTA (Federal Unemployment Tax Act) tax

i.merit-rating system

j.self-employment income

k.self-employment tax

l.SUTA (state unemployment tax) tax

m.workers' compensation insurance

An electronic funds transfer system for making federal tax deposits.

b.employer FICA taxes

c.Employer Identification Number (EIN)

d.Form W-2

e.Form W-3

f.Form 940

g.Form 941

h.FUTA (Federal Unemployment Tax Act) tax

i.merit-rating system

j.self-employment income

k.self-employment tax

l.SUTA (state unemployment tax) tax

m.workers' compensation insurance

An electronic funds transfer system for making federal tax deposits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

66

From the following information from the payroll register of Veronica's Auto Supply Store, calculate the amount of taxable earnings for unemployment and FICA tax, and prepare the journal entry to record the employer's payroll taxes as of April 30, 20--. Social Security tax is 6.2% on the first $94,200 of earnings for each employee. Medicare tax is 1.45% of gross earnings. FUTA tax is 0.8%, and SUTA tax is 5.4% each on the first $7,000 of earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

67

Match the terms with the definitions.a.Electronic Federal Tax Payment System (EFTPS)

b.employer FICA taxes

c.Employer Identification Number (EIN)

d.Form W-2

e.Form W-3

f.Form 940

g.Form 941

h.FUTA (Federal Unemployment Tax Act) tax

i.merit-rating system

j.self-employment income

k.self-employment tax

l.SUTA (state unemployment tax) tax

m.workers' compensation insurance

A tax levied on employers to raise funds to pay unemployment benefits.

b.employer FICA taxes

c.Employer Identification Number (EIN)

d.Form W-2

e.Form W-3

f.Form 940

g.Form 941

h.FUTA (Federal Unemployment Tax Act) tax

i.merit-rating system

j.self-employment income

k.self-employment tax

l.SUTA (state unemployment tax) tax

m.workers' compensation insurance

A tax levied on employers to raise funds to pay unemployment benefits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

68

Match the terms with the definitions.a.Electronic Federal Tax Payment System (EFTPS)

b.employer FICA taxes

c.Employer Identification Number (EIN)

d.Form W-2

e.Form W-3

f.Form 940

g.Form 941

h.FUTA (Federal Unemployment Tax Act) tax

i.merit-rating system

j.self-employment income

k.self-employment tax

l.SUTA (state unemployment tax) tax

m.workers' compensation insurance

A contribution to the FICA program.

b.employer FICA taxes

c.Employer Identification Number (EIN)

d.Form W-2

e.Form W-3

f.Form 940

g.Form 941

h.FUTA (Federal Unemployment Tax Act) tax

i.merit-rating system

j.self-employment income

k.self-employment tax

l.SUTA (state unemployment tax) tax

m.workers' compensation insurance

A contribution to the FICA program.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

69

Match the terms with the definitions.a.Electronic Federal Tax Payment System (EFTPS)

b.employer FICA taxes

c.Employer Identification Number (EIN)

d.Form W-2

e.Form W-3

f.Form 940

g.Form 941

h.FUTA (Federal Unemployment Tax Act) tax

i.merit-rating system

j.self-employment income

k.self-employment tax

l.SUTA (state unemployment tax) tax

m.workers' compensation insurance

Employer's Quarterly Federal Tax Return

b.employer FICA taxes

c.Employer Identification Number (EIN)

d.Form W-2

e.Form W-3

f.Form 940

g.Form 941

h.FUTA (Federal Unemployment Tax Act) tax

i.merit-rating system

j.self-employment income

k.self-employment tax

l.SUTA (state unemployment tax) tax

m.workers' compensation insurance

Employer's Quarterly Federal Tax Return

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

70

Match the terms with the definitions.a.Electronic Federal Tax Payment System (EFTPS)

b.employer FICA taxes

c.Employer Identification Number (EIN)

d.Form W-2

e.Form W-3

f.Form 940

g.Form 941

h.FUTA (Federal Unemployment Tax Act) tax

i.merit-rating system

j.self-employment income

k.self-employment tax

l.SUTA (state unemployment tax) tax

m.workers' compensation insurance

Employer's Annual Federal Unemployment Tax Return

b.employer FICA taxes

c.Employer Identification Number (EIN)

d.Form W-2

e.Form W-3

f.Form 940

g.Form 941

h.FUTA (Federal Unemployment Tax Act) tax

i.merit-rating system

j.self-employment income

k.self-employment tax

l.SUTA (state unemployment tax) tax

m.workers' compensation insurance

Employer's Annual Federal Unemployment Tax Return

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

71

Match the terms with the definitions.a.Electronic Federal Tax Payment System (EFTPS)

b.employer FICA taxes

c.Employer Identification Number (EIN)

d.Form W-2

e.Form W-3

f.Form 940

g.Form 941

h.FUTA (Federal Unemployment Tax Act) tax

i.merit-rating system

j.self-employment income

k.self-employment tax

l.SUTA (state unemployment tax) tax

m.workers' compensation insurance

Provides insurance for employees who suffer a job-related illness or injury.

b.employer FICA taxes

c.Employer Identification Number (EIN)

d.Form W-2

e.Form W-3

f.Form 940

g.Form 941

h.FUTA (Federal Unemployment Tax Act) tax

i.merit-rating system

j.self-employment income

k.self-employment tax

l.SUTA (state unemployment tax) tax

m.workers' compensation insurance

Provides insurance for employees who suffer a job-related illness or injury.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

72

Match the terms with the definitions.a.Electronic Federal Tax Payment System (EFTPS)

b.employer FICA taxes

c.Employer Identification Number (EIN)

d.Form W-2

e.Form W-3

f.Form 940

g.Form 941

h.FUTA (Federal Unemployment Tax Act) tax

i.merit-rating system

j.self-employment income

k.self-employment tax

l.SUTA (state unemployment tax) tax

m.workers' compensation insurance

A tax levied on employers to raise funds to administer the federal/state unemployment compensation program.

b.employer FICA taxes

c.Employer Identification Number (EIN)

d.Form W-2

e.Form W-3

f.Form 940

g.Form 941

h.FUTA (Federal Unemployment Tax Act) tax

i.merit-rating system

j.self-employment income

k.self-employment tax

l.SUTA (state unemployment tax) tax

m.workers' compensation insurance

A tax levied on employers to raise funds to administer the federal/state unemployment compensation program.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

73

Match the terms with the definitions.a.Electronic Federal Tax Payment System (EFTPS)

b.employer FICA taxes

c.Employer Identification Number (EIN)

d.Form W-2

e.Form W-3

f.Form 940

g.Form 941

h.FUTA (Federal Unemployment Tax Act) tax

i.merit-rating system

j.self-employment income

k.self-employment tax

l.SUTA (state unemployment tax) tax

m.workers' compensation insurance

Employee's Wage and Tax Statement

b.employer FICA taxes

c.Employer Identification Number (EIN)

d.Form W-2

e.Form W-3

f.Form 940

g.Form 941

h.FUTA (Federal Unemployment Tax Act) tax

i.merit-rating system

j.self-employment income

k.self-employment tax

l.SUTA (state unemployment tax) tax

m.workers' compensation insurance

Employee's Wage and Tax Statement

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

74

Selected information from the payroll register of Barbara's Stables for the week ended September 28, 20--, is as follows: Social Security tax is 6.2% on the first $110,100 of earnings for each employee. Medicare tax is 1.45% of gross earnings, FUTA tax is 0.8%, and SUTA tax is 5.4% each on the first $7,000 of earnings.

Calculate the amount of taxable earnings for unemployment and Social Security taxes, and prepare the journal entry to record the employer's payroll taxes as of September 28, 20--.

Calculate the amount of taxable earnings for unemployment and Social Security taxes, and prepare the journal entry to record the employer's payroll taxes as of September 28, 20--.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

75

Match the terms with the definitions.a.Electronic Federal Tax Payment System (EFTPS)

b.employer FICA taxes

c.Employer Identification Number (EIN)

d.Form W-2

e.Form W-3

f.Form 940

g.Form 941

h.FUTA (Federal Unemployment Tax Act) tax

i.merit-rating system

j.self-employment income

k.self-employment tax

l.SUTA (state unemployment tax) tax

m.workers' compensation insurance

A system to encourage employers to provide regular employment to workers.

b.employer FICA taxes

c.Employer Identification Number (EIN)

d.Form W-2

e.Form W-3

f.Form 940

g.Form 941

h.FUTA (Federal Unemployment Tax Act) tax

i.merit-rating system

j.self-employment income

k.self-employment tax

l.SUTA (state unemployment tax) tax

m.workers' compensation insurance

A system to encourage employers to provide regular employment to workers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

76

Match the terms with the definitions.a.Electronic Federal Tax Payment System (EFTPS)

b.employer FICA taxes

c.Employer Identification Number (EIN)

d.Form W-2

e.Form W-3

f.Form 940

g.Form 941

h.FUTA (Federal Unemployment Tax Act) tax

i.merit-rating system

j.self-employment income

k.self-employment tax

l.SUTA (state unemployment tax) tax

m.workers' compensation insurance

A number that identifies the employer on all payroll forms and reports filed with the IRS.

b.employer FICA taxes

c.Employer Identification Number (EIN)

d.Form W-2

e.Form W-3

f.Form 940

g.Form 941

h.FUTA (Federal Unemployment Tax Act) tax

i.merit-rating system

j.self-employment income

k.self-employment tax

l.SUTA (state unemployment tax) tax

m.workers' compensation insurance

A number that identifies the employer on all payroll forms and reports filed with the IRS.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

77

Match the terms with the definitions.a.Electronic Federal Tax Payment System (EFTPS)

b.employer FICA taxes

c.Employer Identification Number (EIN)

d.Form W-2

e.Form W-3

f.Form 940

g.Form 941

h.FUTA (Federal Unemployment Tax Act) tax

i.merit-rating system

j.self-employment income

k.self-employment tax

l.SUTA (state unemployment tax) tax

m.workers' compensation insurance

The net income of a trade or business run by an individual.

b.employer FICA taxes

c.Employer Identification Number (EIN)

d.Form W-2

e.Form W-3

f.Form 940

g.Form 941

h.FUTA (Federal Unemployment Tax Act) tax

i.merit-rating system

j.self-employment income

k.self-employment tax

l.SUTA (state unemployment tax) tax

m.workers' compensation insurance

The net income of a trade or business run by an individual.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

78

The cost of workers' compensation insurance for the employer depends on all of the following EXCEPT

A) the number of employees.

B) the riskiness of the jobs the employees perform.

C) the company's accident history.

D) the amount of FICA, FUTA, and SUTA taxes due.

A) the number of employees.

B) the riskiness of the jobs the employees perform.

C) the company's accident history.

D) the amount of FICA, FUTA, and SUTA taxes due.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

79

The adjustment to journalize an additional premium due at the end of the year for workers' compensation insurance (WCI) is

A) debit WCI Expense and credit Cash.

B) debit WCI Expense and credit Insurance Refund.

C) debit WCI Expense and credit WCI Payable.

D) debit Insurance Payable and credit WCI Payable.

A) debit WCI Expense and credit Cash.

B) debit WCI Expense and credit Insurance Refund.

C) debit WCI Expense and credit WCI Payable.

D) debit Insurance Payable and credit WCI Payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck